7-15 End of Day: Grains Mixed: Corn Finds Support, Soybeans Slide, Wheat Faces Supply Headwinds

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 401.25 | 1.25 |

| DEC ’25 | 419.75 | 1.75 |

| DEC ’26 | 454.75 | 0.5 |

| Soybeans | ||

| AUG ’25 | 995 | -6 |

| NOV ’25 | 1001.75 | -5.25 |

| NOV ’26 | 1040.25 | -5.25 |

| Chicago Wheat | ||

| SEP ’25 | 538 | -3.5 |

| DEC ’25 | 558.75 | -3.5 |

| JUL ’26 | 596.25 | -2.5 |

| K.C. Wheat | ||

| SEP ’25 | 523.75 | 0.75 |

| DEC ’25 | 546 | 0.5 |

| JUL ’26 | 590.5 | -0.25 |

| Mpls Wheat | ||

| SEP ’25 | 6.0125 | -0.025 |

| DEC ’25 | 6.2125 | -0.0225 |

| SEP ’26 | 6.52 | -0.01 |

| S&P 500 | ||

| SEP ’25 | 6309 | -2 |

| Crude Oil | ||

| SEP ’25 | 65.41 | -0.4 |

| Gold | ||

| OCT ’25 | 3362.1 | -24.9 |

Grain Market Highlights

- 🌽 Corn: Corn futures posted modest gains Tuesday, but December failed to break above the $4.20 level or the 10-day moving average, leaving the market vulnerable to renewed selling.

- 🌱 Soybeans: Soybean futures ended lower Tuesday, with front-month contracts leading the decline. Crop conditions improved, with 70% of the crop rated good-to-excellent — up 4 points from last week and 2 points above last year.

- 🌾 Wheat: Wheat futures closed mixed Tuesday — Minneapolis and Kansas City posted slight gains while Chicago slipped — amid lingering bearish pressure from last week’s WASDE, which pegged 2025/26 U.S. ending stocks at a six-year high.

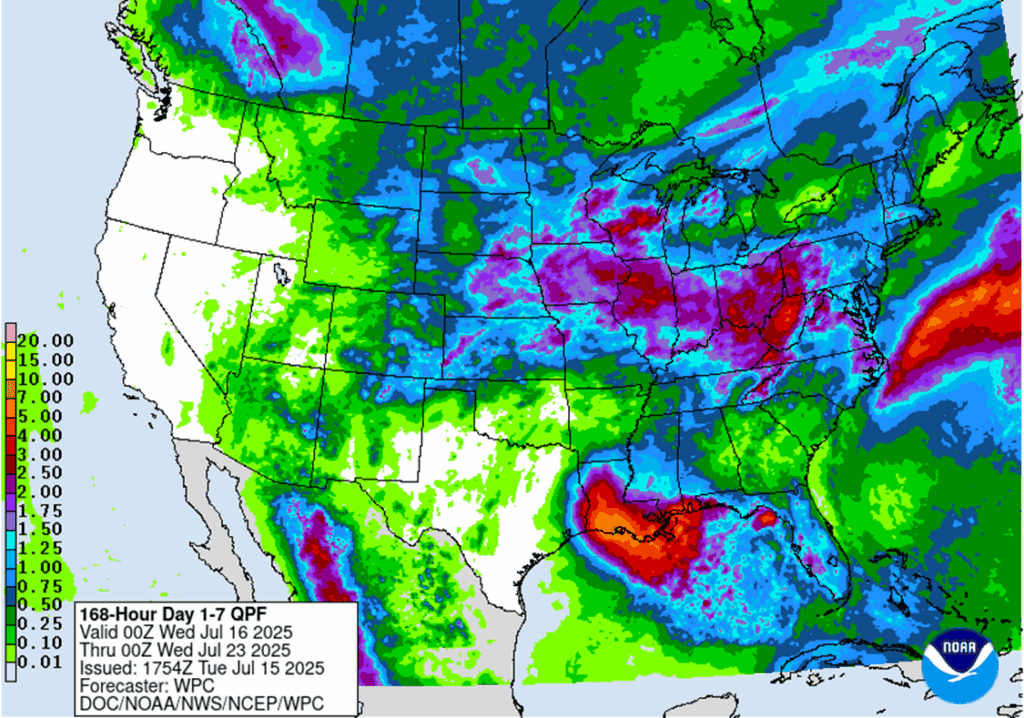

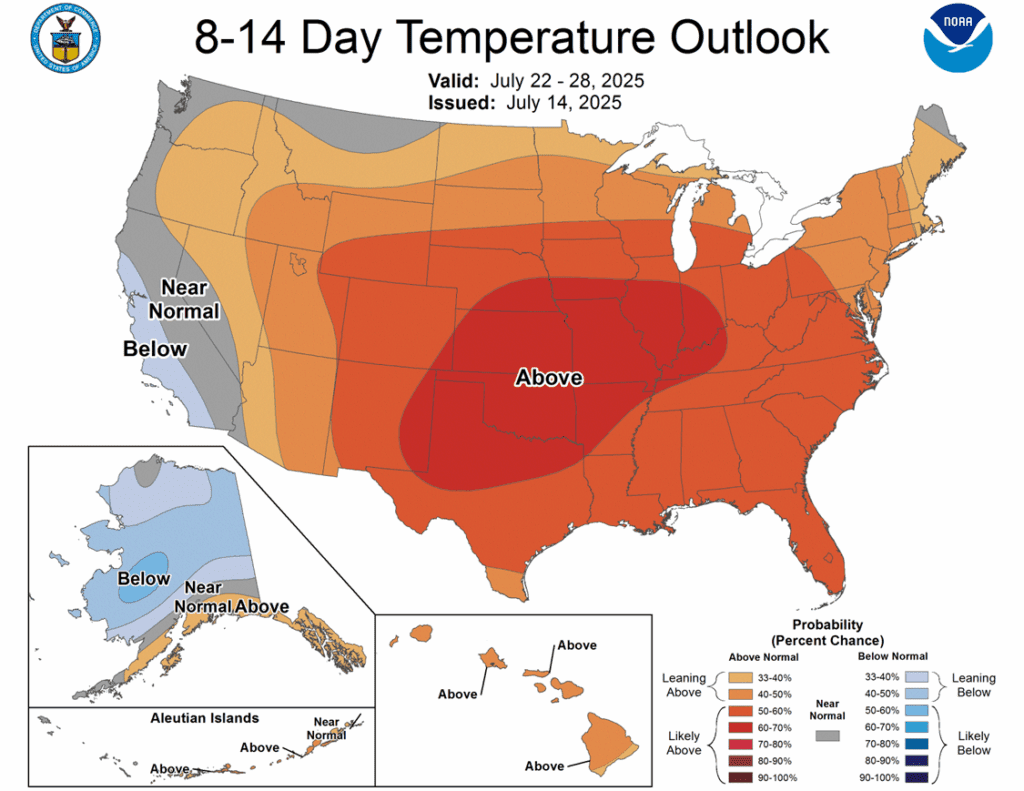

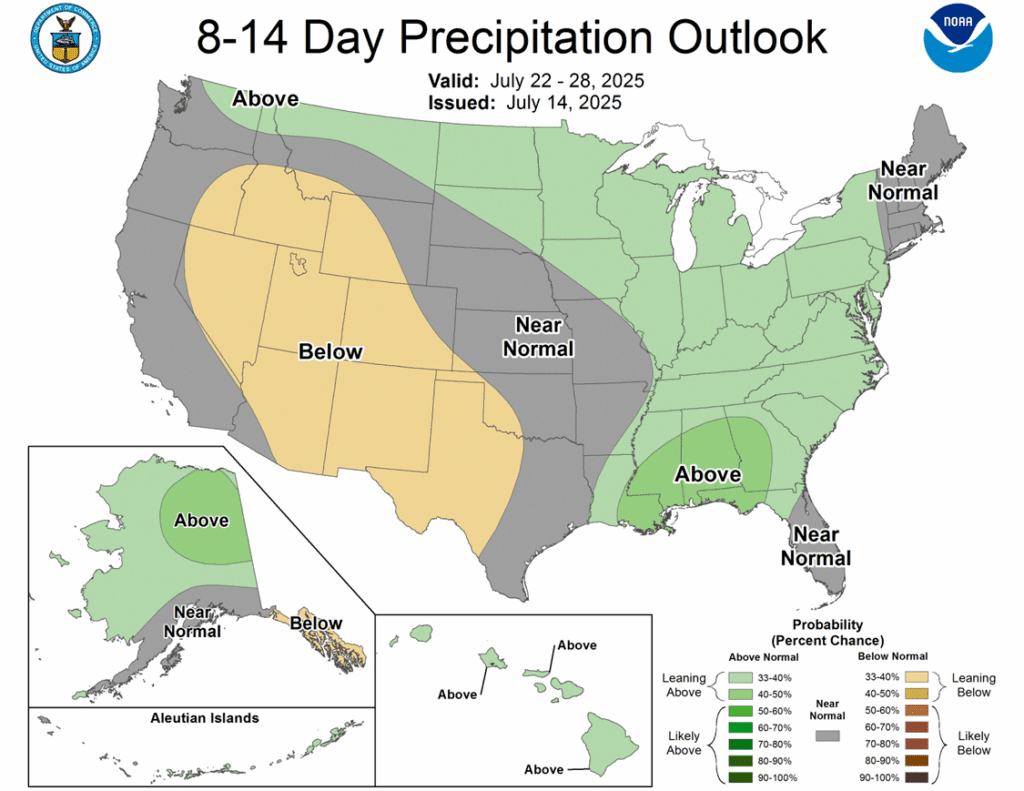

- To see update U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

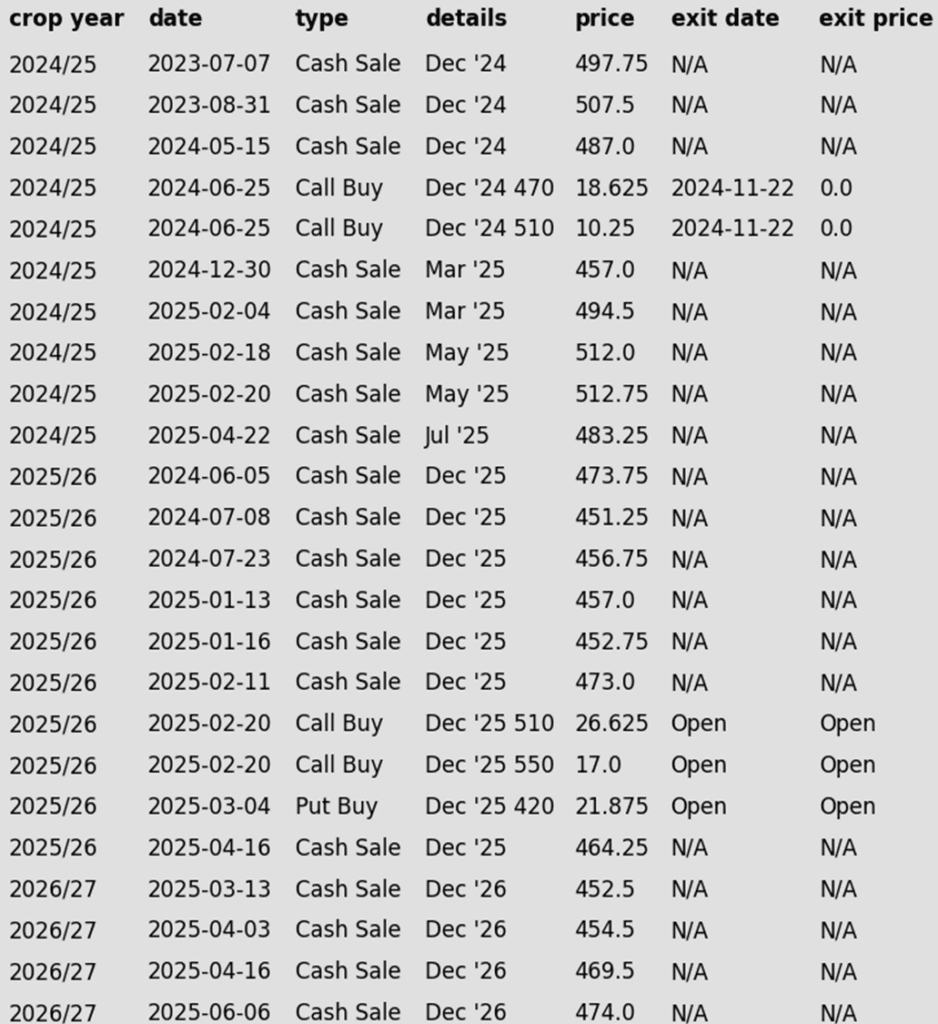

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- There is unlikely to be any further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. Any remaining old crop 2024 corn should be getting priced into market strength. Next week the 2024 crop will drop off the report.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

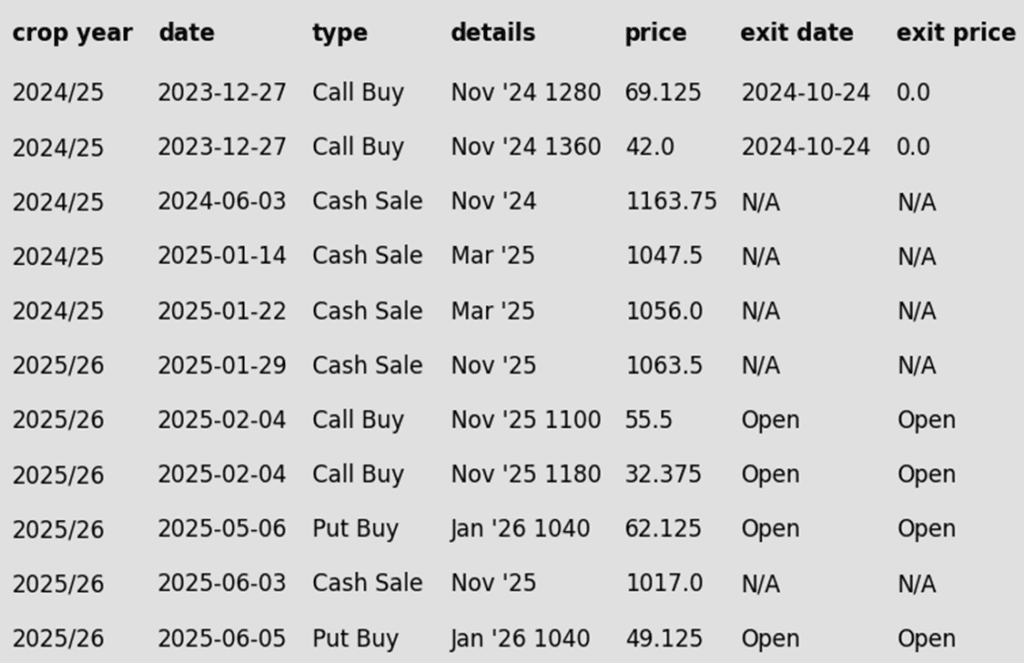

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures posted modest gains Tuesday, but December failed to break above the $4.20 level or the 10-day moving average, leaving the market vulnerable to renewed selling.

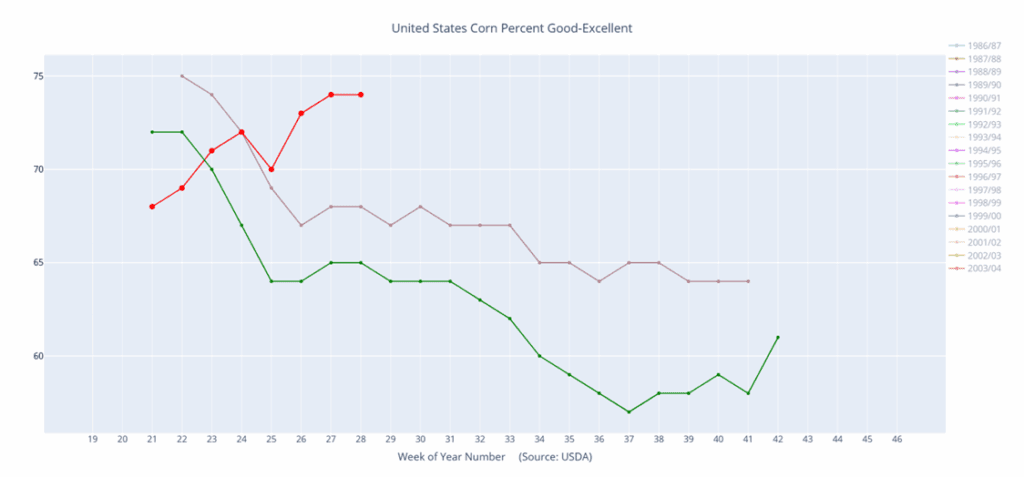

- Crop conditions held steady at 74% good-to-excellent — matching expectations and marking the second-best rating in the past decade for this time of year (trailing only 2016 at 76% G/E).

- The strong ratings improve the chances for a possible higher than trendline yield. In 2016, final corn yield was 3.9% higher than trend line yield after peaking at 4.6% over trend line on the September 2016 WASDE report. Participants in the corn market are likely pricing in a 3-4% possible over trend yield, which would significantly increase the carryout for the 2025-26 marketing year. Weather will be a big factor in determining the final yield.

- The U.S. dollar has rallied nine straight sessions, raising concerns over export competitiveness.

- Brazilian corn harvest pace continues to expand but is well behind historical pace. Ag analyst firm, AgRural estimates that Brazil second crop corn harvest is 40% complete as of last Thursday. This is 12% higher than last week, but well behind the 74% completed from last year in this time window.

Corn Futures Attempt Rebound with Bullish Reversal

Corn futures show signs of recovery mid-July, posting a bullish key reversal to start the week. An unfilled gap near 413 is the first upside target, followed by a gap at 430 if 420 is cleared. On the downside, support rests at this week’s low of 391.

Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Soybeans

Action Plan: Soybeans

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- There is unlikely to be any further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. Any remaining old crop 2024 soybeans should be getting priced into market strength. Next week the 2024 crop will drop off the report.

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

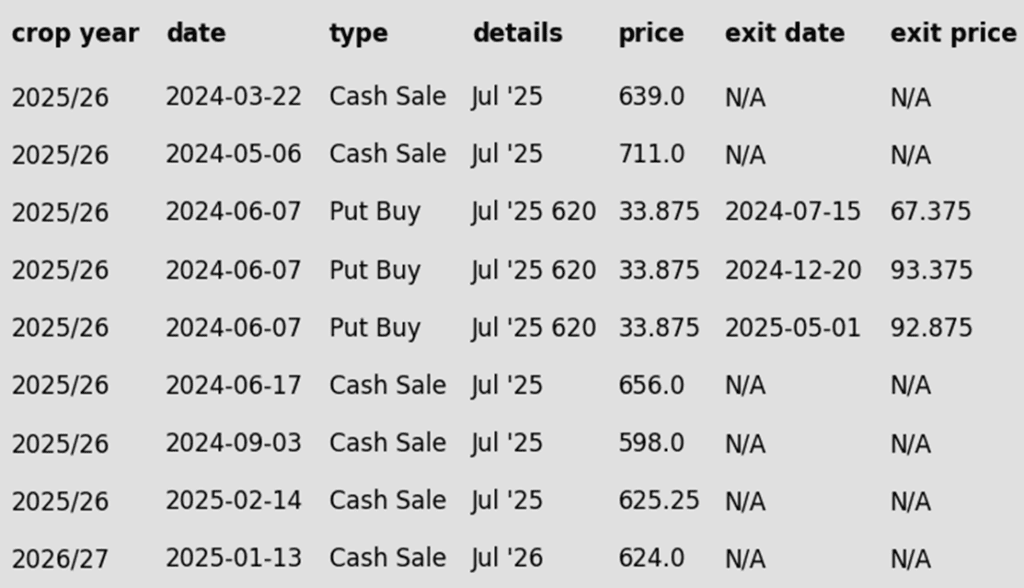

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower with the front months once again posting the brunt of the losses. November futures posted an inside day lower with the high at $10.10 and the low at $10.00. Crop progress results were bearish as good weather supports development. Soybean meal was lower while bean oil was higher.

- NOPA’s June crush came in at 185.71 million bushels — above expectations and the highest June total on record. Though down 3.7% from May, it was up 5.8% year-over-year.

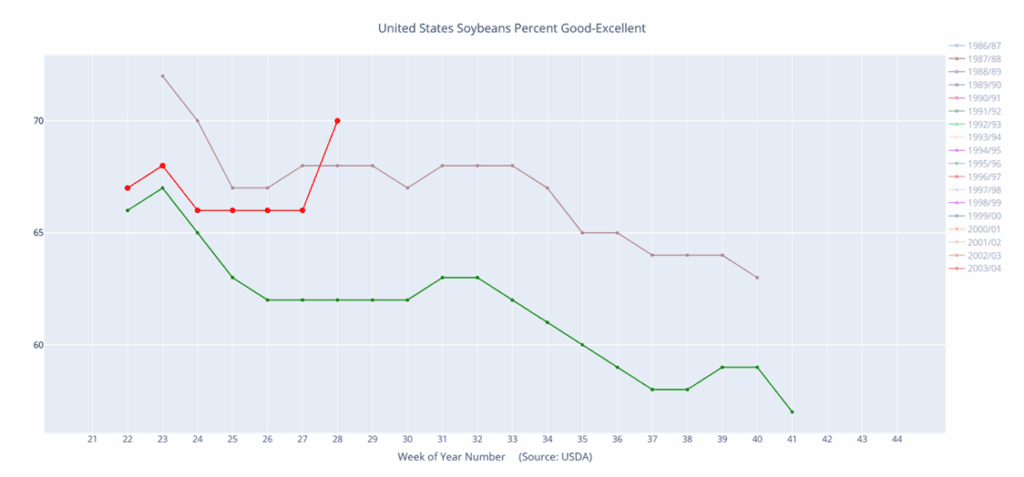

- Yesterday’s Crop Progress report saw soybean crop ratings improve 4 points from last week to 70% good to excellent. This was also 2 points higher than last year at this time. 47% of the crop is blooming and 15% is setting pods.

- Yesterday’s export sales report saw soybean sales on the poor side at 147k tons which compared to 400k the previous week and 175k tons a year ago. Top buyers were Mexico, Egypt, and Japan.

Soybeans Break Below 200-day

Soybeans failed to break above key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. A close above that level would target the June 2023 gap between 1161 and 1177. On the downside, futures recently slipped below the 200-day moving average, with next support at the April low near 980.

Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Wheat

Market Notes: Wheat

- Wheat futures closed mixed Tuesday — Minneapolis and Kansas City posted slight gains while Chicago slipped — amid lingering bearish pressure from last week’s WASDE, which pegged 2025/26 U.S. ending stocks at a six-year high.

- Spring wheat conditions improved more than expected, with 54% rated good-to-excellent, up 4 points from last week. Winter wheat harvest reached 63% complete, slightly behind average.

- CONAB has reported Brazilian wheat has been planted on 79.5% of the projected area as of July 5. Additionally, they are estimating that the crop will reach 7.81 mmt, down 4.6% from the June estimate. Planted area is expected to decline 16.5% to 2.55 million hectares, though productivity is anticipated to increased 18.7% to 3.06 tons per hectare.

- IKAR has lowered their wheat production forecast for Russia by 0.5 mmt to 84 mmt and also reduced their export estimate by .05 mmt to 42 mmt. For reference, the USDA is using at 83.5 mmt production figure, and 46 mmt for exports.

- On a bearish note, the French farm ministry has estimated their nation’s 2025 soft wheat production at 32.6 mmt. If accurate, this would be a 27% jump over last year’s harvest due to an estimated 19% increase in yields. However, this would be only 2.4% above average, as last year’s wheat crop struggled with excess rain.

- Morocco is set to import its first U.S. wheat shipment this month (100,000 MT), with total purchases possibly reaching 600,000 MT for the season — roughly 6% of its grain imports.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- Upside target of 675 was adjusted to 681.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Returns to Recent Range

Chicago wheat’s sharp mid-June rally proved short-lived, with futures retreating to the upper end of the 2025 range. Initial support lies at the 50-day moving average, with a break targeting the June low of 522.25. On the upside, a weekly close above 558 could open the door for a retest of the recent highs near 590.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 688 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- Upside target of 693 was adjusted lower to 688.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Back Near Support

Strength in June pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness late in June sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75.

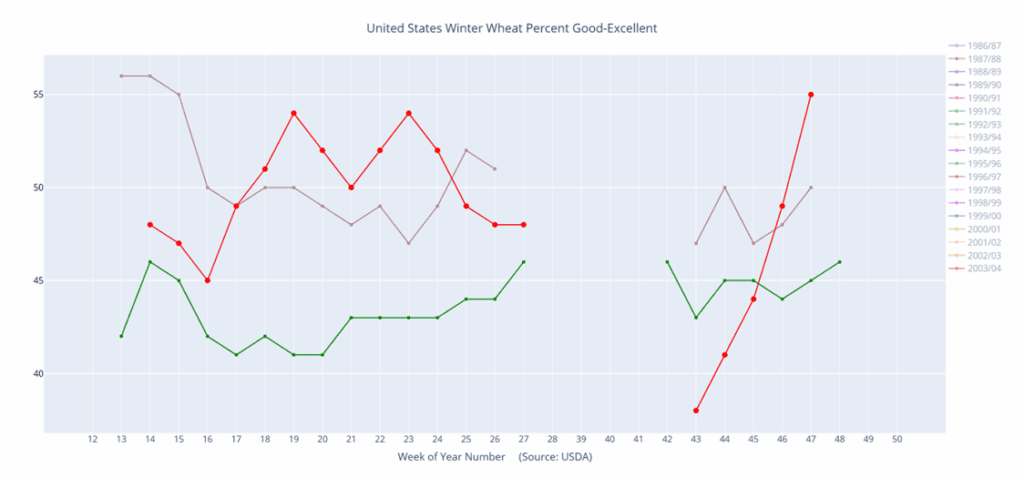

Winter wheat condition percentage good-excellent (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- CONTINUED OPPORTUNITY – Sell the first portion of your 2026 Minneapolis wheat crop.

- Plan A:

- Make your first sale.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Sales Recs: Now one sales recommendation made to date, at a price of 678.75.

- Changes:

- A downside sales stop of 639 has been added to the Plan B strategy.

- Changes:

- Sales Recs: Now one sales recommendation made to date, at a price of 678.75.

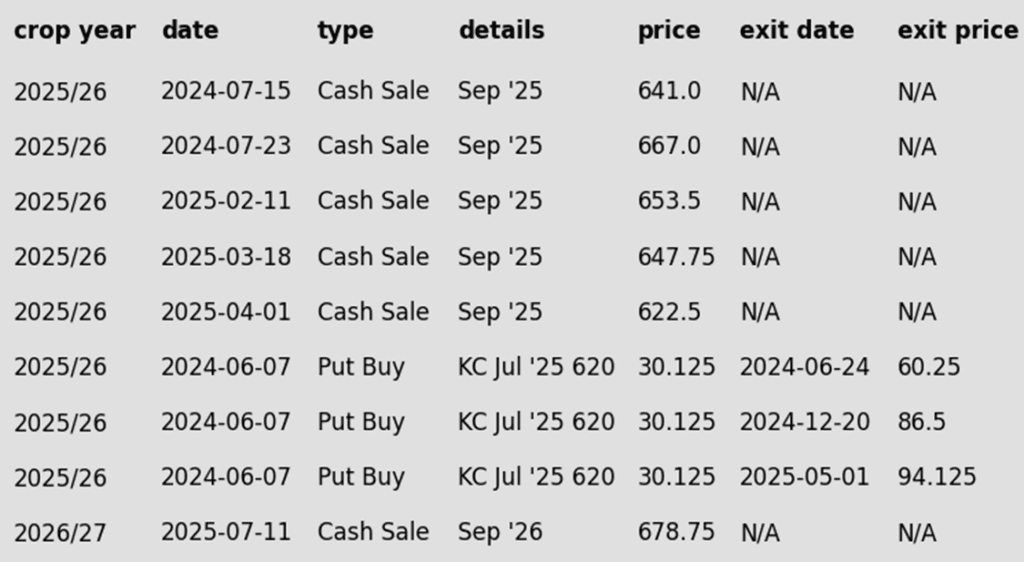

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holds Above Support

Spring wheat futures held above the upper end of their prior range for most of June, supported by a confluence of major moving averages. The June high near 665 is the next upside target. Key support lies at the 200-day moving average around 607, with a close below that level — and especially under the May low of 572.50 — likely opening the door to increased downside risk.

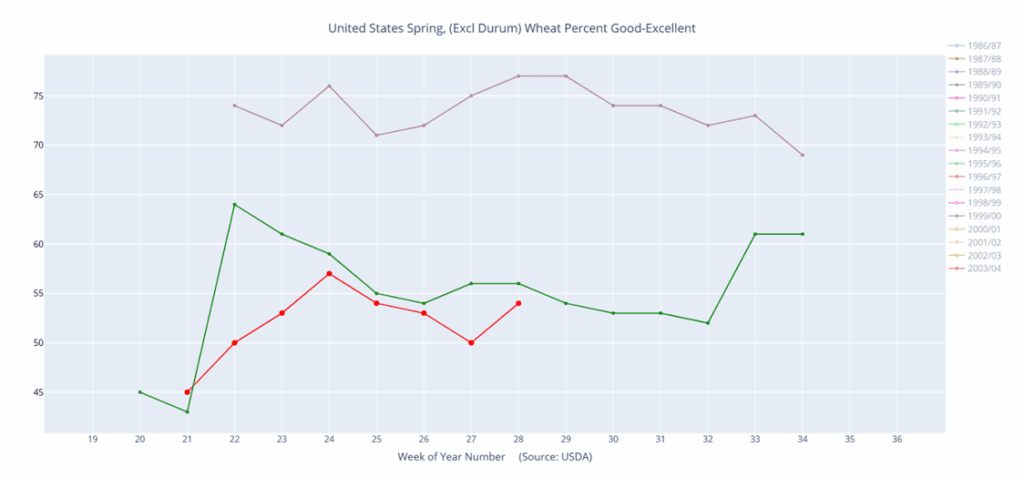

Spring wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Other Charts / Weather