7-14 End of Day: Corn Bucks Grain Trend, Closes Higher to Start Week

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 400 | 4 |

| DEC ’25 | 418 | 5.75 |

| DEC ’26 | 454.25 | 3.75 |

| Soybeans | ||

| AUG ’25 | 1001 | -3.25 |

| NOV ’25 | 1007 | -0.25 |

| NOV ’26 | 1045.5 | 1.5 |

| Chicago Wheat | ||

| SEP ’25 | 541.5 | -3.5 |

| DEC ’25 | 562.25 | -3.25 |

| JUL ’26 | 598.75 | -2.75 |

| K.C. Wheat | ||

| SEP ’25 | 523 | -1.25 |

| DEC ’25 | 545.5 | -2.75 |

| JUL ’26 | 590.75 | -4 |

| Mpls Wheat | ||

| SEP ’25 | 6.0375 | -0.1 |

| DEC ’25 | 6.235 | -0.1 |

| SEP ’26 | 6.5 | -0.125 |

| S&P 500 | ||

| SEP ’25 | 6314.25 | 14.25 |

| Crude Oil | ||

| SEP ’25 | 65.8 | -1.24 |

| Gold | ||

| OCT ’25 | 3385.9 | -5.7 |

Grain Market Highlights

- 🌽 Corn: After setting new lows in Sunday night trade, corn futures staged a strong reversal Monday, closing above Friday’s high in an encouraging technical rebound.

- 🌱 Soybeans: Soybeans closed lower Monday, led by front-month weakness amid bear spreading and pressure from a wet weather outlook.

- 🌾 Wheat: Wheat futures closed lower across all three classes Monday, pressured by last week’s higher-than-expected spring wheat production estimate, which offset reductions to winter wheat.

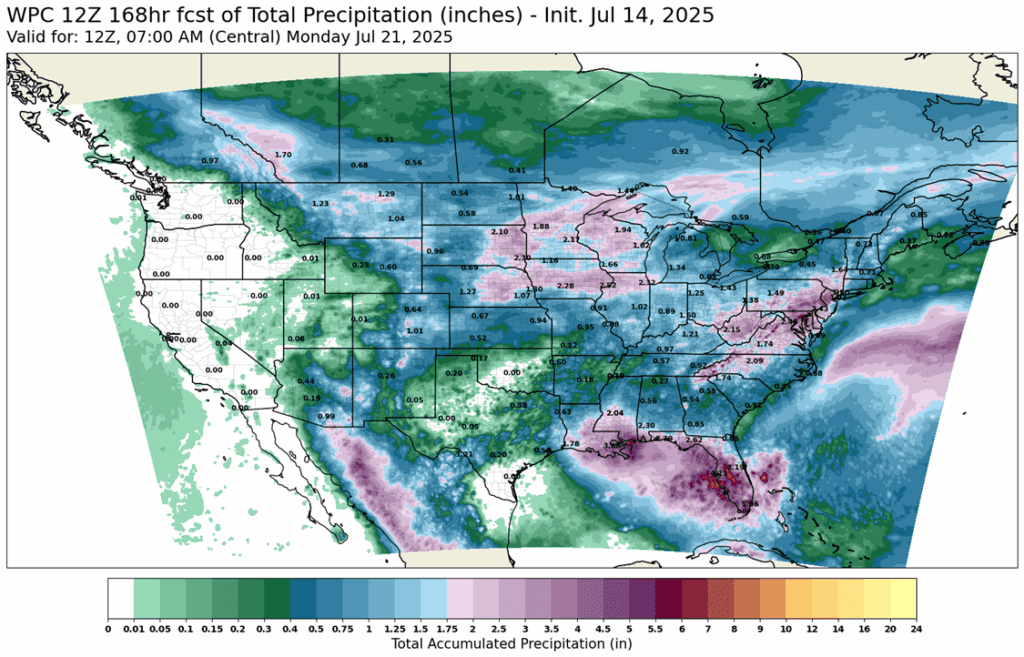

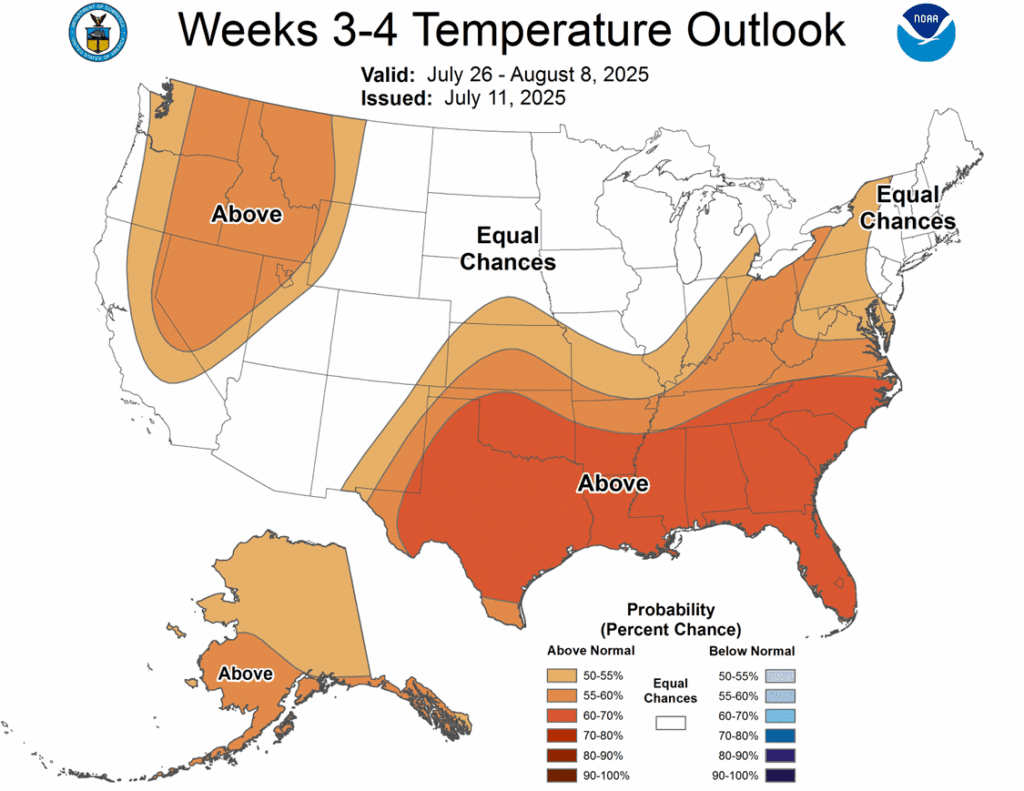

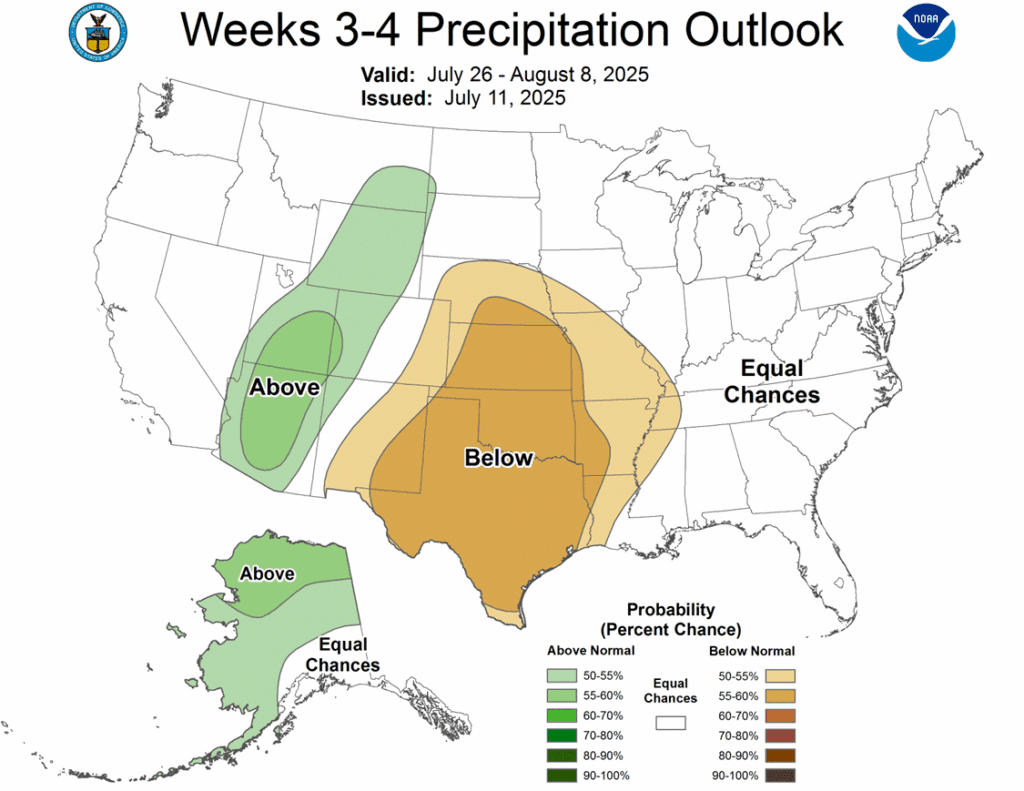

- To see update U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

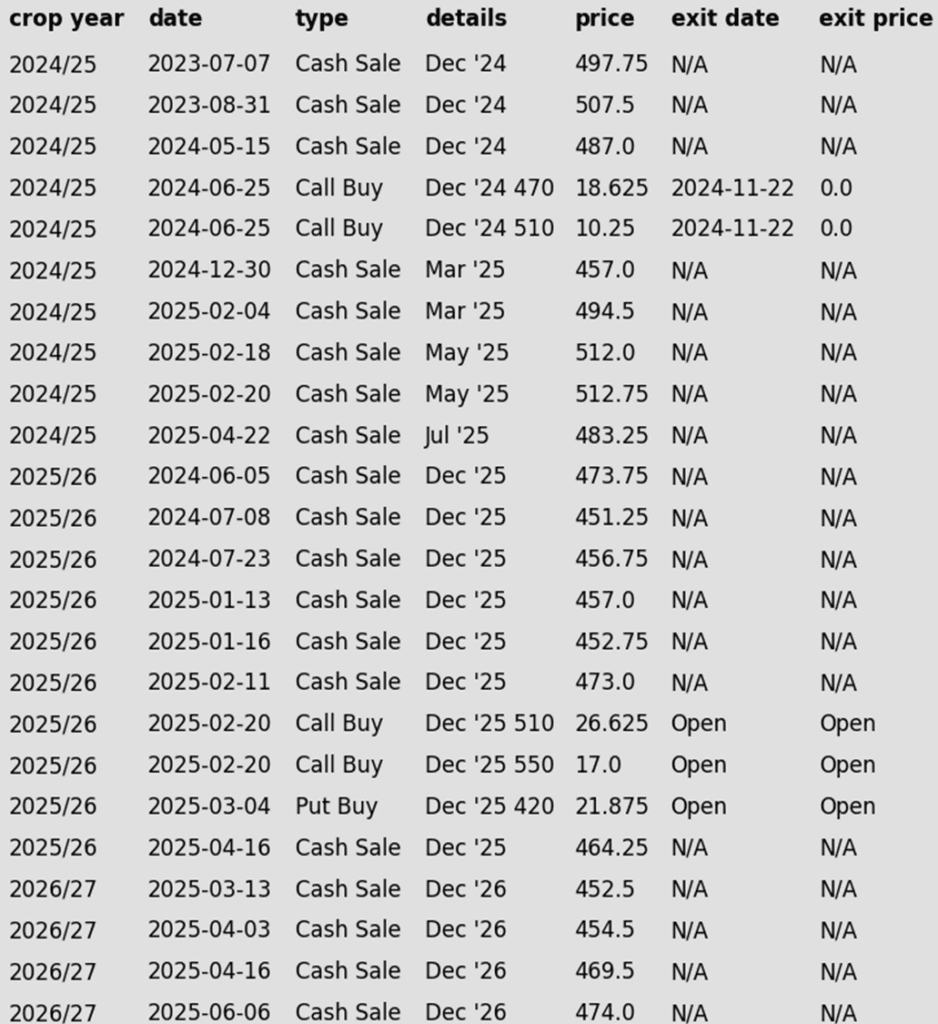

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- There is unlikely to be any further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. Any remaining old crop 2024 corn should be getting priced into market strength. Next week the 2024 crop will drop off the report.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

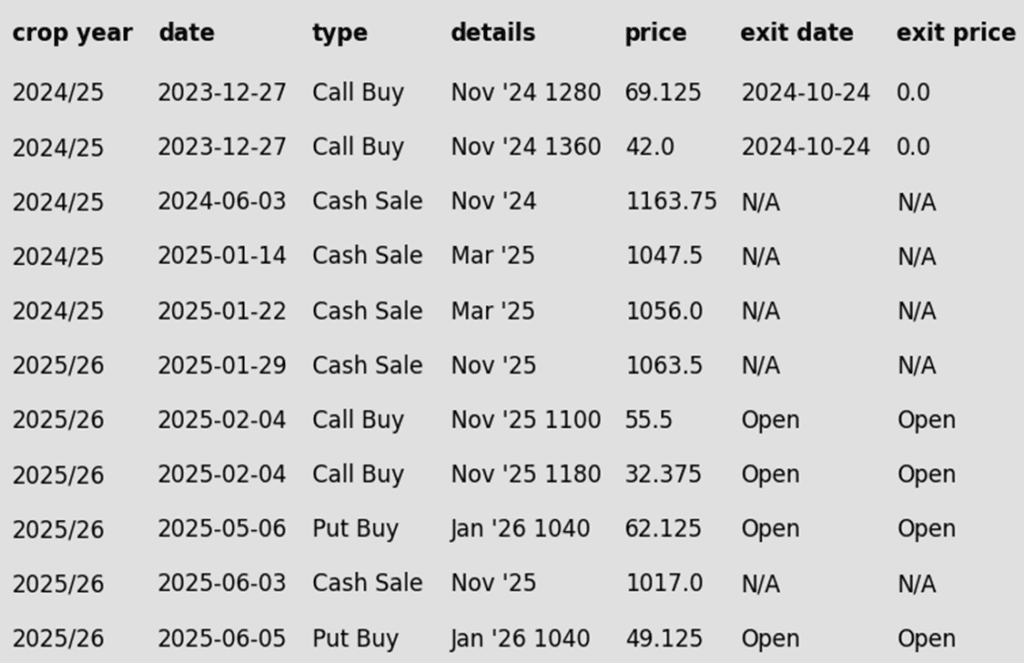

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- After setting new lows in Sunday night trade, corn futures staged a strong reversal Monday, closing above Friday’s high in an encouraging technical rebound.

- Friday’s report pegged old crop corn carryout at 1.340 billion bushels — the lowest in four years if realized. That stands in sharp contrast to prices, which are among the lowest seen in the past five years.

- USDA raised Brazil’s 2025 corn production estimate by 2 MMT to 132 MMT, aligning with Conab’s update the day prior. This bumped up global corn stocks (excluding China), though overall inventories remain near 12-year lows, keeping the global supply picture historically tight.

- Over the weekend, the Trump administration announced a 30% tariff on both the EU and Mexico starting August 1. The news is particularly significant for corn, as Mexico is the top U.S. buyer. The move adds fresh uncertainty to a market already weighed down by strong crop prospects and multi-year low prices.

- Short-term weather remains favorable as pollination advances, with weekly crop progress expected to show steady conditions and development tracking close to the five-year average.

Corn Futures Break to New Lows

Front-month corn futures struggled through June, breaking key support and leaving an unfilled gap near 430 after the roll to September — now the first upside target. On the downside, stronger support emerges at 394.

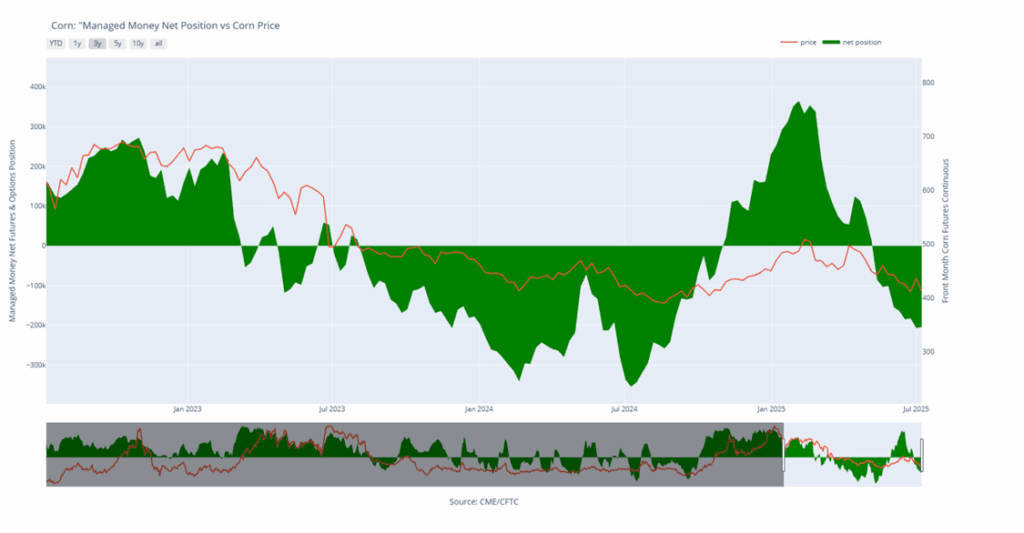

Corn Managed Money Funds net position as of Tuesday, July 8. Net position in Green versus price in Red. Money Managers net bought 2,602 contracts between July 1- July 8, bringing their total position to a net short 203,861 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- There is unlikely to be any further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. Any remaining old crop 2024 soybeans should be getting priced into market strength. Next week the 2024 crop will drop off the report.

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

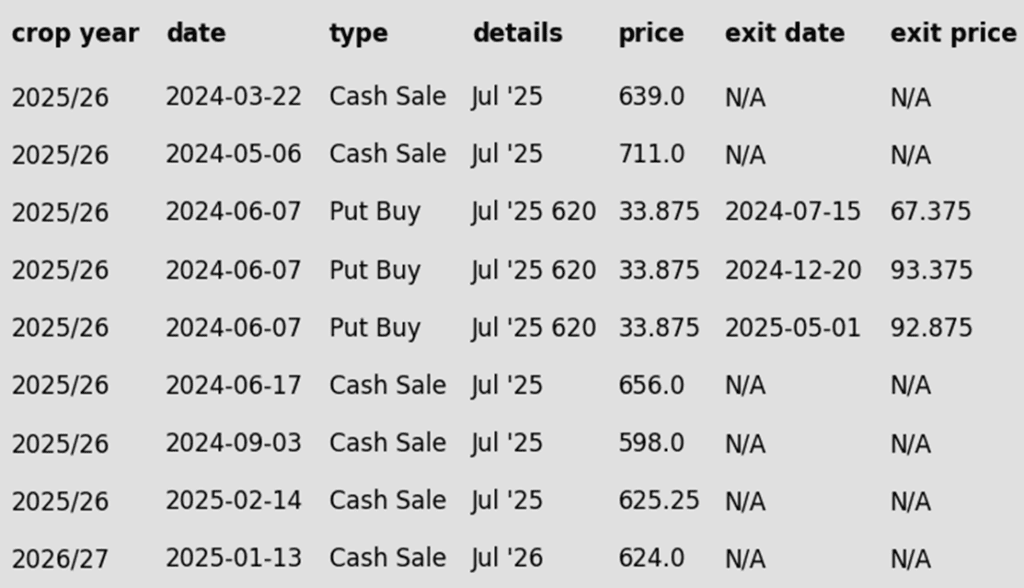

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower in bear spreading action with the bulk of losses in the front months. Overnight, November soybeans fell to $9.98-1/4 but recovered throughout the day. Prospects of continued wet weather have pressured the market. Soybean meal was lower but soybean oil higher to end the day.

- Biofuel policy support continues to provide a bullish backdrop, with USDA projecting a 5% increase in 2025/26 soybean crush, driven by rising demand for renewable fuels. This is expected to support soybean oil prices, though meal values may remain under pressure due to rising supply.

- Highlights from Friday’s WASDE report saw predictions for the 25/26 soybean crop decreased slightly from last month’s guess. Ending stocks for 24/25 were unchanged at 350 mb and ending stocks for 25/26 were called higher at 310 mb vs 295 mb last month. Yields were unchanged, new crop bean exports were lowered, but soybean crush was increased to 2.54 from 2.49

- Friday’s CFTC report saw funds as sellers of soybeans by 6,641 contracts which left them with a net short position of 6,216 contracts. They sold 1,670 contracts of bean oil leaving them long 37,741 contracts and bought 459 contracts of meal leaving them short 131,479 contracts.

Soybeans Break Below 200-day

Soybeans failed to break above key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. A close above that level would target the June 2023 gap between 1161 and 1177. On the downside, futures recently slipped below the 200-day moving average, with next support at the April low near 980.

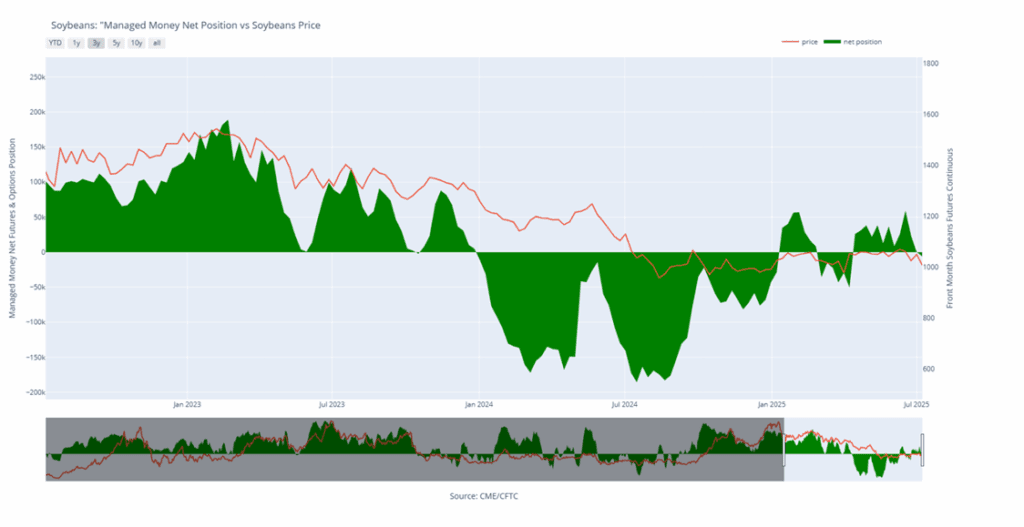

Soybean Managed Money Funds net position as of Tuesday, July 8. Net position in Green versus price in Red. Money Managers net sold 6,641 contracts between July 1 – July 8, bringing their total position to a net short 6,216 contracts.

Wheat

Market Notes: Wheat

- Wheat futures closed lower across all three classes Monday, pressured by last week’s higher-than-expected spring wheat production estimate, which offset reductions to winter wheat. The spring wheat yield forecast of 51.7 bpa would be the second highest on record if realized.

- Weekly wheat inspections totaled 16.2 mb, bringing 2025/26 cumulative inspections to 83.9 mb, down 3% from last year and lagging the pace needed to reach USDA’s 850 mb export projection.

- Russian export activity continues to rise, with IKAR reporting wheat values up $4 to $229/mt last week, and SovEcon estimating weekly exports at 160,000 mt, up 60,000 mt from the prior week. Meanwhile, former President Trump has threatened 100% tariffs on Russian goods if no peace deal is reached within 50 days.

- Weather remains a concern globally, with persistent drought in key wheat areas of Australia, and parts of Saskatchewan and Manitoba in Canada seeing limited moisture. Both regions face yield risks as their crops approach reproductive stages.

- In the EU, grain production is forecast up 6.9% year over year, according to Copa-Cogeca, with total output seen at 275.2 mmt. While wheat production is expected to rise, durum wheat is projected to fall 32% from last year.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- Upside target of 675 was adjusted to 681.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Returns to Recent Range

Chicago wheat’s sharp mid-June rally proved short-lived, with futures retreating to the upper end of the 2025 range. Initial support lies at the 50-day moving average, with a break targeting the June low of 522.25. On the upside, a weekly close above 558 could open the door for a retest of the recent highs near 590.

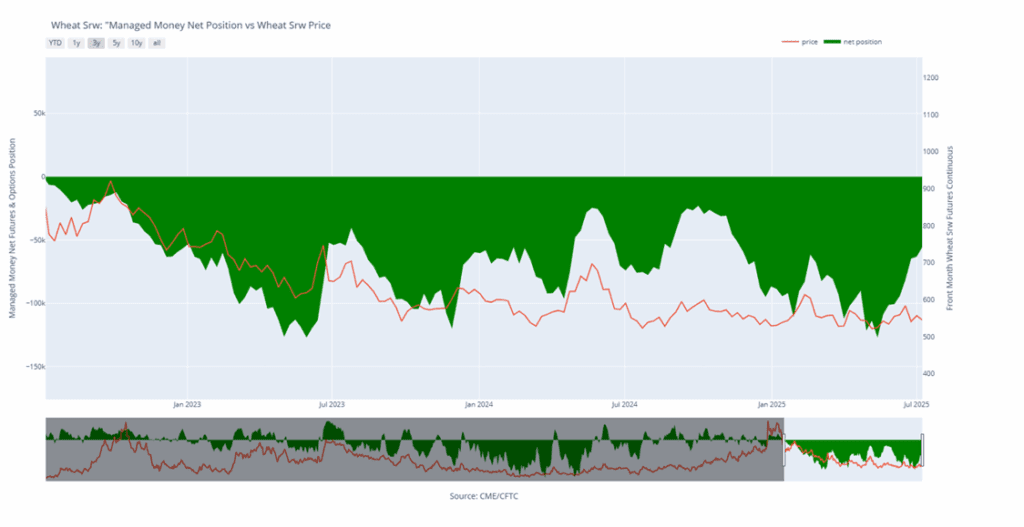

Chicago Wheat Managed Money Funds’ net position as of Tuesday, July 8. Net position in Green versus price in Red. Money Managers net bought 7,477 contracts between July 1 – July 8, bringing their total position to a net short 55,594 contracts.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 688 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- Upside target of 693 was adjusted lower to 688.

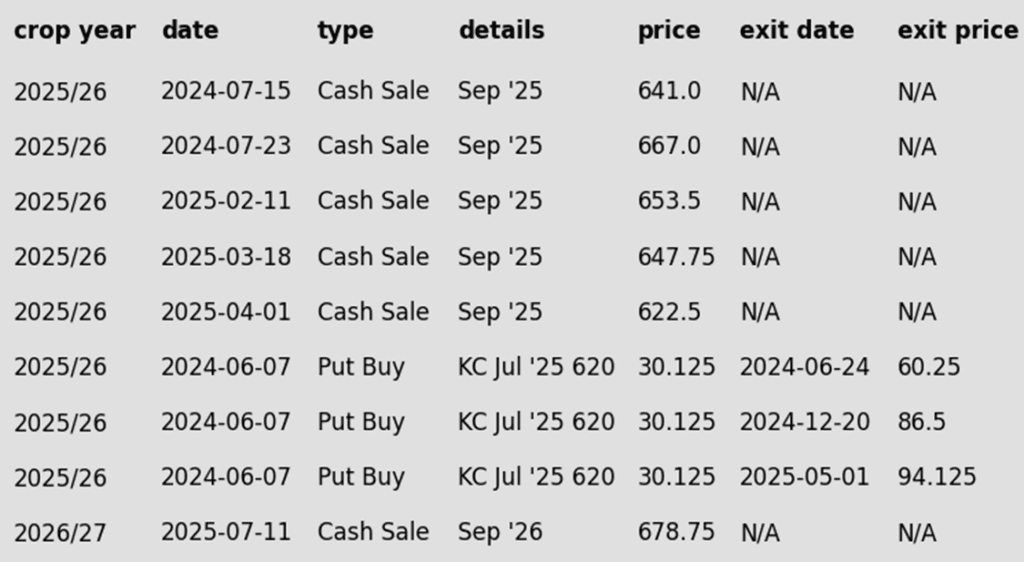

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Back Near Support

Strength in June pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness late in June sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75.

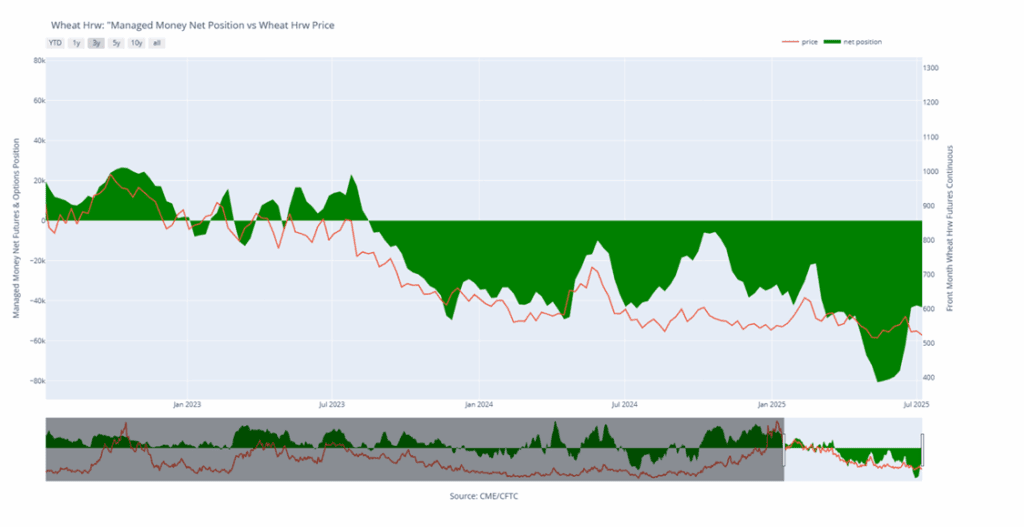

KC Wheat Managed Money Funds’ net position as of Tuesday, July 8. Net position in Green versus price in Red. Money Managers net sold 871 contracts between July 1– July 8, bringing their total position to a net short 43,319 contracts.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

Active

Sell SEP ’26 Cash

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- CONTINUED OPPORTUNITY – Sell the first portion of your 2026 Minneapolis wheat crop.

- Plan A:

- Make your first sale.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Sales Recs: Now one sales recommendation made to date, at a price of 678.75.

- Changes:

- A downside sales stop of 639 has been added to the Plan B strategy.

- Changes:

- Sales Recs: Now one sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holds Above Support

Spring wheat futures held above the upper end of their prior range for most of June, supported by a confluence of major moving averages. The June high near 665 is the next upside target. Key support lies at the 200-day moving average around 607, with a close below that level — and especially under the May low of 572.50 — likely opening the door to increased downside risk.

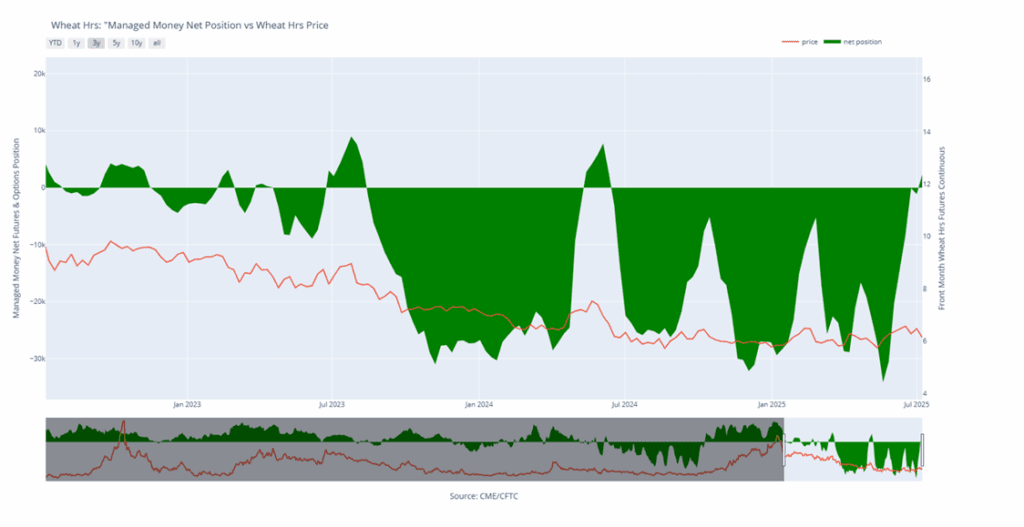

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, July 8. Net position in Green versus price in Red. Money Managers net bought 3,426 contracts between July 1 – July 8, bringing their total position to a net long 2,287 contracts.

Other Charts / Weather