7-11 End of Day: WASDE Report Provides Little Support as Grains End Lower

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 396 | -3.25 |

| DEC ’25 | 412.25 | -4.25 |

| DEC ’26 | 450.5 | -2.5 |

| Soybeans | ||

| AUG ’25 | 1004.25 | -8.25 |

| NOV ’25 | 1007.25 | -6.5 |

| NOV ’26 | 1044 | -4.25 |

| Chicago Wheat | ||

| SEP ’25 | 545 | -9.5 |

| DEC ’25 | 565.5 | -9.5 |

| JUL ’26 | 601.5 | -10.5 |

| K.C. Wheat | ||

| SEP ’25 | 524.25 | -10.5 |

| DEC ’25 | 548.25 | -10 |

| JUL ’26 | 594.75 | -9.5 |

| Mpls Wheat | ||

| SEP ’25 | 6.1375 | -0.18 |

| DEC ’25 | 6.335 | -0.1825 |

| SEP ’26 | 6.6225 | -0.165 |

| S&P 500 | ||

| SEP ’25 | 6309.5 | -14.75 |

| Crude Oil | ||

| SEP ’25 | 67.1 | 1.72 |

| Gold | ||

| OCT ’25 | 3399.5 | 46.2 |

Grain Market Highlights

- 🌽 Corn: Corn futures ended lower Friday, capping a losing week as traders shrugged off mildly supportive USDA data and stayed focused on favorable U.S. weather, which could lift future yield estimates.

- 🌱 Soybeans: Soybeans ended lower Friday, as traders largely ignored a neutral-to-slightly-bearish WASDE report and turned focus back to favorable U.S. weather. Soybean meal closed lower, while bean oil gained.

- 🌾 Wheat: Wheat futures closed lower across all classes Friday, pressured by a rising U.S. dollar, higher global production estimates, and better-than-expected U.S. spring wheat output.

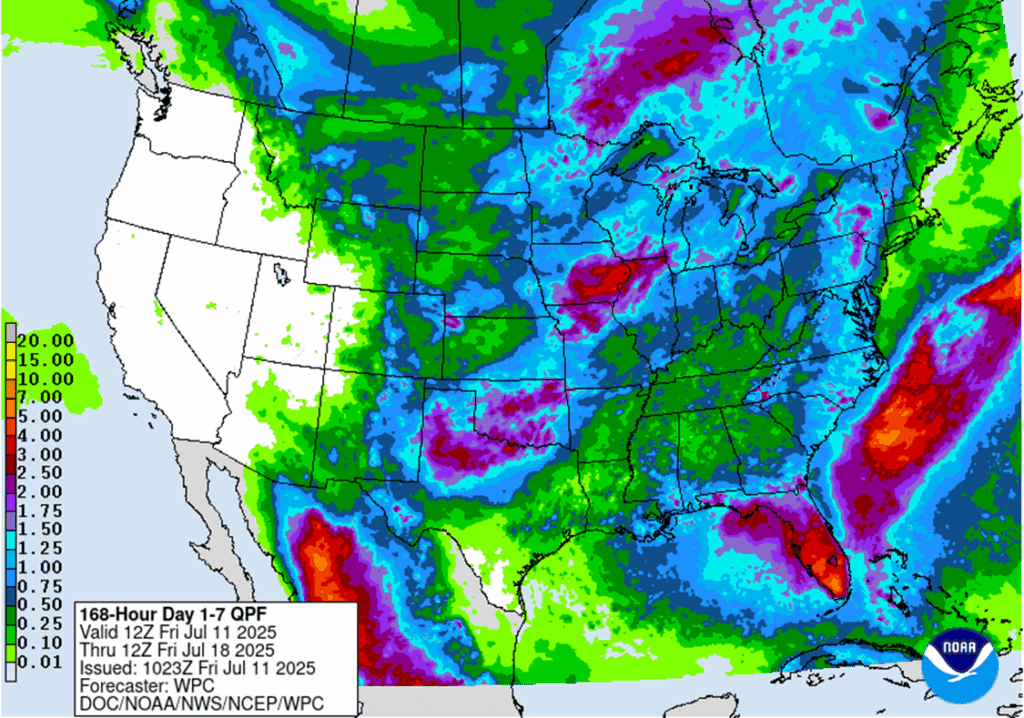

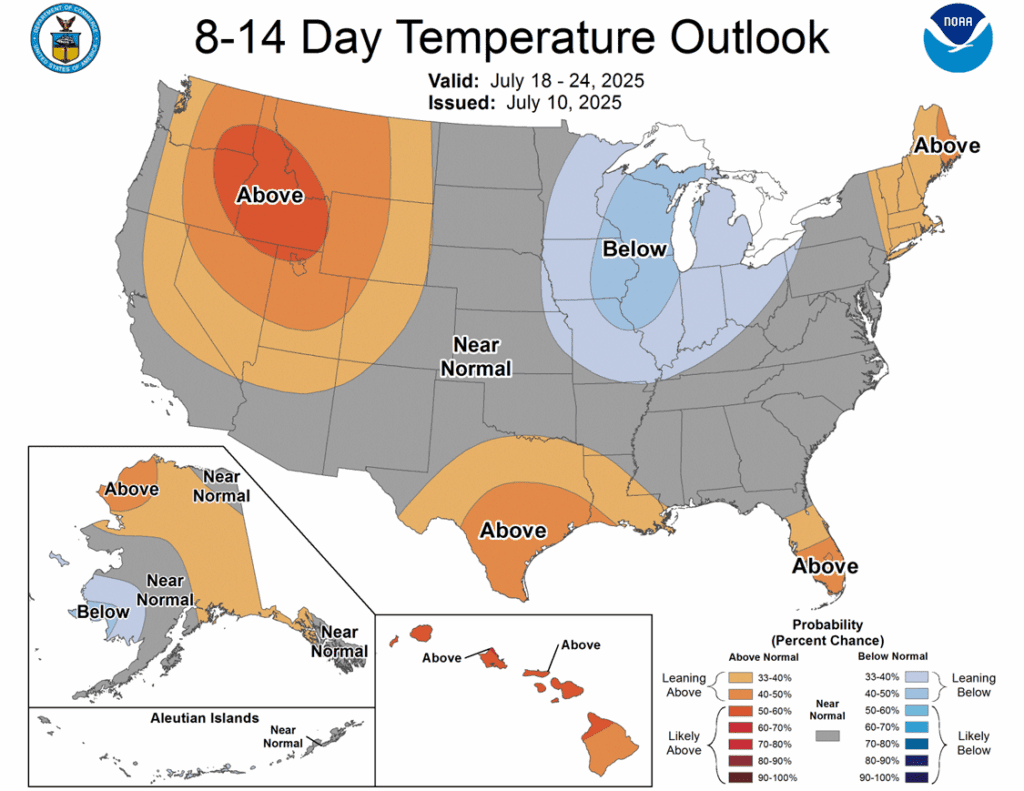

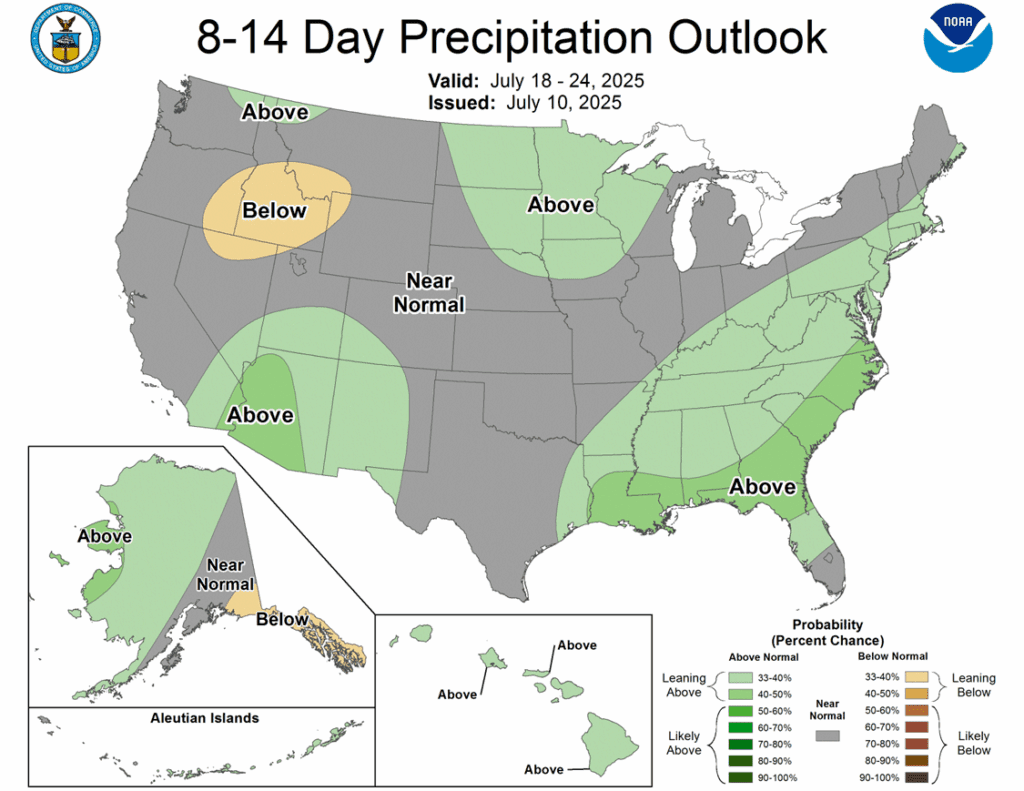

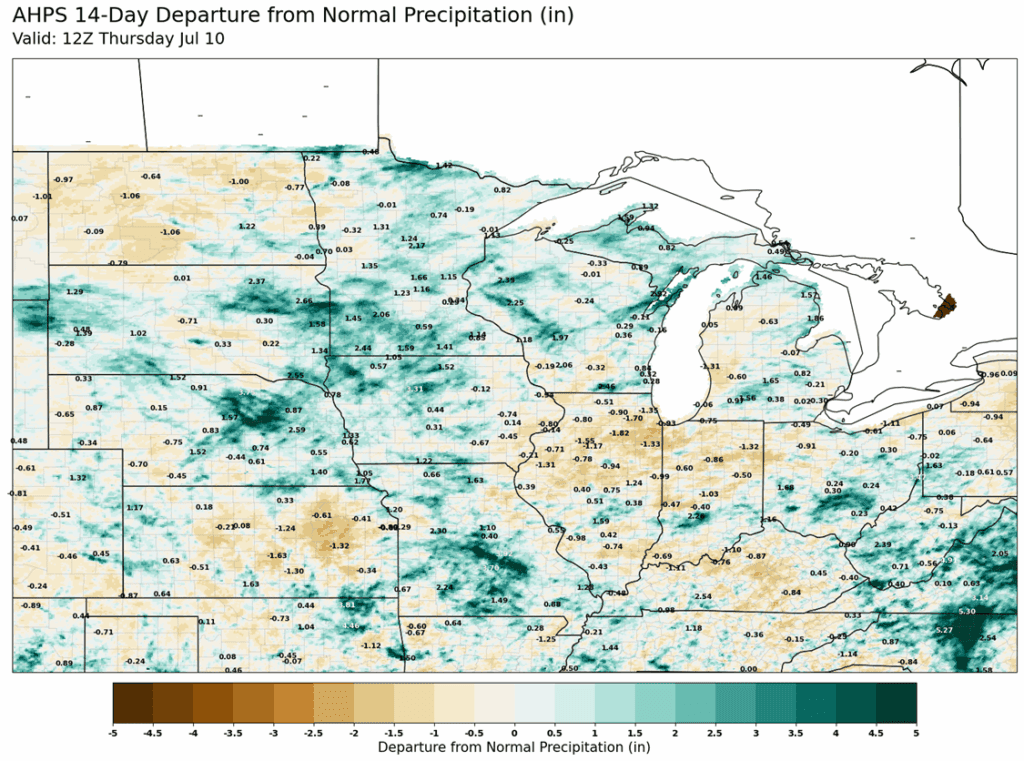

- To see update U.S. weather maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

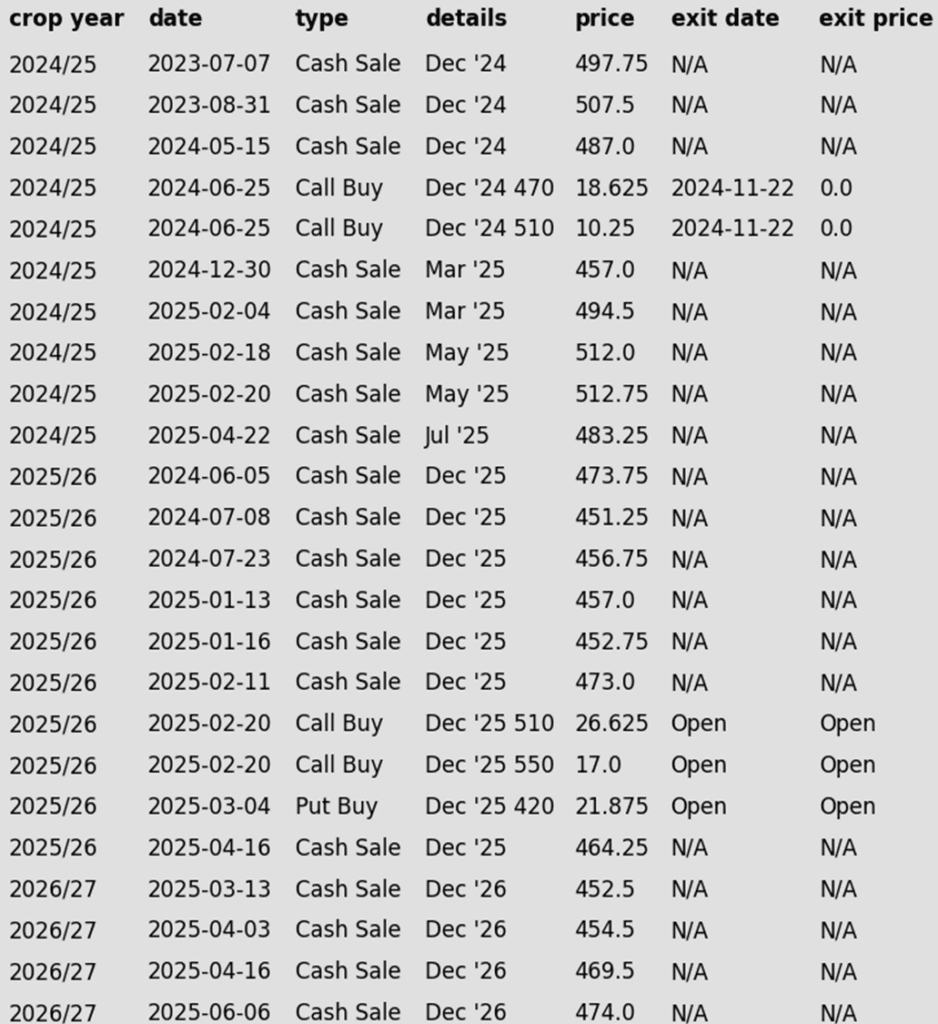

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- There is unlikely to be any further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. Any remaining old crop 2024 corn should be getting priced into market strength. Next week the 2024 crop will drop off the report.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

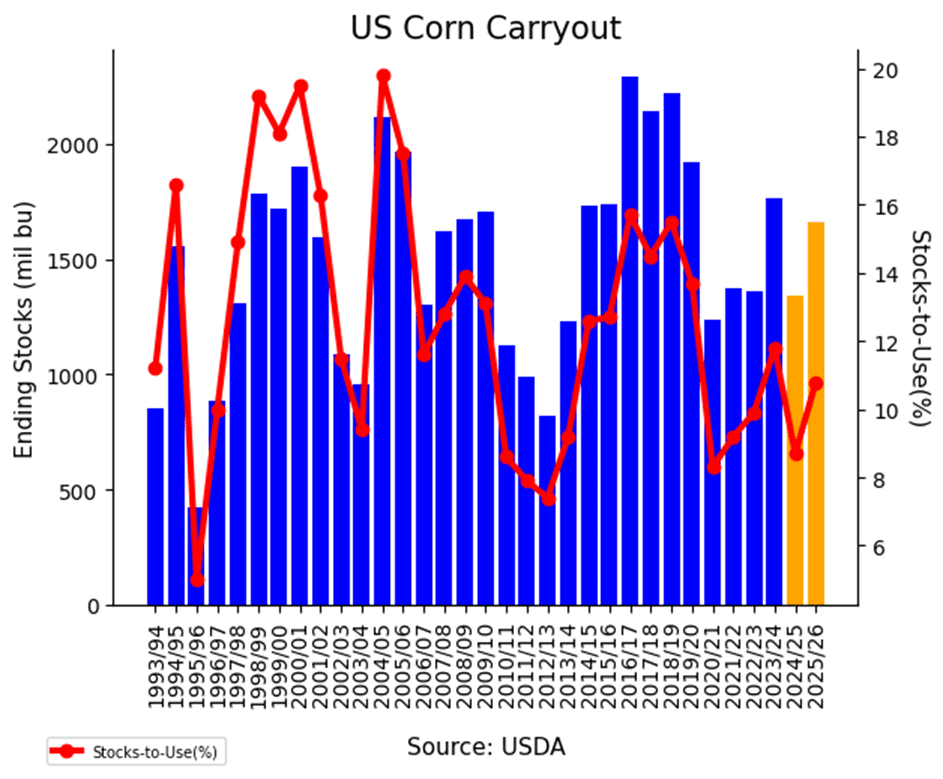

- Corn futures closed lower on Friday, wrapping up the week with losses following the release of the highly anticipated USDA WASDE report. Despite the report offering somewhat supportive figures, the market failed to gain traction. Traders remained focused on favorable weather conditions across key growing regions, which could lead to increased production estimates in future reports.

- The July WASDE trimmed 2024/25 U.S. corn ending stocks by 25 mb to 1.340 bb, with exports raised 100 mb and feed usage cut 75 mb. Production was revised to 15.705 bb, down 115 mb due to lower harvested acreage; yield held at 181.0 bpa.

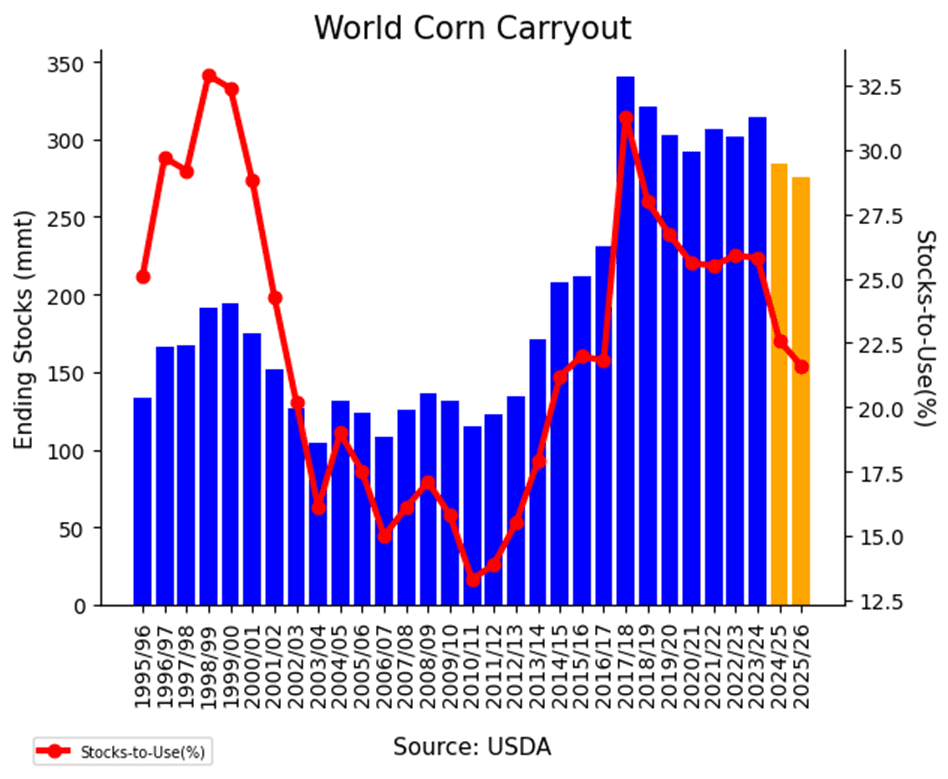

- On the global front, the July WASDE report raised Brazil’s 2024/25 corn production estimate by 2 million metric tons to 132 MMT—on the low end of trade expectations. Meanwhile, projected 2025/26 global ending stocks were pegged at 272 MMT, down 3.2 MMT from the previous estimate and notably below market expectations.

- Weather continues to play a critical role in shaping corn market sentiment. In South America, harvest progress moves steadily forward, with Brazil 40% complete and Argentina at 70.4%. In the U.S., attention remains focused on weather developments as parts of the Corn Belt face ongoing drought stress. Currently, 12% of the U.S. corn crop is experiencing drought conditions—up from 7% at the same time last year.

Corn Futures Break to New Lows

Front-month corn futures struggled through June, breaking key support and leaving an unfilled gap near 430 after the roll to September—now the first upside target. On the downside, stronger support emerges at 394.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

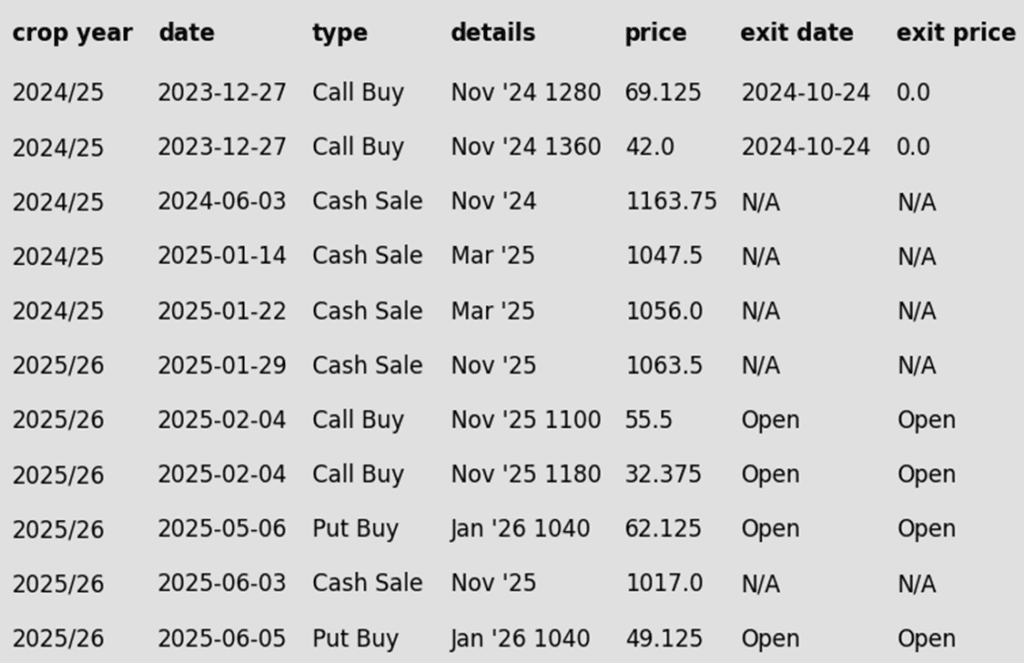

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- There is unlikely to be any further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. Any remaining old crop 2024 soybeans should be getting priced into market strength. Next week the 2024 crop will drop off the report.

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

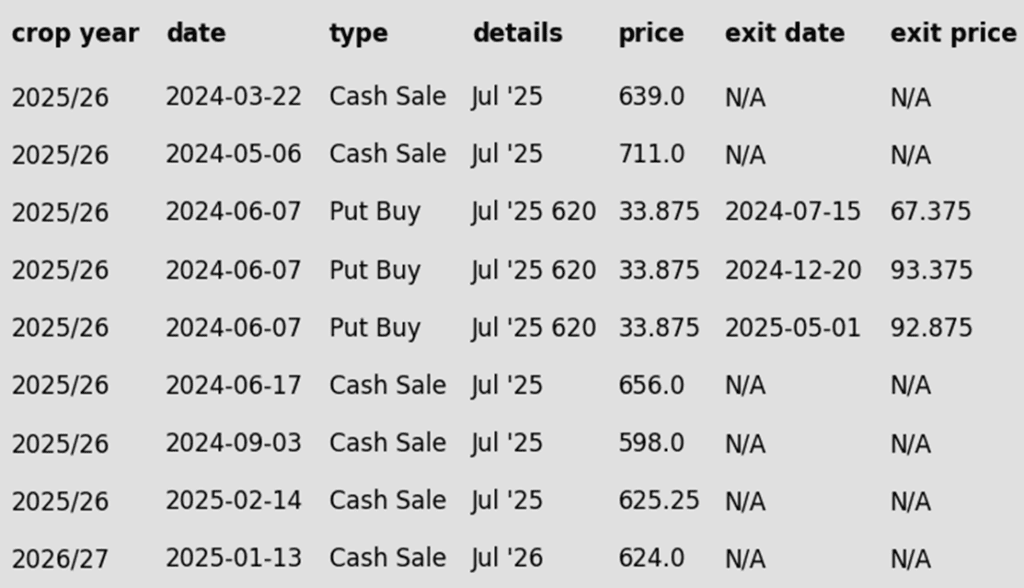

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower following a neutral to slightly bearish WASDE report. Traders likely shrugged off today’s numbers to focus on weather instead which is expected to continue being beneficial for the crop. Next month’s report will likely hold more changes. Soybean meal was lower to end the day while bean oil was higher.

- This morning, private exporters reported a sale of 219,900 metric tons of soybeans for delivery to Mexico during the 25/26 marketing year. Yesterday’s export sales were decent as well but have been overshadowed by weather trade.

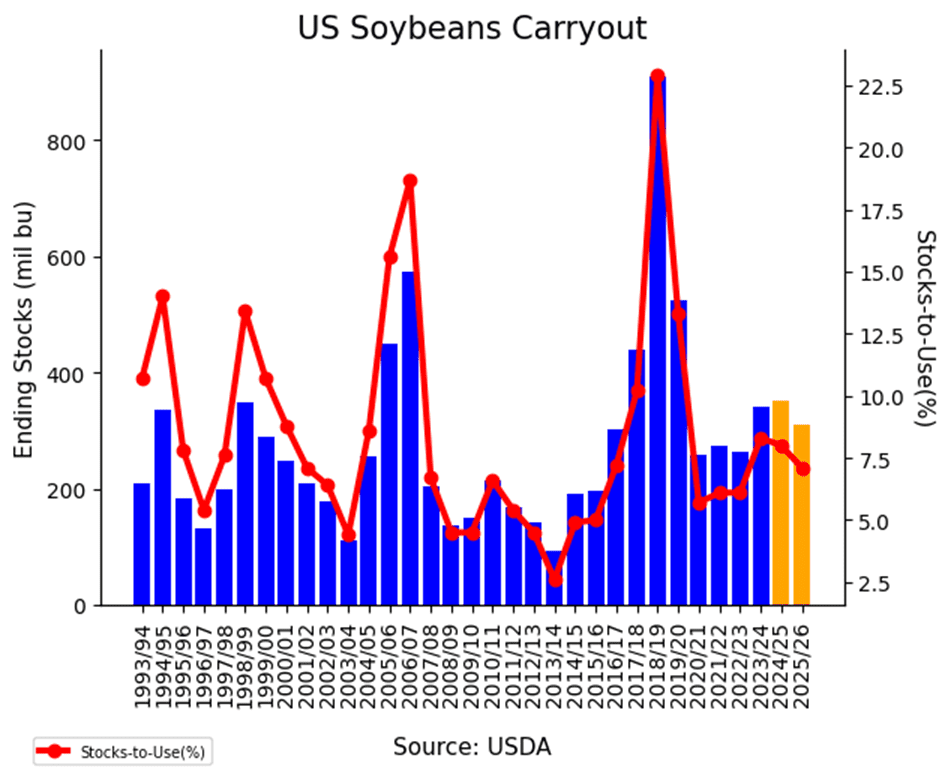

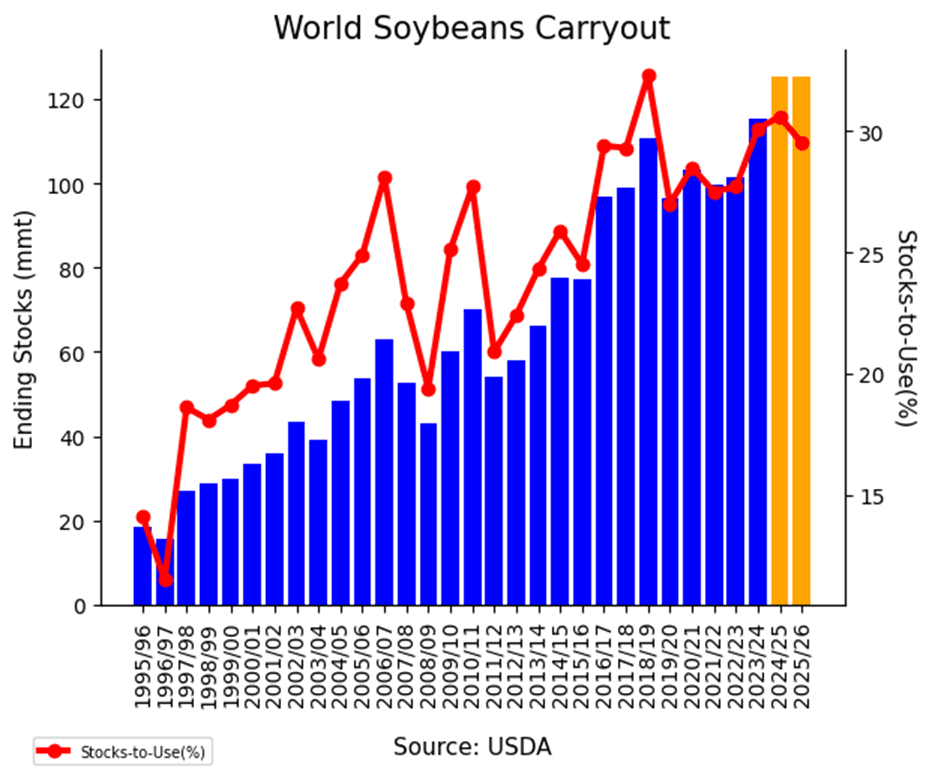

- Highlights from today’s WASDE report saw predictions for the 25/26 soybean crop decreased slightly from last month’s guess. Ending stocks for 24/25 were unchanged at 350 mb and ending stocks for 25/26 were called higher at 310 mb vs 295 mb last month. Yields were unchanged, new crop bean exports were lowered, but soybean crush was increased to 2.54 from 2.49.

- For the week, August soybeans lost 51-1/2 cents to $10.04-1/4 and November lost 42 cents to $10.07-1/4. August soybean meal lost $7.10 to $270.30 while August soybean oil lost 0.80 cents to 53.75 cents.

Soybeans Break Below 200-day

Soybeans failed to break above key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. A close above that level would target the June 2023 gap between 1161 and 1177. On the downside, futures recently slipped below the 200-day moving average, with next support at the April low near 980.

Wheat

Market Notes: Wheat

- Wheat futures closed lower across all classes Friday, pressured by a rising U.S. dollar, higher global production estimates, and better-than-expected U.S. spring wheat output.

- The July WASDE pegged all U.S. wheat production at 1.929 bb, up 8 mb from June and above expectations. Yields were raised to 54.2 bpa. U.S. exports for 2025/26 were also increased by 25 mb.

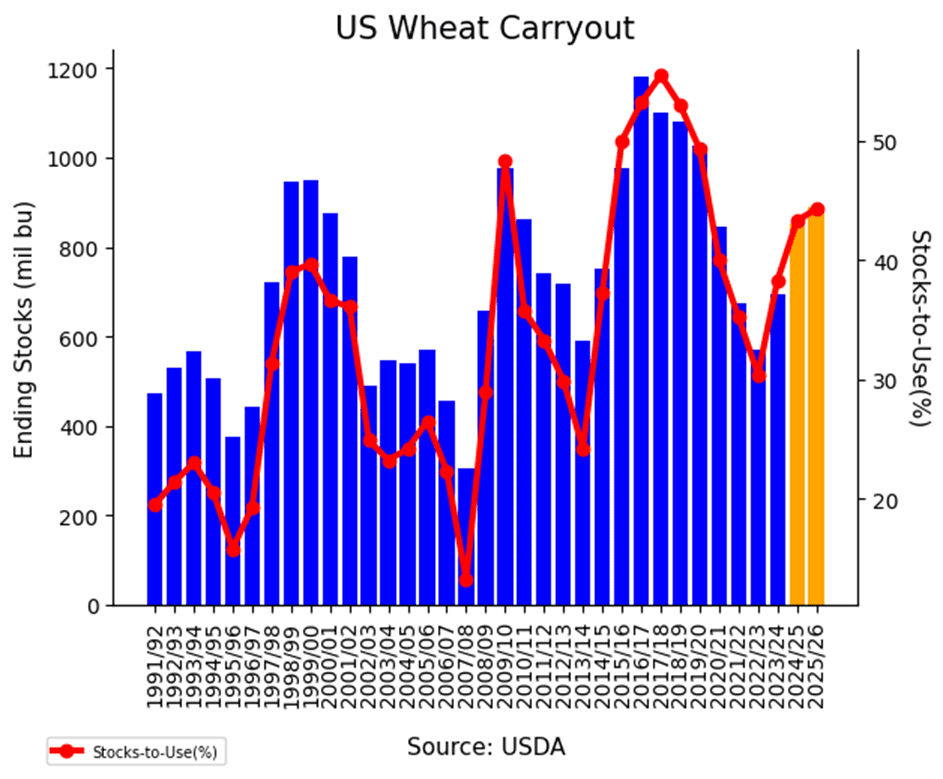

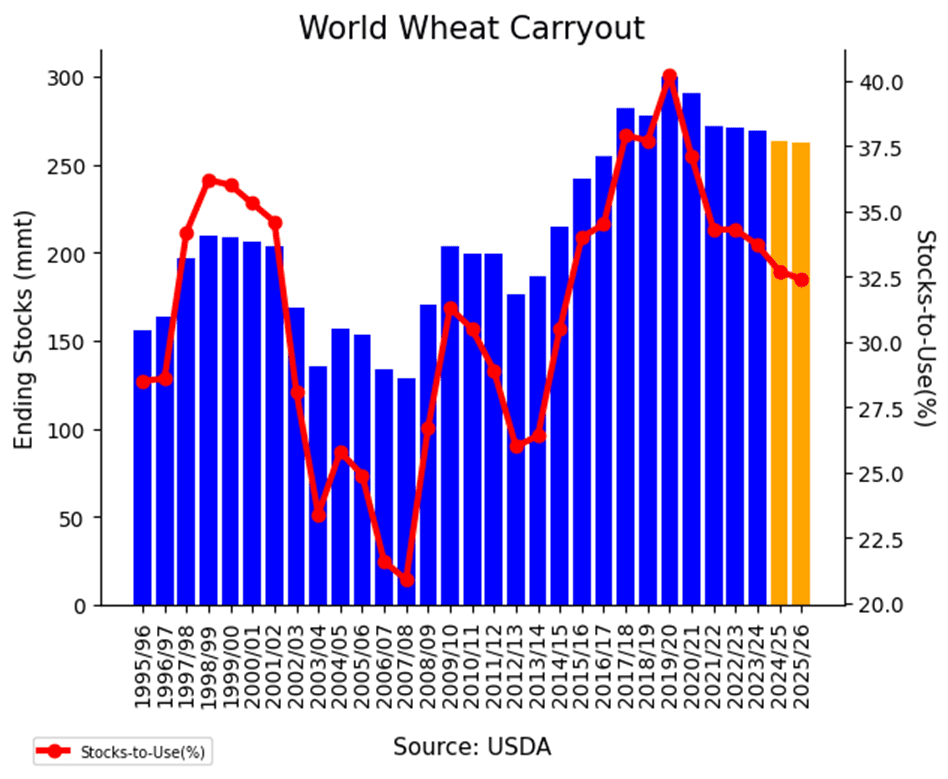

- U.S. 2024/25 ending stocks rose 10 mb to 851 mb, while 2025/26 stocks were trimmed 8 mb to 890 mb. Globally, 2024/25 stocks were lowered 0.4 MMT to 263.6 MMT, and 2025/26 fell 1.3 MMT to 261.5 MMT.

- As for some of the world numbers, the USDA estimated EU wheat production up 0.7 mmt to 137.25 mmt and Russian production increased 0.5 mmt to 83.5 mmt. However, they kept Chinese production steady at 142 mmt.

- The 25/26 wheat crop in Argentina is said to have gotten a boost in condition from recent rainfall, according to the Buenos Aires Grain Exchange. An estimated 91% of the crop is planted, with the total projected sowing at 6.7 million hectares.

- The Ukrainian agriculture ministry has said that approximately 2.6 mmt of grain has been harvested so far. Of that total, wheat accounts for 1.2 mmt. However, for wheat this is down 78% when compared with the 8.4 mmt harvested at this time last year.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 681 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- Upside target of 675 was adjusted to 681.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Returns to Recent Range

Chicago wheat’s sharp mid-June rally proved short-lived, with futures retreating to the upper end of the 2025 range. Initial support lies at the 50-day moving average, with a break targeting the June low of 522.25. On the upside, a weekly close above 558 could open the door for a retest of the recent highs near 590.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

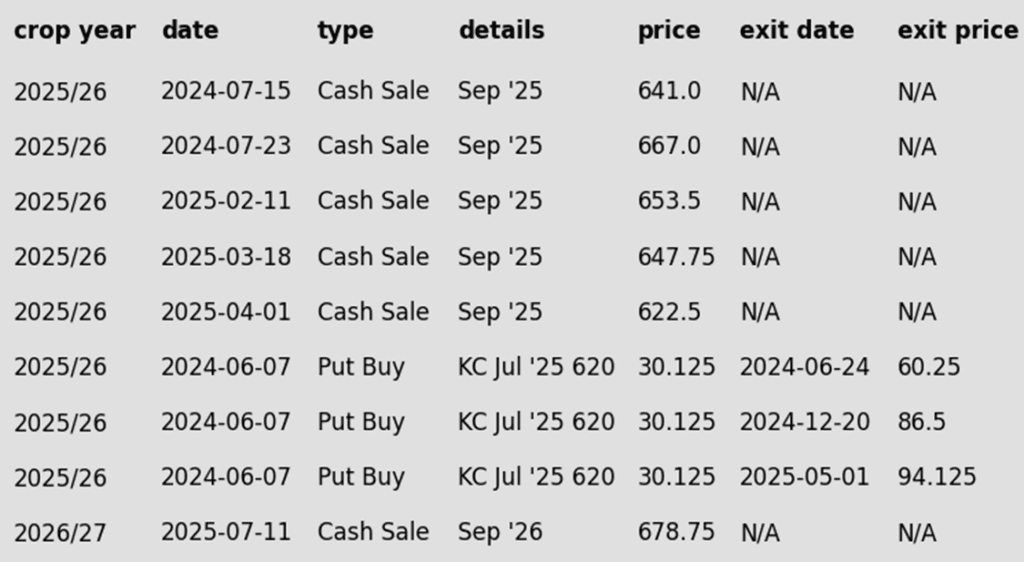

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 688 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- Upside target of 693 was adjusted lower to 688.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Back Near Support

Strength in June pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness late in June sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75.

Action Plan: Mpls Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

New Alert

Sell SEP ’26 Cash

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- NEW ALERT – Sell the first portion of your 2026 Minneapolis wheat crop today.

- Plan A:

- Make your first sale today.

- Plan B:

- Sell a second portion if September ‘26 closes below 639 support.

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Sales Recs: Now one sales recommendation made to date, at a price of 678.75.

- Changes:

- A downside sales stop of 639 has been added to the Plan B strategy.

- Changes:

- Sales Recs: Now one sales recommendation made to date, at a price of 678.75.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holds Above Support

Spring wheat futures held above the upper end of their prior range for most of June, supported by a confluence of major moving averages. The June high near 665 is the next upside target. Key support lies at the 200-day moving average around 607, with a close below that level — and especially under the May low of 572.50 — likely opening the door to increased downside risk.

Other Charts / Weather