7-10 End of Day: Traders Position Ahead of Friday’s USDA’s WASDE Report

All Prices as of 2:00 pm Central Time

| Corn | ||

| SEP ’25 | 399.25 | 0 |

| DEC ’25 | 416.5 | 1 |

| DEC ’26 | 453 | 0.5 |

| Soybeans | ||

| AUG ’25 | 1012.5 | 3.5 |

| NOV ’25 | 1013.75 | 6.5 |

| NOV ’26 | 1048.25 | 6.25 |

| Chicago Wheat | ||

| SEP ’25 | 554.5 | 7.5 |

| DEC ’25 | 575 | 7.75 |

| JUL ’26 | 612 | 8 |

| K.C. Wheat | ||

| SEP ’25 | 534.75 | 10.75 |

| DEC ’25 | 558.25 | 10.5 |

| JUL ’26 | 604.25 | 10.25 |

| Mpls Wheat | ||

| SEP ’25 | 631.75 | 0.25 |

| DEC ’25 | 651.75 | 1.75 |

| SEP ’26 | 678.75 | 4 |

| S&P 500 | ||

| SEP ’25 | 6331 | 23.75 |

| Crude Oil | ||

| SEP ’25 | 65.49 | -1.48 |

| Gold | ||

| OCT ’25 | 3353.4 | 4.9 |

Grain Market Highlights

- 🌽 Corn: Corn futures closed Thursday’s session mixed, with some contracts edging higher. The market found modest support as traders positioned ahead of Friday’s USDA WASDE report.

- 🌱 Soybeans: Soybean futures closed higher on Thursday, breaking a three-day losing streak. The market found support from today’s export sales report by the USDA, along with positioning ahead of Friday’s closely watched WASDE report.

- 🌾 Wheat: Wheat futures ended Thursday’s trade on a positive note, with all three classes posting gains. The market found support from mounting concerns over worsening drought conditions in key U.S. wheat-growing regions, which continue to stress crop development and yield potential.

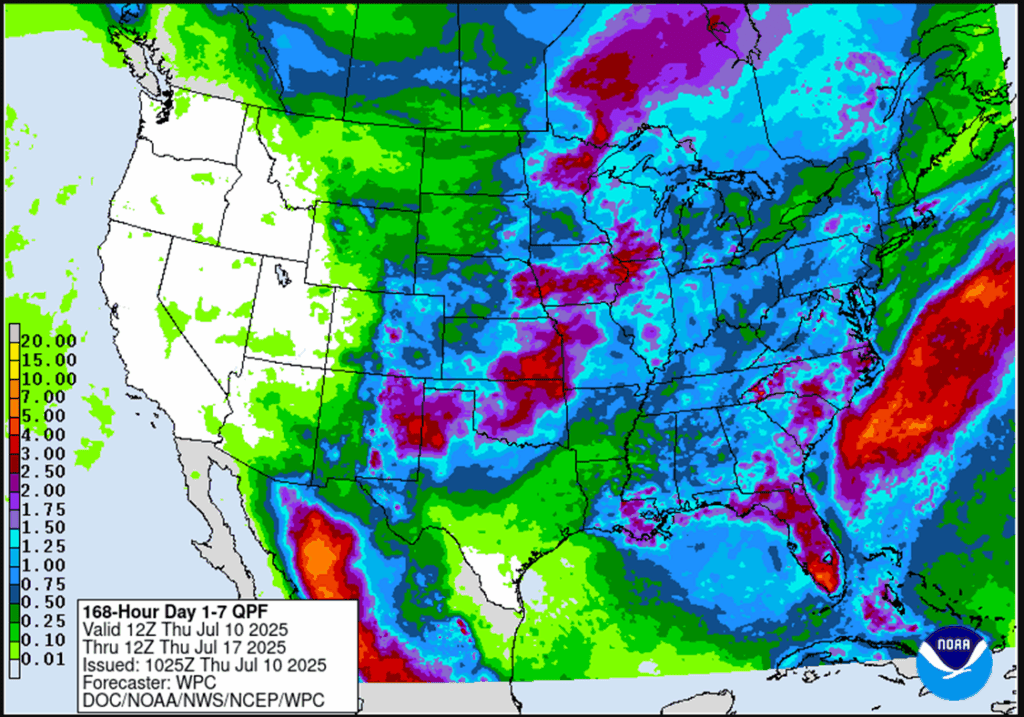

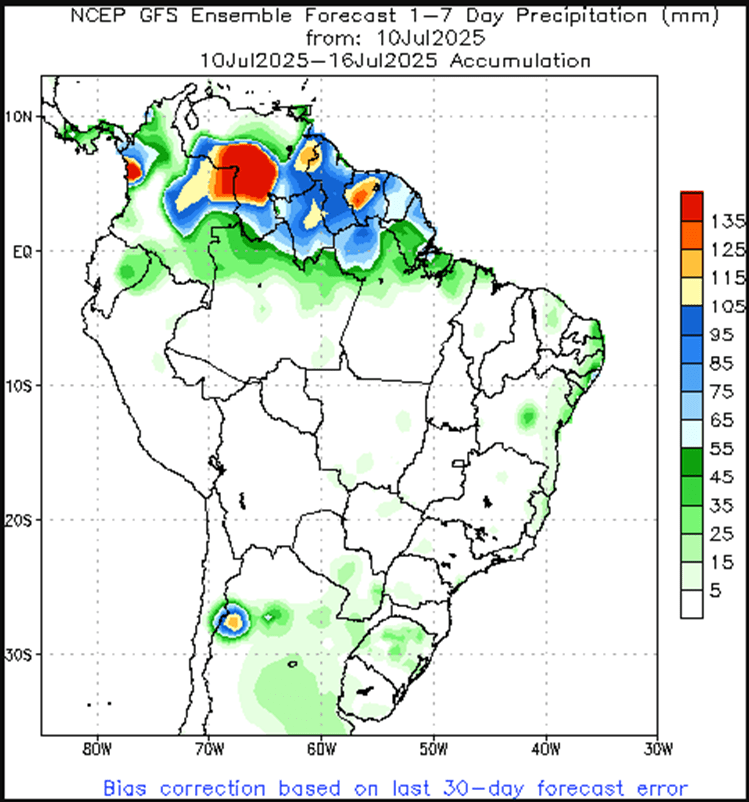

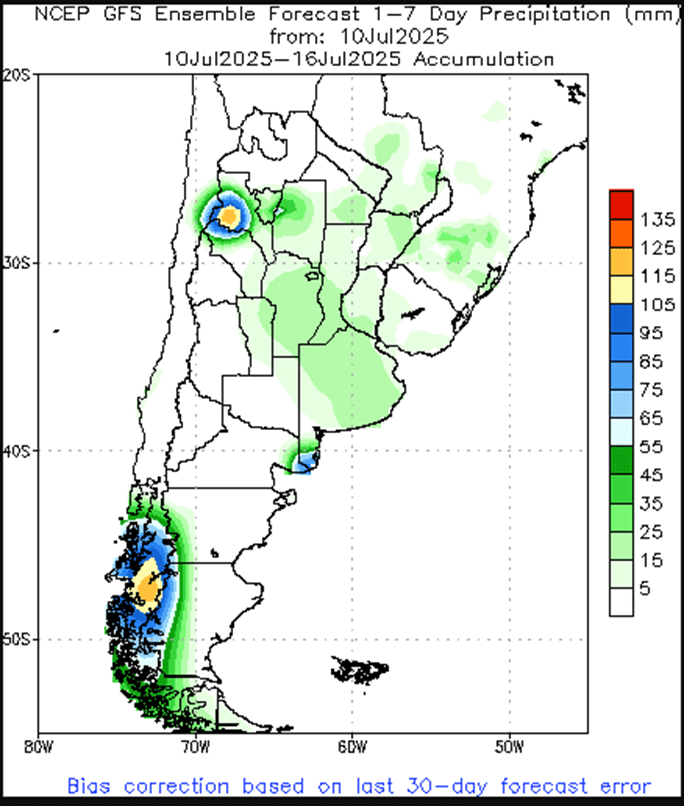

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Wheat section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- There is unlikely to be any further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. Any remaining old crop 2024 corn should be getting priced into market strength. Next week the 2024 crop will drop off the report.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

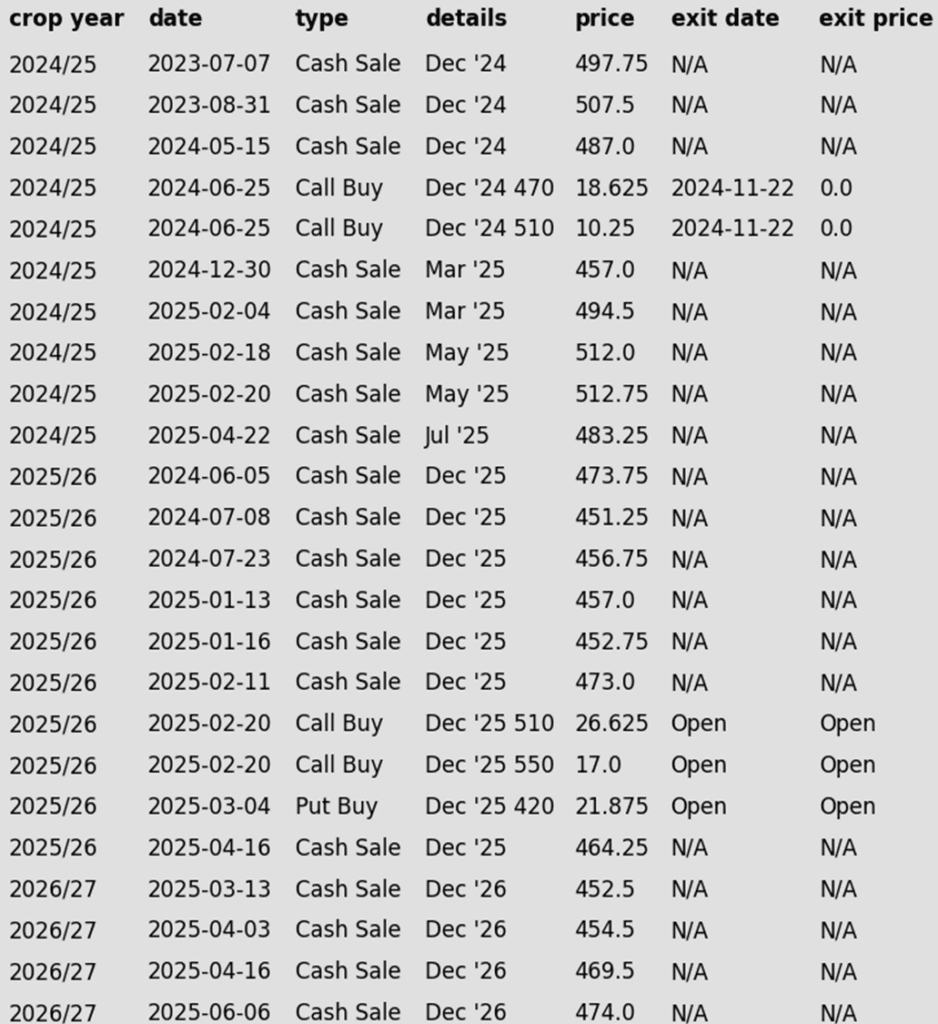

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

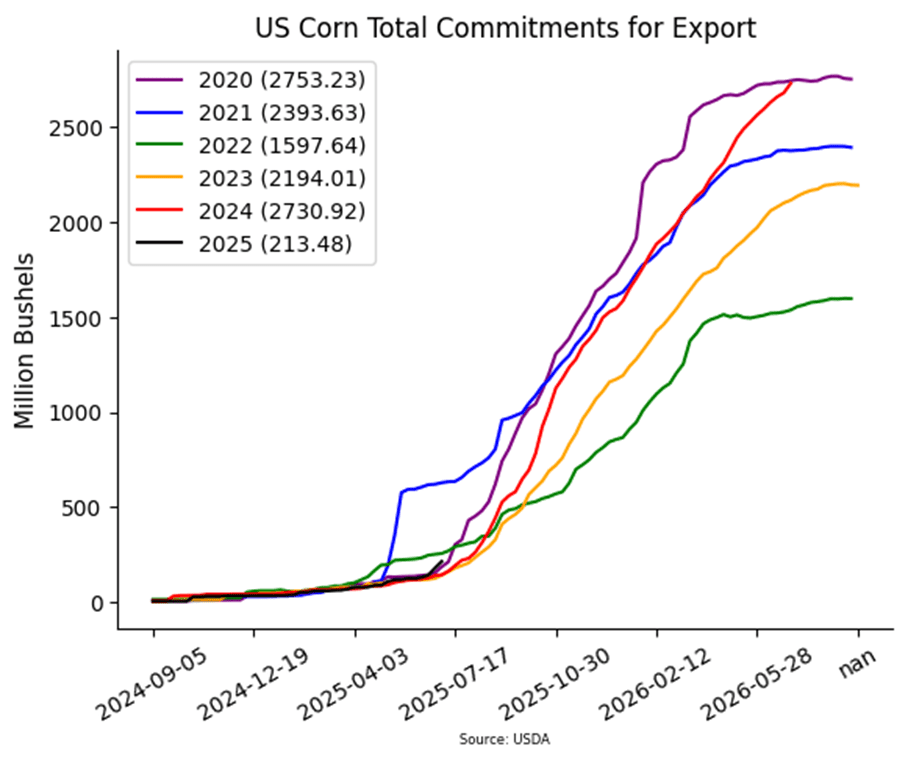

- Corn futures finished Thursday’s session with mixed to mostly higher trade. Support came from short covering and a firm demand tone, bolstered by solid export sales reported by the USDA Thursday morning. The market remains in oversold territory, prompting some positioning ahead of Friday’s USDA July WASDE report.

- The USDA is set to release its next WASDE and Crop Production report on Friday. While corn yield estimates are likely to remain unchanged until the August update, the trade is watching closely for revisions to planted acreage and old crop demand. Current export sales of old crop corn are running ahead of USDA projections for the marketing year, leading analysts to anticipate potential demand adjustments that could reduce old crop ending stocks and tighten new crop carryout expectations.

- The USDA released weekly export sales on Thursday morning. For the week ending July 3, U.S. exporters reported new sales of 1.262 MMT (49.7 MB) for the 2024-25 marketing year and 888,600 MT (35.0 MB) for the 2025-26 marketing year. These totals were above analyst expectations for both years. With today’s reported sales, old crop total commitments are at 2.731 BB with the USDA target of 2.675 BB for the marketing year.

- The Brazil Ag agency, CONAB, raised the forecast for this year’s Brazil corn on their July report. CONAB expects this year’s corn crop to reach 131.97 MMT, up 3.721 MMT from June. The agency also raised Brazil corn exports by 2 MMT from their June estimates.

- On Wednesday, President Trump announced a 50% tariff on Brazil imports to go into effect on August 1. The announcement pushed the Brazilian real currency to its lowest levels since the first of June versus the U.S. dollar. The break in currency value reduces the cost on Brazil grain products on the export market.

Corn Futures Back Near Lower end of Recent Range

Front-month corn futures struggled throughout June, breaking key support and leaving an unfilled chart gap following the roll to September. That gap near 430 now stands as the first upside target. On the downside, the late June low of 404 offers initial support, with stronger support seen at 394.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs August.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- There is unlikely to be any further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. Any remaining old crop 2024 soybeans should be getting priced into market strength. Next week the 2024 crop will drop off the report.

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

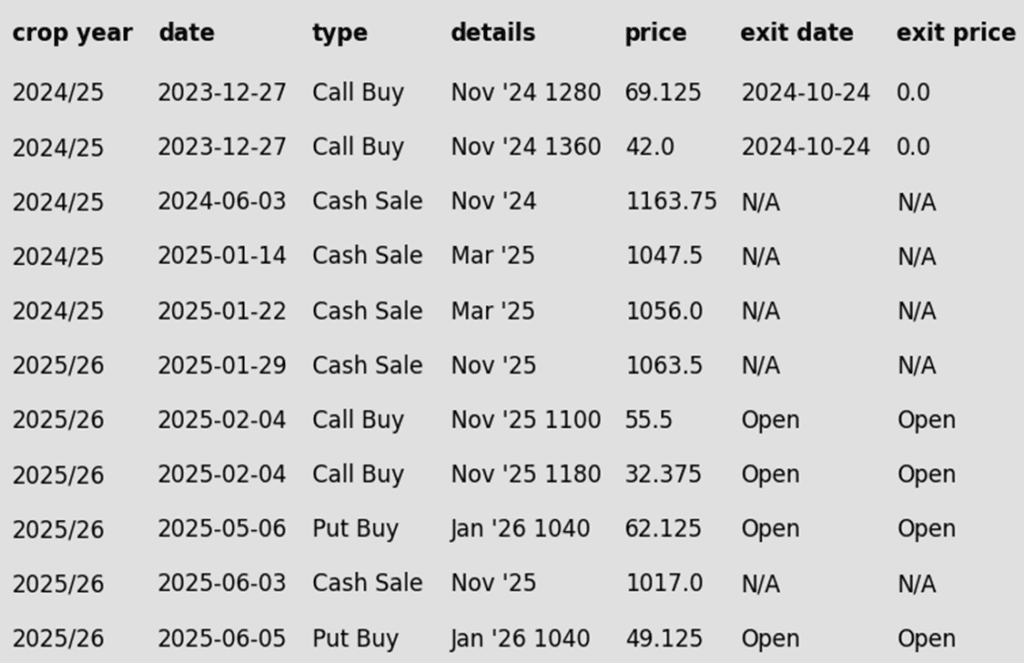

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

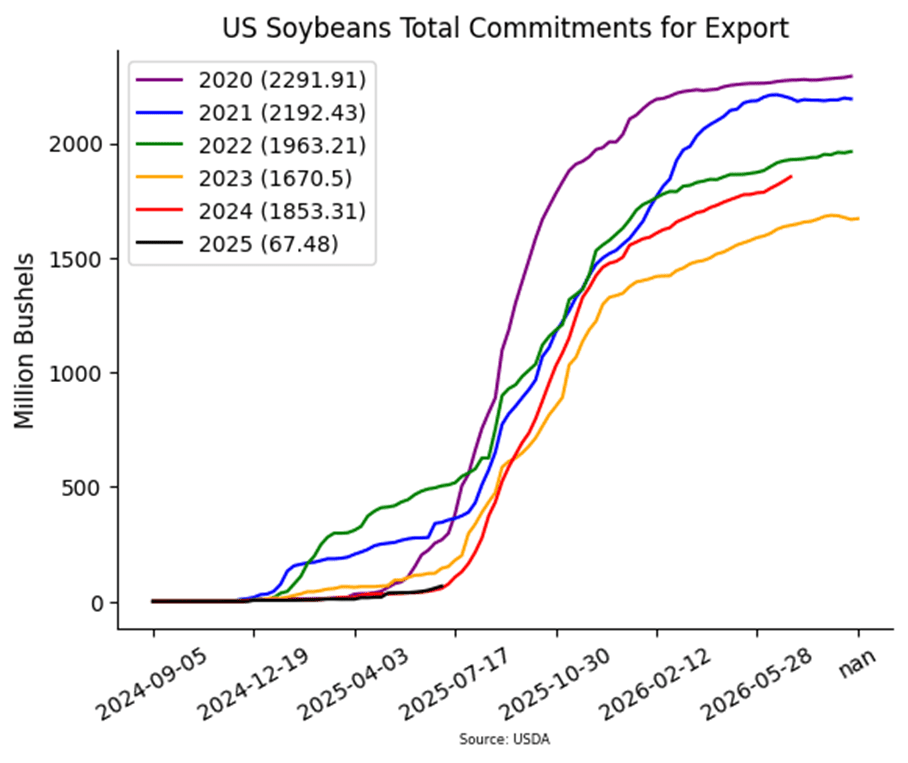

- Soybeans ended the day higher, breaking a 3-day losing streak which has seen August futures lose 43 cents for the week so far. Traders may have been covering short positions ahead of tomorrow’s WASDE report, and export sales were within expectations. Both soybean meal and oil ended the day higher as well.

- Pre-report estimates for tomorrow’s USDA update estimate old crop soybean ending stocks at 358 mb which would be up from June’s 350 mb, and new crop 2025/26 stocks at 302 mb which would compare to 295 mb in June.

- Today’s export sales report saw an increase in soybean sales of 18.5 million bushels, which was up 9% from the previous week and 43% from the prior 4-week average. Top buyers were unknown destinations, Egypt, and Japan. Last week’s export shipments of 14.5 mb were above the 14.1 mb needed each week to meet USDA expectations.

- While prices recovered slightly today, soybean meal prices have pushed lower as the increase in crush demand for oil has produced an excess supply of soybean meal on the global market.

Soybeans Retreat from Recent Highs

Soybeans failed to close above key resistance at the May high of 1082 in mid-June, keeping the broader trend sideways. A breakout above 1082 would open the door toward filling the June 2023 gap between 1161 and 1177. Soybean futures found support last week at the 200-day moving average and the bottom end of the recent range near 1030. A break below the 200-day would likely open the door to a test of the April lows near 980.

Wheat

Market Notes: Wheat

- Wheat closed in the green across all three classes, boosted by sharply higher Paris milling wheat futures, worsening drought conditions in U.S. wheat areas, and expectations for lower U.S. production on tomorrow’s WASDE report. There may have also been a short covering technical bounce with futures having recently become oversold.

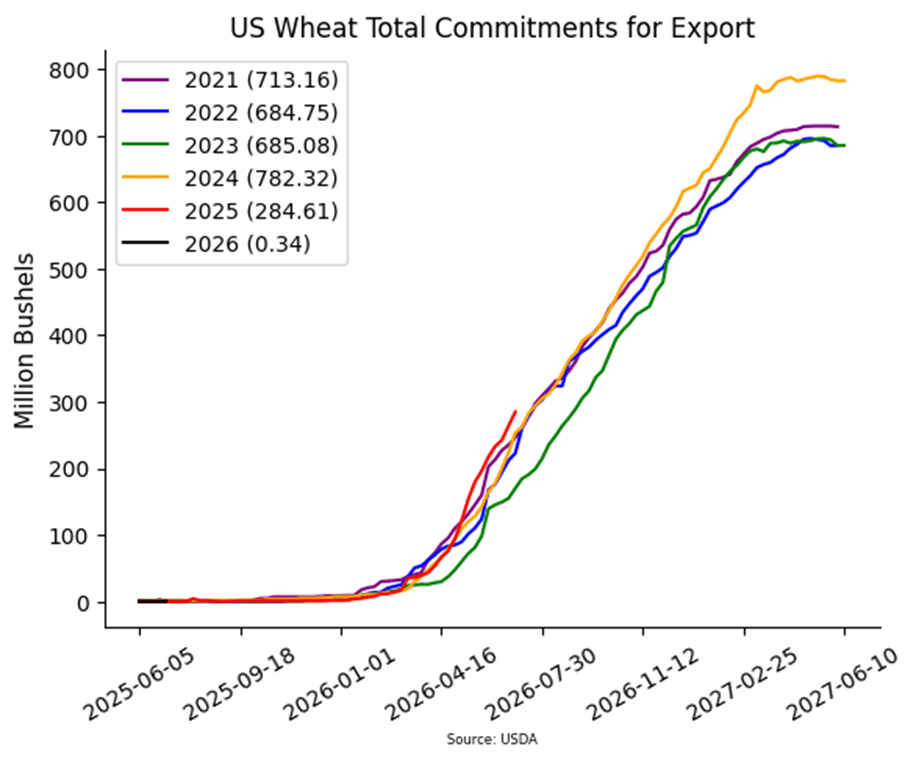

- The USDA reported an increase of 20.9 mb of wheat export sales for 25/26 and an increase of 0.3 mb for 26/27. Shipments last week totaled 16.4 mb, which was above the 16.2 mb pace needed per week to reach the USDA 25/26 export goal of 825 mb. Export commitments for 25/26 have reached 285 mb, which is up 9% from last year.

- The average pre-report estimate for 25/26 all wheat production is pegged at 1.903 bb, down from 1.921 in June and 1.971 last year. U.S. 24/25 wheat ending stocks are expected to rise from 841 mb to 848, while 25/26 is expected to decline from 898 mb to 893. Global 24/25 wheat carryout is anticipated to come in 0.3 mmt higher than last month at 264.3 mmt, and for 25/26 is expected to rise 1.9 mmt to 264.7 mmt.

- CONAB has reduced their estimate of Brazilian wheat production by 0.4 mmt to 7.8 mmt. For reference, the USDA is using a production figure of 8 mmt. Meanwhile, China is also reported to have lowered their wheat production forecast by 0.1% to 138.16 mmt. The USDA’s projection is sitting at 142 mmt, though this could be adjusted on tomorrow’s report.

- According to the USDA, as of July 8, an estimated 26% of U.S. winter wheat acres are experiencing drought conditions, which is up 2% from last week. During the same period, spring wheat increased 6% to 35% of the area in drought. This is well above the July 9, 2024 reading of just 7%.

Action Plan: Chicago Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

2027 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

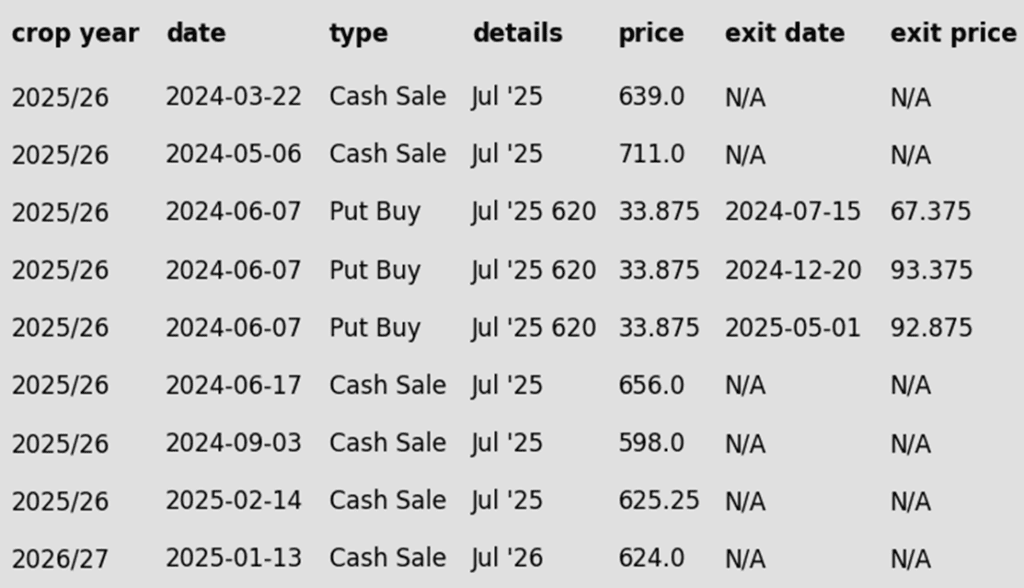

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Returns to Recent Range

A sharp rally in mid-June was short lived for Chicago wheat futures. Prices have now returned back to the upper end of the range that has held prices for much of 2025. Initial support is at the June low of 522.25, with a break below that exposing further downside toward 506.25. On the upside, a weekly close above 558 could spark a test of the recent highs near 590.

Action Plan: KC Wheat

Calls

2025

No New Action

2026

No New Action

2027

No New Action

Cash

2025

No New Action

2026

No New Action

2027

No New Action

Puts

2025

No New Action

2026

No New Action

2027

No New Action

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if September closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A: Target 693 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

2027 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

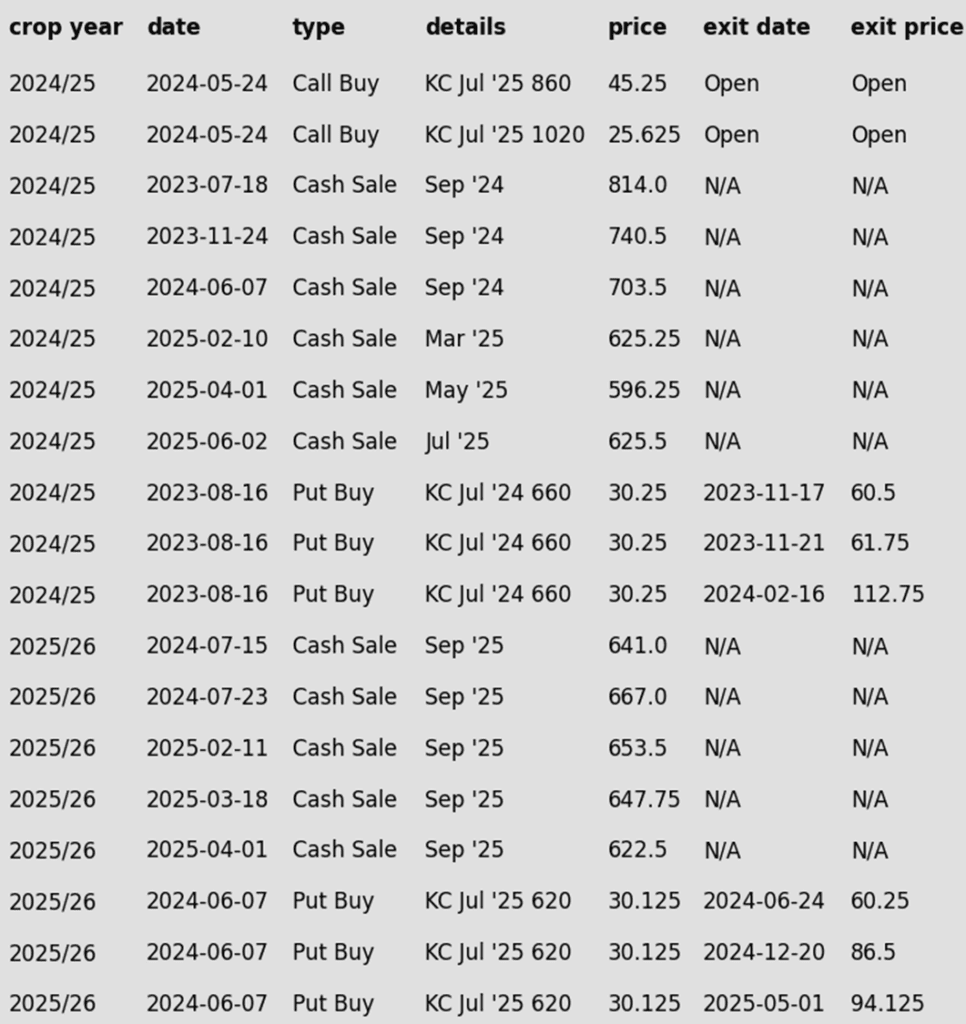

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Struggles Above Major Moving Averages

Strength in June pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness late in June sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Six sales recommendations made to date, with an average price of 684.

- Changes:

- There is no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. The 2024 crop will drop off the report tomorrow.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Changes:

- None.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat on the Move Higher

Spring wheat futures spent nearly all of June above the upper end of the previous range and above a confluence of major moving averages. The first resistance and upside target would be the June high near 665. Key support now sits at the 200-day moving average near 607. A close below that level — and especially beneath the May low of 572.50 — would open the door to further downside risk.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.