6-6 End of Day: Grains Finish Higher to End Week

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 442.5 | 3 |

| DEC ’25 | 449.25 | 1 |

| DEC ’26 | 476.25 | 1.25 |

| Soybeans | ||

| JUL ’25 | 1057.25 | 5.5 |

| NOV ’25 | 1037 | 3.75 |

| NOV ’26 | 1059.75 | 3.25 |

| Chicago Wheat | ||

| JUL ’25 | 554.75 | 9.25 |

| SEP ’25 | 568.75 | 9 |

| JUL ’26 | 625 | 8 |

| K.C. Wheat | ||

| JUL ’25 | 549.25 | 6.75 |

| SEP ’25 | 562.5 | 7 |

| JUL ’26 | 620.75 | 6 |

| Mpls Wheat | ||

| JUL ’25 | 635.25 | 10 |

| SEP ’25 | 644 | 8 |

| SEP ’26 | 681.75 | 5.75 |

| S&P 500 | ||

| SEP ’25 | 6071.75 | 72.5 |

| Crude Oil | ||

| AUG ’25 | 63.65 | 1.17 |

| Gold | ||

| AUG ’25 | 3342.1 | -33 |

Grain Market Highlights

- 🌽 Corn: Corn futures found close higher on short covering going into the weekend. Extended weather forecast turning drier helped drive prices.

- 🌱 Soybeans: Soybeans rebounded from early losses, led by concerns over drought conditions heading further into June and July.

- 🌾 Wheat: All three wheat classes finished higher today, finding support from increasing war tensions between Russia and Ukraine.

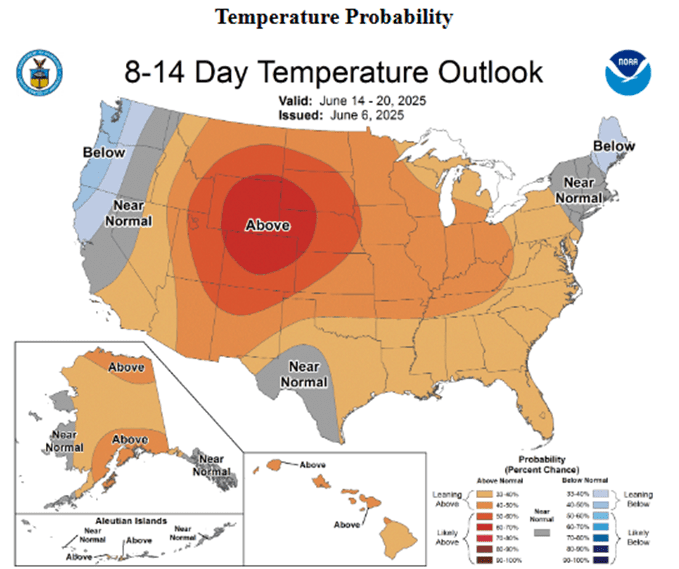

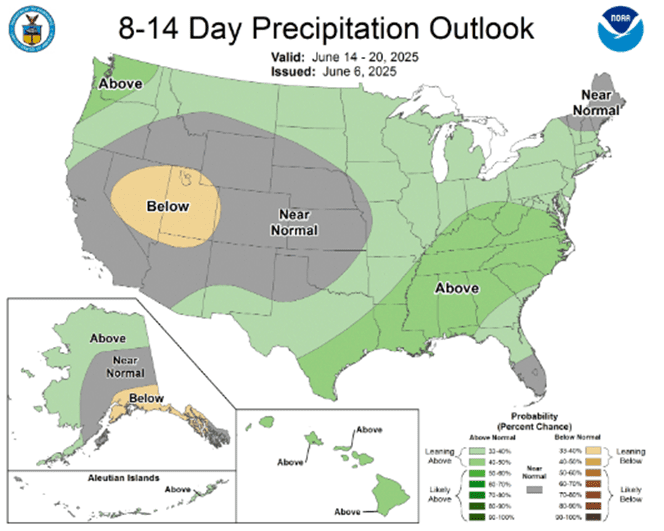

- To see the updated U.S. weather outlook maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

New Alert

Sell DEC ’26 Cash

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

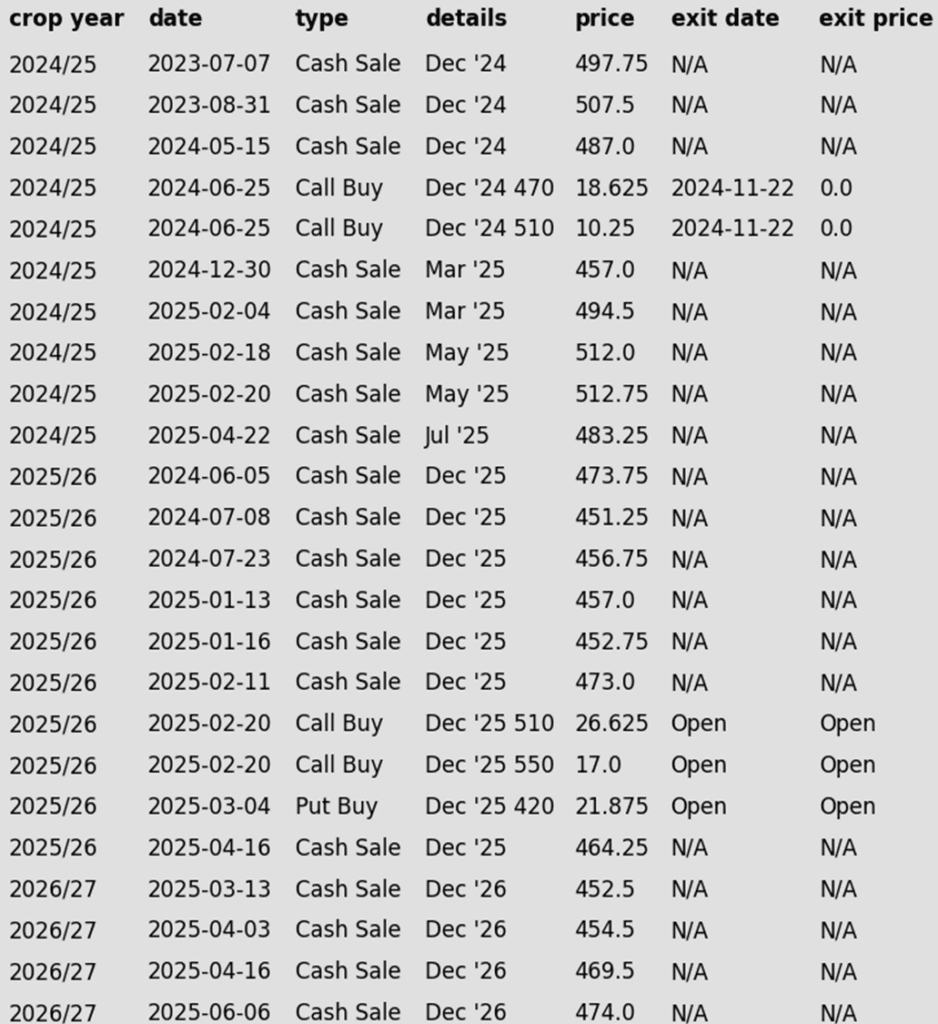

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

- Continuing to hold out for potential upside volatility during the growing season before issuing the next sales recommendations.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

- Well positioned for growing season volatility, with a solid base of sales already in place. Both upside and downside targets remain active — ready to begin legging out of open options positions and to roll down call options as market conditions warrant.

2026 Crop:

- NEW ALERT – Sell a fourth portion of your 2026 corn. The December ‘26 contract has reached the upside target of 474.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Now four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market finished the week with some buying strength, led by short covering and value buying in the July futures. December corn closed the week 10 ¾ cents higher and traded higher for 4 consecutive sessions. July corn was still 1 ½ cents lower on the week and posted its lowest weekly close since October.

- Early season weather has been favorable for a good start to this year’s corn crop, but some longer-range models are showing a possibility of drier forecast for the west-central corn belt for the end of June into July. A possible weather concern has triggered some short covering of new crop corn this week.

- USDA will release the June WASDE report on June 12. While changes will likely be minimal for new crop projections, analysts are anticipating a demand increase for old crop bushel, lowering the 2024-25 carryout projects. Solid ethanol and export demand this spring supports possible adjustments.

- Brazil corn prices have been under heavy pressure as harvest picks up speed and the prospects of a large harvest build due to good growing conditions. Weakness in Brazil corn prices have pressured old crop US corn prices.

- Despite fresh corn supplies from Argentina and Brazil in the export market, US corn prices are still competitive. Rumors were in the market that South Korea was a purchaser of corn this week out of the Pacific Northwest ports.

Corn Futures Eye Weather Risks After May Pullback

After bouncing off the key $4.50 level in April following a bullish WASDE and a break above the 50-day moving average, corn futures faced renewed pressure through May. Rapid planting progress and lingering demand concerns dragged prices back below $4.70. So far, the $4.45–$4.50 support zone — reinforced by the 200-day moving average — has held firm. With planting nearing completion, market focus is quickly shifting to summer weather. NOAA’s extended outlook for a warmer, drier Western Corn Belt could revive risk premium and set the stage for weather-driven rallies. Resistance emerges near $4.70, with stronger resistance around the April highs at $4.90.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell NOV ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

Active

Enter(Buy) JAN ’26 Puts:

1040 @ ~ 49c

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

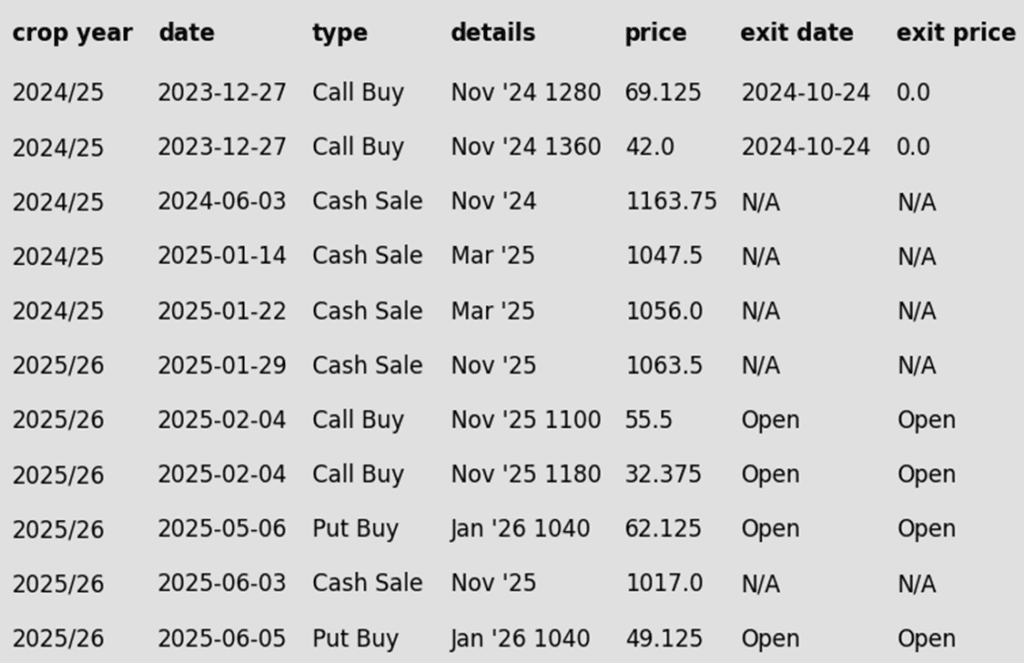

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

- No Changes (for Now): While there are no adjustments at the moment, Monday’s close below 1036 support could prompt a revision to Plan A in the near future. Stay alert for potential updates.

2025 Crop:

- CONTINUED OPPORTUNITIES –

- Buy January ‘26 1040 put options for approximately 49 cents in premium, plus fees and commission. This is a recommendation to purchase a second round of 1040 puts, following the first round advised on May 6.

- Sell another portion of your 2025 soybean crop.

- Plan A:

- No active sales targets.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Now two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- We’re now in the seasonal window where first sales targets for next year’s crop could post at any time. Stay tuned.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans were higher to end the week and posted their fourth consecutive higher close as the longer-term forecasts turn hotter and drier. Positive trade talks between President Trump and China’s Xi this week were supportive to the soy complex as well. Soybean meal ended the day lower while soybean oil was higher.

- The Buenos Aires Grain Exchange reported that soybean harvest in Argentina is now 88.7% complete, up 8% from the week prior.

- Drought conditions are still persistent across the soybean belt but were seen shrinking by 1% to 16%. This compares to just 2% during the same period last year.

- For the week, July soybeans gained 15-1/2 cents to 10.57-1/4 while November gained just 10-1/4 cents. July soybean meal was virtually unchanged losing just $0.60 at $295.70, and July soybean oil gained 0.61 cents closing at 47.50 cents.

Soybean Futures Remain Range-Bound into June

Soybean futures tumbled below the key $10.00 mark in early April on tariff-related headlines, triggering technical selling after breaking the March low. However, the decline was short-lived as buyers stepped in, lifting prices back above $10.00 and reclaiming key moving averages, including a clean break above the 200-day moving average — a level that now serves as solid support. With no fresh bullish catalyst and favorable weather weighing on sentiment, futures remain range-bound. The 200-day should continue to offer support, while resistance holds near the May high of $10.82.

Wheat

Market Notes: Wheat

- Wheat futures found good buying strength across all three classes of wheat during Friday’s session. The July Chicago wheat contract posted its highest daily close since April 23 and finished the week 20 ¾ cents higher.

- An increase in tensions between Russia and Ukraine triggered some short covering in the wheat market as traders have added some war premium back into the market.

- Chinese wheat producing regions are experiencing some drought conditions as harvest approaches. The prospects of a below-average harvest have the wheat market watching for some possible increased export activity as China may need to maintain wheat supplies.

- USDA announced that wheat export shipments for the 2024-25 marketing year reached 768.3 MB as of May 29. The total was well below the USDA target of 820 mb for the marketing, which closed on May 30. New crop wheat export sales are firm to start the new marketing year as early totals are the best in the past twelve years for this time frame.

- Recent rainfall forecast in Hard red winter wheat growing areas has trended wetter than normal with precipitation. As harvest ramps up, wet conditions could impact the quality of the wheat harvest.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- The 699.25 target has been cancelled.

- Looking ahead, next week will likely be the final week that Grain Market Insider provides guidance on the 2024 crop before fully shifting focus to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The 693.75 target has been cancelled.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None. Continue to target 675 to make a second sale.

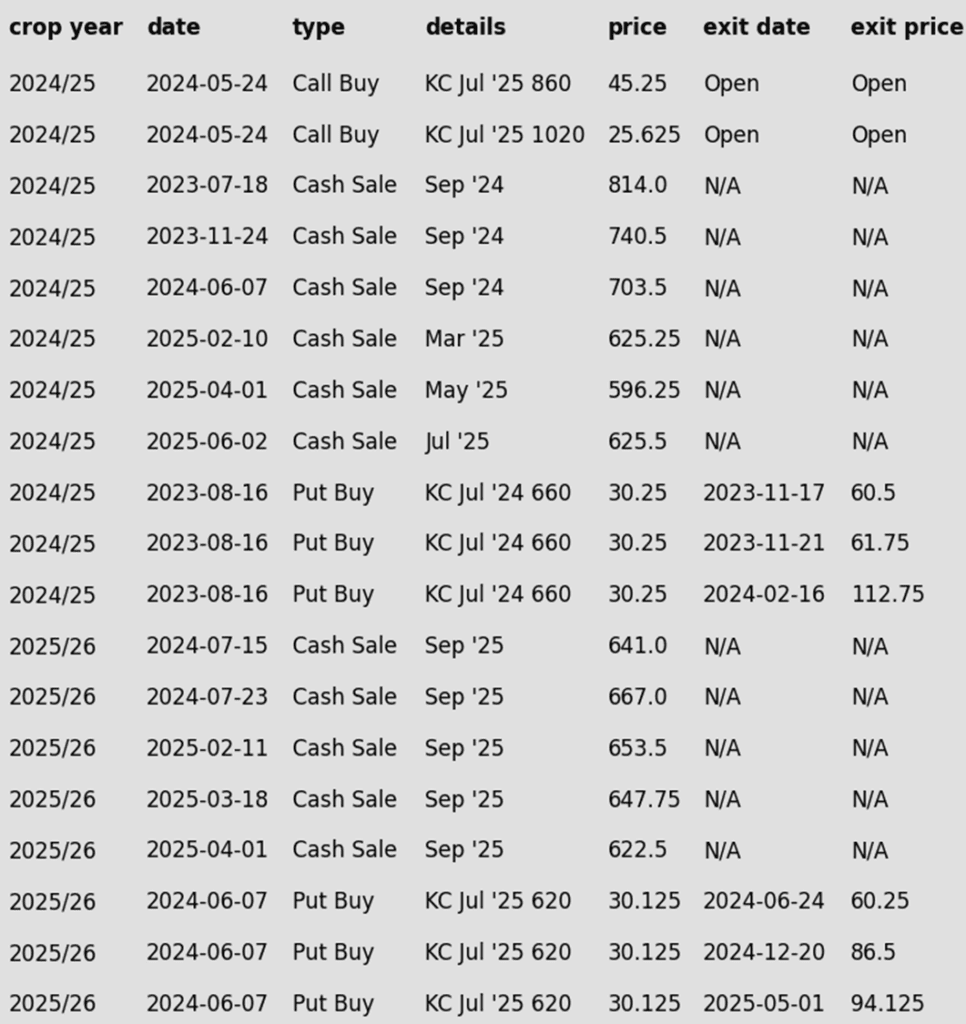

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Potentially Finds Support

After months of range-bound trade, Chicago wheat futures broke out in February, reaching October highs above $6.15 before quickly retreating back into their 2024 range. By mid-May, prices slipped below key support near $5.30 but have since stabilized around $5.20. The next major resistance is the 200-day moving average — a firm weekly close above it could signal a trend reversal and open the door to broader gains.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- None.

- Looking ahead, next week will likely be the final week that Grain Market Insider provides guidance on the 2024 crop before fully shifting focus to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- The first sales targets could post this week — keep checking back for updates.

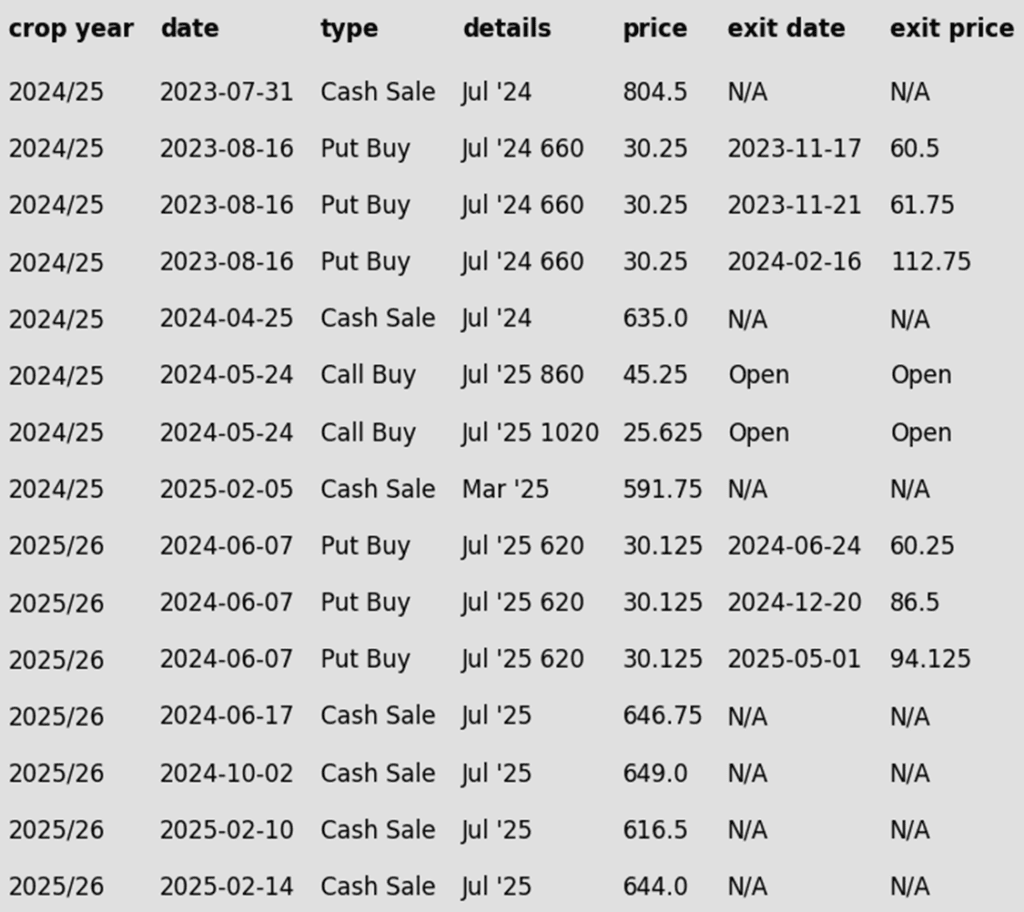

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Finds Support

With ample spring moisture across the Plains and sluggish demand, wheat futures have lacked bullish momentum, recently touching multi-year lows near $5.00 in early May—a level that has since held. A recovery above $5.40 would suggest a potential bottom is in place. On a rebound, the 200-day moving average marks initial resistance, with a stronger ceiling at the February highs near $6.40.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell JUL ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Sell another portion of your 2024 Minneapolis wheat crop. This marks the sixth sale for the 2024 crop and may well be the final sales recommendation for this marketing year, as Grain Market Insider shifts focus to the 2025 and 2026 crops moving forward. Use this rally as an opportunity to consider pricing any remaining unsold bushels.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Now six sales recommendations made to date, with an average price of 684.

- Changes:

- None.

- Looking ahead, next week will likely be the final week that Grain Market Insider provides guidance on the 2024 crop before fully shifting focus to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if July KC closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- First sales targets are expected to post after July 1.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Runs Higher on Poor Conditions

Spring wheat futures broke out of a prolonged sideways trend in late January, with momentum accelerating in mid-February after a decisive close above the 200-day moving average. Although late-month weakness briefly pulled prices below key support, futures traded mostly sideways through spring. A sharp rally was triggered in late May after crop condition ratings came in at their second lowest in 40 years, sparking short covering. Prices are now back above a confluence of moving averages and nearing the top of the recent range. Key support sits just above $6.00, with the next upside target near February’s highs around $6.60.

Other Charts / Weather