6-3 End of Day: Beans Break Below Support to Start the Week

All prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’24 | 443.5 | -2.75 |

| DEC ’24 | 462.75 | -4.25 |

| DEC ’25 | 477.25 | -3.75 |

| Soybeans | ||

| JUL ’24 | 1184.5 | -20.5 |

| NOV ’24 | 1163.75 | -20.75 |

| NOV ’25 | 1153 | -14.5 |

| Chicago Wheat | ||

| JUL ’24 | 672.75 | -5.75 |

| SEP ’24 | 694 | -5.5 |

| JUL ’25 | 737.75 | -4.5 |

| K.C. Wheat | ||

| JUL ’24 | 700 | -8.75 |

| SEP ’24 | 713.75 | -9.5 |

| JUL ’25 | 737.75 | -8 |

| Mpls Wheat | ||

| JUL ’24 | 733.75 | -6 |

| SEP ’24 | 744 | -5.75 |

| SEP ’25 | 753.75 | 0.75 |

| S&P 500 | ||

| SEP ’24 | 5338.5 | -19.25 |

| Crude Oil | ||

| AUG ’24 | 74.05 | -2.68 |

| Gold | ||

| AUG ’24 | 2368.9 | 23.1 |

Grain Market Highlights

- Despite strong weekly export inspections, corn futures fell for a fifth consecutive session as spillover weakness in soybeans and wheat pressured corn.

- Soybeans were sharply lower on Monday. Heavily pressured soybean oil futures along with lower soybean meal futures pushed July soybeans back below the 100-day moving average.

- After trading higher on the overnight, all three wheat classes closed lower on the day on anticipated good crop conditions this afternoon.

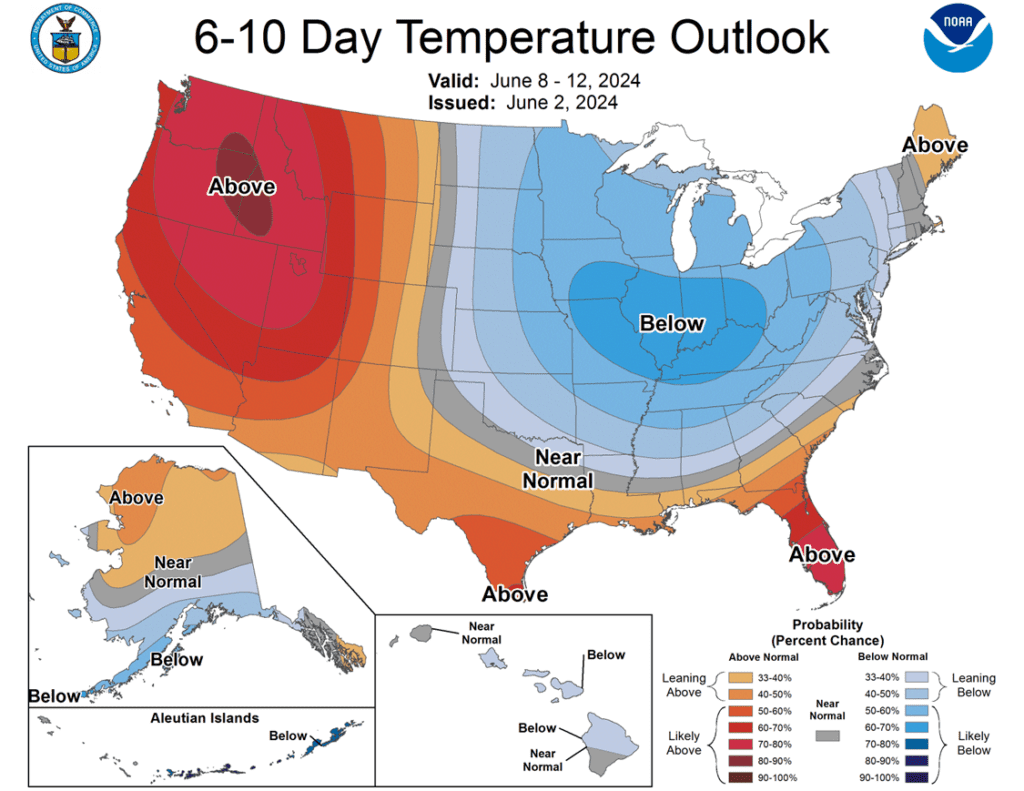

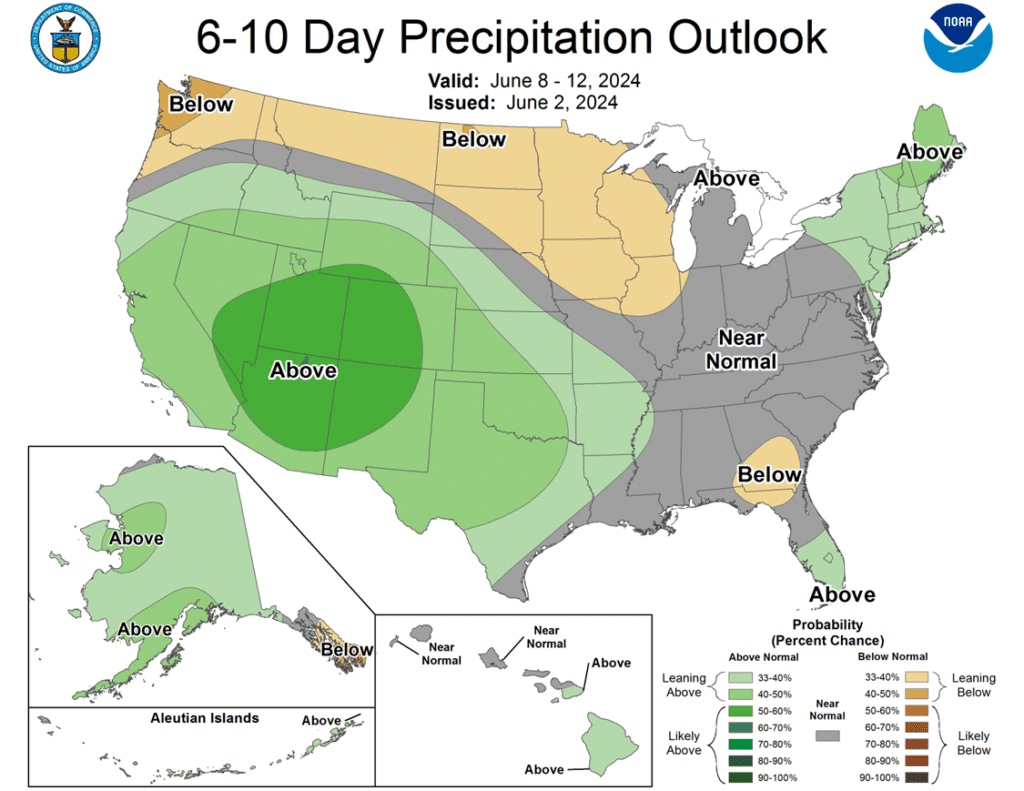

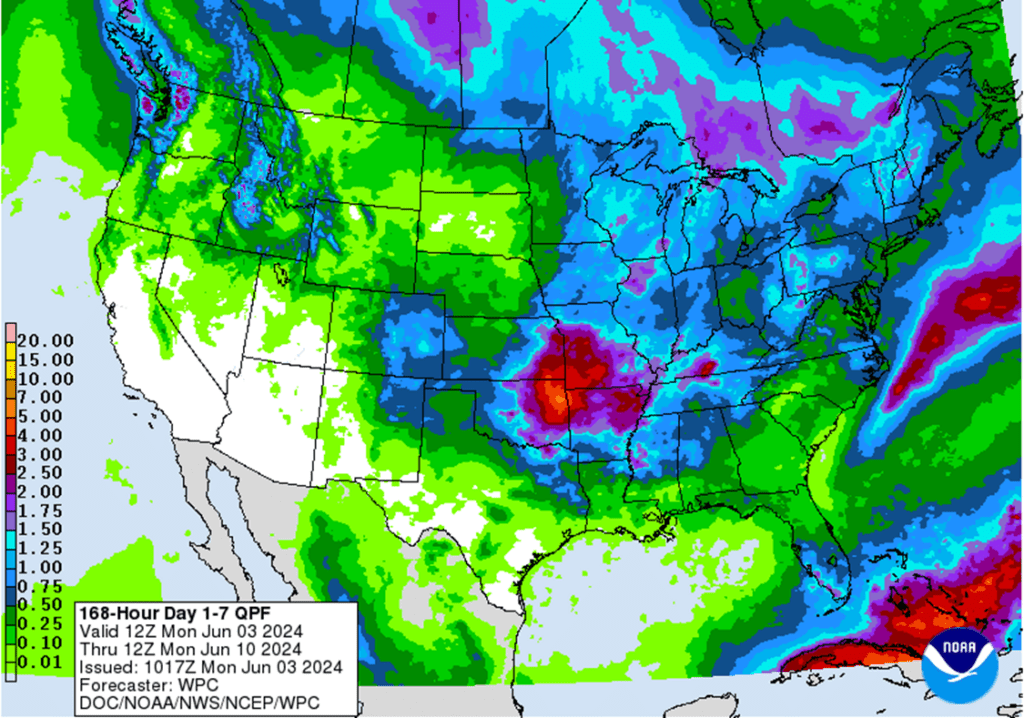

- To see the updated US 7-day precipitation forecast, updated US 6–10-day Temperature and Precipitation Outlooks, courtesy of NWS, CPC, and NOAA, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Corn Action Plan Summary

As July ’24 corn rallied beyond the congestion range on the front-month continuous charts, it began showing signs of being overbought, suggesting potential resistance to higher prices. Although managed funds have covered a significant portion of their net short position (sparking the recent rally) their remaining net short position could provide fuel for a more substantial upside move as we transition into the growing season. While obstacles persist for higher prices, weather is still a dominant feature, and seasonal tendencies remain positive.

- No new action is recommended for 2023 corn. Given the recent weakness in the July ’24 contract, and that we are at the time of year when the perception of any improving weather can move prices lower very quickly, we recently employed our Plan B stop strategy and recommended making additional sales. Although the technical picture could look better, weather remains a dominant factor and could still move prices back higher if conditions deteriorate. Therefore, we are currently targeting the 480 – 520 range versus July ’24 to make what will likely be our final sales recommendation for the 2023 crop.

- No new action is recommended for 2024 corn. After the Dec ’24 contract posted a bearish key reversal in mid-May, we implemented our Plan B stop strategy and advised making additional sales considering we are in the time of year when changes in weather, actual or perceived, can move the market swiftly in either direction. Also considering the volatility that this time of year can bring, our current strategy is to have several targets in place to provide both upside coverage as well as downside. While targeting 520 – 540 to recommend additional sales versus Dec ’24, we are targeting the 510 – 520 area to buy puts on any production that cannot be priced ahead of harvest. We are also targeting a close below 451 in Dec ’24 to buy upside calls for their value to protect any existing or future new crop sales.

- No Action is currently recommended for 2025 corn. At the beginning of the year, Dec ’25 corn futures left a gap between 502 ½ and 504 on the daily chart. Considering the tendency for markets to fill price gaps like these, we are targeting the 495 – 510 area to recommend making additional sales.

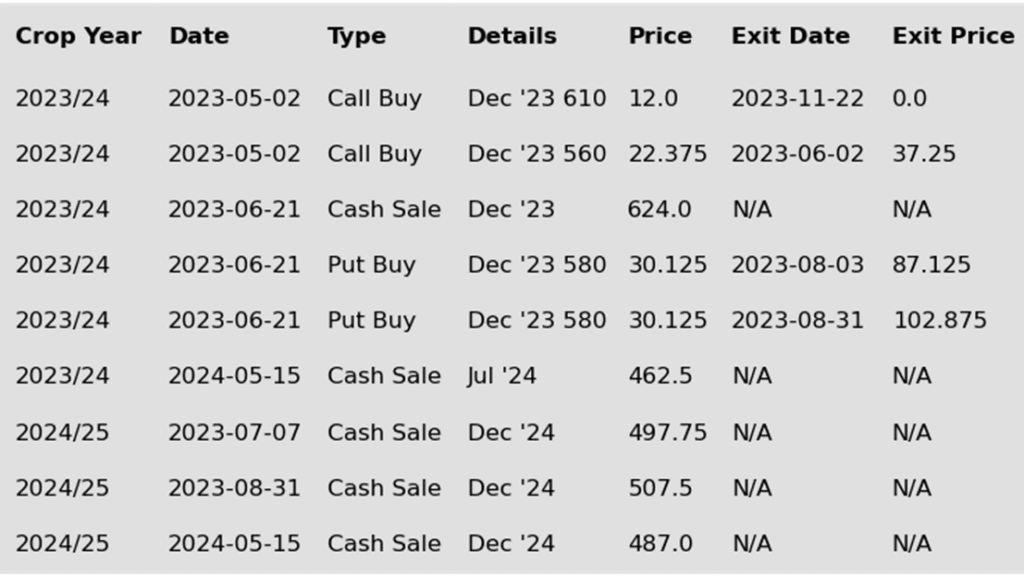

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

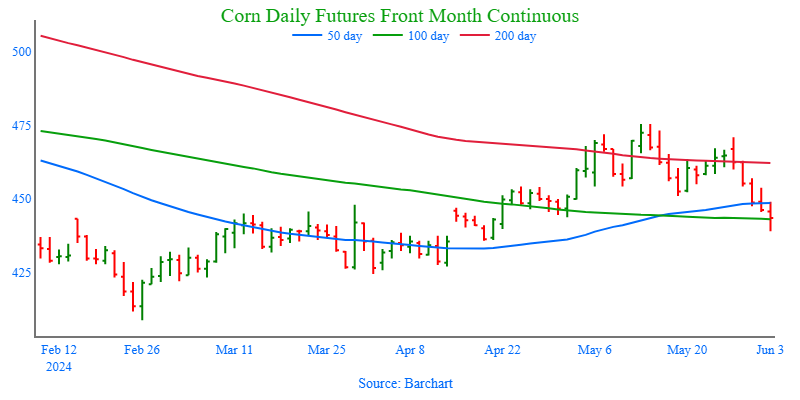

- Corn futures saw a fifth straight day of selling as prices are still looking to find a near-term bottom. Strong selling and a reversal off session highs in the wheat market helped pressure corn futures. Dec corn closed at its lowest price point since the April 18 set of lows.

- The technical picture remains weak in the corn market, leaving the door open for additional downside pressure as price broke through trendline support on the December futures on Monday.

- USDA will release planting progress and the first crop ratings for corn on the afternoon planting progress report. Expectations are for planting to reach 92% complete as of Sunday. This will be up 9% from last week. Analysts are expecting the first crop ratings to be near 70% good to excellent.

- Weekly export inspections for corn were strong last week. U.S. exports shipped 1.374 MMT (54.1 mb) of corn last week, up from the previous week’s total. Total inspections in 2023-24 are now at 1.486 bb, up 26% over last year.

- USDA announced a flash sale of corn on Monday morning. Exporters sold 110,000 MT (4.3 mb) of corn to Spain for the 2023-24 marketing year.

Above: The close below 452 in July corn puts the market on track towards 445 – 437 support just below the market. Should this area hold, and prices recover, they could possibly challenge the overhead resistance area of 471 – 475 ½. Otherwise, they could challenge 427 – 424 support.

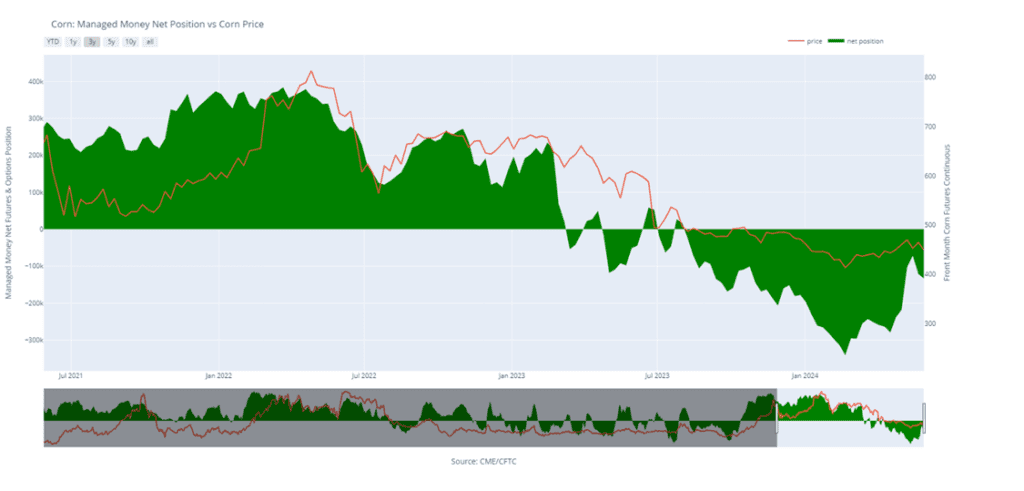

Corn Managed Money Funds net position as of Tuesday, May 28. Net position in Green versus price in Red. Managers net sold 12,315 contracts between May 21 – 28, bringing their total position to a net short 133,477 contracts.

Soybeans

Action Plan: Soybeans

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

New Alert

Sell NOV ’24 Cash

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Soybeans Action Plan Summary

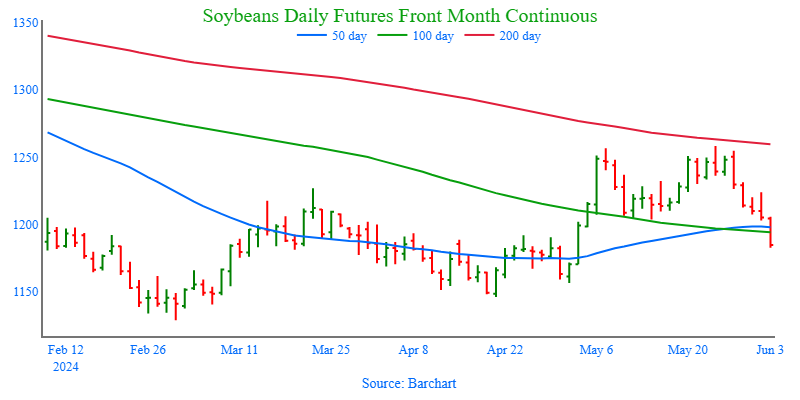

After rallying out of its previous congestion range in early May on planting concerns, the soybean market has been rangebound, capped overhead by resistance around 1250 with support below the market near 1200 for much of May. To start June, soybean prices have broken underlying support and look poised to test the recent lows which sit near the 1150 level on the July chart. With much of the growing season in front of the market a weather-related issue or surge in currently poor demand appear to be the most likely catalysts to push prices back near their recent highs.

- No new action is recommended for 2023 soybeans. We are currently targeting a rebound to the 1275 – 1325 area versus July ’24 futures for what will likely be our final sales recommendation for the 2023 crop. If you need to move inventory for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- Grain Market Insider recommends selling a portion of your 2024 soybean crop. Since peaking in May, the market has broken through 100-day moving average support (1180-81) and retraced over 50% back towards the April low. This suggests that our Plan A upside targets are now less likely to be achieved and prices could trend lower. Considering this and the currently weak demand picture, Grain Market Insider is implementing a Plan B Stop strategy to recommend beginning to market your 2024 soybean crop by making sales at these still elevated prices.

- No Action is currently recommended for 2025 Soybeans. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

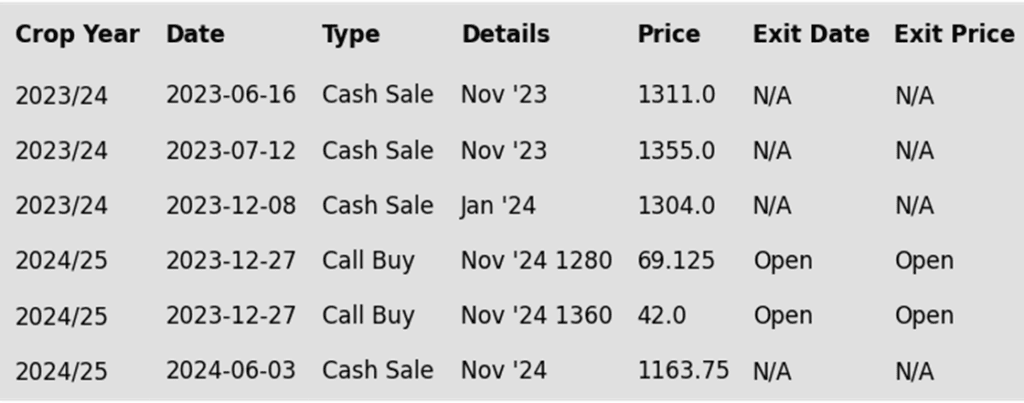

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day sharply lower, making a fifth consecutively lower close in the July contract and is now down 73 3/4 cents from last week’s high. Both soybean meal and oil ended the day lower as well, but soybean oil posted the majority of losses. Pressure is likely coming from the anticipation of today’s crop progress report showing soybean planting pace at a good speed.

- Estimates for today’s Crop Progress Report are that soybeans will be between 75% and 83% planted with an average guess of 80%. This would compare to 68% completion last week. If wet weather persists, there is a possibly that some corn acres will shift to soybeans.

- Soybean crush in the month of April has been estimated at 175.5 million bushels as analyst expect that the USDA will peg crush at a 7-month low. If realized, this would be down 13.9% from the 203.7 mb crushed in March and down 6.1% from April 2023.

- Today’s export inspections report showed an increase of 12.8 mb of soybean inspections as of May 30. This puts total inspections for 23/24 at 1.481 billion bushels and is down 17% from the previous year. The USDA has estimated soybean exports at 1.700 bb for 23/24 which is down 15% from the previous year.

Above: On May 23, July soybeans traded through the May 7 high but closed lower, posting a bearish reversal. Prices continued to work lower after that reversal into the end of May. A close below the 100-day ma to start June could set the market up for further declines with support between 1192 – 1146.

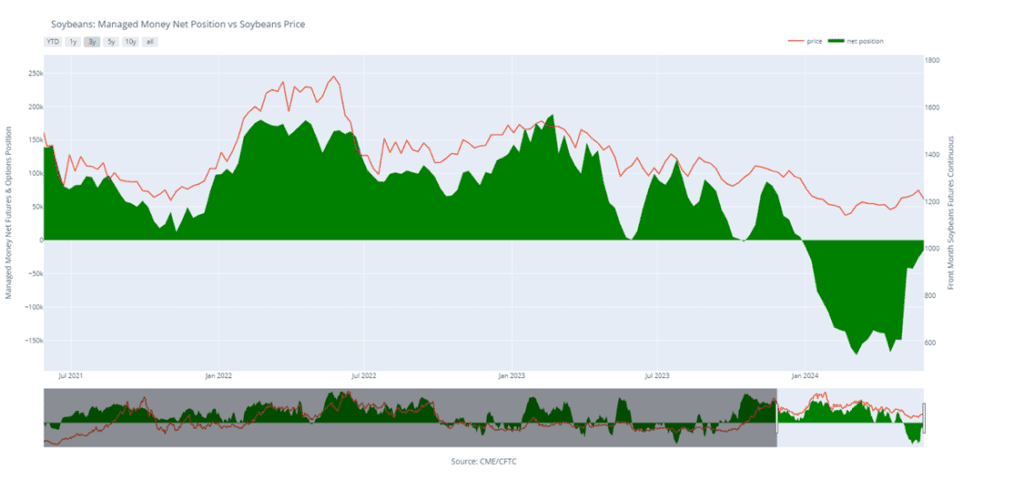

Soybean Managed Money Funds net position as of Tuesday, May 28. Net position in Green versus price in Red. Money Managers net bought 12,208 contracts between May 21 – 28, bringing their total position to a net short 14,218 contracts.

Wheat

Market Notes: Wheat

- All three wheat classes closed lower today after volatile trade which saw Chicago wheat trade as much as 19 cents higher before fading into the close. KC wheat led the complex lower as trade anticipates good crop conditions in today’s report.

- In today’s Crop Progress Report, trade is estimating that spring wheat will be 95% planted which compares to 88% a week ago, and expectations are that crop conditions will be 69% good to excellent, the first ratings we will get for this crop. Winter wheat is estimated to be rated 48% good to excellent which would be steady from last week, and 3% of the crop is expected to be harvested.

- In Russia, two large consultancies have reduced their estimates for the Russian wheat crop to between 78 and 82 mmt which is well below the USDA’s recent estimate of 88 mmt. Temperatures are hotter than normal, reaching up to 100 degrees and it is dry as well. Russian cash values have increased as production estimates fall.

- Today’s export inspections report showed an increase of 15.3 million bushels of soybean inspections for the week ending May 30. This put total wheat inspections at 687 million bushels for 23/24 which is down 6% from last year. The USDA is estimating total wheat exports at 720 mb for 23/24 which is down 5% from last year.

Action Plan: Chicago Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

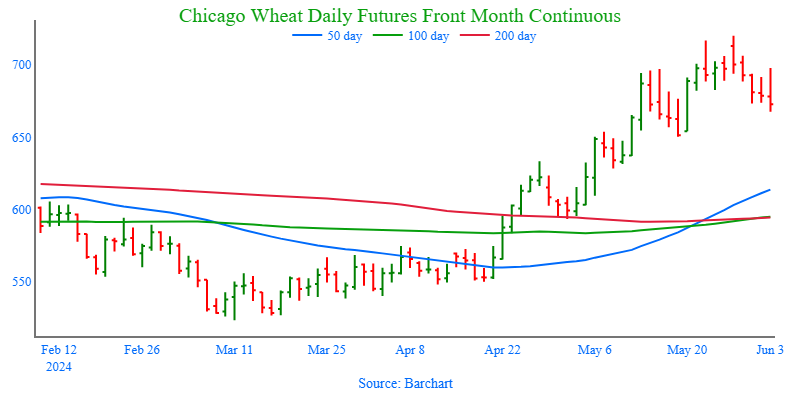

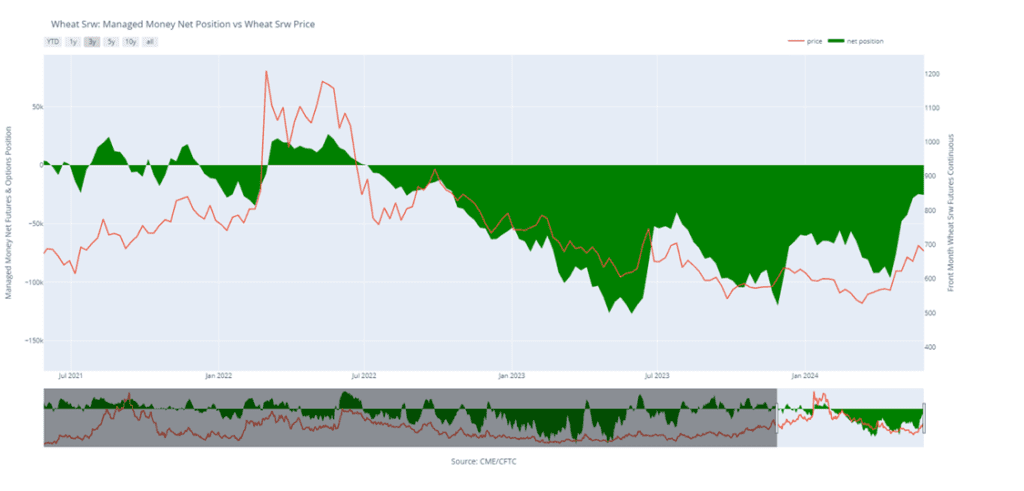

Chicago Wheat Action Plan Summary

In late April, Chicago wheat staged a rally, fueled mostly by Managed fund short covering on dryness in the southwestern Plains and potential damage to the Russian wheat crop, that took it through the major moving averages on the continuous chart, and last December highs. Although the market is showing signs of being overbought, which adds downside risk, the world wheat crop remains vulnerable which has the potential to drive an extended rally should production concerns linger or intensify.

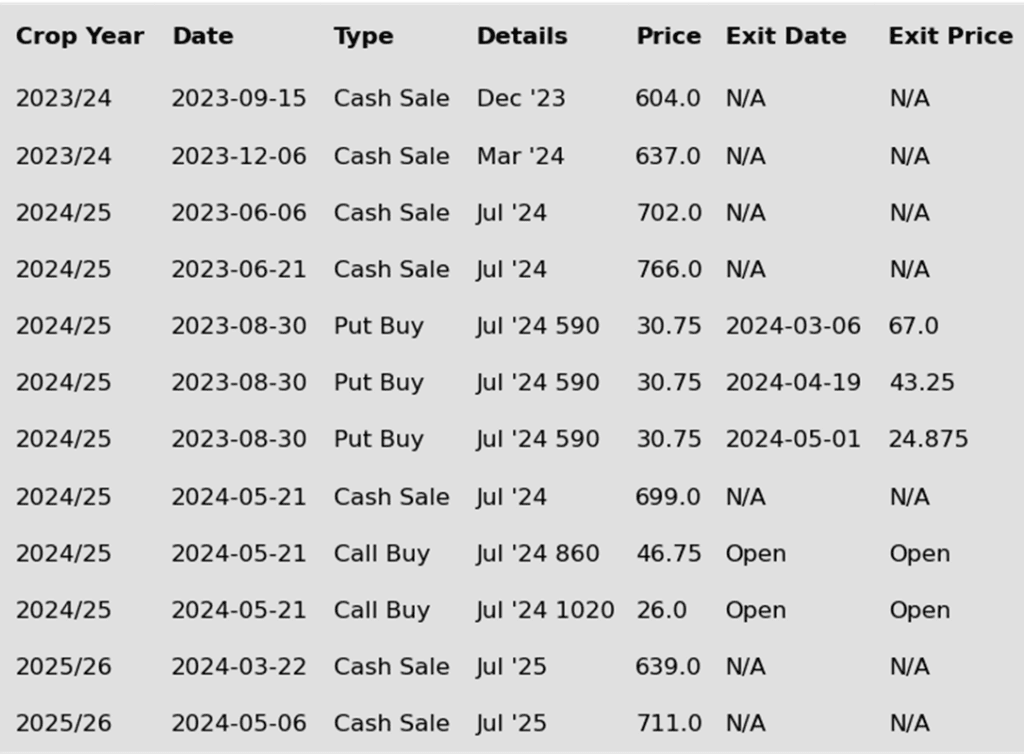

- No new action is currently recommended for 2023 Chicago wheat. Any remaining 2023 soft red winter wheat should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 Chicago wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Chicago wheat. Considering the recent rally in wheat, we recommended taking advantage of the elevated prices to make additional sales and buy upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 740 – 760 versus July ’24 to recommend further sales and to target a selling price of about 73 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No new action is currently recommended for 2025 Chicago Wheat. This spring, Grain Market Insider issued two sales recommendations to capitalize on the recent rally in July ’25 Chicago wheat prices for next year’s crop. To take further action, Plan A is to recommend making additional sales in the 775 – 800 range. In case the market comes up short of this upside target range, our current Plan B is a downside stop at 667. As long as the Jul ’25 contract remains above 667 support, the trend looks up to us and we will continue to target 775 – 800. If the Jul ’25 contract were to close below 667, it could be a sign that the trend is changing and 775 – 800 may no longer be an upside opportunity. Thus, a break of support would trigger an additional sale immediately.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: After setting a 720 high and closing lower on May 28, July Chicago could be set up to test nearby downside support near 650. If support holds and prices close above 720, they could be on track to test the 770 – 777 resistance area. Otherwise, further support may be found near 628.

Chicago Wheat Managed Money Funds net position as of Tuesday, May 28. Net position in Green versus price in Red. Money Managers net sold 838 contracts between May 21 – 28, bringing their total position to a net short 25,431 contracts.

Action Plan: KC Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

KC Wheat Action Plan Summary

Between the end of February and the middle of April, KC wheat was mostly rangebound between the mid-590s on the topside and mid 550s down low, with little to move prices higher, all the while Managed funds continued adding to their large net short positions. Toward the end of April, dryness in the Black Sea region and the US HRW growing areas started becoming more concerning and triggered a short covering rally across the wheat complex, driving prices to levels not seen in over six months. Although US wheat exports continue to struggle to compete on the world market, which can keep a lid on US prices, they could still push higher if world production concerns persist.

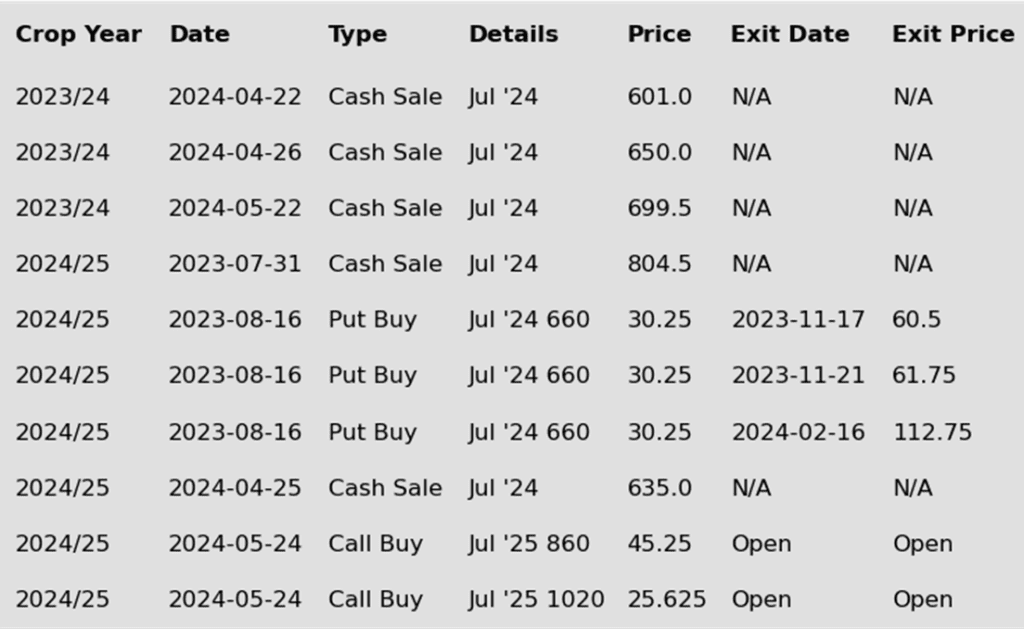

- No new action is recommended for 2023 KC wheat. Any remaining 2023 hard red winter wheat should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 KC wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 KC wheat. Considering the recent upside breakout in KC wheat, we recommended buying upside July ’25 860 and 1020 calls (for their extended time frame) in case of a protracted rally. Our current strategy is to target 820 – 840 versus July ’24 to recommend further sales and to target a selling price of about 71 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. The remaining 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices.

- No action is currently recommended for 2025 KC Wheat. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

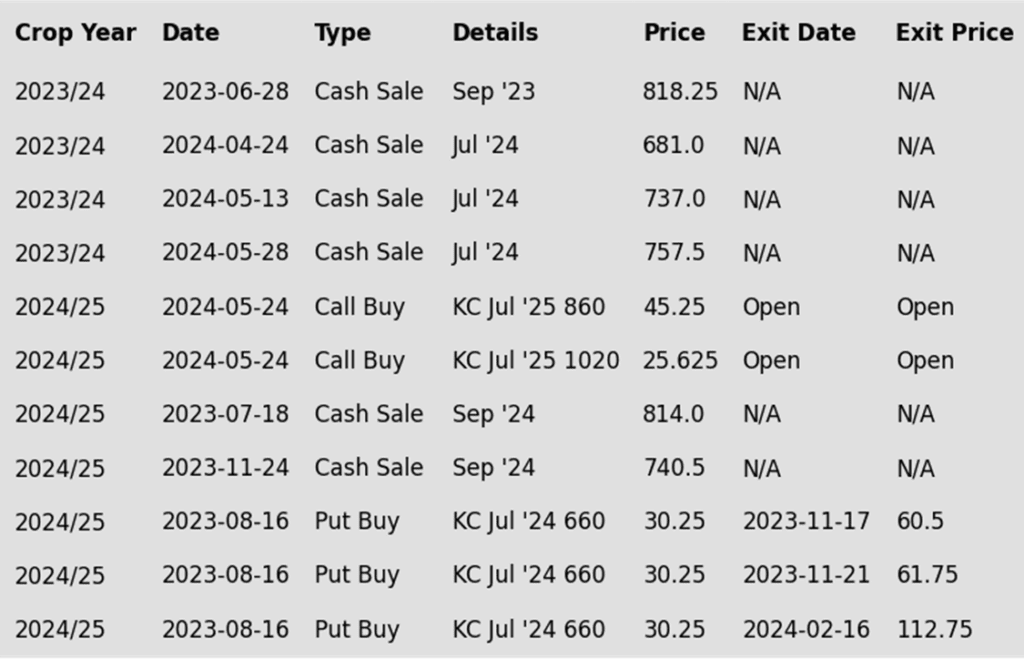

To date, Grain Market Insider has issued the following KC recommendations:

Above: May 28, July ’24 gapped higher and closed below its open in a bearish reversal after piercing the 720 – 754 congestion area. For now, resistance remains just overhead between 746 and 754, a close above which could put the market on track towards 780. If prices retreat, initial support may come in near 689, with further support between 660 and 646.

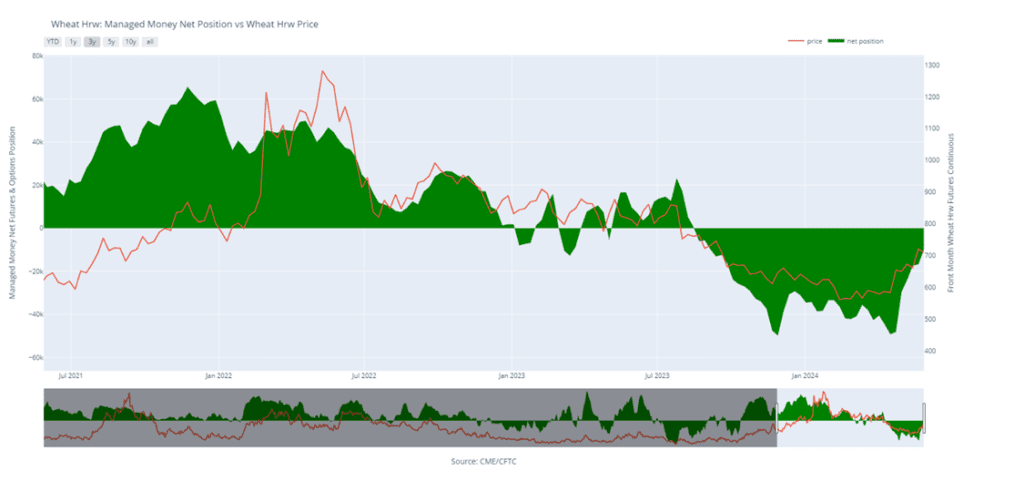

KC Wheat Managed Money Funds net position as of Tuesday, May 28. Net position in Green versus price in Red. Money Managers net bought 7,016 contracts between May 21 – 28, bringing their total position to a net short 9,748 contracts.

Action Plan: Mpls Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Mpls Wheat Action Plan Summary

From mid-February through most of April, Minneapolis wheat traded mostly sideways to lower, lacking significant bullish fundamental news to drive prices upward. However, in late April, spurred by concerns over the world wheat crop and dry conditions in the HRW growing regions, Minneapolis wheat experienced a rally back towards last fall’s highs. Despite lingering obstacles for the US wheat market, historical seasonal trends typically strengthen in late spring and early summer, and production concerns remain in Russia and Europe that could potentially feed an extended rally if they intensify.

- No new action is recommended for 2023 Minneapolis wheat. Any remaining 2023 spring wheat should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 Minneapolis wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Minneapolis wheat. Considering the recent strength in wheat, we recommended buying upside July ’25 KC wheat 860 and 1020 calls (for their extended time frame, greater liquidity, and high correlation to Minneapolis wheat) in case of a protracted rally. For now, moving forward, our current Plan A is to try and let the market run, while targeting a selling price of about 71 cents in the 860 calls to achieve a net neutral cost on the remaining 1020 calls. Those 1020 calls would then continue to protect existing sales and give you confidence to make additional sales at higher prices. Should the market slide back down, our current Plan B is a downside stop of 717 versus Sept ’24 Minneapolis wheat. While the market stays above 717, it is our contention that the uptrend remains intact. However, if Sept ’24 closes below 717 support, upside momentum may be waning, and the trend could be turning down. Therefore, a close below 717 would trigger an additional sale immediately.

- No action is currently recommended for the 2025 Minneapolis wheat crop. We are currently not considering any recommendations at this time for the 2025 crop that will be planted in the spring of next year. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: After gapping higher and trading to a 767 ¾ high on May 28, July ’24 closed below its open price creating a bearish reversal. Overhead resistance remains between the 767 ¾ high and 790, a close above which could allow prices to test the 837 level. A slide lower could run into support near 729 and again between 710 and 697.

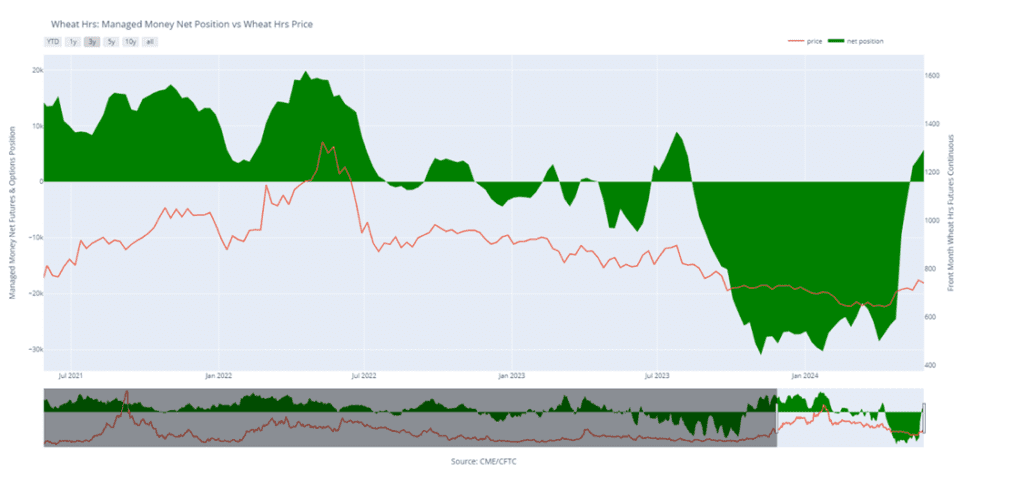

Minneapolis Wheat Managed Money Funds net position as of Tuesday, May 28. Net position in Green versus price in Red. Money Managers net bought 1,561 contracts between May 21 – 28, bringing their total position to a net long 5,740 contracts.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.