6-27 End of Day: Grains Rebound Ahead of USDA Report and Weather Shift

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 417.5 | 8 |

| DEC ’25 | 427 | 6 |

| DEC ’26 | 456.25 | 2.75 |

| Soybeans | ||

| JUL ’25 | 1027.75 | 5 |

| NOV ’25 | 1024.75 | 8.25 |

| NOV ’26 | 1050 | 7.5 |

| Chicago Wheat | ||

| JUL ’25 | 524.75 | 3.75 |

| SEP ’25 | 540.75 | 4 |

| JUL ’26 | 598.75 | 1.75 |

| K.C. Wheat | ||

| JUL ’25 | 516 | -2.25 |

| SEP ’25 | 533.75 | 0 |

| JUL ’26 | 598.25 | 1 |

| Mpls Wheat | ||

| JUL ’25 | 608 | 1.25 |

| SEP ’25 | 628 | 2.5 |

| SEP ’26 | 670.75 | 3 |

| S&P 500 | ||

| SEP ’25 | 6200.75 | 5.75 |

| Crude Oil | ||

| AUG ’25 | 65.41 | 0.17 |

| Gold | ||

| AUG ’25 | 3283.1 | -64.9 |

Grain Market Highlights

- 🌽 Corn: Corn futures closed higher Friday for the first time in five sessions, ending the week with moderate to strong gains. Support came from short covering ahead of Monday’s USDA Acreage Report, though December corn still finished the week down 14 ¼ cents.

- 🌱 Soybeans: Soybean futures closed higher on Friday, breaking a five-day losing streak. The rally was supported by updated European weather models pointing to a hotter, drier July outlook, along with likely short covering ahead of the weekend.

- 🌾 Wheat: Wheat futures halted their recent slide Friday, with gains in Chicago and Minneapolis while Kansas City ended mixed.

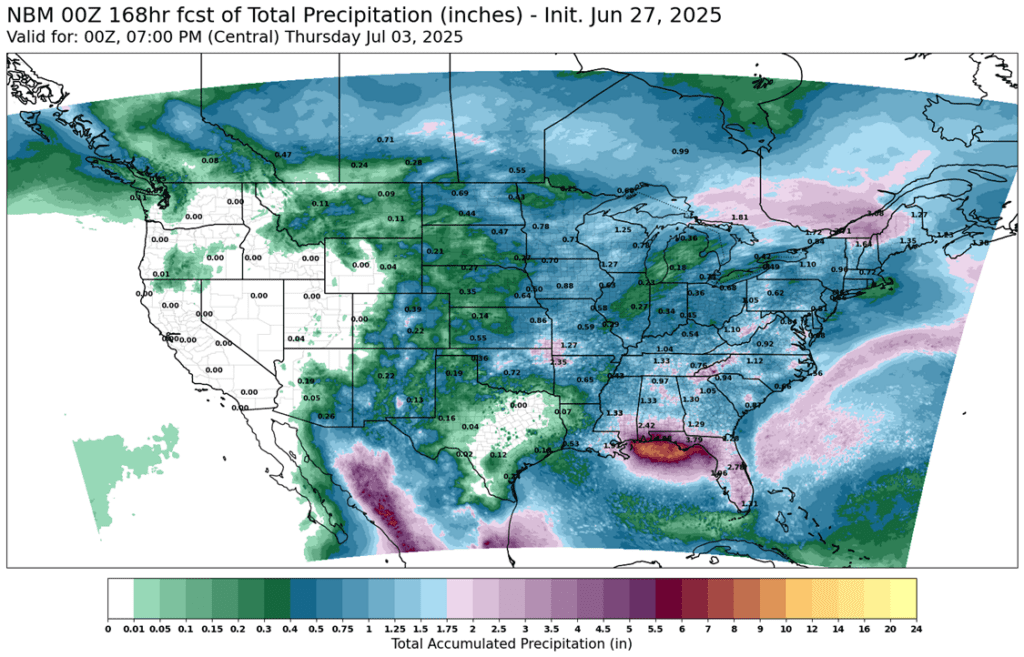

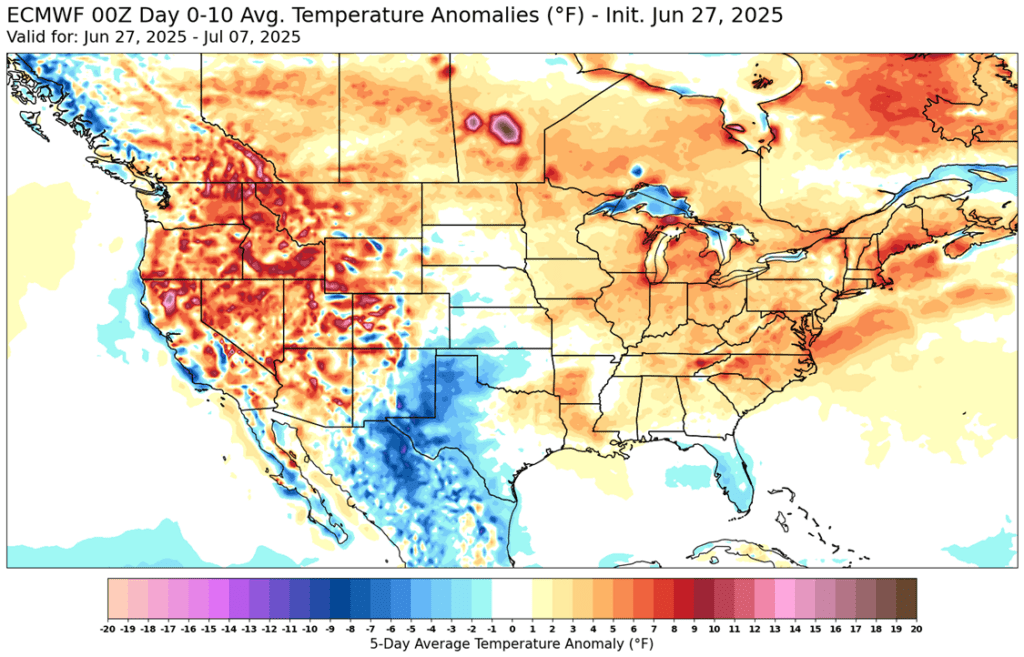

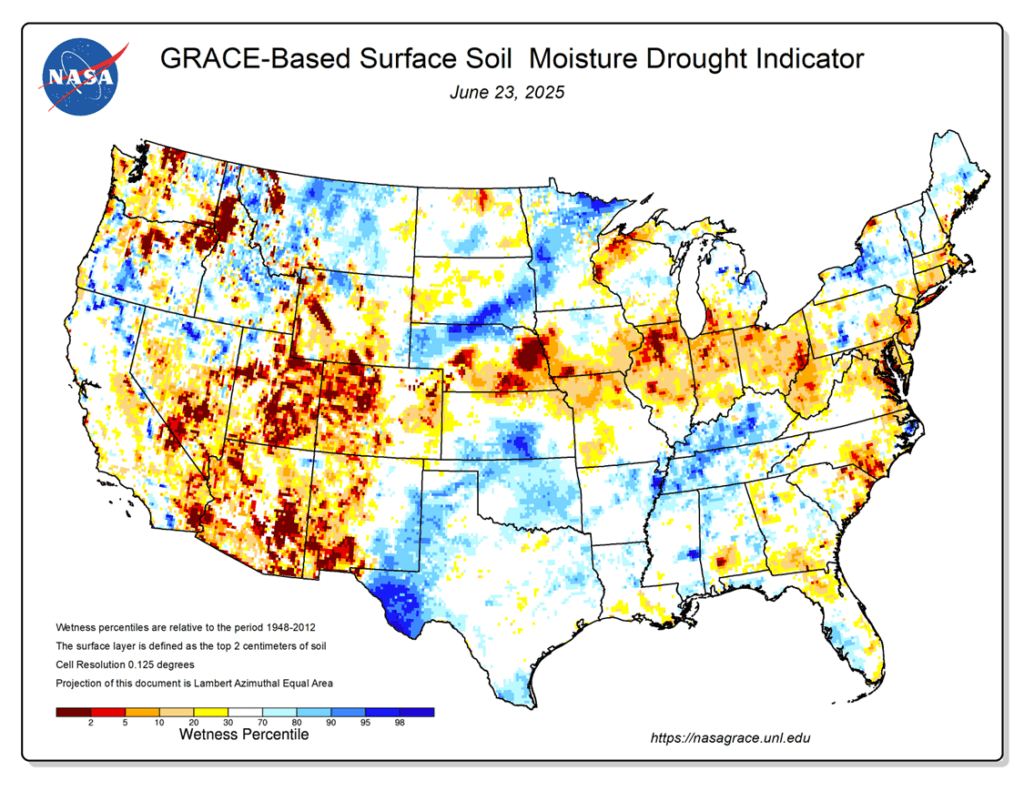

- To see updated U.S. weather forecasts scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

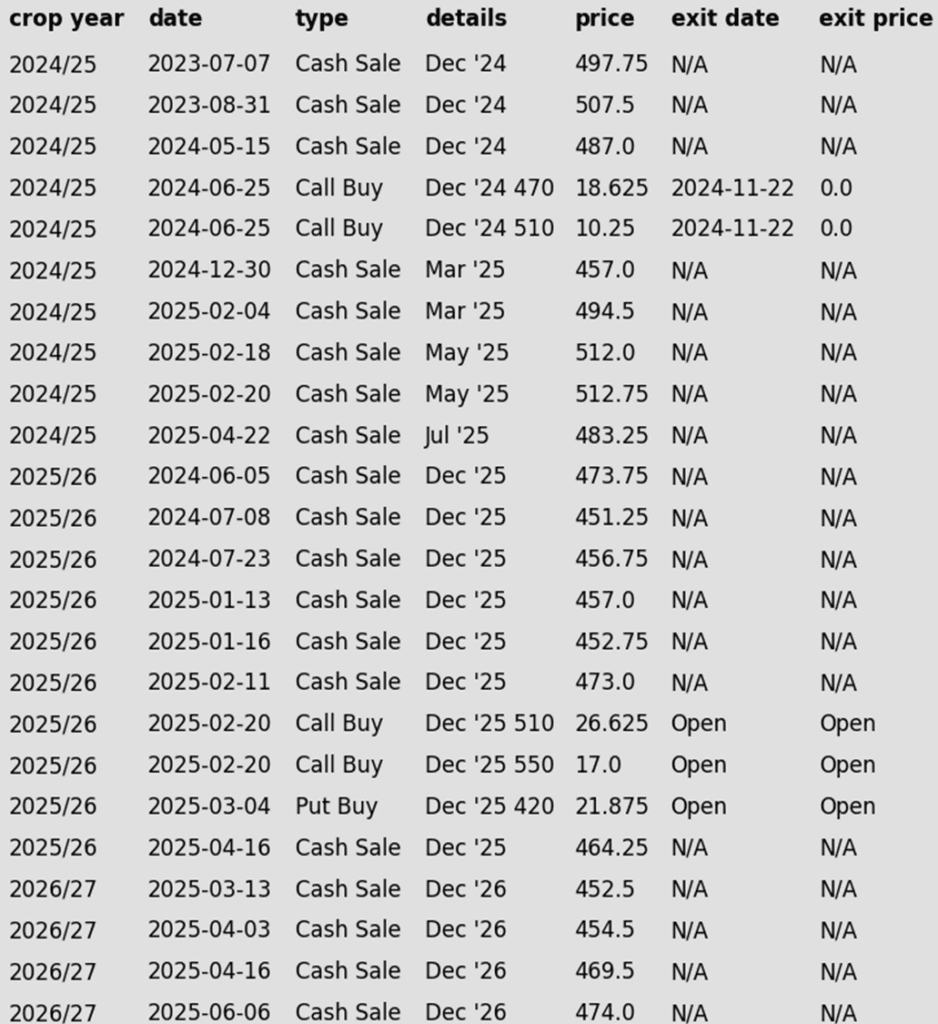

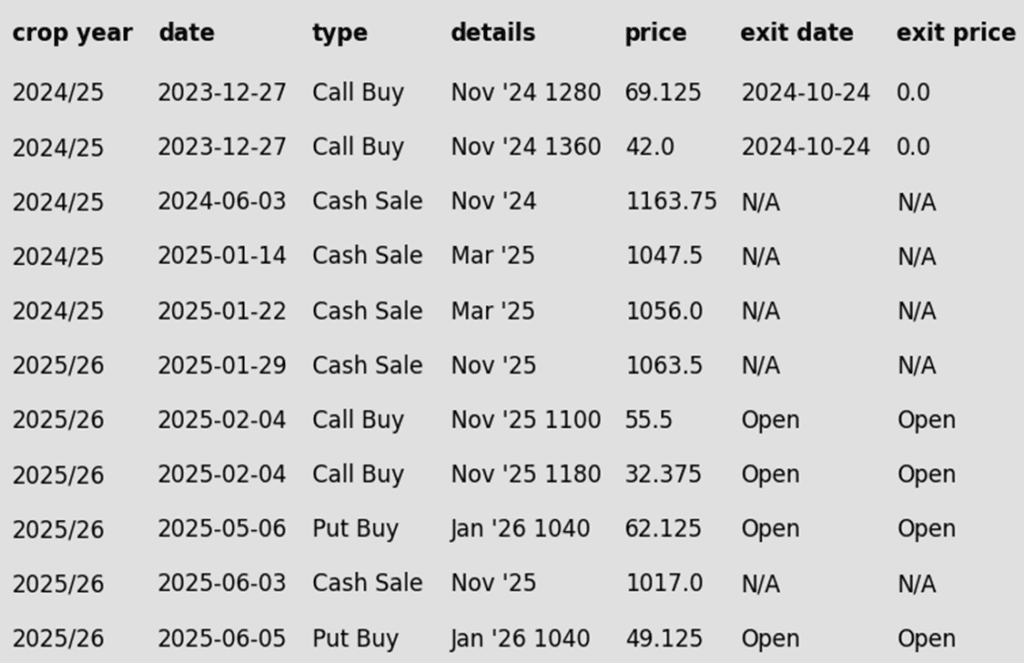

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None. Still no active targets to report. So far, typical growing season volatility has yet to materialize and generate additional selling opportunities. The next 2–3 weeks will be critical, as the likelihood of weather-driven price spikes tends to drop off significantly after that window.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None. The strategy remains ready for weather-related volatility, but so far the markets have yet to experience anything significant enough to trigger action.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished higher Friday for the first time in five sessions, closing the week with moderate to strong gains. A weaker U.S. dollar, short covering ahead of Monday’s USDA Acreage Report, and July first notice day helped lift the market. Despite Friday’s rebound, December corn still ended the week down 14 ¼ cents.

- Much of Friday’s strength was likely tied to pre-report positioning and short covering. The trade expects planted corn acres as of June 1 to total 95.35 million, slightly above the March estimate of 95.3 million. However, the wide range of analyst estimates (93.8 to 96.8 million) adds potential for volatility when the report is released.

- Argentina will be reinstalling their export taxes on July 1, increasing the costs of Argentina ag products. The taxes were originally dropped to promote demand and raise revenue.

- Weather forecasts remain favorable for crop development into early July, with near-normal temperatures and above-average rainfall expected. However, some models are now introducing hotter conditions for mid-July, which could impact pollination.

- New-crop corn sales have picked up recently. Last week saw 12 million bushels in export sales, while Mexico added 25 million bushels of new-crop purchases during the week.

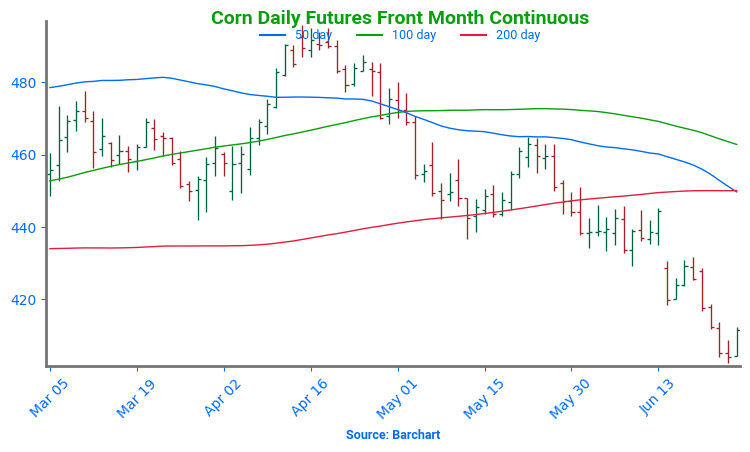

Corn Futures Break Lower end of Recent Range

Front-month corn futures have struggled throughout June, breaking key support and leaving an unfilled chart gap following the roll to September. That gap near 430 now stands as the first upside target. On the downside, this week’s low of 404 offers initial support, with stronger support seen at 394.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs August.

- Plan B: No active targets.

- Details:

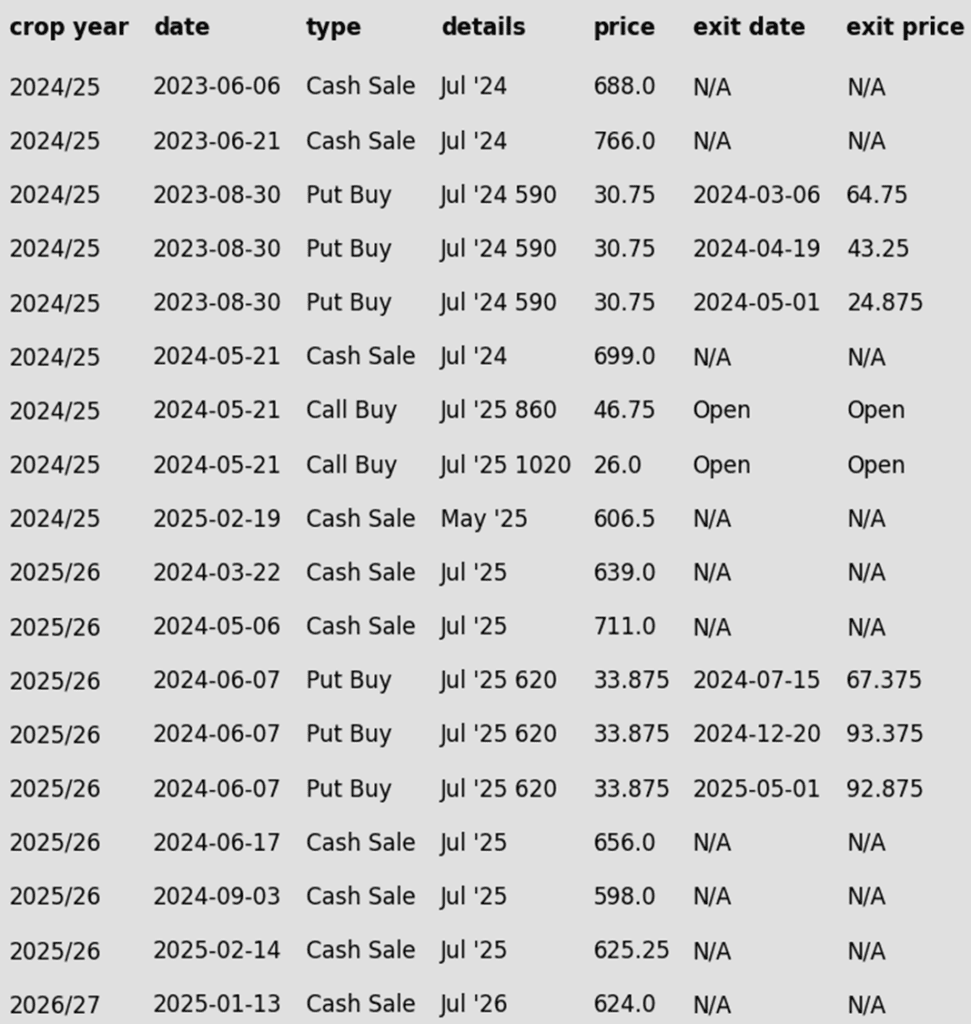

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None. No adjustment to the 1107 target, as it remains a feasible objective for this time of year based on historical weather-driven rally patterns.

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None. Same approach as with 2025 corn and 2024 soybeans — the strategy remains positioned for significant volatility, though nothing substantial has developed yet. The 1114 upside target also remains unchanged, as it continues to be a realistic objective based on historical rally patterns for this time of year.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Still no posted targets yet.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybean futures ended higher Friday, snapping a five-day losing streak. Support came after the European weather model shifted overnight, projecting a hotter and drier July than previously expected. Additionally, short covering ahead of the weekend likely added to the strength. Soybean meal closed higher, while soybean oil remained under pressure.

- Soybean meal continues to face global headwinds, with increased crush capacity in both the U.S. and South America leading to abundant supplies. The August soybean meal contract has dropped $20 per ton over the past two weeks after breaking technical support, and this week marked the lowest price levels since 2016.

- Looking ahead to Monday, USDA will release its updated Acreage Report. While expectations are for soybean acreage to remain steady at 83.5 million acres, trade estimates range between 82.0 and 85.0 million, leaving room for a surprise.

- On Monday, the USDA will release its updated acreage report, and although a change in soybean acres from 83.5 ma is not expected, there is some wiggle room with trade estimates between 82 and 85 ma.For the week, July soybeans lost 40 1/4 cents, settling at $10.27 3/4, while November fell 36 cents to $10.24 3/4. July soybean meal dropped $13.00 to $271.10, and July soybean oil slipped 2.02 cents to 52.45 cents. First notice day for July grain contracts is June 30, with expiration on July 14.

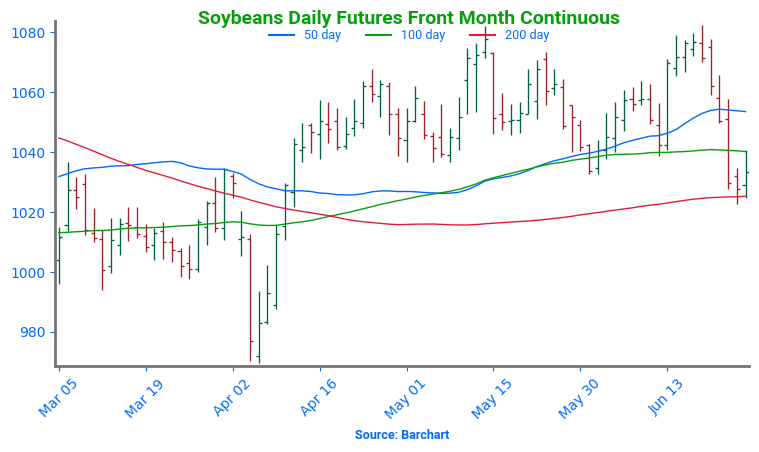

Soybeans Retreat from Recent Highs

Soybeans failed to close above key resistance at the May high of 1082 last week, keeping the broader trend sideways. A breakout above 1082 would open the door toward filling the June 2023 gap between 1161 and 1177. Soybean futures found support this week at the 200-day moving average and the bottom end of the recent range near 1030. A break below the 200-day would likely open the door to a test of the April lows near 980.

Wheat

Market Notes: Wheat

- Wheat futures halted their recent slide Friday, with gains in Chicago and Minneapolis while Kansas City ended mixed. Support came from a higher close in Matif wheat, strength in corn and soybeans, and optimism around potential progress in U.S.-China trade discussions, prompting a technical bounce.

- Attention now shifts to Monday’s USDA Quarterly Stocks and Acreage Reports. Pre-report estimates peg U.S. wheat stocks at 835 million bushels, significantly above last year’s 696 mb. All-wheat planted acreage is expected to remain unchanged from March at 45.4 million acres — if realized, the second smallest total since 1919.

- According to the Buenos Aires Grain Exchange, Argentina’s wheat crop is 73% planted. This is slightly behind last year’s pace, but above the five-year average, as dry weather has allowed sowing to progress. However, it is being reported that both Argentina and Australian wheat corps are in need of moisture.

- Statistics Canada estimated all-wheat acreage at 26.925 million acres, a reduction from March’s 27.475 million and below trade expectations. Spring wheat acreage was pegged at 18.809 million acres, also down from March (19.4 ma) and under the Bloomberg survey estimate of 19.2 ma.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. The 2024 wheat crops will drop off the report next week.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

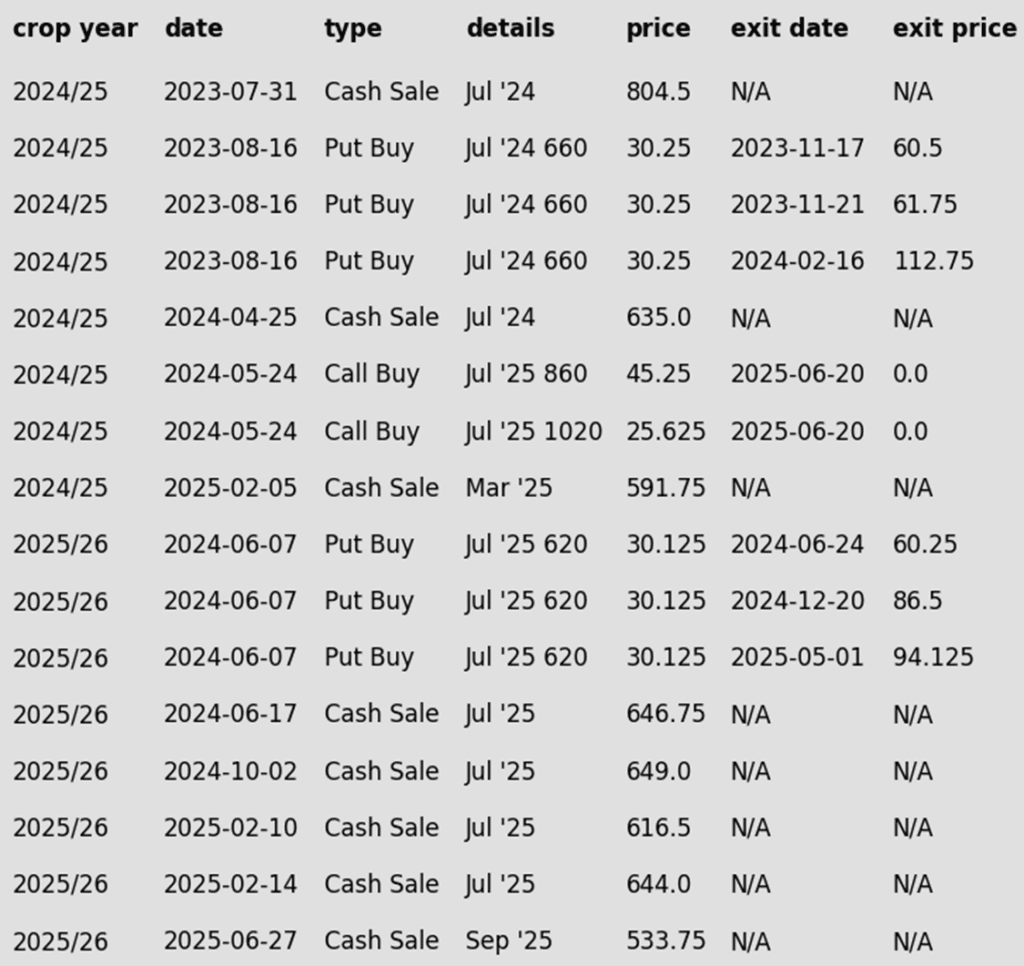

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

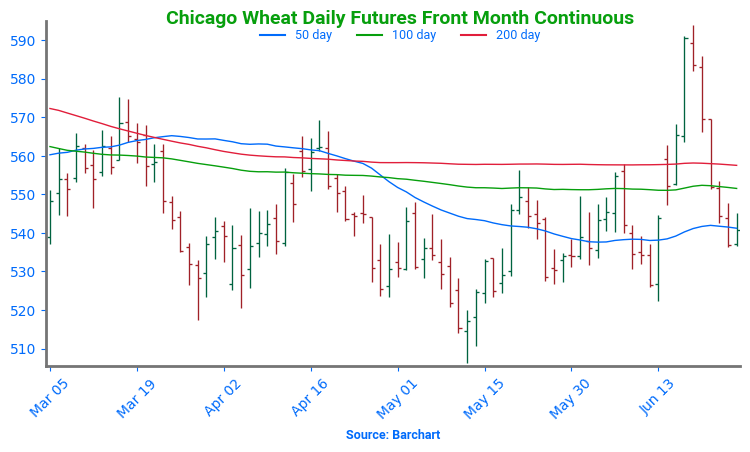

Chicago Wheat Returns to Recent Range

After running up to resistance levels last week, wheat futures have fallen sharply back below the upper end of the previous range. Initial support is at the June low of 522.25, with a break below that exposing further downside toward 506.25. On the upside, a weekly close above 558 could spark a larger move toward the winter high of 621.75.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

New Alert

Sell SEP ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. The 2024 wheat crops will drop off the report next week.

2025 Crop:

- NEW ALERT – Sell a fifth portion of your 2025 KC wheat following yesterday’s close below 535.75 support on the September contract — the designated Plan B stop to trigger a sale. As long as the market held above that support, the trend remained up, and Plan A was to wait for better opportunities. However, breaking below 535.75 now signals a risk that the trend is turning back down, with the first downside target potentially being a retest of the May low at 500.25.

- Plan A: No active targets.

- Plan B:

- Close below 535.75 support vs September and sell more cash. – HIT 6/26

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Now five sales recommendations made to date, with an average price of 618.

- Changes:

- None.

2026 Crop:

- Plan A: Target 693 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

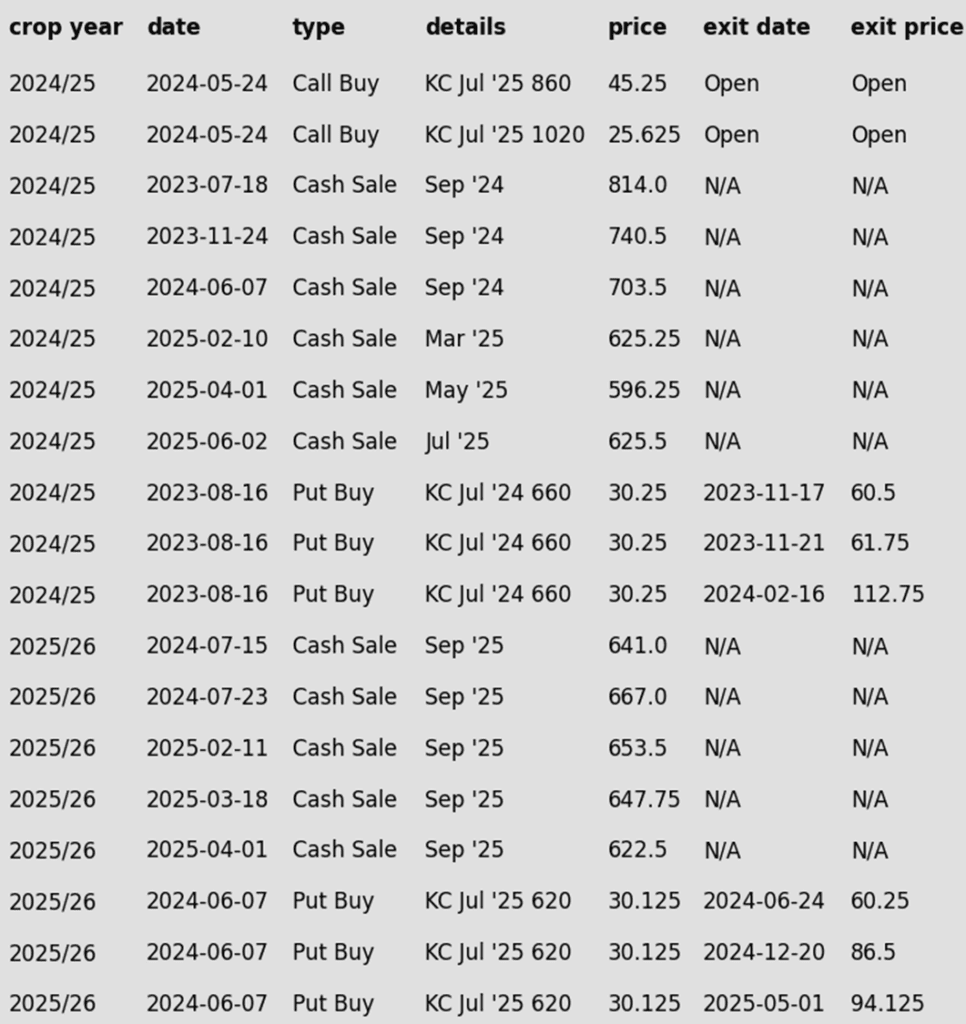

To date, Grain Market Insider has issued the following KC recommendations:

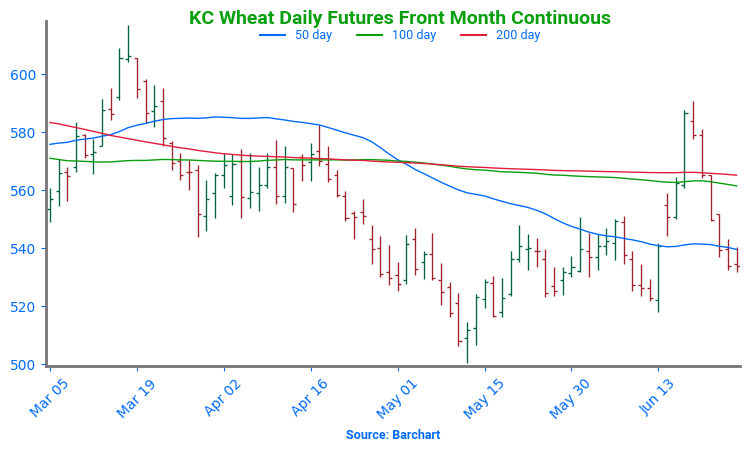

Kansas City Struggles Above Major Moving Averages

Strength last week pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness so far this week has sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Six sales recommendations made to date, with an average price of 684.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. The 2024 wheat crops will drop off the report next week.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Changes:

- None.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

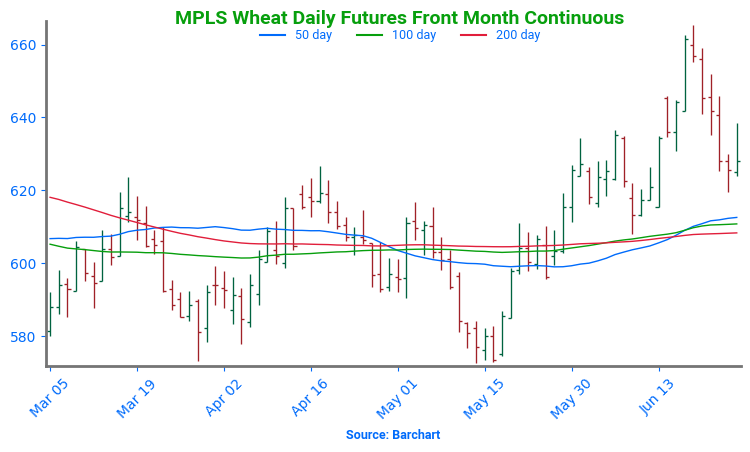

Spring Wheat Holding Above Resistance

Spring wheat futures broke out above key resistance last week, establishing 660 as the next upside target. The early-week pullback appears to be a healthy correction within the broader uptrend. Key support now sits at the 200-day moving average near 607. A close below that level — and especially beneath the May low of 572.50 — would open the door to further downside risk.

Other Charts / Weather