6-26 End of Day: Grains Face Downside Pressure Once Again

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 409.5 | -0.75 |

| DEC ’25 | 421 | -1.5 |

| DEC ’26 | 453.5 | -1.75 |

| Soybeans | ||

| JUL ’25 | 1022.75 | -2.5 |

| NOV ’25 | 1016.5 | -2 |

| NOV ’26 | 1042.5 | -1 |

| Chicago Wheat | ||

| JUL ’25 | 521 | -7.25 |

| SEP ’25 | 536.75 | -7.75 |

| JUL ’26 | 597 | -7.25 |

| K.C. Wheat | ||

| JUL ’25 | 518.25 | -6 |

| SEP ’25 | 533.75 | -5.5 |

| JUL ’26 | 597.25 | -4.25 |

| Mpls Wheat | ||

| JUL ’25 | 606.75 | -4.75 |

| SEP ’25 | 625.5 | -2.5 |

| SEP ’26 | 667.75 | -4.75 |

| S&P 500 | ||

| SEP ’25 | 6195.25 | 48.25 |

| Crude Oil | ||

| AUG ’25 | 65.28 | 0.36 |

| Gold | ||

| AUG ’25 | 3346.3 | 3.2 |

Grain Market Highlights

- 🌽 Corn: Corn prices were pressured again for a fifth straight session on bearish weather and lack of bullish news.

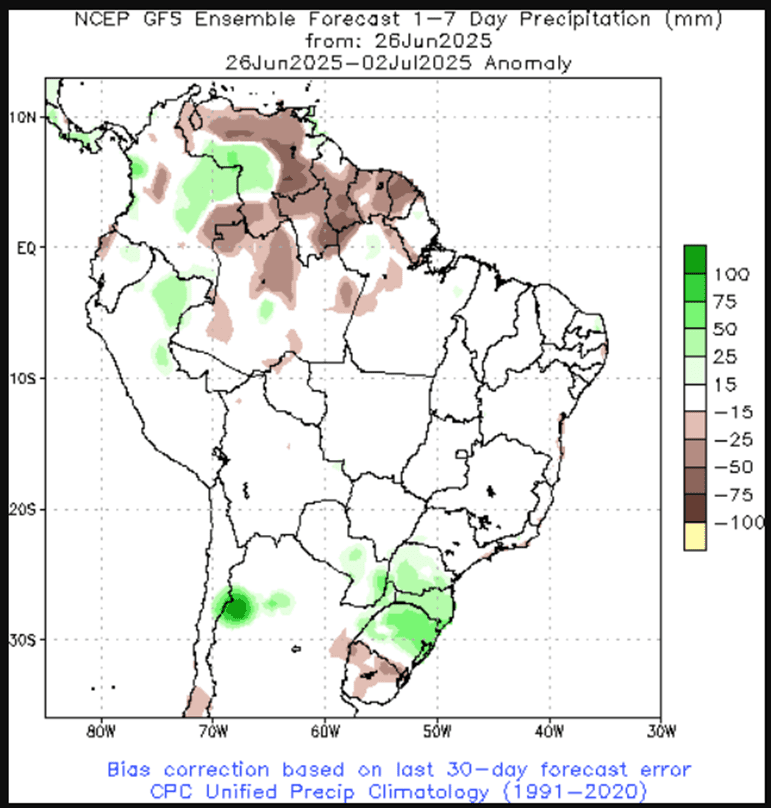

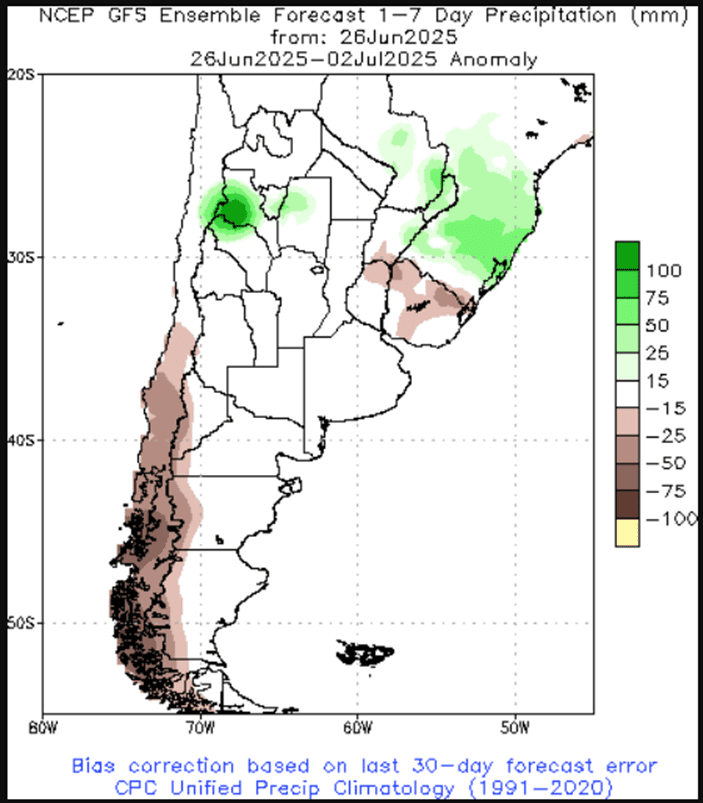

- 🌱 Soybeans: Soybeans closed lower as sellers remain active with beneficial rainfall for much of the growing areas throughout the US.

- 🌾 Wheat: Wheat markets continue to see weakness despite a three-year low on the dollar index today. Bearish weather and geopolitical risk cooling off are creating pressure on wheat prices.

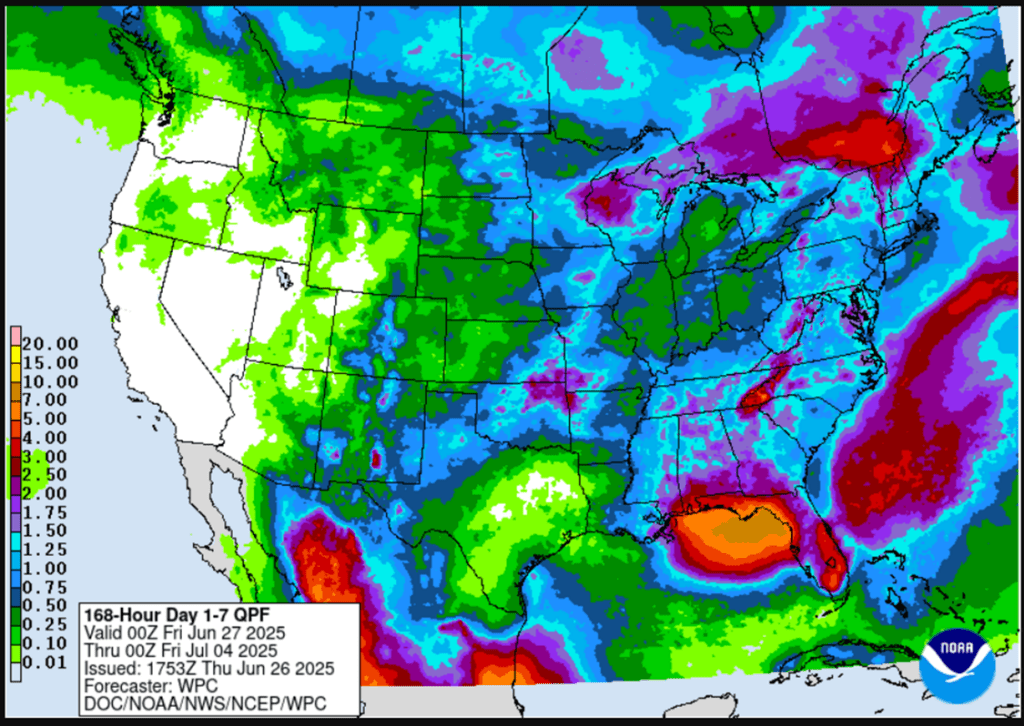

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Wheat section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

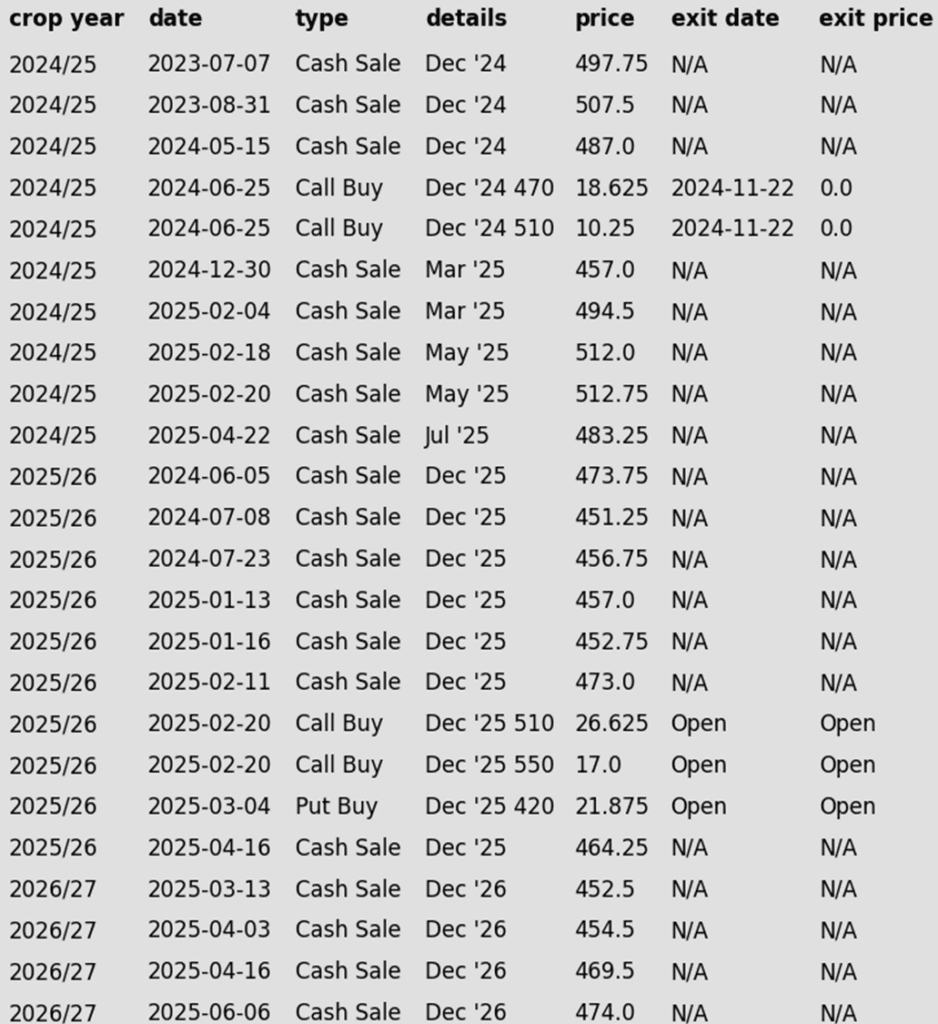

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None. Still no active targets to report. So far, typical growing season volatility has yet to materialize and generate additional selling opportunities. The next 2–3 weeks will be critical, as the likelihood of weather-driven price spikes tends to drop off significantly after that window.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None. The strategy remains ready for weather-related volatility, but so far the markets have yet to experience anything significant enough to trigger action.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

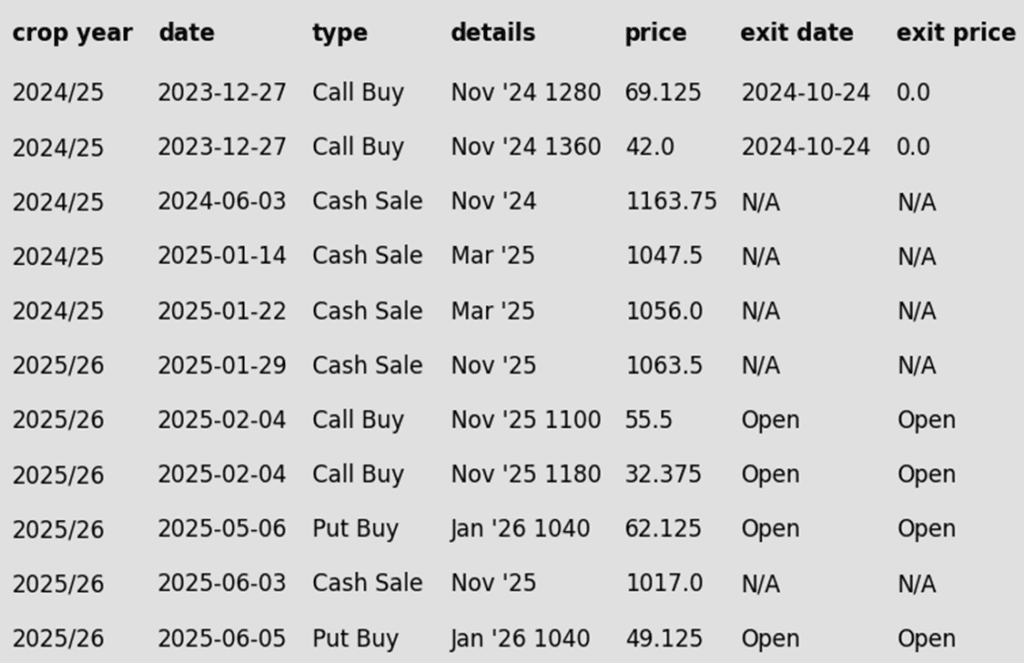

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- While the selling pressure seemed to slow on Thursday, the corn market still placed new contract lows and finished lower for the fifth consecutive session. Continued weakness in the wheat market and lack of a weather threat keep buyers mostly on the sideline again.

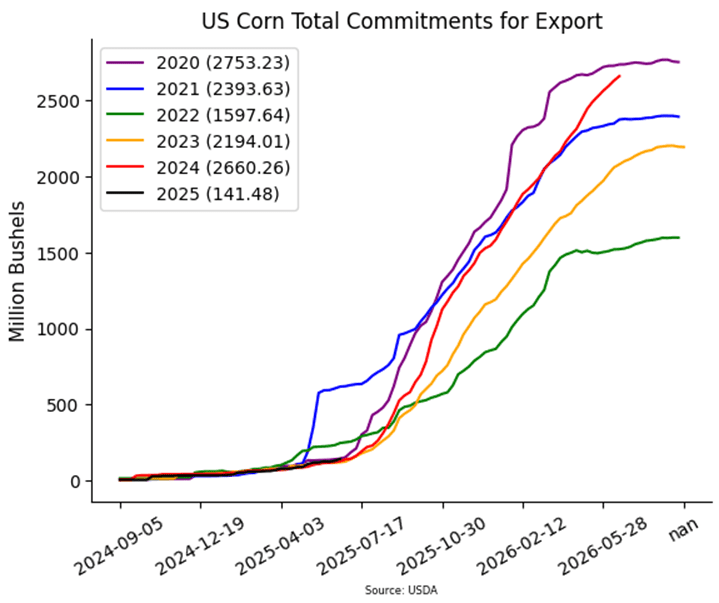

- USDA released weekly corn export sales on Thursday morning. For the week ending June 19, US exporters posted new sales of 741,200 MT (29.2 mb) of corn for the 2024-25 marketing year and 305,500 MT (12.0 mb) for 2025-26. With today’s sales, this puts the total sold for the 2024-25 marketing year at 2.660 billion bushels. This is 99.4% of the USDA target of 2.675 BB with 10 weeks left in the marketing year.

- The mmarket may be starting to position for Monday USDA Planted Acres report. Expectations for corn acres as of June 1 to be 95.4 million acres, up 100,000 acres from the March projection of 95.3 million. The range of analyst estimates is wide from 93.8 – 96.8 million acres. The wide range adds to the potential volatility before Monday’s report.

- Extended forecasts remain supportive for crop development heading into July, with near-normal temperatures and above-normal precipitation expected — ideal conditions as fields approach pollination. For now, the market sees no major weather threats.

- The prospects of lower interest rates has pressured the US dollar. On Thursday, the US dollar index traded to its lowest level since February 2022 which should help support commodity prices.

Corn Futures Break Lower end of Recent Range

Front-month corn futures have struggled through June, recently breaking key support and leaving an unfilled gap after the roll to September. A close above $4.46 would open the door to resistance near $4.65. On the downside, support lies at $4.20, with a weekly break below that exposing a potential move to $4.08.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs August.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None. No adjustment to the 1107 target, as it remains a feasible objective for this time of year based on historical weather-driven rally patterns.

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None. Same approach as with 2025 corn and 2024 soybeans — the strategy remains positioned for significant volatility, though nothing substantial has developed yet. The 1114 upside target also remains unchanged, as it continues to be a realistic objective based on historical rally patterns for this time of year.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None. Still no posted targets yet.

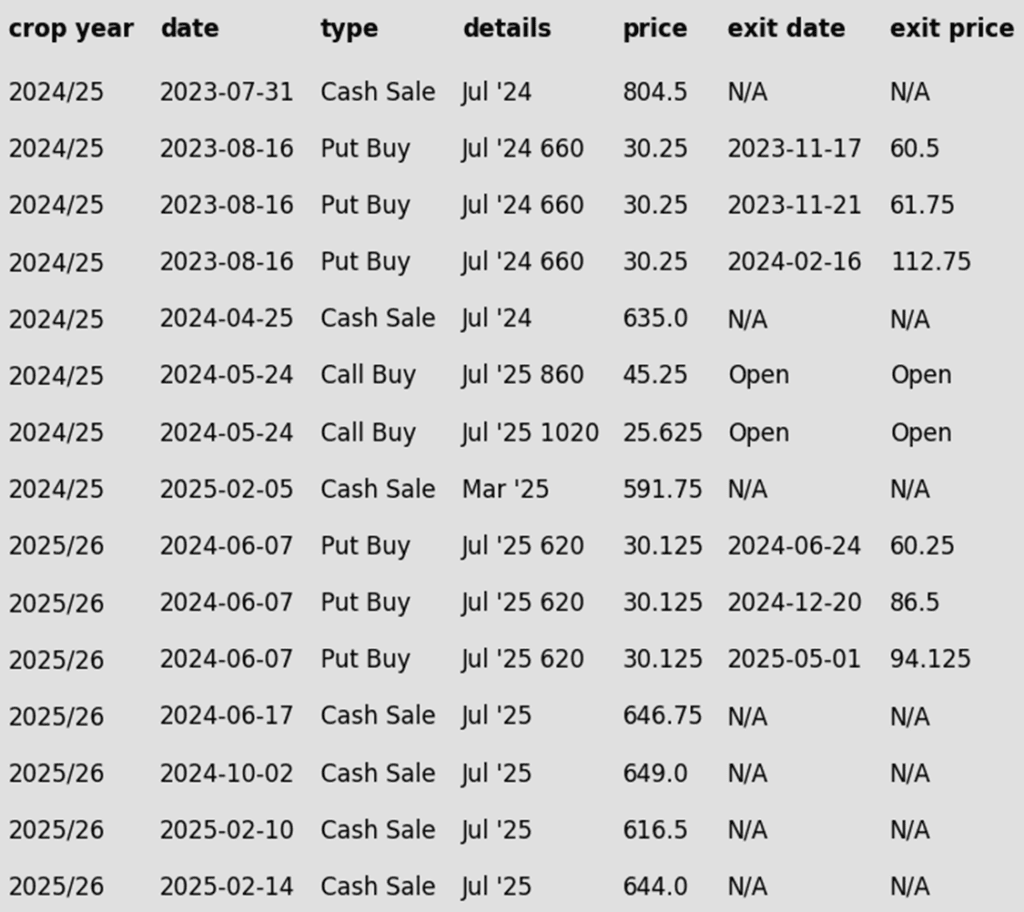

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed lower for the fifth consecutive day as selling pressure continues on good, wet weather through the Corn Belt and a general bearish tone from the funds. Soybean meal finished the day lower while soybean oil was higher along with crude oil.

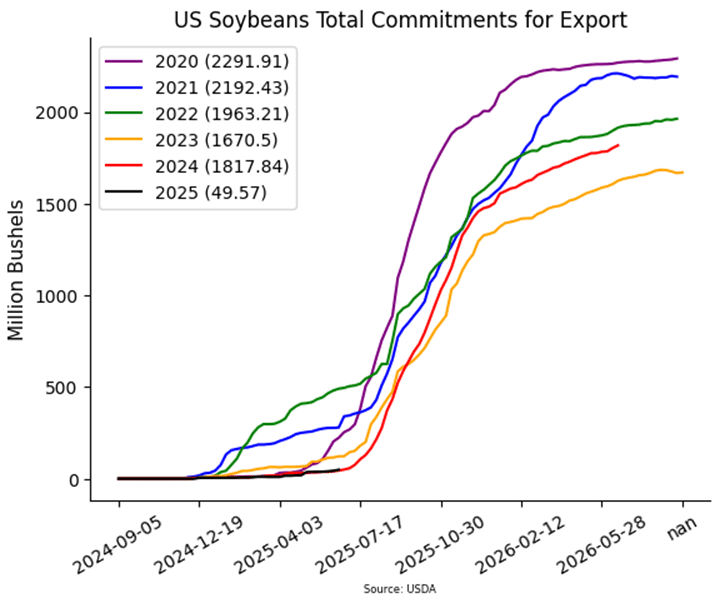

- Today’s export sales report came in better than expected with an increase of 14.8 million bushels for 24/25 and 5.7 mb for 25/26. This was above last week’s sales and up from the prior 4-week average. Top destinations were to the Netherlands, Mexico, and Egypt.

- Last week’s export shipments of 9.8 mb were below the 13.4 mb needed each week to meet the USDA’s export estimate of 1.850 bb for 24/25. In more friendly news, the USDA reported a flash sale of 110,000 tons of US soybeans to Egypt for delivery in the 24/25 marketing year.

- On Monday, the USDA will release its updated acreage report, and although a change in soybean acres from 83.5 ma is not expected, there is some wiggle room with trade estimates between 82 and 85 ma.

Soybeans Retreat from Recent Highs

Soybeans failed to close above key resistance at the May high of 1082 last week, keeping the broader trend sideways. A breakout above 1082 would open the door toward filling the June 2023 gap between 1161 and 1177. However, with this week’s break below support at 1032.50, the next downside target shifts to the April low at 970.25.

Wheat

Market Notes: Wheat

- Wheat sustained yet another round of losses during today’s session, shrugging off support from a sharply lower US Dollar Index. A combination of poor export sales, winter crop harvest pressure, and another lower close for Matif wheat all weighed on prices. On a positive note, wheat is nearing oversold territory on some technical indicators, which could mean that a bottom is near.

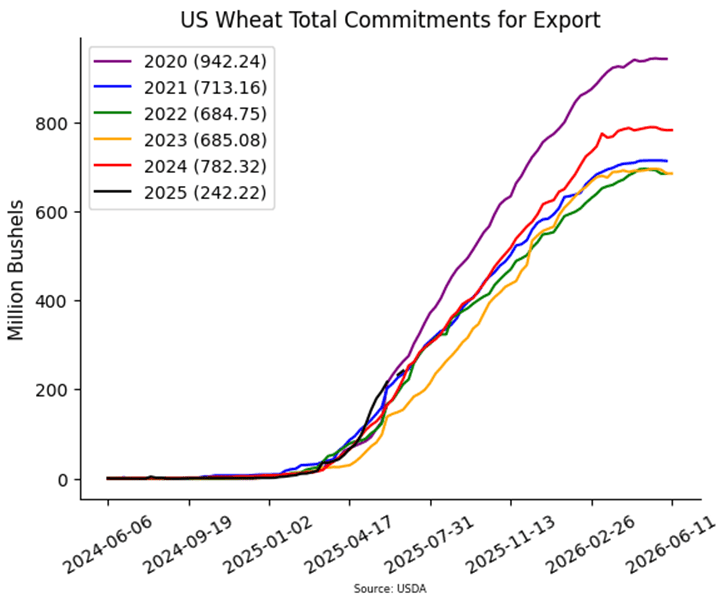

- The USDA reported an increase of 9.4 mb of wheat export sales for 25/26. Shipments last week totaled 9.4 mb, which falls under the 15.7 mb pace needed per week to reach their export goal of 825 mb. Total sales commitments for 25/26 are now at 242 mb, up 8% from last year.

- According to the USDA, as of June 24, an estimated 20% of US winter wheat acres are experiencing drought conditions, up 6% from a week ago. Spring wheat acres in drought also saw an uptick of 3% versus last week to 25%. For reference, only 5% of spring wheat was in drought at this time last year.

- IKAR reportedly increased their estimate of Russian wheat production by 700,000 mt to 84.5 mmt. For reference, both the USDA and SovEcon are projecting the Russian wheat harvest at 83 mmt; SovEcon also just raised their forecast by 200,000 mt.

- The International Grains Council has issued a new world wheat production forecast for the 25/26 season, raising their estimate by 2 mmt to 808 mmt. This is now more in line with the USDA’s estimate of 808.6 mmt.

- In a survey from Bloomberg, the average guess for Canadian all wheat planted area is expected at 27.7 million acres, with a range of 26.0 to 28.5. This would be up 200,000 acres from Stats Canada’s estimate in March, and up 900,000 from 2024.

- One private research firm is pegging Chinese 25/26 wheat production at 141.7 mmt, which is unchanged from their last update. However, this is despite drought in southern China. It is said that irrigation in these areas helped to keep wheat conditions satisfactory, while adequate moisture in northern areas will help offset any losses in the south.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. The 2024 wheat crops will drop off the report next week.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Returns to Recent Range

After running up to resistance levels last week, wheat futures have fallen sharply back below the upper end of the previous range. Initial support is at the June low of 522.25, with a break below that exposing further downside toward 506.25. On the upside, a weekly close above 558 could spark a larger move toward the winter high of 621.75.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. The 2024 wheat crops will drop off the report next week.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Close below 535.75 support vs September and sell more cash.

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- None.

2026 Crop:

- Plan A: Target 693 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

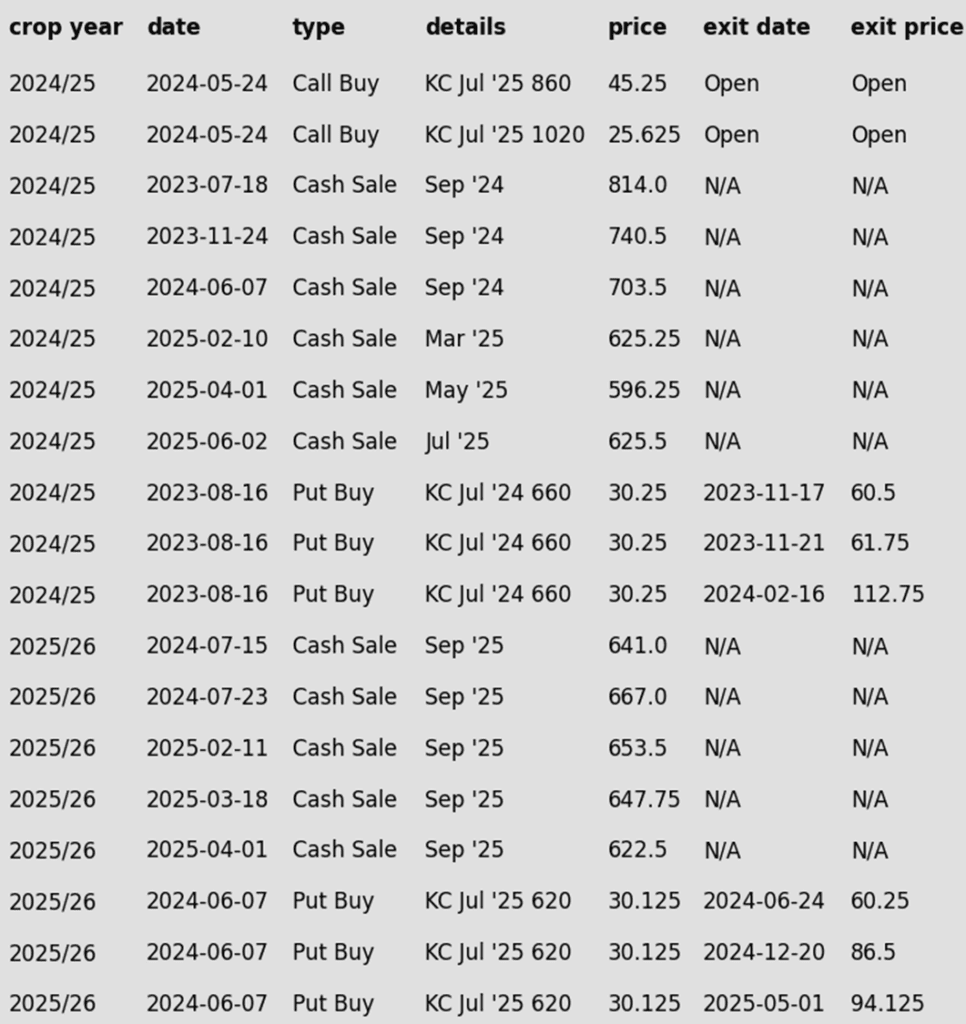

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Struggles Above Major Moving Averages

Strength last week pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness so far this week has sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Six sales recommendations made to date, with an average price of 684.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops. The 2024 wheat crops will drop off the report next week.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Changes:

- None.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holding Above Resistance

Spring wheat futures broke out above key resistance last week, establishing 660 as the next upside target. The early-week pullback appears to be a healthy correction within the broader uptrend. Key support now sits at the 200-day moving average near 607. A close below that level — and especially beneath the May low of 572.50 — would open the door to further downside risk.

Other Charts / Weather