6-24 End of Day: Grains Slide as Crude Drops, Selling Pressure Builds Across the Complex

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 416.25 | -3 |

| DEC ’25 | 429 | -4.75 |

| DEC ’26 | 459 | -2.25 |

| Soybeans | ||

| JUL ’25 | 1046.75 | -12 |

| NOV ’25 | 1037 | -9.75 |

| NOV ’26 | 1058.25 | -10.25 |

| Chicago Wheat | ||

| JUL ’25 | 535.75 | -17 |

| SEP ’25 | 552 | -17.5 |

| JUL ’26 | 613.25 | -17 |

| K.C. Wheat | ||

| JUL ’25 | 534.75 | -15.25 |

| SEP ’25 | 549.75 | -15.25 |

| JUL ’26 | 612.25 | -13 |

| Mpls Wheat | ||

| JUL ’25 | 625 | -1.75 |

| SEP ’25 | 641.75 | -3.5 |

| SEP ’26 | 681.25 | -3.25 |

| S&P 500 | ||

| SEP ’25 | 6148.5 | 71.5 |

| Crude Oil | ||

| AUG ’25 | 64.43 | -4.08 |

| Gold | ||

| AUG ’25 | 3332.3 | -62.7 |

Grain Market Highlights

- 🌽 Corn: Selling pressure remained in the corn market on Tuesday, as futures posted new nearby lows. July and September contracts marked new contract lows for the second consecutive session.

- 🌱 Soybeans: Soybeans closed lower for the third consecutive session, with July futures down 21 1/4 cents and November down 23 3/4 cents so far this week. Most of the pressure stems from weakness in soybean oil, which is following crude oil sharply lower.

- 🌾 Wheat: Wheat led the grain complex lower on Tuesday, with both winter wheat classes posting double-digit losses. Spring wheat also finished in the red but fared slightly better.

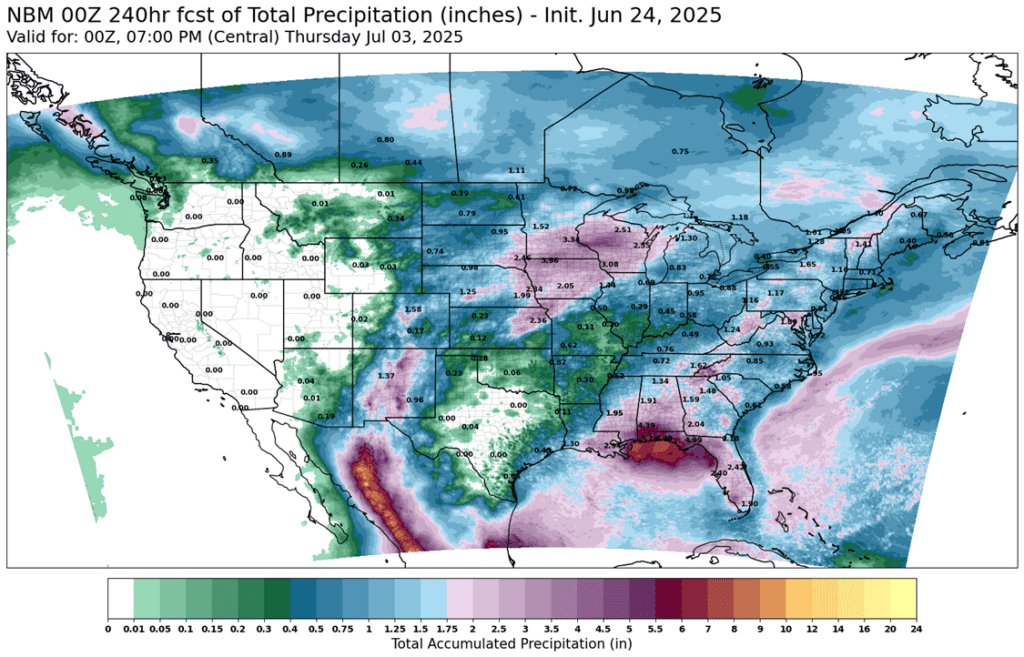

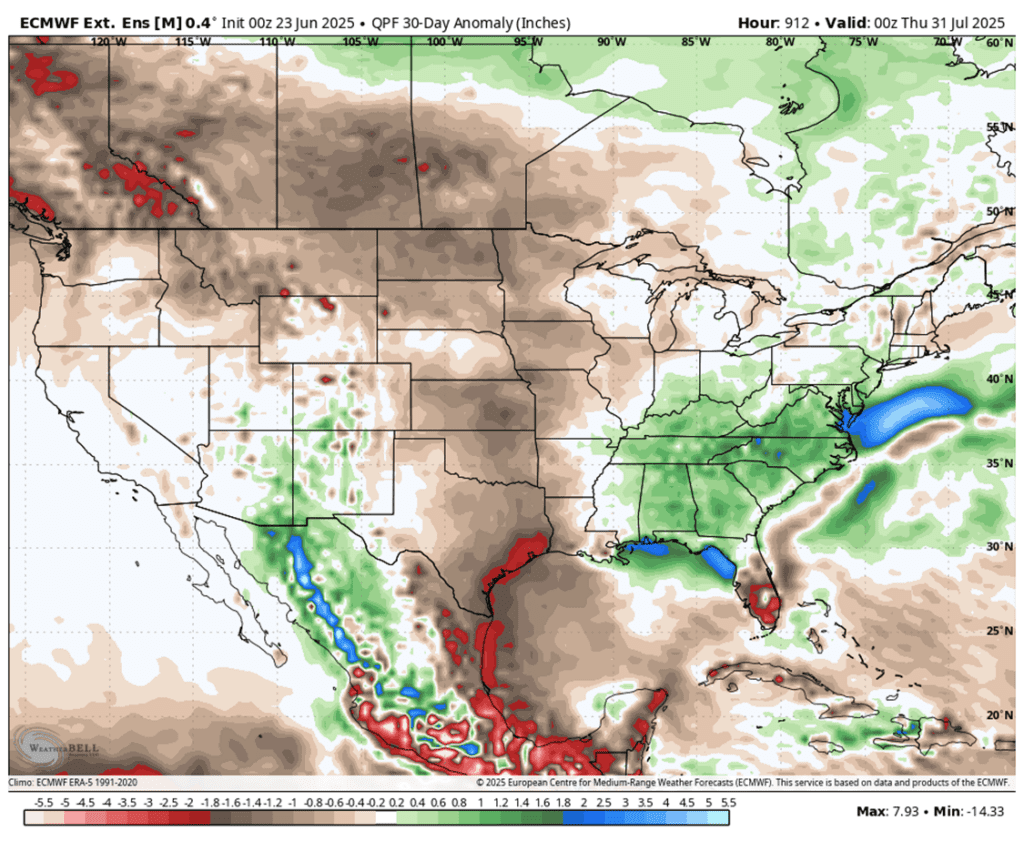

- To see updated U.S. weather outlook maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

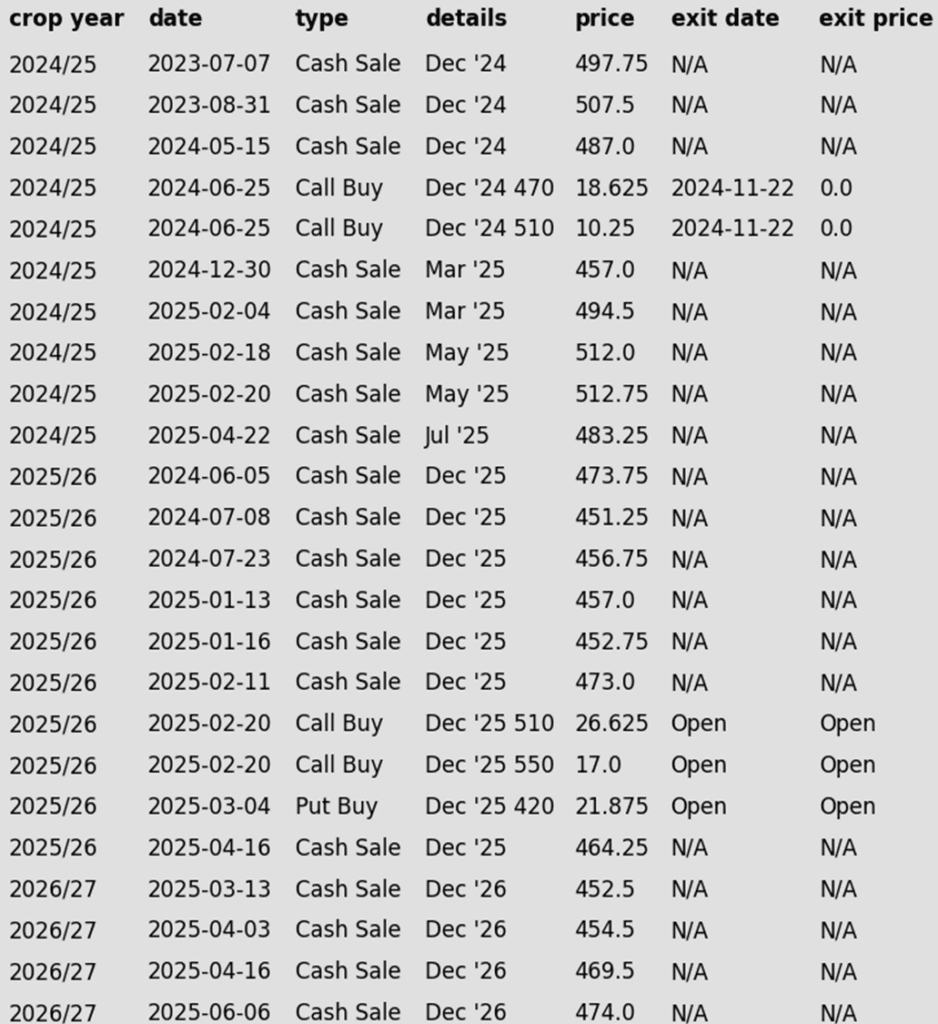

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Target 483 vs December ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- New upside target added.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Selling pressure remained in the corn market on Tuesday, as futures posted new nearby lows. July and September contracts marked new contract lows for the second consecutive session. Broad-based commodity weakness and favorable weather forecasts continue to keep buyers on the sidelines, allowing sellers to maintain control.

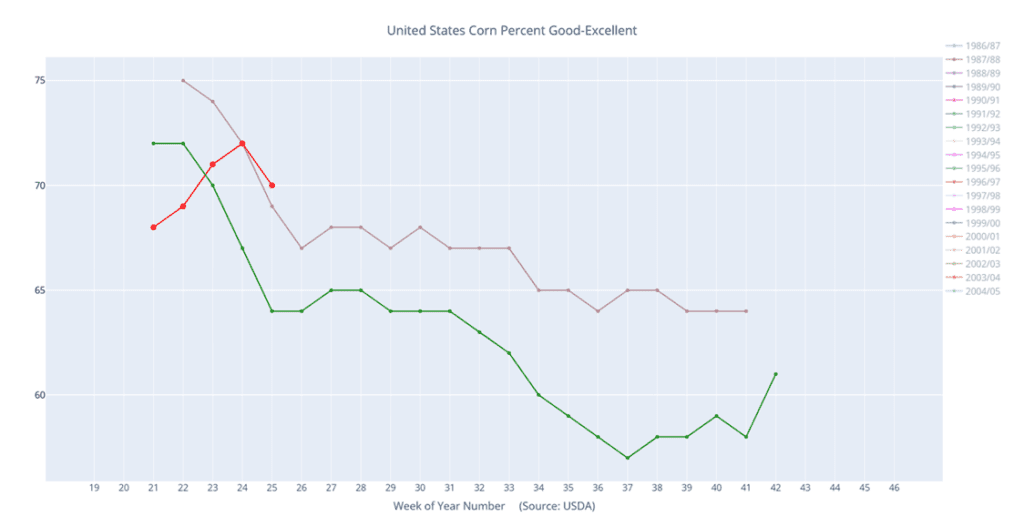

- Monday afternoon’s USDA Crop Progress report showed corn conditions at 70% good-to-excellent, down 2 percentage points from last week and below trade expectations for steady ratings at 72%. This compares to 69% good-to-excellent at the same time last year.

- Analyst expectations for Brazil’s second corn crop continue to rise. Agroconsult raised its forecast to a record 123.3 MMT, up 10.4 MMT from last month and 20.2 MMT above last year’s crop, despite delays from late planting and weather-related harvest setbacks.

- Speculative hedge funds expanded their net short position by more than 20,000 contracts as of June 17, bringing the total to 184,788 contracts. Given recent price action, current estimates likely place the net short above 200,000 contracts.

- The USDA reported a flash sale to Mexico of 630,000 metric tons of new-crop corn on Tuesday. Of that total, 554,500 MT is for the 2025-26 marketing year, with the remaining 57,600 MT for 2026-27.

Corn Futures Continue to Trade Within Recent Range

Front-month corn remains rangebound within a 30-cent band, mostly trading below resistance at 4.46. The recent roll to September futures left an unfilled chart gap. A close above 4.46 could open the door to a move toward 4.65, while support rests near the recent low of 4.20. A break below that would expose the next downside target at 4.08.

Above: Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

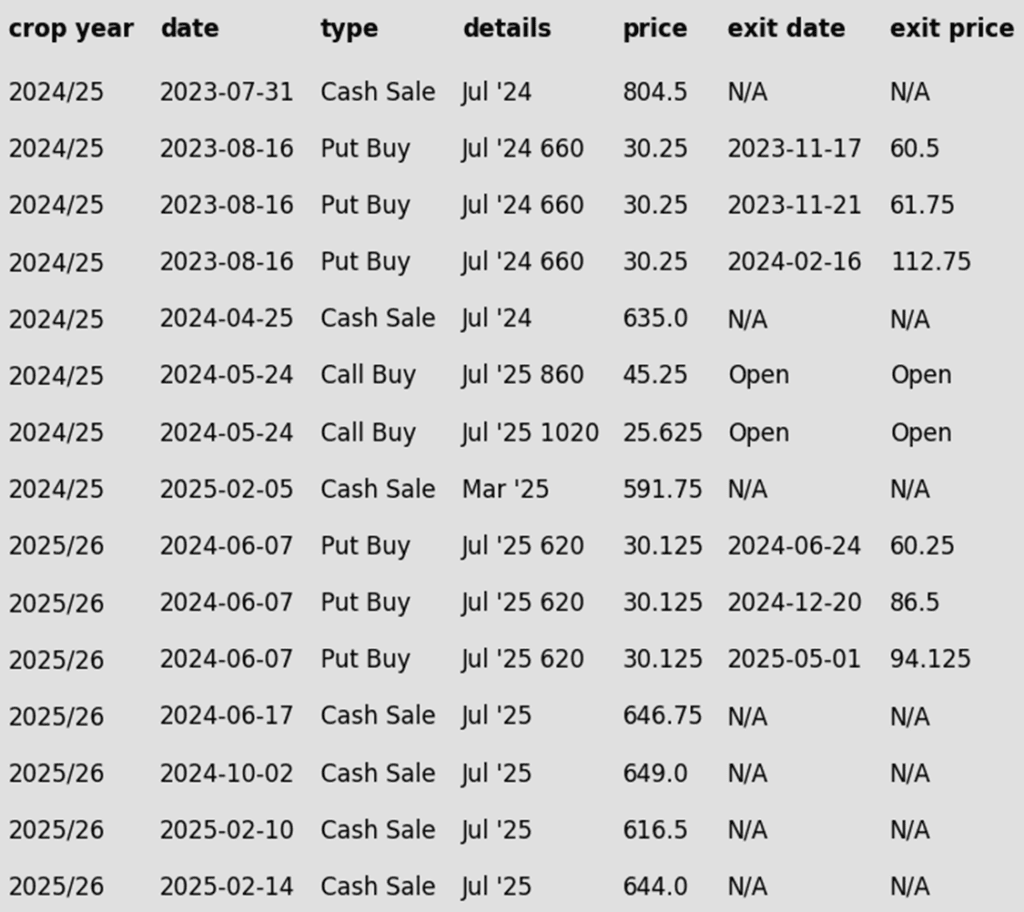

2024 Crop:

- Plan A: Next cash sale at 1107 vs August.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

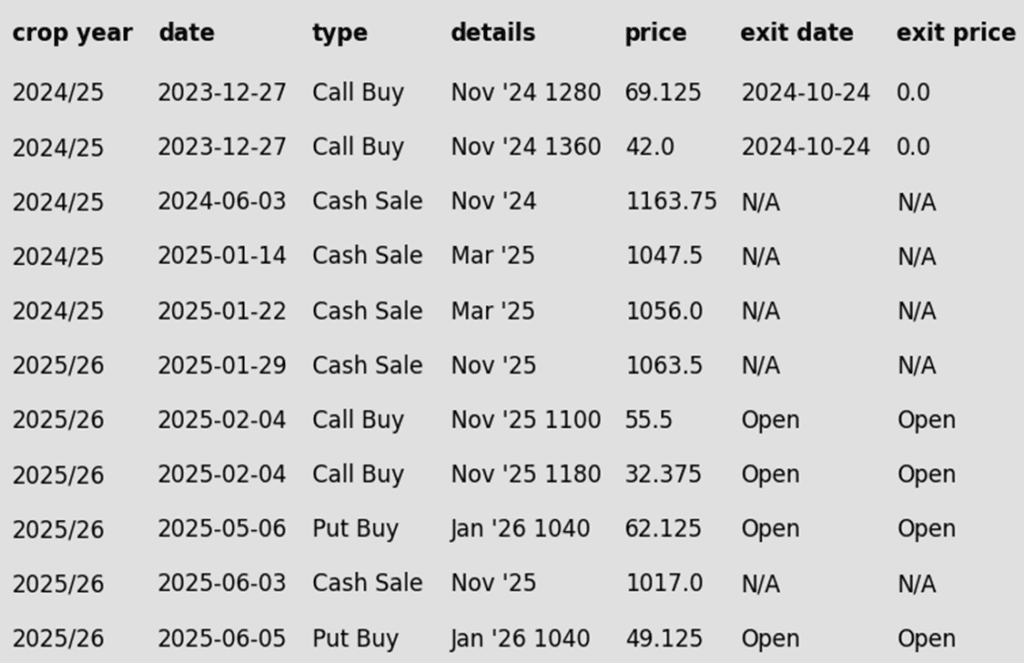

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed lower for the third consecutive day with the July contract losing 21-1/4 cents and November losing 23-3/4 cents so far this week. Pressure has primarily come from declines in soybean oil as it follows crude oil sharply lower. Crude oil has lost nearly 13 dollars per barrel since yesterday’s high as Iran and Israel seem close to agreeing to a cease fire.

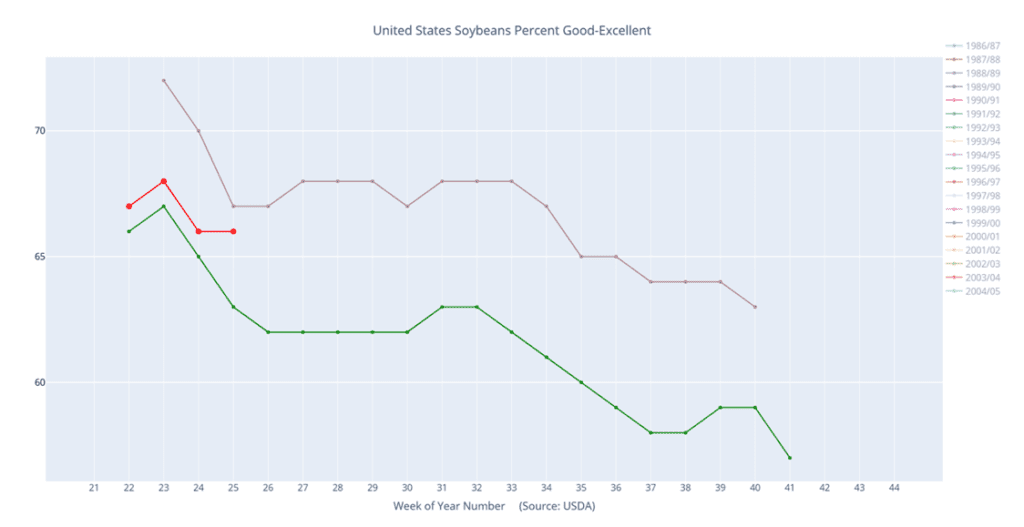

- Yesterday’s Crop Progress report saw crop conditions for soybeans unchanged with the good to excellent rating still at 66%. 96% of the crop is planted, 90% is emerged, compared to 84% last week, and 8% is blooming.

- Geopolitical tensions remain elevated, as reports emerged that Iran launched six missiles toward U.S. bases in Qatar and Iraq in response to weekend U.S. airstrikes on Iranian nuclear facilities. However, the absence of direct attacks on energy infrastructure led to selling in both crude oil and soybean oil.

- Yesterday’s CFTC report saw funds as buyers of soybeans. They bought 33,526 contacts which increased their net long position to 59,165 contracts. They bought 21,375 contracts of bean oil and sold 20,273 contracts of meal.

Soybeans Pause Near Upper End of Recent Range

Soybeans remain near major resistance that must be cleared to unlock broader upside potential. The macro trend remains sideways, with key resistance at the May high of 1082. A close above that level could target the open gap on the front-month continuous chart from last June, which spans 1161 to 1177. If July futures fail to break 1082, the risk shifts back toward rangebound or lower trade. Initial support is at 1032.5, with a close below that exposing the April low of 970.25 as the next downside risk.

Above: Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Wheat

Market Notes: Wheat

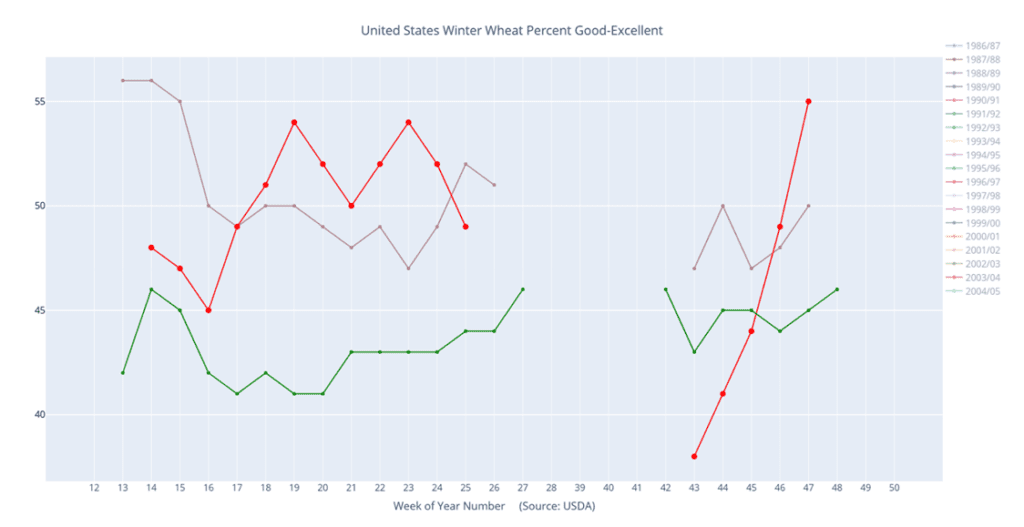

- Wheat led the grain complex to the downside today. Both of the winter wheat classes sustained double-digit losses. Spring wheat, though also closing lower, was able to come away with less damage. The declines came despite a weaker U.S. dollar and deteriorating crop conditions, suggesting that traders are prioritizing macroeconomic and geopolitical drivers. Crude oil’s continued slide through key moving average support added pressure across the commodity space.

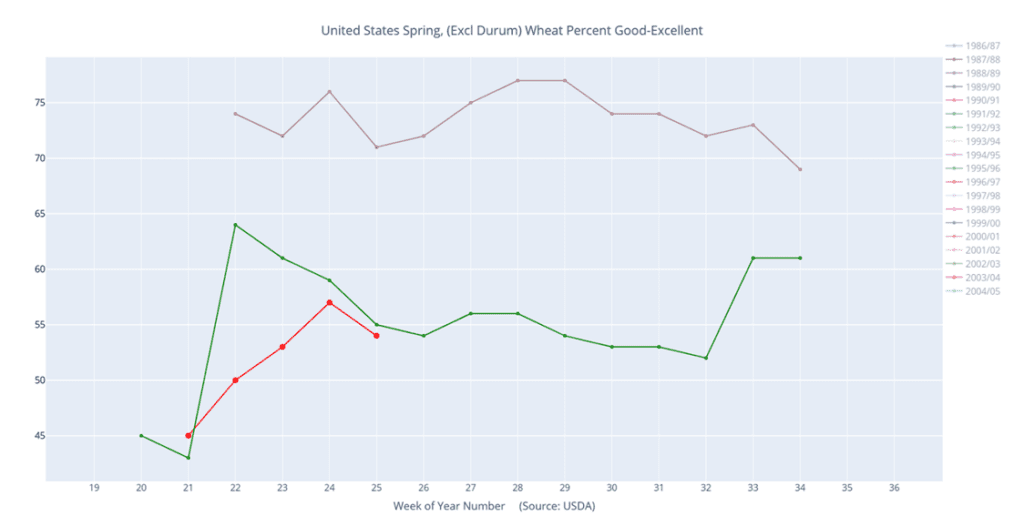

- Yesterday afternoon’s Crop Progress report indicated that winter wheat conditions fell 3% from last week to 49% good to excellent. Additionally, 96% of the crop is headed and 19% of the crop has been harvested. This is well below the 38% harvested last year and the five-year average of 28%. Spring wheat conditions also slipped 3% to 54% good to excellent; 93% of that crop is emerged and 17% is headed.

- According to the Commitments of Traders report, managed funds bought over 31,000 wheat contracts across all three classes, reducing their net short to about 152,000 contracts. However, this data is through Tuesday, June 17, and it is likely they have re-established short positions over the past few sessions.

- Analyst group ASAP Agri has estimated Ukraine’s 2025 wheat production will fall 3% year over year to 21.74 mmt. Additionally, they forecasted the yield at 4.37 mt per hectare, which would be down 3.5%. Finally, they projected Ukrainian 25/26 wheat exports at 15 mmt.

- Brazil’s Emater/RS pegged 2025 wheat yields at 2.997 mt/ha, an 8% improvement over 2024. However, planted area is expected to decline by 10% to 1.198 million hectares. Total production is estimated at 3.591 MMT, down about 3% from last season.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B:

- Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Returns to Recent Range

After running up to resistance levels last week, wheat futures have fallen sharply back below the upper end of the previous range. Initial support is at the June low of 522.25, with a break below that exposing further downside toward 506.25. On the upside, a weekly close above 558 could spark a larger move toward the winter high of 621.75.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Close below 535.75 support vs September and sell more cash.

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- None.

2026 Crop:

- Plan A: Target 693 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

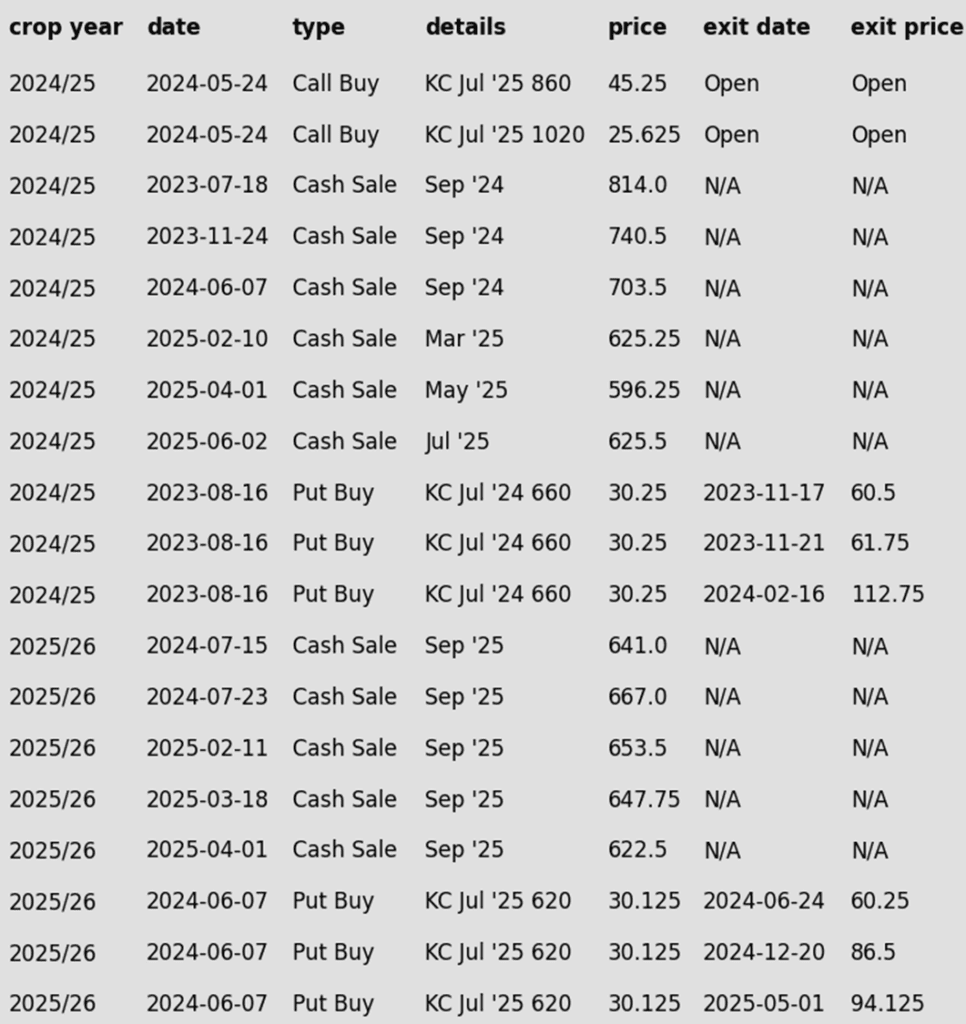

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Struggles Above Major Moving Averages

Strength last week pushed KC wheat futures to their highest level in months, testing the April highs near 580. Weakness so far this week has sent futures back below both the 100- and 200-day moving averages which should now act as resistance. First support should appear at the June low of 517.75

Above: Winter wheat condition percentage good-excellent (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Six sales recommendations made to date, with an average price of 684.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance (strikes TBD).

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B:

- Close below 584 vs July ‘26 KC and buy July KC put options (strikes TBD).

- Details:

- Changes:

- None.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holding Above Resistance

Spring wheat futures broke out above key resistance last week, establishing 660 as the next upside target. The early-week pullback appears to be a healthy correction within the broader uptrend. Key support now sits at the 200-day moving average near 607. A close below that level—and especially beneath the May low of 572.50—would open the door to further downside risk.

Above: Spring wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Other Charts / Weather