6-20 End of Day: Grains Slide into the Weekend on Risk-Off Trade and Profit-Taking

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 428.75 | -4.75 |

| DEC ’25 | 441.25 | -2.75 |

| DEC ’26 | 468.25 | -3.5 |

| Soybeans | ||

| JUL ’25 | 1068 | -6.75 |

| NOV ’25 | 1060.75 | -7.5 |

| NOV ’26 | 1079 | -4.5 |

| Chicago Wheat | ||

| JUL ’25 | 567.75 | -6.5 |

| SEP ’25 | 583.5 | -7 |

| JUL ’26 | 641.5 | -4.5 |

| K.C. Wheat | ||

| JUL ’25 | 563.25 | -8 |

| SEP ’25 | 578.75 | -7.75 |

| JUL ’26 | 638.25 | -5.75 |

| Mpls Wheat | ||

| JUL ’25 | 646.25 | 15.5 |

| SEP ’25 | 661.5 | 17.25 |

| SEP ’26 | 688 | 5.5 |

| S&P 500 | ||

| SEP ’25 | 6020.25 | -14 |

| Crude Oil | ||

| AUG ’25 | 73.78 | 0.28 |

| Gold | ||

| AUG ’25 | 3381.5 | -26.6 |

Grain Market Highlights

- 🌽 Corn: Corn futures posted losses Friday alongside soybeans and wheat, as traders adopted a risk-off approach.

- 🌱 Soybeans: Soybeans closed lower Friday, reversing from early session highs in a bearish technical move — taking out Wednesday’s high but closing below its low.

- 🌾 Wheat: Wheat futures closed lower Friday, following the broader grain complex. After Thursday’s sharp rally, profit-taking was likely a factor.

- To see updated U.S. weather outlook maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

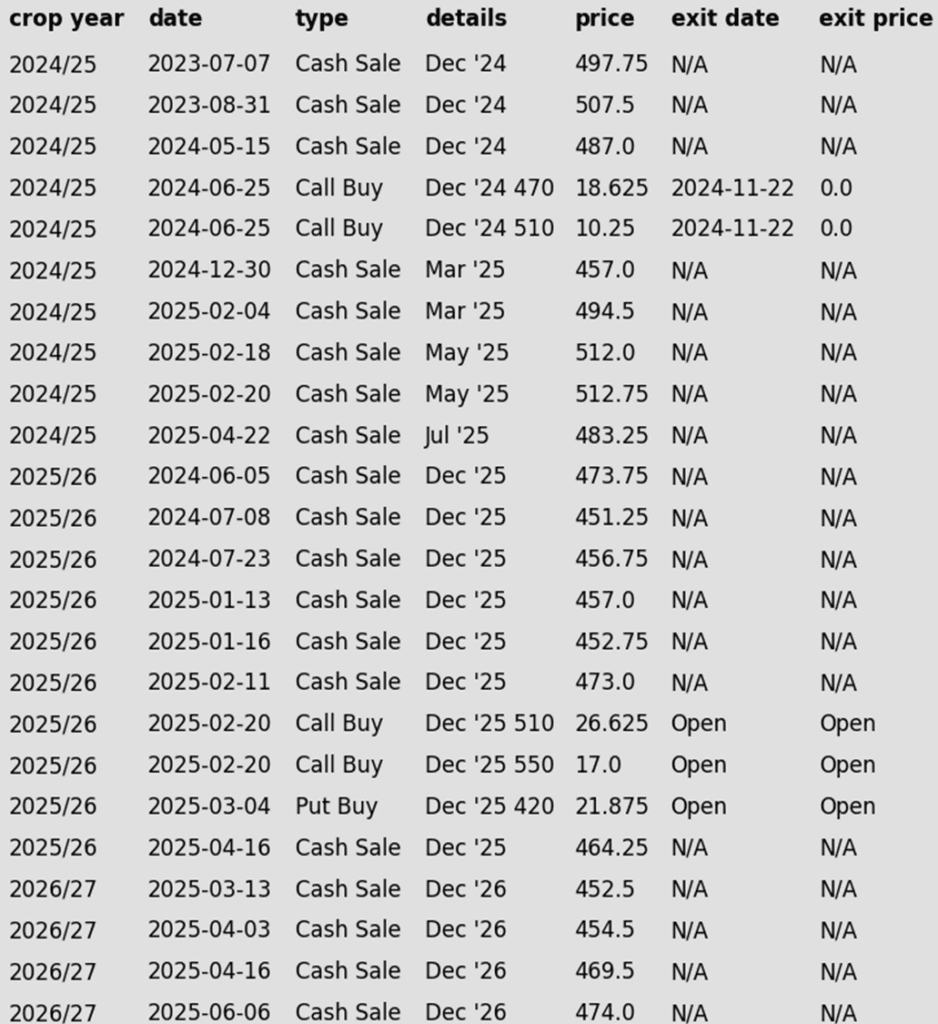

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

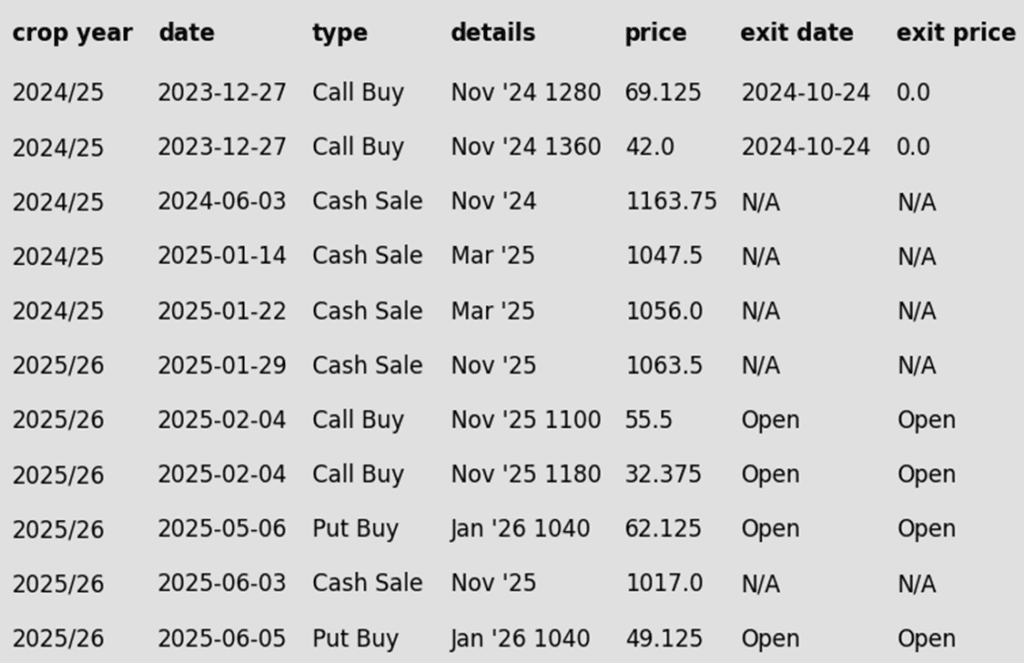

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

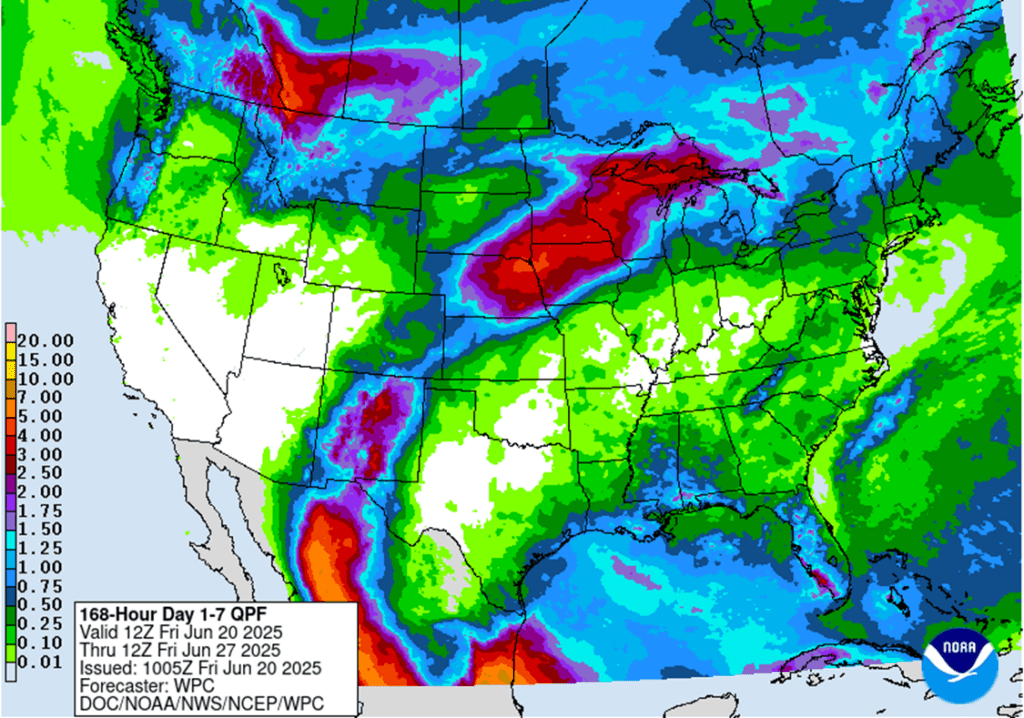

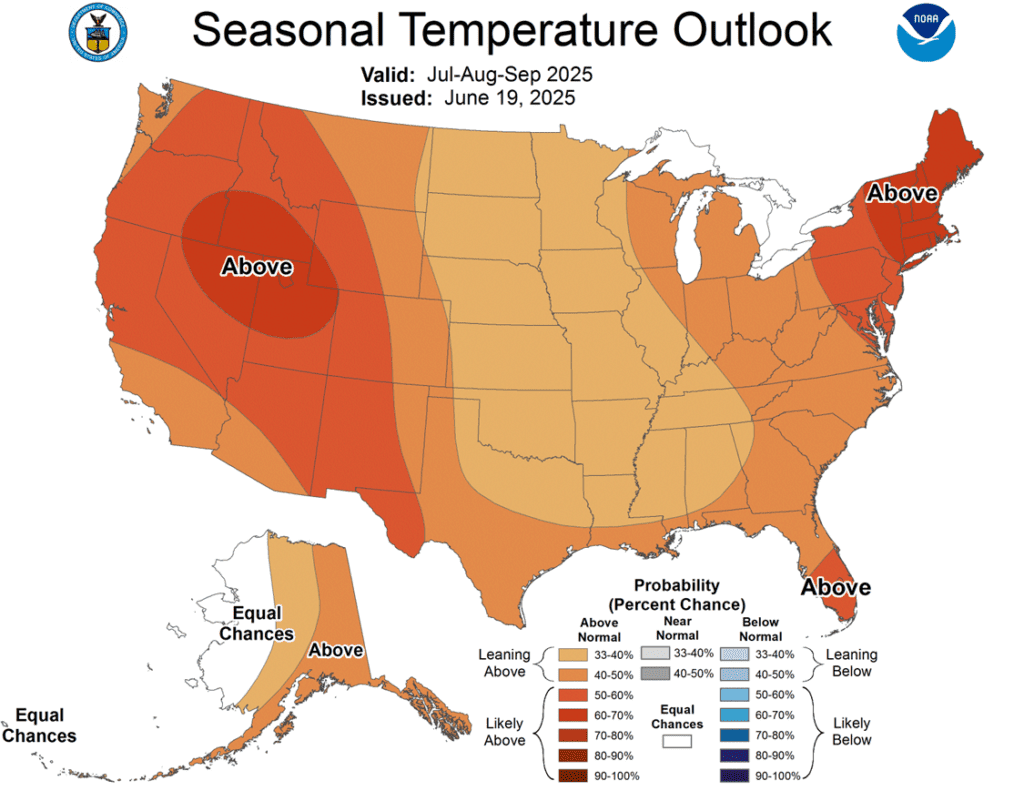

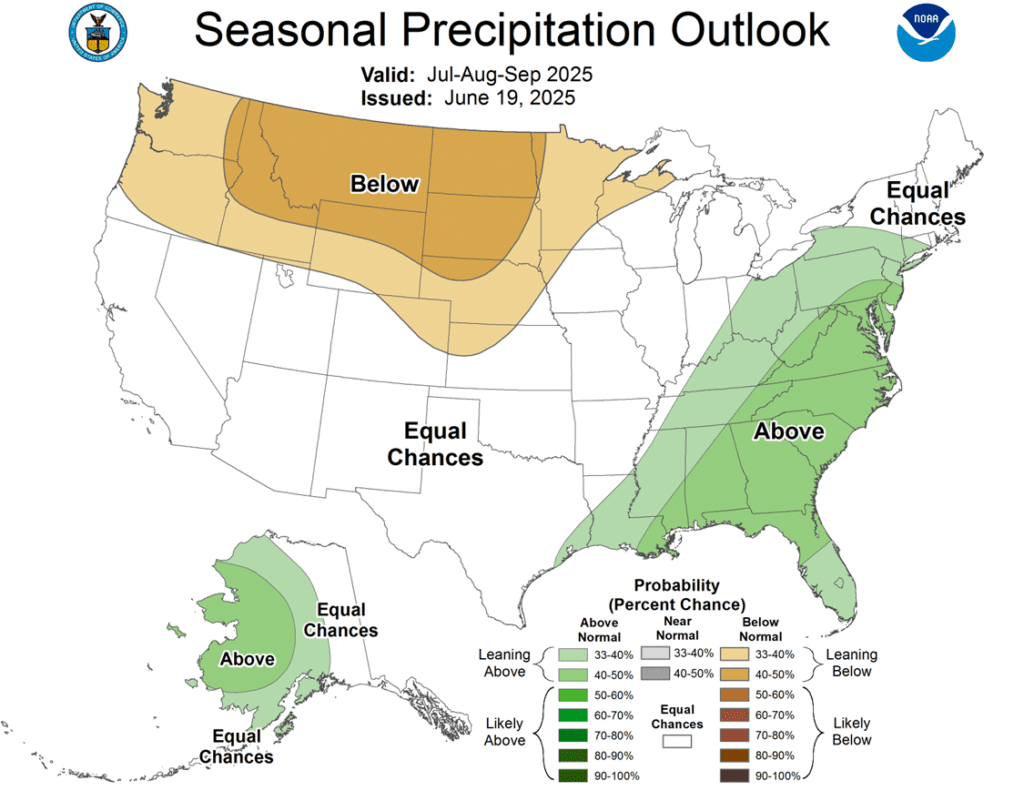

- Corn futures posted losses Friday alongside soybeans and wheat, as traders adopted a risk-off approach. Despite a heat wave expected this weekend, the market remains pressured by forecasts calling for above-normal precipitation across the Midwest, limiting upside momentum.

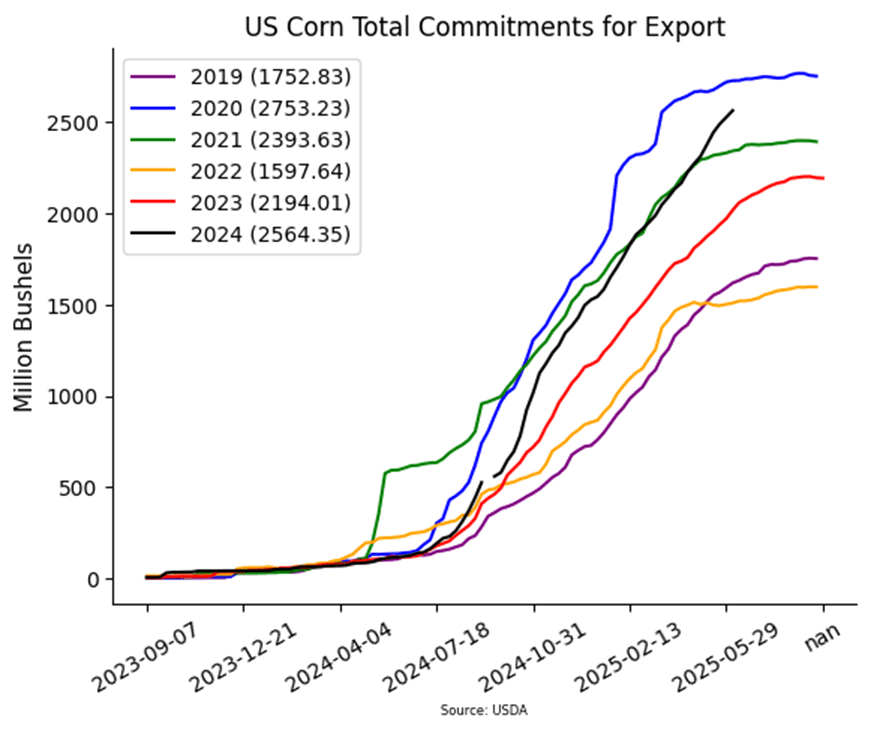

- USDA reported corn export sales of 35.6 mb for 2024/25 and 6.1 mb for 2025/26. Shipments last week totaled 68.7 mb, well above the 44.5 mb weekly pace needed to meet the USDA’s 2.650 bb target. Total 2024/25 commitments now stand at 2.631 bb, up 26% from a year ago.

- Argentina’s corn harvest advanced 3% to 50% complete, according to the Buenos Aires Grain Exchange. While yields are reportedly better than expected, the group maintained its production estimate at 49 MMT — slightly below the USDA’s 50 MMT and last year’s 51.6 MMT.

- The latest EIA report showed ethanol production down 1% on the week to 326 million gallons — still exceeding the pace needed to meet USDA’s 5.5 bb corn use forecast. Ethanol stocks rose 1.6% from the previous week.

Corn Futures Continue to Trade Within Recent Range

Front-month corn remains rangebound within a tight 20-cent band, mostly trading below resistance at 4.46. The recent roll to September futures left an unfilled chart gap. A close above 4.46 could open the door to a move toward 4.65, while support rests near the recent low of 4.20. A break below that would expose the next downside target at 4.08.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs August.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

2025 Crop:

- Plan A:

- Next cash sale at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- A new cash sale target of 1114 has posted.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

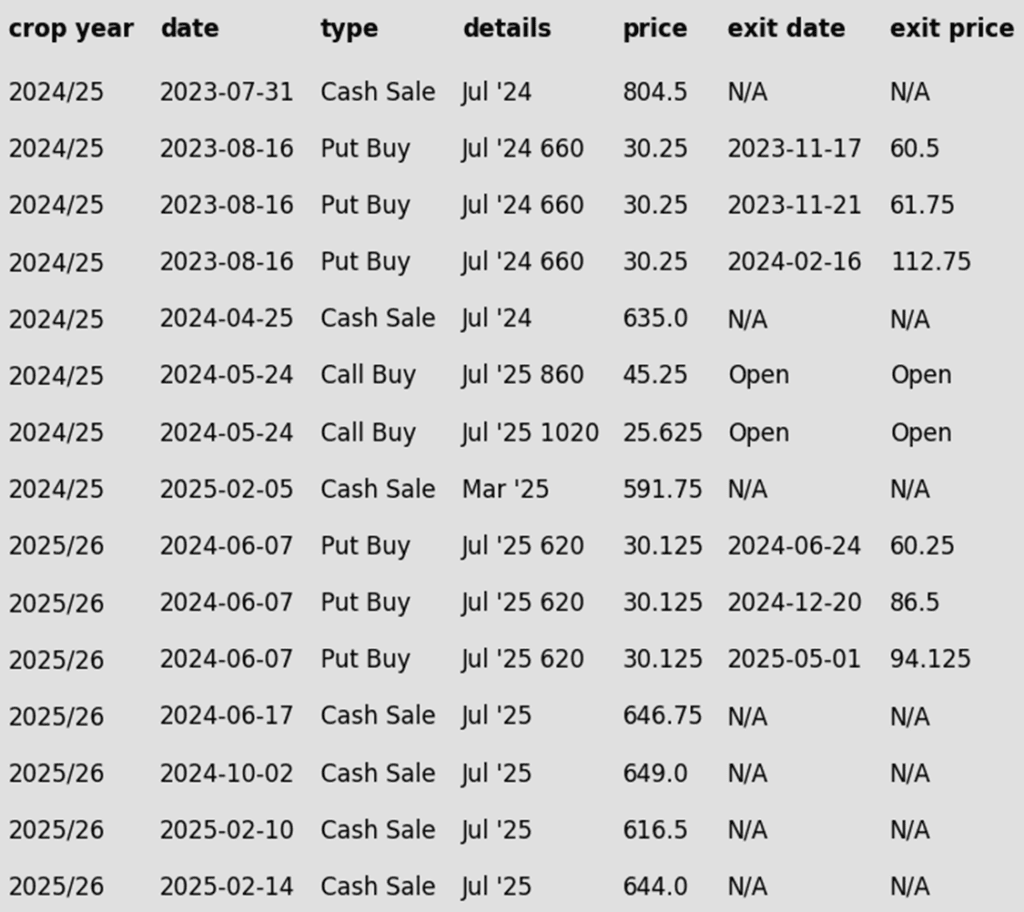

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed lower, reversing from highs earlier in the day. The move was a bearish reversal having taken out Wednesday’s high but closing below its low. Volume was likely lighter than normal following the holiday and going into the weekend. Both soybean meal and oil were lower today as well.

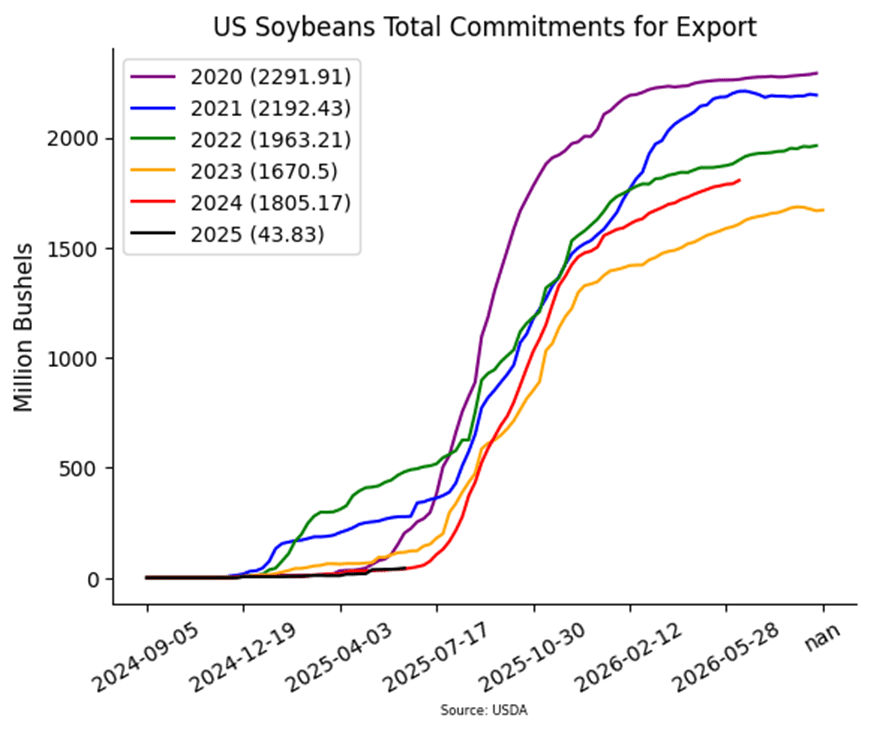

- Export sales came in better than expected, with 19.8 mb booked for 2024/25 and 2.8 mb for 2025/26. Top buyers included Germany, Mexico, and unknown destinations. Shipments totaled 14.9 mb, above the 13.2 mb weekly pace needed to reach USDA’s 1.850 bb target.

- Chinese soybean imports from Brazil surged 37.5% year over year in May, totaling 12.11 MMT versus 8.81 MMT last year. Imports from the U.S. were just 1.63 MMT.

- For the week, July soybeans lost 1-3/4 cents closing at $10.68 while November soybeans gained 6 cents to $10.60-3/4. July soybean meal lost $7.80 to $284.10 while July bean oil gained a whopping 3.86 cents to 54.47 cents reaching the highest level since September 2023.

Soybeans Pause Near Upper End of Recent Range

Soybeans remain near major resistance that must be cleared to unlock broader upside potential. The macro trend remains sideways, with key resistance at the May high of 1082. A close above that level could target the open gap on the front-month continuous chart from last June, which spans 1161 to 1177. If July futures fail to break 1082, the risk shifts back toward rangebound or lower trade. Initial support is at 1032.5, with a close below that exposing the April low of 970.25 as the next downside risk.

Wheat

Market Notes: Wheat

- Wheat futures closed lower Friday, following the broader grain complex. After Thursday’s sharp rally, profit-taking was likely a factor, alongside a mostly non-threatening U.S. weather outlook that pressured corn and soybean futures, limiting wheat’s upside.

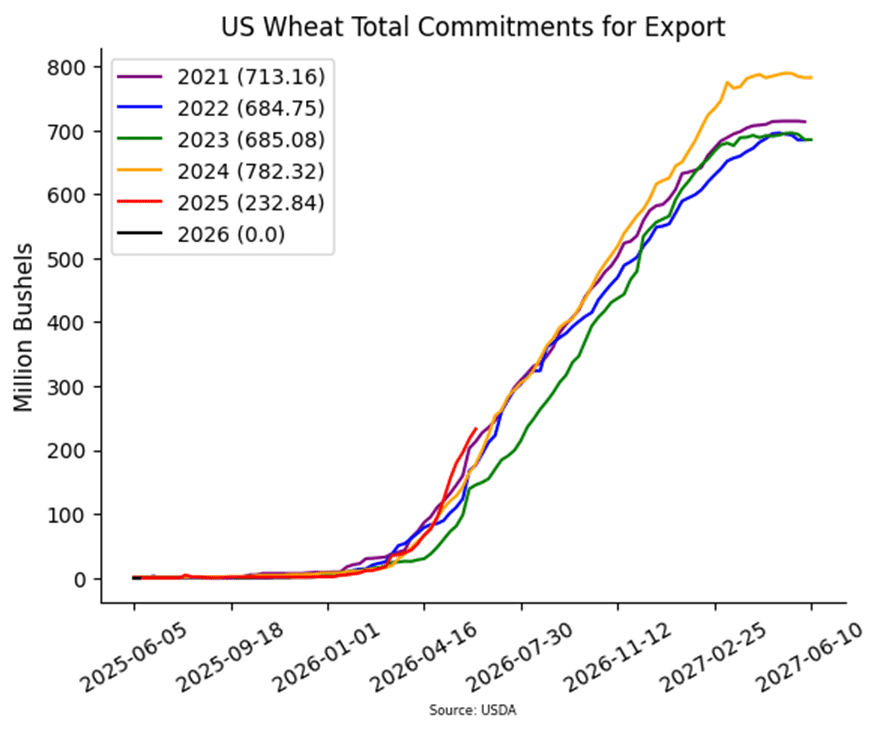

- USDA reported wheat export sales of 15.7 mb for 2025/26. Shipments reached 13.4 mb, below the 15.6 mb weekly pace needed to hit USDA’s 825 mb export goal. Total sales commitments for 2025/26 stand at 233 mb, up 17% from last year.

- Weather conditions in South America could provide underlying support. Heavy rains in southern Brazil are expected to delay winter wheat planting, while persistent dryness in Argentina may hinder crop establishment.

- The Buenos Aires Grain Exchange reported Argentine wheat planting at 60% complete, up 22% from the previous week. They maintained their production estimate at 20 MMT, which would be an 8% increase year-over-year if realized.

- The Russian agriculture ministry is anticipating a 2025 wheat crop totaling 90 mmt. For reference, the USDA is using a figure of just 83 mmt. However, both the ag ministry and the USDA are anticipating Russian wheat exports near 45 mmt.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

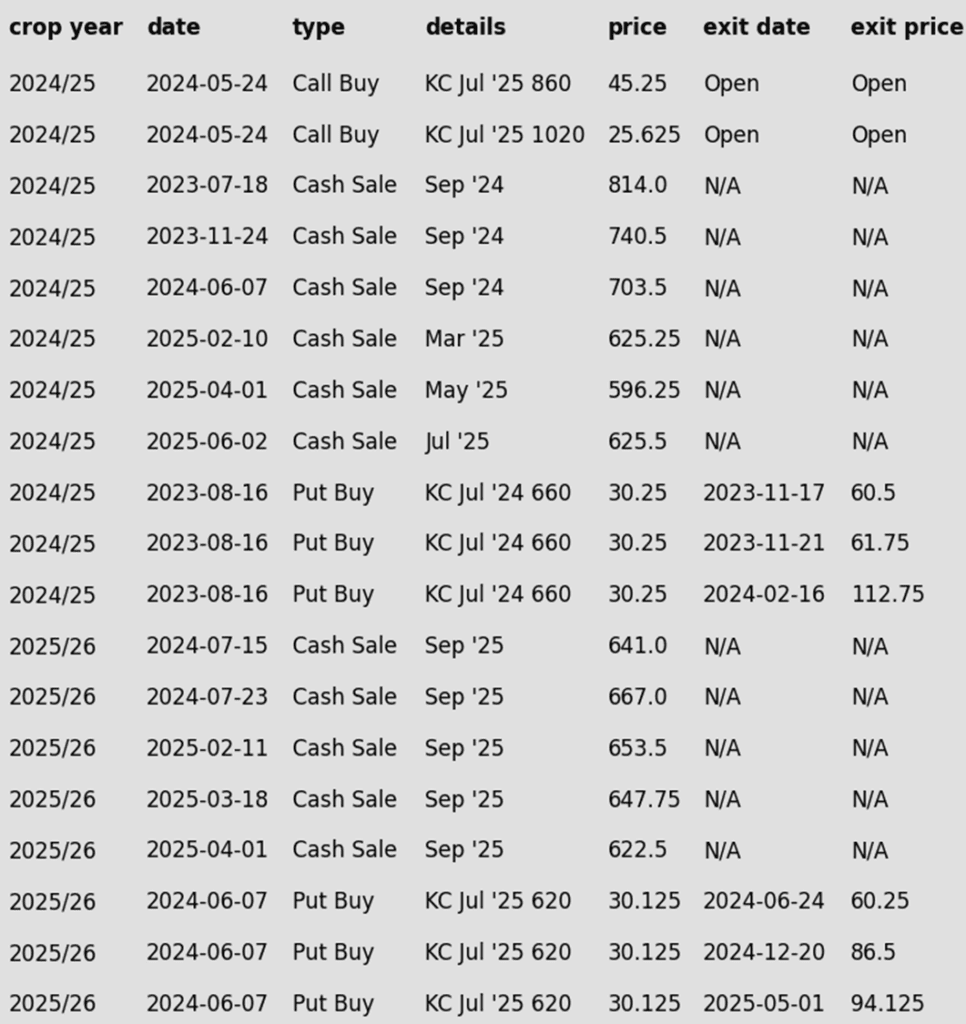

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Breaks Out of Recent Range

A strong breakout above longer-term moving averages and the upper end of the recent range signals bullish momentum. Initial support is at last week’s low of 522.25, with a break below that exposing further downside toward 506.25. On the upside, a weekly close above 558 could spark a larger move toward the winter high of 621.75.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Close below 535.75 support vs September and sell more cash.

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- Plan B downside stop added at 535.75 support. As long as the September contract continues to hold above this support will remain patient for better opportunities. If this support breaks then another cash sale will be recommended as further downside could follow

2026 Crop:

- Plan A: Target 693 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 549 support vs July ‘26 and sell more cash.

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- Plan B downside stop added at 549 support. As long as the July ’26 contract continues to hold above this support will remain patient for better opportunities. If this support breaks then another cash sale will be recommended as further downside could follow.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Finds Resistance at the 50-Day

July closed right at the 50-day moving average today following a strong bullish reversal off today’s low. Closing over today’s high would make the 200-day at 567 the next immediate target.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Six sales recommendations made to date, with an average price of 684.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if September KC closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Rallies Above Resistance

Spring wheat futures surged through resistance this week, setting up 660 as the next upside target. Key support lies at this week’s low and the 200-day moving average near 607. A close below that zone — and especially below the May low of 572.50 — would signal the next downside risk.

Other Charts / Weather