6-2 End of Day: Wheat Futures Climb While Corn and Soybeans Continue Decline

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 438.25 | -5.75 |

| DEC ’25 | 435.75 | -2.75 |

| DEC ’26 | 462 | 1.5 |

| Soybeans | ||

| JUL ’25 | 1033.5 | -8.25 |

| NOV ’25 | 1017 | -9.75 |

| NOV ’26 | 1035.5 | -3.75 |

| Chicago Wheat | ||

| JUL ’25 | 539 | 5 |

| SEP ’25 | 553.25 | 5 |

| JUL ’26 | 613.75 | 2.75 |

| K.C. Wheat | ||

| JUL ’25 | 539.75 | 6.5 |

| SEP ’25 | 553.5 | 6.5 |

| JUL ’26 | 610 | 5 |

| Mpls Wheat | ||

| JUL ’25 | 627.25 | 1.75 |

| SEP ’25 | 640.25 | 3 |

| SEP ’26 | 675.75 | 0.75 |

| S&P 500 | ||

| SEP ’25 | 5988.25 | 19 |

| Crude Oil | ||

| AUG ’25 | 61.75 | 1.96 |

| Gold | ||

| AUG ’25 | 3396.9 | 81.5 |

Grain Market Highlights

- 🌽 Corn: Corn futures ended lower Monday, with favorable weather across much of the Corn Belt continuing to weigh on prices. December futures closed in the red for the seventh straight session, as traders remain reluctant to add risk premium without a clear weather threat.

- 🌱 Soybeans: Soybean futures closed lower Monday, pressured by uncertainty surrounding upcoming trade talks between President Trump and China’s President Xi.

- 🌾 Wheat: Wheat futures closed higher across all three U.S. exchanges Monday, supported by a combination of adverse global weather, a weaker U.S. dollar, and renewed geopolitical risk.

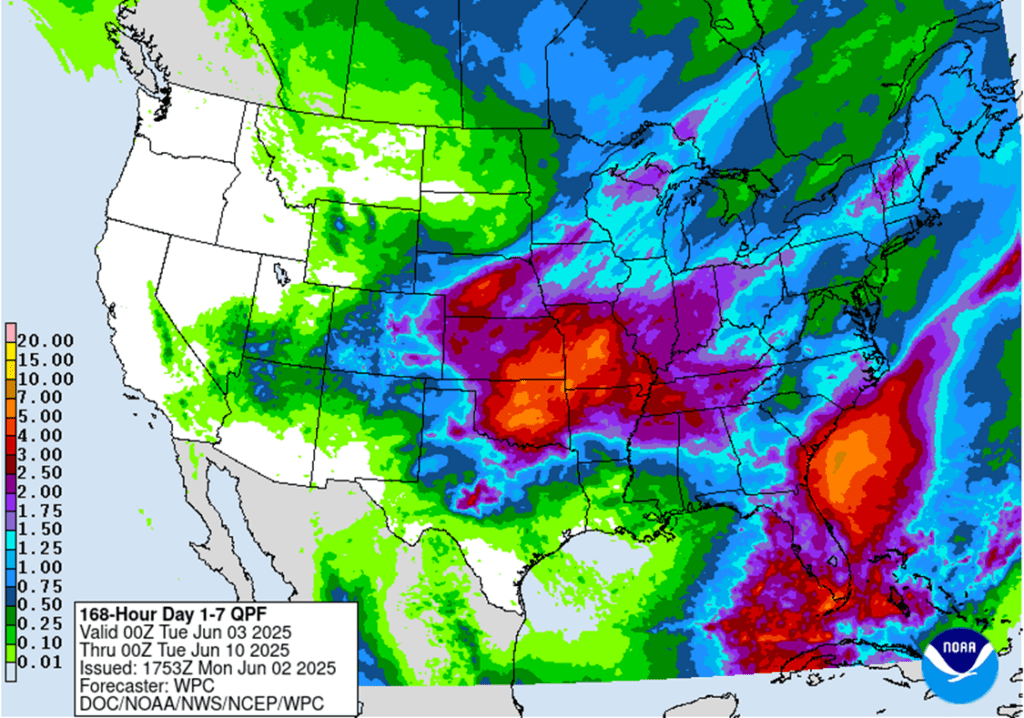

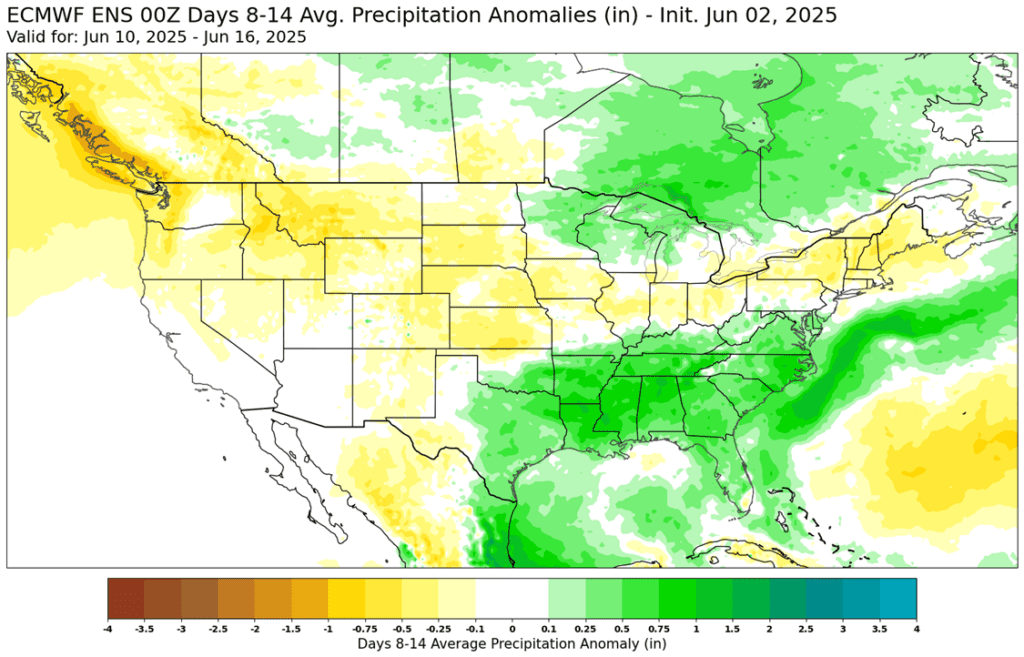

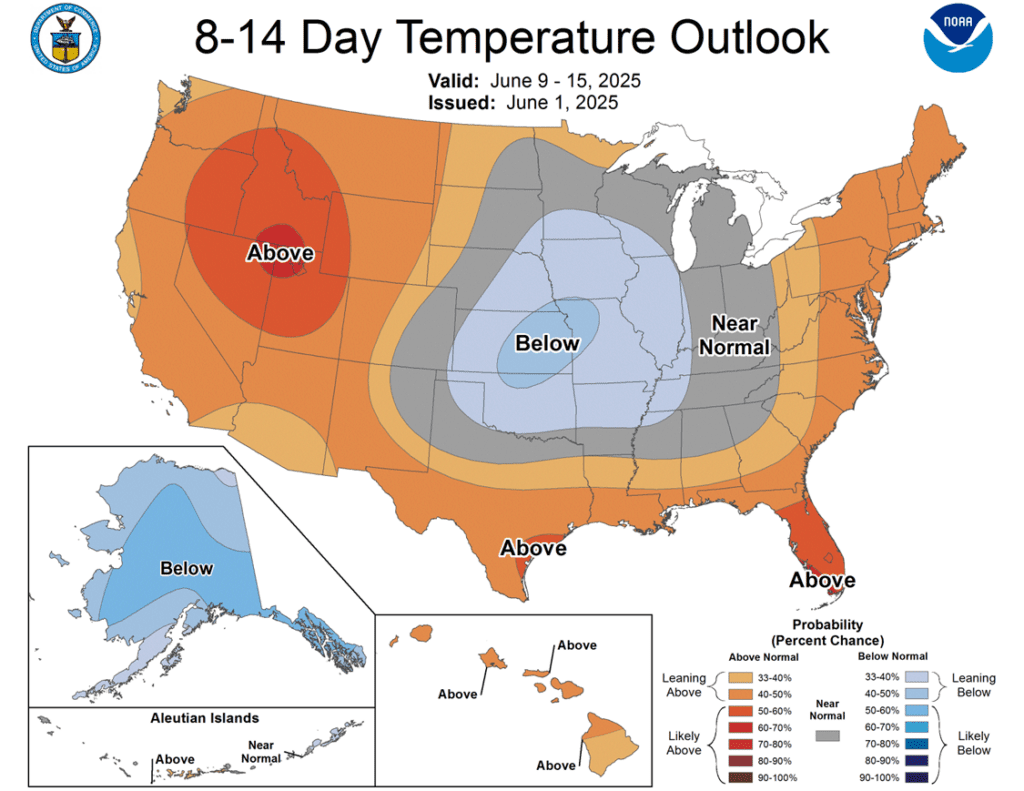

- To see updated U.S. weather outlook maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

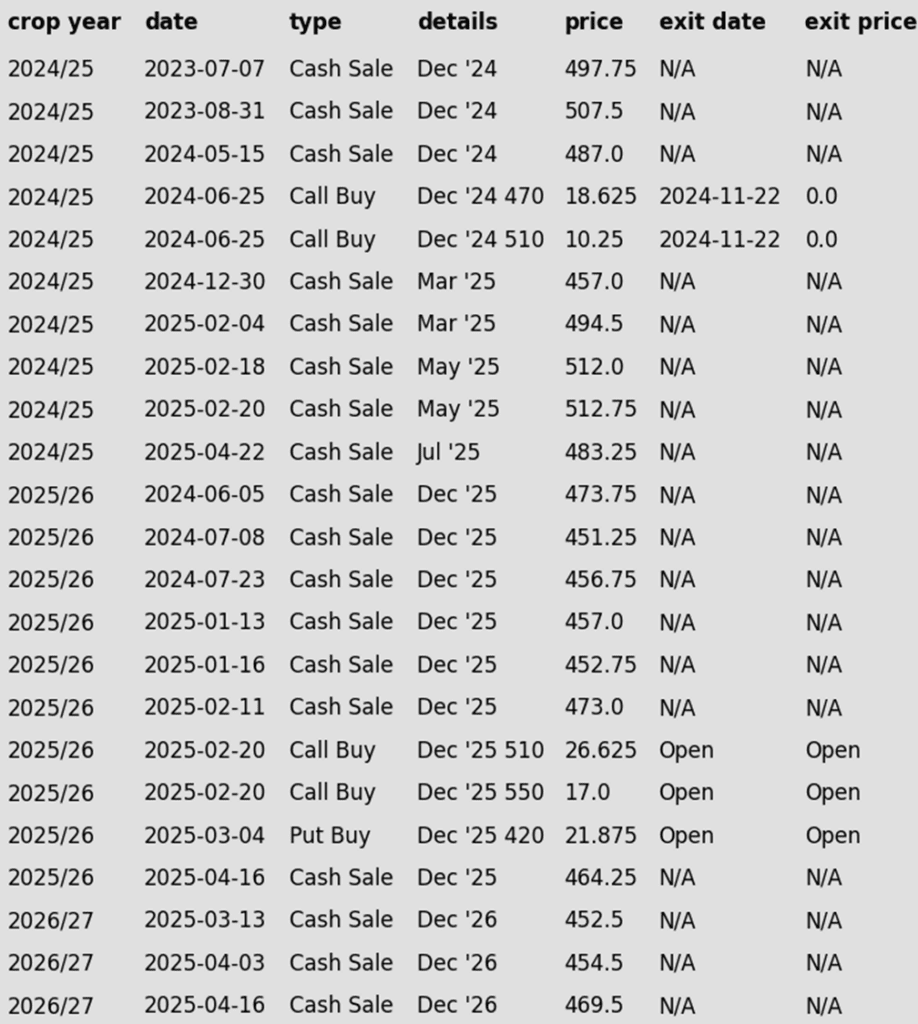

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

- Continuing to hold out for potential upside volatility during the growing season before issuing the next sales recommendations.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

- Well positioned for growing season volatility, with a solid base of sales already in place. Both upside and downside targets remain active — ready to begin legging out of open options positions and to roll down call options as market conditions warrant.

2026 Crop:

- Plan A: Next cash sale at 474 vs December ‘26.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- Changes:

- None.

- Be prepared for the next sales recommendation at any time as sales need to be systematically and incrementally progressed based on the calendar throughout the growing season.

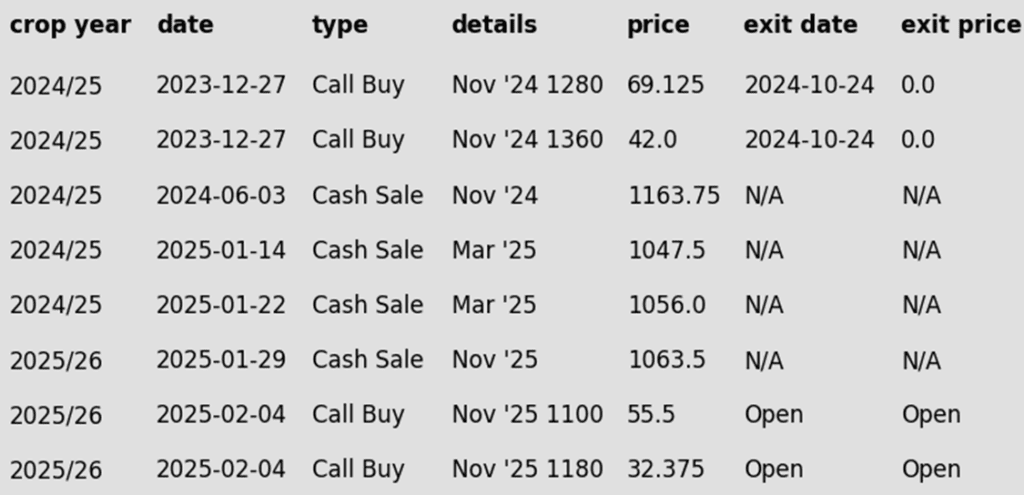

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures ended lower Monday as favorable weather remains the dominant market driver. Despite solid demand and a weaker U.S. dollar, July corn closed at its lowest level since October 22, fading from early session highs.

- USDA export inspections for the week ending May 29 came in at 1.576 MMT (62 mb), topping expectations and up 29% from a year ago, reinforcing strong demand.

- Weather forecasts continue to pressure prices, with cool temperatures and widespread rains expected across much of the Corn Belt over the next two weeks. As a result, the market holds little weather premium, keeping sellers in control.

- Monday afternoon’s Crop Progress report will be closely watched. While planting progress in wetter areas remains in focus, traders may shift their attention to condition ratings. Last week’s 68% good-to-excellent rating was a surprise miss, but improved weather could support crop development going forward.

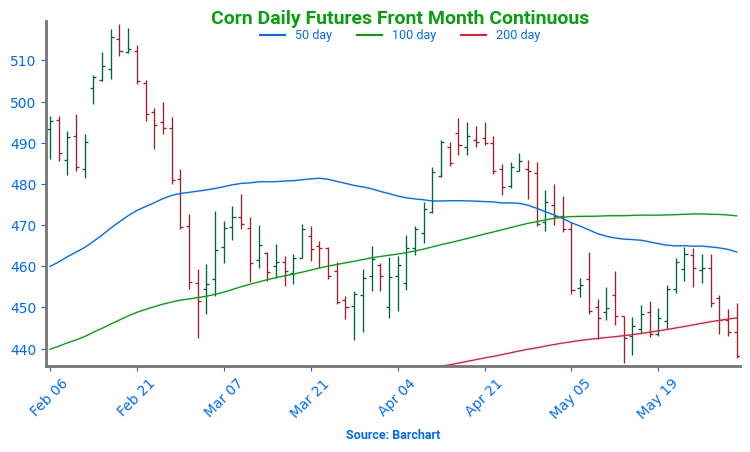

Corn Futures Eye Weather Risks After May Pullback

After bouncing off the key $4.50 level in April following a bullish WASDE and a break above the 50-day moving average, corn futures faced renewed pressure through May. Rapid planting progress and lingering demand concerns dragged prices back below $4.70. So far, the $4.45–$4.50 support zone — reinforced by the 200-day moving average — has held firm. With planting nearing completion, market focus is quickly shifting to summer weather. NOAA’s extended outlook for a warmer, drier Western Corn Belt could revive risk premium and set the stage for weather-driven rallies. Resistance emerges near $4.70, with stronger resistance around the April highs at $4.90.

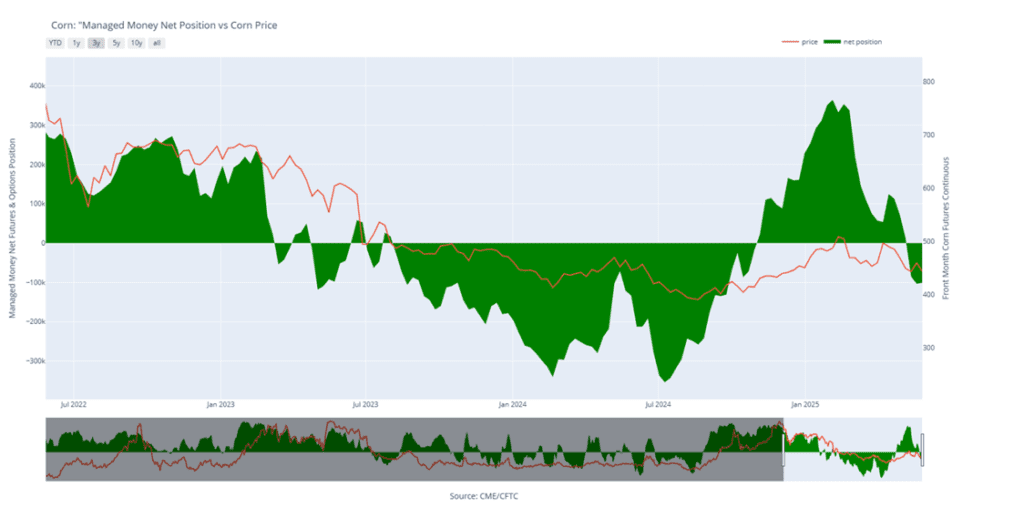

Corn Managed Money Funds net position as of Tuesday, May 27. Net position in Green versus price in Red. Money Managers net bought 2,450 contracts between May 20 – May 27, bringing their total position to a net short 100,760 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

- No Changes (for Now): While there are no adjustments at the moment, today’s close below 1036 support could prompt a revision to Plan A in the near future. Stay alert for potential updates.

2025 Crop:

- Plan A:

- Next cash sales at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- Make a cash sale if November closes below 1018.50 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Changes:

- A recommendation to buy another tranche of January put options is likely coming on Wednesday or Thursday of this week, based on calendar and seasonal timing considerations.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- We’re now in the seasonal window where first sales targets for next year’s crop could post at any time. Stay tuned.

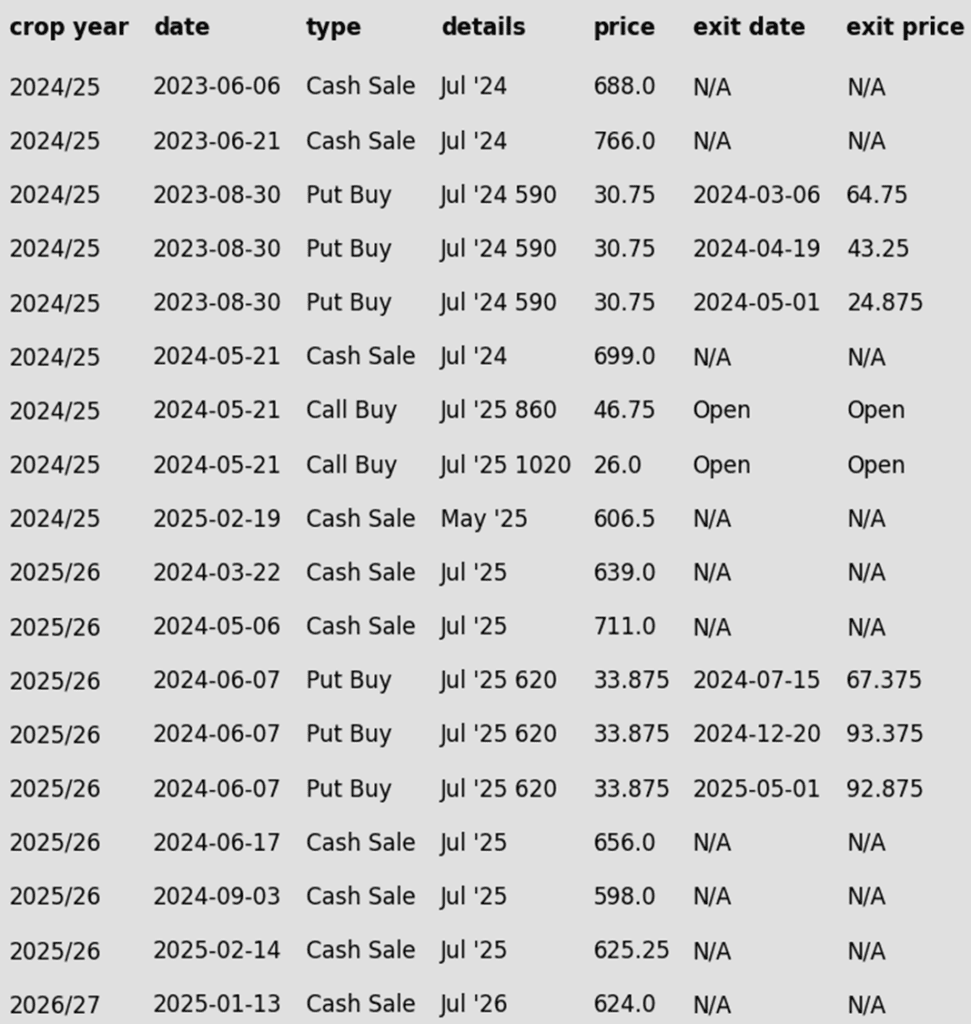

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans were lower to end the day with pressure coming from concerns about a trade deal being negotiated between President Trump and China’s Xi. Pressure also came from lower closes in both soybean meal and oil despite gains in crude oil.

- With Chinese trade concerns mounting, President Trump and Xi are set to speak this week to work out disagreements had at last month’s meeting in Geneva. South America has been the primary supplier of soybeans to China, but the export window for the US will be coming up this fall, and having a trade agreement in place will be crucial.

- Friday’s CFTC report saw funds as buyers of soybeans by 24,043 contracts which left them with a net long position of 36,697 contracts. They sold 3,321 contracts of bean oil leaving them long 53,988 contracts and bought back 13,681 contracts of meal which left them near record short at 93,785 contracts.

- Ahead of the USDA’s upcoming report, analysts expect April soybean crush to total 202 million bushels, up 13.8% from 177.6 mb last year. Corn used for ethanol is also projected to be higher year-over-year.

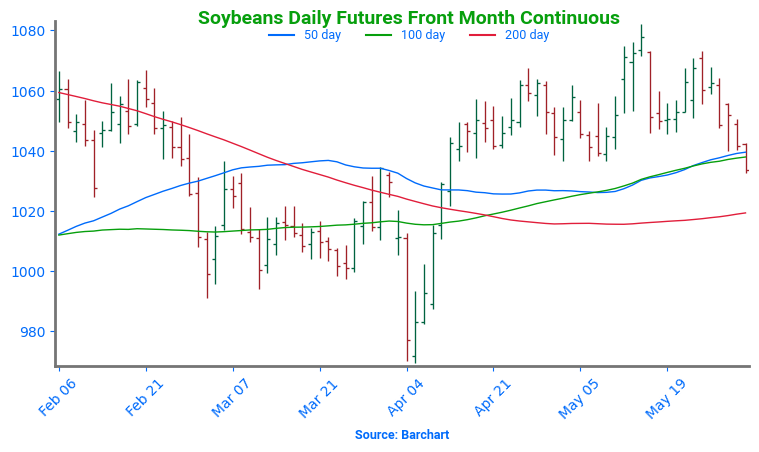

Soybean Futures Remain Range-Bound into June

Soybean futures tumbled below the key $10.00 mark in early April on tariff-related headlines, triggering technical selling after breaking the March low. However, the decline was short-lived as buyers stepped in, lifting prices back above $10.00 and reclaiming key moving averages, including a clean break above the 200-day moving average — a level that now serves as solid support. With no fresh bullish catalyst and favorable weather weighing on sentiment, futures remain range-bound. The 200-day should continue to offer support, while resistance holds near the May high of $10.82.

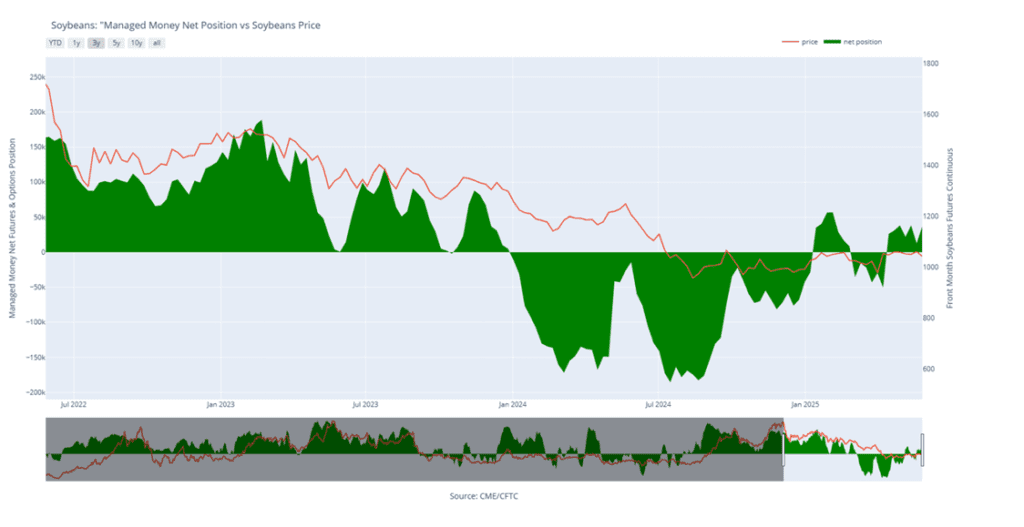

Soybean Managed Money Funds net position as of Tuesday, May 27. Net position in Green versus price in Red. Money Managers net bought 24,043 contracts between May 20 – May 27, bringing their total position to a net long 36,697 contracts.

Wheat

Market Notes: Wheat

- Wheat futures closed higher across all three U.S. exchanges Monday, supported by a combination of adverse global weather, a weaker U.S. dollar, and renewed geopolitical risk. Dryness in key wheat-growing regions — including China, southern Russia, Canada, and northern Europe — continues to underpin prices. In the U.S., excessive rains are raising concerns over potential harvest delays and crop quality issues in the Southern Plains.

- Weekly wheat inspections reached 20.3 mb, bringing total 24/25 inspections to 802 mb, up 16% from last year. The USDA is estimating 24/25 wheat exports at 820 mb, up 17% from the year prior.

- Geopolitical tensions flared again over the weekend, with Ukraine launching drone strikes deep inside Russian territory. Reports suggest four military bases and over 40 Russian bombers were damaged, reintroducing a war premium into the market and casting doubt on the progress of upcoming peace talks.

- The Australian agriculture ministry is estimating their nation’s 2025 wheat harvest will total 30.6 mmt. If that prediction is accurate, it will be a 10% decline from last year. For reference, the USDA is estimating Australian wheat production at 31 mmt.

- Russian wheat export prices held steady at $225/MT, according to IKAR, which also forecast June exports at 1.2 MMT — down from 2.1 MMT in May. Meanwhile, Russia’s agriculture ministry slashed its wheat export tax by 25% to 1,023 rubles per metric ton.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A:

- Target 699.25 vs July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- None.

2025 Crop:

- Plan A:

- Target 693.75 against July for the next sale.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

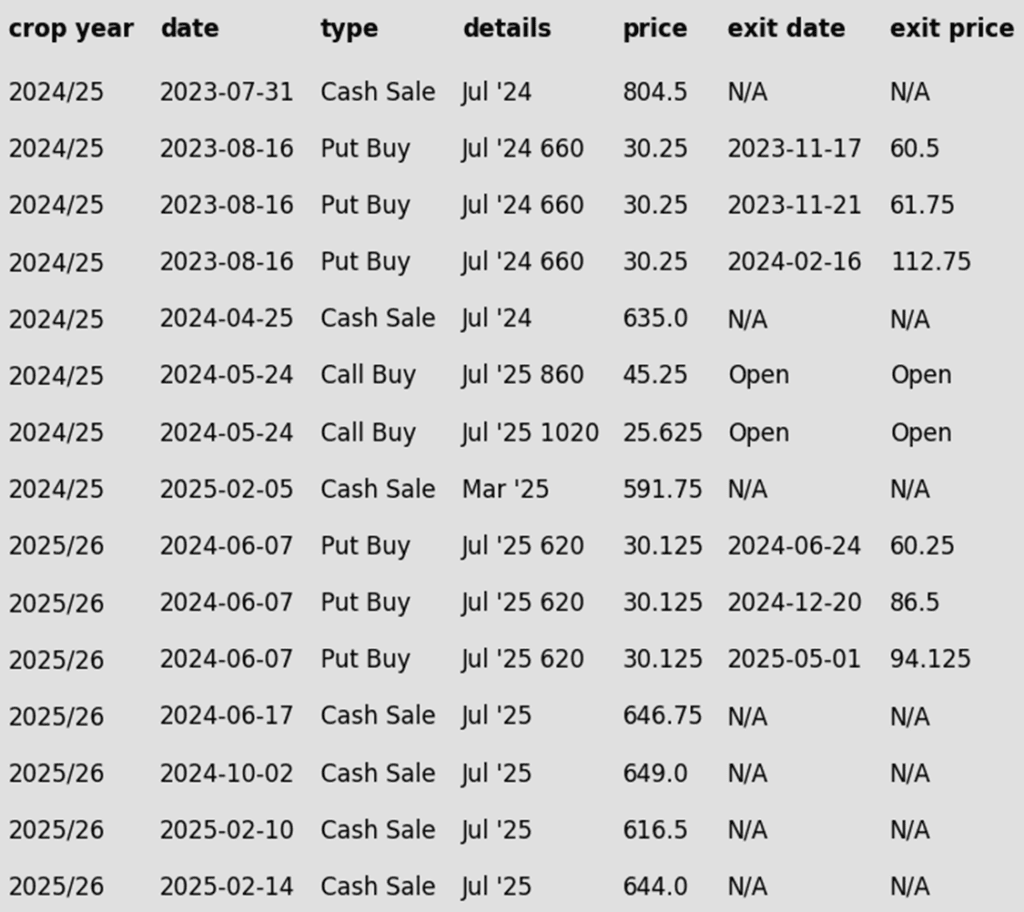

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

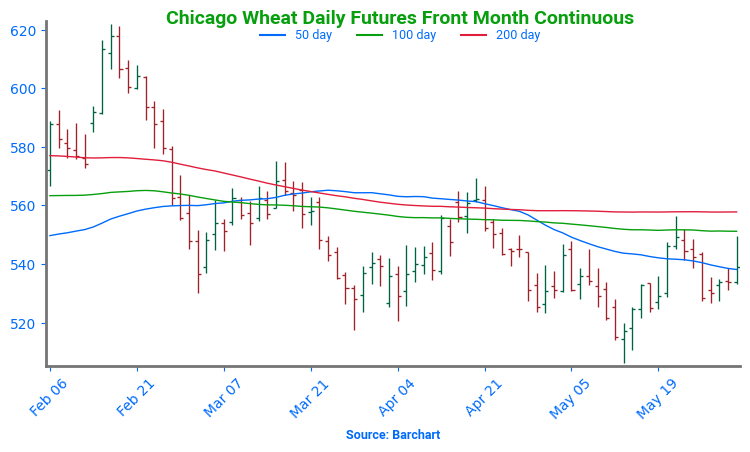

Chicago Wheat Potentially Finds Support

After months of range-bound trade, Chicago wheat futures broke out in February, reaching October highs above $6.15 before quickly retreating back into their 2024 range. By mid-May, prices slipped below key support near $5.30 but have since stabilized around $5.20. The next major resistance is the 200-day moving average — a firm weekly close above it could signal a trend reversal and open the door to broader gains.

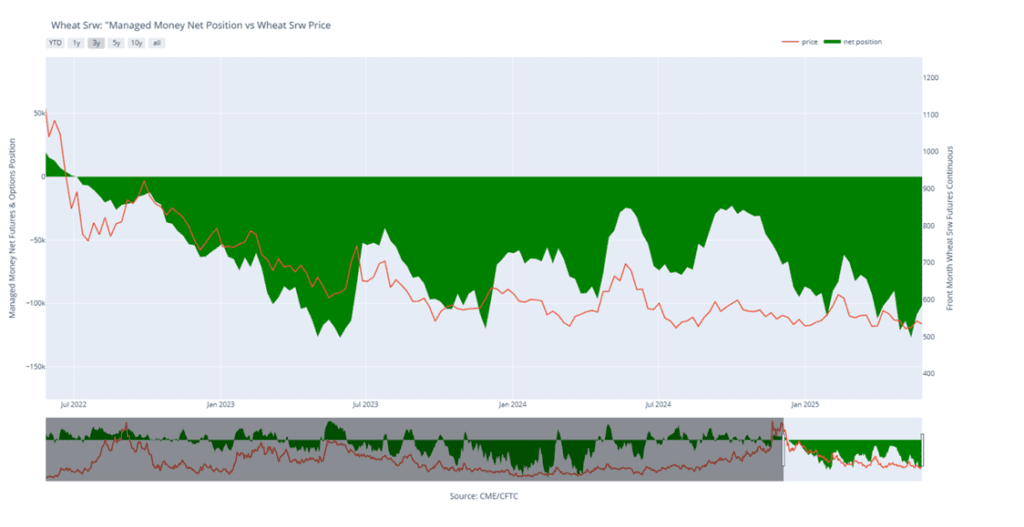

Chicago Wheat Managed Money Funds’ net position as of Tuesday, May 27. Net position in Green versus price in Red. Money Managers net bought 7,667 contracts between May 20– May 27, bringing their total position to a net short 101,226 contracts.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- None.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- The first sales targets could post this week — keep checking back for updates.

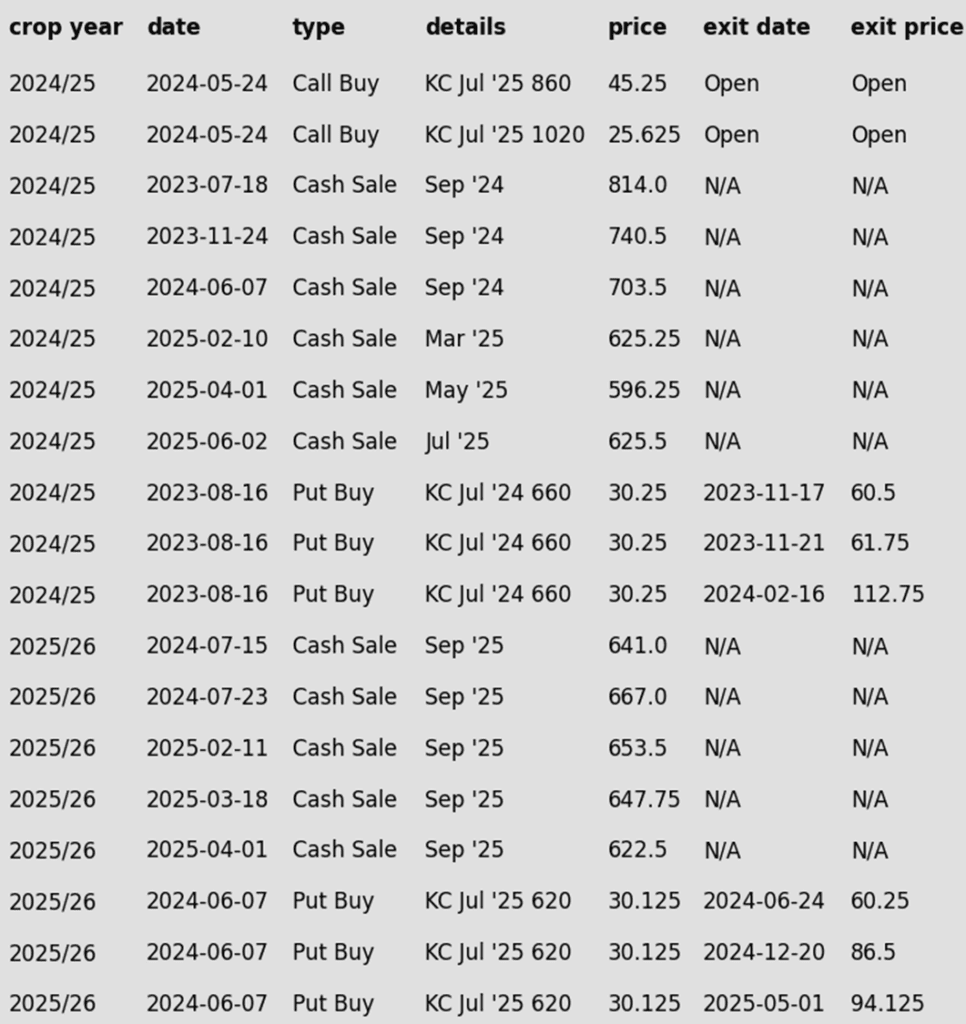

To date, Grain Market Insider has issued the following KC recommendations:

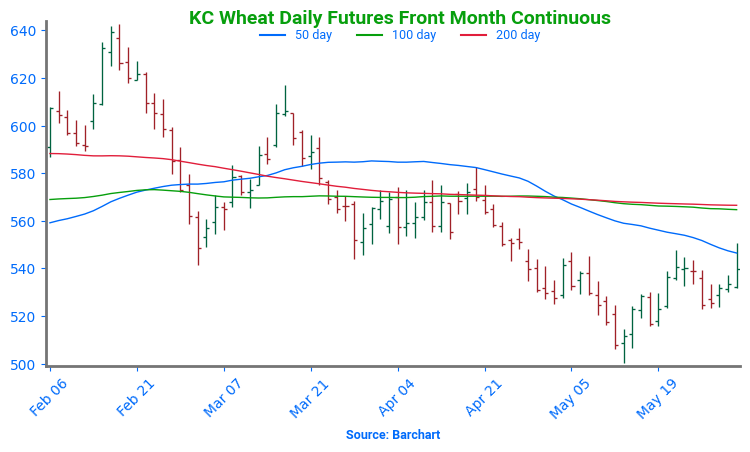

Kansas City Wheat Finds Support

With ample spring moisture across the Plains and sluggish demand, wheat futures have lacked bullish momentum, recently touching multi-year lows near $5.00 in early May—a level that has since held. A recovery above $5.40 would suggest a potential bottom is in place. On a rebound, the 200-day moving average marks initial resistance, with a stronger ceiling at the February highs near $6.40.

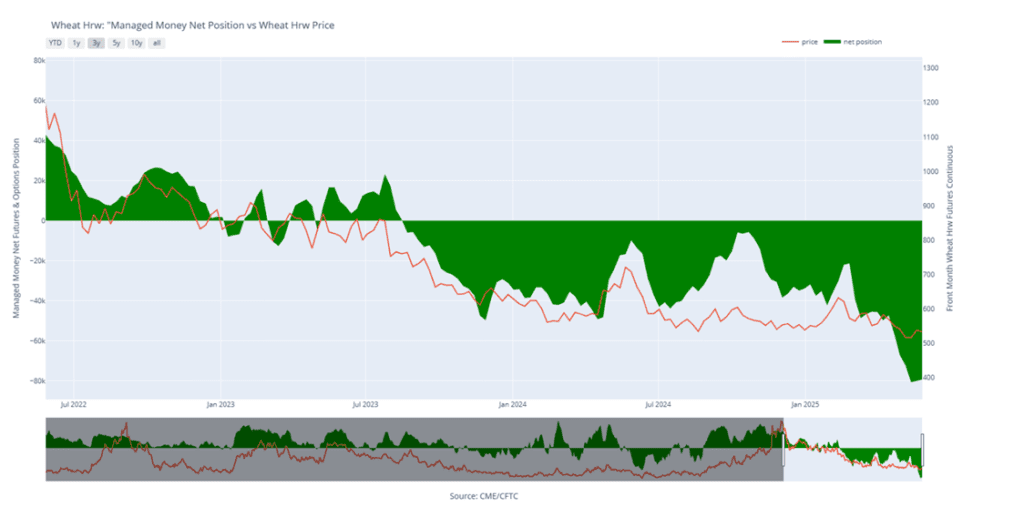

KC Wheat Managed Money Funds’ net position as of Tuesday, May 27. Net position in Green versus price in Red. Money Managers net bought 801 contracts between May 20– May 27, bringing their total position to a net short 79,361 contracts.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

New Alert

Sell JUL ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- NEW ACTION – Sell another portion of your 2024 Minneapolis wheat crop today. This marks the sixth sale for the 2024 crop and may well be the final sales recommendation for this marketing year, as Grain Market Insider shifts focus to the 2025 and 2026 crops moving forward. Use this rally as an opportunity to consider pricing any remaining unsold bushels.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Now six sales recommendations made to date, with an average price of 684.

- Changes:

- None.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if July KC closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- First sales targets are expected to post after July 1.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

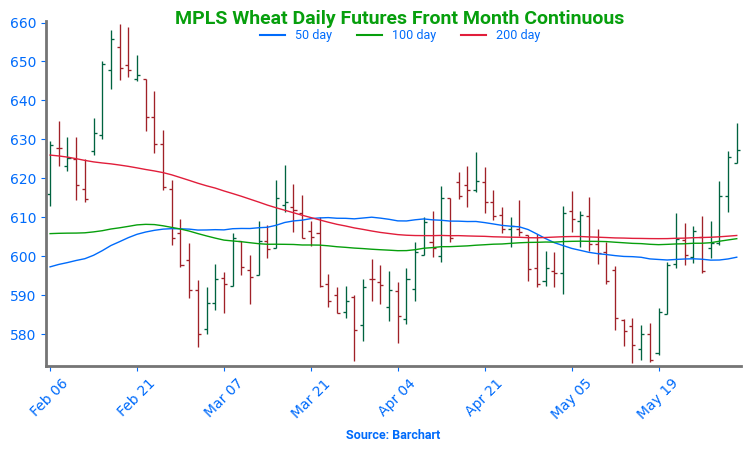

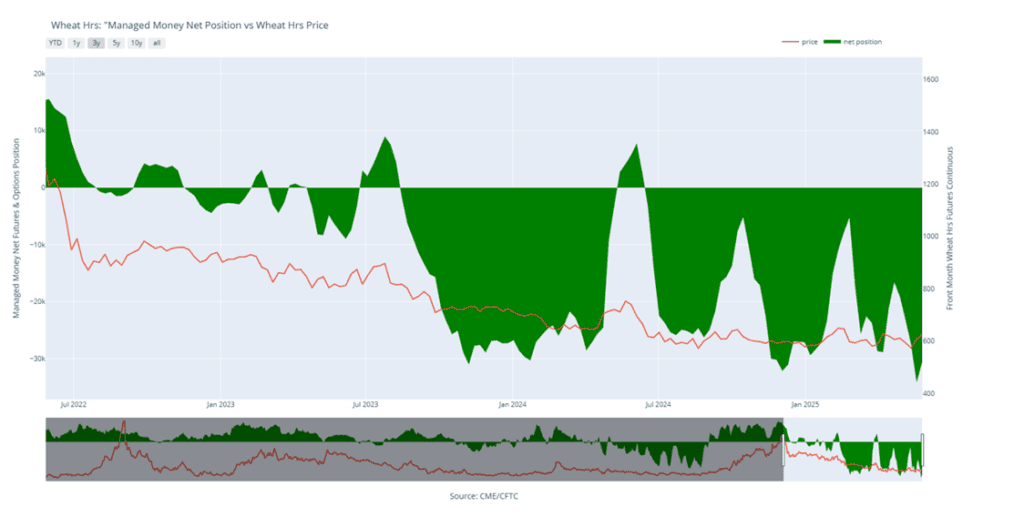

Spring Wheat Runs Higher on Poor Conditions

Spring wheat futures broke out of a prolonged sideways trend in late January, with momentum accelerating in mid-February after a decisive close above the 200-day moving average. Although late-month weakness briefly pulled prices below key support, futures traded mostly sideways through spring. A sharp rally was triggered in late May after crop condition ratings came in at their second lowest in 40 years, sparking short covering. Prices are now back above a confluence of moving averages and nearing the top of the recent range. Key support sits just above $6.00, with the next upside target near February’s highs around $6.60.

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, May 27. Net position in Green versus price in Red. Money Managers net bought 3,622 contracts between May 20 – May 27, bringing their total position to a net short 30,518 contracts.

Other Charts / Weather