6-16 End of Day: Soybeans Continue Higher Monday, Corn and Wheat Lower

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 434.75 | -9.75 |

| DEC ’25 | 435 | -8 |

| DEC ’26 | 466.75 | -4.75 |

| Soybeans | ||

| JUL ’25 | 1069.75 | 0 |

| NOV ’25 | 1060.5 | 5.75 |

| NOV ’26 | 1077.5 | 5.25 |

| Chicago Wheat | ||

| JUL ’25 | 536.5 | -7.25 |

| SEP ’25 | 552.25 | -7 |

| JUL ’26 | 611.25 | -5 |

| K.C. Wheat | ||

| JUL ’25 | 536 | -4.75 |

| SEP ’25 | 550.75 | -4.25 |

| JUL ’26 | 609.5 | -3.5 |

| Mpls Wheat | ||

| JUL ’25 | 622.75 | -11.5 |

| SEP ’25 | 636 | -9.25 |

| SEP ’26 | 674.75 | -7.5 |

| S&P 500 | ||

| SEP ’25 | 6084.75 | 53.25 |

| Crude Oil | ||

| AUG ’25 | 69.8 | -1.49 |

| Gold | ||

| AUG ’25 | 3404.1 | -48.7 |

Grain Market Highlights

- 🌽 Corn: Corn futures started the week on a disappointing note, pressured by weakness in wheat and a reversal in crude oil.

- 🌱 Soybeans: Soybeans ended higher, led by deferred contracts, as Friday’s limit-up move in soybean oil fueled strength across the soy complex and triggered expanded limits today. Soybean oil surged again, gapping higher and closing up 4.50 cents in July, while weaker soybean meal limited additional upside.

- 🌾 Wheat: Wheat futures posted modest losses across all classes, pressured by winter wheat harvest progress, a mostly benign U.S. weather outlook, and reports that Iran may be open to negotiations with Israel, easing geopolitical concerns and weighing on crude oil.

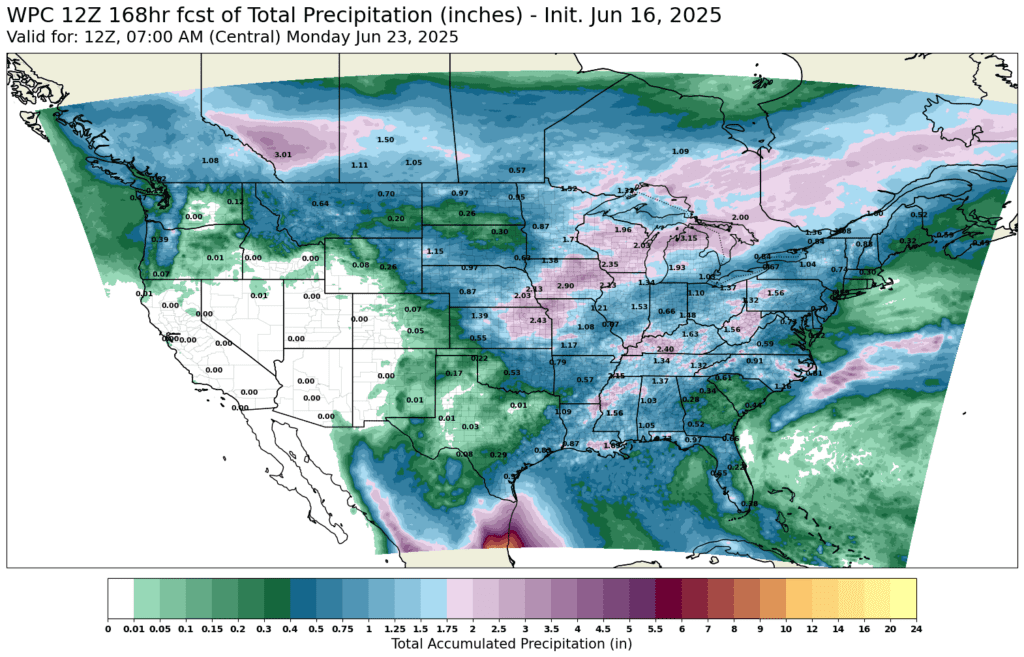

- To see updated U.S. weather outlook maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

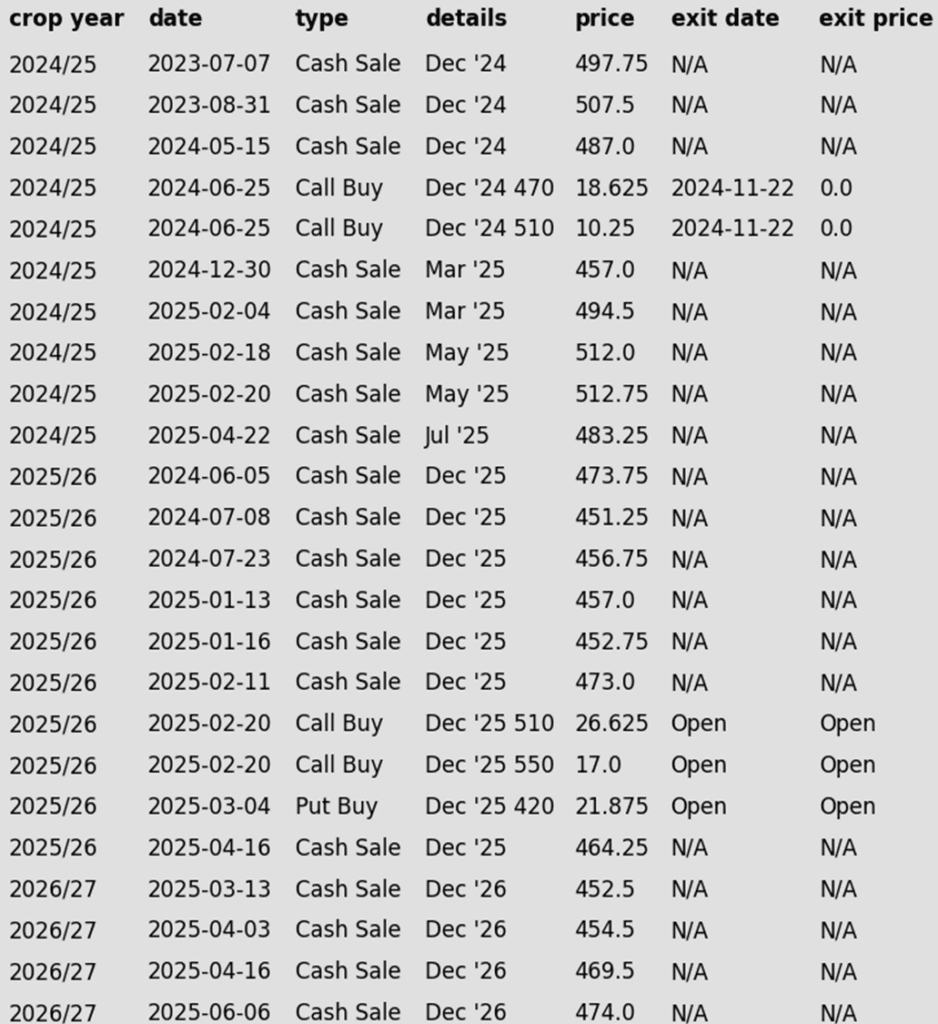

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

- Volatility-Ready: Positioned well for potential market swings, with a solid base of sales and open call and put option positions in place. Active targets remain set to begin legging out of options and roll down call options to lower strikes as conditions warrant.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn was disappointing today, following the lower wheat market and reversal in crude oil. The July contract closed nearly 10 cents lower to start the week while September and December futures were down 8 cents and 7 cents respectively.

- Weekly export inspections totaled 66 mb, near the high end of expectations and well above the pace needed to hit USDA’s 2.650 bb target. Year-to-date inspections stand at 2.049 bb, up 29% from last year.

- This afternoon’s Crop Progress report is widely expected to show corn conditions either unchanged from last week at 71% good-to-excellent or a slight increase to 72% good-to-excellent.

- Patria reported that Brazil’s corn harvest is now 5.5% complete, well below last year’s pace of 14% during the same week last year.

Corn Futures Continue to Trade Within Recent Range

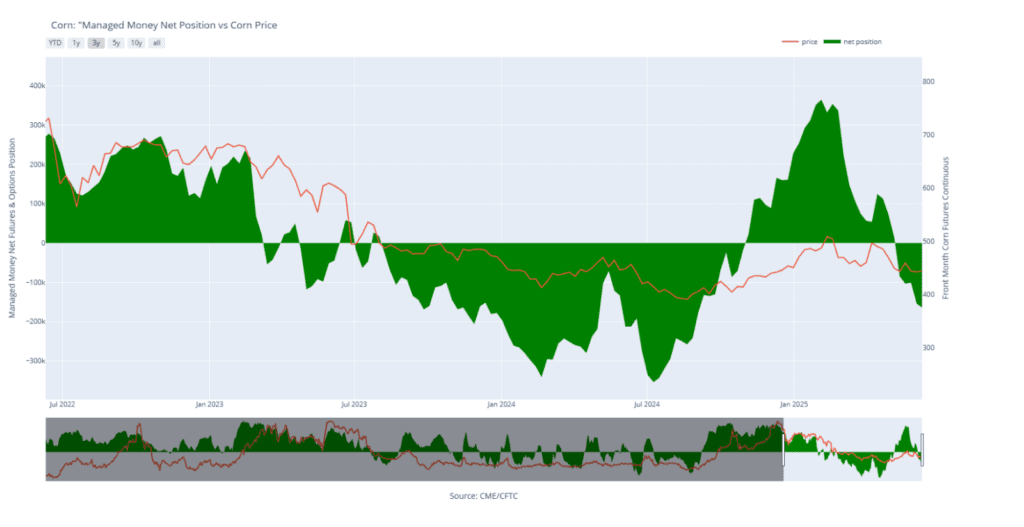

The front-month July contract continues to trade within a tight range, mostly between 434 and 446. A close above 446 would open the door to the next upside opportunity at 465. On the downside, support sits at the June 10 bullish reversal low of 429.25. A close below that level would make 408 the next downside risk to watch.

Above: Corn Managed Money Funds net position as of Tuesday, June 10. Net position in Green versus price in Red. Money Managers net sold 9,977 contracts between June 3 – June 10, bringing their total position to a net short 164,020 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

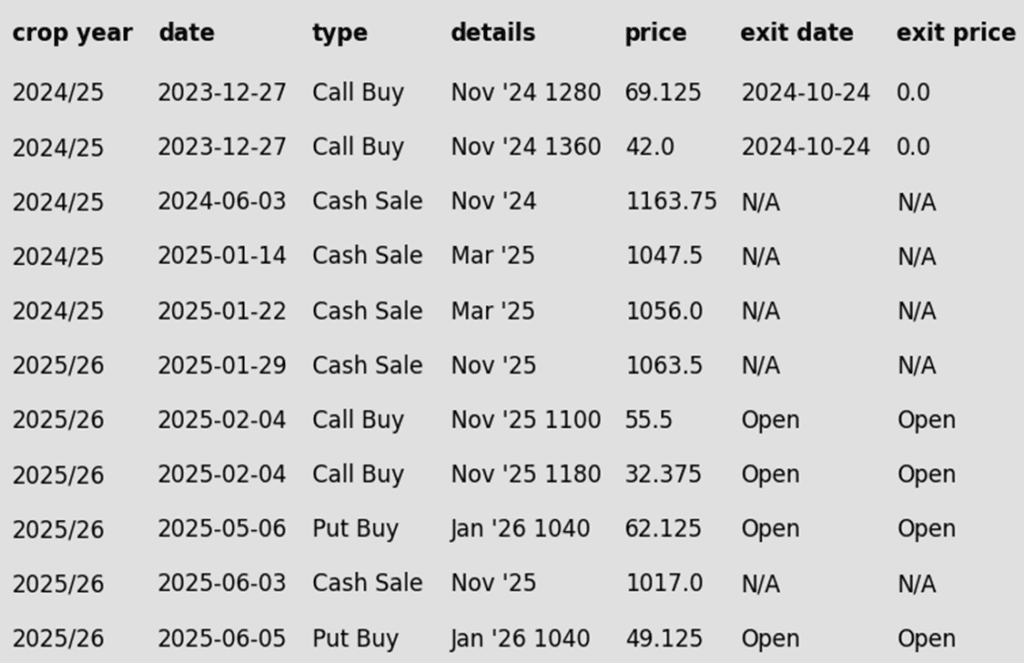

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- No Changes (for Now): Despite last week’s break of 1036.50 support, the 1107 target remains active to recommend making the next sale.

2025 Crop:

- Plan A:

- No active sales targets.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- We’re now in the seasonal window where first sales targets for next year’s crop could post at any time. Stay tuned.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher with the deferred months posting the majority of gains following Friday’s trade in which limit up soybean oil bolstered the soy complex and led to expanded limits today. While soybean meal was lower and keeping soybeans from rallying further, soybean oil took advantage of its expanded limits, gapped higher and closed up 4.50 cents in the July contract. The soy complex will have expanded limits again tomorrow.

- NOPA reported a May crush of 192.83 mb, just below the average estimate of 193.52 mb. Still, it marked a record for May and was up from 190.23 mb in April.

- Friday’s Renewable Fuels Association announcement set biomass-based diesel quotas at 3.35 billion gallons for 2025, 5.61 billion for 2026, and 5.86 billion for 2027 — an extremely bullish signal for soybean oil, which has gained 7.50 cents over the past two sessions.

- Friday’s CFTC report saw funds buying 17,038 contracts of soybeans which increased their net long position to 25,639 contracts. They sold 7,222 contracts of bean oil leaving them long 24,768 contracts as of June 10 and bought 9,909 contracts of meal which left them short 86,808 contracts.

July Soybeans Pause Near Upper End of Recent Range

July still has major resistance to clear before broader upside opportunities can become more immediate possibilities. Macro trend remains sideways with resistance at the May high of 1082. A close over that resistance and the first upside objective could be the open gap on the front month continuous chart from last June. The gap starts at 1161 and ends at 1177. If July cannot clear 1082 then rangebound to lower trade remains the risk. First support is now at 1032.50. A close below that support and the April low of 970.25 would be the next risk.

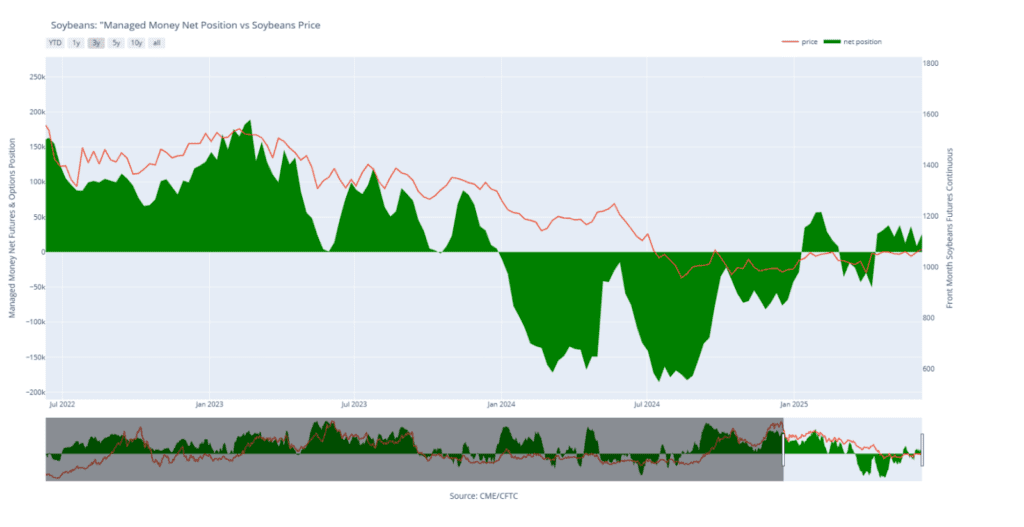

Above: Soybean Managed Money Funds net position as of Tuesday, June 10. Net position in Green versus price in Red. Money Managers net bought 3,724 contracts between June 3 – June 10, bringing their total position to a net long 86,005 contracts.

Wheat

Market Notes: Wheat

- Wheat posted modest losses across the board, perhaps following crude oil lower after news outlets reported that Iran is willing to negotiate with Israel to bring an end to the hostilities. Additionally, winter wheat harvest pressure and a largely non-threatening U.S. weather forecast add weight to the shoulders of the market.

- Weekly wheat inspections reached 14.3 mb, bringing total 25/26 inspections to 22 mb, which is down 17% from the year prior. Inspections are running below the USDA’s estimated pace; total 25/26 exports are forecast at 825 mb, up 1% from the year before.

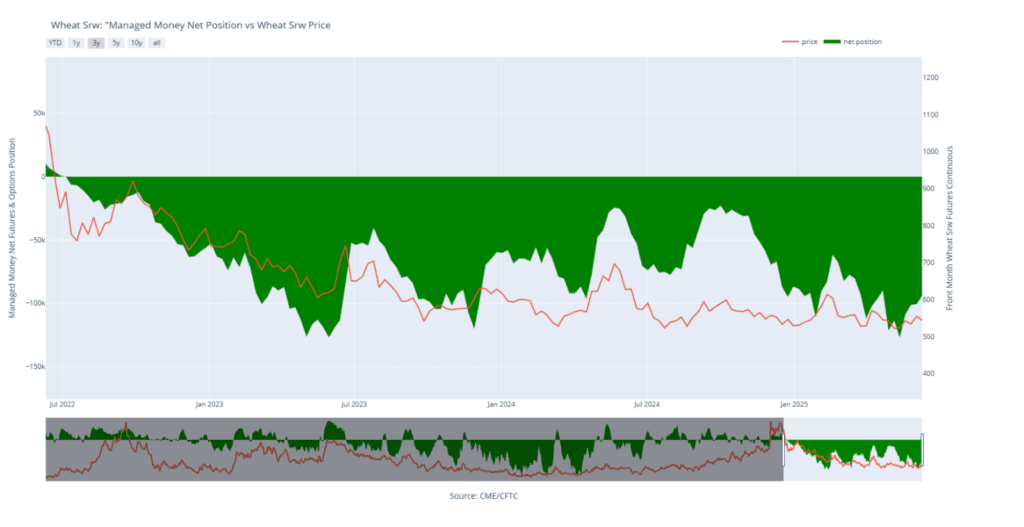

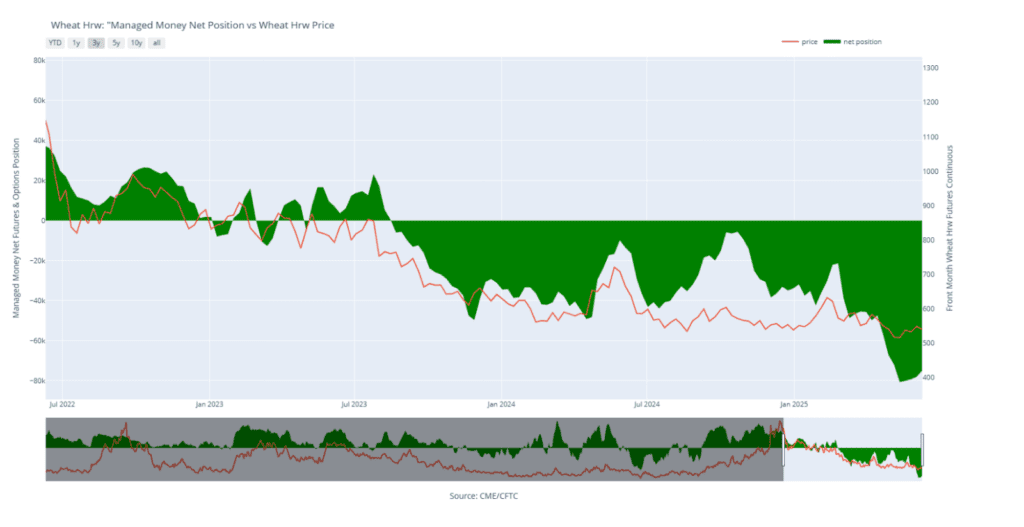

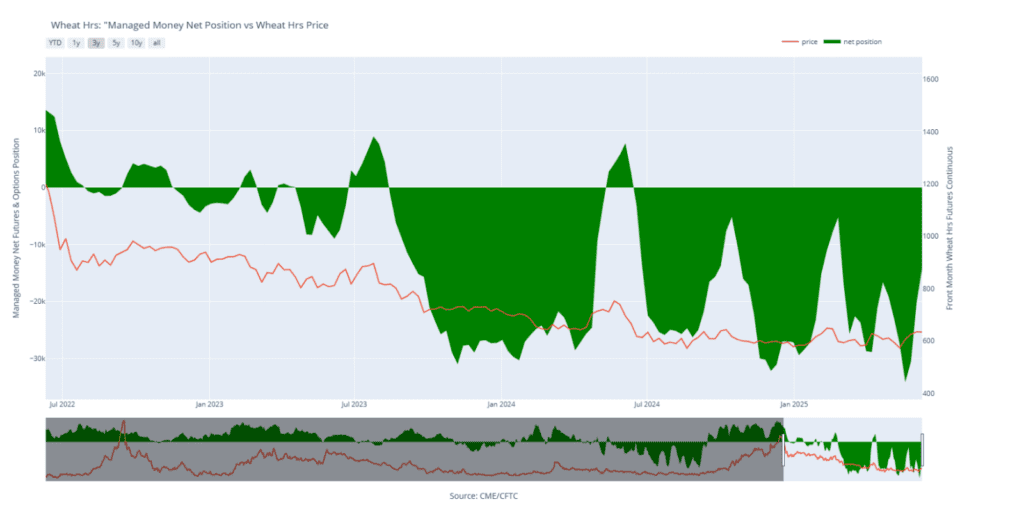

- CFTC data showed managed funds were net buyers of wheat for the fourth straight week, covering 6,500 contracts in Chicago and 3,000 in Kansas City. The total net short across all three wheat classes has narrowed from a record 235,000 contracts to about 183,000.

- Scattered rains fell in Argentina’s central and northern wheat-growing areas over the weekend, aiding early development. Western Europe, the Black Sea region, and parts of China also saw rain, though it may be too late to significantly help crops there.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

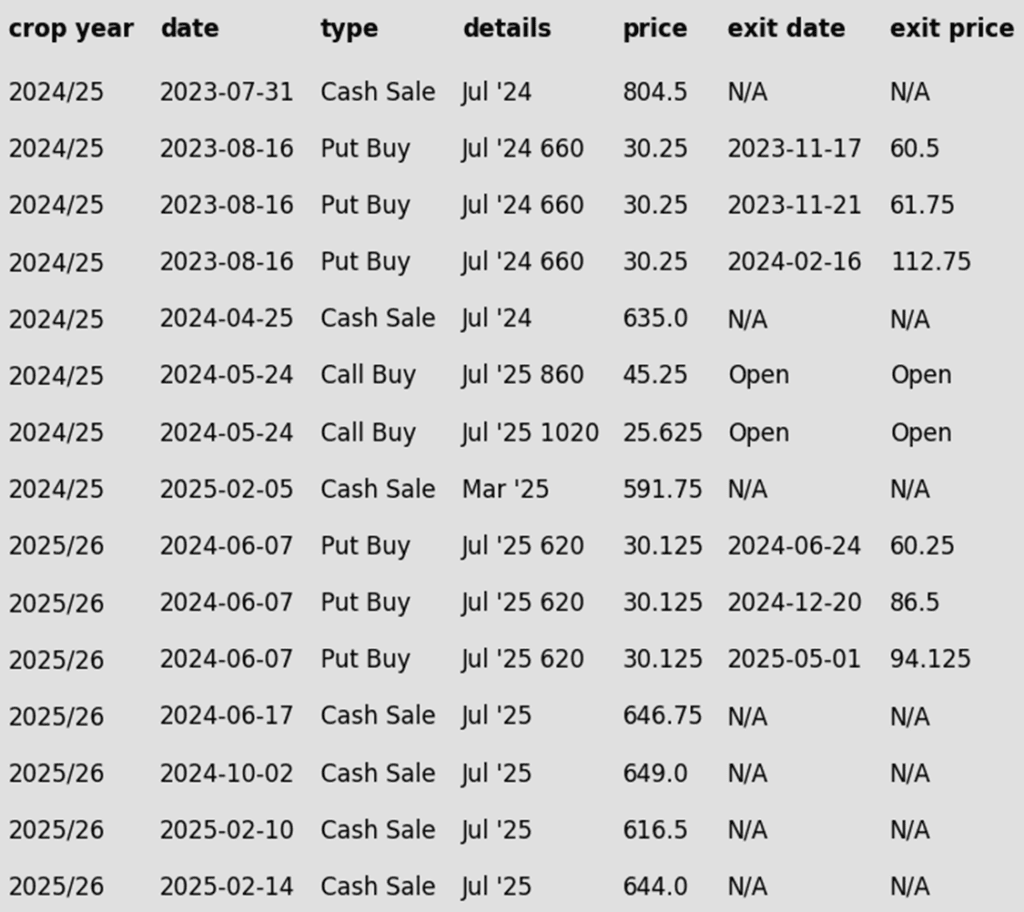

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: Close below 588 support vs July ‘26 and buy put options (strikes TBD).

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- New put options target added.

- Put option coverage is leveraged for early downside protection in the event of a break of support.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Remains Rangebound

First downside support should appear at last week’s low of 522.25. A close below that support and the next downside risk would be 506.25. A lot of resistance remains above the market, yet with the recent high and 200-day at 558. A close over 558 and that could provide fuel for a bigger move towards the winter high of 621.75.

Above: Chicago Wheat Managed Money Funds’ net position as of Tuesday, June 10. Net position in Green versus price in Red. Money Managers net bought 17,038 contracts between June 3 – June 10, bringing their total position to a net long 25,639 contracts.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- None.

2026 Crop:

- Plan A: Target 697 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- New cash sale target and new put option target.

- Given the high yield variability from year to year in Hard Red Winter wheat, put option coverage is leveraged for early downside protection in the event of a break of support.

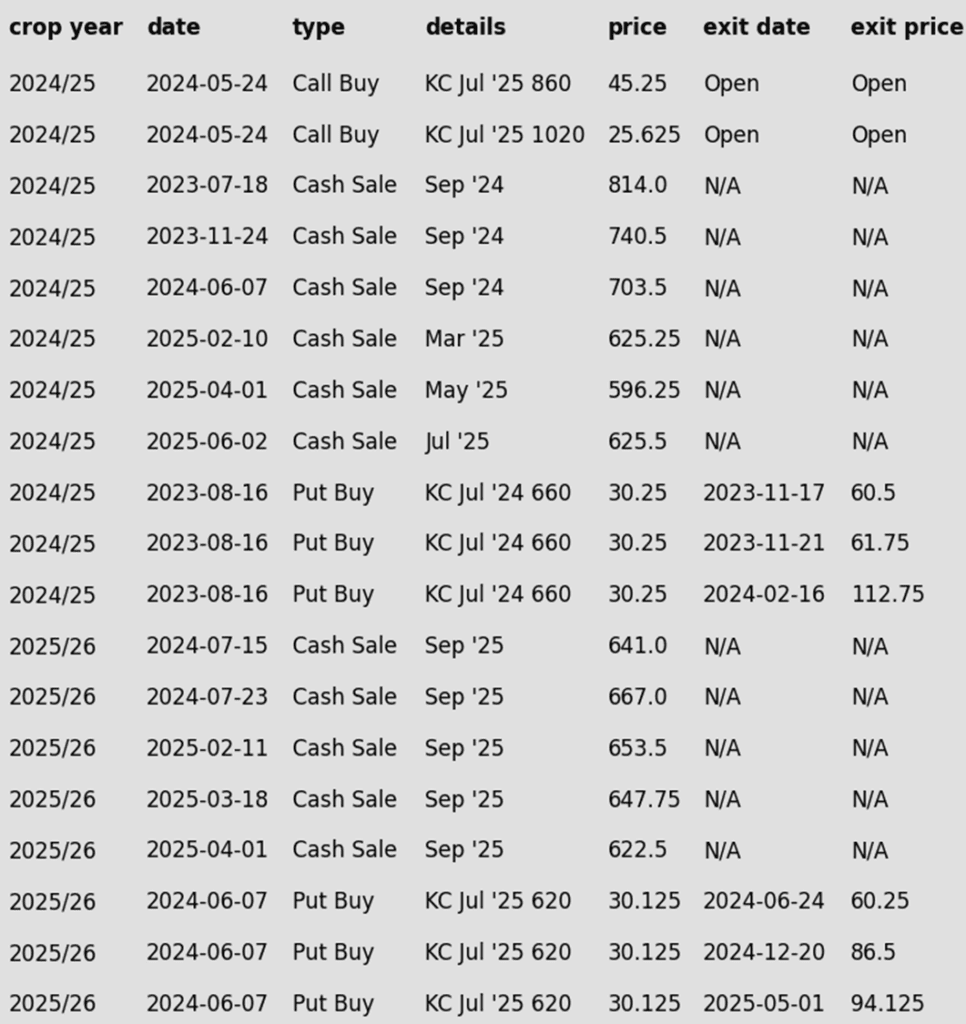

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Finds Resistance at the 50-Day

July closed right at the 50-day moving average today following a strong bullish reversal off today’s low. Closing over today’s high would make the 200-day at 567 the next immediate target.

Above: KC Wheat Managed Money Funds’ net position as of Tuesday, June 10. Net position in Green versus price in Red. Money Managers net bought 3,064 contracts between June 3 – June 10, bringing their total position to a net short 74,964 contracts.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Now six sales recommendations made to date, with an average price of 684.

- Changes:

- There is likely to be no further guidance on the 2024 crop as focus will be fully shifting to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if July KC closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- None. Another few weeks before price targets may post.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Retests Recent Highs

uly spring wheat futures closed last week just below the previous Friday’s close of 635.25. A close over that resistance would make 660 the next first upside target. Downside support is at this week’s low and the 200-day in the 607 area. A close below that support and the May low of 572.50 would be the first downside risk.

Above: Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, June 10. Net position in Green versus price in Red. Money Managers net bought 5,927 contracts between June 3 – June 10, bringing their total position to a net short 14,150 contracts.

Other Charts / Weather