6-12 End of Day: Grains Mixed After Uneventful WASDE Report

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 438.5 | 1.5 |

| DEC ’25 | 440.5 | 0.75 |

| DEC ’26 | 470.5 | 1 |

| Soybeans | ||

| JUL ’25 | 1042.25 | -8.25 |

| NOV ’25 | 1027.25 | -2 |

| NOV ’26 | 1051.25 | -1.75 |

| Chicago Wheat | ||

| JUL ’25 | 526.5 | -7.75 |

| SEP ’25 | 541.75 | -7.25 |

| JUL ’26 | 601 | -7 |

| K.C. Wheat | ||

| JUL ’25 | 522.75 | -3.5 |

| SEP ’25 | 537.5 | -2.75 |

| JUL ’26 | 597.25 | -1.5 |

| Mpls Wheat | ||

| JUL ’25 | 621.25 | 4 |

| SEP ’25 | 631.75 | 4.5 |

| SEP ’26 | 672 | 0.25 |

| S&P 500 | ||

| SEP ’25 | 6098 | 15.75 |

| Crude Oil | ||

| AUG ’25 | 66.79 | -0.11 |

| Gold | ||

| AUG ’25 | 3407.4 | 63.7 |

Grain Market Highlights

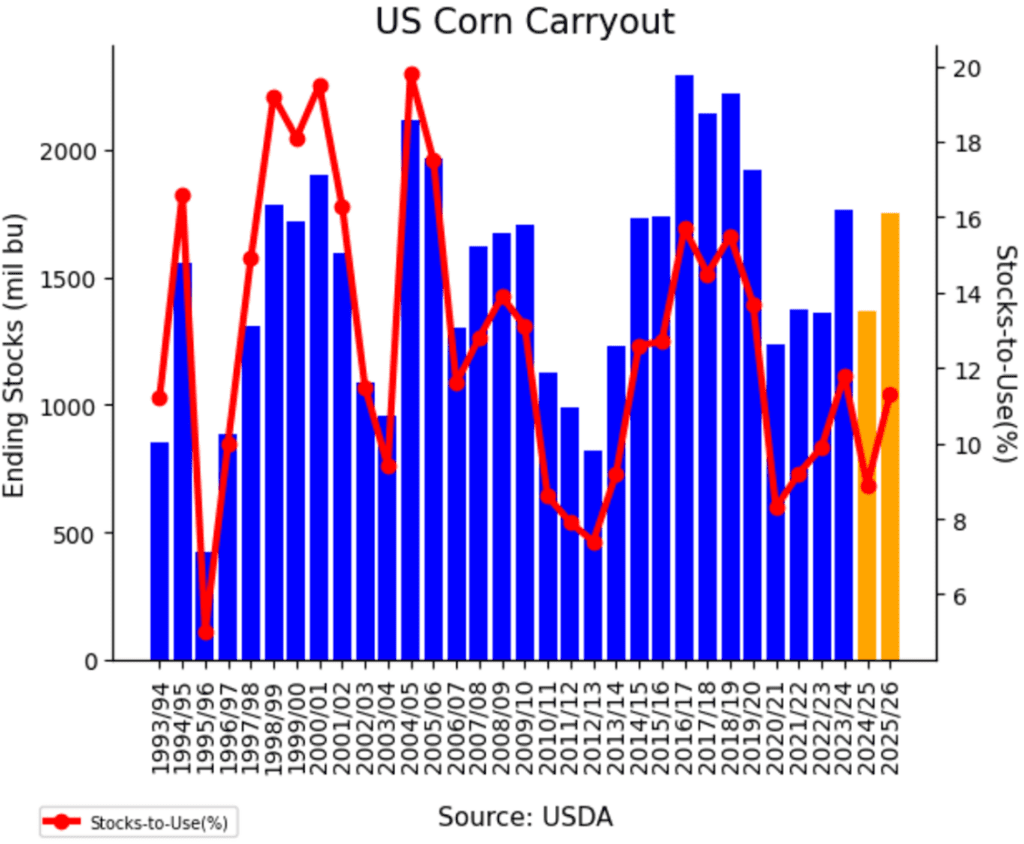

- 🌽 Corn: Corn futures ended slightly higher on Thursday, supported by a lower-than-expected old crop carryout in the USDA’s WASDE report due to stronger export demand. However, gains were limited by weakness in other grains and uncertainty around upcoming biofuel blending targets.

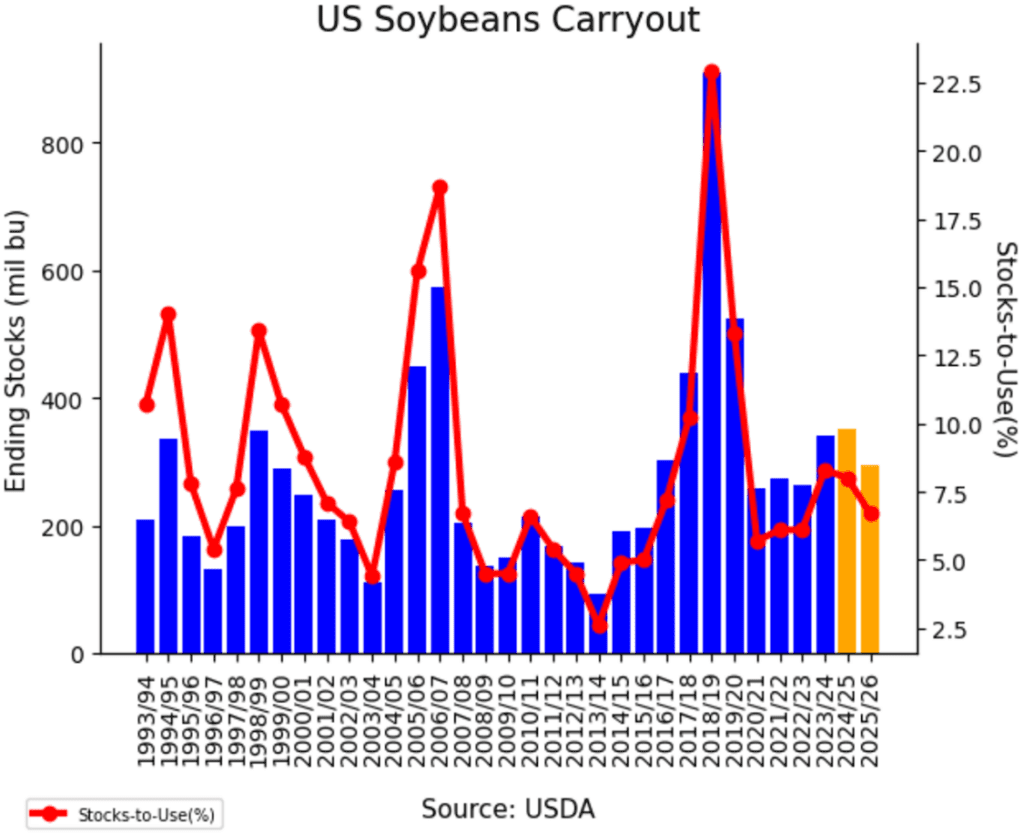

- 🌱 Soybeans: Soybean prices closed lower as traders reacted to a mostly neutral WASDE report that made minimal changes to U.S. and global balance sheets, while a bearish weather outlook added pressure. Slight increases in global carryout and Brazil’s production estimate also contributed to the weakness.

- 🌾 Wheat: Wheat futures were mixed following a neutral USDA WASDE report that held U.S. production and stocks mostly steady but showed slight global stock declines. Harvest pressure and shifting trader focus to field activity weighed on Chicago and Kansas City markets, while Minneapolis found modest support.

- To see the updated U.S. weather outlook maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

Active

Sell DEC ’26 Cash

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

- Rally Watch: With five sales recommendations since December 30 at an average price of around 492, there’s a solid cushion in place to continue aiming for a weather rally for next sales recommendations.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

- Volatility-Ready: Positioned well for potential market swings, with a solid base of sales and open call and put option positions in place. Active targets remain set to begin legging out of options and roll down call options to lower strikes as conditions warrant.

2026 Crop:

- CONTINUED OPPORTUNITY – Sell a fourth portion of your 2026 corn. The December ‘26 contract has reached the upside target of 474.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Now four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

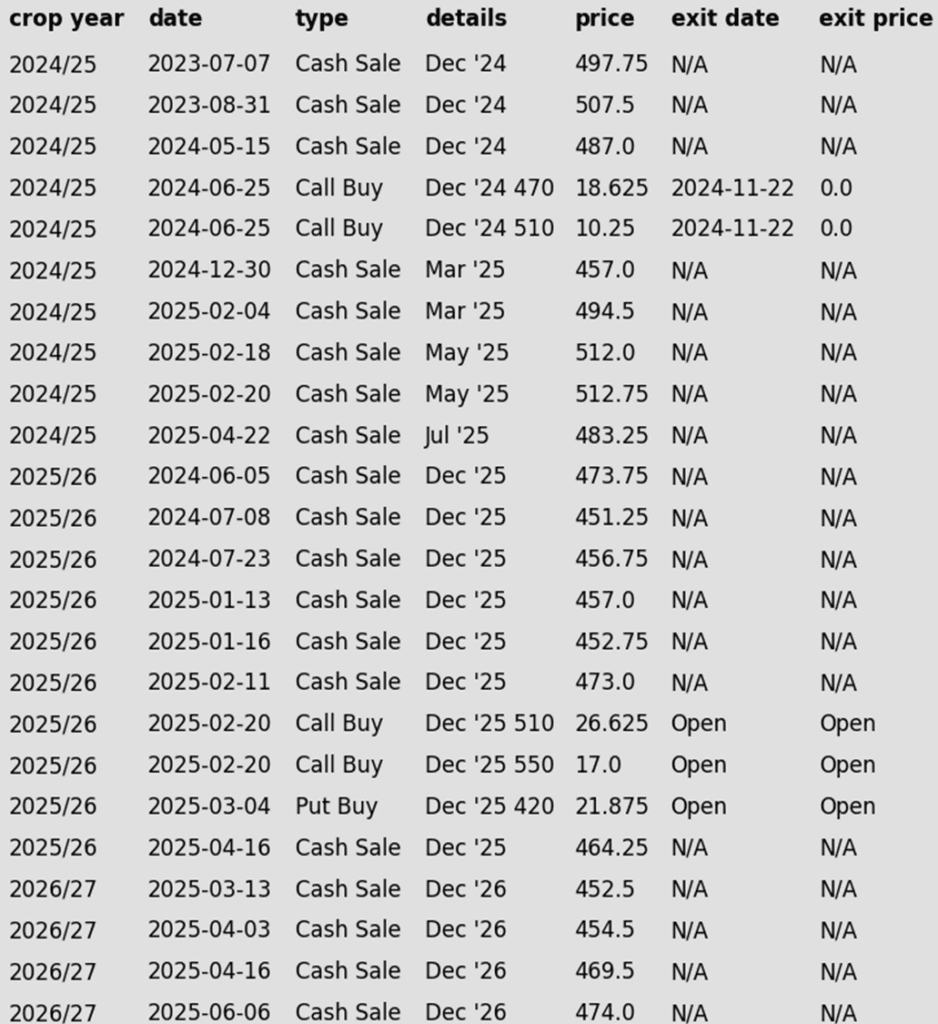

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished the session slightly higher on Thursday after the USDA report lowered old crop corn carryout due to stronger than anticipated export demand. Weakness in other grains limited the corn market’s upside. Going into Friday, July corn futures are trading 4 cents lower on the week; Dec corn futures were 8 ¾ cents lower.

- USDA released the June WASDE report on Thursday morning. While the June report is typically a quiet report, the USDA did raise the current export forecast to 2.650 BB, lowering 2024-25 marketing year carryout to 1.365 BB. This was lower than analyst expectations and helped support the old crop futures in the session.

- The USDA released the weekly Export Sales report on Thursday morning. For the week ending June 5, exporters reported new sales of 791,000 MT (31.2 mb). This total was down 26% from last week, but still within expectations. Japan was the largest buyer on U.S. corn last week.

- The Trump administration announced the EPA has completed their review of the biofuels blending requirements and should announce the targets for 2025-26 on Friday. Concerns that the total could be less than expected may limit corn futures.

- With the USDA report behind the market, the focus of the corn market will shift back to weather, and the planted acres report at the end of the month.

Corn Futures Settle Into a Tight, Five-Day Range

The front-month July contract has settled into a tight five-day trading range, largely between 433 and 445. A close below 433 would open the door to downside risk toward 408, while a close above 445 would point to an upside opportunity near 465.

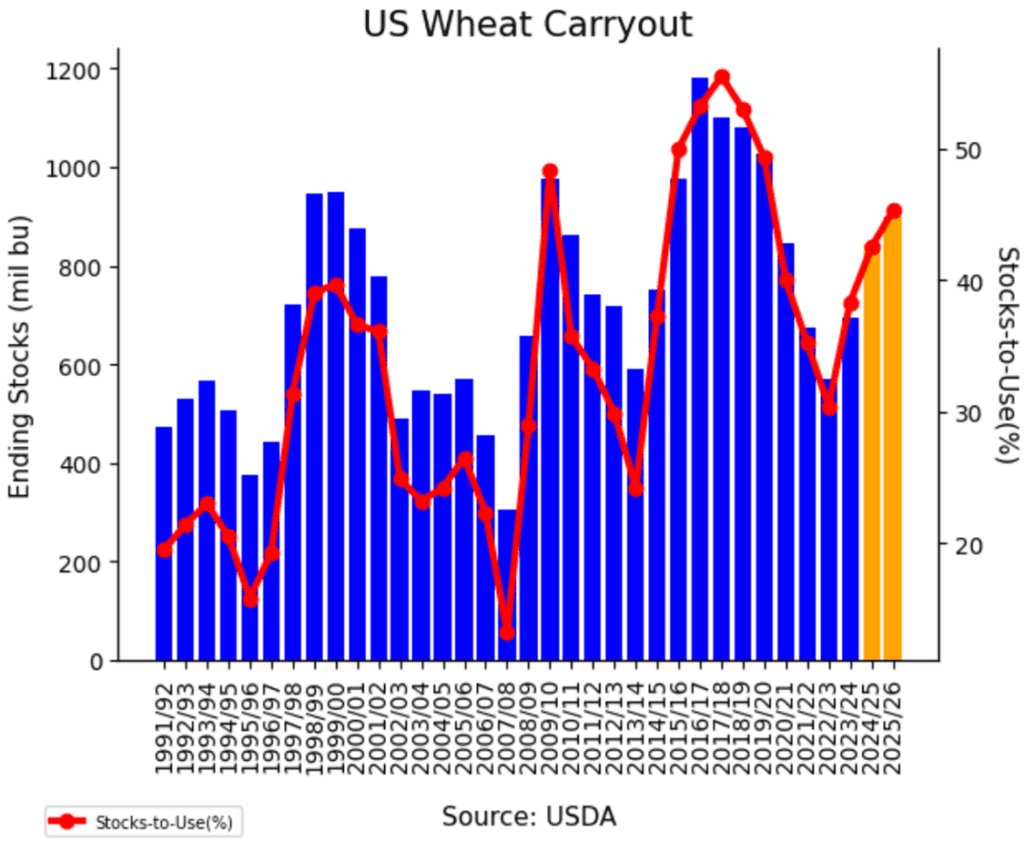

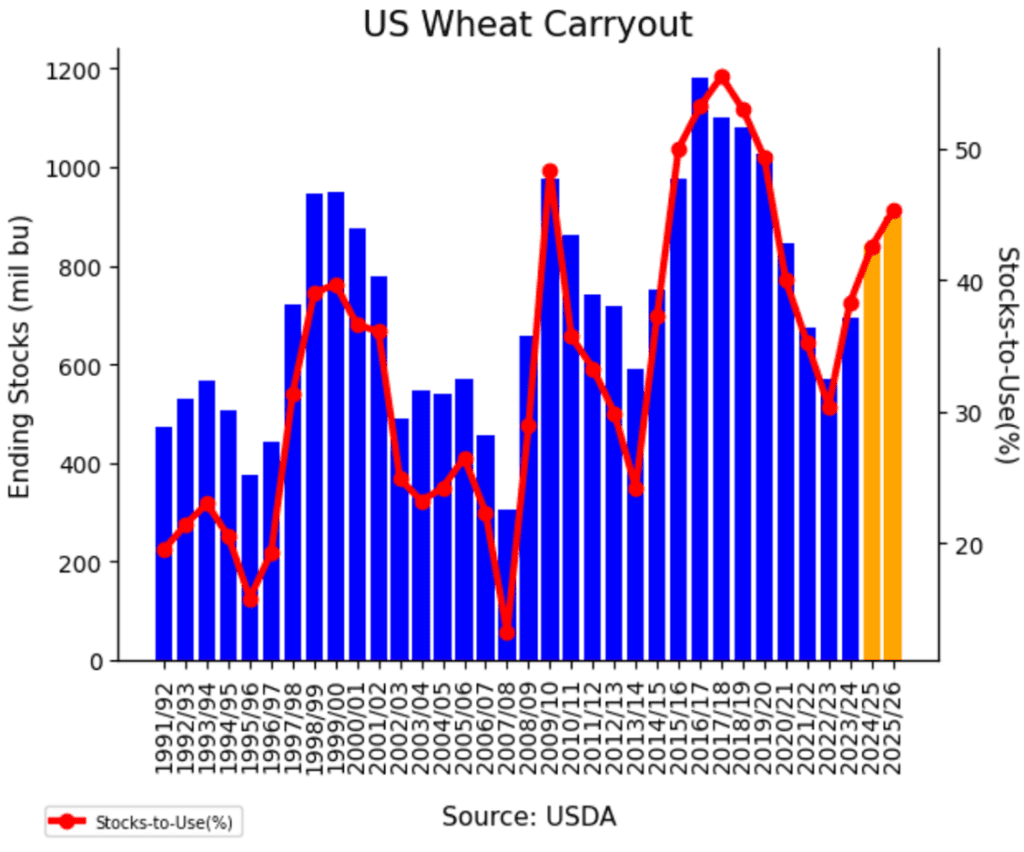

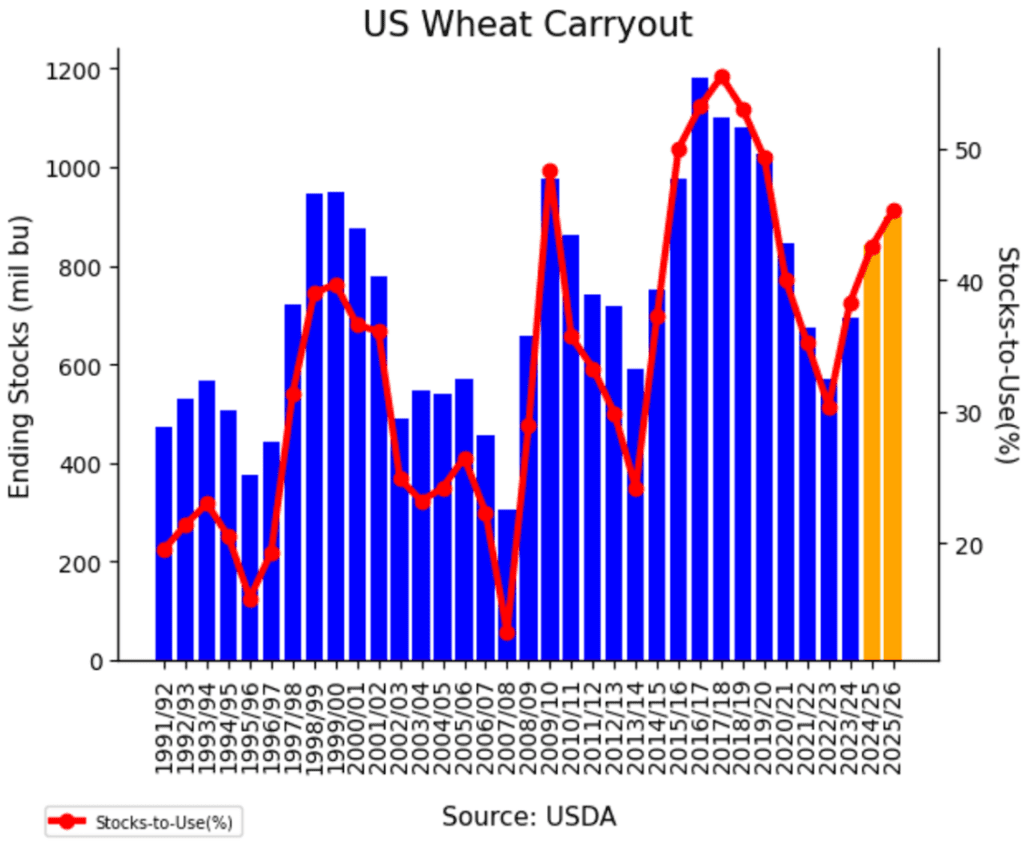

Above: Update on US carryout and stocks-to-use after today’s June WASDE report.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Enter(Buy) JAN ’26 Puts:

1040 @ ~ 49c

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- No Changes (for Now): Despite last week’s break of 1036.50 support, the 1107 target remains active to recommend making the next sale.

2025 Crop:

- CONTINUED OPPORTUNITIES – Buy January ‘26 1040 put options for approximately 49 cents in premium, plus fees and commission.

- Plan A:

- No active sales targets.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Now two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- We’re now in the seasonal window where first sales targets for next year’s crop could post at any time. Stay tuned.

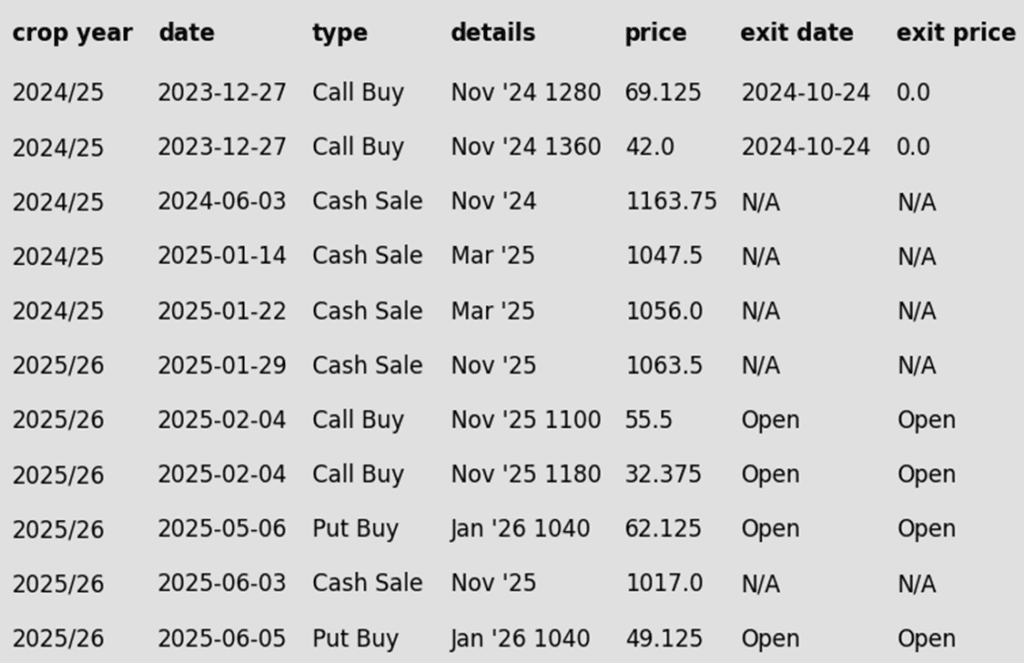

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed lower on the day following an overall neutral WASDE report, which showed very few changes to the soybean outlook both in the U.S. and globally.

- June’s WASDE report showed minor changes for soybeans, but did increase the 2025/26 world carryout number from 124.3 mmt in May to 125.3 mmt. Ending stocks were left unchanged for 2024/25 at 350 MB, along with 2025/26 ending stocks at 295 mb.

- Production estimates for 2024 soybeans in Brazil and Argentina were left unchanged from the month prior in today’s report at 169.0 mmt and 49.0 mmt, respectively.

- Conab raised their soybean production forecast to 169.6 mmt, up from 168.34 mmt last month and slightly higher than the USDA’s 169.0 mmt number.

- The weather outlook over the next week remains bearish for much of the soybean belt as chances of rain step back in, which may add further downward pressure to prices.

Soybean Futures Stall – Resistance Remains

Last Monday, the July contract closed 8 cents lower, breaking 1036.50 support and posting its lowest close since April 10. Over the next four trading days, July rallied, gaining about 24 cents and finishing the week up 16 cents net. The four-day winning streak pushed July back above all major moving averages, but to break out of the broader sideways trading range that’s held since last summer, the contract still needs to clear the May high of 1082.

Above: Update on US carryout and stocks-to-use after today’s June WASDE report.

Wheat

Market Notes: Wheat

- After a two-sided trade, Chicago and Kansas City wheat futures posted losses, while Minneapolis made modest gains. All eyes were focused on this morning’s USDA Supply and Demand report, which was relatively neutral overall. Traders have likely moved their attention back to winter wheat harvest, which is adding pressure to those markets.

- On today’s WASDE report, the USDA kept their 25/26 all wheat production estimate unchanged from May at 1.921 mb – the trade was anticipating a slight increase. U.S. ending stocks for 24/25 were kept steady at 841 mb. However, for the 25/26 marketing year, ending stocks decreased 25 mb from last month to 898 mb due to higher exports.

- Globally, 24/25 wheat carryout declined from 265.2 mmt in May to 264 mmt today. For 25/26, there was also a decrease from 265.7 mmt to 262.8 mmt.

- The USDA reported an increase of 14.3 mb of wheat export sales for 25/26. Shipments last week at 4.3 mb were well under the 15.38 mb pace needed per week to reach their 25/26 export goal of 800 mb. Total 25/26 export commitments have reached 217 mb, up 22% from last year.

- The Rosario Exchange in Argentina has reduced their nation’s 25/26 wheat production estimate from 21 mmt to 20.7 mmt. The reason for the decline is said to be a smaller planted area due to recent heavy rains that caused flooding issues.

- Coceral has increased their estimate of 2025 European Union soft wheat production to 143.1 mmt from the March estimate of 137.2 mmt. For reference, the 2024 crop totaled 126.3 mmt. The reason for the increase was cited as favorable weather in France, Spain, and southeastern Europe.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

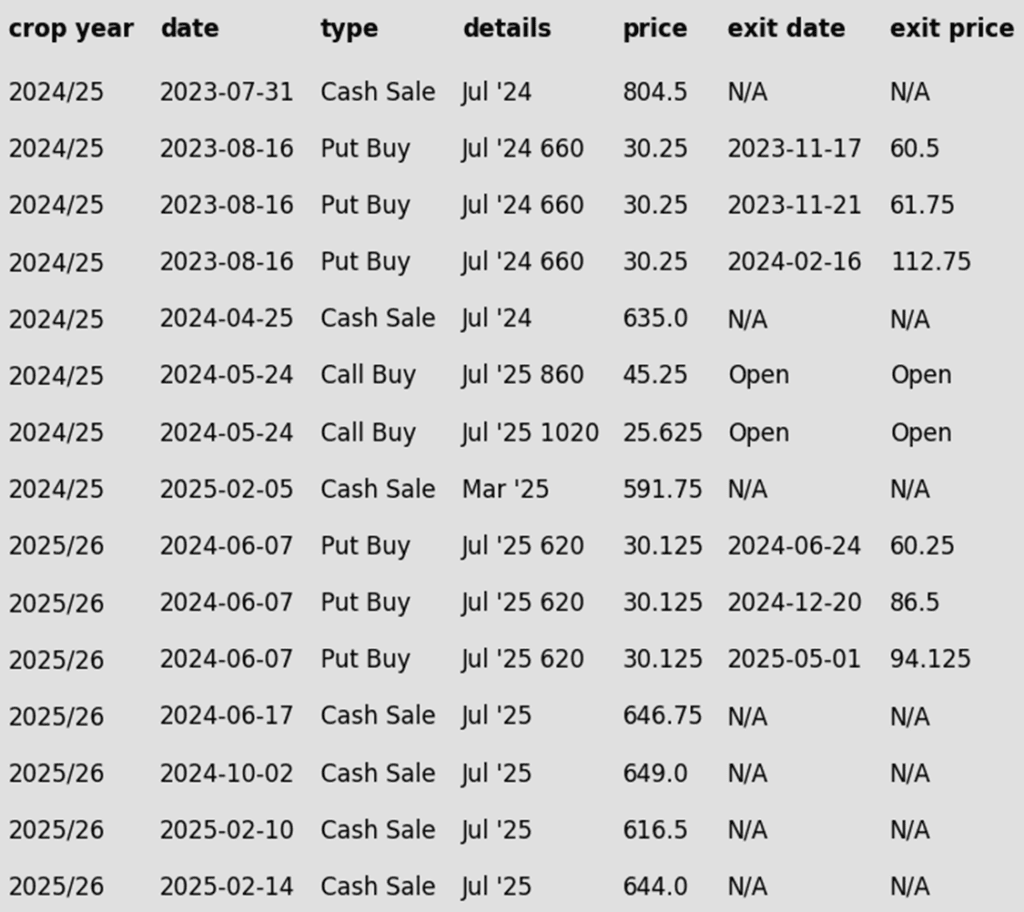

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- None.

- This week will likely be the final week that Grain Market Insider provides guidance on the 2024 crop before fully shifting focus to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- New put options target added.

- Put option coverage is leveraged for early downside protection in the event of a break of support.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Hits Resistance

The July contract faced a sharp rejection after testing the 200-day moving average at 557.75. A close above that level could open the door for a broader rally toward the April high of 621.75. However, until that resistance is cleared, the risk remains for sideways-to-lower trade, with 506.25 as the recent downside reference point.

Above: Update on US carryout and stocks-to-use after today’s June WASDE report.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

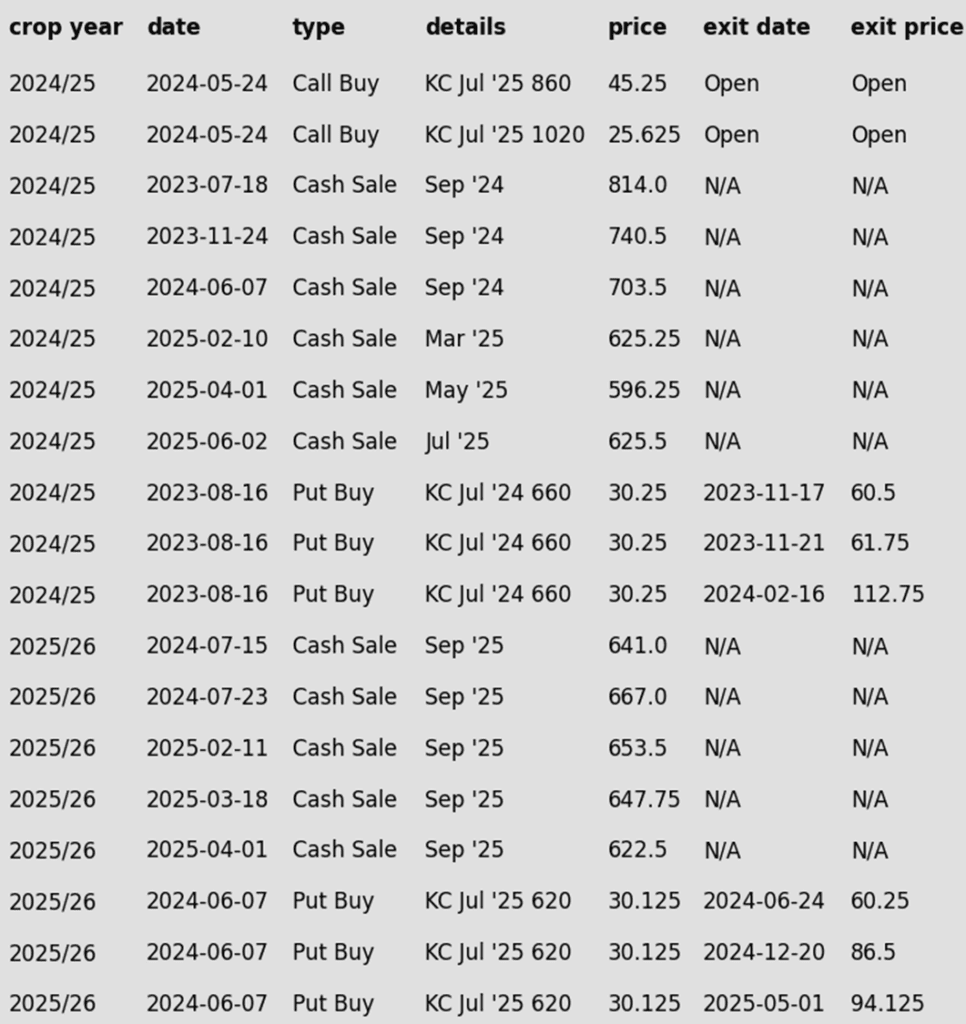

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- None.

- This week will likely be the final week that Grain Market Insider provides guidance on the 2024 crop before fully shifting focus to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- None.

2026 Crop:

- Plan A: Target 697 vs July ‘26 to make the first cash sale.

- Plan B:

- Close below 584 support and buy July ‘26 put options (strikes TBD).

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- New cash sale target and new put option target.

- Given the high yield variability from year to year in Hard Red Winter wheat, put option coverage is leveraged for early downside protection in the event of a break of support.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Finds Resistance At 550

First resistance stands at last week’s high of 550.50. A breakout above that level would shift focus to the 100-day and 200-day moving averages in the 565–567 range. Clearing that secondary resistance could open the door to broader upside potential, with targets in the 600–620 zone — near the early spring highs. On the downside, the May low of 500.25 remains a key support level. Failure to break out above resistance would keep the trend sideways to lower, with that low as the next risk.

Above: Update on US carryout and stocks-to-use after today’s June WASDE report.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Now six sales recommendations made to date, with an average price of 684.

- Changes:

- None.

- This week will likely be the final week that Grain Market Insider provides guidance on the 2024 crop before fully shifting focus to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if July KC closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- First sales targets are expected to post after July 1.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Leading the Complex

July spring wheat futures have outperformed both Chicago and KC wheat since all three markets bottomed in mid-May. It is the only July wheat contract currently trading above all three major moving averages — the 50-, 100-, and 200-day — which have now converged in the 605–610 range, establishing a key support zone. A close below 605 would expose the market to downside risk toward 580. However, as long as 605 holds, the broader upside potential remains intact, with room to rally toward the 660 level.

Above: Update on US carryout and stocks-to-use after today’s June WASDE report.

Other Charts / Weather

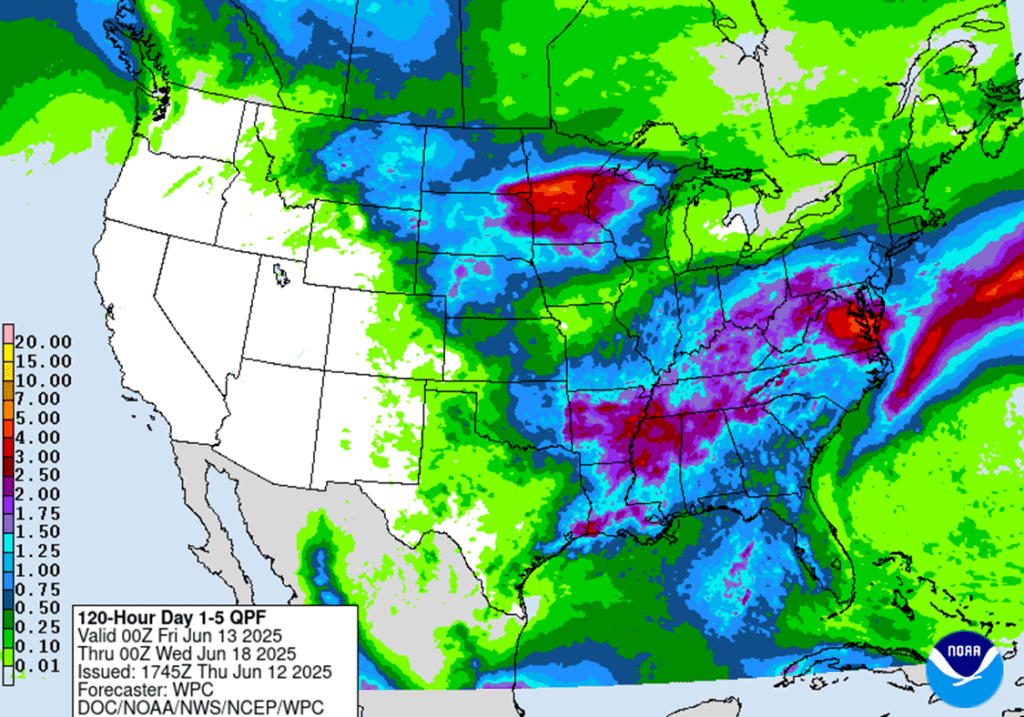

Above: US 5-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

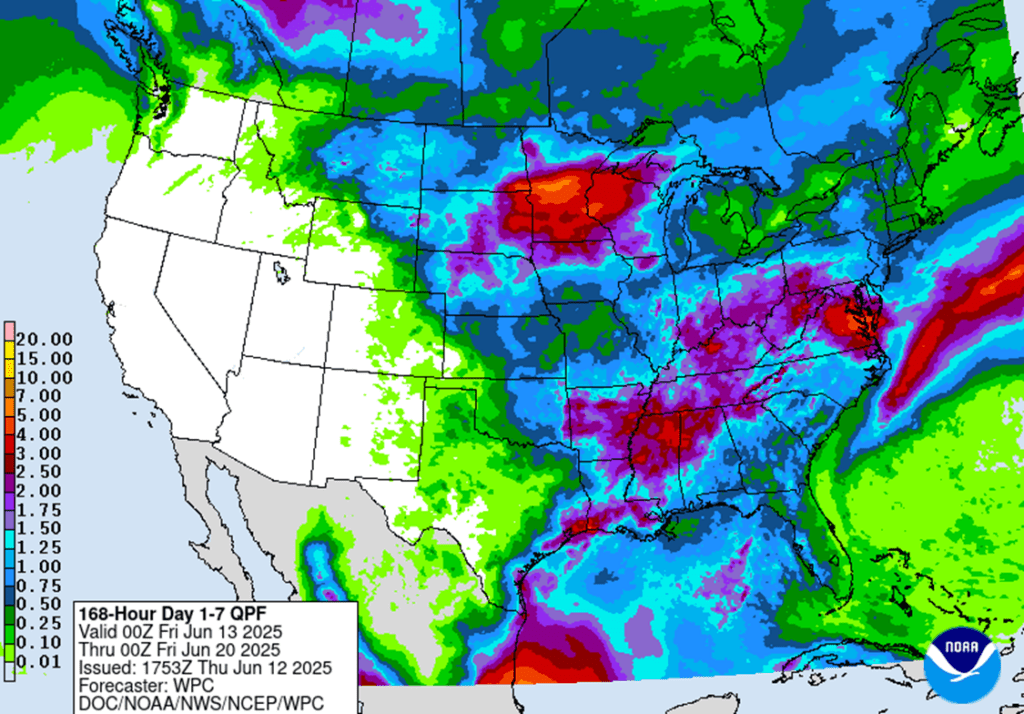

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

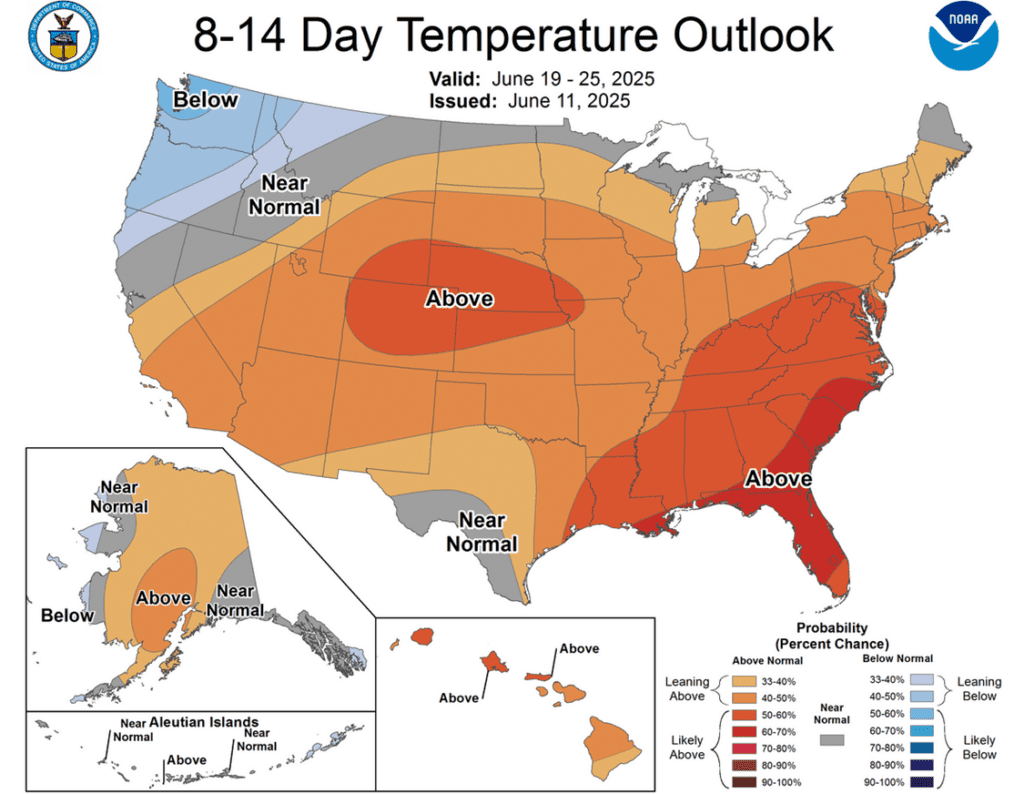

Above: US 8-14 day temperature outlook courtesy of NOAA.