6-10 End of Day: Corn & Soybeans Steady-to-Higher, Wheat Lower Again

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 438.75 | 5.25 |

| DEC ’25 | 440 | 2 |

| DEC ’26 | 470.5 | -0.75 |

| Soybeans | ||

| JUL ’25 | 1057.75 | 1.75 |

| NOV ’25 | 1031.25 | 0.5 |

| NOV ’26 | 1056 | -1.5 |

| Chicago Wheat | ||

| JUL ’25 | 534.5 | -7.5 |

| SEP ’25 | 548.75 | -8.25 |

| JUL ’26 | 606.75 | -9 |

| K.C. Wheat | ||

| JUL ’25 | 527.25 | -10.25 |

| SEP ’25 | 540 | -10.25 |

| JUL ’26 | 598.5 | -10.5 |

| Mpls Wheat | ||

| JUL ’25 | 613.25 | -9.25 |

| SEP ’25 | 623.75 | -8.75 |

| SEP ’26 | 670 | -2.25 |

| S&P 500 | ||

| SEP ’25 | 6080 | 16 |

| Crude Oil | ||

| AUG ’25 | 63.53 | -0.69 |

| Gold | ||

| AUG ’25 | 3342.1 | -12.8 |

Grain Market Highlights

- 🌽 Corn: Corn prices rebounded off session lows to finish higher on the day, despite a 2% increase to 71% Good/Excellent in Monday’s USDA Crop Progress report. Today’s reversal may also signal the beginning of position-squaring ahead of Thursday’s USDA WASDE report.

- 🌱 Soybeans: Soybeans ended the day in positive territory, though well off their session highs. Beneficial weather continues to provide resistance, while optimism over potential trade deals is offering support. Reports indicate that U.S.–China trade talks went well yesterday, but no official agreement has been announced.

- 🌾 Wheat: All three wheat classes posted sizeable losses for a second consecutive session following improvements in winter and spring wheat crop conditions, as reported in the latest USDA Crop Progress Report. Adding to the bearish tone was an overnight statement from Russia’s Deputy Prime Minister, projecting this year’s Russian grain harvest at 135 million metric tons — a 7% increase from last year.

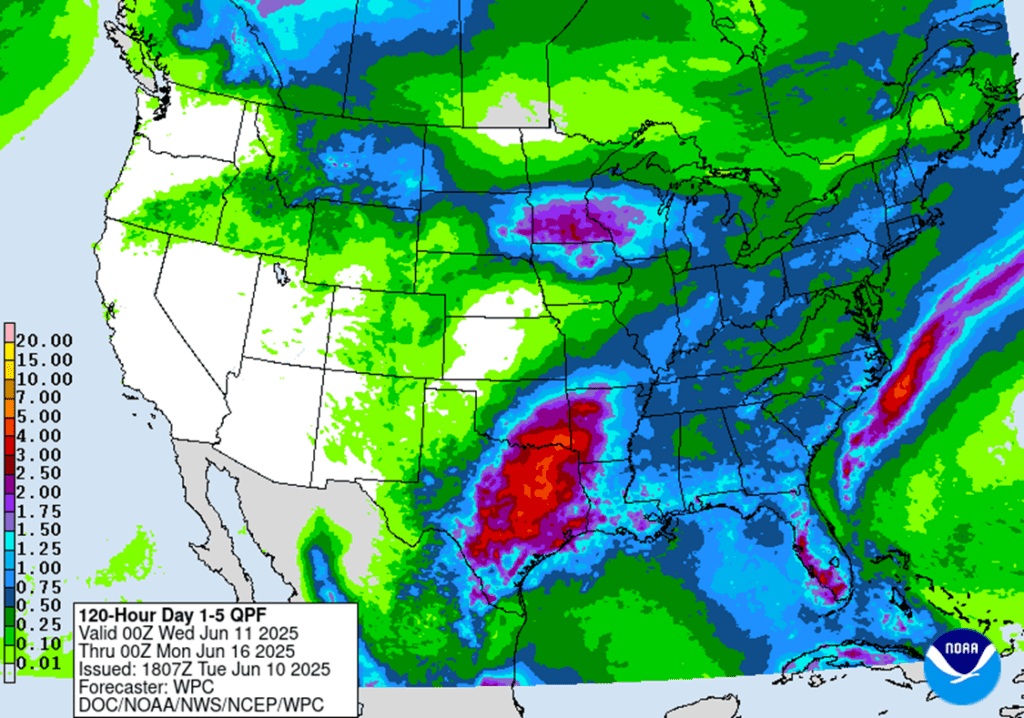

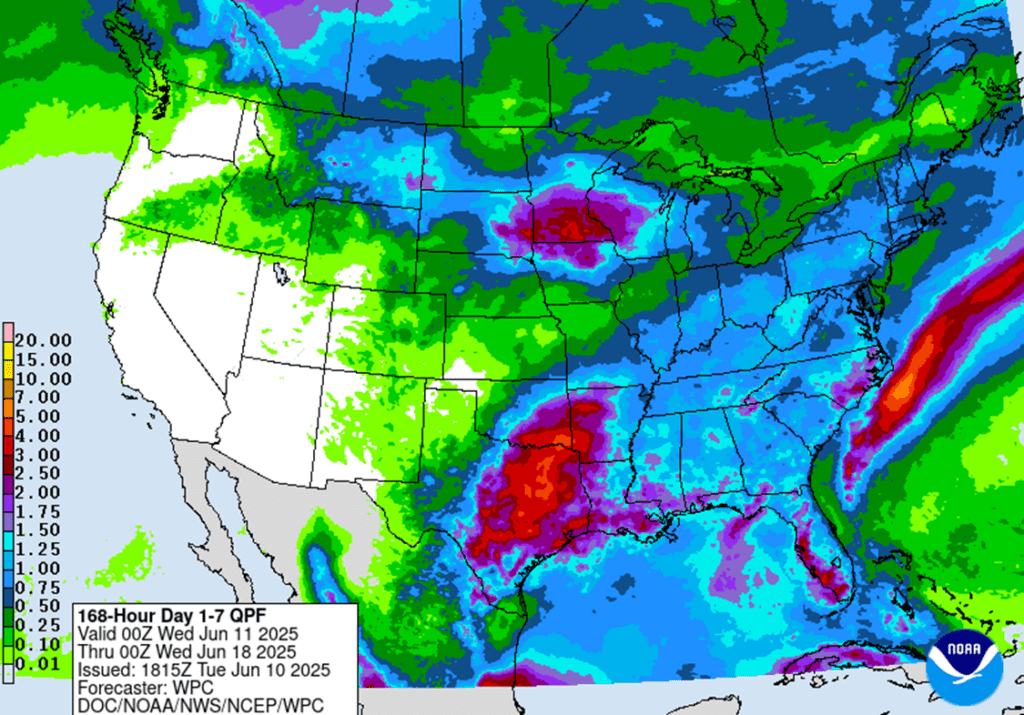

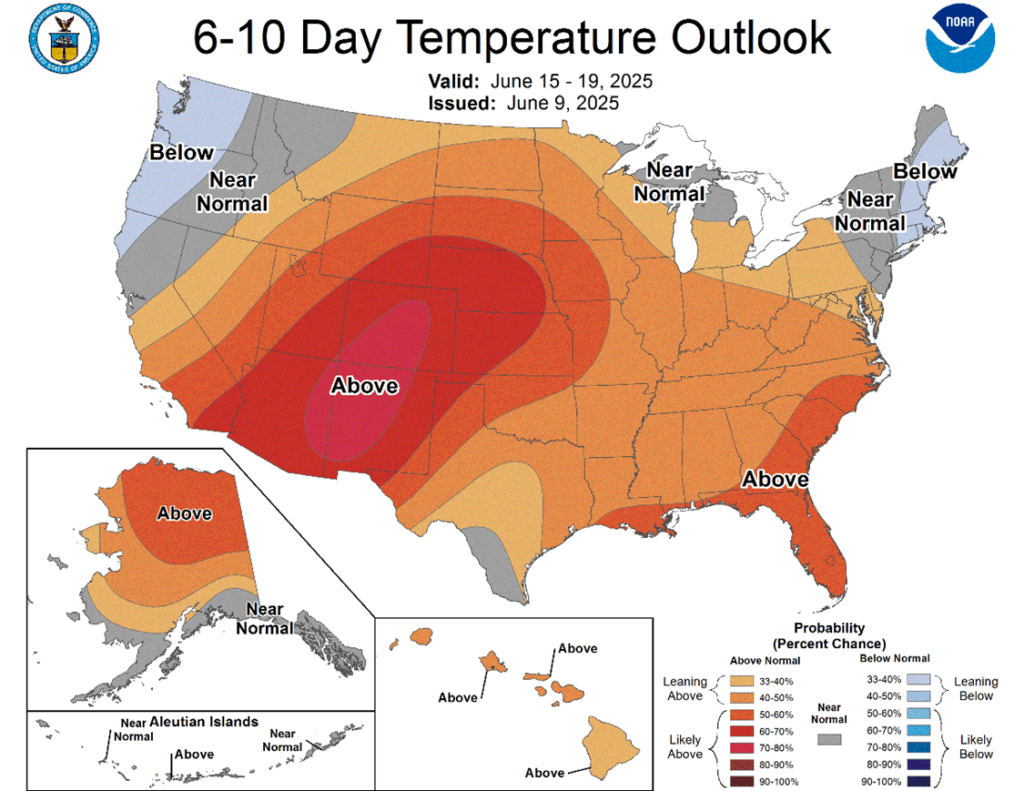

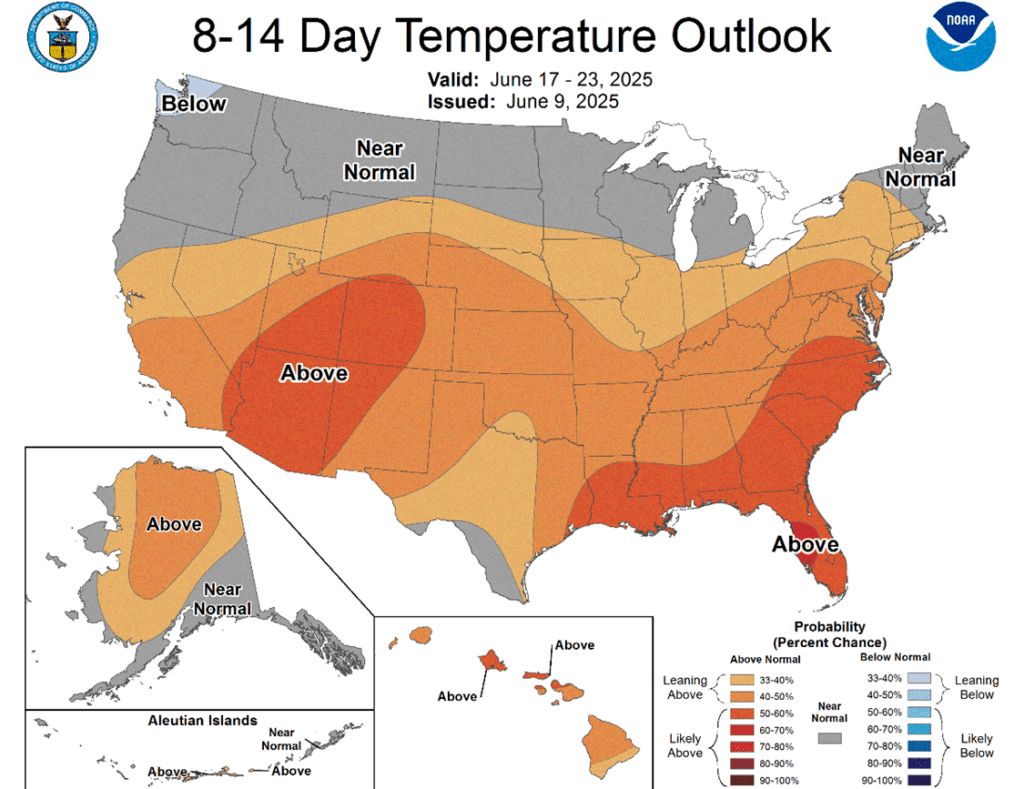

- To see the updated U.S. weather outlook maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

Active

Sell DEC ’26 Cash

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

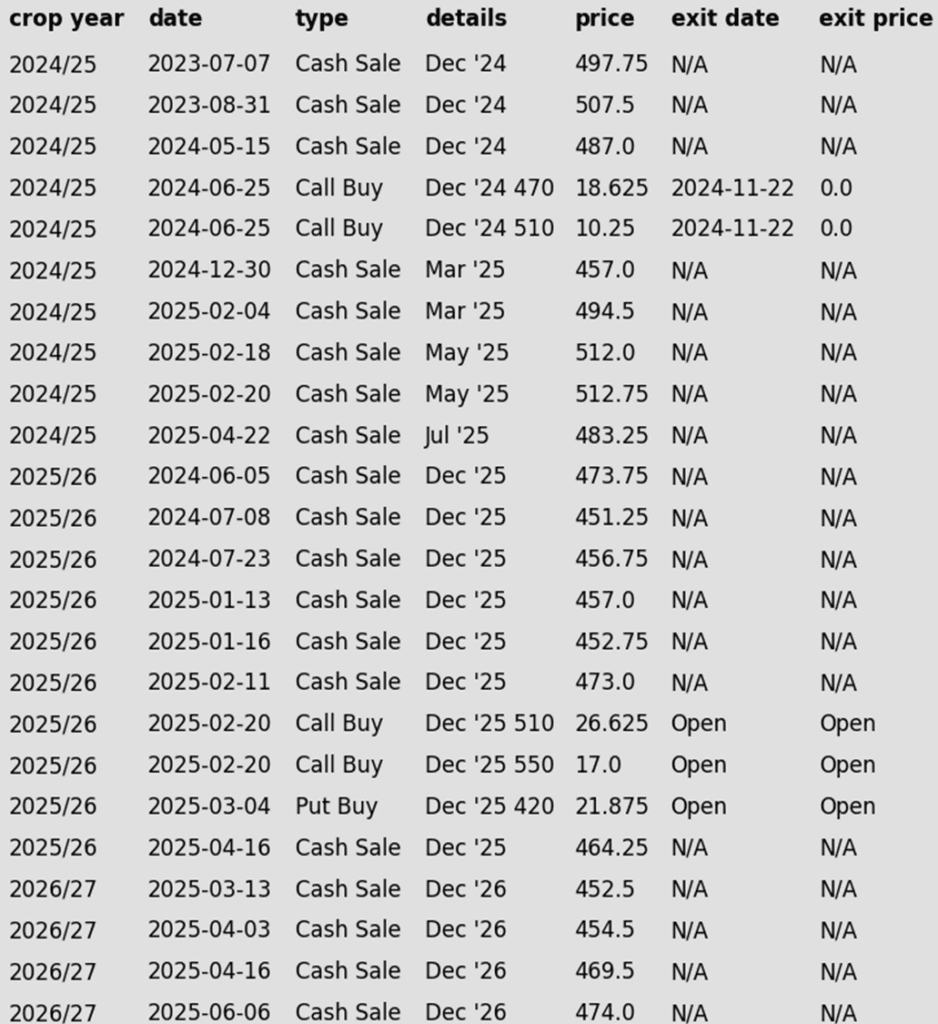

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

- No Action Yet: Still waiting on a potential spring/summer weather volatility rally before recommending the next sale.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

- Volatility-Ready: Positioned well for potential market swings, with a solid base of sales and open call and put option positions in place. Active targets remain set to begin legging out of options and roll down call options to lower strikes as conditions warrant.

2026 Crop:

- CONTINUED OPPORTUNITY – Sell a fourth portion of your 2026 corn. The December ‘26 contract has reached the upside target of 474.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Now four sales recommendations have been made to date, with an average price of 462.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

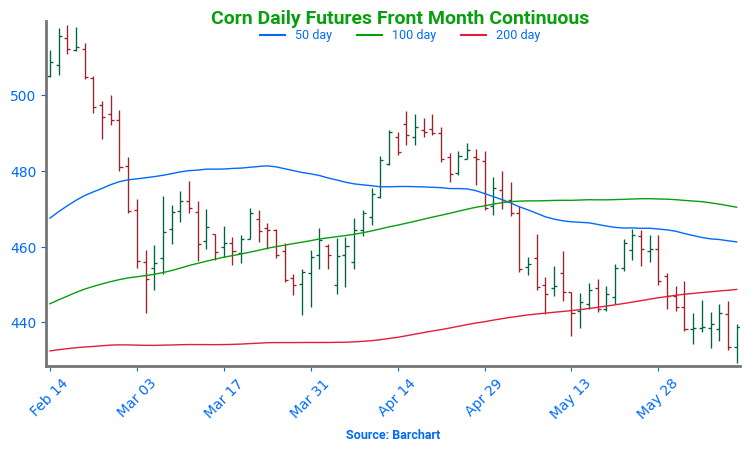

Market Notes: Corn

- Buyers came back into the corn market on a “turn around” Tuesday as the market was pulled higher by the front month futures as traders may have started covering short positions before Thursday’s USDA WASDE report.

- According to the USDA ‘s latest Crop Progress and Condition report on Monday afternoon, 97% of the corn crop is planted. This leaves approximately 2.8 million acres left to be planted on June 10. These acres, if unplanted, could lower the total planted acres for corn on the June 30 acre report back below 95 million, which should support Dec corn futures at these levels.

- The USDA will release the June WASDE report on Thursday. Analysts are expecting little change in the new crop forecasts from May, but the focus will be on demand projections for the old crop. Expectations are for adjustments higher in export demand, which could lower corn carryout for 2024-25 below 1.400 billion bushels.

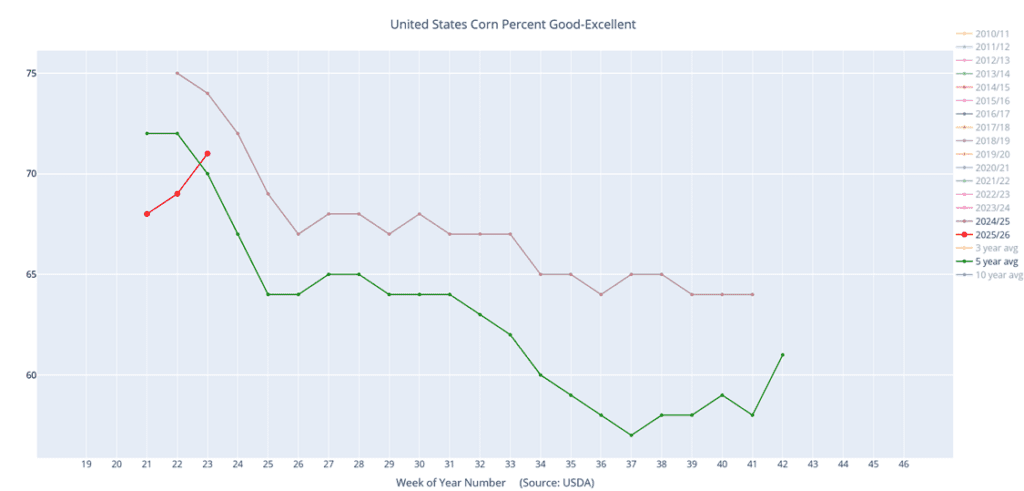

- Corn crop conditions improved by 2% Good/Excellent to 71% G/E in Monday’s Crop Progress report. The firmness in corn prices on Tuesday may have signified that those conditions were priced in with the weakness on Monday.

- Corn charts saw an improved technical picture with Tuesday’s close as prices reversed higher off early session lows. Price follow-through on Wednesday may be key for signaling a turn in an oversold market.

Corn Futures Settle Into a Tight, Five-Day Range

The front-month July contract has settled into a tight five-day trading range, largely between 433 and 445. A close below 433 would open the door to downside risk toward 408, while a close above 445 would point to an upside opportunity near 465.

Above: Corn condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell NOV ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

Active

Enter(Buy) JAN ’26 Puts:

1040 @ ~ 49c

2026

No New Action

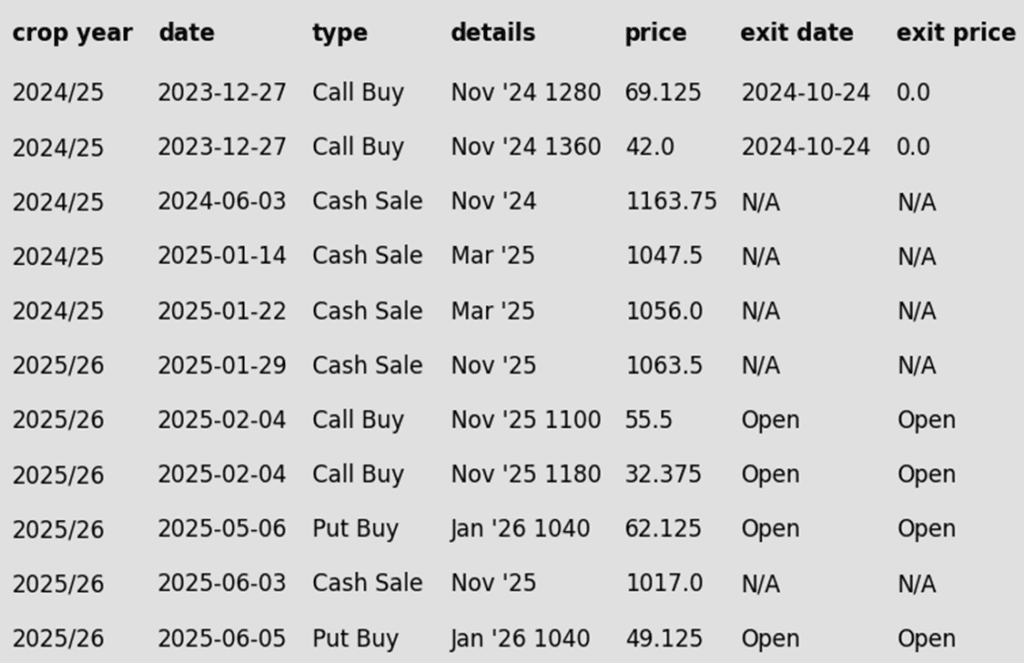

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- No Changes (for Now): Despite last week’s break of 1036.50 support, the 1107 target remains active to recommend making the next sale.

2025 Crop:

- CONTINUED OPPORTUNITIES –

- Buy January ‘26 1040 put options for approximately 49 cents in premium, plus fees and commission. This is a recommendation to purchase a second round of 1040 puts, following the first round advised on May 6.

- Sell another portion of your 2025 soybean crop.

- Plan A:

- No active sales targets.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- No active targets.

- Details:

- Sales Recs: Now two sales recommendations made to date, with an average price of 1040.25.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- We’re now in the seasonal window where first sales targets for next year’s crop could post at any time. Stay tuned.

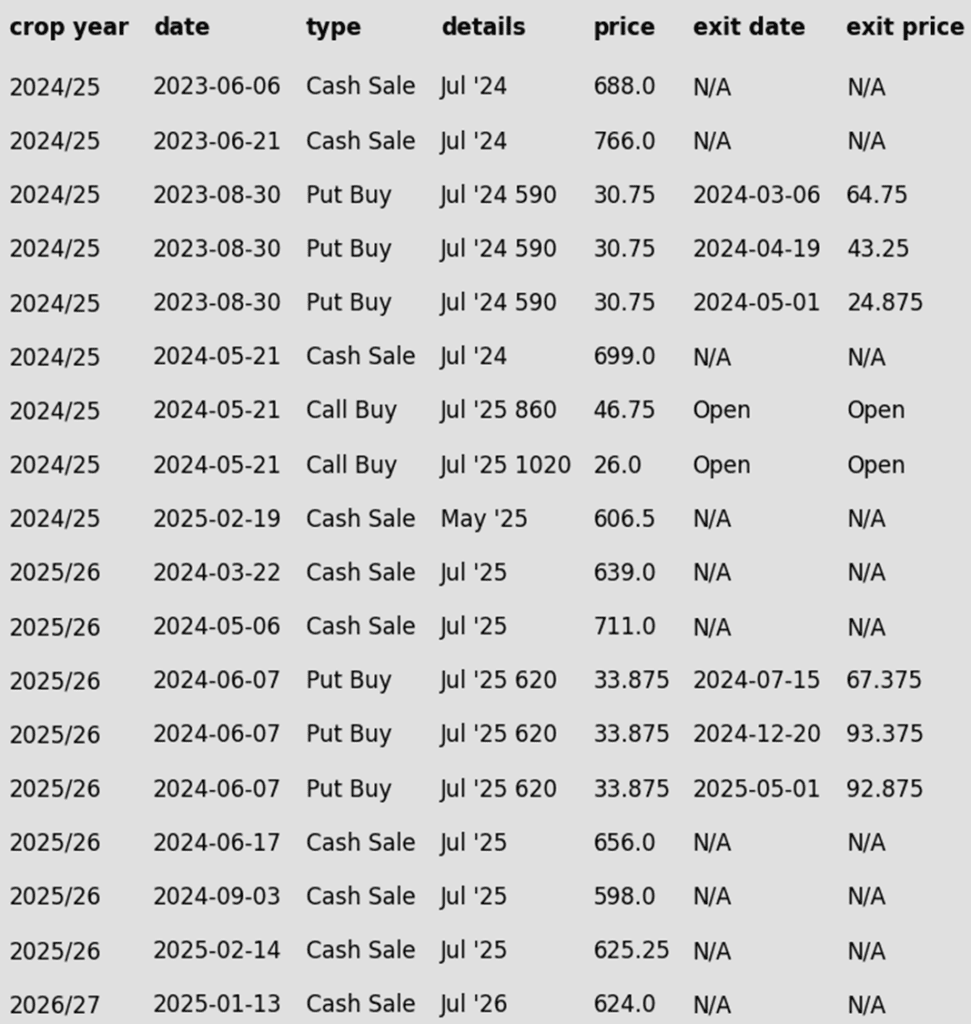

To date, Grain Market Insider has issued the following soybean recommendations:

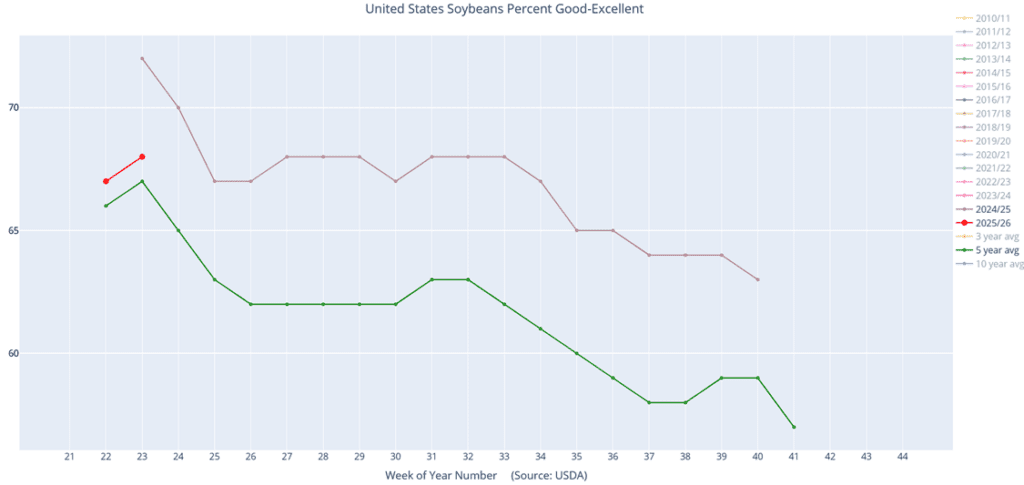

Market Notes: Soybeans

- Soybeans finished the day in positive territory, though they reversed off earlier highs that saw the July contract up more than 6 cents at one point. Beneficial weather has continued to apply downward pressure, while optimism over potential trade deals with other countries has offered support. Both soybean meal and soybean oil also ended the day higher.

- Yesterday afternoon, the USDA released its updated Crop Progress report which showed the crop at 90% planted which was up from 84% a week ago, and 75% has emerged which compared to 63% a week ago. Crop conditions improved by 1 point with 68% of the crop now rated good to excellent.

- China imported a record number of soybeans in the month of May. For the month, China imported an estimated 13.92 MMT (511 MB). The strong imports followed disappointing totals in February, March, and April as Chinese importers were waiting for the freshly harvested Brazilian soybeans to hit the export market.

- The trade talks between the U.S. and China yesterday reportedly went well but a deal has not yet been released. Trade deals with Japan, India, Vietnam, and South Korea are reportedly very close.

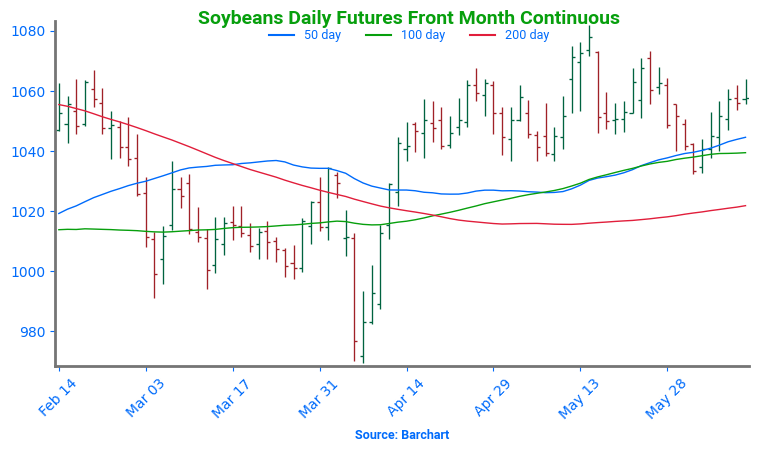

Soybean Futures Stall – Resistance Remains

Last Monday, the July contract closed 8 cents lower, breaking 1036.50 support and posting its lowest close since April 10. Over the next four trading days, July rallied, gaining about 24 cents and finishing the week up 16 cents net. The four-day winning streak pushed July back above all major moving averages, but to break out of the broader sideways trading range that’s held since last summer, the contract still needs to clear the May high of 1082.

Above: Soybeans condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Wheat

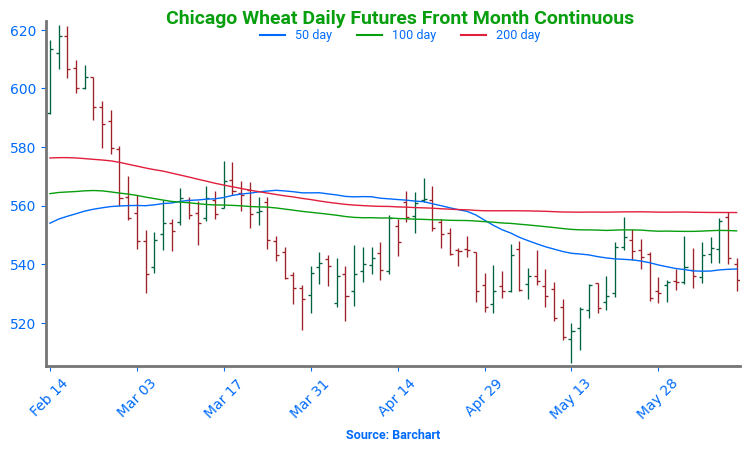

Market Notes: Wheat

- Wheat was the downside leader in the grain complex today, pressured by a firmer U.S. dollar, lower Matif wheat futures, and improving U.S. crop ratings. Additionally, from a technical perspective, all three U.S. futures classes now have downward momentum on the daily RSI and stochastics.

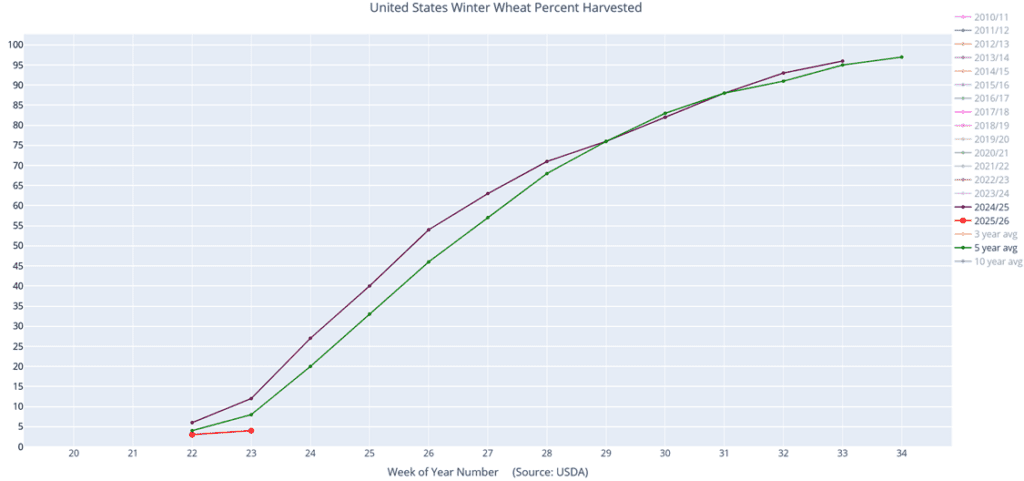

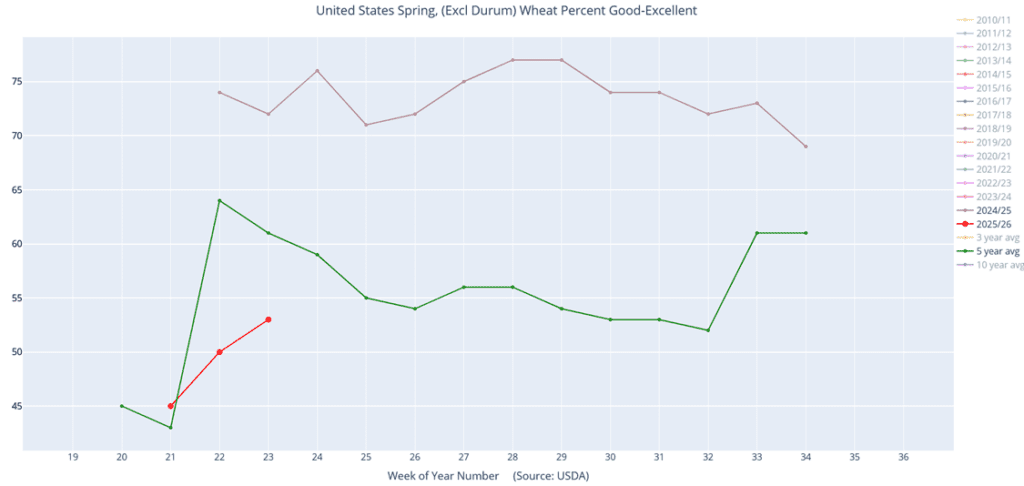

- According to the USDA Crop Progress report, winter wheat conditions improved 2% from last week to 54% good to excellent. Additionally, 88% of the crop is headed and harvest is 4% complete, which is well below last year’s 11% pace and the average of 7%. The Spring wheat crop is 82% emerged, and conditions improved 3% from a week ago to 53% good to excellent.

- Overnight, the Deputy Prime Minister of Russia stated that this year’s Russian grain harvest would total 135 mmt, which would be 7% above last year’s 125.9 mmt production. Additionally, 93% of their winter crops are said to be in good condition. This added to pressure in the U.S. wheat market today.

- Wheat harvest is set to start in the North China Plain this week, though may be delayed by scattered rains late in the week. Heaviest rain totals will be across southeast China into next week.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- None.

- This week will likely be the final week that Grain Market Insider provides guidance on the 2024 crop before fully shifting focus to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- The 693.75 target has been cancelled.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None. Continue to target 675 to make a second sale.

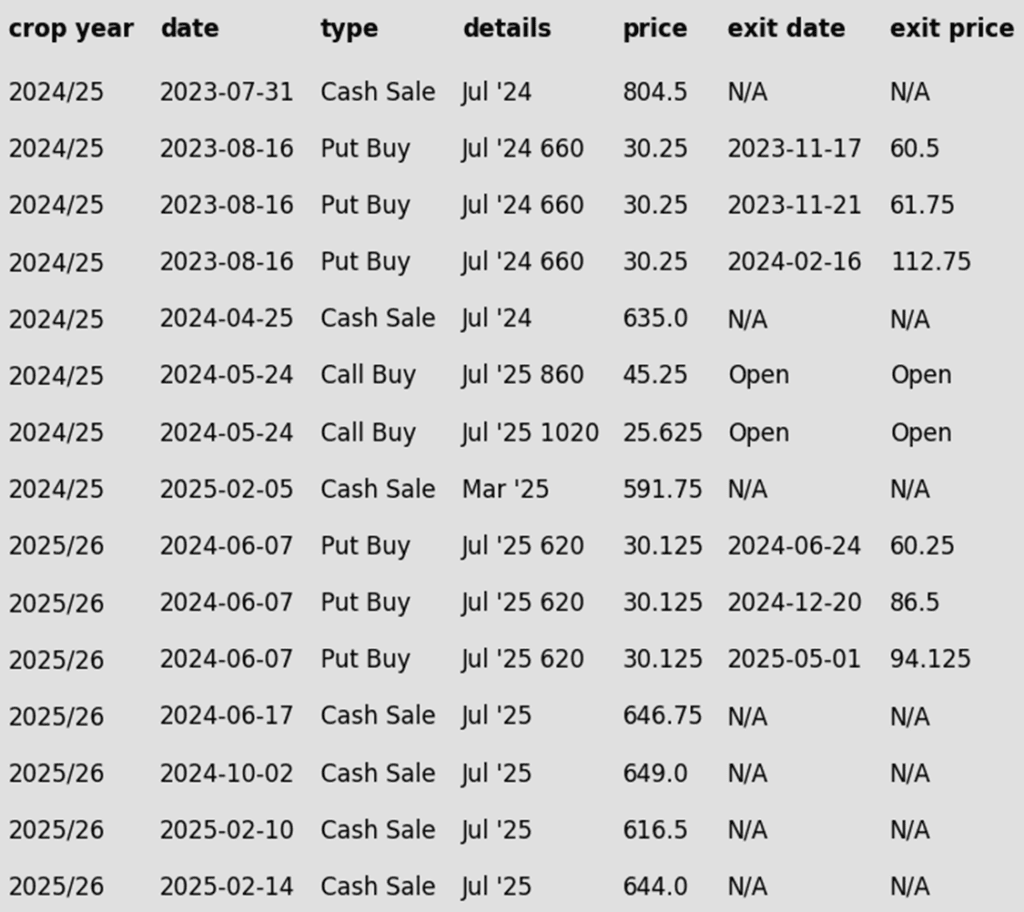

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Hits Resistance

The July contract faced a sharp rejection after testing the 200-day moving average at 557.75. A close above that level could open the door for a broader rally toward the April high of 621.75. However, until that resistance is cleared, the risk remains for sideways-to-lower trade, with 506.25 as the recent downside reference point.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- None.

- This week will likely be the final week that Grain Market Insider provides guidance on the 2024 crop before fully shifting focus to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- The first sales targets could post this week — keep checking back for updates.

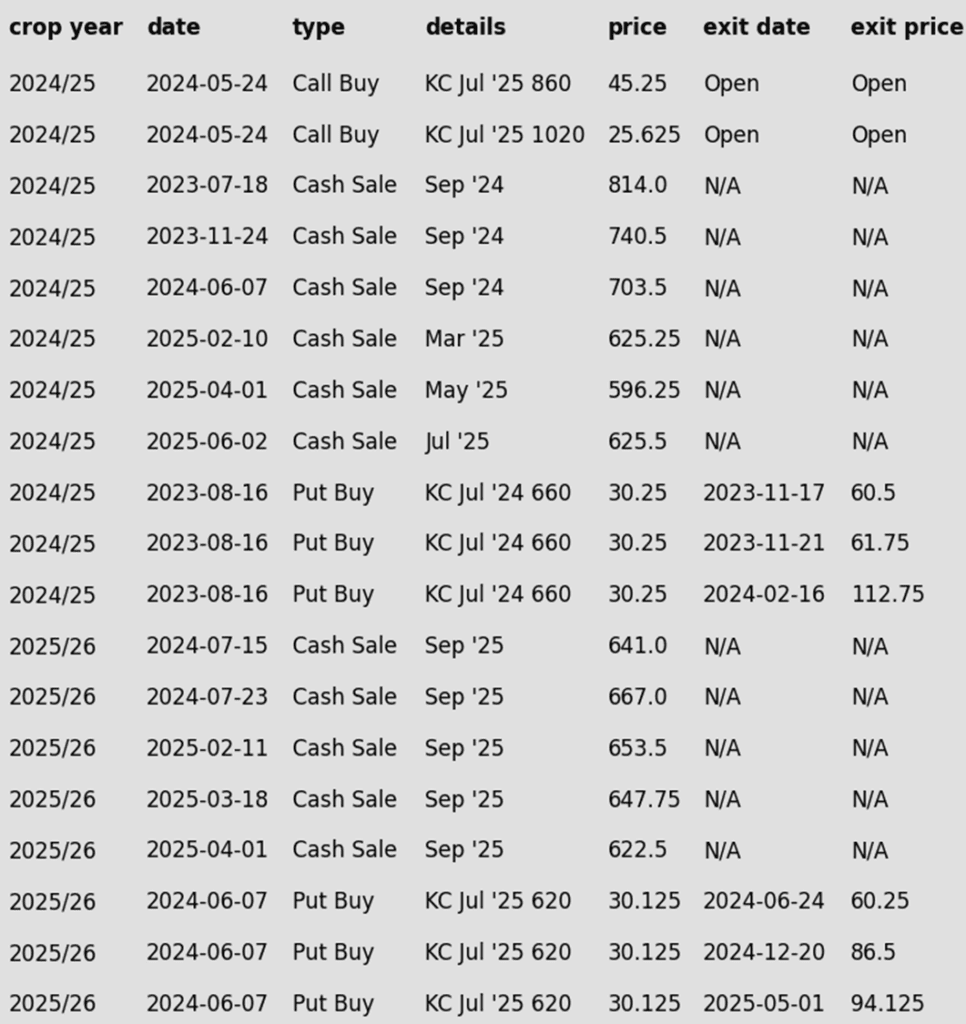

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Finds Resistance At 550

First resistance stands at last week’s high of 550.50. A breakout above that level would shift focus to the 100-day and 200-day moving averages in the 565–567 range. Clearing that secondary resistance could open the door to broader upside potential, with targets in the 600–620 zone — near the early spring highs. On the downside, the May low of 500.25 remains a key support level. Failure to break out above resistance would keep the trend sideways to lower, with that low as the next risk.

Above: Winter wheat percent harvested (red) versus the 5-year average (green) and last year (purple).

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell JUL ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Sell another portion of your 2024 Minneapolis wheat crop. This marks the sixth sale for the 2024 crop and may well be the final sales recommendation for this marketing year, as Grain Market Insider shifts focus to the 2025 and 2026 crops moving forward. Use this rally as an opportunity to consider pricing any remaining unsold bushels.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Now six sales recommendations made to date, with an average price of 684.

- Changes:

- None.

- This week will likely be the final week that Grain Market Insider provides guidance on the 2024 crop before fully shifting focus to the 2025 and 2026 crops.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if July KC closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- First sales targets are expected to post after July 1.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

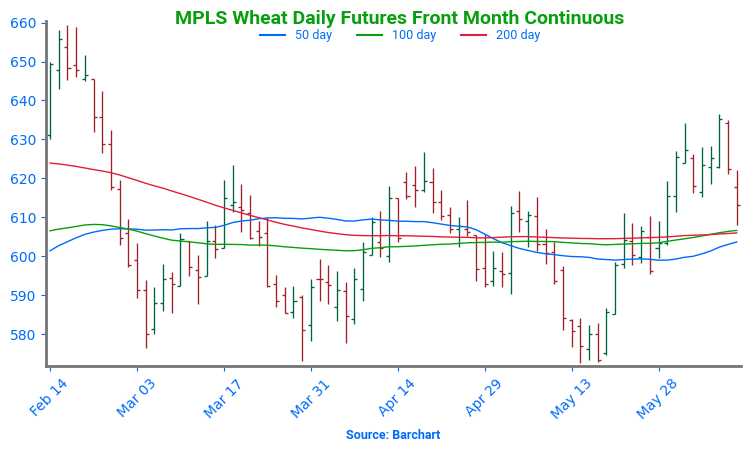

Spring Wheat Leading the Complex

July spring wheat futures have outperformed both Chicago and KC wheat since all three markets bottomed in mid-May. It is the only July wheat contract currently trading above all three major moving averages — the 50-, 100-, and 200-day — which have now converged in the 605–610 range, establishing a key support zone. A close below 605 would expose the market to downside risk toward 580. However, as long as 605 holds, the broader upside potential remains intact, with room to rally toward the 660 level.

Above: Spring wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Other Charts / Weather