5-7 End of Day: Grains Slide Despite News of U.S./China Upcoming Meeting

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 449.25 | -6.25 |

| DEC ’25 | 440.75 | -0.5 |

| DEC ’26 | 458.5 | 0 |

| Soybeans | ||

| JUL ’25 | 1039.25 | -2 |

| NOV ’25 | 1022 | 2.75 |

| NOV ’26 | 1032 | 1.5 |

| Chicago Wheat | ||

| JUL ’25 | 534.25 | -1.75 |

| SEP ’25 | 549 | -1 |

| JUL ’26 | 608 | 0.5 |

| K.C. Wheat | ||

| JUL ’25 | 529.5 | -8.5 |

| SEP ’25 | 543.75 | -7.75 |

| JUL ’26 | 601.5 | -5.75 |

| Mpls Wheat | ||

| JUL ’25 | 603 | -7.5 |

| SEP ’25 | 615 | -6.5 |

| SEP ’26 | 661.5 | 3 |

| S&P 500 | ||

| JUN ’25 | 5627.5 | 1.75 |

| Crude Oil | ||

| JUL ’25 | 57.78 | -0.9 |

| Gold | ||

| AUG ’25 | 3420.9 | -31.2 |

Grain Market Highlights

- Corn: Corn futures ended lower despite strong overnight gains after news of U.S.-China trade talks set for this weekend.

- Soybeans: Soybeans ended mixed in bear spreading action, with front months lower and deferred contracts higher.

- Wheat: Wheat futures ended lower, with Chicago posting small losses while Kansas City and Minneapolis saw steeper declines.

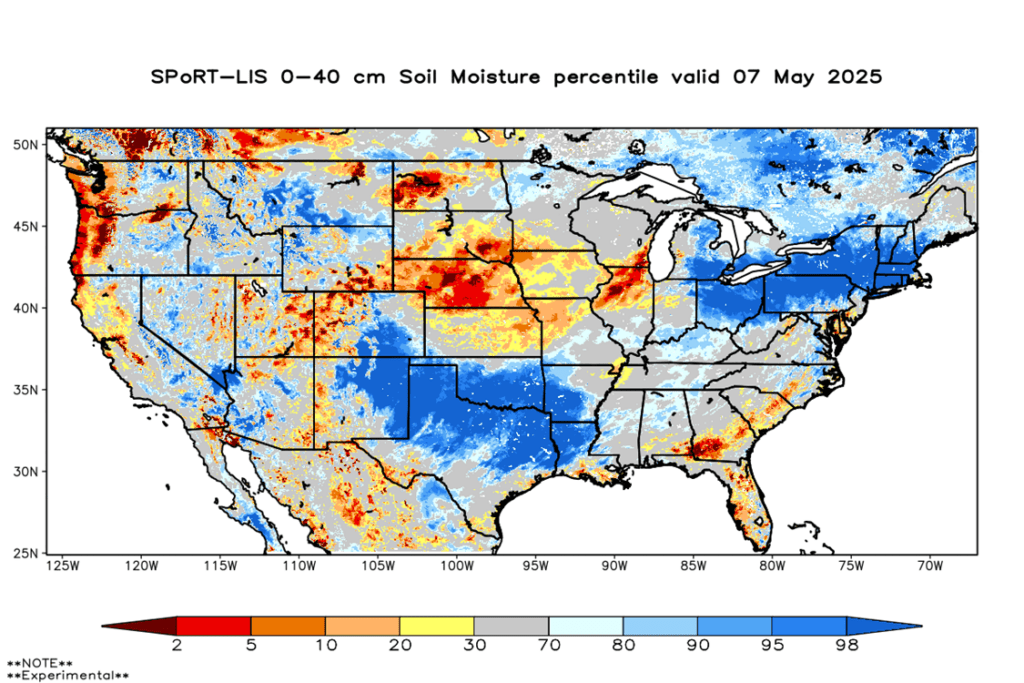

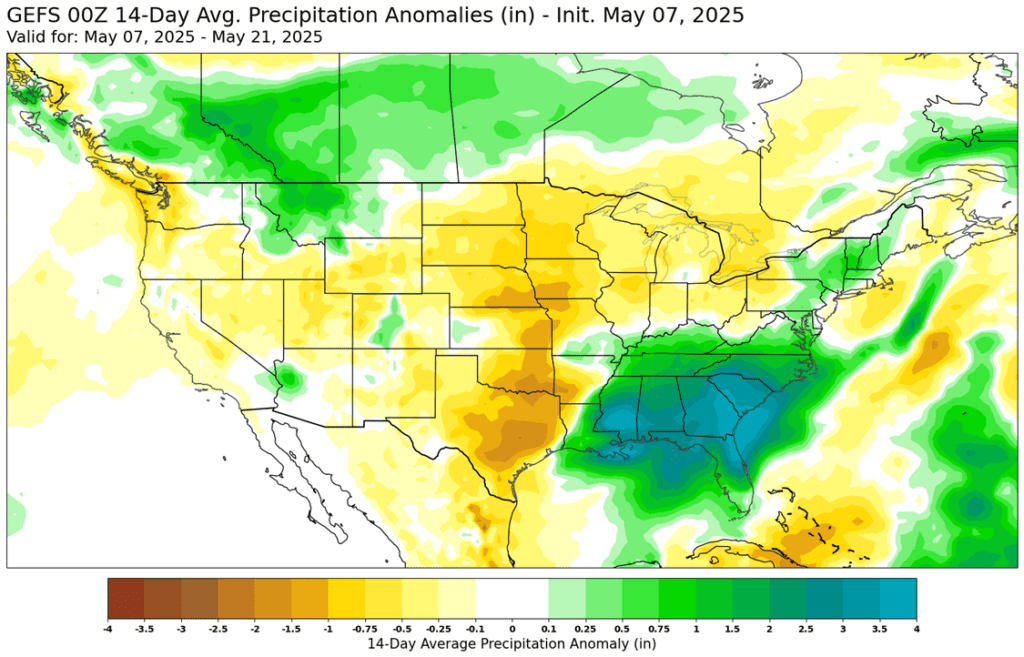

- To see the updated soil moisture percentile map and the 14-day GFS precipitation anomaly outlook for the U.S. scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

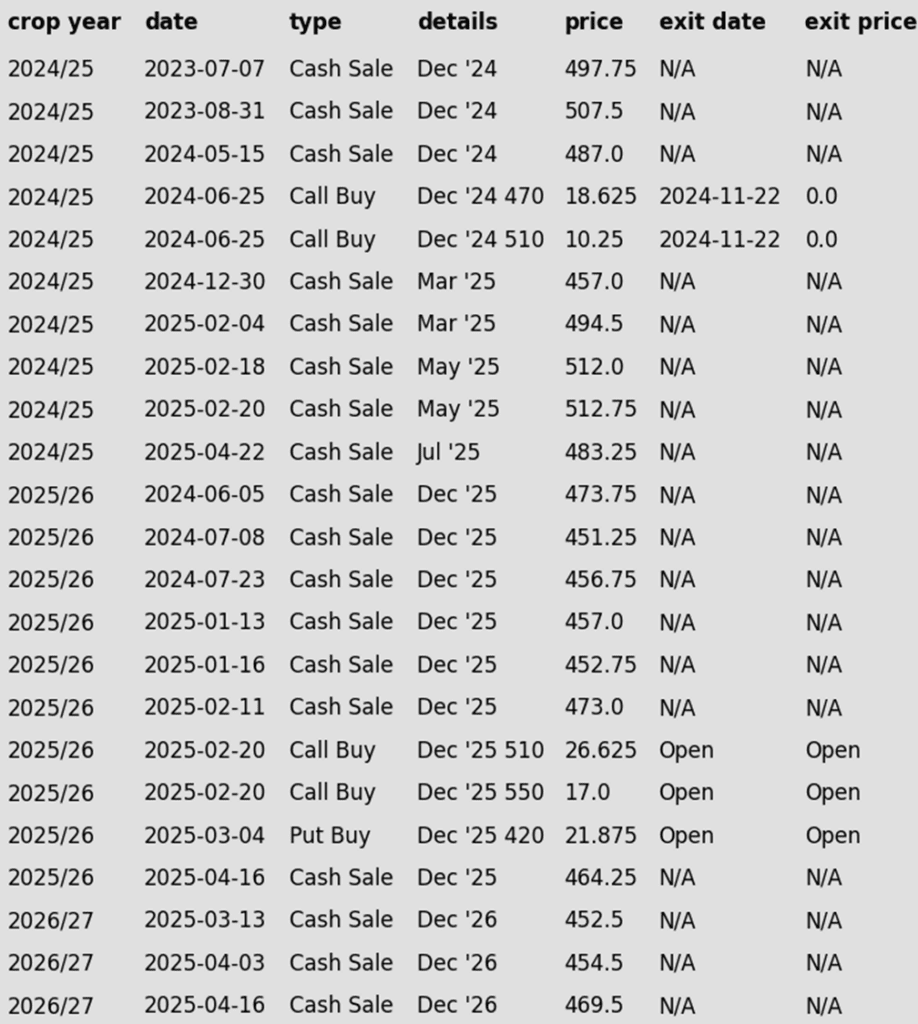

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes: None.

- No upside targets at this time.

- If July regains upward momentum, a Plan B downside sales stop could be added.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- NEW: Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- NEW: Roll-down 510 & 550 December calls if December touches 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- An additional downside target has been added to liquidate another quarter of the 420 December put options. This target may be reached before the 43 ¾ cents target.

- A downside target was also set to roll down the current 510 & 550 call options, which would enhance upside protection on prior cash sales recommendations through the summer.

2026 Crop:

- Plan A: Next cash sale at 474 vs December ‘26.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- Changes: None.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Despite strong overnight prices in the corn market, the sellers held their grip on the old crop futures, pushing July to its lowest close since December. The selling pressure trickled into new crop prices, finishing the December contract with marginal losses on the session. July corn has traded lower for 4 of the past 5 sessions and nearly 50 cents off the most recent high.

- Overnight strength came from news of U.S.-China trade talks set for this weekend in Switzerland, sparking short covering. However, futures failed to break resistance and faded through the day session.

- Ethanol production averaged 1.020 million bpd last week, down 1.9% from the prior week but still 5.9% above last year. Ethanol stocks remain heavy at 25.191 million barrels, while corn use for ethanol totaled 102.91 mb — on pace to meet USDA targets.

- USDA will release weekly export sales on Thursday morning. The trend in export sales has been supportive of corn prices as accumulated sales are trending well ahead of the USDA totals to reach the marketing year export target. Last week, export sales totaled 1.014 MMT.

- Weather models remain friendly for possible rapid planting pace. Temperatures across most of the corn belt are expected to be above normal and drier than normal precipitation. If the current pattern holds, some areas will turn significantly dry and may be in need of precipitation to aid early development of the corn crop.

Corn Back Near Calander Year Lows

Corn futures broke higher in April after repeatedly holding support near 450, with a bullish April WASDE — highlighting stronger demand — fueling the move through the 50-day moving average. As May begins, traders are watching weather developments and demand signals to guide the next leg. February highs above 510 are the next upside target. However, early May weakness has taken out support at 470, setting up a potential retest of the critical 450 zone — the early 2025 low and a key technical floor.

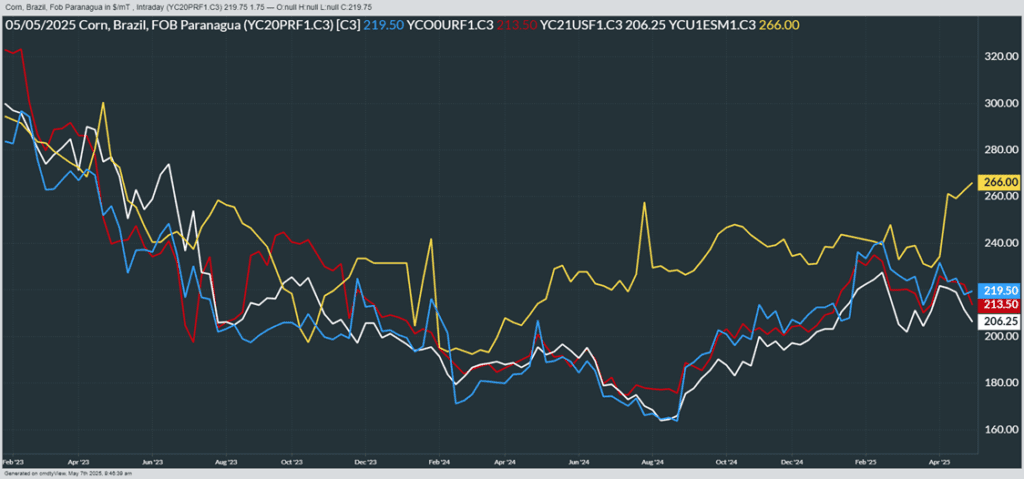

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Enter(Buy) JAN ’26 Puts:

1040 @ ~ 62c

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes: None.

2025 Crop:

- CONTINUED OPPORTUNITY – Buy January ‘26 1040 put options for approximately 62 cents in premium, plus fees and commission.

- Since last summer, soybeans have largely traded within a range of 950 to 1060. If this rangebound price action continues, the first risk would be a move back toward the lower end at 950. Seasonally, May and June are key months to secure downside protection. Adding 1040 put options will provide coverage against lower prices while keeping upside potential open and not having to commit any physical bushels.

- Plan A:

- Next cash sales at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- Make a cash sale if November closes below 1016.75 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Changes: None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes: None.

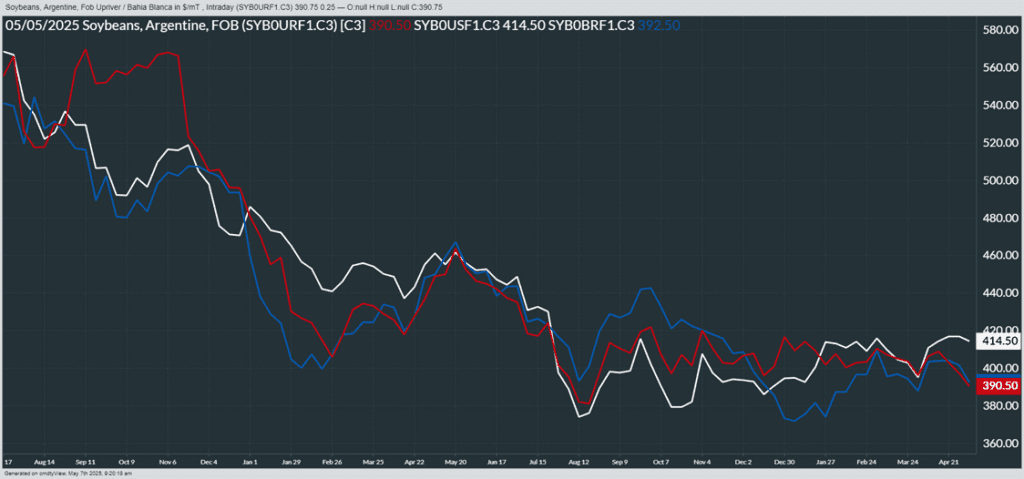

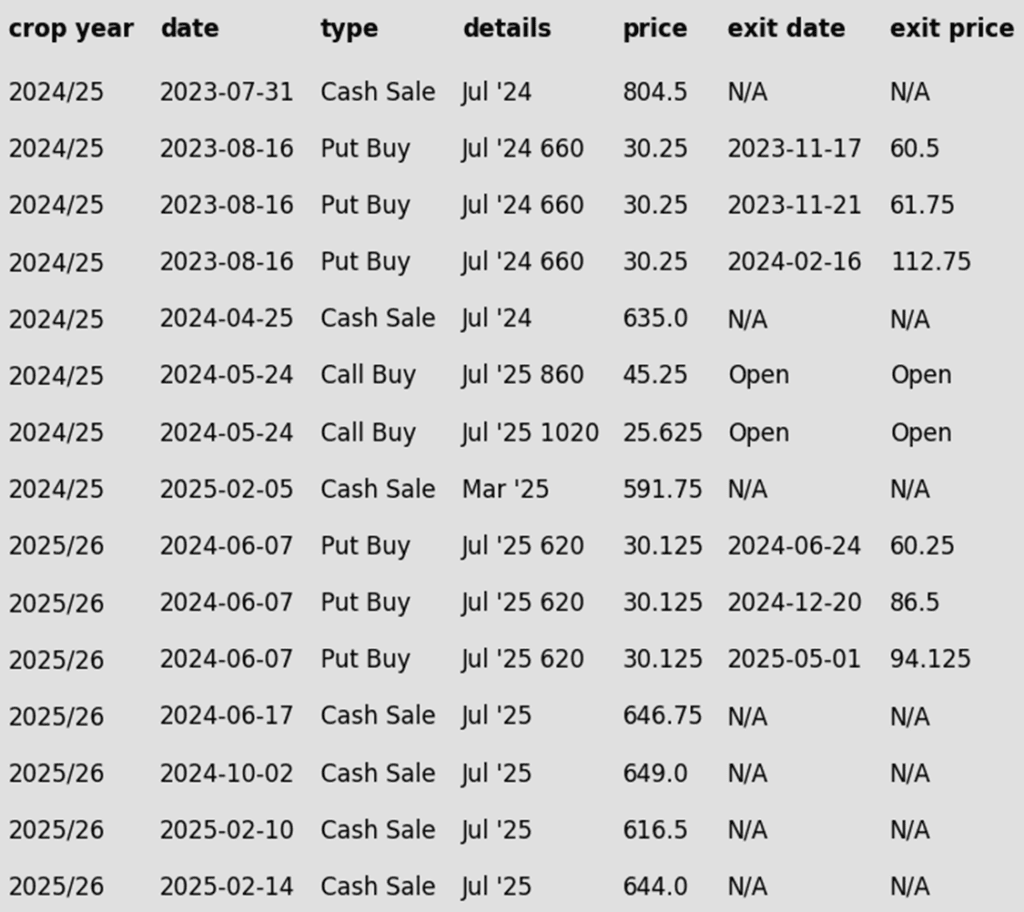

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended mixed in bear spreading action, with front months lower and deferred contracts higher. Prices faded from overnight highs after news of planned U.S.-China trade talks. Soybean meal firmed, while soybean oil followed crude lower.

- Despite progress on U.S.-China talks, trader skepticism over a quick resolution weighed on futures throughout the session. Without a deal before harvest, demand concerns could pressure prices further.

- Over the next two weeks, the weather is forecast to be warmer and drier than normal in the corn and soy belts. While some areas have received rain over the past few weeks, many already have low soil moisture levels which could become a bigger problem given a drier summer.

- In Brazil, the Mato Grosso Institute for Agricultural Economics (IMEA) has projected that state’s soybean production at 50.89 mmt. If realized, this would be a 30% jump over 2024 production. This is said to be due to higher estimated acreage and yields. Over the past few years, Mato Grosso has produced nearly one-third of Brazil’s soybeans.

Soybean Futures Drift Near Upper End of Yearly Range

Soybean futures plunged below the critical 1000 level in early April on tariff news, triggering technical selling after a firm March floor gave way. But the drop was short-lived — strong buying quickly reversed the slide, lifting prices back above 1000 and reclaiming major moving averages. Most notably, the 200-day moving average — long a ceiling — was decisively cleared. With momentum shifting higher, the market is eyeing a retest of February’s highs near 1080, while the 200-day average now serves as a key layer of support on any pullbacks.

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

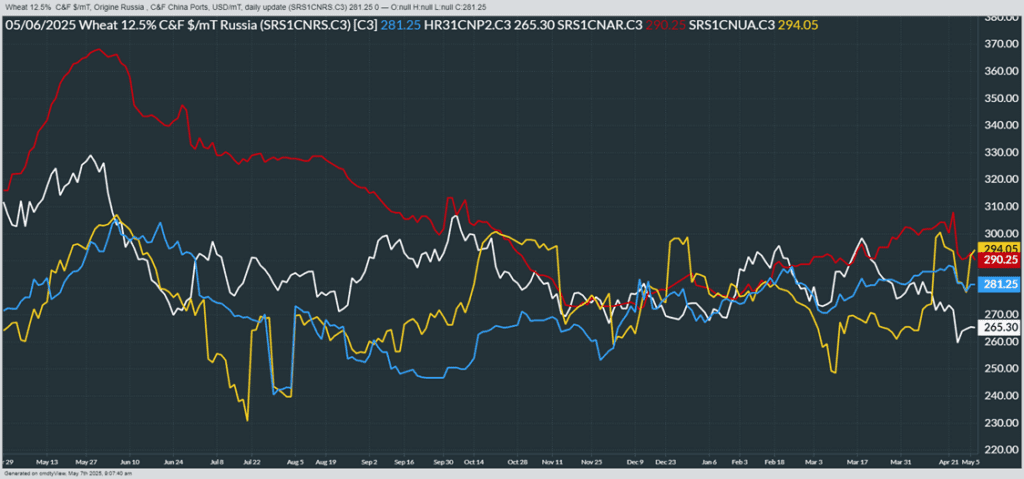

Market Notes: Wheat

- Wheat futures ended lower, with Chicago posting small losses while Kansas City and Minneapolis saw steeper declines. Pressure on hard red wheat followed the Oklahoma Wheat Commission’s production forecast of 101.2 mb — marking a second consecutive year above 100 mb. Western Kansas also received beneficial rains, and a firmer U.S. Dollar plus weakness in Matif wheat added to the downside.

- Early strength was tied to reports that U.S. and Chinese officials will meet in Switzerland this weekend to discuss trade — a broad boost for the grain complex, though direct benefits may lean more toward soybeans and corn.

- On a bullish note, the Henan province in China is expected to see a windy weather pattern, along with hot and dry conditions; this province produces about a third of China’s wheat. Drought continues to expand throughout China’s wheat belt, which could mean that they will need to import down the road. Also supportive is the fact that U.S. SRW wheat is currently the world’s cheapest. Furthermore, U.S. HRW wheat at the Gulf is said to be at a 25-cent discount to Russian wheat.

- Global turmoil is likely to continue to inject volatility into commodity markets. News outlets have reported that India launched an attack on Pakistan overnight in response to an attack last month on tourists that resulted in 26 deaths. Pakistan also claims to have shot down several Indian jets. This has raised concerns about war brewing between the two nations.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Exit All JUL ’25 620 Puts ~ 92c

2026

No New Action

2024 Crop:

- Plan A: Target 701 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes: None.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell all remaining July ‘25 620 Chicago wheat puts at approximately 92 cents in premium minus fees and commission.

- Plan A:

- Target 693.75 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- New:

- With just 46 days remaining until expiration and following gains from the recent decline in July futures off its April 11 high, it’s time to close out the final portion of the July 620 put options.

2026 Crop:

- Plan A:

- Target 696 against July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Holds Support

After months of range-bound trade, Chicago wheat futures broke out in February, rallying to October highs just above 615. But the rally was short-lived, with prices quickly retreating back into the 2024 range. Solid support near 530 has held through March and early May, reinforcing its importance. The next key hurdle is the 200-day moving average — a firm weekly close above it could mark a turning point and open the door to a broader uptrend.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Exit All JUL ’25 KC 620 Puts ~ 94c

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes: None.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell all remaining July ‘25 620 KC wheat puts at approximately 94 cents in premium minus fees and commission.

- Plan A:

- Target 645 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- New:

- With just 46 days remaining until expiration and following gains from the recent decline in July futures off its April 10 high, it’s time to close out the final portion of the 620 KC put options.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes: None.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Searching for Support

Kansas City wheat experienced sharp volatility in February, rallying early before settling flat by month’s end. Persistent weakness through March and April pushed prices toward recent lows — and the market broke below that support to start May. A recovery back above the prior 540 level would signal a potential bottom. On a rebound, the 200-day moving average stands as the first resistance, with a more formidable ceiling at the February highs near 640.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Exit All JUL ’25 KC 620 Puts ~ 94c

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- Changes: None.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell all remaining July ‘25 620 KC wheat puts at approximately 94 cents in premium minus fees and commission.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- New:

- With just 46 days remaining until expiration and following gains from the recent decline in July KC futures off its April 10 high, it’s time to close out the final portion of the 620 KC put options.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes: None.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holds Ground Amid Historic Acreage Lows

Spring wheat broke out of its prolonged sideways trend in late January, igniting a wave of bullish momentum. The rally accelerated in mid-February with a close above the 200-day moving average, though late-month weakness briefly pulled futures below key support. Unlike winter wheat, spring wheat has managed to consolidate near multiple moving averages, which are currently holding as support. The next upside target is the February high near 660. With spring wheat acreage expected to be the lowest in 55 years, weather will likely be a key driver of price direction this season.

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather