5-30 End of Day: Grain Markets Cool as Weather Improves, Trade Tensions Rise

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 444 | -3 |

| DEC ’25 | 438.5 | -2.75 |

| DEC ’26 | 460.5 | 1 |

| Soybeans | ||

| JUL ’25 | 1041.75 | -10 |

| NOV ’25 | 1026.75 | -10.5 |

| NOV ’26 | 1039.25 | -5.5 |

| Chicago Wheat | ||

| JUL ’25 | 534 | 0 |

| SEP ’25 | 548.25 | -0.5 |

| JUL ’26 | 611 | -2 |

| K.C. Wheat | ||

| JUL ’25 | 533.25 | 1.5 |

| SEP ’25 | 547 | 1.25 |

| JUL ’26 | 605 | 0.25 |

| Mpls Wheat | ||

| JUL ’25 | 625.5 | 10 |

| SEP ’25 | 637.25 | 9.25 |

| SEP ’26 | 675 | 1 |

| S&P 500 | ||

| JUN ’25 | 5901.75 | -21 |

| Crude Oil | ||

| JUL ’25 | 60.68 | -0.26 |

| Gold | ||

| AUG ’25 | 3319 | -24.9 |

Grain Market Highlights

- 🌽 Corn: Corn futures closed lower for a third straight session, down 15¼ cents on the week. A favorable weather outlook and renewed U.S.–China trade tensions weighed on prices, overshadowing fresh export activity.

- 🌱 Soybeans: Soybean futures ended the day in the red, with July closing below all major moving averages for the first time since early April. Prices settled at the bottom of their recent range as beneficial weather and weaker soybean oil added pressure.

- 🌾 Wheat: Wheat futures finished mixed on Friday. Chicago slipped slightly, Kansas City notched modest gains, and Minneapolis led to the upside for a third straight session, buoyed by poor spring wheat crop ratings and technical momentum.

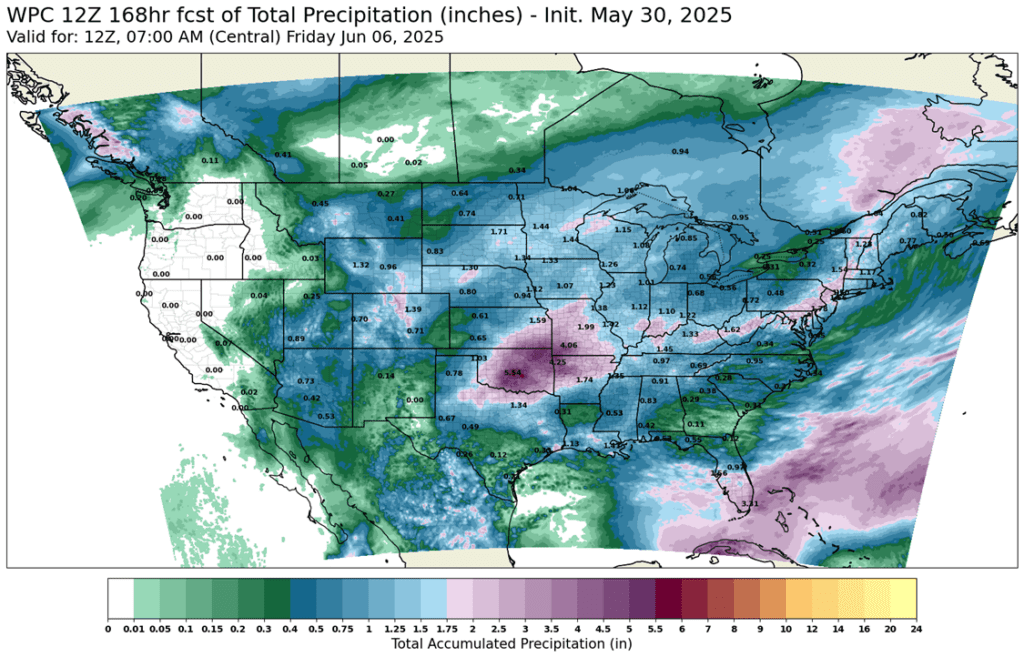

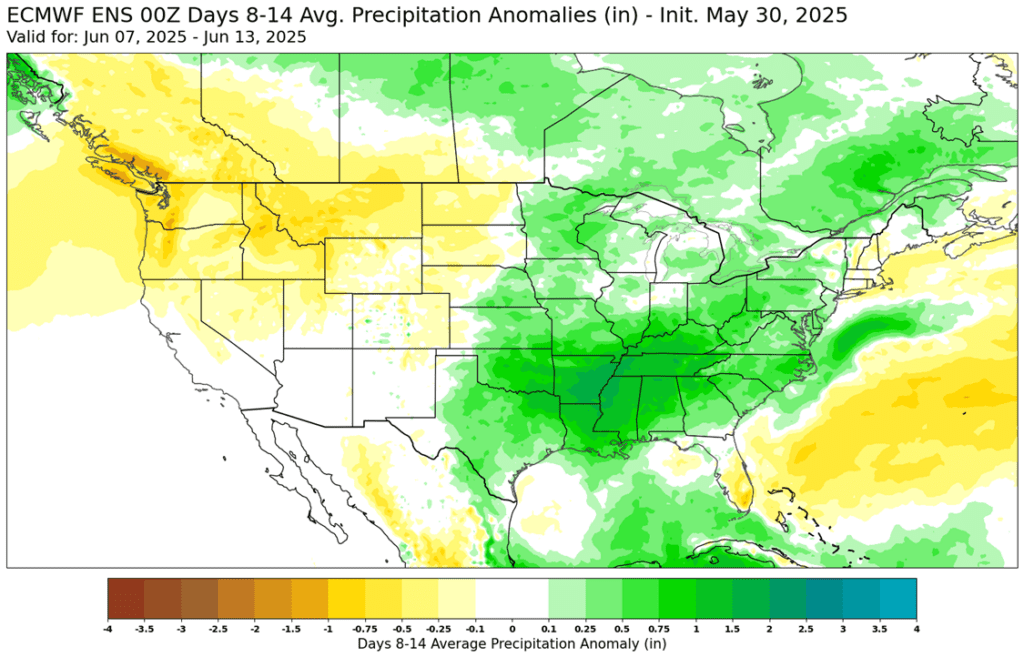

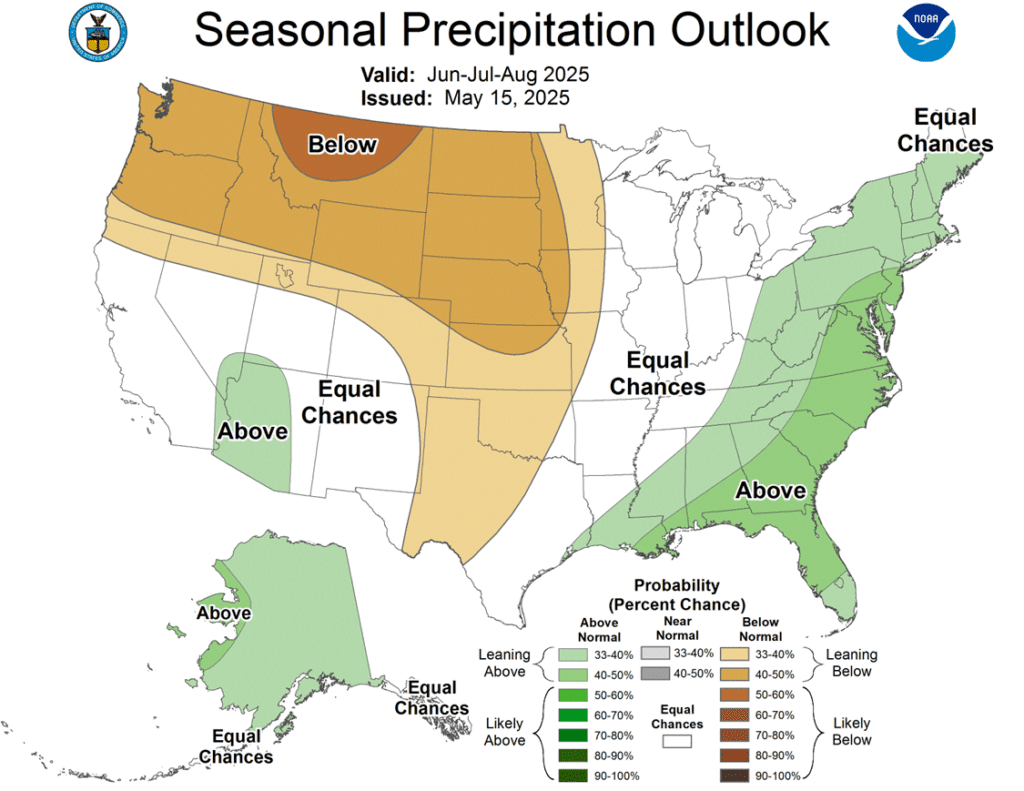

- To see updated U.S. weather outlook maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

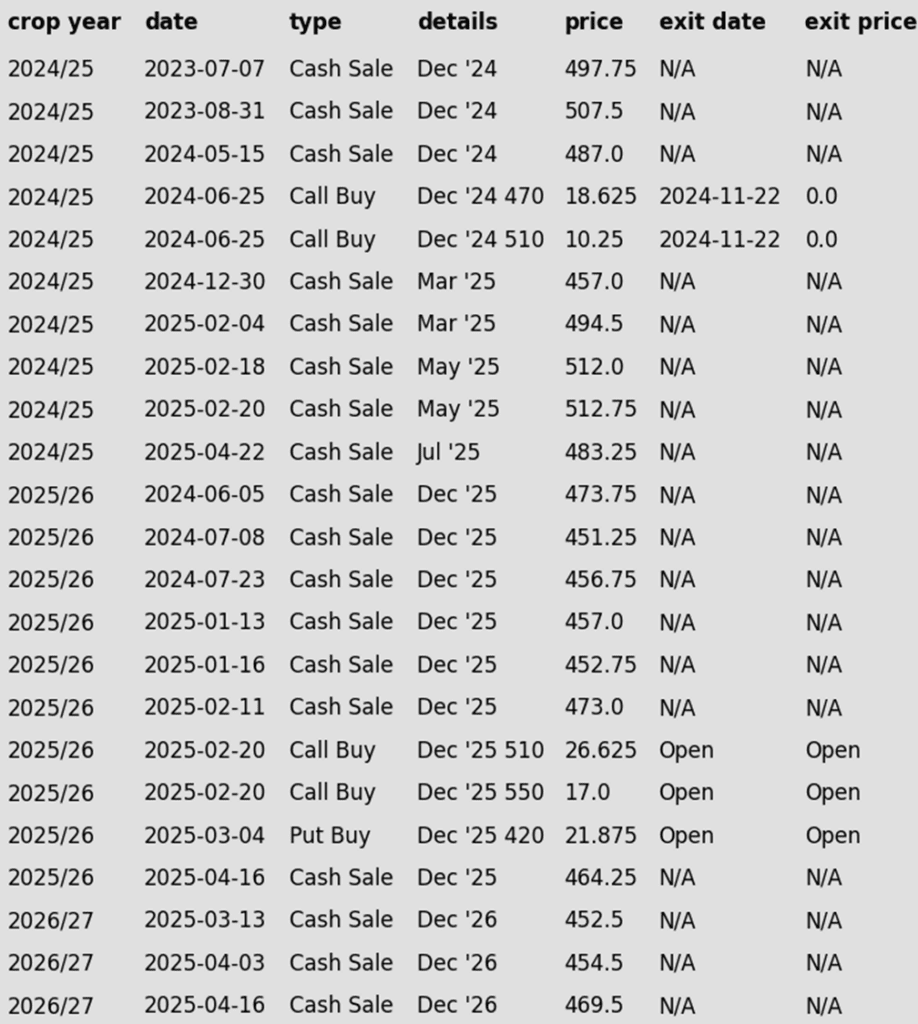

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

- Continuing to hold out for potential upside volatility during the growing season before issuing the next sales recommendations.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

- Well positioned for growing season volatility, with a good base of sales in place and both upside and downside targets active to begin legging out of open options positions.

2026 Crop:

- Plan A: Next cash sale at 474 vs December ‘26.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- Changes:

- None.

- With the 474 target failing to hit this week, be prepared for a sales recommendation next week. Sales need to be systematically and incrementally progressed based on the calendar throughout the growing season.

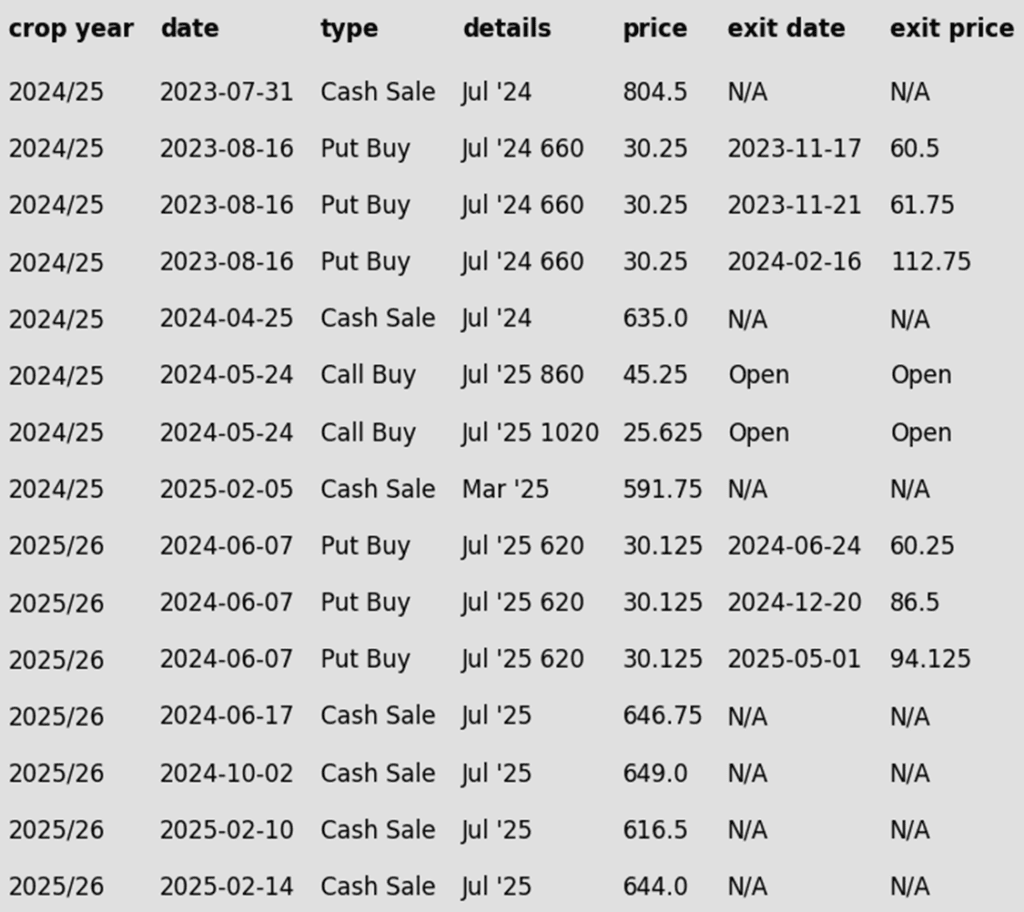

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures ended the week lower, falling for a third straight session and shedding 15¼ cents overall. A softer demand tone, large expectations for Brazil corn crop, and trade concerns between the U.S. and China pressured the market.

- President Trump reignited trade concerns Thursday with comments accusing China of violating a recent agreement, suggesting potential sanctions, though no details were provided. The uncertainty pressured markets late in the session.

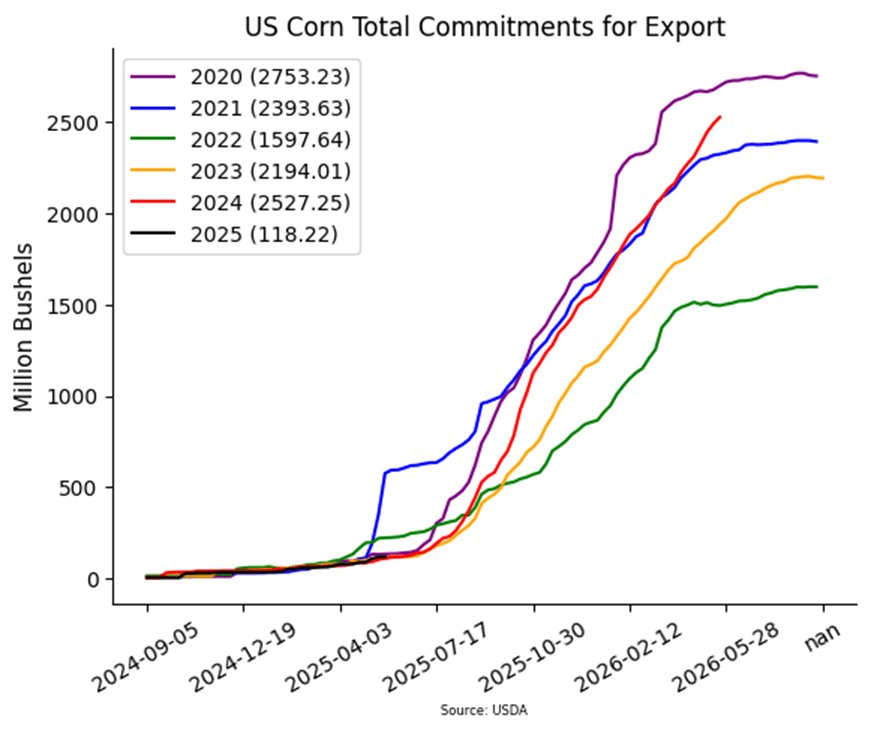

- USDA released weekly corn export sales on Thursday morning. For the week ending May 22, USDA reported new sales of 916,000 MT (36.1 mb). This was within, but towards the low end of expectations and down 23% from last week. Japan was the top buyer of U.S. corn last week. Corn sales commitments now total 2.527 BB for the 2024-25 marketing year and are up 28% from last year. The USDA export target for the marketing year is 2.600 BB.

- USDA also confirmed a flash sale of 210,560 MT (8.3 mb) of corn to unknown destinations — the third consecutive daily export announcement.

- The total corn production out of Brazil is larger than expected and could be pushing 140 MMT. The USDA forecast is for 130 MMT. Safras, a Brazilian Agriculture Analyst firm, raised their forecast 139 MMT today, with a nearly 4MMT bump in the second crop corn due to strong yield and favorable weather in the growing season.

Corn Finds Support at 200-day

After bouncing off the key $4.50 level in April on a bullish WASDE and a break above the 50-day moving average, corn futures have come under renewed pressure in May. Rapid planting progress and lingering demand concerns have pushed prices back below $4.70. For now, the $4.45–$4.50 support zone and 200-day moving average have held. As planting wraps up, the market’s focus will shift quickly to summer weather. NOAA’s extended outlook calls for a warmer, drier pattern across the Western Corn Belt into June — potentially rekindling risk premium and setting the stage for weather-driven rallies. Initial resistance is expected near $4.70, with stronger resistance at the April highs around $4.90.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

- Still content with the 1107 target as long as 1036 support holds. If that support level is broken, the current strategy will need to be revisited and potentially adjusted.

2025 Crop:

- Plan A:

- Next cash sales at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- Make a cash sale if November closes below 1018.50 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Changes:

- Mid-to-late next week, another tranche of January put options may be recommended, based on calendar and seasonal timing considerations.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Approaching the seasonal window where first sales targets could post at any time.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower at the bottom of their recent trading range with the July contract closing below all major moving averages for the first time since the beginning of April. Beneficial weather has pressured grains, but today, a sharp decline in soybean oil brought the soy complex lower. Soybean oil closed over 3% lower while meal was unchanged to lower.

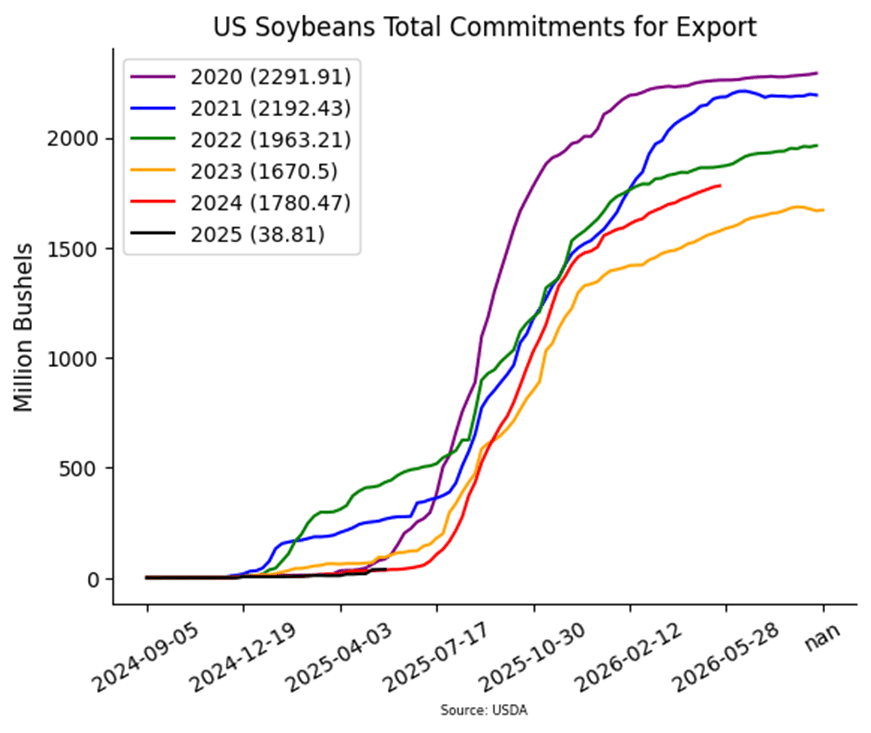

- Today’s export sales were on the poor side for soybeans with the USDA reporting an increase of 5.4 million bushels of sales in 24/25 and an increase of 1.2 mb for 25/26. Primary destinations were to Mexico, Indonesia, and Japan. Last week’s export shipments of 7.7 mb were below the 13.0 mb needed each week to meet the USDA’s estimates.

- In South America, estimates for Brazilian soybean production are beginning to rise with the highest estimates near 182.5 mmt, which would be significantly higher than the USDA’s most recent estimate of 169 mmt. In addition, Brazilian soybean exports for May are expected to be higher than expected at 15.0 mmt.

- For the week, July soybeans lost 18-1/2 cents while November soybeans posted larger losses at 23 cents. July soybean meal was nearly unchanged at 0.1 higher to $296.30. July soybean oil lost 2.46 cents at 46.89 cents.

Soybean Futures Remain Range-Bound into June

Soybean futures tumbled below the key $10.00 mark in early April on tariff-related headlines, triggering technical selling after breaking the March low. However, the decline was short-lived as buyers stepped in, lifting prices back above $10.00 and reclaiming key moving averages, including a clean break above the 200-day moving average — a level that now serves as solid support. With no fresh bullish catalyst and favorable weather weighing on sentiment, futures remain range-bound. The 200-day should continue to offer support, while resistance holds near the May high of $10.82.

Wheat

Market Notes: Wheat

- Wheat futures ended mixed Friday: Chicago slipped slightly, Kansas City posted small gains, and Minneapolis led again, though the July contract stalled at its 200-day moving average (626 ¾). Delayed harvests and 2–4 inches of forecasted rain in the Southern Plains helped support HRW prices. Technically, all three classes are forming the right shoulder of an inverted head-and-shoulders pattern — a potential bullish signal.

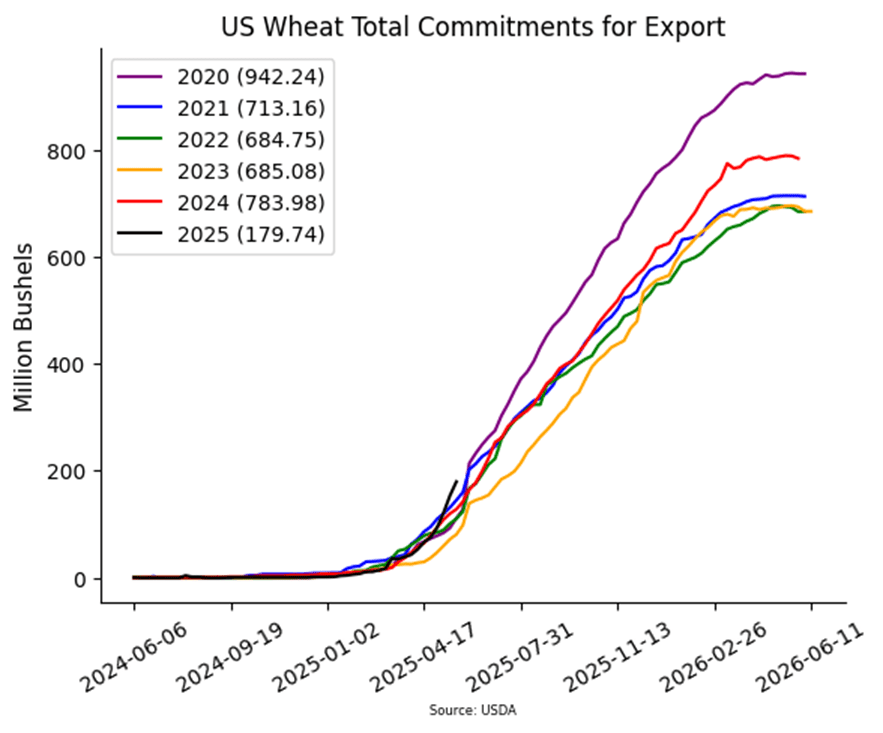

- The USDA reported a decrease of 4.7 mb of wheat export sales for 24/25, but an increase of 26.1 mb for 25/26. Shipments last week at 18.4 mb fell under the 34.5 mb pace needed per week to reach their 24/25 export goal of 820 mb. Total 24/25 wheat shipments have reached 748 mb, up 13% from last year.

- SovEcon recently increased their estimate of Russian wheat exports by 1.1 mmt to 40.8 mmt. However, the Russian deputy ag minister is projecting their 2025 wheat exports much higher, at 44.5 mmt. The minister is also estimating their total 2025 grain exports at 53 mmt.

- Dry conditions persist in key Chinese wheat regions, prompting efforts to induce rainfall via cloud seeding using drones and artillery. Reports suggest rainfall could increase 4% over 8,000 sq km.

- According to the Buenos Aires Grain Exchange, dry weather in western and northern Argentina has allowed wheat planting to get off to a good start. The exchange is expecting a total planted area of 6.7 million hectares, with 10.5% of it now complete. Planting in eastern growing regions, however, may see delays due to recent heavy rainfall, which has also hindered corn and soybean harvest.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A:

- Target 699.25 vs July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- None.

2025 Crop:

- Plan A:

- Target 693.75 against July for the next sale.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Potentially Finds Support

After months of range-bound trade, Chicago wheat futures broke out in February, reaching October highs above $6.15 before quickly retreating back into their 2024 range. By mid-May, prices slipped below key support near $5.30 but have since stabilized around $5.20. The next major resistance is the 200-day moving average — a firm weekly close above it could signal a trend reversal and open the door to broader gains.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- None.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Expect the first sales targets to post next week.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Finds Support

With ample spring moisture across the Plains and sluggish demand, wheat futures have lacked bullish momentum, recently touching multi-year lows near $5.00 in early May—a level that has since held. A recovery above $5.40 would suggest a potential bottom is in place. On a rebound, the 200-day moving average marks initial resistance, with a stronger ceiling at the February highs near $6.40.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- Changes:

- None.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if July KC closes over 653 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- First sales targets are expected to post after July 1.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Runs Higher on Poor Conditions

Spring wheat futures broke out of a prolonged sideways trend in late January, with momentum accelerating in mid-February after a decisive close above the 200-day moving average. Although late-month weakness briefly pulled prices below key support, futures traded mostly sideways through spring. A sharp rally was triggered in late May after crop condition ratings came in at their second lowest in 40 years, sparking short covering. Prices are now back above a confluence of moving averages and nearing the top of the recent range. Key support sits just above $6.00, with the next upside target near February’s highs around $6.60.

Other Charts / Weather