5-27 End of Day: Grains Mixed to Start the Week

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 459.5 | 0 |

| DEC ’25 | 446.5 | -4.25 |

| DEC ’26 | 463.75 | -3 |

| Soybeans | ||

| JUL ’25 | 1062.5 | 2.25 |

| NOV ’25 | 1050.75 | 0.25 |

| NOV ’26 | 1054.75 | 3.25 |

| Chicago Wheat | ||

| JUL ’25 | 528.5 | -14 |

| SEP ’25 | 544.25 | -13.75 |

| JUL ’26 | 608.75 | -11.25 |

| K.C. Wheat | ||

| JUL ’25 | 524.5 | -14.25 |

| SEP ’25 | 539.5 | -14.25 |

| JUL ’26 | 600.75 | -12.75 |

| Mpls Wheat | ||

| JUL ’25 | 596.25 | -10.25 |

| SEP ’25 | 609.25 | -11.5 |

| SEP ’26 | 681.5 | 8 |

| S&P 500 | ||

| JUN ’25 | 5934 | 117 |

| Crude Oil | ||

| JUL ’25 | 60.9 | -0.63 |

| Gold | ||

| AUG ’25 | 3329.3 | -65.2 |

Grain Market Highlights

- 🌽 Corn: Corn futures began the week on the defensive, with pressure from favorable crop weather and weakness in wheat weighing on new-crop contracts. However, July corn found modest support from strong weekly export shipment totals, helping limit losses in front-month trade.

- 🌱 Soybeans: Soybeans closed higher on the day, outperforming the broader grain complex. While overall trade was quiet, early strength was fueled by gains in palm and soybean oil. Both soybean meal and oil also finished higher, despite funds maintaining a heavy net short in the meal market.

- 🌾 Wheat: Wheat futures suffered double-digit losses across Chicago, Kansas City, and Minneapolis, pressured by improving weather in the U.S. and Europe, a stronger U.S. dollar, and competitive global pricing—particularly from Russia. Paris milling wheat also declined, adding weight to the U.S. market.

- To see updated U.S. weather outlook maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

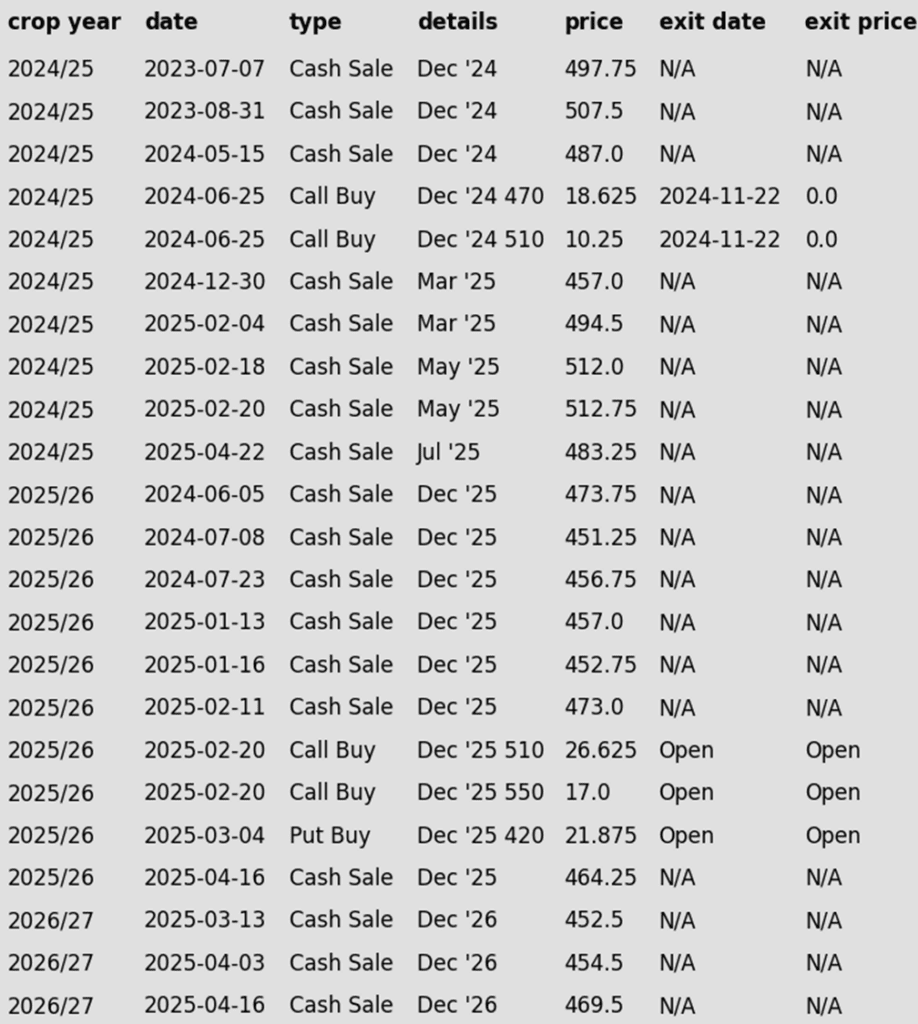

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

- With July corn continuing to hold support at 440, the strategy remains to hold out for potential upside volatility opportunities.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

- No adjustments needed at the moment. Positioned well for growing season volatility, with a good base of sales in place and both upside and downside targets active to begin legging out of open options positions.

2026 Crop:

- Plan A: Next cash sale at 474 vs December ‘26.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- Changes:

- None.

- The 474 target will be given this week. If it hasn’t been hit by Friday’s close, another sales recommendation may be made early next week based on the calendar and timing considerations.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures started the week under pressure, with July contracts finding modest support from strong export shipments. However, weakness in the wheat market and expectations for improving crop conditions weighed on new-crop contracts.

- USDA reported corn export inspections at 1.396 MMT (55 mb) for the week ending May 22, bringing total shipments for the marketing year to 1.850 billion bushels—up 29% from a year ago. Inspections remain ahead of pace to meet USDA’s projection for the second-largest corn export program in five years.

- USDA will release weekly crop progress on Tuesday afternoon. The expectation for corn planting is to reach 87% planted, up 9% from last week. Areas in the southern to eastern corn belt will be closely watched for progress as those regions have been behind pace due to wetness.

- The first condition rating for the 2025/26 corn crop is also due Tuesday, with analysts expecting a Good/Excellent rating around 73% (range: 64–78%). Cooler, wetter weather across parts of the Corn Belt may weigh on early crop development by limiting growing degree day accumulation.

- Harvest of Brazil’s second corn crop has begun, with AgRural estimating progress at 0.9%, down from 2% at this time last year. Brazil’s crop agency, CONAB, projects the safrinha crop at nearly 100 MMT as of its May estimate.

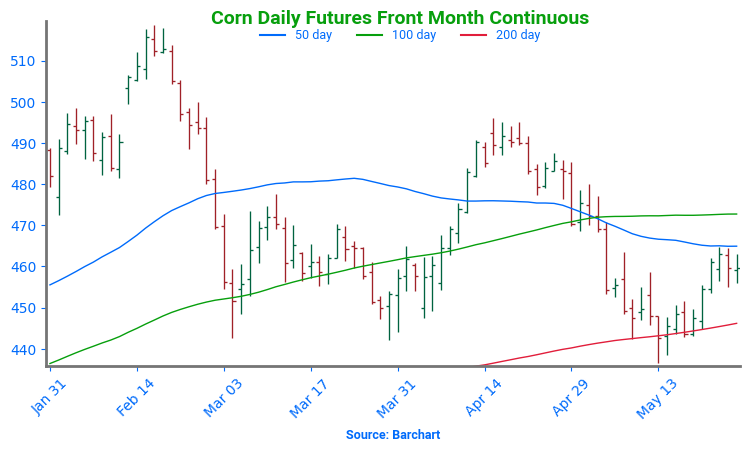

Corn Finds Support at 200-day

After bouncing off the key $4.50 level in April on a bullish WASDE and a break above the 50-day moving average, corn futures have come under renewed pressure in May. Rapid planting progress and lingering demand concerns have pushed prices back below $4.70. For now, the $4.45–$4.50 support zone and 200-day moving average have held. As planting wraps up, the market’s focus will shift quickly to summer weather. NOAA’s extended outlook calls for a warmer, drier pattern across the Western Corn Belt into June — potentially rekindling risk premium and setting the stage for weather-driven rallies. Initial resistance is expected near $4.70, with stronger resistance at the April highs around $4.90.

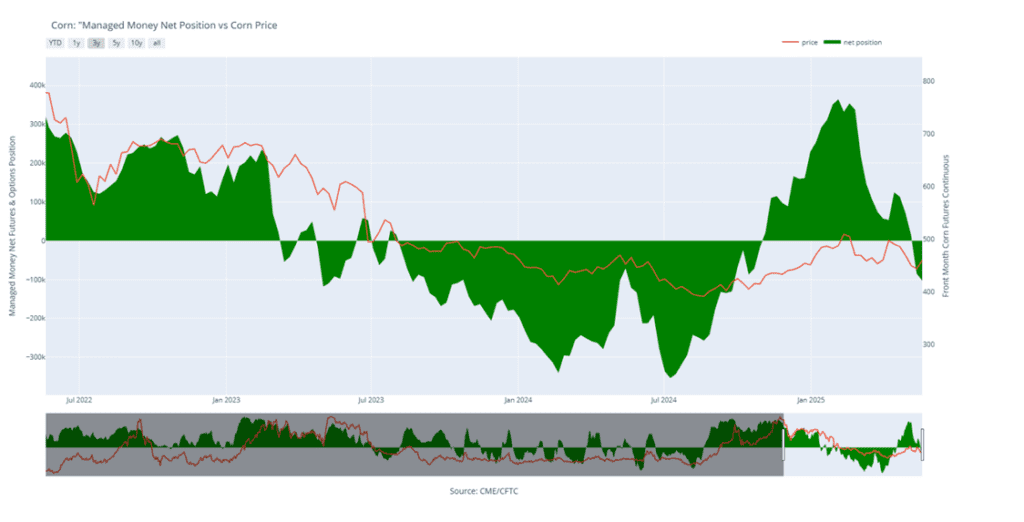

Above: Corn Managed Money Funds net position as of Tuesday, May 20. Net position in Green versus price in Red. Money Managers net sold 18,234 contracts between May 13 – May 20, bringing their total position to a net short 103,210 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

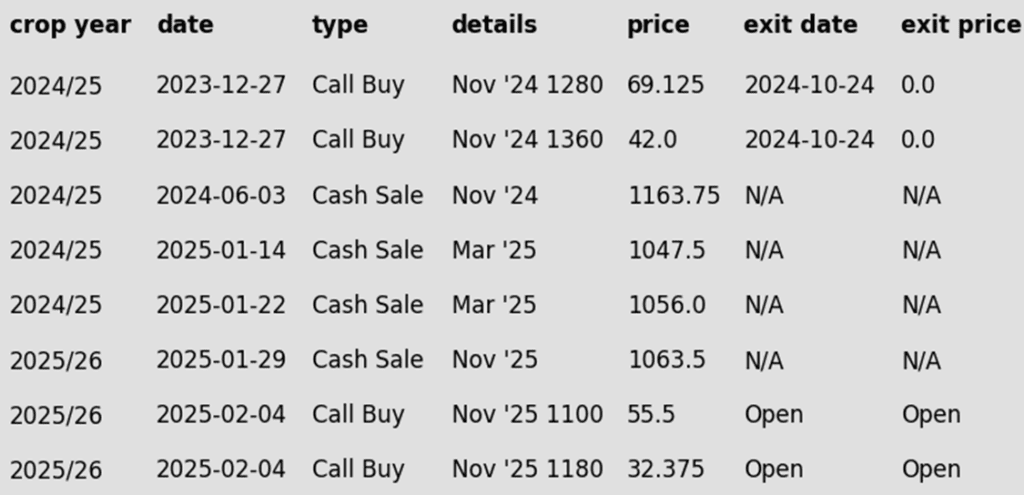

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

- Still content with the 1107 target as long as 1036 support holds. If that support level is broken, the current strategy will need to be revisited and potentially adjusted.

2025 Crop:

- Plan A:

- Next cash sales at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- Make a cash sale if November closes below 1018.50 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Changes:

- In about a week, another tranche of January put options may be recommended based on the calendar and seasonal timing considerations.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Approaching the seasonal window where first sales targets could post at any time.

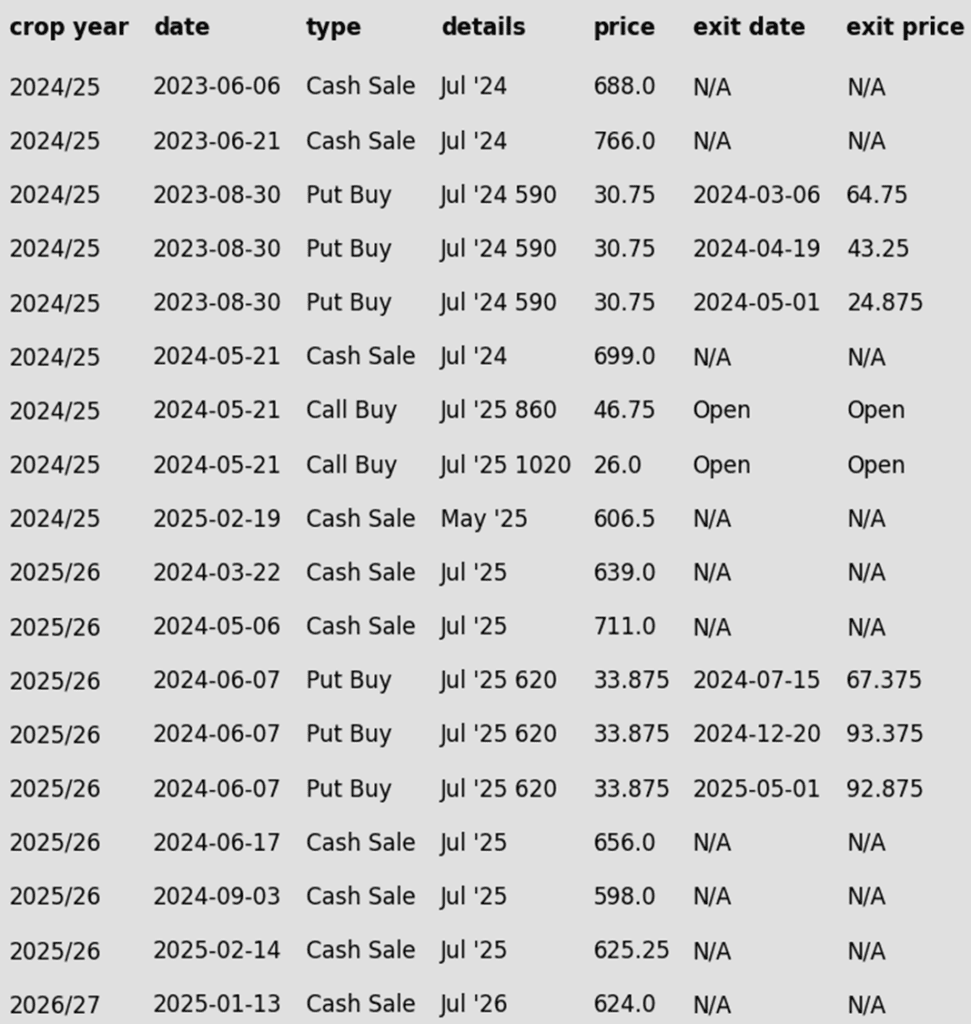

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher despite losses in the rest of the grain complex. Overall, soybeans traded quietly but had some early strength thanks to gains in both palm and soybean oil. Funds currently hold a record large net short position in soybean meal, but both meal and oil closed higher today.

- Weekly export inspections for soybeans came in weak, totaling just 7.1 million bushels for the week ending May 22. Still, total inspections for the 2024/25 marketing year stand at 1.629 billion bushels—up 11% from last year.

- Soybean acreage in India is reportedly set to shrink as farmers are looking to plant more corn and sugarcane due to higher returns. Lower oilseed output could force the world’s largest importer of edible oils to increase buying from other countries.

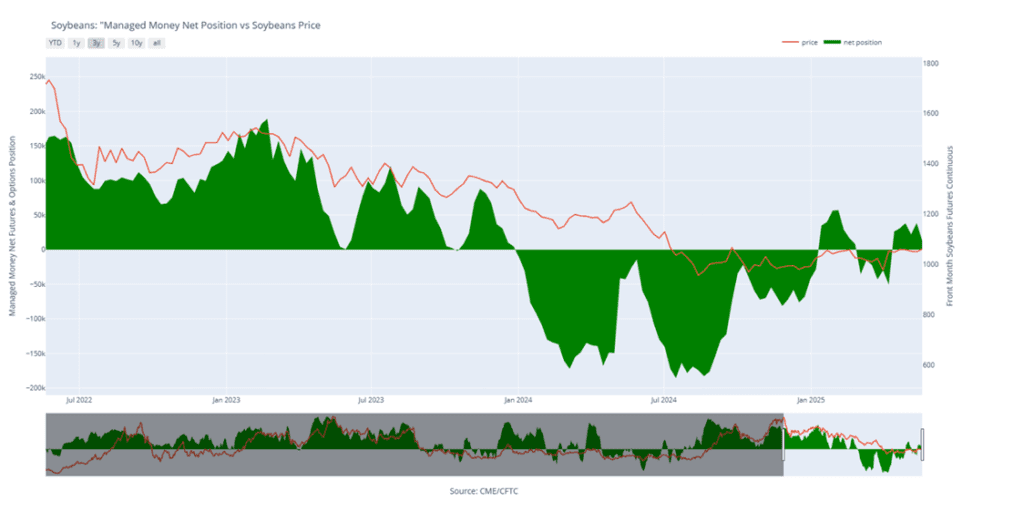

- Friday’s CFTC report saw funds as sellers of soybeans by 25,753 contracts, which left them with a net long position of 12,654 contracts. They sold 10,123 contracts of bean oil and 4,721 contracts of meal.

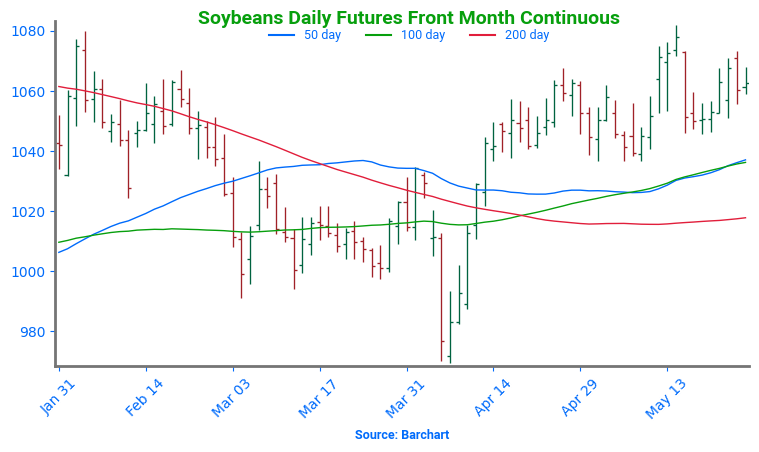

Soybean Futures Hover Near Top of Yearly Range Amid Renewed Optimism

After tumbling below the psychologically important 1000 mark in early April on tariff-related headlines, soybean futures appeared to be in freefall. The break of the March floor sparked a wave of technical selling, briefly sending prices spiraling. But the decline proved fleeting. Buyers quickly stepped in, reversing the momentum and powering futures back above 1000, reclaiming key moving averages along the way.

Of particular note was the clean break above the 200-day moving average — a barrier that had long capped upside attempts. With that ceiling now acting as solid support, bullish sentiment has taken the driver’s seat. Futures are now consolidating near the upper end of their 2024 range, setting their sights on a potential retest of the February peak around $10.80. As long as pullbacks hold the 200-day line, the path of least resistance may remain higher.

Above: Soybean Managed Money Funds net position as of Tuesday, May 20. Net position in Green versus price in Red. Money Managers net sold 25,753 contracts between May 13 – May 20, bringing their total position to a net long 12,654 contracts.

Wheat

Market Notes: Wheat

- Wheat futures posted double-digit losses across all three U.S. exchanges to start the week, pressured by both global and domestic developments. Paris milling wheat futures also closed 4–5 euros lower, dragging on U.S. prices. A firmer U.S. dollar added headwinds for U.S. wheat on the export market.

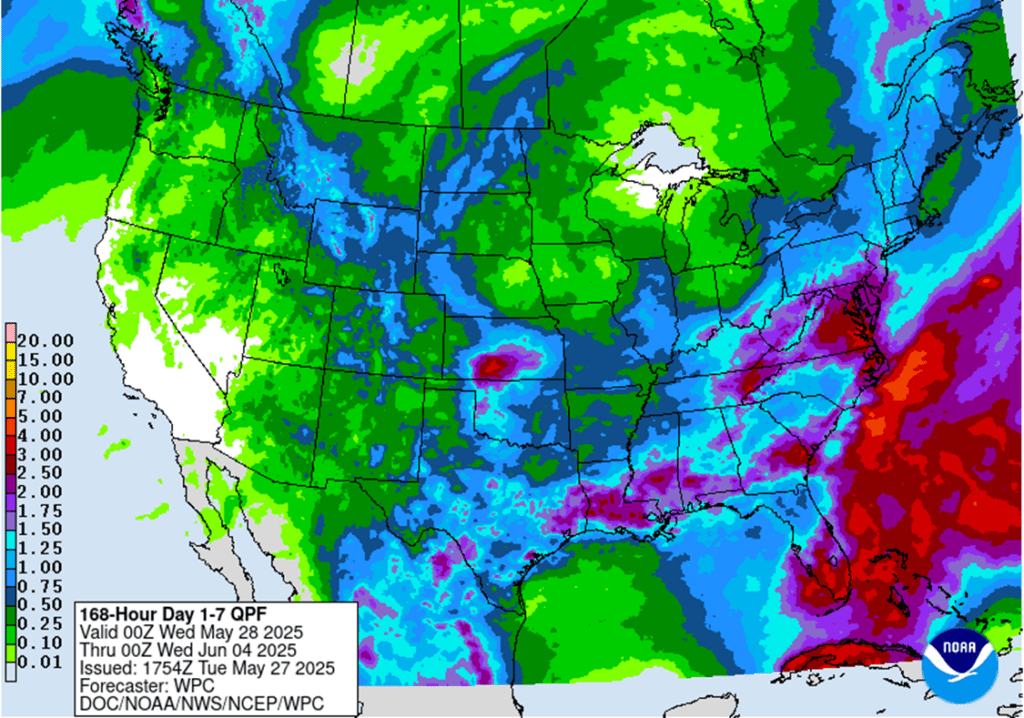

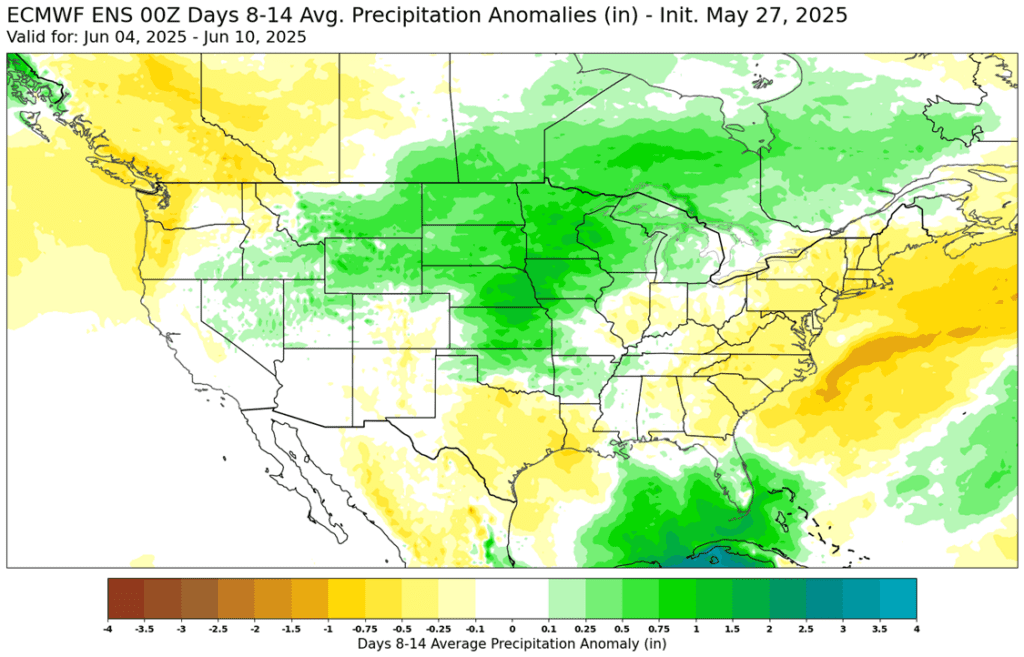

- Weekend rains across the U.S. southern and western Plains, along with scattered showers in Europe, eased immediate crop concerns. Heavier rainfall is expected next week in drier regions of France, Germany, and the UK, which further pressured futures.

- Weekly wheat inspections at 20.6 mb bring the total 24/25 inspections figure to 782 mb, up 16% from last year. The inspections pace is steady with the USDA’s estimate – total 24/25 exports are projected at 820 mb, up 16% from the year prior.

- China’s National Meteorological Center is predicting rainfall through the early part of next week for key wheat growing regions, including Henan and Shaanxi. This should help to ease drought conditions there. Henan province recently issued weather alerts due to excessive heat, which was a threat to their crops.

- Australian customs data indicates that they exported only 546,000 mt of wheat to China during the October – March timeframe, due to a lack of Chinese demand. This compares with 2.9 mmt in the first half of the 23/24 season and 4.4 mmt for the same period of the 22/23 season. This could significantly increase Australia’s wheat stocks, with some estimates as high as 8 mmt. For reference, the five-year average for their end of season wheat stocks is 3.3 mmt.

- According to SovEcon, Russian spot wheat export values range from $248-$250 per mt FOB. And as reported by IKAR, Russian export values July onward are around $225 per mt FOB, which is down $2 from last week. Competition from Russia has been weighing on wheat prices globally. Furthermore, Interfax has stated that the 2025 Russian grain harvest is likely to exceed last year’s, which would also be bearish to prices.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A:

- Target 699.25 vs July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- None.

- While 699.25 is still a long way off, it’s tough to justify adjusting it lower at this point — historically, when volatility shows up this time of year, it can be significant.

2025 Crop:

- Plan A:

- Target 693.75 against July for the next sale.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- Plan B Update: A Plan B Update: A Plan B upside call buy stop has been added, with 633.50 identified as a key resistance level for the broader trend. A close above this level could indicate a shift toward a more bullish macro trend. In that scenario, buying call options would enable sales into strength while maintaining paper ownership.

- The purpose of this stop is to try to avoid recommending call option purchases unless the market clearly signals it’s warranted — and a close above 633.50 would be that signal. As long as the market remains below this level, the expectation is for a continued sideways-to-lower macro trend, where call options would provide little or no benefit.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

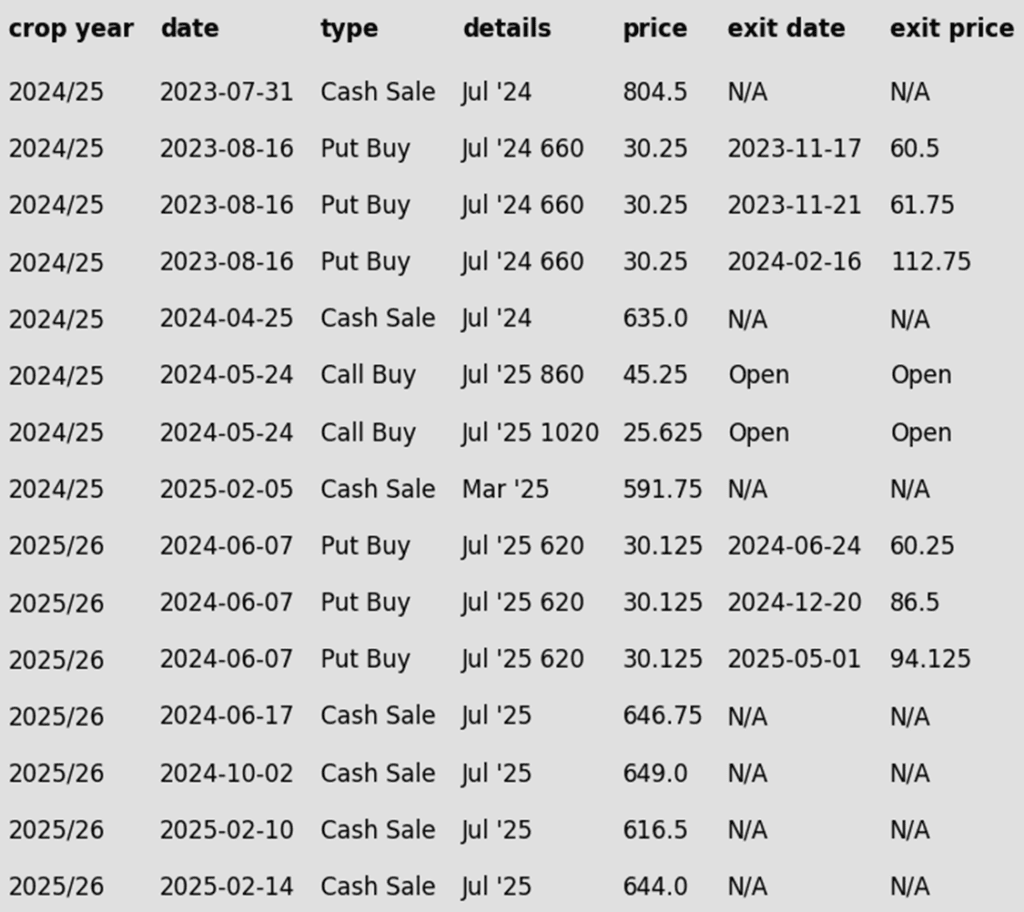

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

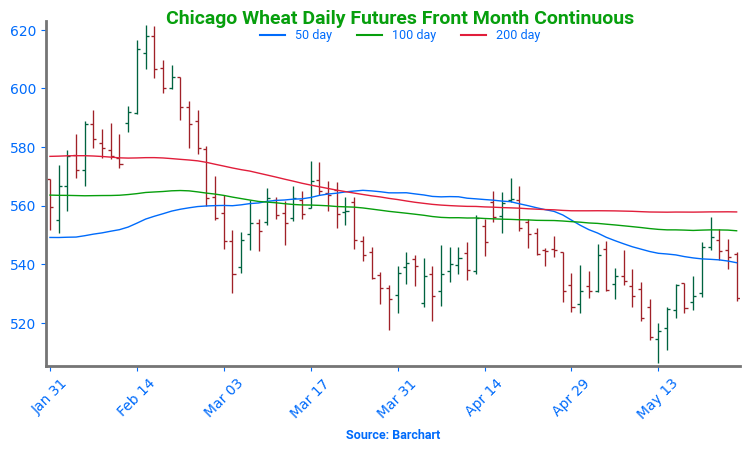

Chicago Wheat Looking for Support

After months of range-bound trading, Chicago wheat futures broke out in February, climbing to October highs just above 615. However, the rally proved short-lived, with prices quickly retreating back into their 2024 range. By mid-May, futures broke below key support near 530 and are now searching for a bottom around the 520 level. The next major technical hurdle is the 200-day moving average — a firm weekly close above this level could signal a potential trend reversal and open the door to a broader uptrend.

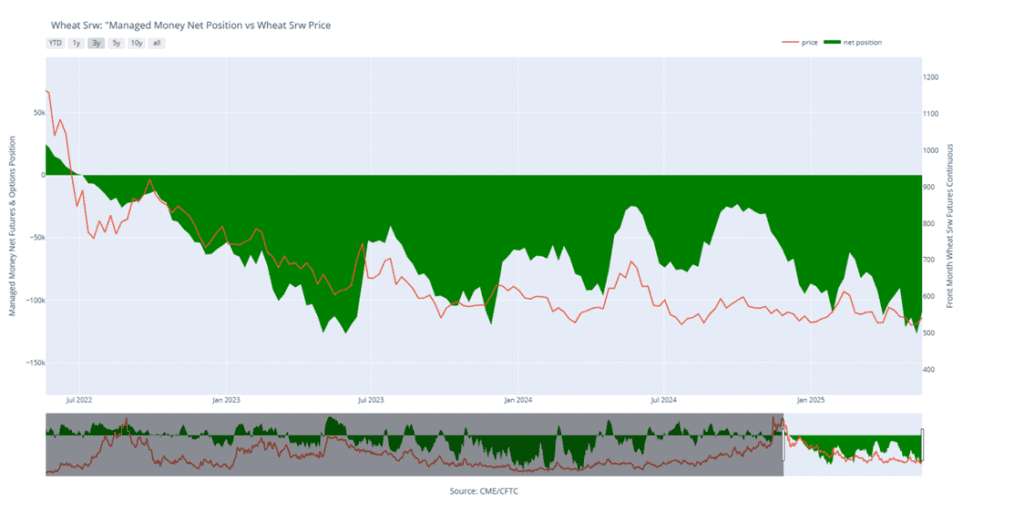

Above: Chicago Wheat Managed Money Funds’ net position as of Tuesday, May 20. Net position in Green versus price in Red. Money Managers net bought 18,002 contracts between May 13 – May 20, bringing their total position to a net short 108,893 contracts.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- None.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- Plan B Update: A Plan B upside call buy stop has been added, with 653 identified as a key resistance level for the broader trend. A close above this level could indicate a shift toward a more bullish macro trend. In that scenario, buying call options would enable sales into strength while maintaining paper ownership.

- The purpose of this stop is to try to avoid recommending call option purchases unless the market clearly signals it’s warranted — and a close above 653 would be that signal. As long as the market remains below this level, the expectation is for a continued sideways-to-lower macro trend, where call options would provide little or no benefit.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- First sales targets are expected to post after June 1.

To date, Grain Market Insider has issued the following KC recommendations:

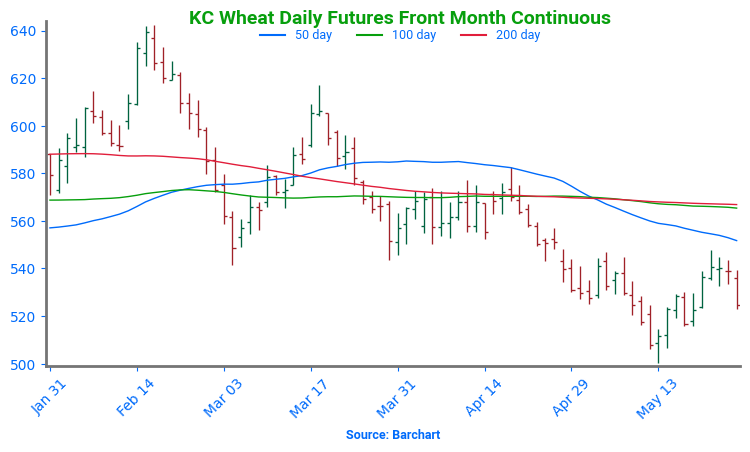

Kansas City Wheat Searching for Support

Kansas City wheat experienced sharp volatility in February, rallying early before settling flat by month’s end. Persistent weakness through March and April pushed prices toward recent lows — and the market broke below that support to start May. A recovery back above the prior 540 level would signal a potential bottom. On a rebound, the 200-day moving average stands as the first resistance, with a more formidable ceiling at the February highs near 640.

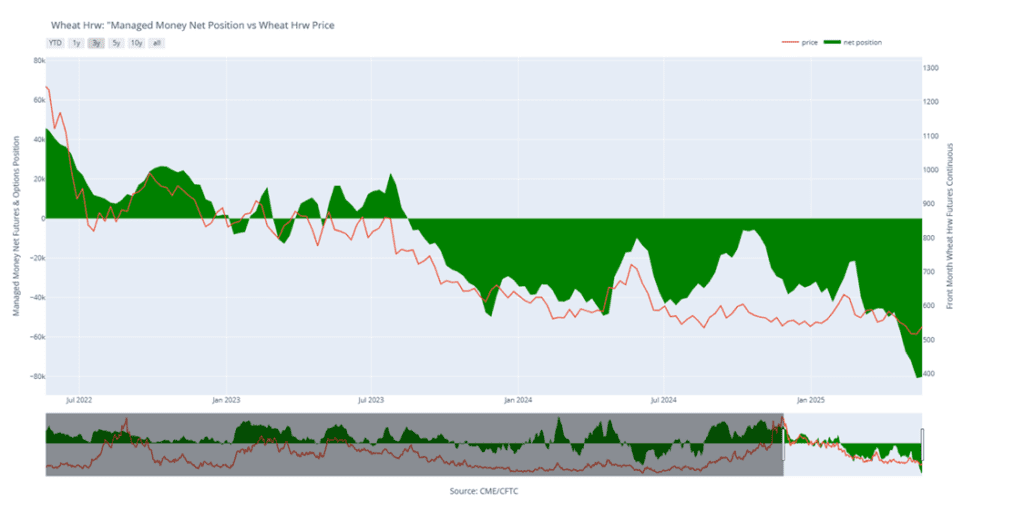

Above: KC Wheat Managed Money Funds’ net position as of Tuesday, May 20. Net position in Green versus price in Red. Money Managers net bought 637 contracts between May 13– May 20, bringing their total position to a net short 80,162 contracts.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- Changes:

- None.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if July KC closes over 653 macro resistance.

- Note: KC options are being used due to the strong correlation between KC and Minneapolis futures prices, as well as the greater liquidity found in the KC options market.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- Plan B Update: A Plan B upside call buy stop has been added, with KC 653 identified as a key resistance level for the broader trend. A close above this level could indicate a shift toward a more bullish macro trend. In that scenario, buying call options would enable sales into strength while maintaining paper ownership.

- The purpose of this stop is to try to avoid recommending call option purchases unless the market clearly signals it’s warranted — and a close above KC 653 would be that signal. As long as the market remains below this level, the expectation is for a continued sideways-to-lower macro trend, where call options would provide little or no benefit.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- First sales targets are expected to post after July 1.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

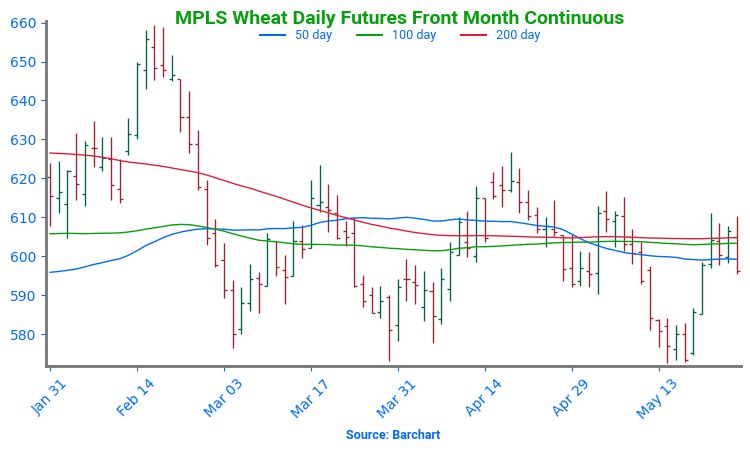

Spring Wheat Holds Recent Lows

Spring wheat futures broke out of a prolonged sideways trend in late January, sparking a wave of bullish momentum. The rally gained strength in mid-February with a decisive close above the 200-day moving average. However, late-month weakness briefly dragged futures back below key support levels.

Currently, futures are retreating toward recent lows, pressured by strong planting progress and favorable weather conditions across major spring wheat-growing regions. On a potential rebound, initial resistance is expected near the 600 level, where a confluence of moving averages could cap gains.

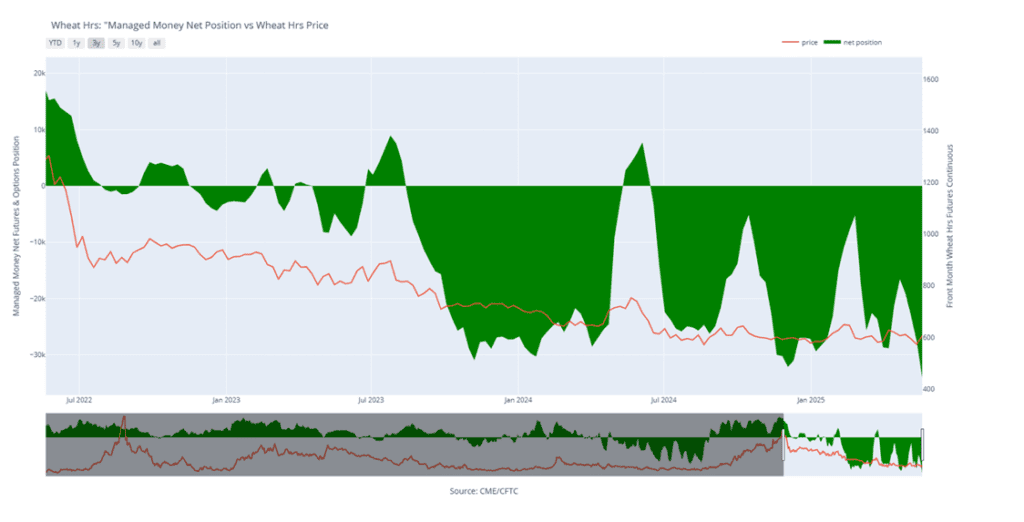

Above: Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, May 20. Net position in Green versus price in Red. Money Managers net sold 6,621 contracts between May 13 – May 20, bringing their total position to a net short 34,140 contracts.

Other Charts / Weather

Above: Courtesy of ag-wx.com