5-23 End of Day: Grains Hold Weekly Gains Amid Trade Tensions and Weather Watch

The CME and Total Farm Marketing Offices will be closed Monday, May 26, in Observance of Memorial Day

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 459.5 | -3.5 |

| DEC ’25 | 450.75 | -2.5 |

| DEC ’26 | 466.75 | -1 |

| Soybeans | ||

| JUL ’25 | 1060.25 | -7.25 |

| NOV ’25 | 1050.5 | -4.75 |

| NOV ’26 | 1051.5 | -3 |

| Chicago Wheat | ||

| JUL ’25 | 542.5 | -2 |

| SEP ’25 | 558 | -2.5 |

| JUL ’26 | 620 | -1.25 |

| K.C. Wheat | ||

| JUL ’25 | 538.75 | -1.25 |

| SEP ’25 | 553.75 | -1.25 |

| JUL ’26 | 613.5 | -0.25 |

| Mpls Wheat | ||

| JUL ’25 | 606.5 | 6.25 |

| SEP ’25 | 620.75 | 6.75 |

| SEP ’26 | 681.5 | 8 |

| S&P 500 | ||

| JUN ’25 | 5836.5 | -20.25 |

| Crude Oil | ||

| JUL ’25 | 61.66 | 0.46 |

| Gold | ||

| AUG ’25 | 3394.4 | 70.8 |

Grain Market Highlights

- 🌽 Corn: Corn futures ended the week on a softer note but still managed to post their first weekly gain in six weeks.

- 🌱 Soybeans: Soybean futures closed lower Friday, pressured alongside the broader grain complex after former President Trump’s renewed tariff threats against the EU rattled markets.

- 🌾 Wheat: Wheat futures ended the week mixed, holding relatively firm amid broader grain market pressure.

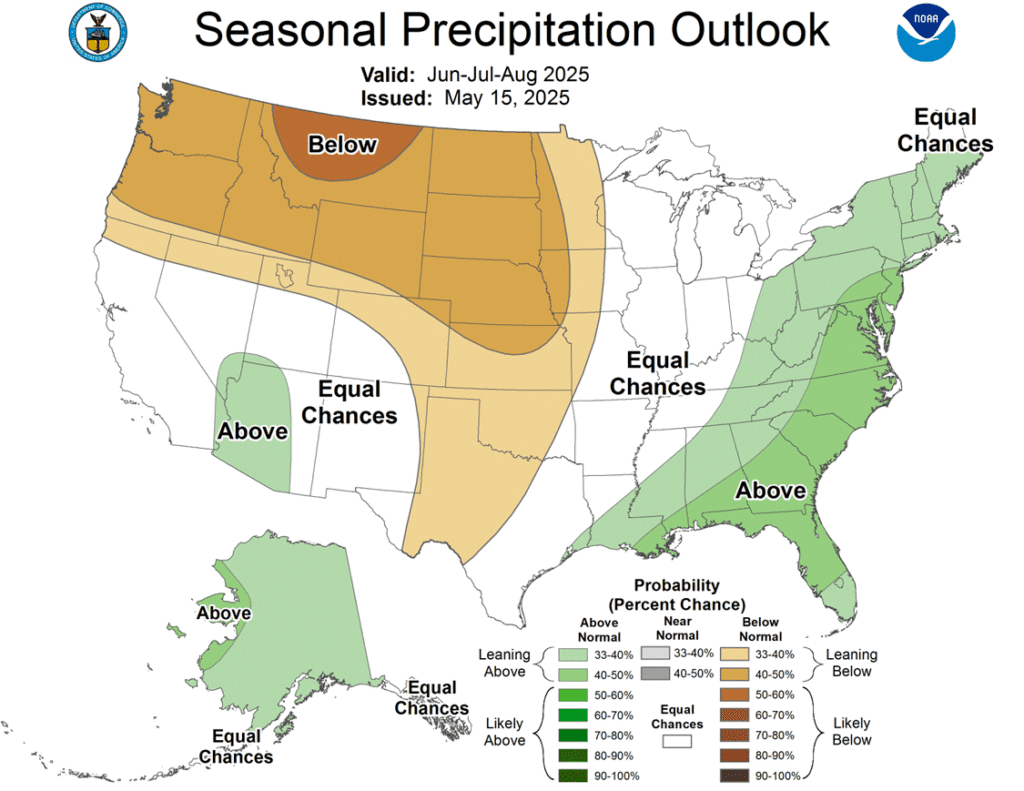

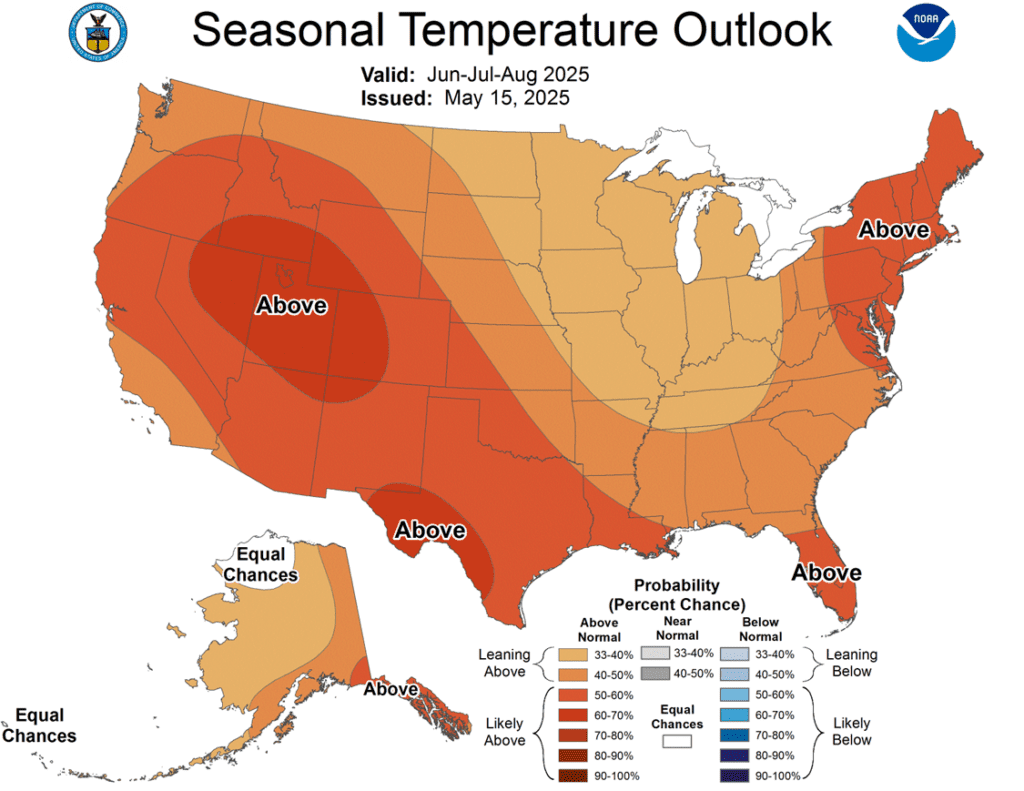

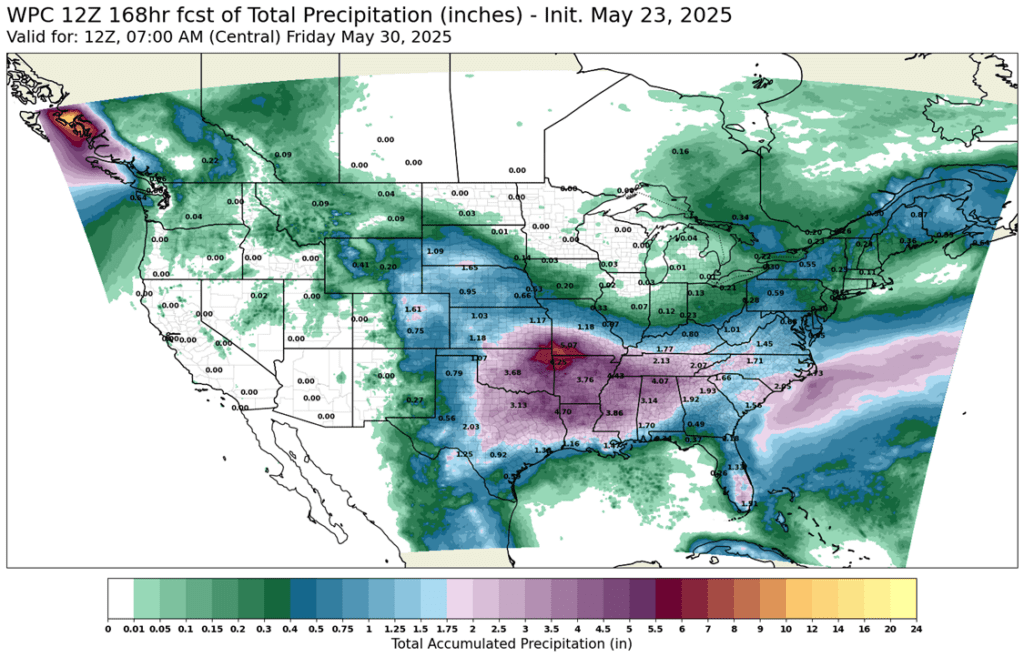

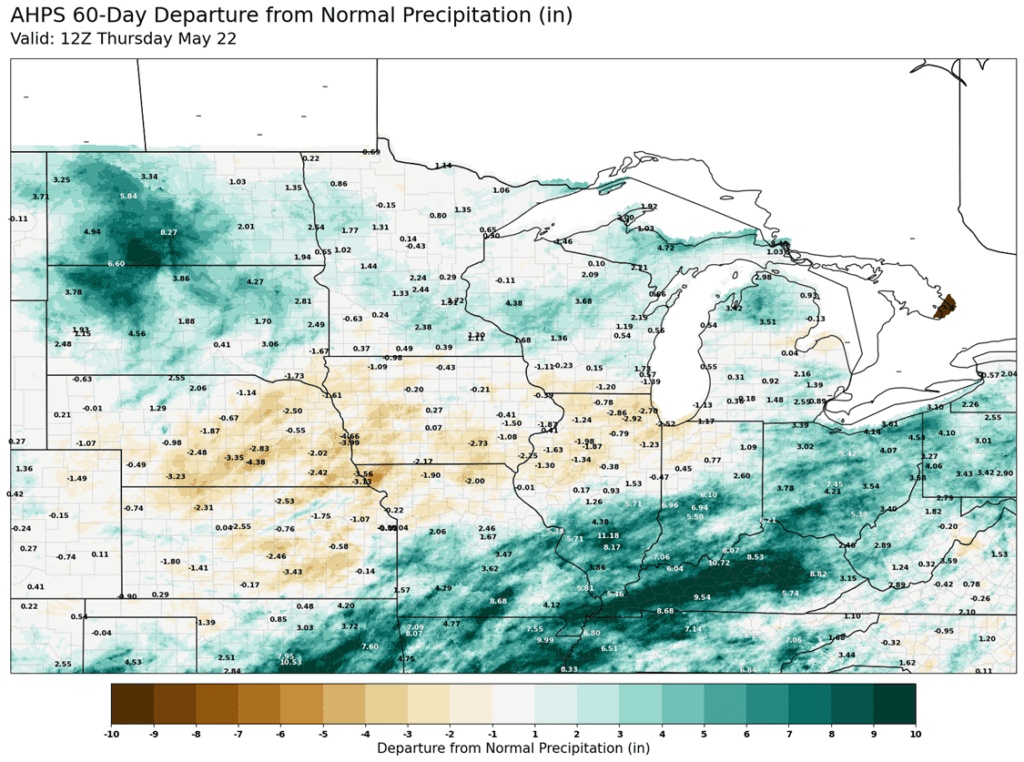

- To see updated U.S. weather outlook maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

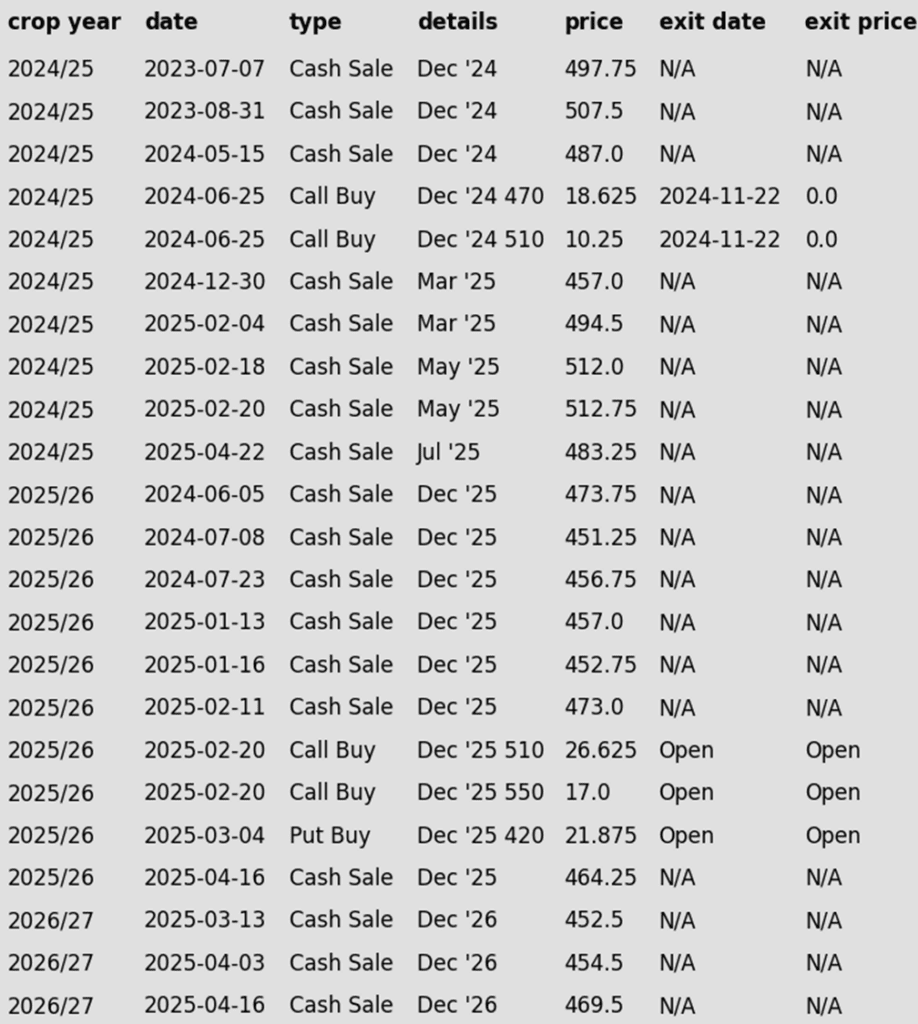

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

- With July corn continuing to hold support at 440, the strategy remains to hold out for potential upside volatility opportunities.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

- No adjustments needed at the moment. Positioned well for growing season volatility, with a good base of sales in place and both upside and downside targets active to begin legging out of open options positions.

2026 Crop:

- Plan A: Next cash sale at 474 vs December ‘26.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- Changes:

- None.

- The 474 target will be given another week or two. If it hasn’t been hit by then, another sales recommendation may be made based on the calendar and timing considerations.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures ended the week on a softer note, weighed down by renewed trade tensions with the European Union and end-of-week profit-taking. Despite Friday’s pullback, July corn still closed 16 cents higher on the week—its first weekly gain after five straight weeks of losses.

- The corn market had to fight off early session selling pressure on Friday as President Trump made comments about the disappointing pace of trade negotiations with the European Union. The administration is planning a 50% tariff on the EU starting on June 1. The headline pressured the entire market complex to start the day.

- June corn options expired Friday, contributing to intraday volatility. Markets often gravitate toward areas of heavy open interest during expiration, and this month’s concentration around the $4.55–$4.60 strikes added technical pressure.

- Looking ahead, early June weather is set to take center stage. The National Weather Service’s 8–14-day outlook shows a hot and dry pattern across much of the Corn Belt. If this trend continues, concerns over early-season dryness could support prices heading into the summer.

Corn Finds Support at 200-day

After bouncing off the key $4.50 level in April on a bullish WASDE and a break above the 50-day moving average, corn futures have come under renewed pressure in May. Rapid planting progress and lingering demand concerns have pushed prices back below $4.70. For now, the $4.45–$4.50 support zone and 200-day moving average have held. As planting wraps up, the market’s focus will shift quickly to summer weather. NOAA’s extended outlook calls for a warmer, drier pattern across the Western Corn Belt into June — potentially rekindling risk premium and setting the stage for weather-driven rallies. Initial resistance is expected near $4.70, with stronger resistance at the April highs around $4.90.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

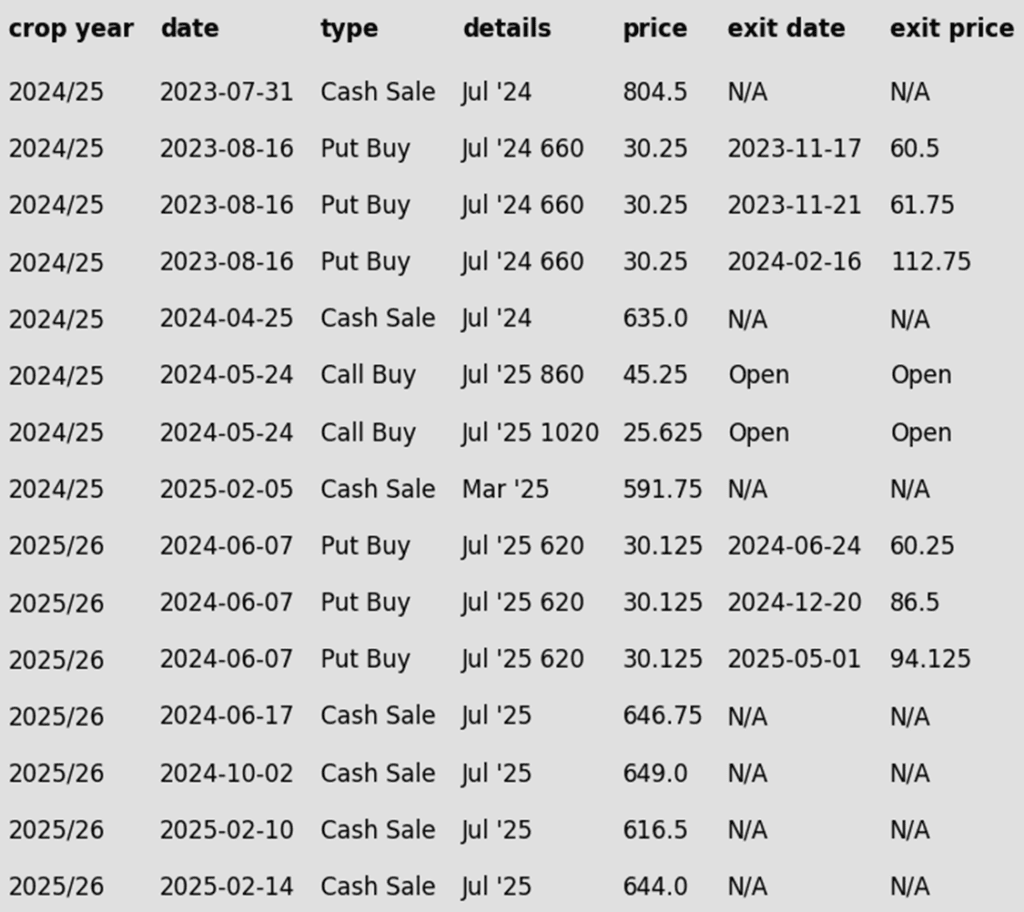

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

- Still content with the 1107 target as long as 1036 support holds. If that support level is broken, the current strategy will need to be revisited and potentially adjusted.

2025 Crop:

- Plan A:

- Next cash sales at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- Make a cash sale if November closes below 1018.50 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Changes:

- In about a week, another tranche of January put options may be recommended based on the calendar and seasonal timing considerations.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- Approaching the seasonal window where first sales targets could post at any time.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybean futures closed lower Friday, pressured alongside the broader grain complex after former President Trump’s renewed tariff threats against the EU rattled markets. Despite the pullback, soybeans still notched weekly gains. Soybean meal ended the day lower, while soybean oil finished higher amid continued volatility.

- The Buenos Aires Grain Exchange released its weekly crop report which did not have an updated production number, it was kept at 50 mmt despite the recent flooding, but the bean crop is now said to be 74.3% harvested.

- For the week, July soybeans gained 10-1/4 cents while November soybeans gained 15 cents. July soybean meal gained $4.30 on the week to end at $296.20, and July soybean oil gained 0.42 cents at 49.35 cents. Trade in soybean oil has been volatile due to rumors floating back and forth about potential biodiesel blending obligations.

- Managed Money remains net short in soybeans, with hedge funds holding a 38,000-contract short as of last week’s CFTC report. While this week’s strength likely trimmed that position, a shift to net long will likely require a larger bullish catalyst. Global supply burdens and persistent demand concerns continue to cap upside potential into the summer.

Soybean Futures Hover Near Top of Yearly Range Amid Renewed Optimism

After tumbling below the psychologically important 1000 mark in early April on tariff-related headlines, soybean futures appeared to be in freefall. The break of the March floor sparked a wave of technical selling, briefly sending prices spiraling. But the decline proved fleeting. Buyers quickly stepped in, reversing the momentum and powering futures back above 1000, reclaiming key moving averages along the way.

Of particular note was the clean break above the 200-day moving average — a barrier that had long capped upside attempts. With that ceiling now acting as solid support, bullish sentiment has taken the driver’s seat. Futures are now consolidating near the upper end of their 2024 range, setting their sights on a potential retest of the February peak around $10.80. As long as pullbacks hold the 200-day line, the path of least resistance may remain higher.

Wheat

Market Notes: Wheat

- Wheat futures had another mixed close, posting small losses in Chicago and Kansas City, but modest gains in Minneapolis. Relative to corn and soybeans, the wheat close appears strong. With little other fresh news to drive the market, talk that President Trump may enact 50% tariffs on the EU beginning June 1 weighed on both equity and grain markets today.

- According to the Buenos Aires Grain Exchange, wheat planting in Argentina is only 3.4% complete. This compares with 13% at this time last year, and a five-year average pace of 7%. Recent heavy rains and flooding have been the cause of slow soybean and corn harvests, in addition to the slow wheat sowing pace.

- The Rosario Grain Exchange is estimating Argentina’s wheat crop could exceed 21 mmt. If realized, this would be the second largest crop on record. For reference, the USDA is estimating the Argentine crop at 20 mmt, while the Buenos Aires Grain Exchange is projecting a 20.5 mmt crop.

- In the U.S., drought conditions continue to ease. Just 21% of winter wheat acres are experiencing drought, down 2% from last week, while spring wheat drought coverage dropped sharply from 38% to 29%.

- On a bearish note, the International Grains Council has increased their estimate of global 25/26 grain stockpiles by 5 mmt from last month, to 585 mmt. This is in part due to an increased wheat stockpile estimate, going from 260 mmt in April to 262 mmt this month.

- Since their export season began on July 1, Ukrainian grain exports have now reached 37.6 mmt according to their agriculture ministry. For the same time period, this is a reduction of about 17% year over year. Of the total, wheat exports account for 14.6 mmt, which is down 14% year over year.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A:

- Target 699.25 vs July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- None.

- While 699.25 is still a long way off, it’s tough to justify adjusting it lower at this point — historically, when volatility shows up this time of year, it can be significant.

2025 Crop:

- Plan A:

- Target 693.75 against July for the next sale.

- Plan B:

- Buy call options if July closes over 633.50 macro resistance.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- Plan B Update: A Plan B Update: A Plan B upside call buy stop has been added, with 633.50 identified as a key resistance level for the broader trend. A close above this level could indicate a shift toward a more bullish macro trend. In that scenario, buying call options would enable sales into strength while maintaining paper ownership.

- The purpose of this stop is to try to avoid recommending call option purchases unless the market clearly signals it’s warranted — and a close above 633.50 would be that signal. As long as the market remains below this level, the expectation is for a continued sideways-to-lower macro trend, where call options would provide little or no benefit.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Looking for Support

After months of range-bound trading, Chicago wheat futures broke out in February, climbing to October highs just above 615. However, the rally proved short-lived, with prices quickly retreating back into their 2024 range. By mid-May, futures broke below key support near 530 and are now searching for a bottom around the 520 level. The next major technical hurdle is the 200-day moving average — a firm weekly close above this level could signal a potential trend reversal and open the door to a broader uptrend.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- None. Still waiting for a bottom to form.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy call options if July closes over 653 macro resistance.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- Plan B Update: A Plan B upside call buy stop has been added, with 653 identified as a key resistance level for the broader trend. A close above this level could indicate a shift toward a more bullish macro trend. In that scenario, buying call options would enable sales into strength while maintaining paper ownership.

- The purpose of this stop is to try to avoid recommending call option purchases unless the market clearly signals it’s warranted — and a close above 653 would be that signal. As long as the market remains below this level, the expectation is for a continued sideways-to-lower macro trend, where call options would provide little or no benefit.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

- First sales targets are expected to post after June 1.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Searching for Support

Kansas City wheat experienced sharp volatility in February, rallying early before settling flat by month’s end. Persistent weakness through March and April pushed prices toward recent lows — and the market broke below that support to start May. A recovery back above the prior 540 level would signal a potential bottom. On a rebound, the 200-day moving average stands as the first resistance, with a more formidable ceiling at the February highs near 640.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- Changes:

- None.

2025 Crop:

- Plan A: No active targets.

- Plan B:

- Buy KC call options if July KC closes over 653 macro resistance.

- Note: KC options are being used due to the strong correlation between KC and Minneapolis futures prices, as well as the greater liquidity found in the KC options market.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- Plan B Update: A Plan B upside call buy stop has been added, with KC 653 identified as a key resistance level for the broader trend. A close above this level could indicate a shift toward a more bullish macro trend. In that scenario, buying call options would enable sales into strength while maintaining paper ownership.

- The purpose of this stop is to try to avoid recommending call option purchases unless the market clearly signals it’s warranted — and a close above KC 653 would be that signal. As long as the market remains below this level, the expectation is for a continued sideways-to-lower macro trend, where call options would provide little or no benefit.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- First sales targets are expected to post after July 1.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holds Recent Lows

Spring wheat futures broke out of a prolonged sideways trend in late January, sparking a wave of bullish momentum. The rally gained strength in mid-February with a decisive close above the 200-day moving average. However, late-month weakness briefly dragged futures back below key support levels.

Currently, futures are retreating toward recent lows, pressured by strong planting progress and favorable weather conditions across major spring wheat-growing regions. On a potential rebound, initial resistance is expected near the 600 level, where a confluence of moving averages could cap gains.

Other Charts / Weather

Above: Courtesy of ag-wx.com