5-22 End of Day: Grains Mixed as Soybeans Extend Rally, Corn Steady, Wheat Eases

The CME and Total Farm Marketing Offices will be closed Monday, May 26, in Observance of Memorial Day

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 463 | 2 |

| DEC ’25 | 453.25 | -2.25 |

| DEC ’26 | 467.75 | -0.5 |

| Soybeans | ||

| JUL ’25 | 1067.5 | 4.75 |

| NOV ’25 | 1055.25 | 3 |

| NOV ’26 | 1054.5 | 3.75 |

| Chicago Wheat | ||

| JUL ’25 | 544.5 | -4.75 |

| SEP ’25 | 560.5 | -3.25 |

| JUL ’26 | 621.25 | -1 |

| K.C. Wheat | ||

| JUL ’25 | 540 | -0.5 |

| SEP ’25 | 555 | 0.25 |

| JUL ’26 | 613.75 | 0 |

| Mpls Wheat | ||

| JUL ’25 | 600.25 | -4 |

| SEP ’25 | 614 | -3 |

| SEP ’26 | 673.5 | -4.5 |

| S&P 500 | ||

| JUN ’25 | 5885.5 | 24.25 |

| Crude Oil | ||

| JUL ’25 | 61.25 | -0.32 |

| Gold | ||

| AUG ’25 | 3321.4 | -20.5 |

Grain Market Highlights

- 🌽 Corn: Corn futures saw quiet trade on Thursday. July contracts posted modest gains, buoyed by solid export sales, while deferred contracts faced light profit-taking.

- 🌱 Soybeans: The July soybean contract closed higher again Thursday, extending its winning streak to four days.

- 🌾 Wheat: Wheat futures closed mixed Thursday, with Chicago and Minneapolis posting losses, while Kansas City managed a marginal gain in the deferred months.

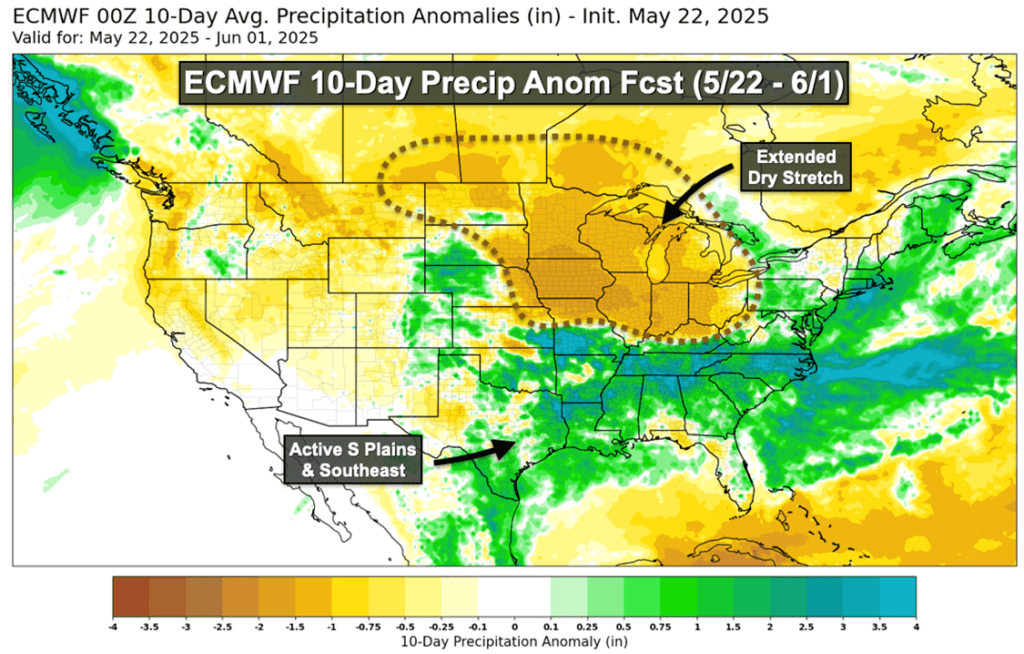

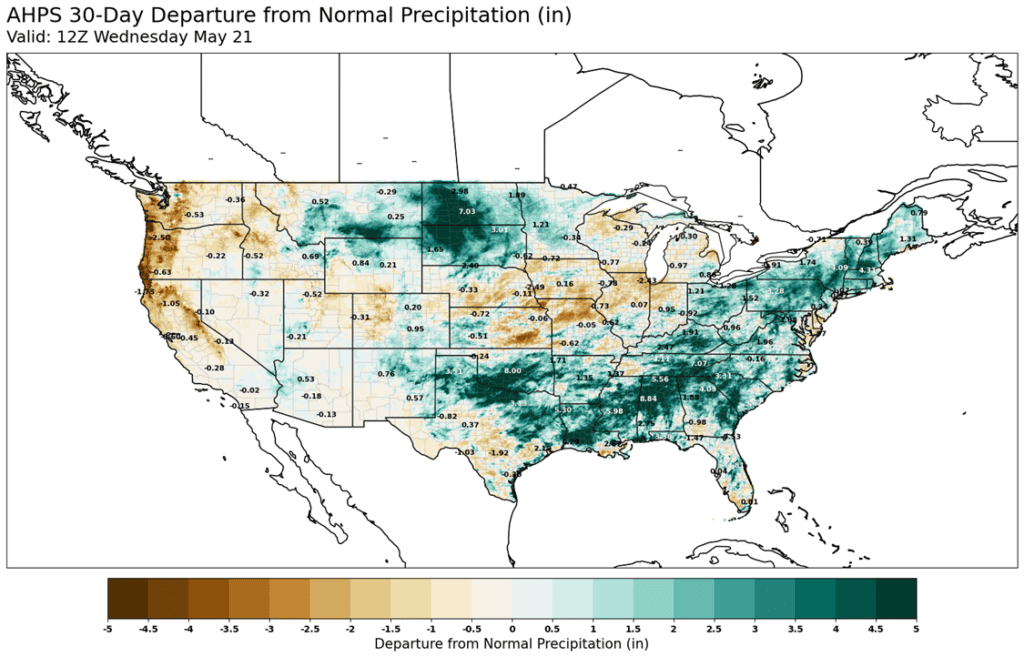

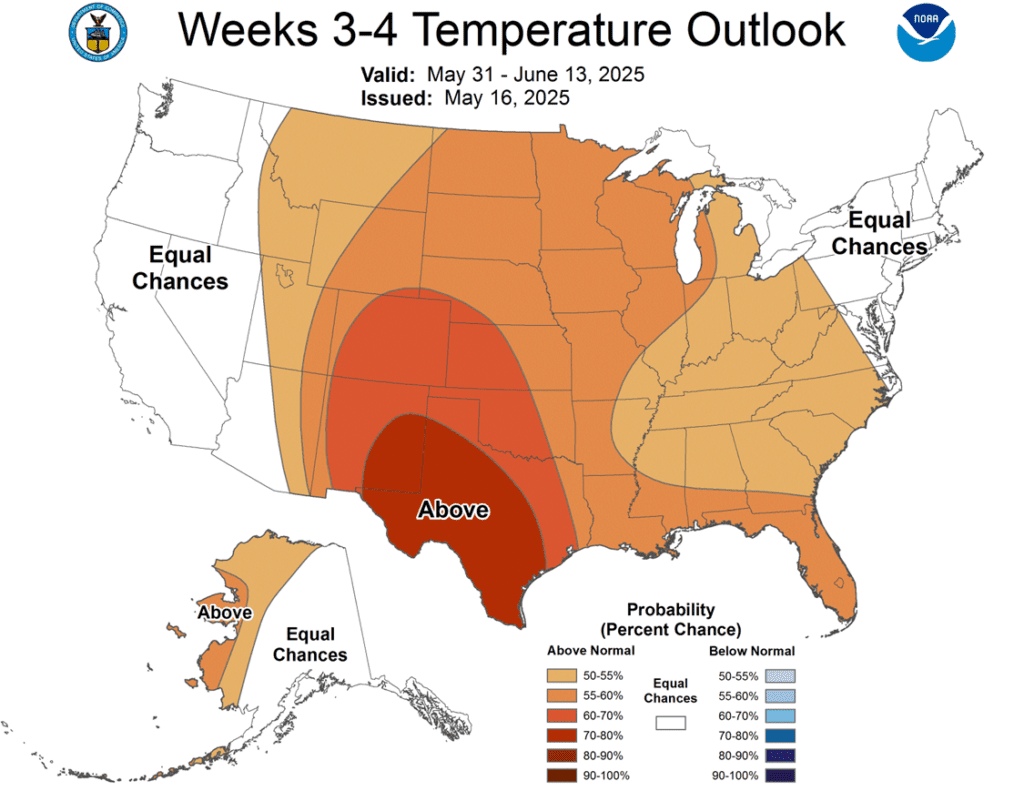

- To see updated U.S. weather outlook maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

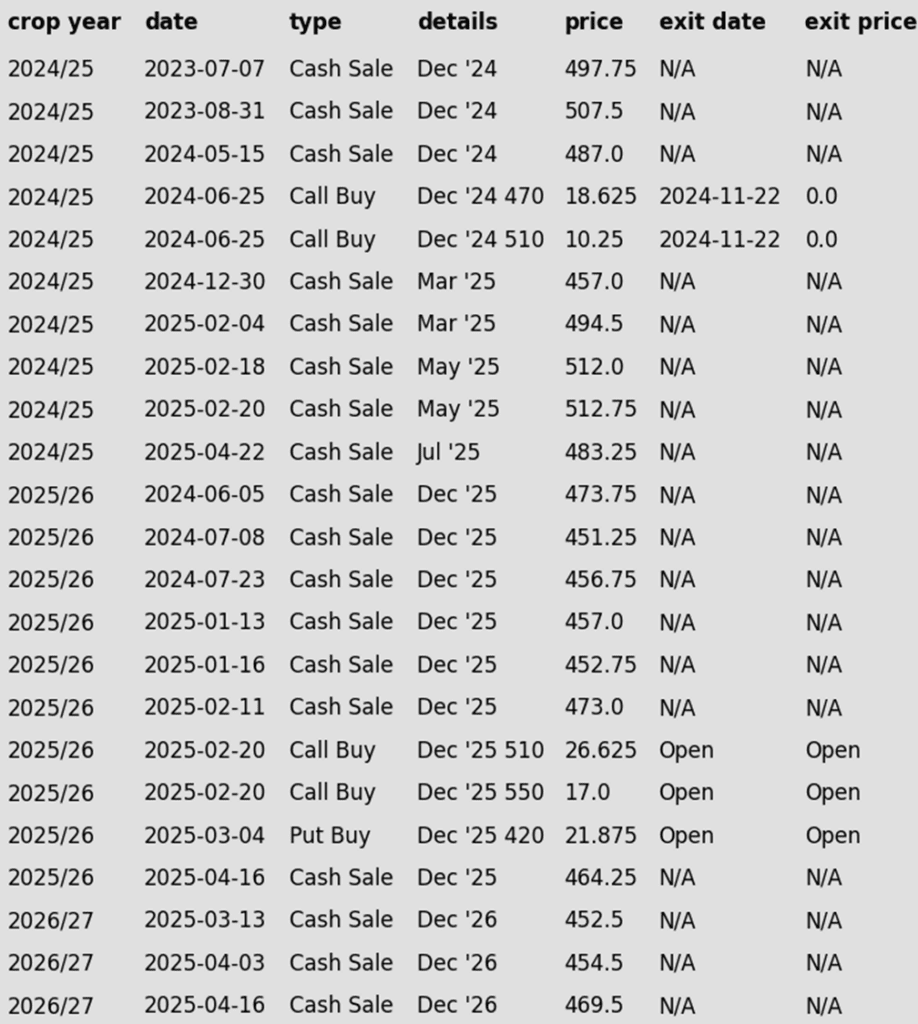

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None. Prepped for growing season volatility with upside and downside targets to start legging out of open options positions.

2026 Crop:

- Plan A: Next cash sale at 474 vs December ‘26.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- Changes:

- None.

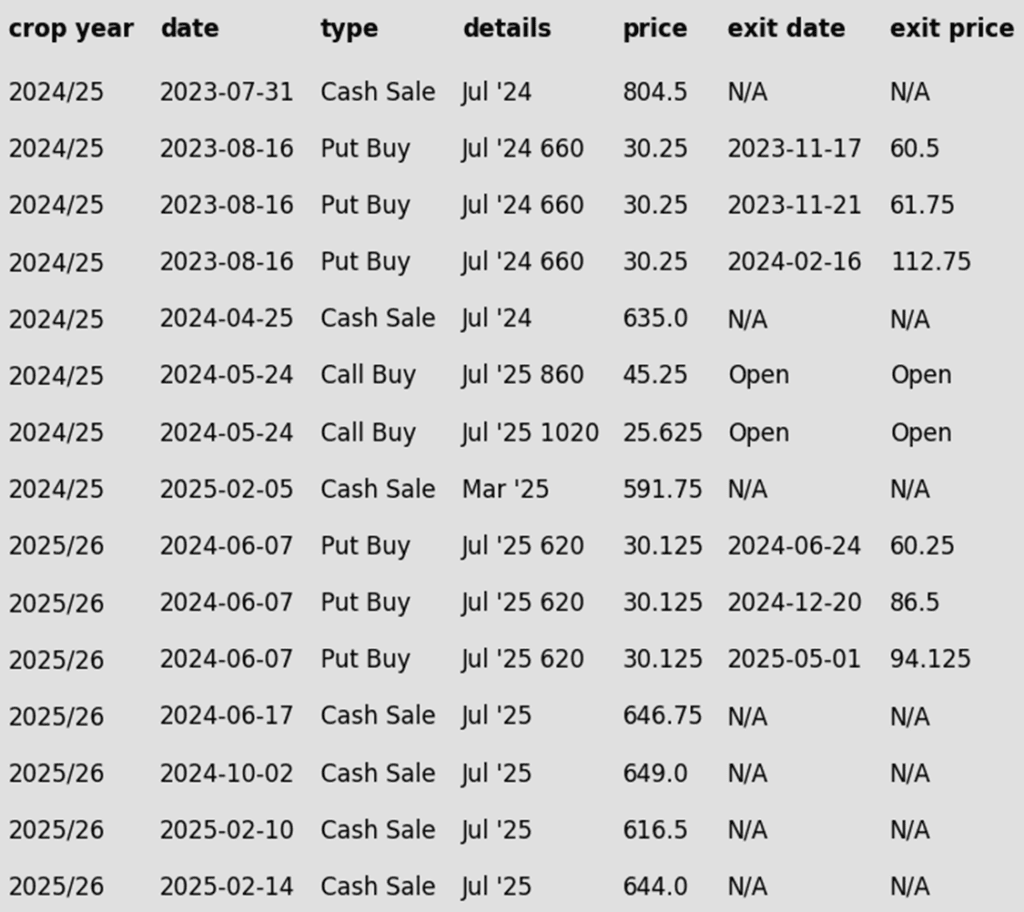

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures saw quiet trade on Thursday. July contracts posted modest gains, buoyed by solid export sales, while deferred contracts faced light profit-taking. As of Thursday’s close, December corn futures are up 17 ¾ cents for the week heading into Friday’s session and the Memorial Day weekend.

- With the recent strong price move, the corn market had entered technically overbought territory. Some short-term correction and position-squaring emerged as traders looked to reduce risk ahead of the three-day weekend.

- USDA’s weekly export report showed new corn sales of 1.190 MMT (46.9 mb) for 2023-24 and 218,400 MT (8.6 mb) for 2024-25 — within trade expectations and supportive for nearby contracts. Japan was the top buyer for the week.

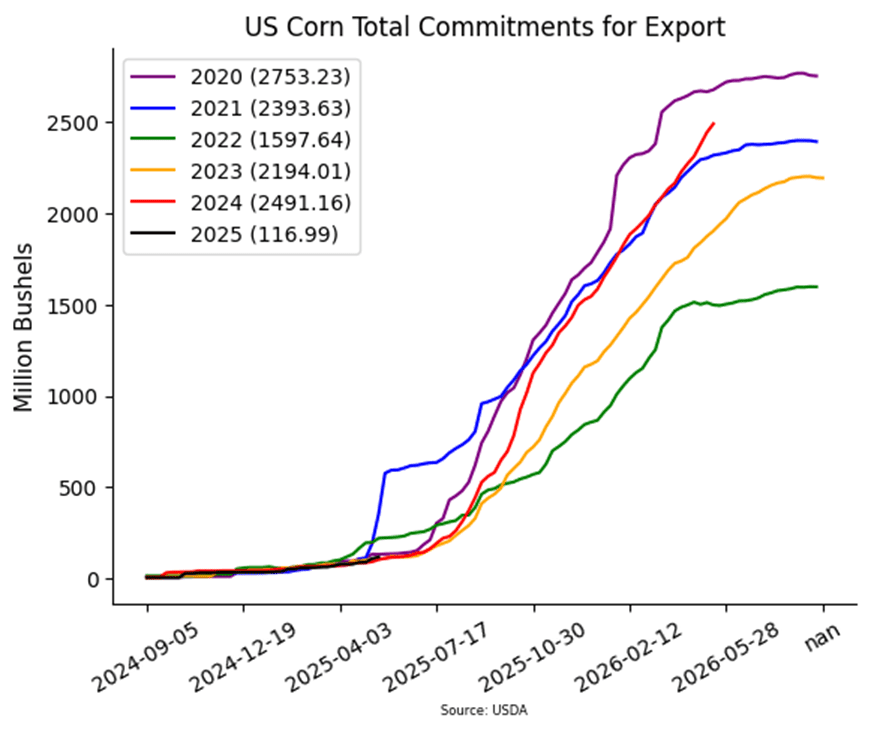

- Total U.S. corn export commitments now stand at 2.491 billion bushels, up 28% from last year and just 109 mb shy of the USDA’s full-year projection of 2.6 bb. With the marketing year ending August 30, upward revisions to the USDA’s export forecast and lower ending stocks are becoming more likely.

- Despite recent rains, roughly 22% of corn-growing areas remain under drought conditions. NOAAs extended 8–14-day outlook calls for above-normal temperatures and below-normal rainfall across much of the Corn Belt — conditions that may support prices if dryness persists into June.

Corn Finds Support at 200-day

After bouncing off the key $4.50 level in April on a bullish WASDE and a break above the 50-day moving average, corn futures have come under renewed pressure in May. Rapid planting progress and lingering demand concerns have pushed prices back below $4.70. For now, the $4.45–$4.50 support zone and 200-day moving average have held. As planting wraps up, the market’s focus will shift quickly to summer weather. NOAA’s extended outlook calls for a warmer, drier pattern across the Western Corn Belt into June — potentially rekindling risk premium and setting the stage for weather-driven rallies. Initial resistance is expected near $4.70, with stronger resistance at the April highs around $4.90.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

2025 Crop:

- Plan A:

- Next cash sales at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- Make a cash sale if November closes below 1018.50 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Changes:

- Another tranche of January put options may be recommended in a couple weeks.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- The July soybean contract closed higher again Thursday, extending its winning streak to four days. Prices have consistently held support between $10.45 and $10.50, anchored by the 100-day moving average. A drier 30-day forecast across key U.S. growing regions continues to fuel concerns of a hot, dry summer — adding a weather premium to the market.

- Soybean meal ended the day higher, but soybean oil was once again dragged lower by potentially bearish biofuel rumors. Soybean oil gapped down overnight after a rumor circulated that the White House could soon grant a large backlog of Small Refinery Exemptions which would decrease blending and bean oil demand.

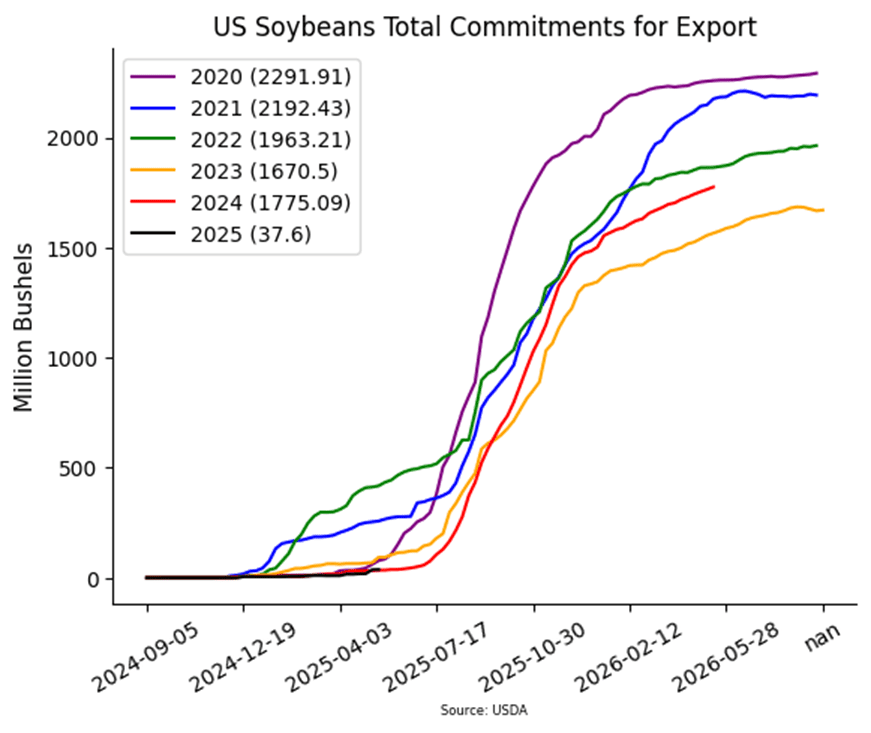

- Today’s export sales were within expectations for soybeans with an increase of 11.3 million bushels reported for 24/25 and an increase of 0.6 mb for 25/26. Primary destinations were to Mexico, Taiwan, and Indonesia. Last week’s export shipments of 9.2 mb were below the 12.8 mb needed each week to meet the USDA’s expectations.

- The Brazilian soybean market saw its cash market premiums rise with strong buying activity by China. China is estimated to have bought 100 cargoes of soybeans in the month of May with the majority coming from Brazil, including purchase into new crop Brazil soybeans for next spring. The strong Chinese demand has lifted global soybean prices, helping support the global price of soybeans.

Soybean Futures Hover Near Top of Yearly Range Amid Renewed Optimism

After tumbling below the psychologically important 1000 mark in early April on tariff-related headlines, soybean futures appeared to be in freefall. The break of the March floor sparked a wave of technical selling, briefly sending prices spiraling. But the decline proved fleeting. Buyers quickly stepped in, reversing the momentum and powering futures back above 1000, reclaiming key moving averages along the way.

Of particular note was the clean break above the 200-day moving average — a barrier that had long capped upside attempts. With that ceiling now acting as solid support, bullish sentiment has taken the driver’s seat. Futures are now consolidating near the upper end of their 2024 range, setting their sights on a potential retest of the February peak around $10.80. As long as pullbacks hold the 200-day line, the path of least resistance may remain higher.

Wheat

Market Notes: Wheat

- Wheat futures closed mixed Thursday, with Chicago and Minneapolis posting losses, while Kansas City managed a marginal gain. A lower Euro failed to support Paris (Matif) wheat, which closed broadly lower — adding pressure to U.S. futures alongside a firmer U.S. dollar. Additionally, profit-taking after recent gains and uncompetitive U.S. Gulf wheat offers — reportedly $10/mt above Russian FOB levels — contributed to softer trade.

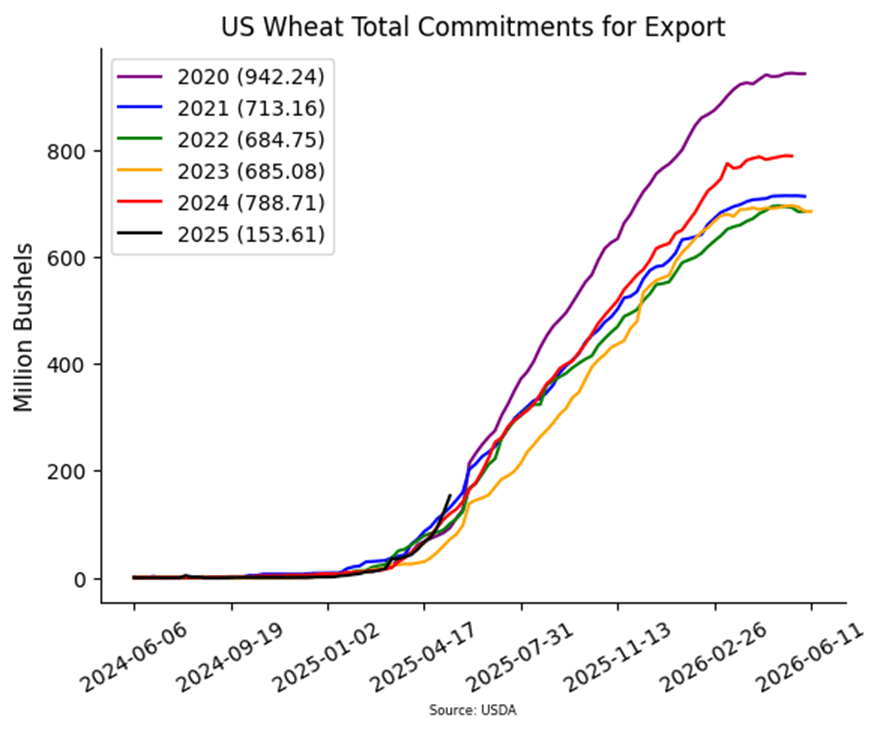

- The USDA reported a decrease of 0.5 mb of wheat export sales for 24/25 and an increase of 32.4 mb for 25/26. Shipments last week at 16.1 mb fell under the 28.3 mb pace needed per week to reach the USDA’s export goal of 820 mb. Total 24/25 shipments have reached 730 mb, up 12% from last year.

- A wheat crop tour in Illinois reported an average day-one yield of 106 bpa — well above last year’s estimate of 104 bpa and far exceeding the USDA’s current 85 bpa projection. However, excessive rainfall across southern Illinois and the broader Midwest is raising concerns over potential disease pressure that could threaten final yields.

- Despite experiencing the second-warmest February in over a century, India is on track to harvest a record wheat crop. USDA pegs production at 117 mmt, which would push stockpiles to a four-year high. As India typically consumes what it produces, this surplus offers limited trade implications but contributes to the global supply glut, adding bearish sentiment to world prices.

- According to Interfax, Russia exported 1.214 mmt of wheat from May 1 to May 20. Compared with the 3.319 mmt shipped during the same timeframe last year, this represents a 63% decline year over year. Reportedly, only 18 companies shipped wheat this May, versus 77 companies in May of last year. Furthermore, total May 2025 shipments are expected to reach 1.8 mmt, which would be 2.6 mmt under the five-year average.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A:

- Target 699.25 vs July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- None. Still waiting for a bottom to form.

2025 Crop:

- Plan A:

- Target 693.75 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- Plan B Update: A Plan B upside call buy stop has been added, with 633.50 identified as a key resistance level for the broader trend. A close above this level could indicate a shift toward a more bullish macro trend. In that scenario, buying call options would enable sales into strength while maintaining paper ownership.

- The purpose of this stop is to try to avoid recommending call option purchases unless the market clearly signals it’s warranted — and a close above 633.50 would be that signal. As long as the market remains below this level, the expectation is for a continued sideways-to-lower macro trend, where call options would provide little or no benefit.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Looking for Support

After months of range-bound trading, Chicago wheat futures broke out in February, climbing to October highs just above 615. However, the rally proved short-lived, with prices quickly retreating back into their 2024 range. By mid-May, futures broke below key support near 530 and are now searching for a bottom around the 520 level. The next major technical hurdle is the 200-day moving average — a firm weekly close above this level could signal a potential trend reversal and open the door to a broader uptrend.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- None. Still waiting for a bottom to form.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- Plan B Update: A Plan B upside call buy stop has been added, with 653 identified as a key resistance level for the broader trend. A close above this level could indicate a shift toward a more bullish macro trend. In that scenario, buying call options would enable sales into strength while maintaining paper ownership.

- The purpose of this stop is to try to avoid recommending call option purchases unless the market clearly signals it’s warranted — and a close above 653 would be that signal. As long as the market remains below this level, the expectation is for a continued sideways-to-lower macro trend, where call options would provide little or no benefit.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Searching for Support

Kansas City wheat experienced sharp volatility in February, rallying early before settling flat by month’s end. Persistent weakness through March and April pushed prices toward recent lows — and the market broke below that support to start May. A recovery back above the prior 540 level would signal a potential bottom. On a rebound, the 200-day moving average stands as the first resistance, with a more formidable ceiling at the February highs near 640.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- Changes:

- None. Still waiting for a bottom to form.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- Plan B Update: A Plan B upside call buy stop has been added, with KC 653 identified as a key resistance level for the broader trend. A close above this level could indicate a shift toward a more bullish macro trend. In that scenario, buying call options would enable sales into strength while maintaining paper ownership.

- The purpose of this stop is to try to avoid recommending call option purchases unless the market clearly signals it’s warranted — and a close above KC 653 would be that signal. As long as the market remains below this level, the expectation is for a continued sideways-to-lower macro trend, where call options would provide little or no benefit.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holds Recent Lows

Spring wheat futures broke out of a prolonged sideways trend in late January, sparking a wave of bullish momentum. The rally gained strength in mid-February with a decisive close above the 200-day moving average. However, late-month weakness briefly dragged futures back below key support levels.

Currently, futures are retreating toward recent lows, pressured by strong planting progress and favorable weather conditions across major spring wheat-growing regions. On a potential rebound, initial resistance is expected near the 600 level, where a confluence of moving averages could cap gains.

Other Charts / Weather