5-21 End of Day: Grain Complex Firms on Weather Risks and Technical Strength

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 461 | 6.5 |

| DEC ’25 | 455.5 | 7 |

| DEC ’26 | 468.25 | 4 |

| Soybeans | ||

| JUL ’25 | 1062.75 | 9.75 |

| NOV ’25 | 1052.25 | 11.25 |

| NOV ’26 | 1050.75 | 7.75 |

| Chicago Wheat | ||

| JUL ’25 | 549.25 | 3.25 |

| SEP ’25 | 563.75 | 4 |

| JUL ’26 | 622.25 | 5.75 |

| K.C. Wheat | ||

| JUL ’25 | 540.5 | 4.25 |

| SEP ’25 | 554.75 | 4.75 |

| JUL ’26 | 613.75 | 5.75 |

| Mpls Wheat | ||

| JUL ’25 | 604.25 | 6.5 |

| SEP ’25 | 617 | 6.75 |

| SEP ’26 | 678 | 7.25 |

| S&P 500 | ||

| JUN ’25 | 5889.75 | -70 |

| Crude Oil | ||

| JUL ’25 | 61.53 | -0.5 |

| Gold | ||

| AUG ’25 | 3345.4 | 32.8 |

Grain Market Highlights

- 🌽 Corn: Corn futures extended their rally on Wednesday, marking a third straight day of gains as continued weakness in the U.S. dollar provided additional support.

- 🌱 Soybeans: Soybean futures logged a third consecutive day of gains, driven primarily by extended forecasts calling for drier conditions across key U.S. growing regions.

- 🌾 Wheat: Wheat futures closed higher for another session, fueled by continued short covering and supportive global cues.

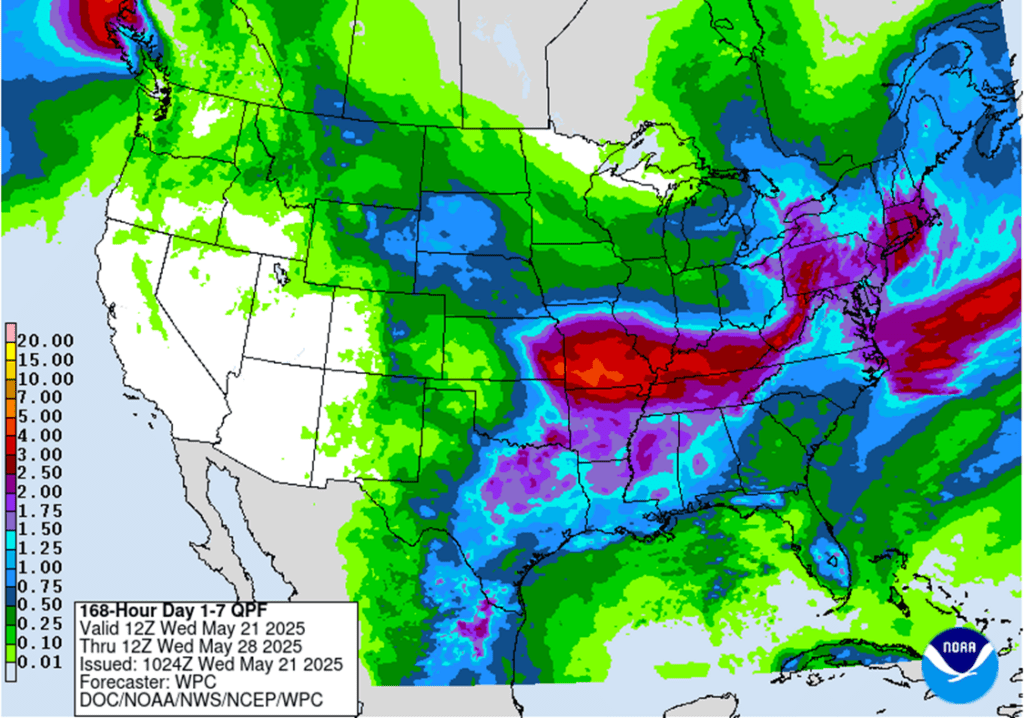

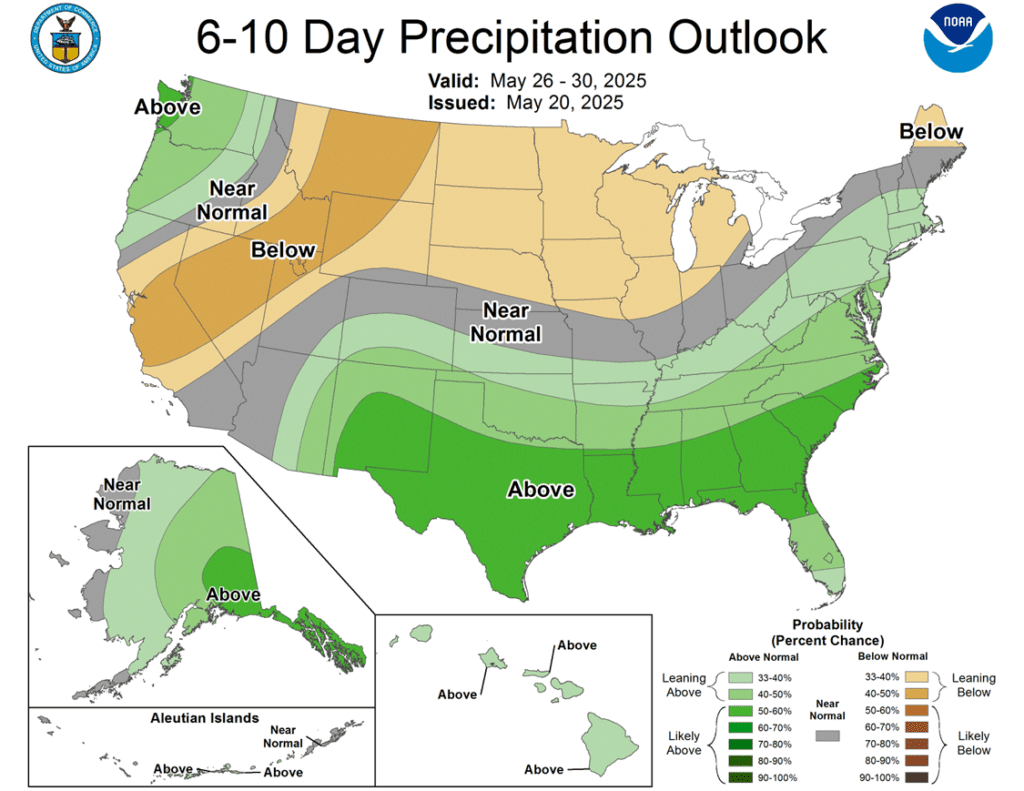

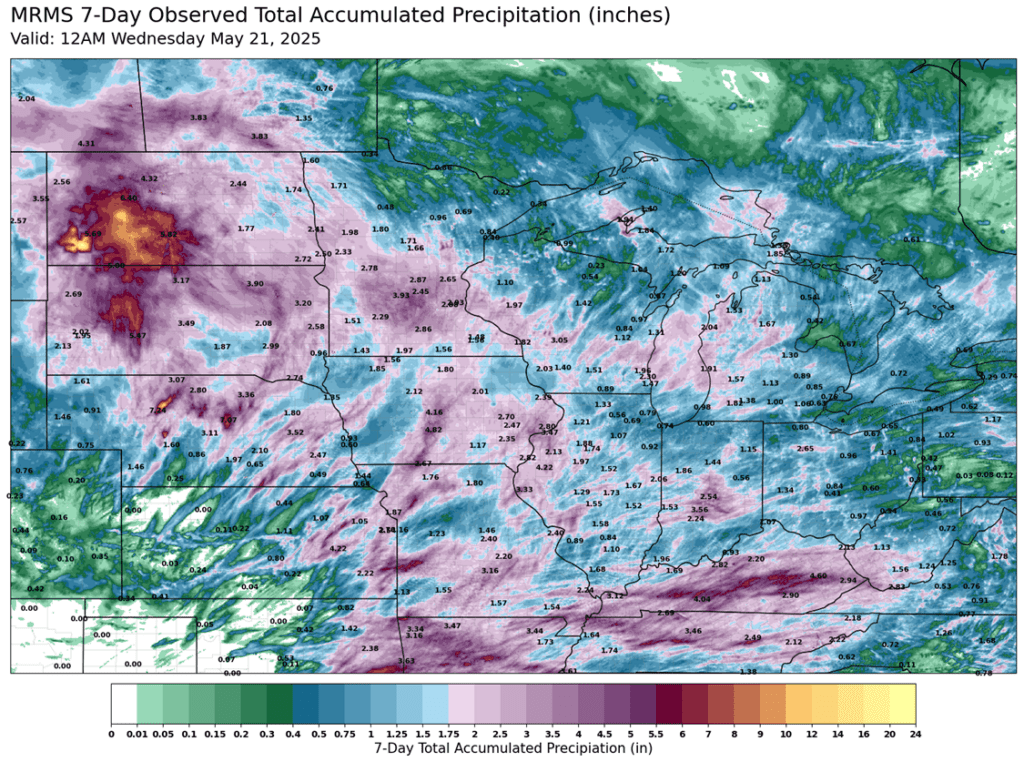

- To see updated 7-day accumulated precipitation map and U.S. weather outlooks maps scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

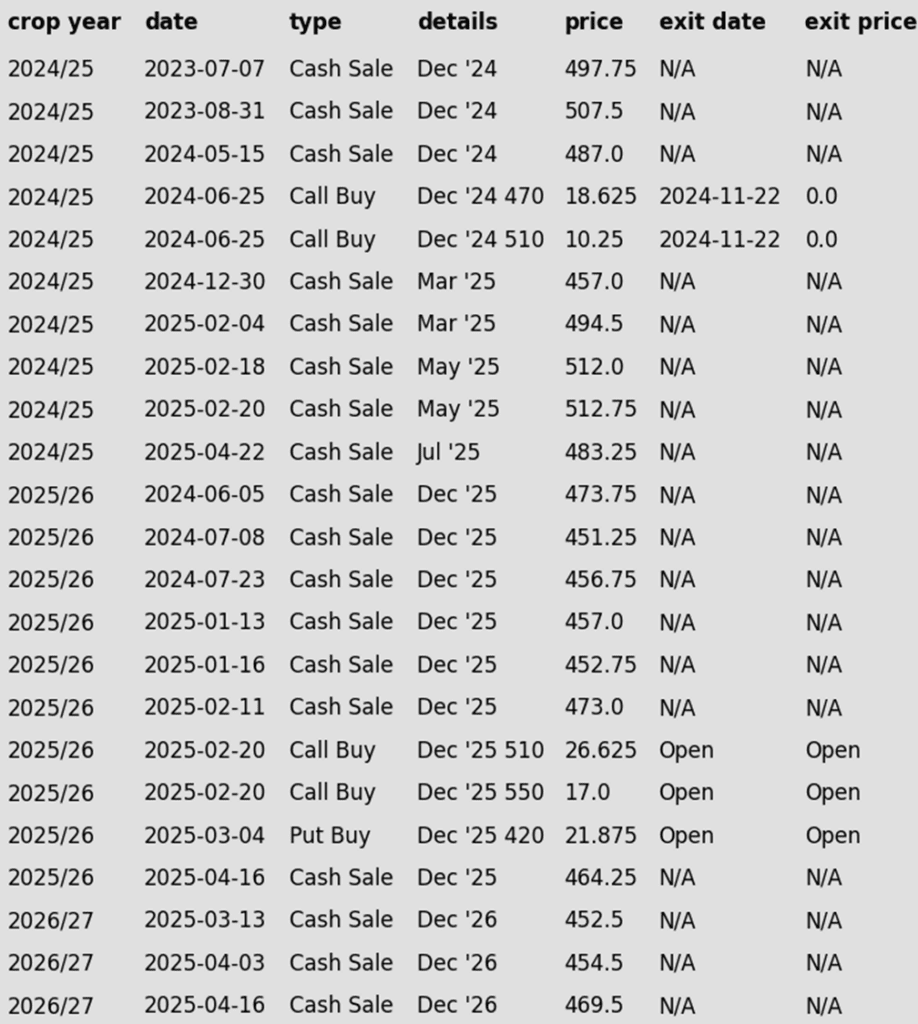

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- None.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None. Prepped for growing season volatility with upside and downside targets to start legging out of open options positions.

2026 Crop:

- Plan A: Next cash sale at 474 vs December ‘26.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures extended their rally Wednesday, closing higher for the third consecutive day. A weaker U.S. dollar and broad-based strength across the grain complex contributed to the gains, reinforcing bullish momentum.

- Rain fell again over much of the Corn Belt on Wednesday, providing some key moisture in areas that have been in need of rain. While moisture is welcomed in the western Corn Belt, the eastern region remains too wet. With the calendar moving past optimal planting windows, the market is turning its attention to the final 20% of acres.

- Ethanol production rebounded to 305 million gallons last week, up from 292 MG and up 1.7% over last year. A total of 103 mb was used in ethanol production last week, which is trending slightly below the USDA usage target for the marketing year.

- USDA will release weekly export sales on Thursday morning. For the week ending May 15, total new corn sales are expected to range from 700,000 – 1.6 MMT for old crop and 50,000 – 5000,000 MT for new crop. Last week’s old crop sales were 1.677 MMT, and toward the top end of expectation.

- The U.S. Dollar Index slipped to a two-week low, adding support to grain markets. Continued dollar weakness could provide further tailwinds for exports.

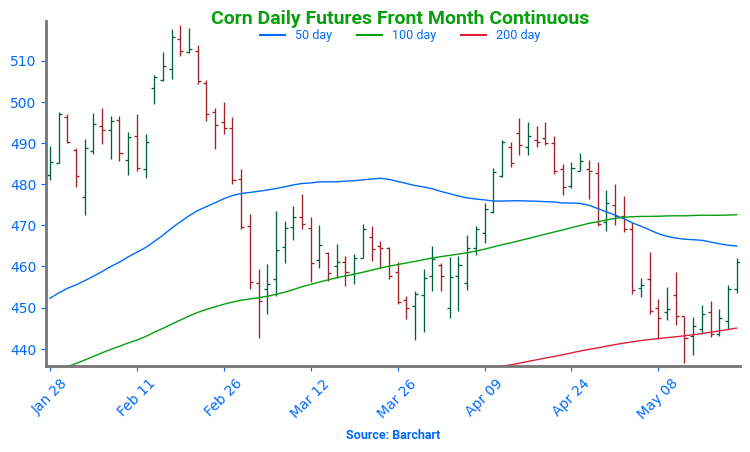

Corn Finds Support at 200-day

After bouncing off the key $4.50 level in April on a bullish WASDE and a break above the 50-day moving average, corn futures have come under renewed pressure in May. Rapid planting progress and lingering demand concerns have pushed prices back below $4.70. For now, the $4.45–$4.50 support zone and 200-day moving average have held. As planting wraps up, the market’s focus will shift quickly to summer weather. NOAA’s extended outlook calls for a warmer, drier pattern across the Western Corn Belt into June — potentially rekindling risk premium and setting the stage for weather-driven rallies. Initial resistance is expected near $4.70, with stronger resistance at the April highs around $4.90.

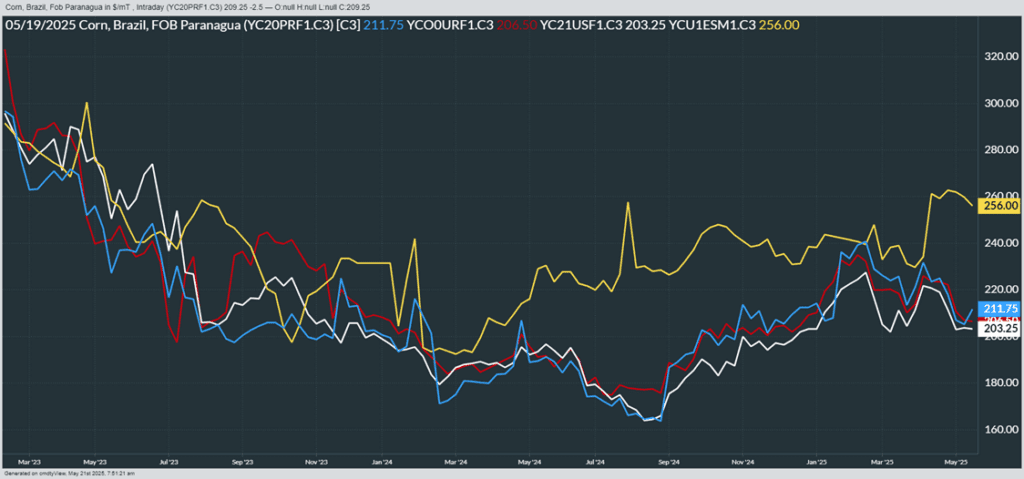

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

2025 Crop:

- Plan A:

- Next cash sales at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- Make a cash sale if November closes below 1018.50 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Changes:

- Another tranche of January put options may be recommended in a couple weeks.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

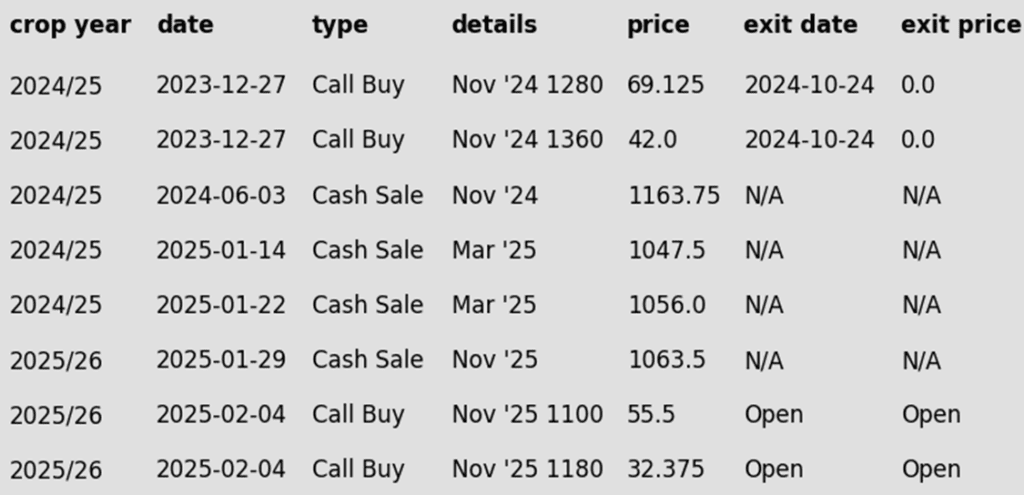

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher for the third consecutive day breaking out of their previous three-day narrow trading range. Both soybean meal and oil traded higher which was supportive, but extended forecasts showing dry weather were likely the larger bullish factor supporting the entire grain complex.

- Brazilian soybean market saw it cash market premiums rise with strong buying activity by China. China is estimated to have bought 100 cargoes of soybeans in the month of May with the majority coming from Brazil, including purchase into new crop Brazil soybeans for next spring. The strong Chinese demand has lifted global soybean prices, helping support the global price of soybeans.

- While U.S. planting progress is ahead of average, recent widespread rains across the Corn Belt may temporarily delay fieldwork. Looking ahead, the 7–14-day forecast points to below-normal precipitation west of Ohio, raising early-season dryness concerns.

- In Argentina, there was severe flooding over the weekend with rainfall totaling 6 to 10 inches in some areas north of Buenos Aires. The 24/25 bean crop was estimated at 50 mmt previously and was 65% harvested last week. The catastrophic flooding will likely bring production lower.

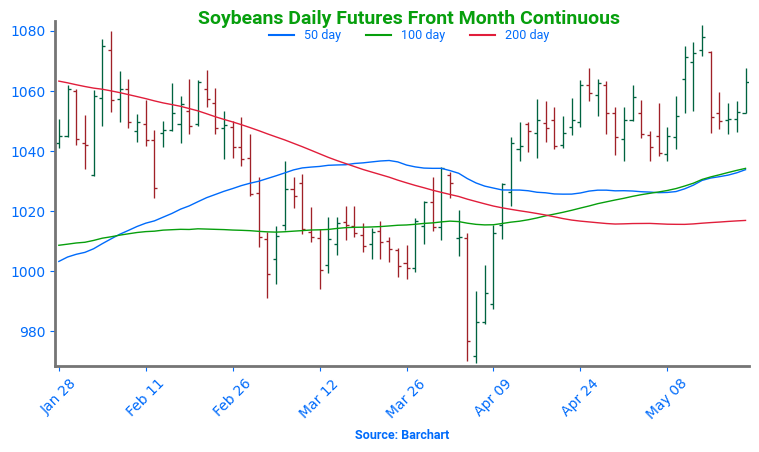

Soybean Futures Hover Near Top of Yearly Range Amid Renewed Optimism

After tumbling below the psychologically important 1000 mark in early April on tariff-related headlines, soybean futures appeared to be in freefall. The break of the March floor sparked a wave of technical selling, briefly sending prices spiraling. But the decline proved fleeting. Buyers quickly stepped in, reversing the momentum and powering futures back above 1000, reclaiming key moving averages along the way.

Of particular note was the clean break above the 200-day moving average — a barrier that had long capped upside attempts. With that ceiling now acting as solid support, bullish sentiment has taken the driver’s seat. Futures are now consolidating near the upper end of their 2024 range, setting their sights on a potential retest of the February peak around $10.80. As long as pullbacks hold the 200-day line, the path of least resistance may remain higher.

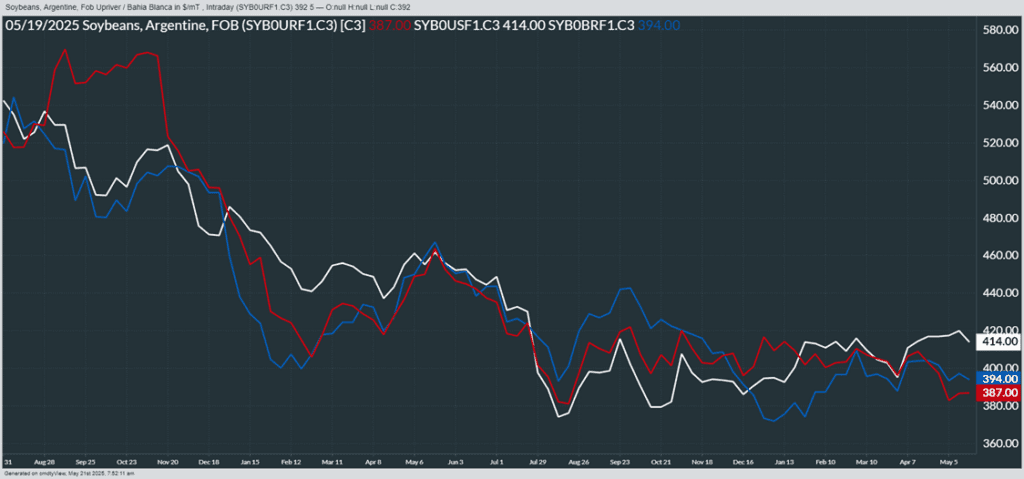

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

- Wheat futures closed higher for another session, fueled by continued short covering and supportive global cues. Chicago open interest fell by about 4,000 contracts, while speculative traders were estimated buyers of 8,000—indicating short liquidation. Paris milling wheat futures added to gains, breaking key moving average resistance despite a firmer Euro. A weaker U.S. Dollar also provided a lift to the U.S. wheat complex.

- China’s east-central growing region is forecast have scattered rains and cooler temperatures later this week, which should offer some relief from the recent heat, drought, and high winds. Nevertheless, some damage may have already been done, which could ultimately lead to increased Chinese wheat imports.

- Argentina announced an extension of its reduced wheat export tax rate (9.5%) through March 31, 2026. The move is intended to support competitiveness but does not apply to corn or soybeans, narrowing the export incentive gap.

- Traders will be keeping an eye on weather in the Black Sea region. Recent frosts in the Rostov region of Russia led to a declaration of a state of emergency, though it is worth noting that the affected area is only about 10% of the size of that which was impacted last year. Looking forward, the month of June is expected to be warm and dry in the Black Sea, which would also be unfavorable for the wheat crop. In related news, SovEcon is estimating Russian 2025 wheat production at 81 mmt, which is under both last year’s 82.6 mmt crop and the USDA’s estimate of 83 mmt.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A:

- Target 699.25 vs July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- None. Still waiting for a bottom to form.

2025 Crop:

- Plan A:

- Target 693.75 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- Plan B Update: A Plan B upside call buy stop has been added, with 633.50 identified as a key resistance level for the broader trend. A close above this level could indicate a shift toward a more bullish macro trend. In that scenario, buying call options would enable sales into strength while maintaining paper ownership.

- The purpose of this stop is to try to avoid recommending call option purchases unless the market clearly signals it’s warranted — and a close above 633.50 would be that signal. As long as the market remains below this level, the expectation is for a continued sideways-to-lower macro trend, where call options would provide little or no benefit.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- None.

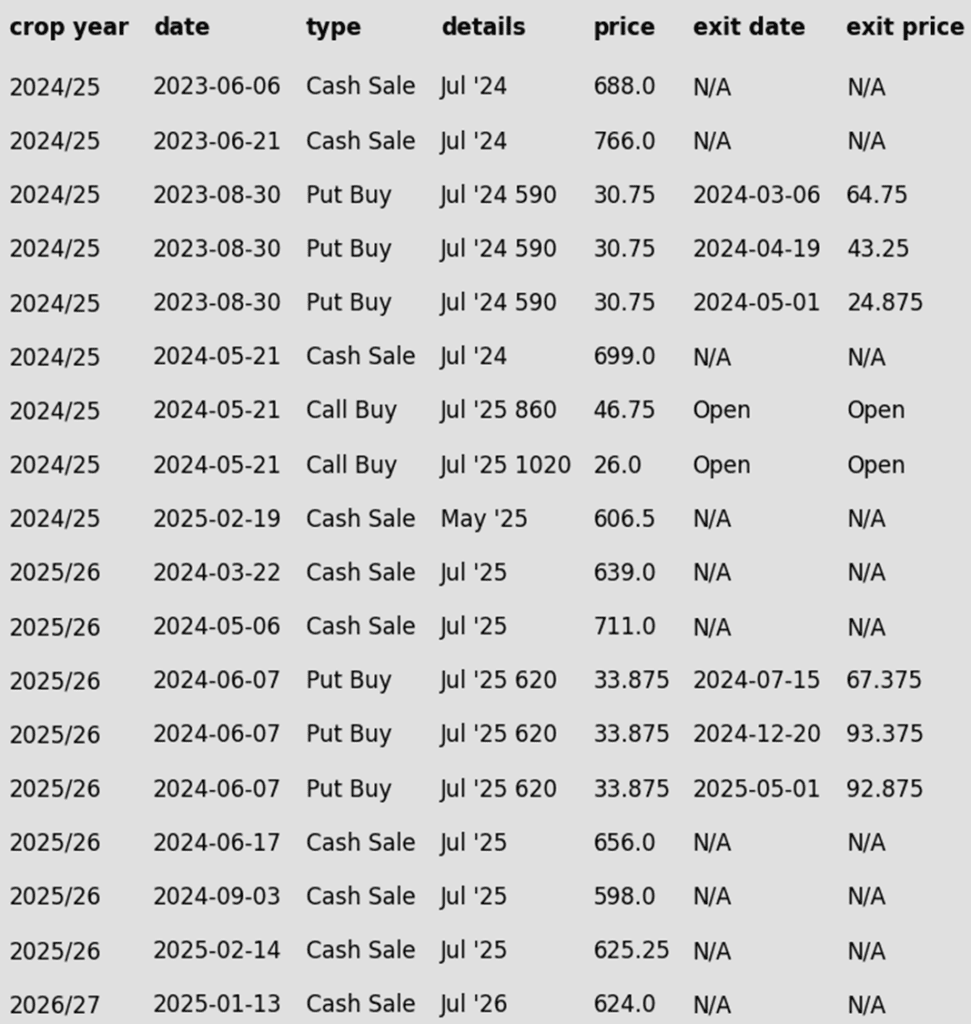

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

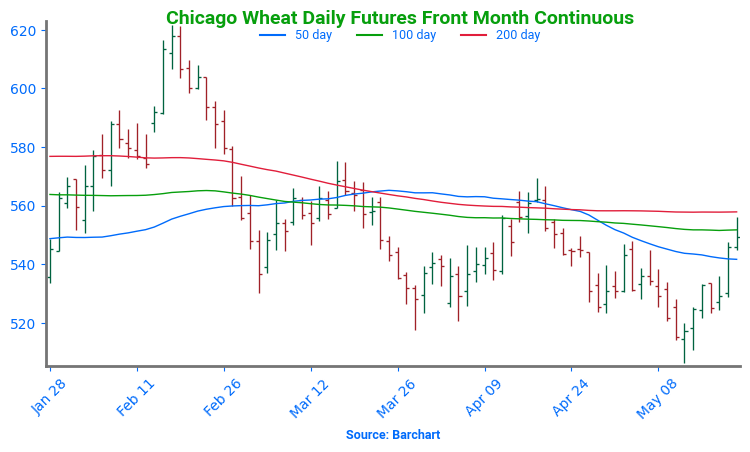

Chicago Wheat Looking for Support

After months of range-bound trading, Chicago wheat futures broke out in February, climbing to October highs just above 615. However, the rally proved short-lived, with prices quickly retreating back into their 2024 range. By mid-May, futures broke below key support near 530 and are now searching for a bottom around the 520 level. The next major technical hurdle is the 200-day moving average — a firm weekly close above this level could signal a potential trend reversal and open the door to a broader uptrend.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- None. Still waiting for a bottom to form.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- Plan B Update: A Plan B upside call buy stop has been added, with 653 identified as a key resistance level for the broader trend. A close above this level could indicate a shift toward a more bullish macro trend. In that scenario, buying call options would enable sales into strength while maintaining paper ownership.

- The purpose of this stop is to try to avoid recommending call option purchases unless the market clearly signals it’s warranted — and a close above 653 would be that signal. As long as the market remains below this level, the expectation is for a continued sideways-to-lower macro trend, where call options would provide little or no benefit.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

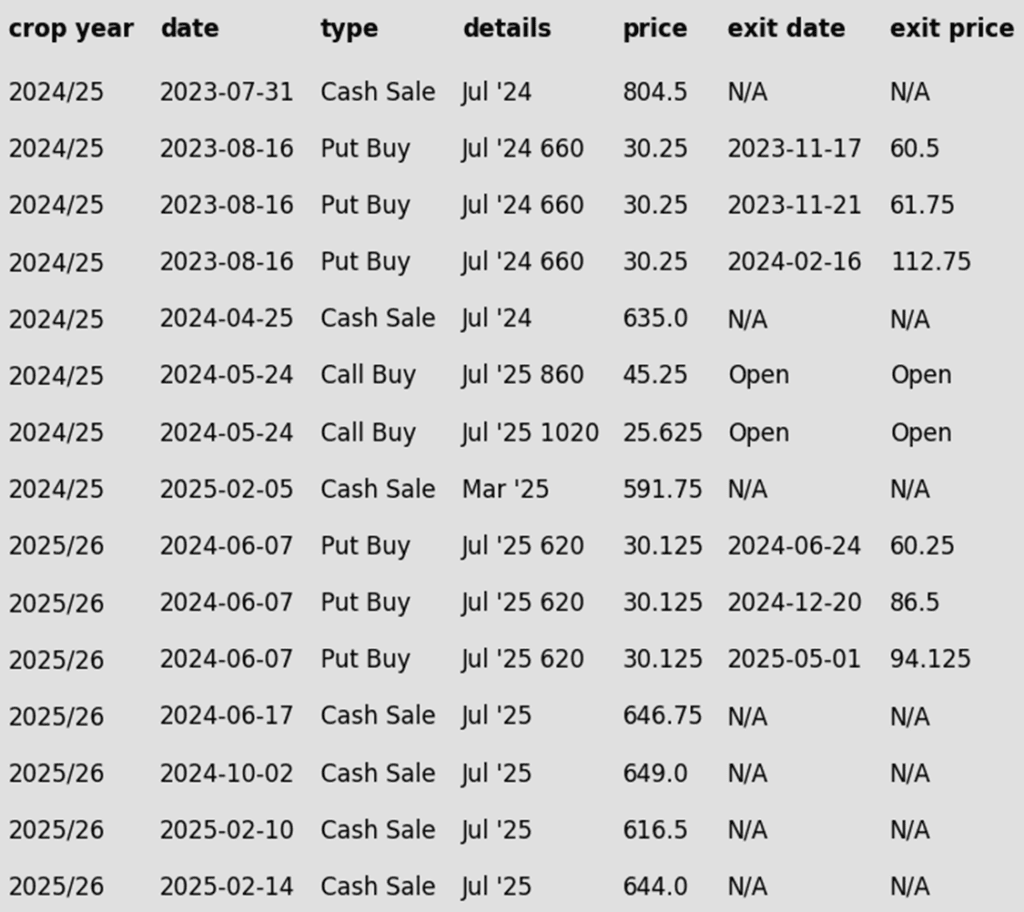

To date, Grain Market Insider has issued the following KC recommendations:

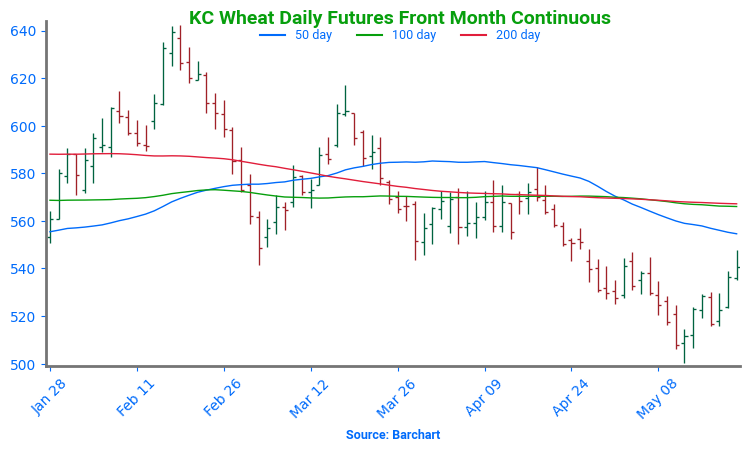

Kansas City Wheat Searching for Support

Kansas City wheat experienced sharp volatility in February, rallying early before settling flat by month’s end. Persistent weakness through March and April pushed prices toward recent lows — and the market broke below that support to start May. A recovery back above the prior 540 level would signal a potential bottom. On a rebound, the 200-day moving average stands as the first resistance, with a more formidable ceiling at the February highs near 640.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- Changes:

- None. Still waiting for a bottom to form.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- Plan B Update: A Plan B upside call buy stop has been added, with KC 653 identified as a key resistance level for the broader trend. A close above this level could indicate a shift toward a more bullish macro trend. In that scenario, buying call options would enable sales into strength while maintaining paper ownership.

- The purpose of this stop is to try to avoid recommending call option purchases unless the market clearly signals it’s warranted — and a close above KC 653 would be that signal. As long as the market remains below this level, the expectation is for a continued sideways-to-lower macro trend, where call options would provide little or no benefit.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

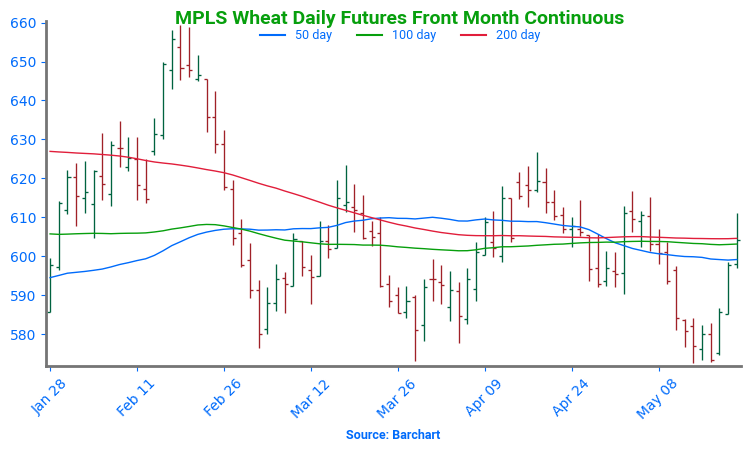

Spring Wheat Holds Recent Lows

Spring wheat futures broke out of a prolonged sideways trend in late January, sparking a wave of bullish momentum. The rally gained strength in mid-February with a decisive close above the 200-day moving average. However, late-month weakness briefly dragged futures back below key support levels.

Currently, futures are retreating toward recent lows, pressured by strong planting progress and favorable weather conditions across major spring wheat-growing regions. On a potential rebound, initial resistance is expected near the 600 level, where a confluence of moving averages could cap gains.

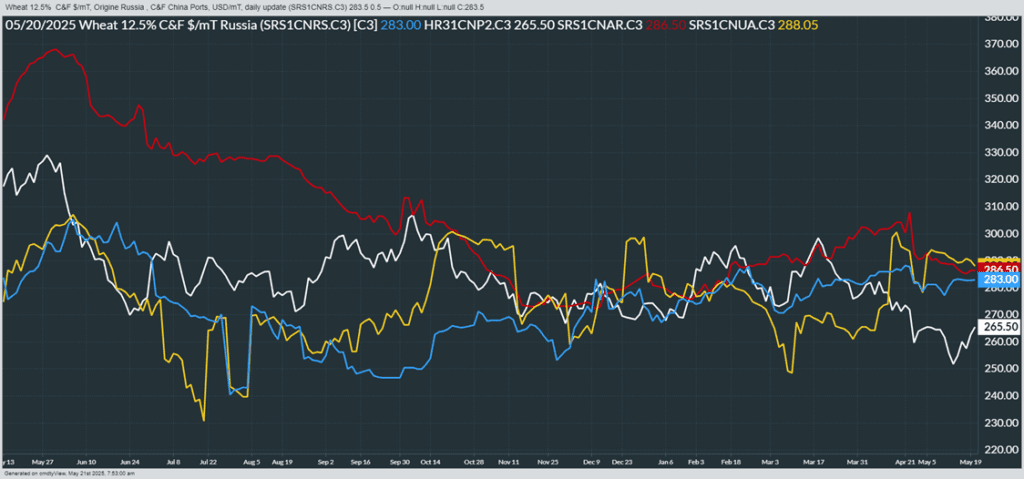

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather

Courtesy of ag-wx.com