5-16 End of Day: Corn and Wheat Slip, Soybeans Mixed to End the Week

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 443.5 | -5 |

| DEC ’25 | 435.5 | -3.25 |

| DEC ’26 | 454.75 | -3.25 |

| Soybeans | ||

| JUL ’25 | 1050 | -1.25 |

| NOV ’25 | 1035.5 | 0.25 |

| NOV ’26 | 1037.75 | -1 |

| Chicago Wheat | ||

| JUL ’25 | 525 | -7.75 |

| SEP ’25 | 539 | -7.5 |

| JUL ’26 | 600 | -5 |

| K.C. Wheat | ||

| JUL ’25 | 516.5 | -11.75 |

| SEP ’25 | 530.5 | -11.5 |

| JUL ’26 | 591.75 | -9 |

| Mpls Wheat | ||

| JUL ’25 | 573.25 | -6.75 |

| SEP ’25 | 587.25 | -5.75 |

| SEP ’26 | 654 | -4.25 |

| S&P 500 | ||

| JUN ’25 | 5966.25 | 33 |

| Crude Oil | ||

| JUL ’25 | 62.03 | 0.88 |

| Gold | ||

| AUG ’25 | 3218.9 | -35.2 |

Grain Market Highlights

- 🌽 Corn: Selling pressure returned to the corn market on Friday, capping off a fifth consecutive negative week for July futures.

- 🌱 Soybeans: Soybeans ended the week mixed, with front-month contracts slightly lower while new crop contracts posted gains in bear spreading action.

- 🌾 Wheat: Wheat futures closed lower across all three classes today, pressured by a stronger U.S. dollar and weaker Paris milling wheat futures.

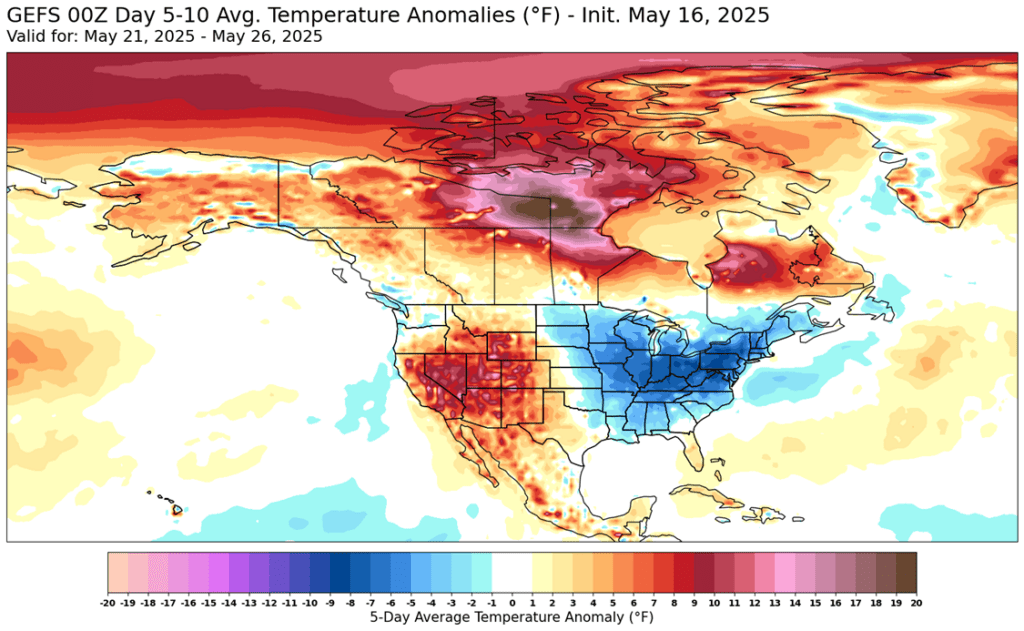

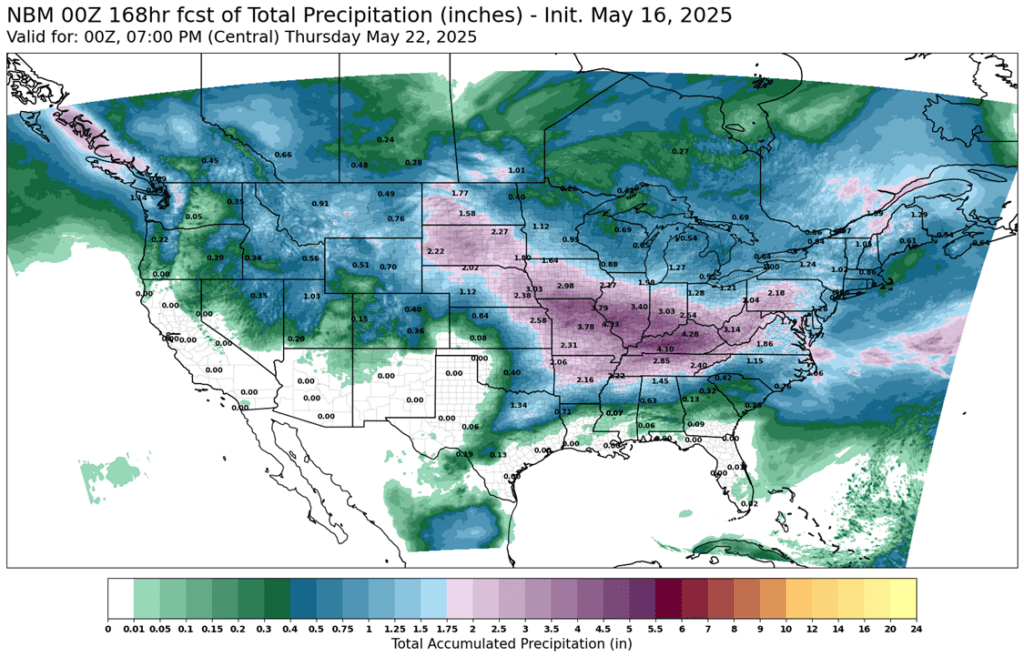

- To see the updated 7-day National Blend of Models precipitation forecast in inches as well as the 5–10-day GEFS temperature anomalies for the U.S. scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

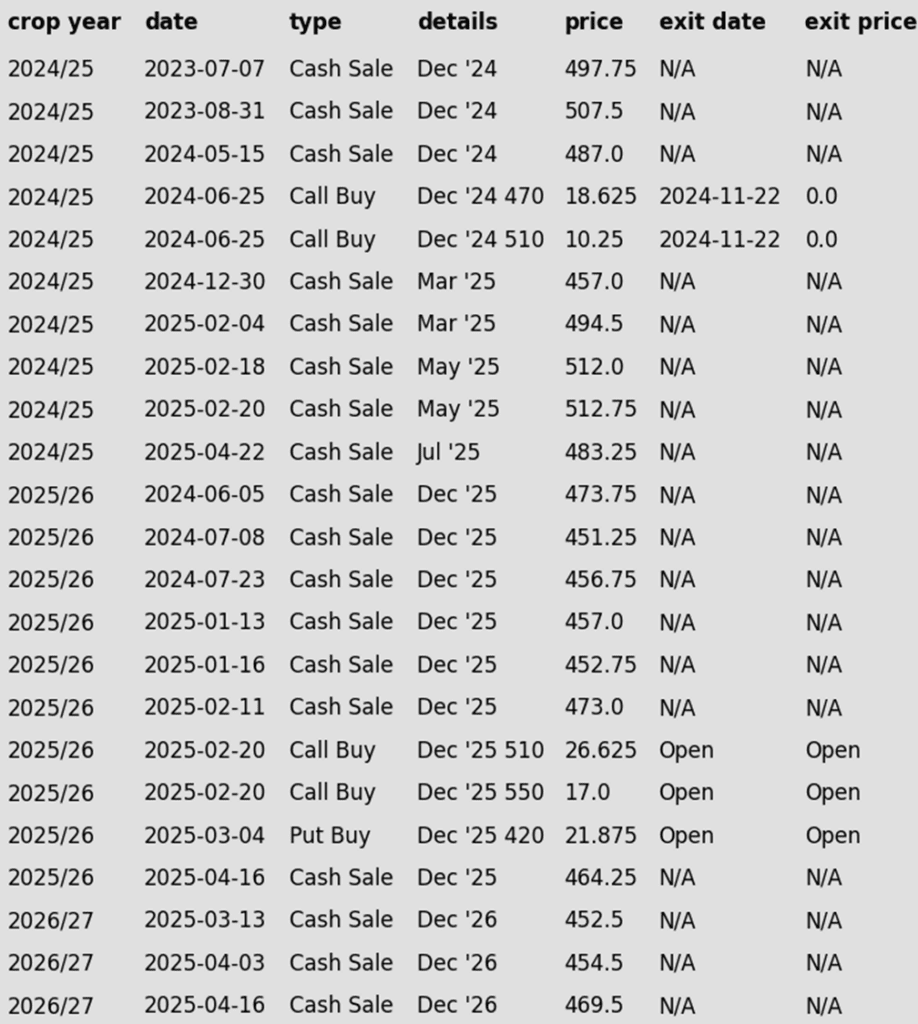

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- A Plan B downside stop could possibly be added within a day or two. The front-month contract hasn’t closed below 440 since mid-December, and the July contract is currently testing that area. If support fails to hold here, the next downside risk could be a move toward 400.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None. Prepped for growing season volatility with upside and downside targets to start legging out of open options positions.

2026 Crop:

- Plan A: Next cash sale at 474 vs December ‘26.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- Changes:

- None.

To date, Grain Market Insider has issued the following corn recommendations:

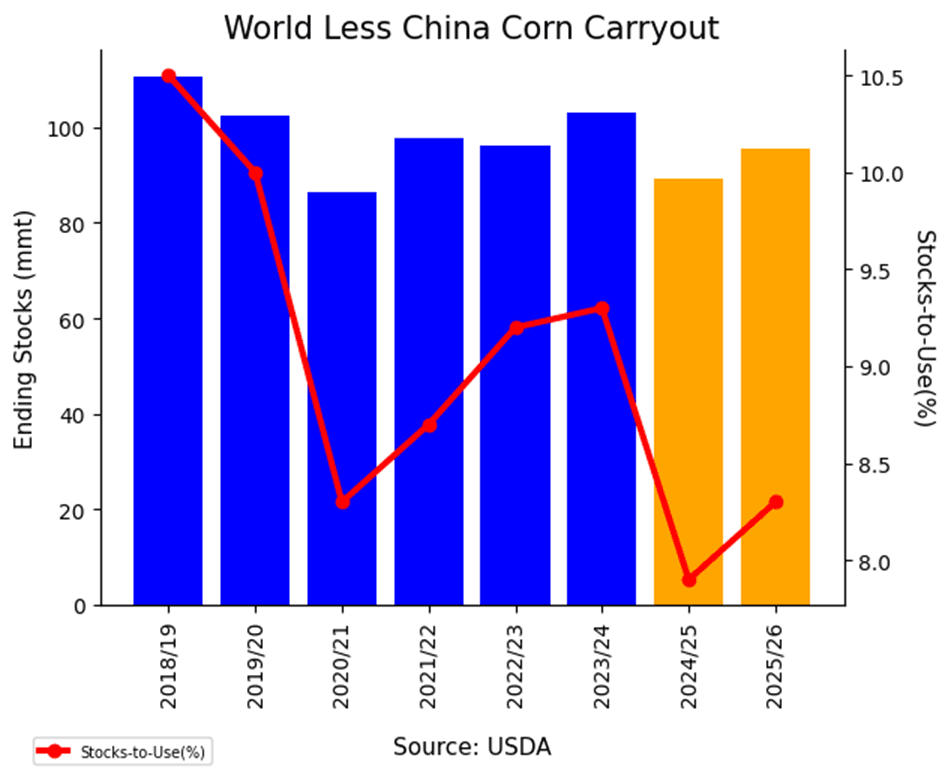

Market Notes: Corn

- Selling pressure returned to the corn market on Friday, capping off a negative week. December corn posted a new low in the current price move, while July corn reversed lower after once again failing to hold above the 450 level. The weak technical close leaves the door open for additional selling pressure to start next week. For the week, July corn ended 6 ¼ cents lower, marking the fifth consecutive weekly loss.

- Renewed discussions of a potential resolution to the Russia-Ukraine conflict weighed on both corn and wheat futures. Speculation around a possible ceasefire raised concerns about increased grain exports and competition from the Black Sea region.

- Some beneficial rainfall fell over the northern parts of the Corn Belt on Thursday. Amounts and coverage in some areas was disappointing, but rainfall is forecasted again into the weekend. That potential rainfall and cooler temperatures pressured the corn market.

- Rumors of a reduced renewable fuel blending mandate added longer-term demand concerns for corn-based ethanol. While the market had been expecting 2026 blending levels near 5.275 billion gallons, reports now suggest a possible reduction to 4.650 billion gallons. Although still above last year’s levels, the number falls short of trade expectations and has pressured futures.

- June corn options expired on Friday, introducing additional volatility. Expiration tends to steer prices toward areas of heavy open interest and can trigger either buying or selling depending on price action relative to strike levels.

Corn Back Near Calendar Year Lows

Corn futures broke higher in April after repeatedly holding support near 450, with a bullish April WASDE — highlighting stronger demand — fueling the move through the 50-day moving average. As May begins, traders are watching weather developments and demand signals to guide the next leg. February highs above 510 are the next upside target. However, early May weakness has taken out support at 470, setting up a potential retest of the critical 445-450 zone — the early 2025 low and a key technical floor.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

2025 Crop:

- Plan A:

- Next cash sales at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- Make a cash sale if November closes below 1018.50 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Changes:

- The Plan B 1016.75 stop price has been adjusted higher to 1018.50.

- Thinking sub-1000 vs November to potentially begin legging out of recently recommended 1040 January put options. More details to come once an official target is posted.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

To date, Grain Market Insider has issued the following soybean recommendations:

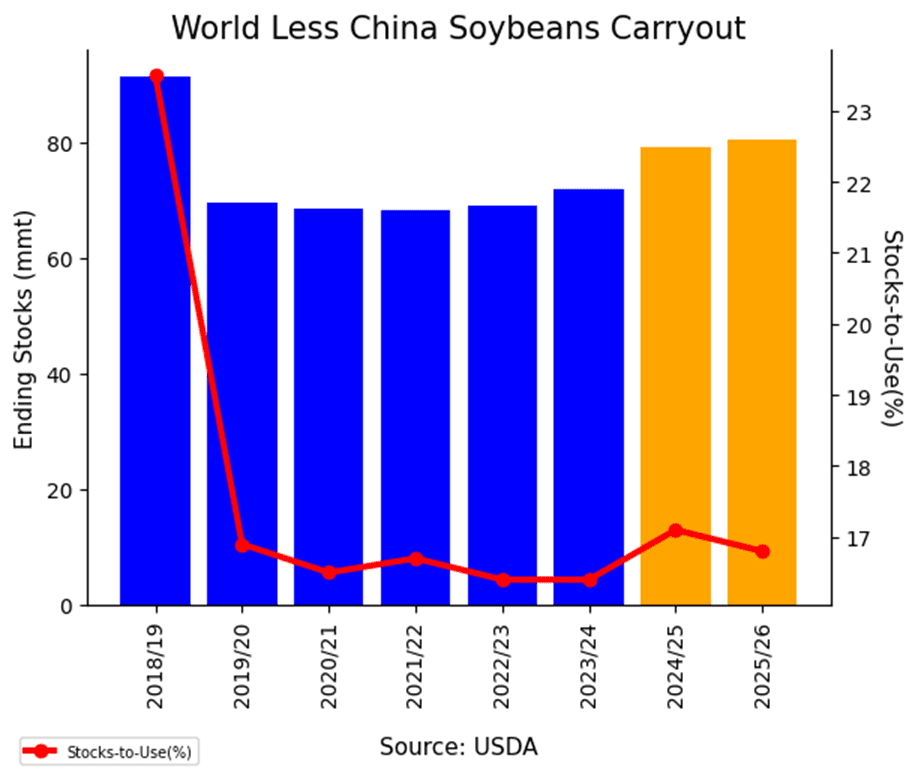

Market Notes: Soybeans

- Soybeans were mixed to end the week with the front months slightly lower and new crop contracts ending higher in bear spreading action. July soybeans found support after yesterday’s sharp sell-off at the 100 and 200-day moving averages, which have converged at $10.47. Both soybean meal and oil ended the day lower.

- Soybean oil has been the downside leader in the soy complex over the past two sessions. Pressure stemmed from comments by EPA Administrator Lee Zeldin, who confirmed that the agency will begin a new rulemaking process over the coming months to revise renewable volume obligations (RVOs). The delay has sparked concern that final biofuel mandates could come in below the expected 4.6 billion gallons, though that remains speculative.

- NOPA soybean crush for the month of April was shown at 190.226 million bushels, which was down 2.2% from March at 194.51 mb but was above trade estimates. Crush was well above last year at this time of 169.43 mb in April.

- For the week, July soybeans lost 1-3/4 cents at $10.50 while November soybeans gained 5 cents to $10.35-1/2. July soybean meal lost $2.20 to $291.90 and July soybean oil actually gained 0.36 cents to finish the week at 48.93 cents.

Soybean Futures Drift Near Upper End of Yearly Range

Soybean futures plunged below the critical 1000 level in early April on tariff news, triggering technical selling after a firm March floor gave way. But the drop was short-lived — strong buying quickly reversed the slide, lifting prices back above 1000 and reclaiming major moving averages. Most notably, the 200-day moving average — long a ceiling — was decisively cleared. With momentum shifting higher, the market is eyeing a retest of February’s highs near 1080, while the 200-day average now serves as a key layer of support on any pullbacks.

Wheat

Market Notes: Wheat

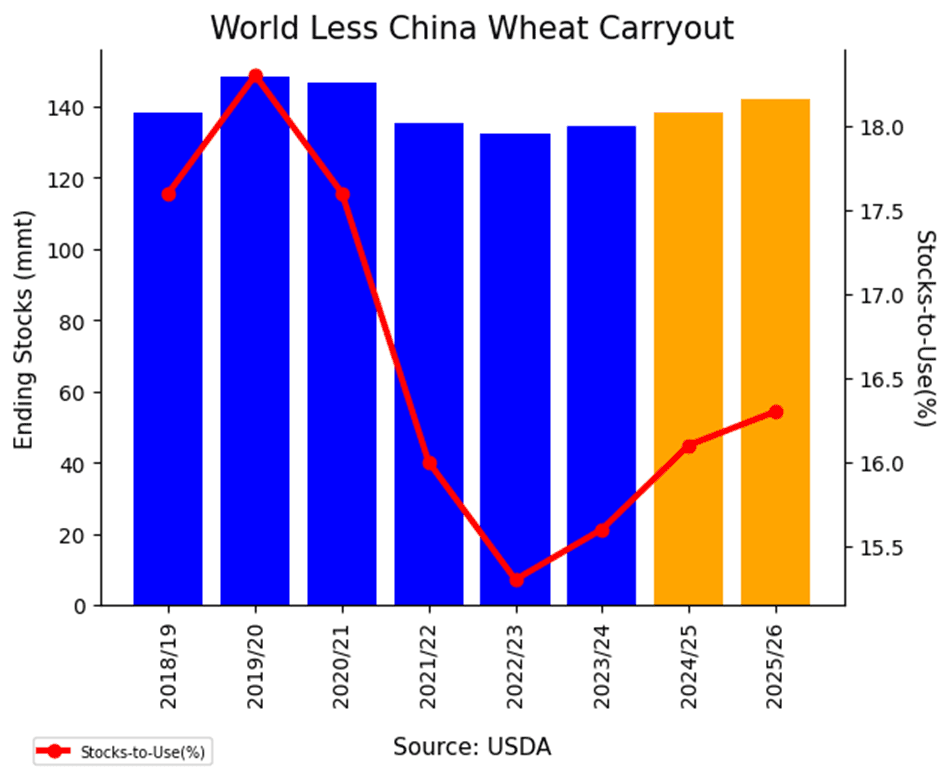

- Wheat futures closed lower across all three classes today, pressured by a stronger U.S. dollar and weaker Paris milling wheat (Matif) futures. Sentiment was also influenced by reports of potential progress in Russia-Ukraine peace talks. Ukrainian President Zelensky told President Trump he was prepared to take swift steps toward peace, as negotiations continue in Turkey. A resolution could eventually boost wheat production and exports from the Black Sea region, applying additional pressure to global prices.

- Yesterday the wheat crop tour in Kansas concluded, with the Wheat Quality Council finding a final average yield of 53 bpa, which compares to the USDA’s estimate of 50 bpa, and is the highest since 2021. However, they also estimated total production at 338.5 mb versus the USDA at 345 mb. This would seem to suggest that they are expecting a lower amount of harvested acreage.

- According to the USDA, as of May 13, an estimated 23% of U.S. winter wheat acres are experiencing drought conditions, which is up 1% from the previous week and down 2% from the same time last year. Spring wheat area in drought also increased by 1% from a week ago to 38%. This is far above last year’s 14% drought reading. But with rains in the northern Plains, spring wheat drought conditions may ease next in next week’s estimate.

- FranceAgriMer has estimated 73% of the French soft wheat crop is in good or very good condition as of May 12. This is down slightly from a week ago, but according to the USDA, areas of northern Europe are too dry – more rain will be needed for development of winter crops.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A:

- Target 699.25 vs July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- None. Still waiting for a bottom to form.

2025 Crop:

- Plan A:

- Target 693.75 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None. Still waiting for a bottom to form.

2026 Crop:

- Plan A:

- Target 675 vs July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- The 688 target was lowered to 675.

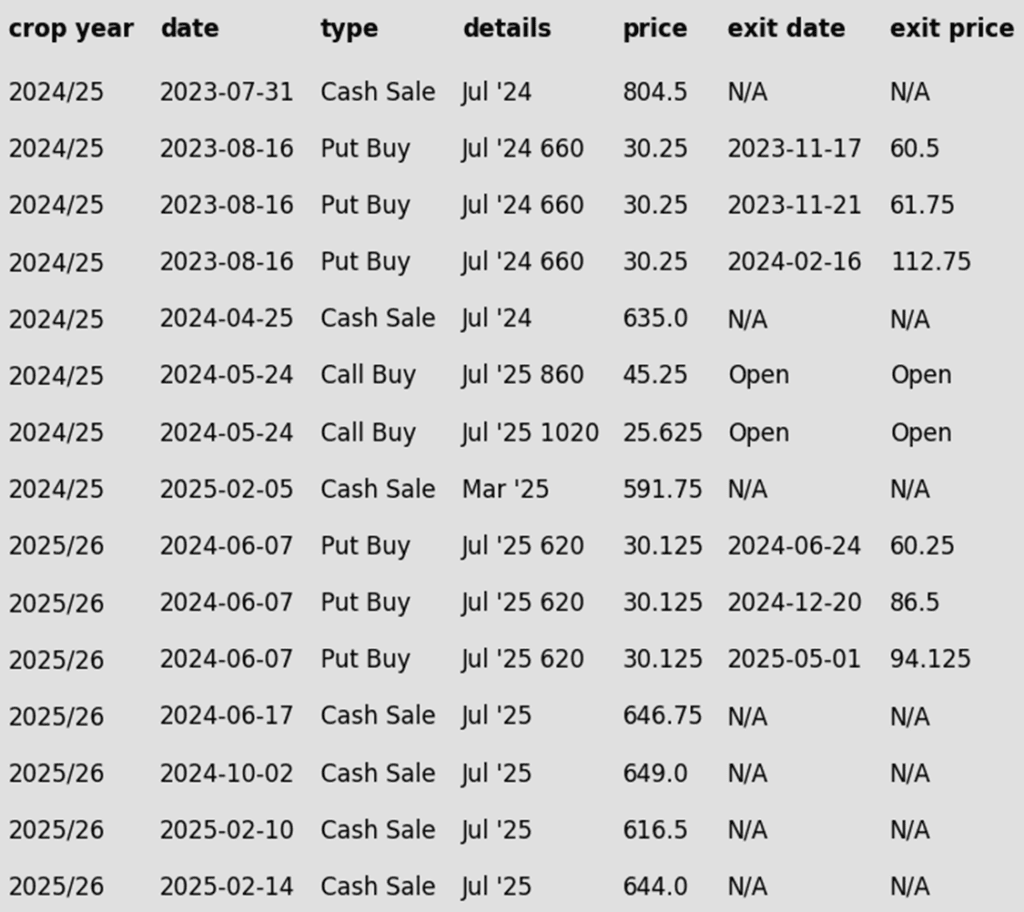

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Looking for Support

After months of range-bound trading, Chicago wheat futures broke out in February, climbing to October highs just above 615. However, the rally proved short-lived, with prices quickly retreating back into their 2024 range. By mid-May, futures broke below key support near 530 and are now searching for a bottom around the 520 level. The next major technical hurdle is the 200-day moving average — a firm weekly close above this level could signal a potential trend reversal and open the door to a broader uptrend.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- None. Still waiting for a bottom to form.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- None. Still waiting for a bottom to form.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Searching for Support

Kansas City wheat experienced sharp volatility in February, rallying early before settling flat by month’s end. Persistent weakness through March and April pushed prices toward recent lows — and the market broke below that support to start May. A recovery back above the prior 540 level would signal a potential bottom. On a rebound, the 200-day moving average stands as the first resistance, with a more formidable ceiling at the February highs near 640.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- Changes:

- None. Still waiting for a bottom to form.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None. Still waiting for a bottom to form.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holds Recent Lows

Spring wheat futures broke out of a prolonged sideways trend in late January, sparking a wave of bullish momentum. The rally gained strength in mid-February with a decisive close above the 200-day moving average. However, late-month weakness briefly dragged futures back below key support levels.

Currently, futures are retreating toward recent lows, pressured by strong planting progress and favorable weather conditions across major spring wheat-growing regions. On a potential rebound, initial resistance is expected near the 600 level, where a confluence of moving averages could cap gains.

Other Charts / Weather

Above: U.S. 7-day precipitation forecast