5-14 End of Day: Wheat Recovery Continues, Corn and Soybeans Close Mostly Higher

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 445.5 | 3 |

| DEC ’25 | 440.5 | -0.5 |

| DEC ’26 | 459.5 | -0.25 |

| Soybeans | ||

| JUL ’25 | 1077.75 | 5.25 |

| NOV ’25 | 1061.25 | 1.75 |

| NOV ’26 | 1059 | 0.5 |

| Chicago Wheat | ||

| JUL ’25 | 524.75 | 7.5 |

| SEP ’25 | 539 | 7.25 |

| JUL ’26 | 597.75 | 6.5 |

| K.C. Wheat | ||

| JUL ’25 | 523 | 11.25 |

| SEP ’25 | 537 | 10.75 |

| JUL ’26 | 596.25 | 8.75 |

| Mpls Wheat | ||

| JUL ’25 | 577 | -3.75 |

| SEP ’25 | 590.75 | -3 |

| SEP ’26 | 657.75 | 3.75 |

| S&P 500 | ||

| JUN ’25 | 5913.75 | 9.25 |

| Crude Oil | ||

| JUL ’25 | 62.61 | -0.64 |

| Gold | ||

| AUG ’25 | 3209.4 | -66.5 |

Grain Market Highlights

- 🌽 Corn: Corn futures ended mixed on Wednesday with old crop contracts slightly higher and new crop contracts fractionally lower.

- 🌱 Soybeans: Soybean futures closed higher Wednesday on bull-spreading activity, with nearby contracts gaining on new crop months.

- 🌾 Wheat: Kansas City wheat futures posted double-digit gains today, with Chicago futures not far behind, as the technical rebound continues.

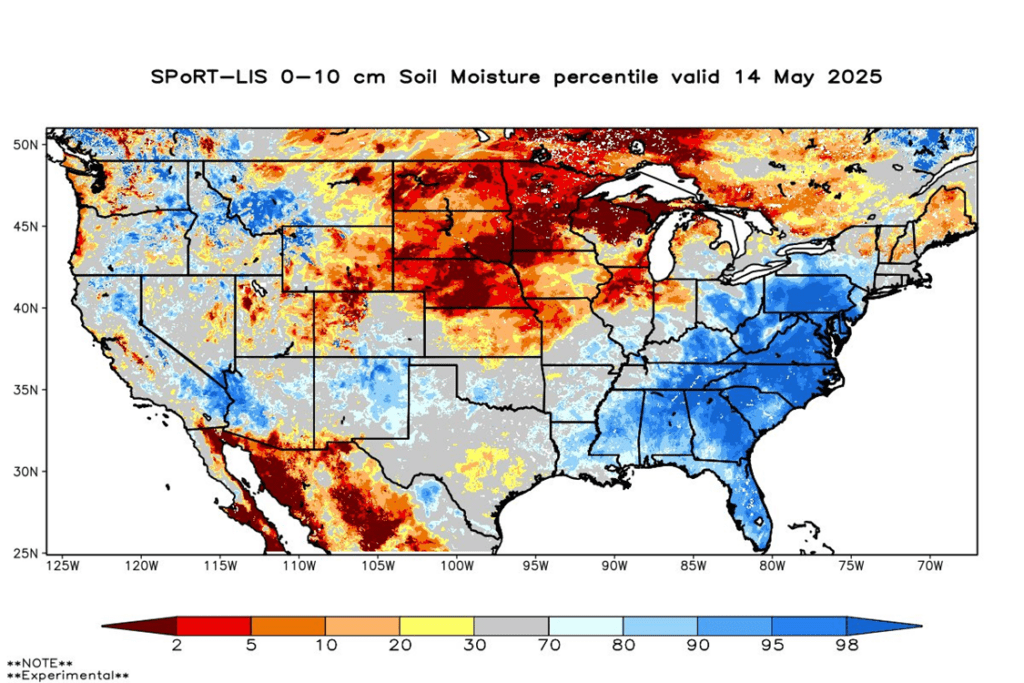

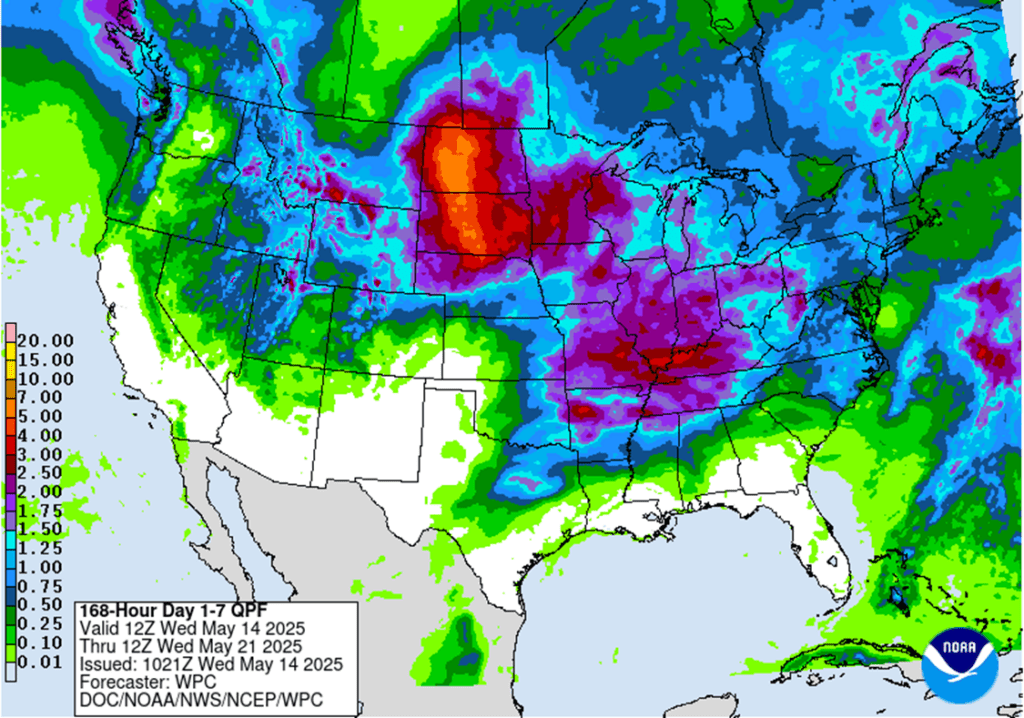

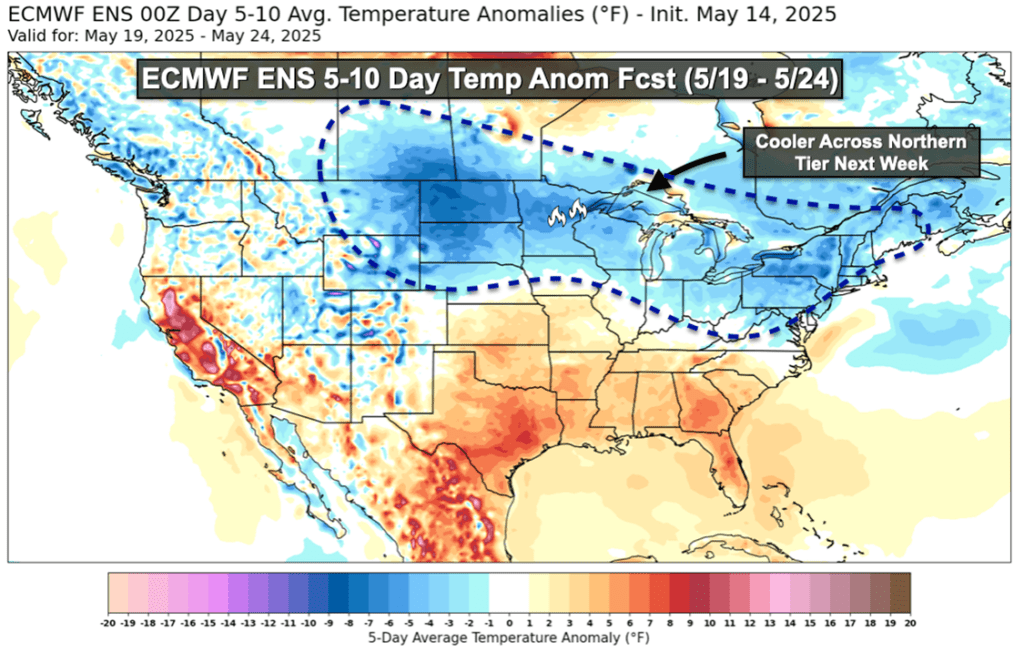

- To see the updated 7-day QPF rainfall forecast for the U.S., the 5-10 day temperature anomaly map and the subsoil moisture map for the U.S. scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes:

- A Plan B downside stop could be added within the next few trading days. The front-month contract hasn’t closed below 440 since mid-December, and the July contract is currently testing that area. If support fails to hold here, the next downside risk could be a move toward 400.

2025 Crop:

- Plan A:

- Exit all 510 December calls @ 43-5/8 cents.

- Exit half of the December 420 puts @ 43-3/4 cents.

- Exit one-quarter of the December 420 puts if December closes at 411 or lower.

- Roll-down 510 & 550 December calls if December drops to 399.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes:

- None.

2026 Crop:

- Plan A: Next cash sale at 474 vs December ‘26.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- Changes:

- None.

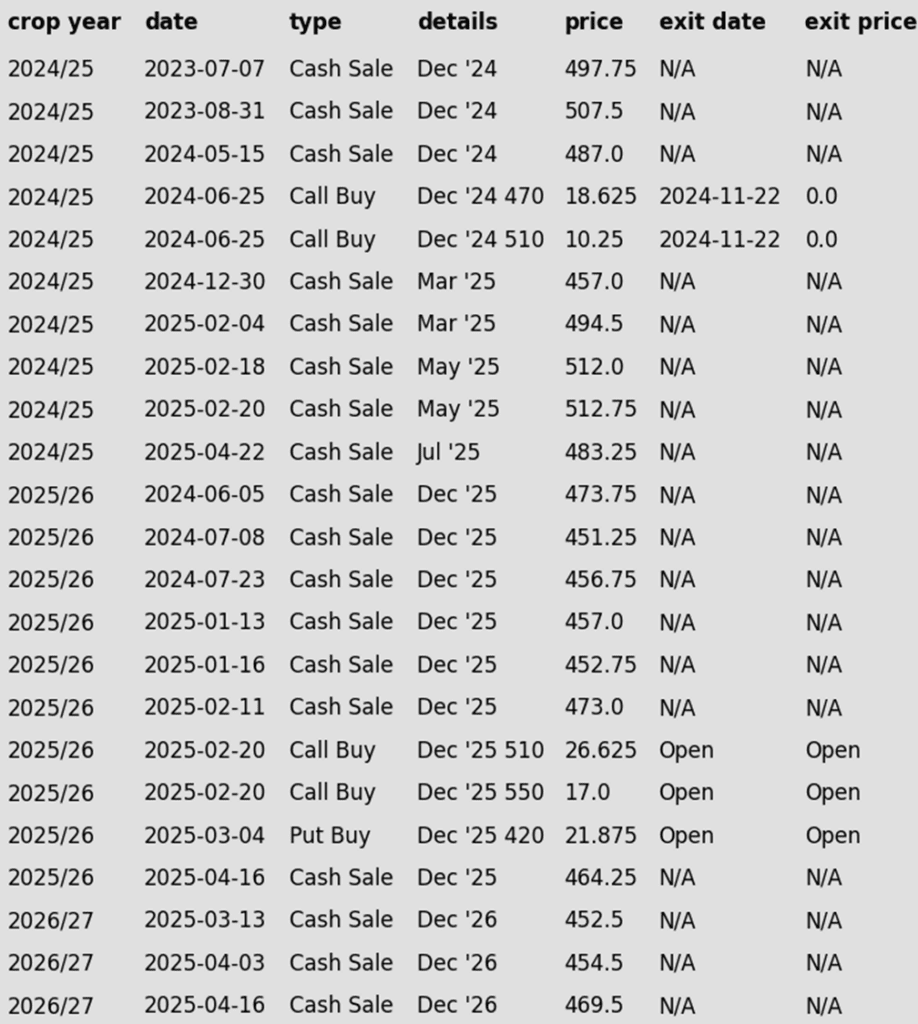

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures saw reduced downward momentum on Wednesday as May contracts expired. Light buying interest emerged in the old crop market, supported by solid demand. May corn futures finished trading on Wednesday, settling at $4.38½.

- The USDA will release its weekly Export Sales report Thursday morning. For the week ending May 8, new corn sales for the 2024-25 marketing year are expected to range between 1.2 and 2.1 million metric tons (MMT). Last week’s sales totaled 1.6805 MMT, reflecting continued strength in old crop demand.

- In weekly ethanol production, total production slipped to 292 million barrels/day, down 8 mbpd from last week and down 1% from last year. This total was below expectations and the lowest production in the past 53 weeks. Total corn used last week was estimated at 99 mb, which was slightly below the pace needed to reach USDA targets for the marketing year.

- Planting conditions remain favorable, with most areas enjoying an open window to complete fieldwork. Heading into the weekend, forecasts show improved chances of beneficial precipitation across key growing regions. While supportive for early crop development, this may limit near-term rallies in the corn market.

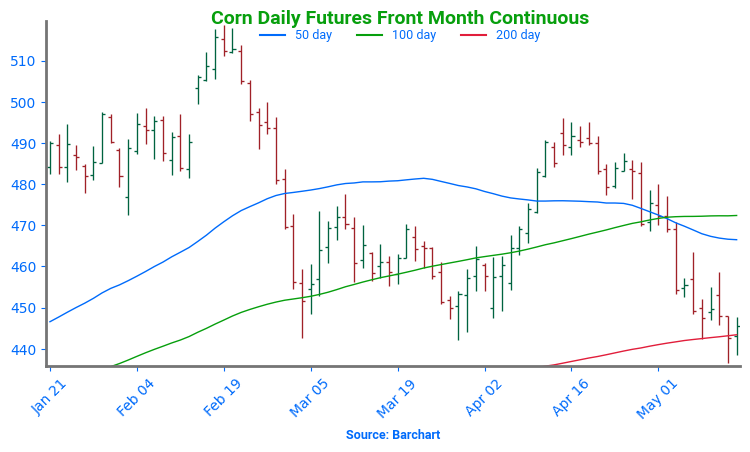

Corn Back Near Calendar Year Lows

Corn futures broke higher in April after repeatedly holding support near 450, with a bullish April WASDE — highlighting stronger demand — fueling the move through the 50-day moving average. As May begins, traders are watching weather developments and demand signals to guide the next leg. February highs above 510 are the next upside target. However, early May weakness has taken out support at 470, setting up a potential retest of the critical 445-450 zone — the early 2025 low and a key technical floor.

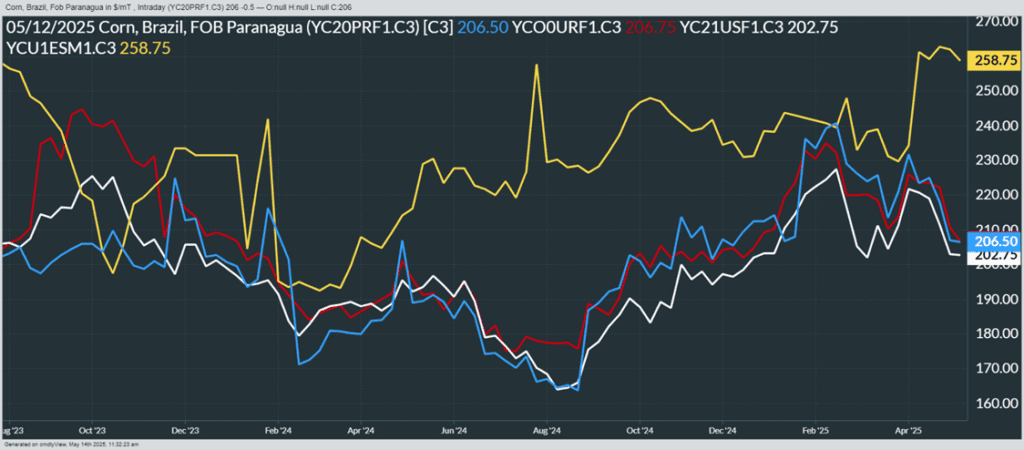

Above: From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Enter(Buy) JAN ’26 Puts:

1040 @ ~ 62c

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes:

- None.

2025 Crop:

- CONTINUED OPPORTUNITY – Buy January ‘26 1040 put options for approximately 62 cents in premium, plus fees and commission.

- Plan A:

- Next cash sales at 1114 vs November.

- Exit one-third of 1100 call options at 1085 vs November.

- Exit remaining two-thirds of 1100 November call options at 88 cents.

- Plan B:

- Make a cash sale if November closes below 1016.75 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

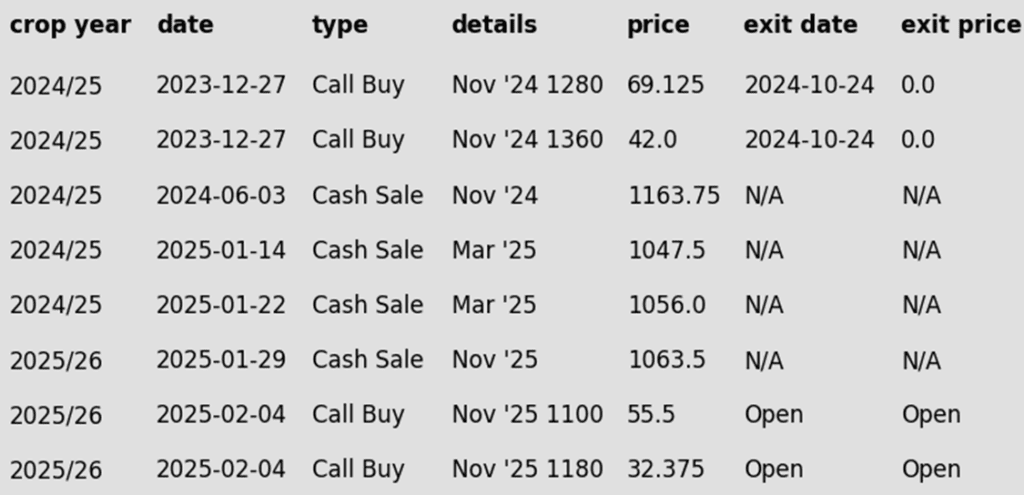

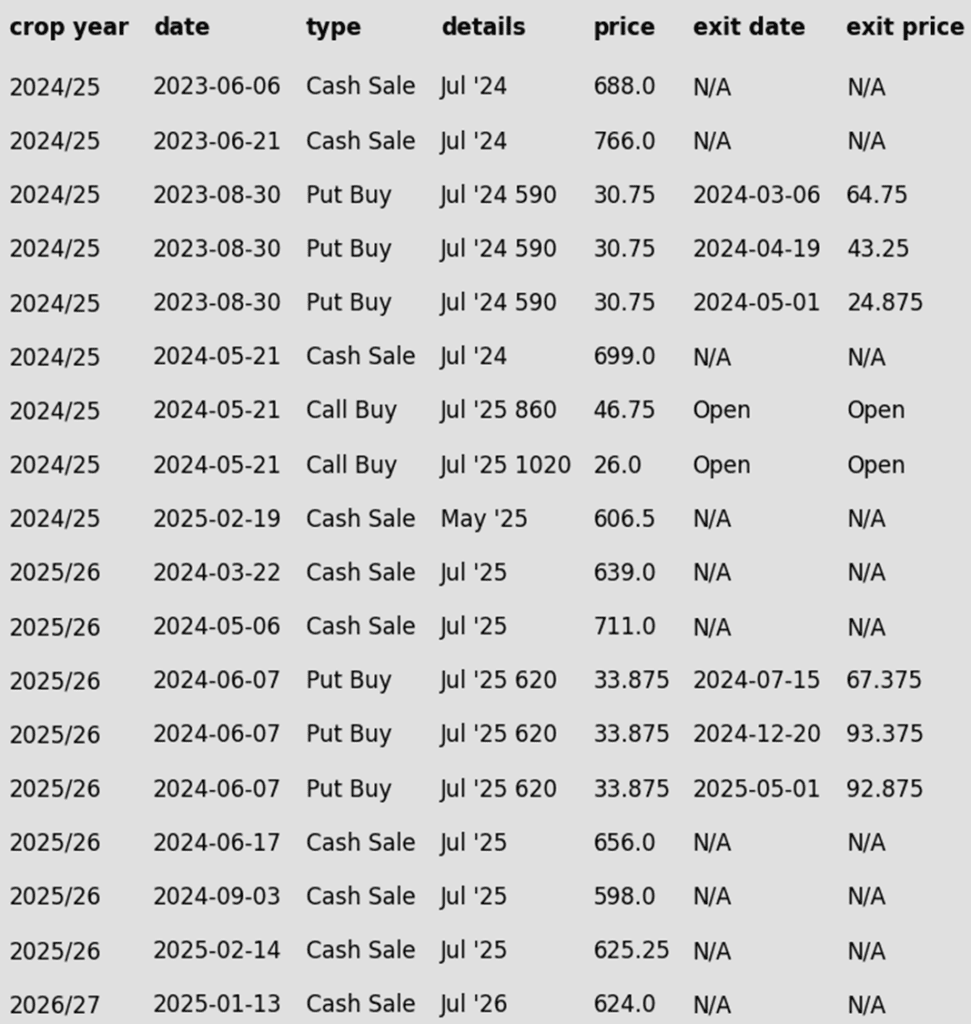

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher in bull spreading action with the front months gaining on the new crop contracts. Futures continued to break out of their recent trading range as traders focus on smaller acres and a potentially very small ending stocks number. Soybean meal ended the day lower while soybean oil was higher.

- U.S. soybean exports could decline by up to 20% without a trade agreement with China, according to AgResource. Although tariffs have been significantly reduced, they remain higher than pre-trade war levels. Meanwhile, Brazilian President Lula has stated he is not concerned about potential U.S. retaliation over Brazil’s strengthening ties with China.

- In Brazil, one of the largest grain producers, SLC Agrícola SA, is expected to increase its planted acreage in 25/26 by nearly 14% starting in July. The company has expanded by acquiring smaller farms and grows corn, soybeans, and cotton.

- China is expected to reduce its soybean imports in 25/26 in order to cut use of soybean meal in the livestock sector. Soybean imports are expected to fall to 95.8 million tons, which would be down 2.8% from the forecast amount this year. This will impact both U.S. and South American export sales.

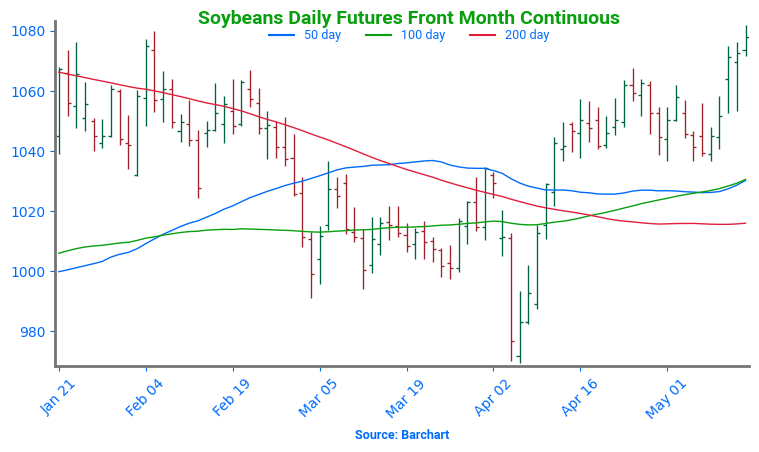

Soybean Futures Drift Near Upper End of Yearly Range

Soybean futures plunged below the critical 1000 level in early April on tariff news, triggering technical selling after a firm March floor gave way. But the drop was short-lived — strong buying quickly reversed the slide, lifting prices back above 1000 and reclaiming major moving averages. Most notably, the 200-day moving average — long a ceiling — was decisively cleared. With momentum shifting higher, the market is eyeing a retest of February’s highs near 1080, while the 200-day average now serves as a key layer of support on any pullbacks.

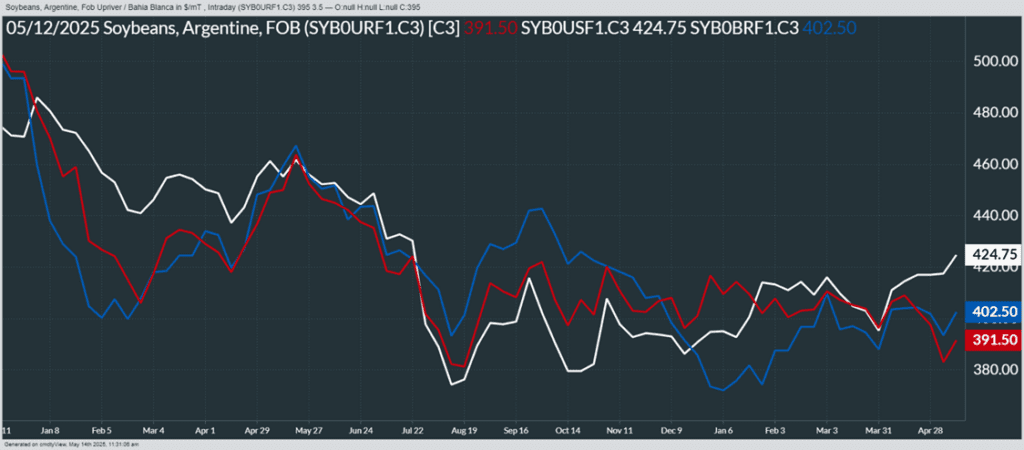

Above: From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

- Kansas City wheat futures posted double-digit gains today, with Chicago futures not far behind, as the technical rebound continues. Winter wheat contracts remain near the bottom of the charts, and oversold conditions may be encouraging short covering. In contrast, Minneapolis wheat closed modestly lower, weighed down by recent rainfall across the Northern Plains and a rapid planting pace.

- The first day of the Kansas wheat crop tour came with an average yield estimate of 50.5 bpa. This compares with last year’s estimate of 49.9 bpa, and a five-year average of 45.1 bpa. For reference, the USDA is estimating Kansas’ wheat yield at 50 bpa versus 43 bpa last year.

- On a bearish note, the Russian ag ministry has said that frost damage has impacted about 100,000 hectares this month. This is only about 10% versus the amount impacted at this time last year. Additionally, the Black Sea region is expecting scattered rains that should benefit crop conditions.

- In Argentina, conditions have been mostly favorable for winter wheat planting so far. Later this week and into the weekend, northern and eastern regions have rain in the forecast. More precipitation is possible next week too, and this would promote establishment of the early planted wheat crop.

- According to their ag ministry, Ukrainian grain exports have reached 36.7 mmt since the season began on July 1. This represents a 17% decline year over year. Wheat exports in particular are down 13.3% year over year at 14.4 mmt. Furthermore, grain exports so far this month, at 1.5 mmt, are down nearly 50% from the same time period a year ago.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A:

- Target 699.25 vs July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes:

- The 701 target was lowered to 699.25.

2025 Crop:

- Plan A:

- Target 693.75 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A:

- Target 688 vs July ‘26 for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes:

- The 696 target was lowered to 688.

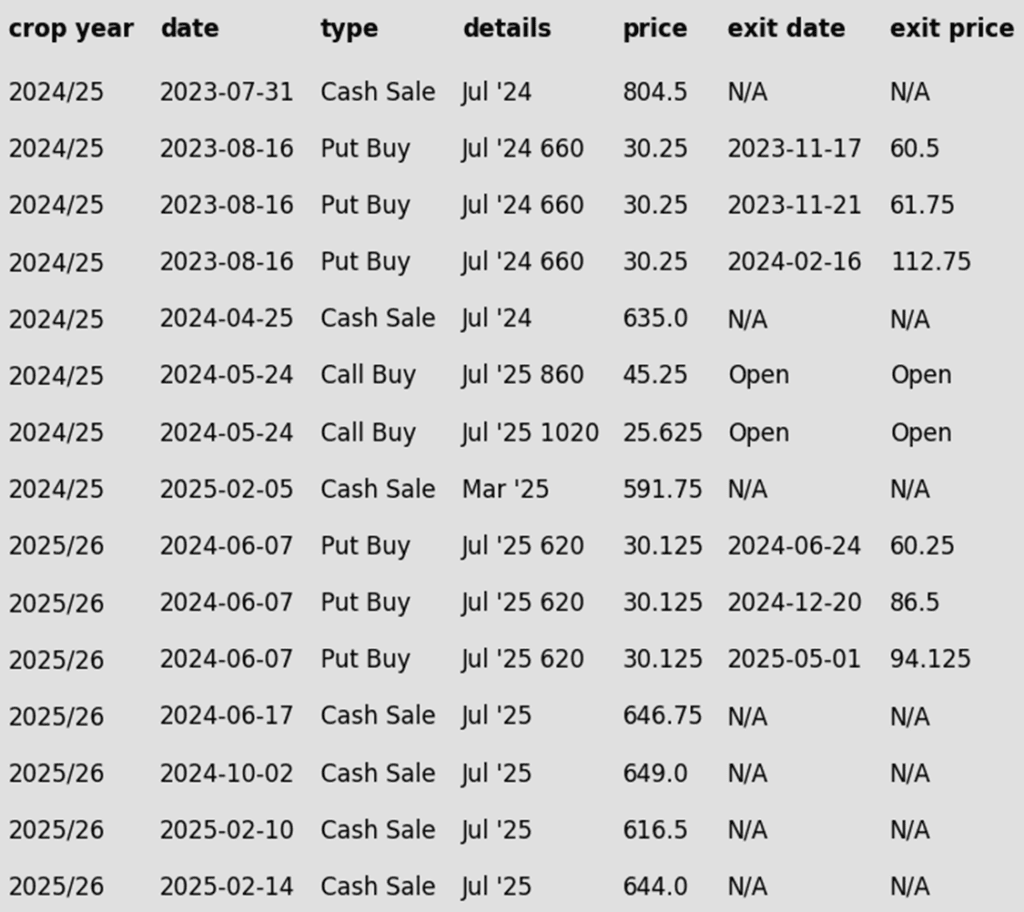

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

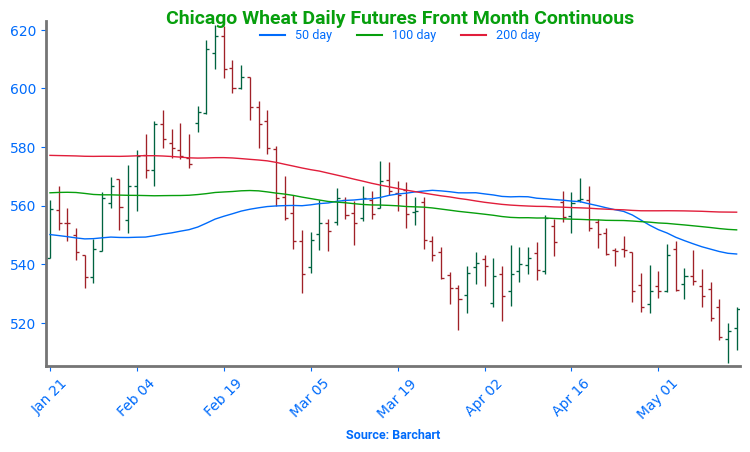

Chicago Wheat Looking for Support

After months of range-bound trading, Chicago wheat futures broke out in February, climbing to October highs just above 615. However, the rally proved short-lived, with prices quickly retreating back into their 2024 range. By mid-May, futures broke below key support near 530 and are now searching for a bottom around the 520 level. The next major technical hurdle is the 200-day moving average — a firm weekly close above this level could signal a potential trend reversal and open the door to a broader uptrend.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes:

- None.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Changes:

- The 645 target was cancelled.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes:

- None.

To date, Grain Market Insider has issued the following KC recommendations:

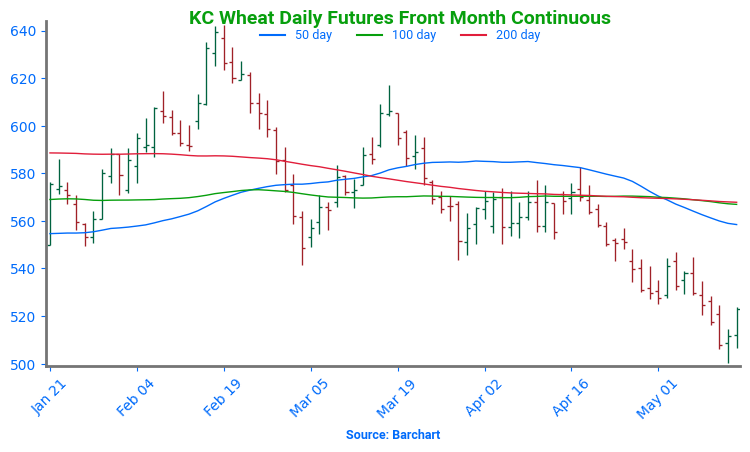

Kansas City Wheat Searching for Support

Kansas City wheat experienced sharp volatility in February, rallying early before settling flat by month’s end. Persistent weakness through March and April pushed prices toward recent lows — and the market broke below that support to start May. A recovery back above the prior 540 level would signal a potential bottom. On a rebound, the 200-day moving average stands as the first resistance, with a more formidable ceiling at the February highs near 640.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- Changes:

- None.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Changes:

- None.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes:

- None.

- Changes:

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

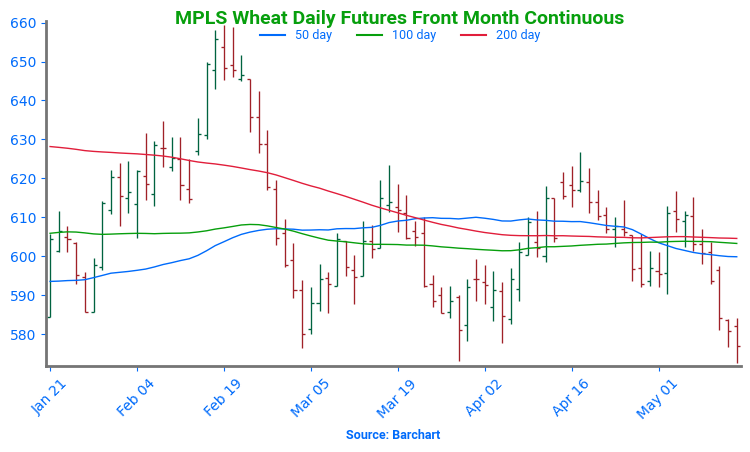

Spring Wheat Holds Recent Lows

Spring wheat futures broke out of a prolonged sideways trend in late January, sparking a wave of bullish momentum. The rally gained strength in mid-February with a decisive close above the 200-day moving average. However, late-month weakness briefly dragged futures back below key support levels.

Currently, futures are retreating toward recent lows, pressured by strong planting progress and favorable weather conditions across major spring wheat-growing regions. On a potential rebound, initial resistance is expected near the 600 level, where a confluence of moving averages could cap gains.

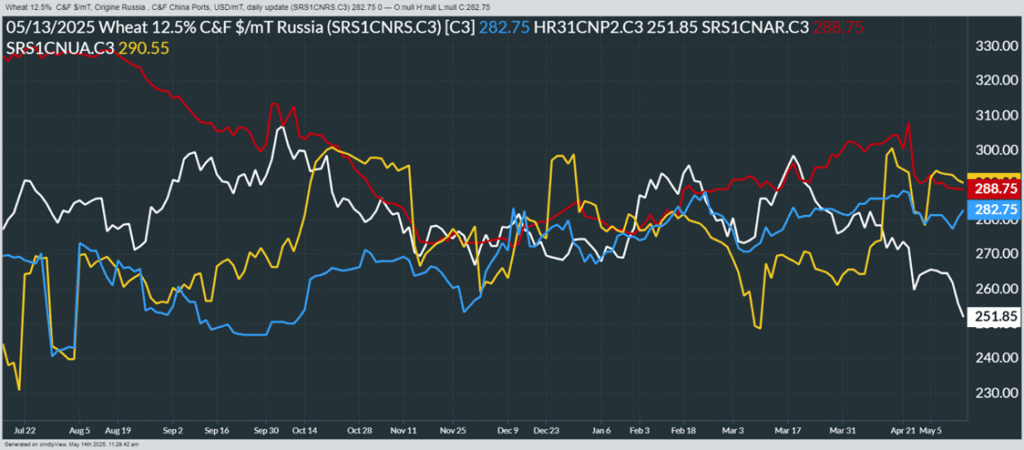

Above: From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather

Above: Courtesy of ag-wx.com