5-02 End of Day: Grains Diverge Friday: Wheat Surges, Corn Slips, Soybeans Stabilize

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 469 | -3.25 |

| DEC ’25 | 450.25 | 3 |

| DEC ’26 | 465.5 | 1.75 |

| Soybeans | ||

| JUL ’25 | 1058 | 7.75 |

| NOV ’25 | 1030.5 | 6.5 |

| NOV ’26 | 1038 | 5.25 |

| Chicago Wheat | ||

| JUL ’25 | 543 | 12 |

| SEP ’25 | 556.75 | 11.5 |

| JUL ’26 | 612.25 | 7.75 |

| K.C. Wheat | ||

| JUL ’25 | 541.25 | 13.75 |

| SEP ’25 | 555.5 | 13.5 |

| JUL ’26 | 611.25 | 11.25 |

| Mpls Wheat | ||

| JUL ’25 | 611 | 15.5 |

| SEP ’25 | 622.5 | 14.75 |

| SEP ’26 | 663.5 | 2 |

| S&P 500 | ||

| JUN ’25 | 5719.5 | 96.25 |

| Crude Oil | ||

| JUL ’25 | 57.8 | -0.88 |

| Gold | ||

| AUG ’25 | 3265 | 14.7 |

Grain Market Highlights

- Corn: Corn futures saw mixed trading on Friday, as selling pressure weighed on front-month contracts while new crop futures posted gains.

- Soybeans: Soybeans ended the week on a firm note, gaining strength over the last two sessions as July contracts test the top of their recent trading range.

- Wheat: Wheat led the grain complex higher, posting double-digit gains across all three classes as prices rebounded from recent lows.

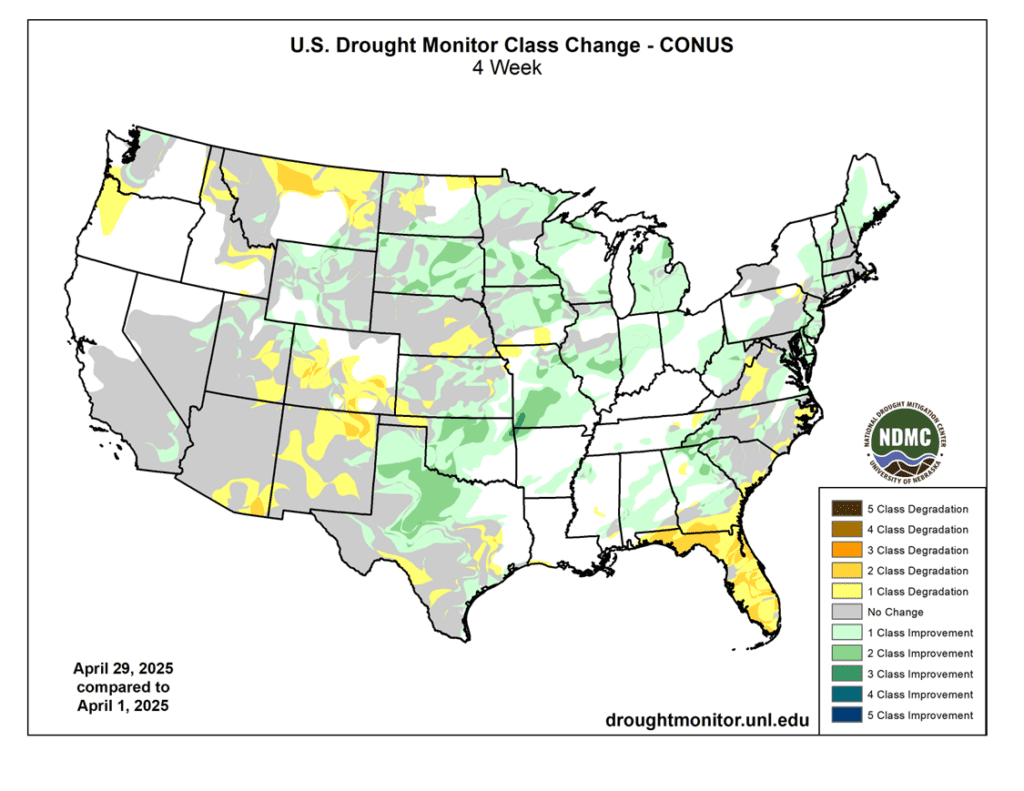

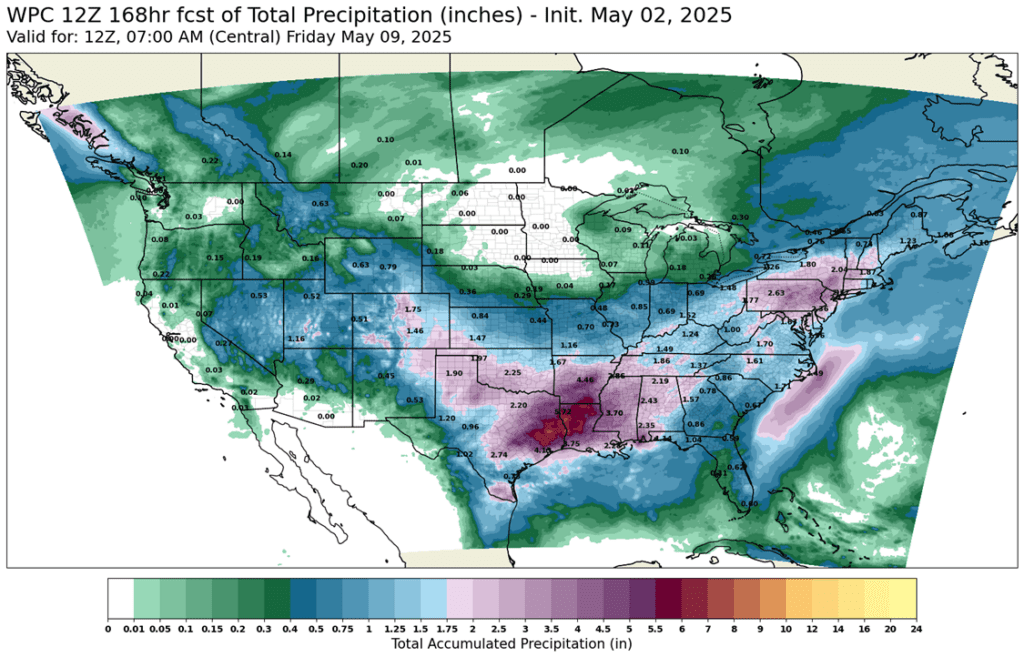

- To see the updated 4-week drought monitor change for the U.S. as well as the 7-day rainfall forecast from the WPC for the U.S. scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- Changes: None.

2025 Crop:

- Plan A: Exit all 510 December calls @ 43-5/8 cents. Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- Changes: None.

2026 Crop:

- Plan A: Next cash sale at 474 vs December ‘26.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- Changes: None.

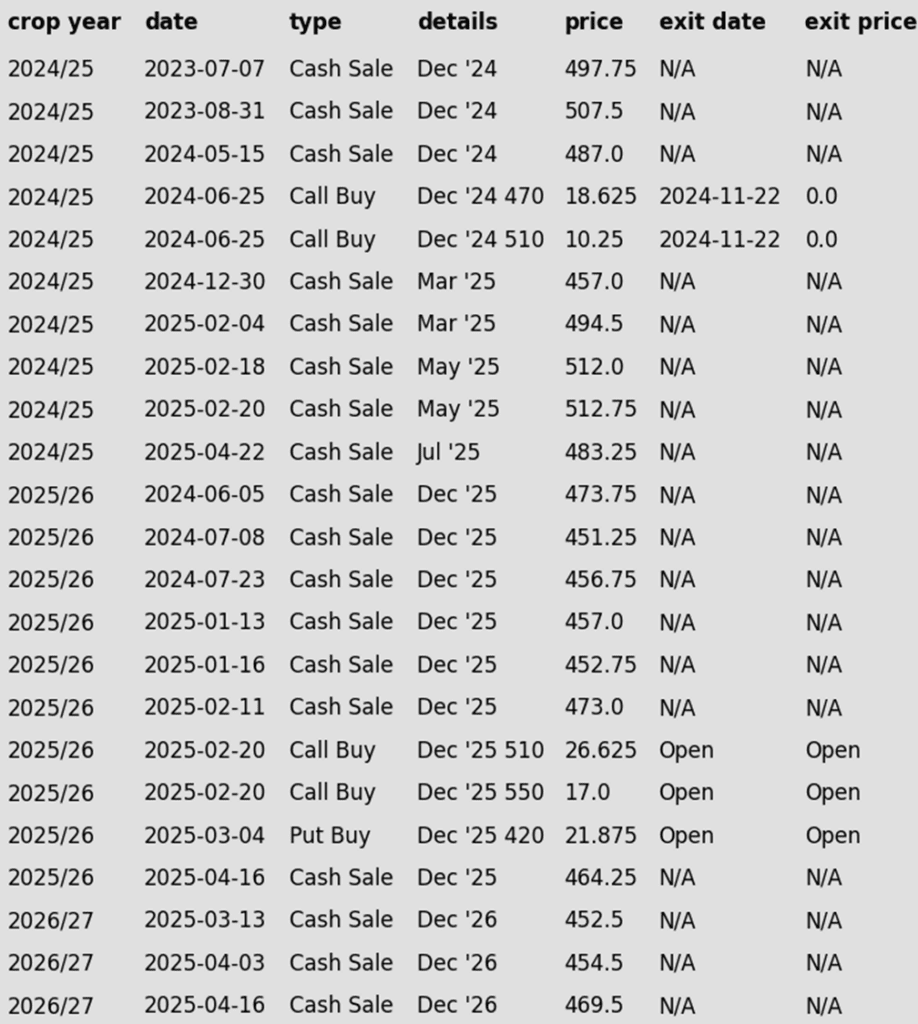

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market saw mixed trade again on Friday as selling pressure at the front end of the market limited gains. Good planting pace, and a strong Brazil corn crop limited the front end of the corn market, despite a still strong demand tone. For the week, July futures finished 16 ¼ cents lower as the corn market saw strong bear spreading.

- The old crop corn demand tone remains supportive despite the weak price action this week. Export sales, export shipments, and ethanol usage are trending ahead of the USDA targets for the marketing year. The USDA may need to make adjustments to the demand on May 12 WASDE report, lowering old crop carryout even further.

- Brazil weather forecast has been favorable for development of the key second crop corn. Analyst estimates for this Brazil crop have been increased, and harvest could limit summer global corn prices in the export market.

- Commodity markets in general were supported by a potential easing of the trade war between the U.S. and China. Reports of both parties may be more open to talks, and China removed the tariffs on $40 billion worth of U.S. imports.

Corn on the Move: Bulls Eye 510+ After Breakout

Corn futures broke out in April after holding key support near 450 through much of March. A bullish April WASDE report highlighting stronger demand sparked the rally, with prices pushing through the 50-day moving average. All eyes now turn to planting progress and demand trends to drive the next move. The February highs just above 510 are the next upside target, while support is firming near 470 at the top of the previous range.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- Changes: None.

2025 Crop:

- Plan A: Next cash sales at 1093 & 1114 vs November. Exit all 1100 November call options at 88 cents.

- Plan B: Make a cash sale if November closes below 1016.75 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Changes: None. If you’re behind on sales, target 1063 vs November for a catch-up opportunity. If you’re in line with current recommendations, Plan A remains to make the next cash sales at 1093 and 1114, while keeping an eye on 1016.75 support as part of Plan B.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes: None.

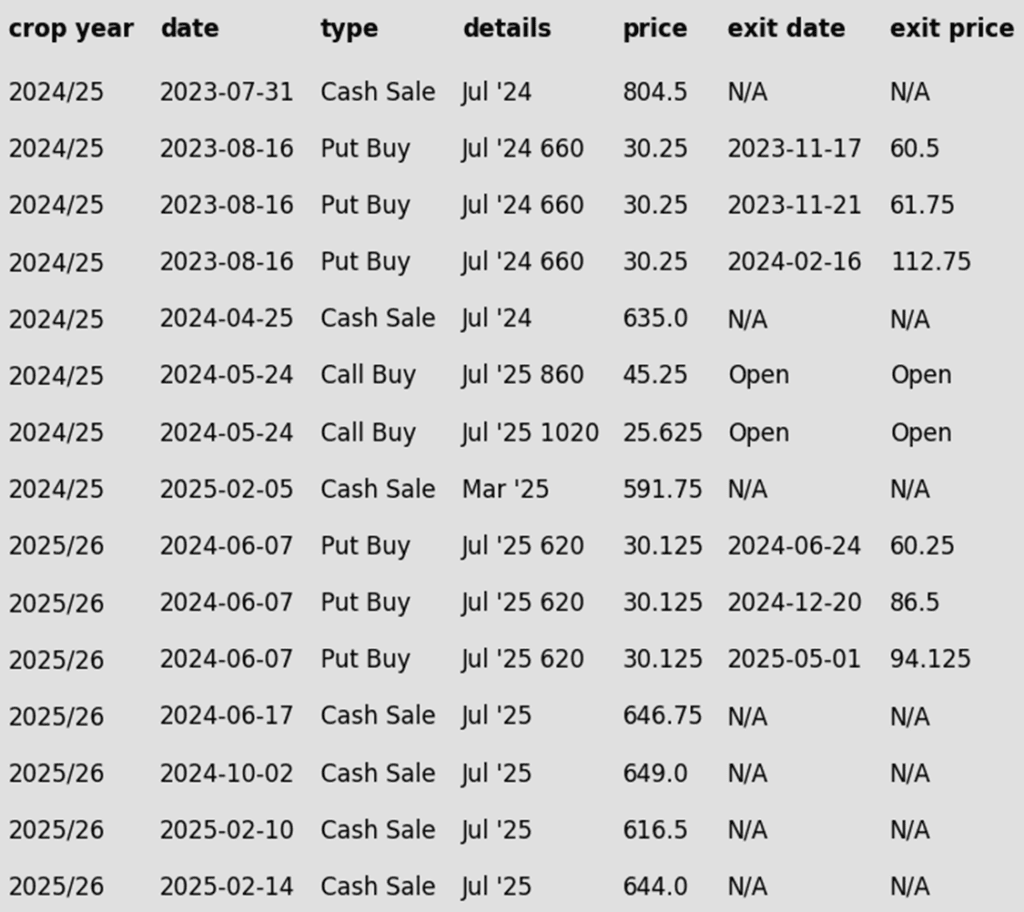

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher with strength over the past two days to close out the week. While July beans remain in their trading range, they are at the top, and another 10-cent increase would be a breakout to the upside. There has been some talk of too much rain in some areas, but funds are likely taking profits ahead of the weekend. Soybean meal was higher while soybean oil followed crude lower.

- Today, StoneX raised their estimate for the Brazilian soybean crop for 24/25 to 168.4 mmt from 167.5 mmt in their previous estimates. This would be a record crop at a time where China may be poised to purchase nearly all of their soybeans from Brazil, forgoing the U.S., unless tariffs are lifted.

- China is reportedly evaluating the U.S. in order to negotiate tariffs as long as “Washington does not engage in extortion and coercion”. While both sides clearly want to negotiate a deal, neither country has seemed willing to back down. A deal being made by harvest would be crucial for soybean demand in the U.S.

- For the week, July soybeans lost 1-1/4 cents, recovering much of their losses earlier in the week. November soybeans meanwhile lost 4-1/2 cents. July soybean meal lost $1.60 to $296.90 while July soybean oil lost 0.38 cents to 49.43 cents.

Soybean Futures Rebound: Momentum Builds Above Key Support

Soybean futures dropped sharply in early April after newly announced tariffs triggered a break below key support near 1000, a level that had held firm through March. However, strong buying interest fueled a swift rebound, pushing futures back above the pivotal 1000 mark and reclaiming major moving averages — especially the 200-day, which had capped rallies for the past two years. With momentum rebuilding, the market is now eyeing the February highs near 1080, while the 200-day moving average is expected to provide support on any spring pullbacks.

Wheat

Market Notes: Wheat

- Wheat led the charge higher in the grain complex today, posting double-digit gains across all three classes. Along with a weaker U.S. dollar and higher close for Paris milling wheat, U.S. futures also gathered strength from improving relations between the U.S. and China. These factors, along with a positive technical outlook, may have also paved the way for fund short covering today.

- Reportedly, China may be open to trade talks with the U.S., which could include ag goods. Additionally, China may be in need of purchasing more wheat due to current dryness in some of their key growing regions. There is also talk that their stockpiles may have declined over the past five years to levels below official reports.

- Heavy rains continue to fall across the U.S. southern Plains, which should be beneficial for crop development and relieving drought. But some areas, including central Oklahoma and northern Texas, will see flash flooding. And with more rain in the forecast for this region next week, winter wheat quality concerns may begin to arise as the crop is heading.

- Aside from the dryness in China’s wheat belt, the Black Sea area is also said to be too dry. Furthermore, cold temperatures and frost concerns in northeastern Europe may have given wheat a boost today via additional fund short covering.

- According to the U.S. ag attaché to Canada, their 25/26 wheat production is expected to increase by 2%. This is largely due to a bigger planted area – in March, Stats Canada projected that area would increase by 2.6% versus the year prior.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Exit All JUL ’25 620 Puts ~ 92c

2026

No New Action

2024 Crop:

- Plan A: Target 701 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Changes: None.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell all remaining July ‘25 620 Chicago wheat puts at approximately 92 cents in premium minus fees and commission.

- Plan A: Target 705.50 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- New:

- With just 49 days remaining until expiration and following gains from the recent decline in July futures off its April 11 high, it’s time to close out the final portion of the July 620 put options.

2026 Crop:

- Plan A: Target 704 against July ‘26 for the next sale

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Changes: None.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Futures Back Near Support

After months of sideways action, Chicago wheat futures broke higher in February, rallying to early October highs just above 615. However, that mid-month peak quickly turned into a reversal point, sending futures back into the late 2024 trading range. Support near 530 held firm through March, and should continue to act as support in the near-term. The next key test is the 200-day moving average — a decisive weekly close above it could signal a shift in momentum and potentially kickstart a broader upside trend.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Exit All JUL ’25 KC 620 Puts ~ 94c

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Changes: None.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell all remaining July ‘25 620 KC wheat puts at approximately 94 cents in premium minus fees and commission.

- Plan A: Target 657 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- New:

- With just 49 days remaining until expiration and following gains from the recent decline in July futures off its April 10 high, it’s time to close out the final portion of the 620 KC put options.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Changes: None.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Holding Support, Watching 200-Day Resistance

February was a volatile month for Kansas City wheat, with prices surging higher before tumbling back and ending the month little changed. March and April brought additional weakness, dragging prices near recent lows, but the ability to hold these lows is encouraging. On a rebound, the 200-day moving average will be the first resistance level to watch, with February highs near 640 serving as a more significant upside barrier. On the downside, support near the December lows around 540 should provide a strong floor if selling pressure continues.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Exit All JUL ’25 KC 620 Puts ~ 94c

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- Changes: None.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell all remaining July ‘25 620 KC wheat puts at approximately 94 cents in premium minus fees and commission.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- New:

- With just 49 days remaining until expiration and following gains from the recent decline in July KC futures off its April 10 high, it’s time to close out the final portion of the 620 KC put options.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Changes: None.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat at a Crossroads

Spring wheat broke out of its long-standing sideways range in late January, triggering a surge of bullish momentum. The rally gained traction in mid-February with a close above the 200-day moving average, though late-month weakness briefly pushed futures back below key technical levels. Unlike the winter wheats, spring wheat has been able to hover near a confluence of moving averages which are acting as support as of now. The next upside target is the February highs near 660. With spring wheat acreage projected to be the lowest in 55 years, weather volatility is likely to play a major role in driving price action this season.

Other Charts / Weather

Above: Courtesy of ag-wx.com