5-01 End of Day: Grains Kick off May with Mixed Performance

All Prices as of 2:00 pm Central Time

| Corn | ||

| JUL ’25 | 472.25 | -3.25 |

| DEC ’25 | 447.25 | 1 |

| DEC ’26 | 463.75 | 2 |

| Soybeans | ||

| JUL ’25 | 1050.25 | 5.75 |

| NOV ’25 | 1024 | 5.75 |

| NOV ’26 | 1032.75 | 3.5 |

| Chicago Wheat | ||

| JUL ’25 | 531 | 0.25 |

| SEP ’25 | 545.25 | 0.25 |

| JUL ’26 | 604.5 | -1.5 |

| K.C. Wheat | ||

| JUL ’25 | 527.5 | -2 |

| SEP ’25 | 542 | -2.25 |

| JUL ’26 | 600 | -3.75 |

| Mpls Wheat | ||

| JUL ’25 | 595.5 | -1.5 |

| SEP ’25 | 607.75 | -1.75 |

| SEP ’26 | 661.5 | 0 |

| S&P 500 | ||

| JUN ’25 | 5662 | 75 |

| Crude Oil | ||

| JUL ’25 | 58.75 | 1.13 |

| Gold | ||

| AUG ’25 | 3257.9 | -90 |

Grain Market Highlights

- Corn: Continuing the mixed trend seen throughout the session, corn futures settled mixed, as selling pressure prevented front-end contracts from posting gains.

- Soybeans: Soybeans ended Thursday’s session with gains, rebounding after two consecutive days of losses, driven by today’s export sales report.

- Wheat: After losing strength during the midday session, wheat futures ended mixed, with deferred contracts closing lower, pressured by a stronger U.S. dollar.

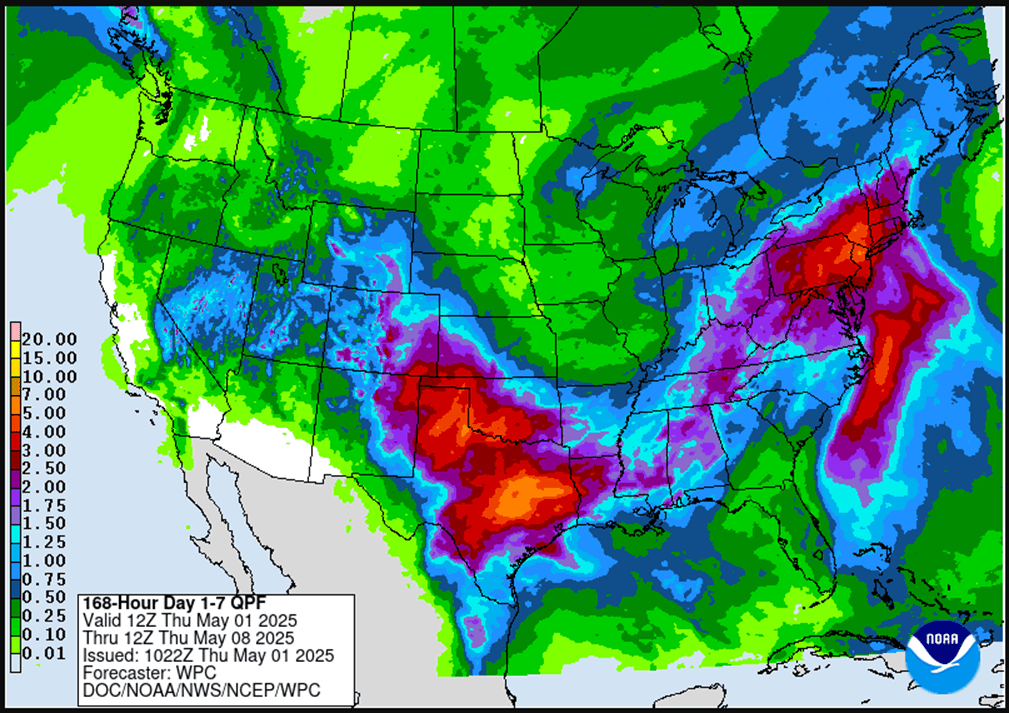

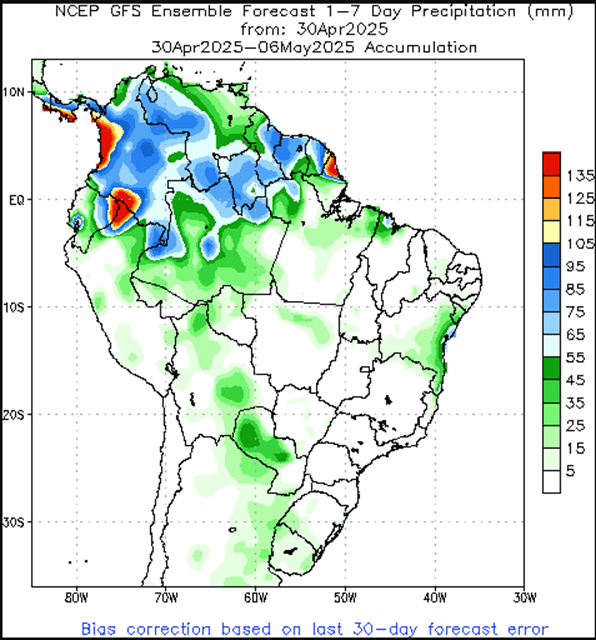

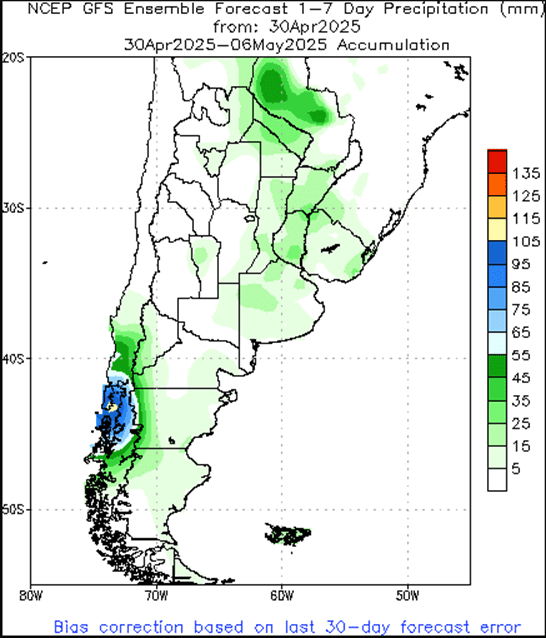

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Wheat section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

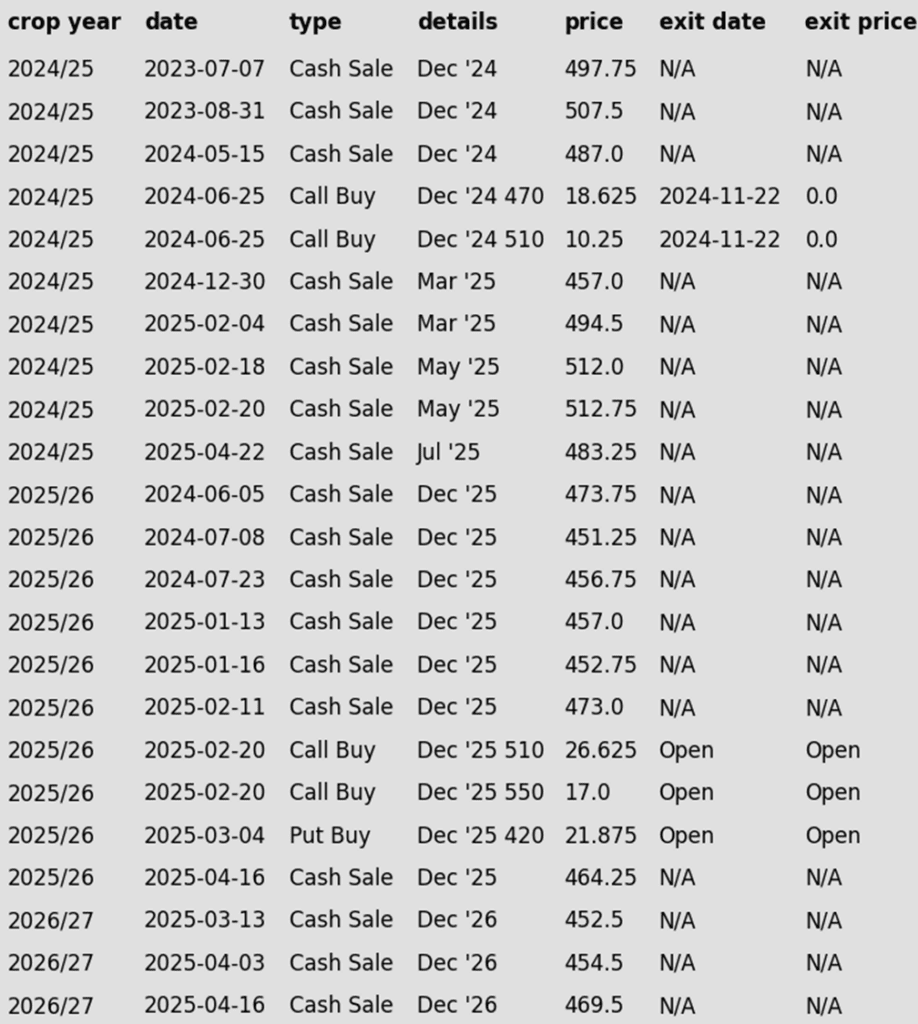

- Sales Recs: Eight sales recommendations made to date, with an average price of 494.

- No Changes: No active sales targets to report.

2025 Crop:

- Plan A: Exit all 510 December calls @ 43-5/8 cents. Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- No Changes: Still no active sales targets to report. Options targets remain active and unchanged.

2026 Crop:

- Plan A: Next cash sale at 474 vs December ‘26.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- New: A new target has posted to make a fourth cash sale at 474 vs December ‘26.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market saw a quiet session with mixed trade, as front-end futures experienced light selling pressure. July corn futures have declined in three of the past four sessions and are down 13 cents for the week heading into Friday’s trade.

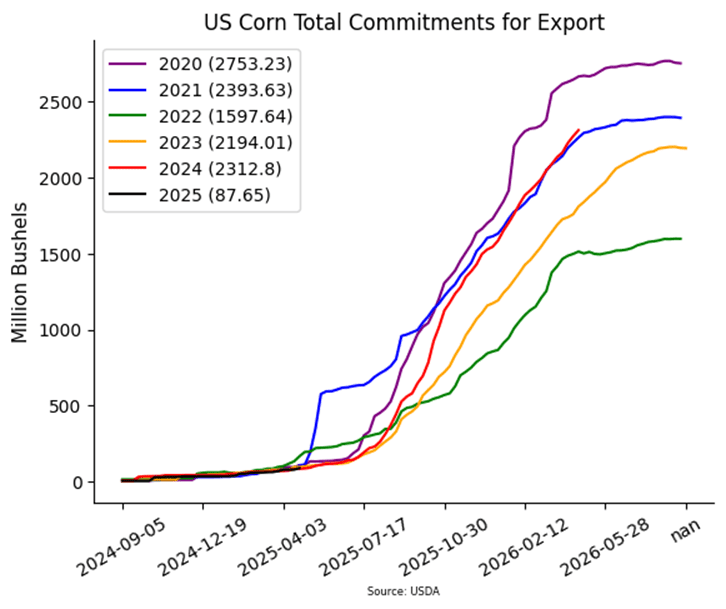

- USDA released weekly export sales on Thursday morning. For the week ending April 24, U.S. exporters sold 1,014 MMT 39.9 mb) of corn for the 2024-25 marketing year and 245,000 MT (9.6 mb) for 2025-26. Old crop sales were within expectations, but well off the pace for the past few weeks. Total sales for the current marketing year are up 26% from last year and corn export demand has remained strong.

- The U.S. dollar index has formed a short-term bottom as trade war concerns have eased, with recent economic data possibly signaling a potential rate cut from the Federal Reserve. A stronger U.S. dollar can hurt U.S. competitiveness on the global stage and may limit any price rallies in corn futures.

- Deliveries against the May corn futures have been light, (25 contract each day), which should help support prices as delivered bushels aren’t retendered back into the market and adding selling pressure. The lack of deliveries is also reflective of a relatively tight nearby corn supply.

Corn on the Move: Bulls Eye 510+ After Breakout

Corn futures broke out in April after holding key support near 450 through much of March. A bullish April WASDE report highlighting stronger demand sparked the rally, with prices pushing through the 50-day moving average. All eyes now turn to planting progress and demand trends to drive the next move. The February highs just above 510 are the next upside target, while support is firming near 470 at the top of the previous range.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

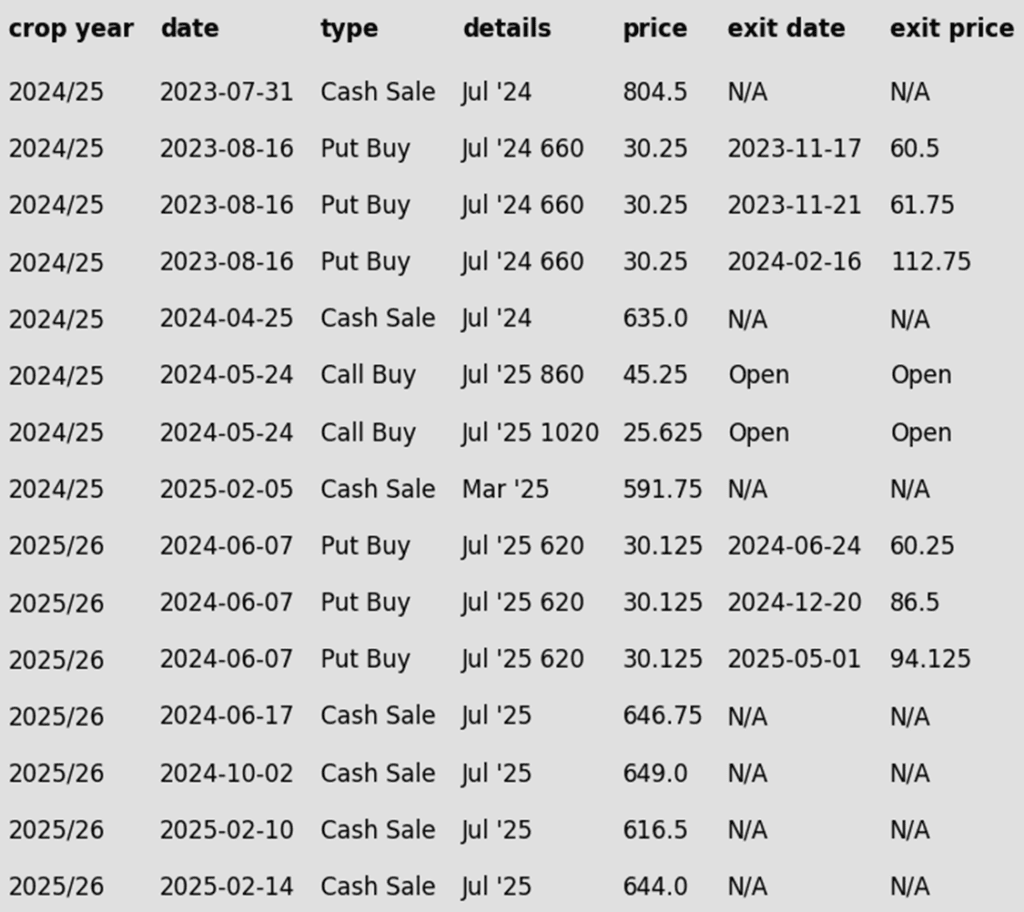

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- No Changes: Continue to target a move to 1107 to make a fourth sale.

2025 Crop:

- Plan A: Next cash sales at 1093 & 1114 vs November. Exit all 1100 November call options at 88 cents.

- Plan B: Make a cash sale if November closes below 1016.75 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- No Changes: If you’re behind on sales, target 1063 vs November for a catch-up opportunity. If you’re in line with current recommendations, Plan A remains to make the next cash sales at 1093 and 1114, while keeping an eye on 1016.75 support as part of Plan B.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- No Changes: The first sales targets may not post until May or later.

To date, Grain Market Insider has issued the following soybean recommendations:

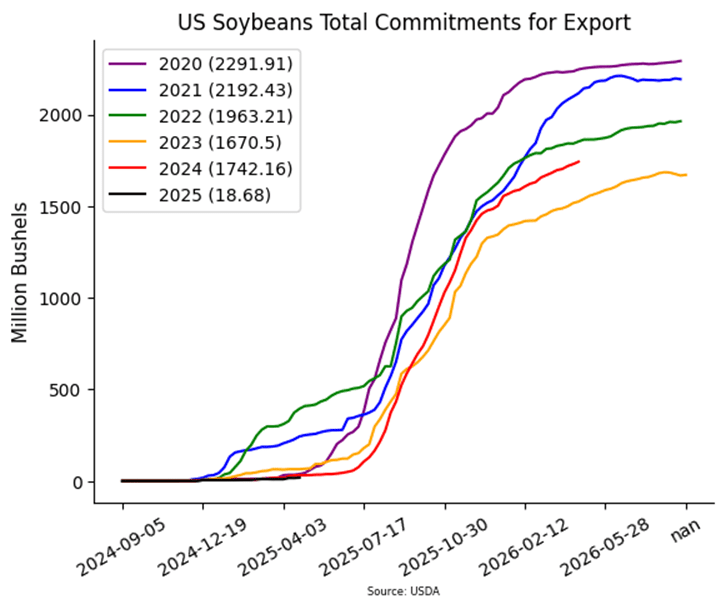

Market Notes: Soybeans

- Soybeans finished the day higher, snapping a two-day losing streak, though July futures remain within a tight trading range, hovering around the 200-day moving average. The market is likely to see a breakout in either direction, with weather conditions playing a key role. Today, soybean oil helped push prices higher, buoyed by a rise in crude oil, while soybean meal posted losses.

- Today’s Export Sales report was once again middle of the road for soybeans, within analyst trade ranges. The USDA reported an increase of 15.7 million bushels of export sales for 24/25 and an increase of 1.8 mb for 25/26. Primary destinations were to China, Germany, and the Netherlands. Last week’s export shipments of 21.6 mb were above the 11.5 mb needed each week.

- The Argentinian soybean harvest may be yielding better than expected. Dr. Cordonnier, crop analyst, has raised his projection for the Argentina soybean crop to 50 MMT, up 1 MMT from his last projection. This is slightly above USDA projections at 49 MMT.

- According to the EIA, soybean oil used for U.S. biofuel production fell in February to 576 million pounds. This compares to January where soybean oil for biodiesel was 654 million pounds.

Soybean Futures Rebound: Momentum Builds Above Key Support

Soybean futures dropped sharply in early April after newly announced tariffs triggered a break below key support near 1000, a level that had held firm through March. However, strong buying interest fueled a swift rebound, pushing futures back above the pivotal 1000 mark and reclaiming major moving averages — especially the 200-day, which had capped rallies for the past two years. With momentum rebuilding, the market is now eyeing the February highs near 1080, while the 200-day moving average is expected to provide support on any spring pullbacks.

Wheat

Market Notes: Wheat

- After a two-sided trade, wheat futures closed in a similar fashion. Light bull spreading was observed in Chicago futures, where front-month contracts finished slightly higher, while deferred contracts ended lower. Kansas City futures were mostly lower, and Minneapolis futures were mixed. Wheat futures remain oversold and in need of a correction, but today’s jump in the U.S. dollar may have limited any rally potential.

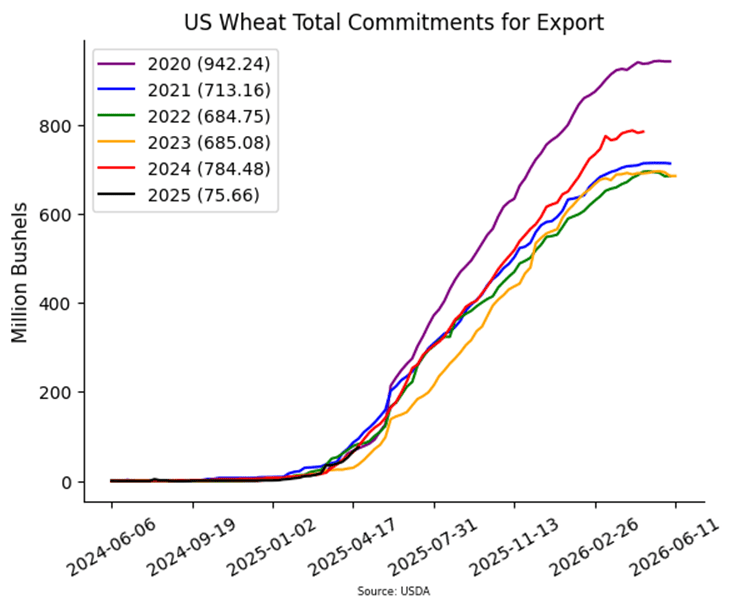

- The USDA reported an increase of 2.6 mb of wheat export sales for 24/25 and an increase of 8.8 mb for 25/26. Shipments last week totaled 18.1 mb, which falls below the 22.6 mb pace needed per week to reach their export goal of 820 mb. Total shipments have reached 682 mb for 24/25, which is up 11% from last year.

- According to the Indian Food Secretary, their government has purchased 25.6 mmt of domestic wheat for state reserves. This is far above the total purchased up to this point last year, at 20.5 mmt. In total, India is expected to purchase 31.2 mmt for their stockpiles.

- After recent rains, both winter and spring wheat growing regions in the U.S. saw big declines in drought readings. According to the USDA, as of April 29, an estimated 23% of winter wheat acres are experiencing drought conditions. This is down 10% from the week before. Additionally, spring wheat acres in drought fell from 49% to 37% during the same time period.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

New Alert

Exit All JUL ’25 620 Puts ~ 92c

2026

No New Action

2024 Crop:

- Plan A: Target 701 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- No Changes: 701 is still the price target to trigger a fifth sales recommendation.

2025 Crop:

- NEW ACTION – Sell all remaining July ‘25 620 Chicago wheat puts at approximately 92 cents in premium minus fees and commission.

- Plan A: Target 705.50 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- New:

- With just 50 days remaining until expiration and following gains from the recent decline in July futures off its April 11 high, today presents a timely opportunity to close out the final portion of the July 620 put options.

2026 Crop:

- Plan A: Target 704 against July ‘26 for the next sale

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- New: The 704 sales target has been lowered to 702.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Futures Back Near Support

After months of sideways action, Chicago wheat futures broke higher in February, rallying to early October highs just above 615. However, that mid-month peak quickly turned into a reversal point, sending futures back into the late 2024 trading range. Support near 530 held firm through March, and should continue to act as support in the near-term. The next key test is the 200-day moving average — a decisive weekly close above it could signal a shift in momentum and potentially kickstart a broader upside trend.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

New Alert

Exit All JUL ’25 KC 620 Puts ~ 94c

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- No Changes: Still no active price targets, as the July contract continues to chop around in the 560–580 range.

2025 Crop:

- NEW ACTION – Sell all remaining July ‘25 620 KC wheat puts at approximately 94 cents in premium minus fees and commission.

- Plan A: Target 657 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- New:

- With just 50 days remaining until expiration and following gains from the recent decline in July futures off its April 10 high, today presents a timely opportunity to close out the final portion of the 620 KC put options.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- No Changes: The expectation is still for targets to begin posting in the May – June timeframe.

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Holding Support, Watching 200-Day Resistance

February was a volatile month for Kansas City wheat, with prices surging higher before tumbling back and ending the month little changed. March and April brought additional weakness, dragging prices near recent lows, but the ability to hold these lows is encouraging. On a rebound, the 200-day moving average will be the first resistance level to watch, with February highs near 640 serving as a more significant upside barrier. On the downside, support near the December lows around 540 should provide a strong floor if selling pressure continues.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

New Alert

Exit All JUL ’25 KC 620 Puts ~ 94c

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- No Changes: No active targets for a sixth sales recommendation at this time.

2025 Crop:

- NEW ACTION – Sell all remaining July ‘25 620 KC wheat puts at approximately 94 cents in premium minus fees and commission.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- New:

- With just 50 days remaining until expiration and following gains from the recent decline in July KC futures off its April 10 high, today presents a timely opportunity to close out the final portion of the 620 KC put options.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- No Changes: The expectation is still for targets to begin posting in the June – July timeframe.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat at a Crossroads

Spring wheat broke out of its long-standing sideways range in late January, triggering a surge of bullish momentum. The rally gained traction in mid-February with a close above the 200-day moving average, though late-month weakness briefly pushed futures back below key technical levels. Unlike the winter wheats, spring wheat has been able to hover near a confluence of moving averages which are acting as support as of now. The next upside target is the February highs near 660. With spring wheat acreage projected to be the lowest in 55 years, weather volatility is likely to play a major role in driving price action this season.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.