4-9 End of Day: Grain Markets Rally Following Announcement of 90-Day Tariff Pause

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’25 | 474 | 5 |

| JUL ’25 | 480.5 | 5.75 |

| DEC ’25 | 450.75 | 5 |

| Soybeans | ||

| MAY ’25 | 1012.75 | 20 |

| JUL ’25 | 1023.5 | 19.5 |

| NOV ’25 | 997 | 19.25 |

| Chicago Wheat | ||

| MAY ’25 | 542.25 | 2.25 |

| JUL ’25 | 555.75 | 1.75 |

| JUL ’26 | 622.25 | 1 |

| K.C. Wheat | ||

| MAY ’25 | 568 | 6.5 |

| JUL ’25 | 580.25 | 5.25 |

| JUL ’26 | 641.25 | 4.25 |

| Mpls Wheat | ||

| MAY ’25 | 608.75 | 7.75 |

| JUL ’25 | 621.5 | 7 |

| SEP ’25 | 632.5 | 7.25 |

| S&P 500 | ||

| JUN ’25 | 5399.5 | 379.25 |

| Crude Oil | ||

| JUN ’25 | 61.48 | 2.38 |

| Gold | ||

| JUN ’25 | 3084.5 | 94.3 |

Grain Market Highlights

- Corn: Corn markets closed the day higher, fueled by new tariff headlines and continued strong demand for U.S. corn.

- Soybeans: Soybeans ended the day higher following news of a 90-day delay on tariffs for most countries, excluding China, whose tariff was increased to 125% effective immediately.

- Wheat: Wheat markets remain the least affected by tariff-related news and closed the midweek trade with gains. However, the stronger U.S. dollar may limit any further upside potential for wheat.

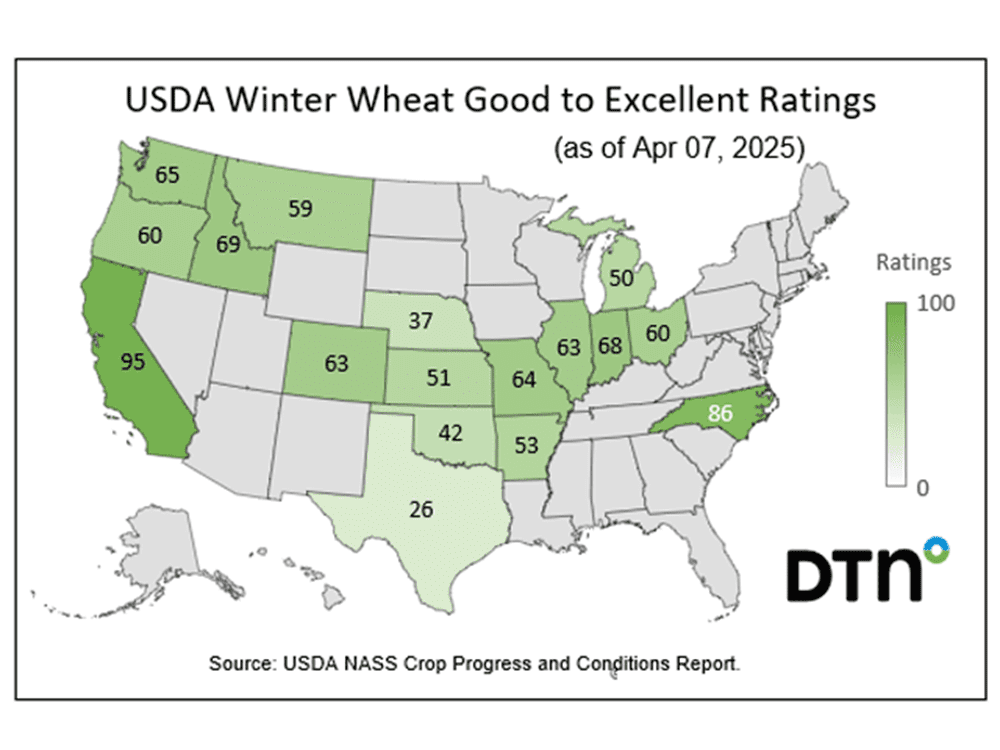

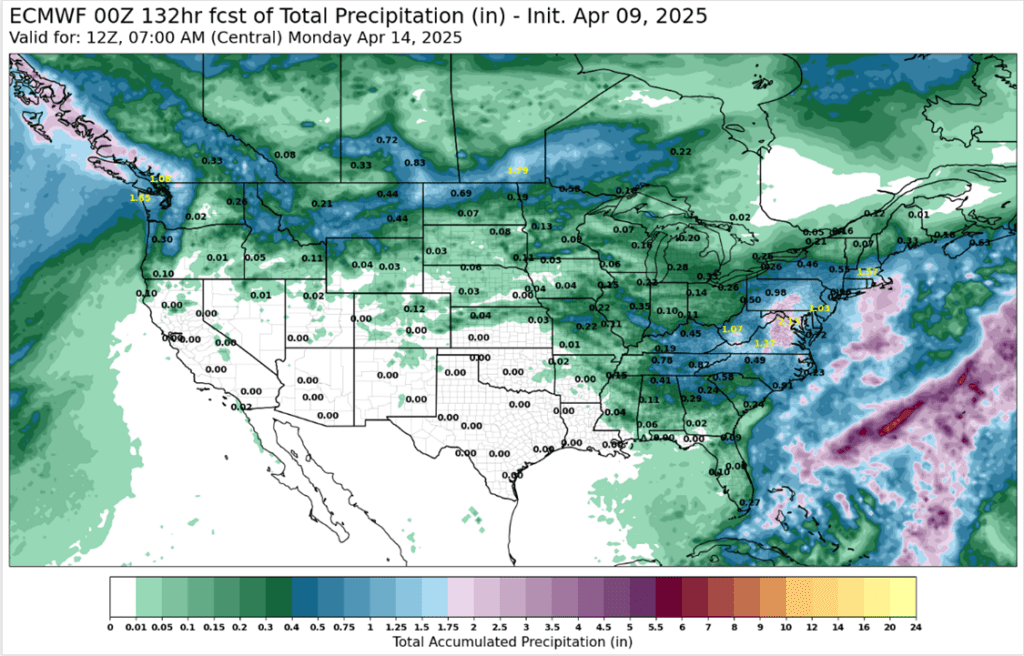

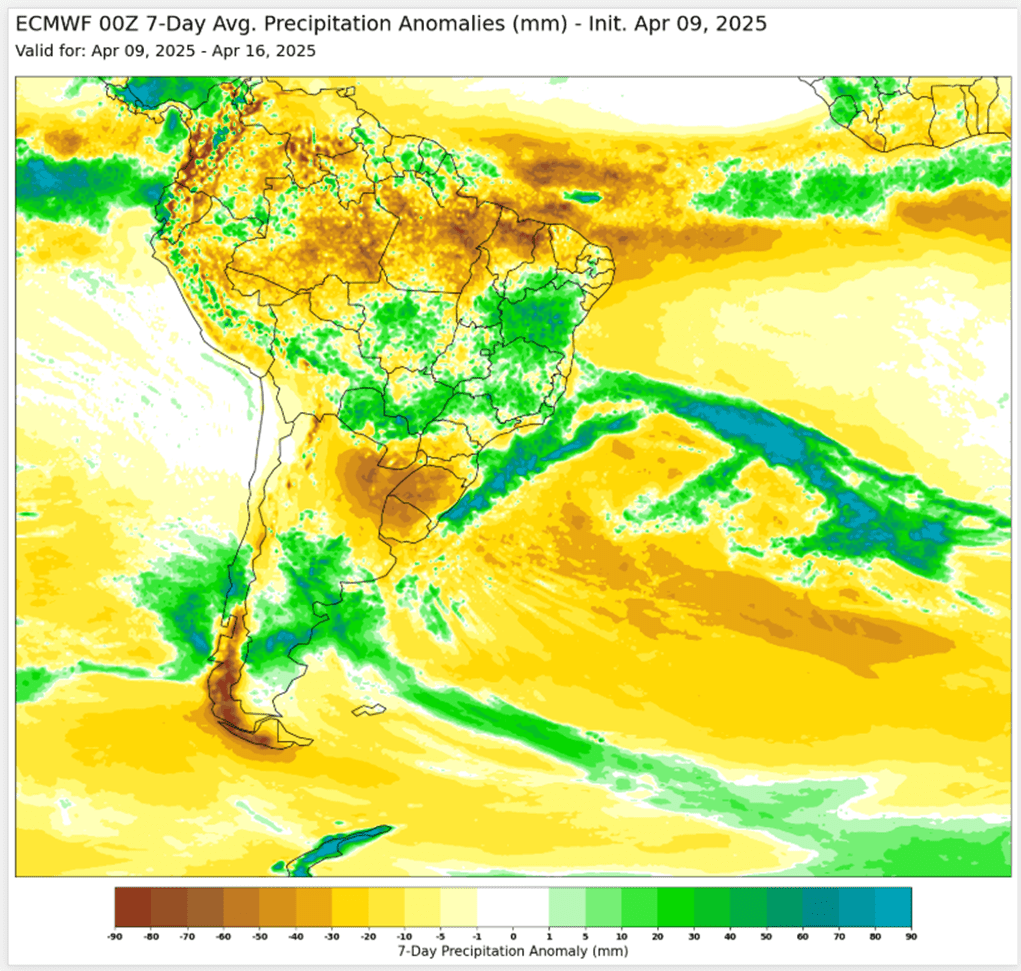

- Too see the updated 5-day ECWMF precipitation forecast for the U.S., the 7-day ECWMF precipitation forecast for South America, as well as USDA winter wheat ratings, scroll down the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

Active

Sell DEC ’26 Cash

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations made so far to date.

- Catch-Up Target: If you haven’t made all seven sales to date, aim for 477 vs May as your catch-up target.

- No New Targets: Still no new recommendations for making an eighth sale. Old crop contracts continue to lead, and we’re content to remain patient for another day.

2025 Crop:

- Plan A: Exit all 510 December calls @ 43-5/8 cents. Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Six sales recommendations made so far to date.

- Catch-Up Target: If you haven’t made all six sales to date, aim for 459 vs December as your first catch-up target.

- No Changes: No new sales targets have posted to trigger a seventh sale for the new crop.

2026 Crop:

- CONTINUED OPPORTUNITY – Sell a second portion of your 2026 corn crop.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Target Hit: The move to 456 vs December ’26 triggered the current sales recommendation.

- Sales Recs: Now two sales recommendations made to date.

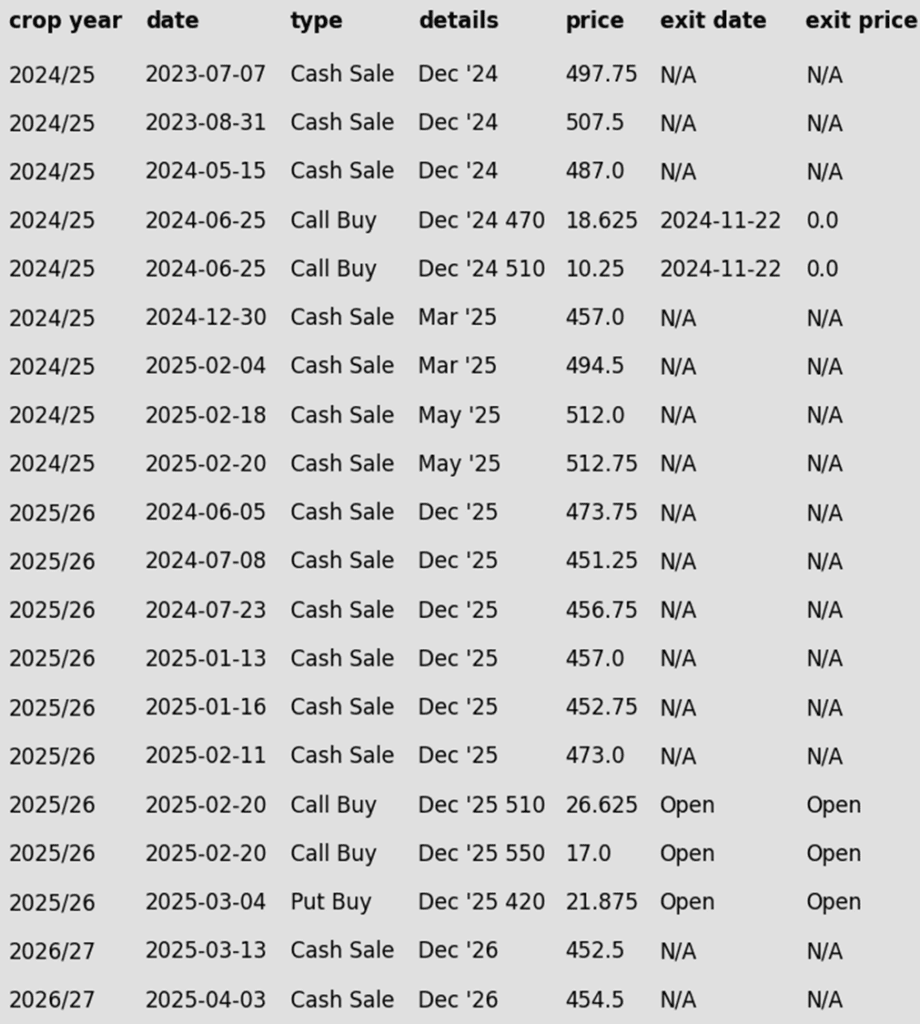

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market rallied into the session’s close, finishing with moderate gains driven by demand and the latest tariff news.

- During the session, President Trump announced a 90-day pause on reciprocal tariffs for most countries, except China. China tariffs were increased to 125% on imports of Chinese goods to counter the increased tariffs China installed last night. The announced pause for 90 days in tariffs sent markets sharply higher across most markets. Corn futures traded off the lows for the session.

- USDA will release weekly exports sales on Thursday morning for corn. For the week ending April 3, new corn sales are expected to range from 700,000 MT –1.3 MMT for the current marketing year. Last week’s sales totaled 1.173 MMT as export demand remains strong.

- The USDA will release the April WASDE report on Thursday. Expectations for the report could show reduced corn carryout if USDA raises export demand. However, adjustments to feed use and tariff impacts may delay major changes until later reports. Current analyst expectations are for corn carryout to be reduced to 1.510 mb, down 30 mb from the March report.

- Brazil Agriculture agency, CONAB, will release the next round of production estimates early on Thursday morning. The corn market will be looking for an adjustment in the Brazil corn crop, especially on the key second crop corn.

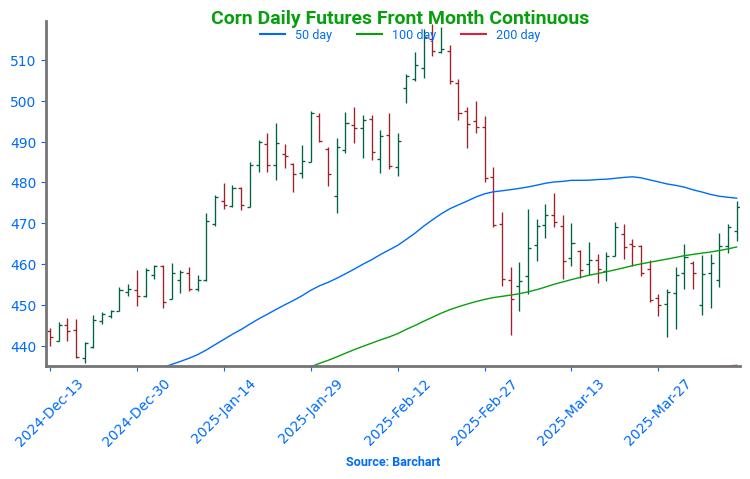

Corn Finds Support Ahead of Growing Season

After surging to 16-month highs in late February, corn futures experienced a sharp pullback, spending much of March testing key technical support levels. As spring planting approaches in earnest, futures have stabilized around the 450 level — a zone that’s likely to continue acting as near-term support into the early part of the growing season. If this area fails to hold, stronger support is expected near the 200-day moving average, currently around 430. On the upside, the first resistance comes at the 100-day moving average, followed by the March highs and the 50-day moving average near the 470 level.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs May. Buy calls with a close over 1079.75 vs May.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made so far to date.

- No Changes: 1107 remains the target to trigger a fourth sales recommendation.

2025 Crop:

- Plan A: Next cash sales at 1093 & 1114 vs November. Exit all 1100 November call options at 88 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made so far to date.

- No Changes: With one sales recommendation made to date, a move to 1093 would trigger the second, and 1114 would trigger the third.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- No Changes: The expectation is still for targets to begin posting in a month or two.

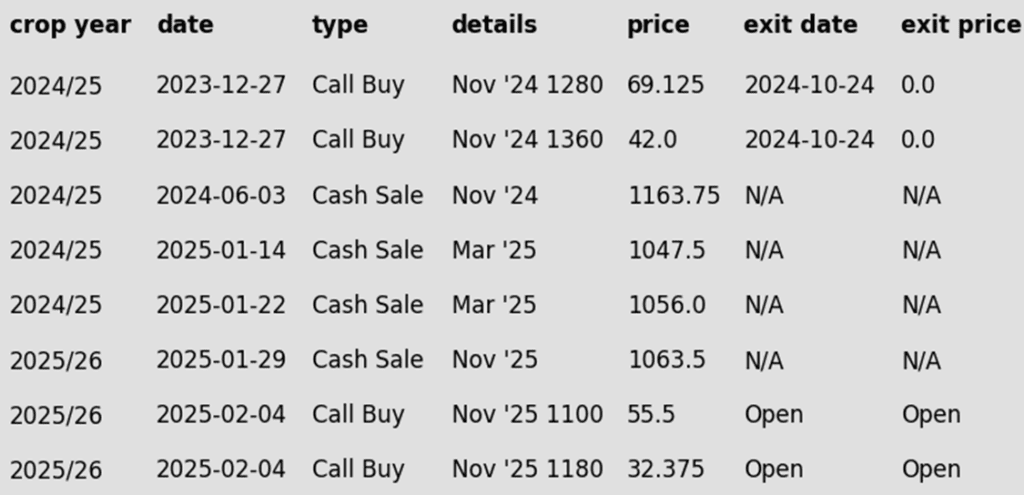

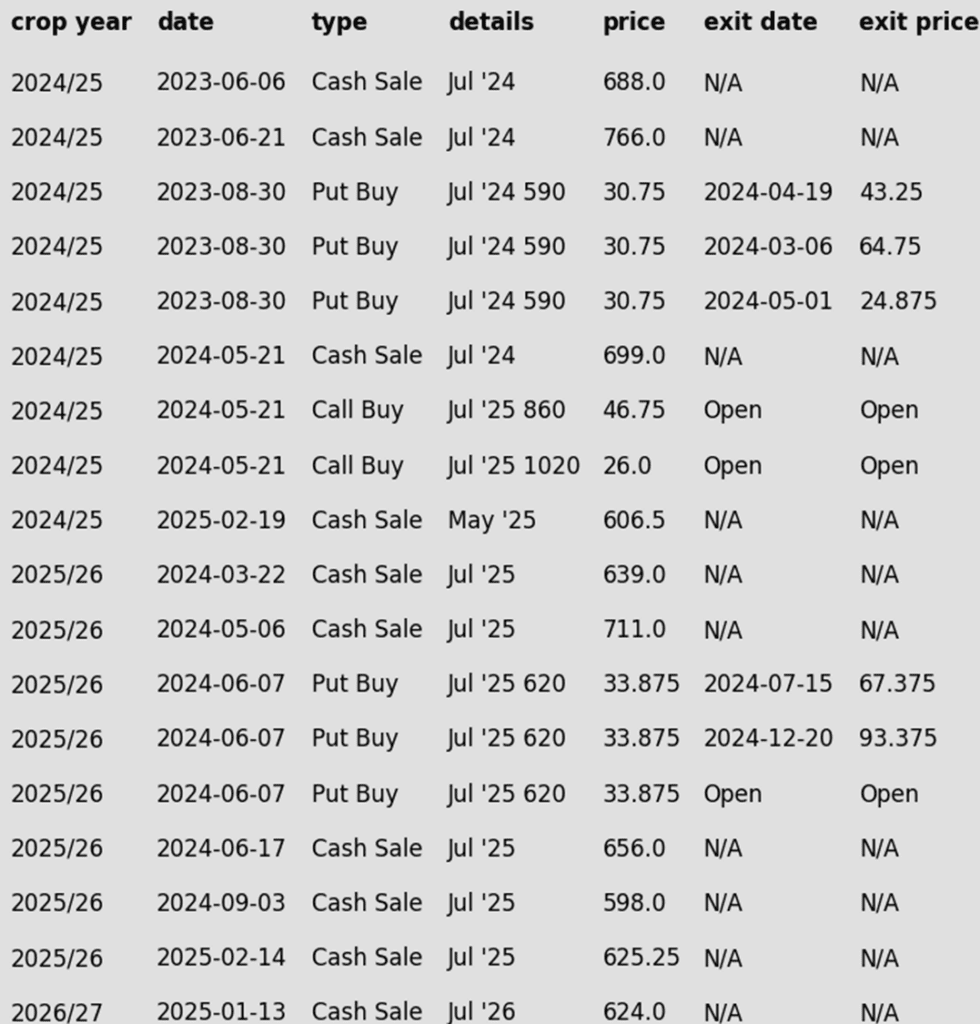

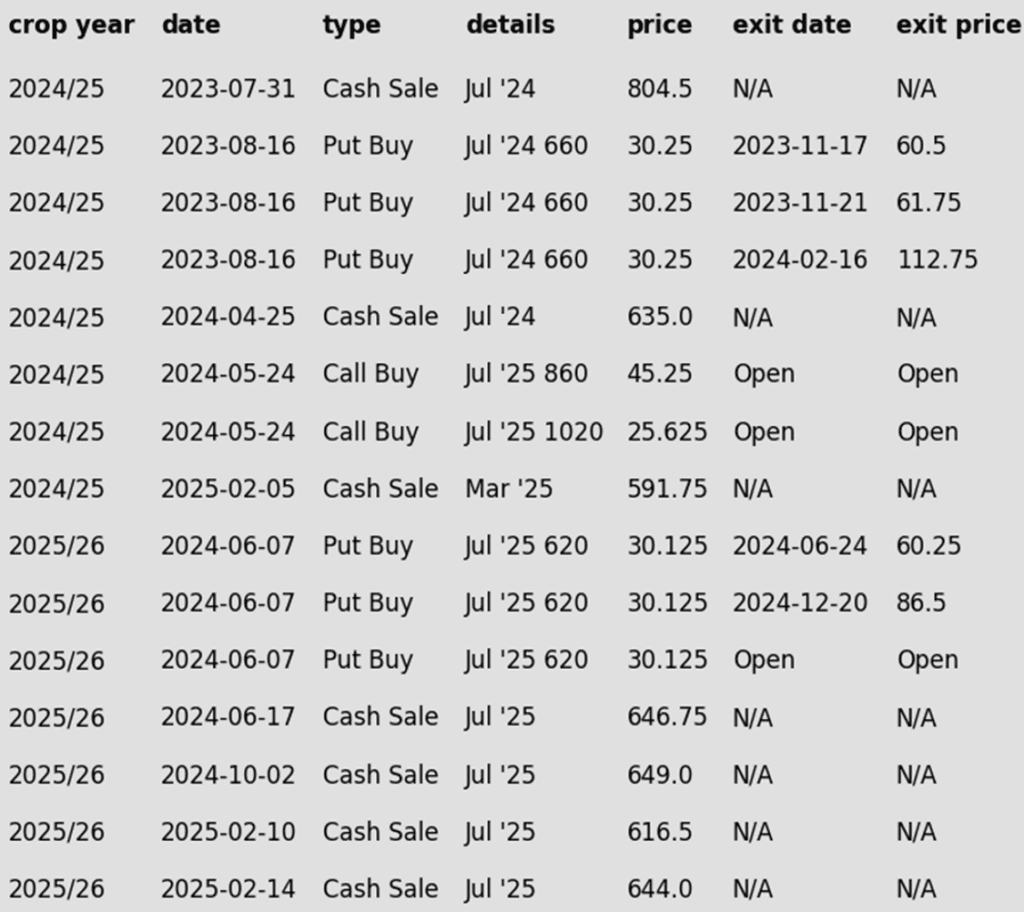

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day sharply higher following breaking news that President Trump would suspend tariffs on most countries for 90 days, while increasing Chinese tariffs to 125% effective immediately. Both soybean meal and oil also rallied in response to the news.

- China has purchased only a minimal amount of soybeans so far this year, making the tariff news bullish overall, but particularly supportive for soybean oil. With tariffs on Chinese cooking oil now so high, imports are likely to slow, boosting domestic demand.

- Tomorrow, the USDA will release its WASDE report, and estimates show U.S. ending stocks increasing slightly by 2 mb to 382 mb and exports being reduced by 8 mb. World ending stocks are expected to increase slightly to 121.9 mmt.

- The Bloomberg survey for Brazilian soybean production has estimated the figure just slightly below CONAB’s last guess at 167.8 mmt compared to CONAB’s 167.37. The range is between 167 and 169 mmt.

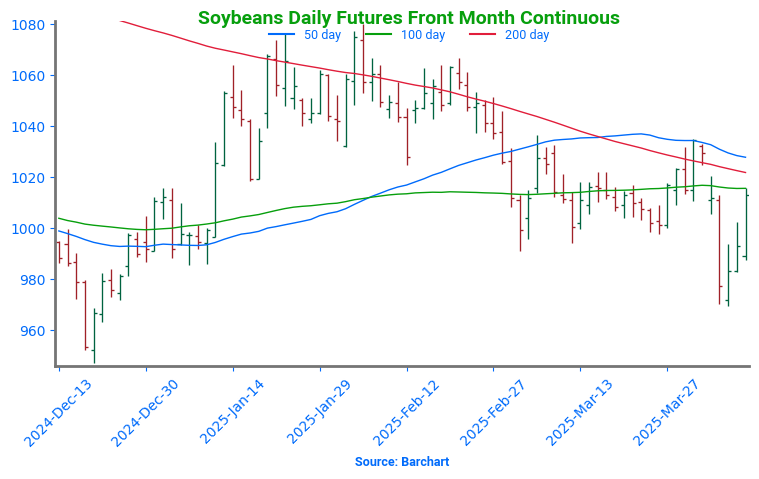

Soybeans Break Lower on Tariff News

The newly announced tariffs in early April caused soybean futures to drop sharply, breaking previously held support near the 1000 level that had sustained the market throughout March. Should the decline persist, support is expected to emerge around the December lows at 950. Conversely, if prices rally, initial resistance will be encountered at the 1000 level, followed by a confluence of major moving averages between 1020 and 1030. Of these, the 200-day moving average has proven particularly challenging for the soybean market to break above, restricting gains for nearly the last year and a half.

Wheat

Market Notes: Wheat

- Markets rallied into the close after President Trump announced a 90-day pause on tariffs for most countries, excluding China. While wheat finished the day in positive territory, the gains were modest, as wheat seems to have been least affected by the tariff news. However, today’s lower close for Matif wheat futures, combined with the stronger U.S. dollar, may have limited the upside potential for the U.S. wheat market.

- Tomorrow, traders will receive the USDA’s monthly supply and demand data. No major changes are expected for the wheat market though. U.S. 24/25 wheat carryout is expected to increase slightly, from 819 mb last month to 822 mb on the average pre-report estimate. World ending stocks are anticipated to be neutral as well – the average guess is 260.8 mmt versus 260.1 mmt in March.

- According to IKAR, Russian 2025 grain production is estimated at 129.5 mmt, which is up from last year’s 125.9 mmt. Of the 2025 total, however, wheat is expected to account for 82.5 mmt, which would be slightly above the level from a year ago.

- The European Commission has stated that since the season began on July 1, EU soft wheat exports have reached 16.4 mmt as of April 6. This represents a 34% decline from the 25 mmt shipped during the same period last year.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 701 against May for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made so far to date.

- No Changes: 701 is still the price target to trigger a fifth sales recommendation.

2025 Crop:

- Plan A: Target 705.50 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made so far to date.

- No Changes: Still targeting 705.50 to trigger the sixth sales recommendation.

2026 Crop:

- Plan A: Target 704 against July ‘26 for the next sale

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made so far to date.

- No Changes: 704 is still the price target to trigger a second sales recommendation.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat – Back to Sideways Trend

After months of sideways movement, Chicago wheat broke higher in February, rallying to early October highs just above 615. However, this mid-month peak quickly turned into a reversal point, with futures sliding back into the trading range that defined late 2024. Currently, support near 530 continues to hold firm. The next major resistance is the 200-day moving average, which now represents a critical test. A decisive weekly close above this level could signal a shift in momentum, potentially marking the beginning of a trend reversal and a return to upside momentum.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made so far to date.

- No Changes: Still no active price targets, as the May contract continues to try forming a base in the 550–570 range.

2025 Crop:

- Plan A: Target 677 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made so far to date.

- No Changes: 677 is still the price target to trigger a sixth sales recommendation.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- No Changes: The expectation is still for targets to begin posting in the May – June timeframe.

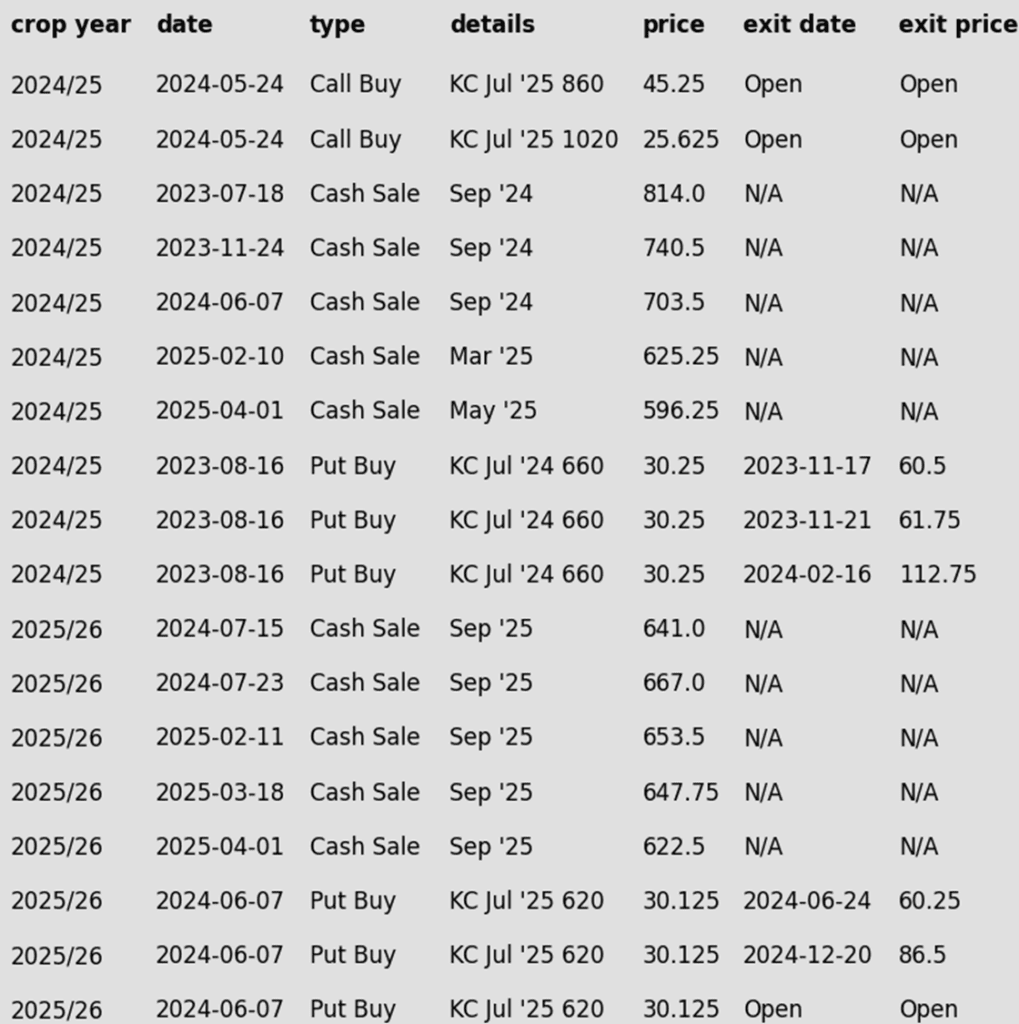

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Seeks Direction After February Whiplash

February was a wild ride for Kansas City wheat, with prices surging higher before tumbling back down, ultimately finishing the month little changed. March ended with weakness, bringing prices back near recent lows, but holding trendline support so far in April remains encouraging. On a rebound, the 200-day moving average is expected to act as initial resistance, with February highs near 640 serving as a more significant barrier. Support near the December lows of 540 should act as stout support on any continued decline.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made so far to date.

- No Changes: No active targets for a sixth sales recommendation at this time.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made so far to date.

- No Changes: No active targets for a sixth sales recommendation at this time.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- No Changes: The expectation is still for targets to begin posting in the June – July timeframe.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Hovers Near Support

Spring wheat broke out of its long-standing sideways range in late January, triggering a surge of bullish momentum. The rally gained further traction in mid-February with a close above the 200-day moving average, but late-month weakness wiped out those gains, pushing futures back below key technical levels. Currently, the 200-day moving average acts as a barrier, limiting any rebound attempts, while support near 580 remains crucial in preventing further downside. To reignite the uptrend, futures would need to make a sustained move above the 200-day, with the next upside target at the February highs near 660. With spring wheat acreage expected to be the lowest in the past 55 years, weather volatility is likely to play a significant role in market movements.

Other Charts / Weather

Above: Courtesy of ag-wx.com

Above: Courtesy of ag-wx.com