4-7 End of Day: Wheat Leads Grains Higher Monday

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’25 | 464.5 | 4.25 |

| JUL ’25 | 470.75 | 3.5 |

| DEC ’25 | 446 | -0.75 |

| Soybeans | ||

| MAY ’25 | 983 | 6 |

| JUL ’25 | 997 | 4 |

| NOV ’25 | 981 | -3.25 |

| Chicago Wheat | ||

| MAY ’25 | 536.5 | 7.5 |

| JUL ’25 | 550.5 | 7.75 |

| JUL ’26 | 618.25 | 1.25 |

| K.C. Wheat | ||

| MAY ’25 | 559.25 | 1.75 |

| JUL ’25 | 572.75 | 2.75 |

| JUL ’26 | 635.75 | 0 |

| Mpls Wheat | ||

| MAY ’25 | 594 | 9.5 |

| JUL ’25 | 608.25 | 8.5 |

| SEP ’25 | 619.5 | 7.5 |

| S&P 500 | ||

| JUN ’25 | 5117.25 | 7 |

| Crude Oil | ||

| JUN ’25 | 60.53 | -1.12 |

| Gold | ||

| JUN ’25 | 2986 | -49.4 |

Grain Market Highlights

- Corn: Front-end corn contracts started the week with moderate gains, supported by buying strength. Deferred contracts lagged amid expectations for large acreage and demand concerns tied to tariffs.

- Soybeans: Soybeans ended mixed with front months higher and deferred contracts lower in bull spreading. Futures spiked early on a false report of a 90-day tariff pause, but gains faded once the headline was debunked.

- Wheat: Wheat led grain gains today, appearing least affected by tariff concerns. Strength in Matif wheat also supported U.S. prices.

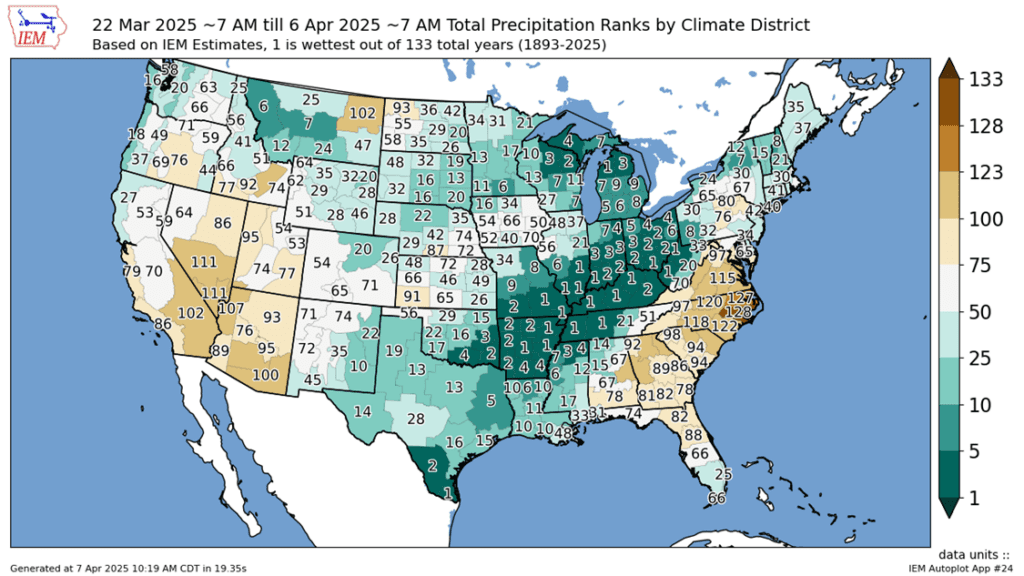

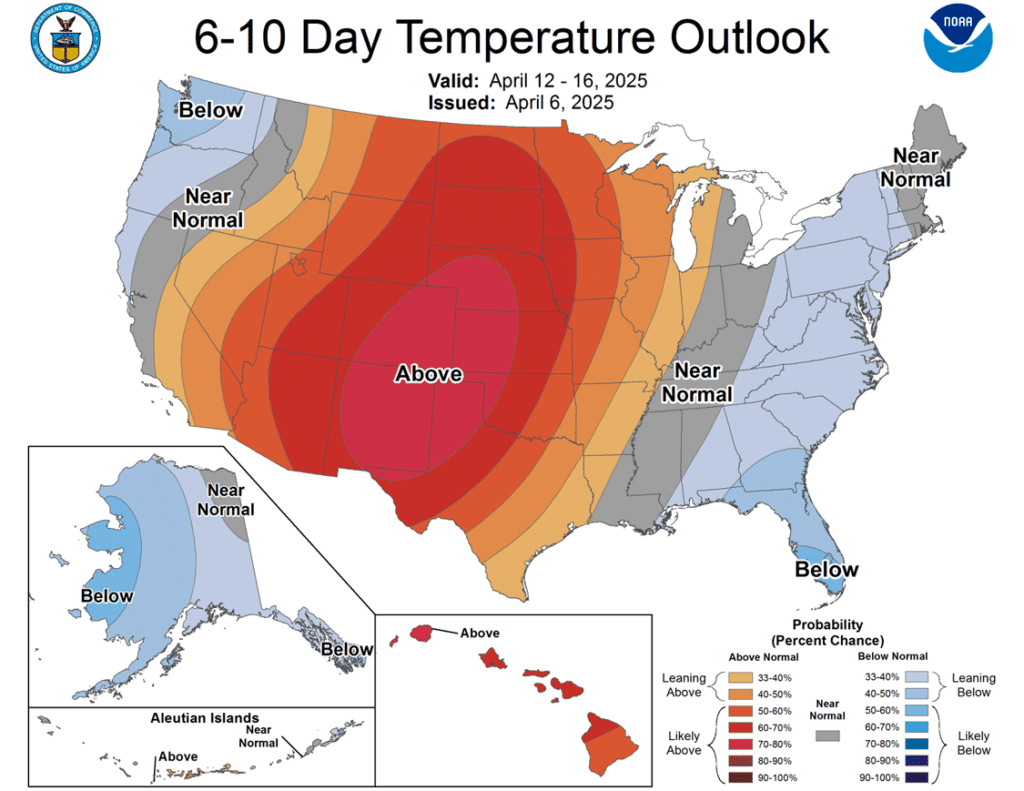

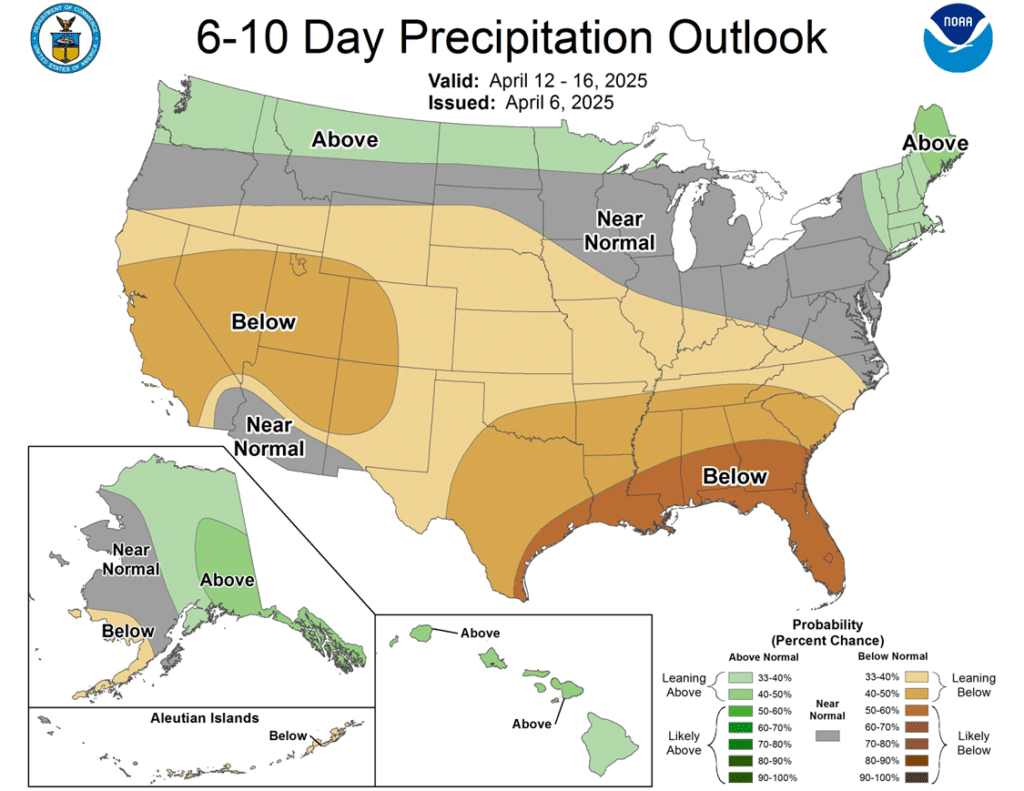

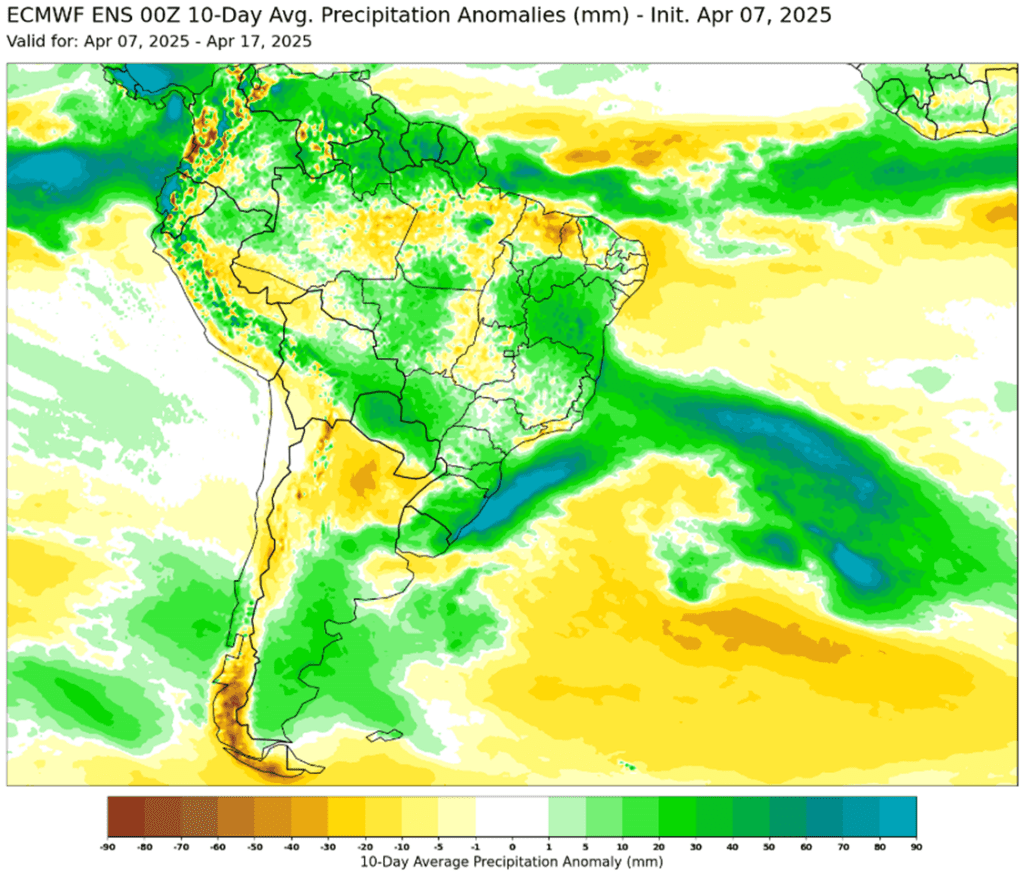

- Too see the updated two-week U.S. precipitation ranks by climate district, 6-10 day U.S. temperature and precipitation outlooks as well as the 10-day ECMWF precipitation anomalies for South America, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

Active

Sell DEC ’26 Cash

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

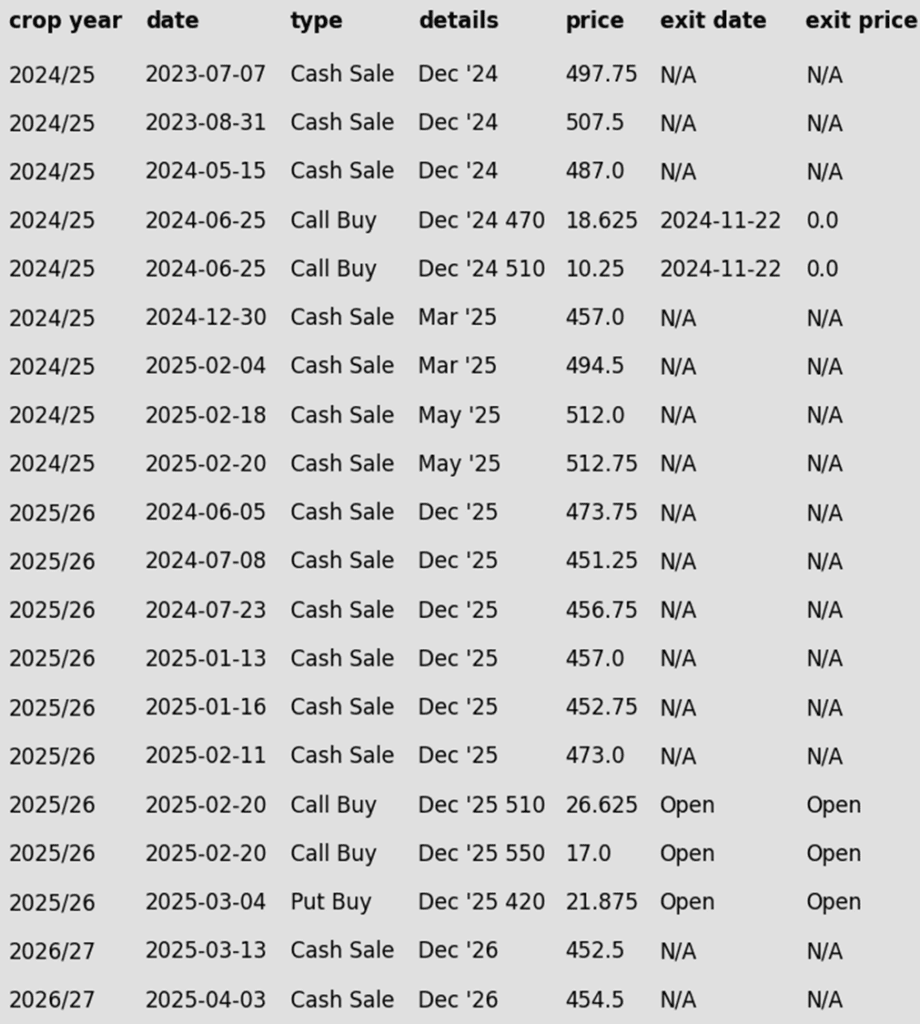

- Sales Recs: Seven sales recommendations made so far to date.

- No New Targets: No new targets to note at this time. The corn market is holding up surprisingly well given how other markets have reacted since ‘Liberation Day’. A positive sign for higher prices ahead? Continue to sit tight for now.

2025 Crop:

- Plan A: Exit all 510 December calls @ 43-5/8 cents. Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Six sales recommendations made so far to date.

- No Changes: No updates to active options targets, and no new sales targets have been posted at this time. Given how well the corn market is holding up, we’re content to continue sitting tight — with only the options exit targets currently active.

2026 Crop:

- CONTINUED OPPORTUNITY – Sell a second portion of your 2026 corn crop.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- MO: The Grain Market Insider strategy is built on a foundation of early corn sales.

- Target Hit: The move to 456 vs December ’26 triggered the current sales recommendation.

- Sales Recs: Now two sales recommendations made to date.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The front end of the corn markets saw buying strength to start the week as old crop contract finished with moderate gains. The expectation of a large acre forecast, and possible demand concerns due to tariffs, limited the deferred contracts on the session.

- USDA announced corn export inspections during the morning. For the week ending April 3, US exporters shipped 62.3 mb of corn. Total corn export shipments for the 2024-25 marketing year are at 1.401 bb, up 30% over last year.

- Heavy rainfall in the southern corn belt over the weekend brings concerns of possible delayed planting and a possible shifting of acres. Some analysts feel that producers could move away from some early planted soybeans and shift to additional corn acres.

- The April WASDE report, due Thursday, could show reduced corn carryout if USDA raises export demand. However, adjustments to feed use and tariff impacts may delay major changes until later reports.

- Recent rainfall in Brazil will likely support the development of the second corn crop. In addition, Brazil farmers were strong sellers as the tariff news supported Brazil cash prices on the prospects of improved global demand for Brazil grains.

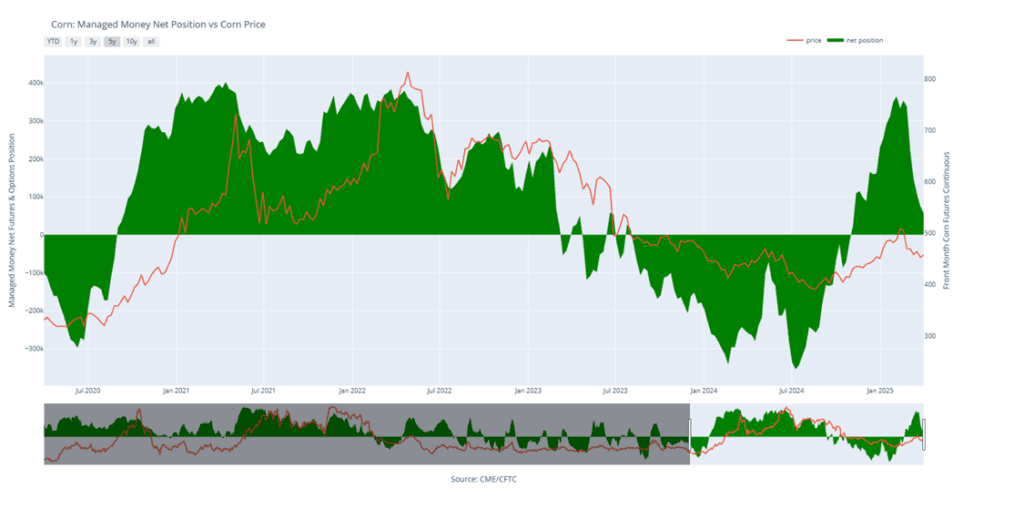

Corn Finds Support Ahead of Growing Season

After surging to 16-month highs in late February, corn futures experienced a sharp pullback, spending much of March testing key technical support levels. As spring planting approaches in earnest, futures have stabilized around the 450 level — a zone that’s likely to continue acting as near-term support into the early part of the growing season. If this area fails to hold, stronger support is expected near the 200-day moving average, currently around 430. On the upside, the first resistance comes at the 100-day moving average, followed by the March highs and the 50-day moving average near the 470 level.

Corn Managed Money Funds net position as of Tuesday, April 1. Net position in Green versus price in Red. Money Managers net sold 17,850 contracts between March 25 – April 1, bringing their total position to a net long 56,757 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs May. Buy calls with a close over 1079.75 vs May.

- Plan B: No active targets.

- Details:

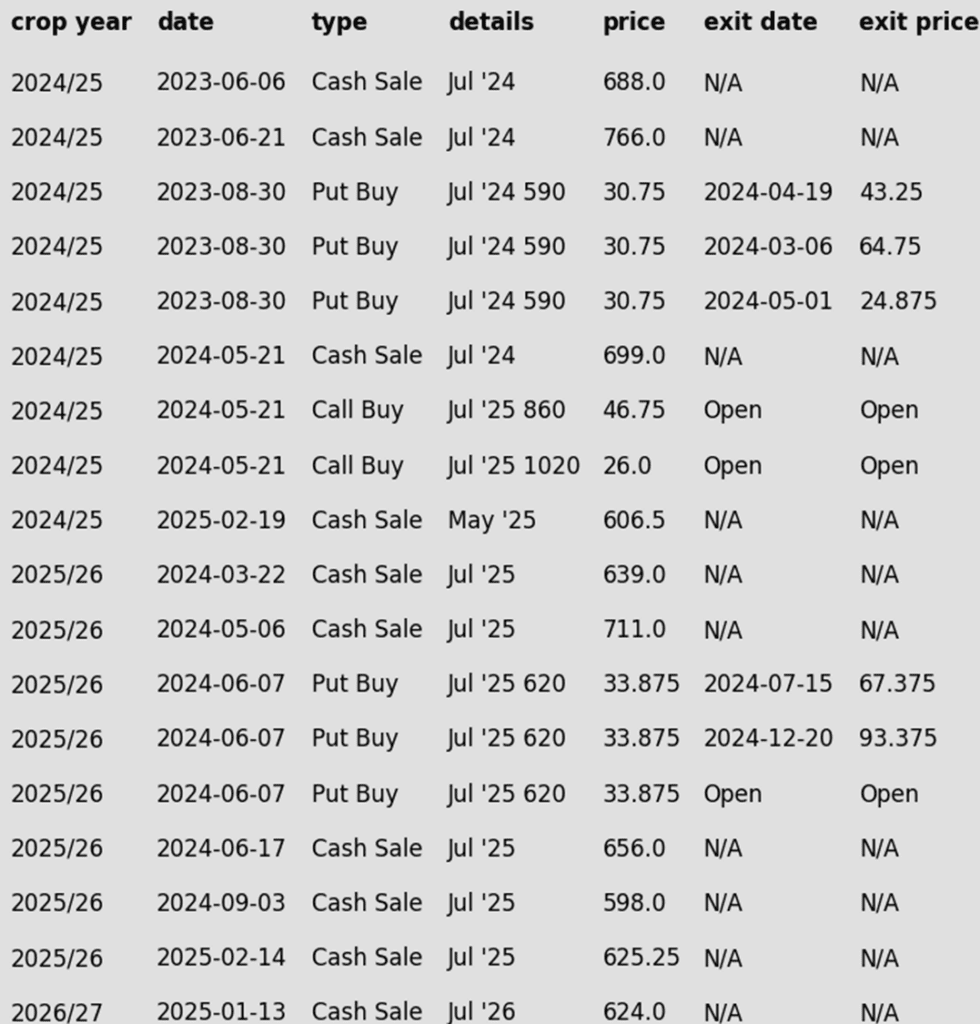

- Sales Recs: Three sales recommendations made so far to date.

- No Changes: No updates to the active option target or the single sales target at this time.

2025 Crop:

- Plan A: Next cash sales at 1093 & 1114 vs November. Exit all 1100 November call options at 88 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made so far to date.

- No Changes: With one sales recommendation made to date, a move to 1093 would trigger the second, and 1114 would trigger the third.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- No Changes: The expectation is still for targets to begin posting in a month or two.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans were mixed to end the day with the three front months higher but deferred contracts lower in bull spreading action. Futures were volatile today spiking as much as 20 cents higher this morning after a fake headline went out that Trump would be pausing the tariffs on all countries apart from China for 90 days. This news was debunked, and prices came back down shortly after.

- Soybean meal ended the day higher after May made a new contract low on Friday as South America sees good weather overall. Soybean oil followed crude oil lower which lost over 7 dollars a barrel on Friday amid the decline in equity markets and tariff negotiations.

- In Brazil, a major Amazon shipping route has been disrupted by Indigenous protesters and poor road conditions. Major global grains traders like Cargill and Bunge have important operations there, and the river port of Miritituba has seen shipping delays as a result.

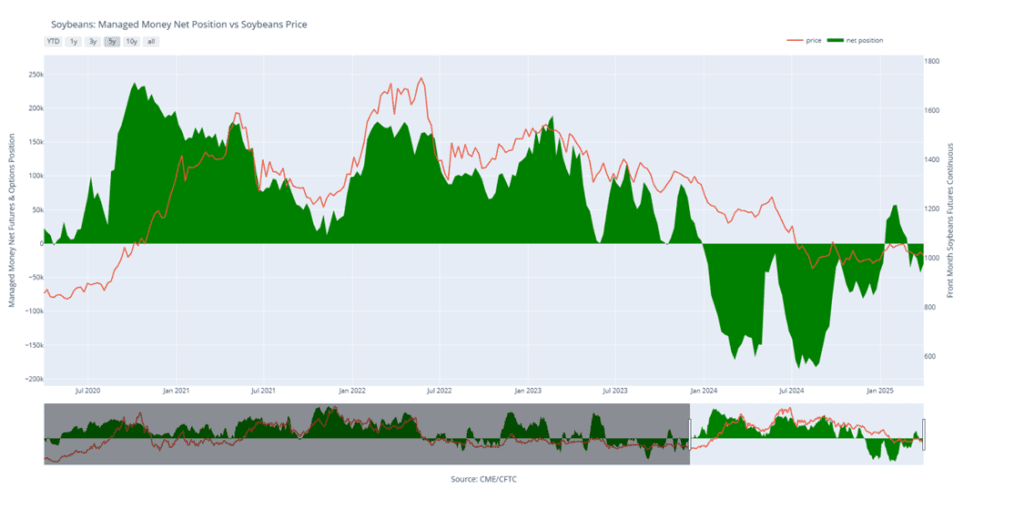

- Friday’s CFTC report saw funds as buyers of 13,112 contracts as of April 1, before the tariffs were announced, which left them with a net short position of 29,847 contracts. They were buyers of soybean oil by 38,856 contracts and sellers of bean meal by 16,683 contracts.

Soybeans Break Lower on Tariff News

The newly announced tariffs in early April caused soybean futures to drop sharply, breaking previously held support near the 1000 level that had sustained the market throughout March. Should the decline persist, support is expected to emerge around the December lows at 950. Conversely, if prices rally, initial resistance will be encountered at the 1000 level, followed by a confluence of major moving averages between 1020 and 1030. Of these, the 200-day moving average has proven particularly challenging for the soybean market to break above, restricting gains for nearly the last year and a half.

Soybean Managed Money Funds net position as of Tuesday, April 1. Net position in Green versus price in Red. Money Managers net bought 13,112 contracts between March 25 – April 1, bringing their total position to a net short 29,847 contracts.

Wheat

Market Notes: Wheat

- Wheat led grain gains today, appearing least affected by tariff concerns. Volatility spiked after early reports of a 90-day tariff pause (excluding China) were later denied, trimming market highs. Strength in Matif wheat also supported U.S. prices.

- Weekly wheat export inspections reached 12.3 mb, bringing total 24/25 inspections to 650 mb, up 15% from last year. Wheat inspections are running behind the USDA’s estimated pace; total 24/25 exports are forecast at 835 mb, up 18% from the previous year.

- Over the weekend, temperatures in the Plains states dropped below freezing. While minimal damage is expected for the winter wheat crop, this may still have injected some weather premium into the market today.

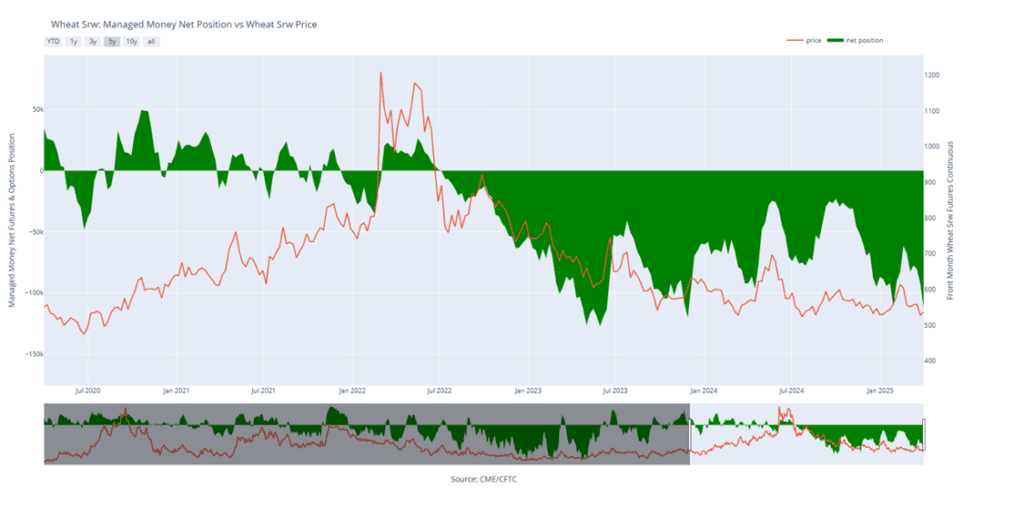

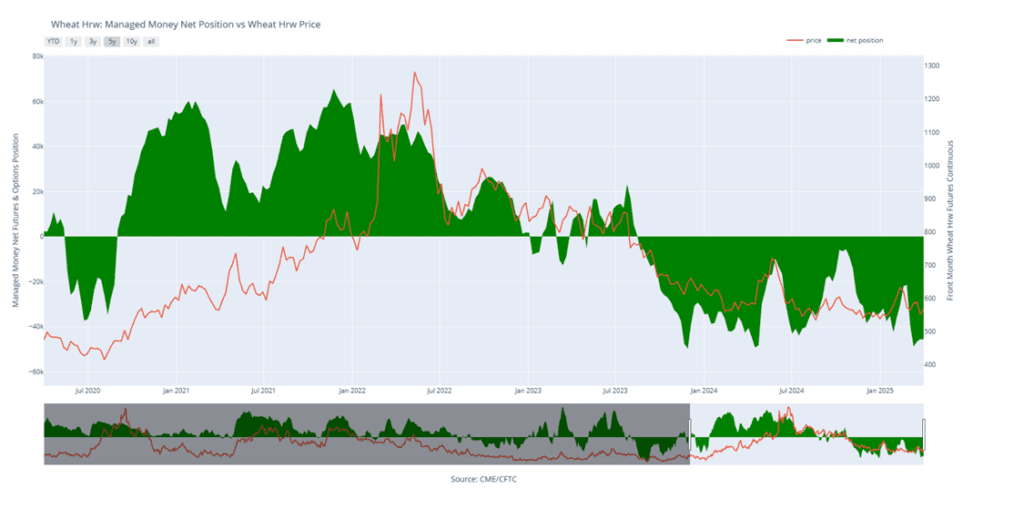

- CFTC data shows managed money increased net short positions in Chicago wheat to 112,000 contracts as of April 1, with total shorts across all wheat classes at 186,000 — the highest since December 2023.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 701 against May for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made so far to date.

- No Changes: 701 is still the price target to trigger a fifth sales recommendation.

2025 Crop:

- Plan A: Target 705.50 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made so far to date.

- No Changes: Still targeting 705.50 to trigger the sixth sales recommendation.

2026 Crop:

- Plan A: Target 704 against July ‘26 for the next sale

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made so far to date.

- No Changes: 704 is still the price target to trigger a second sales recommendation.

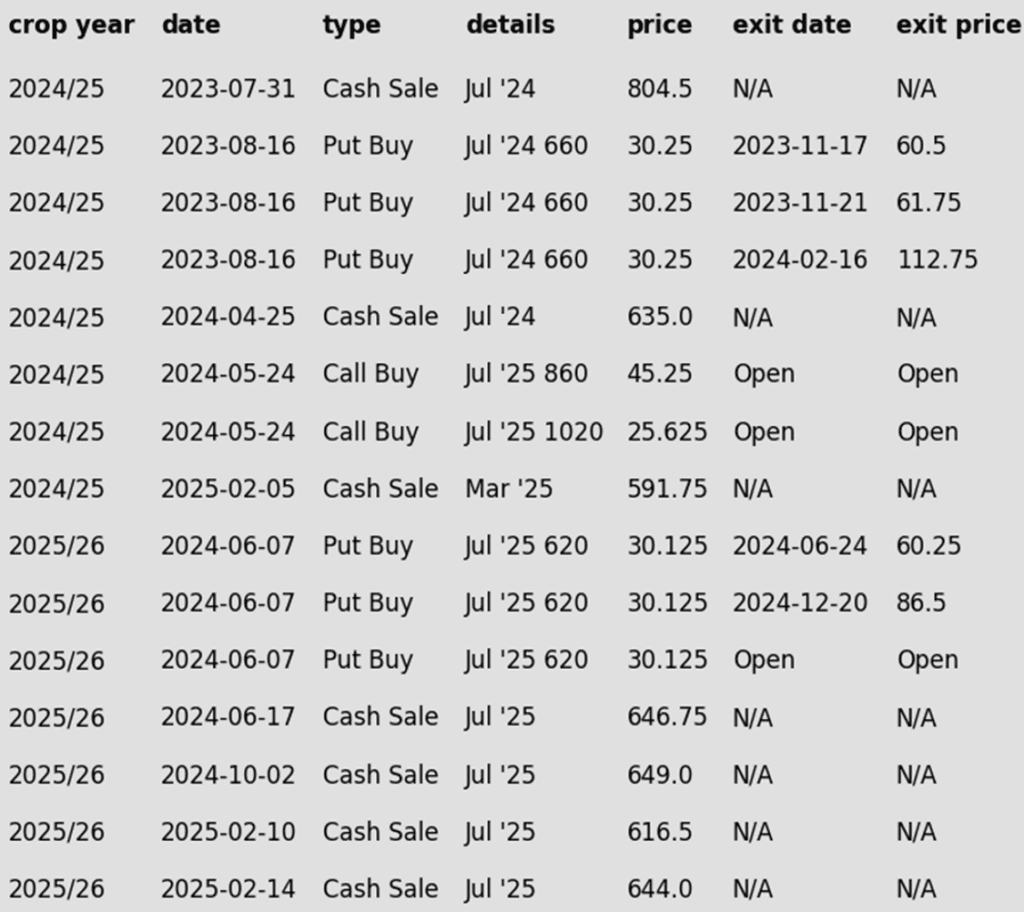

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat – Back to Sideways Trend

After months of sideways movement, Chicago wheat broke higher in February, rallying to early October highs just above 615. However, this mid-month peak quickly turned into a reversal point, with futures sliding back into the trading range that defined late 2024. Currently, support near 530 continues to hold firm. The next major resistance is the 200-day moving average, which now represents a critical test. A decisive weekly close above this level could signal a shift in momentum, potentially marking the beginning of a trend reversal and a return to upside momentum.

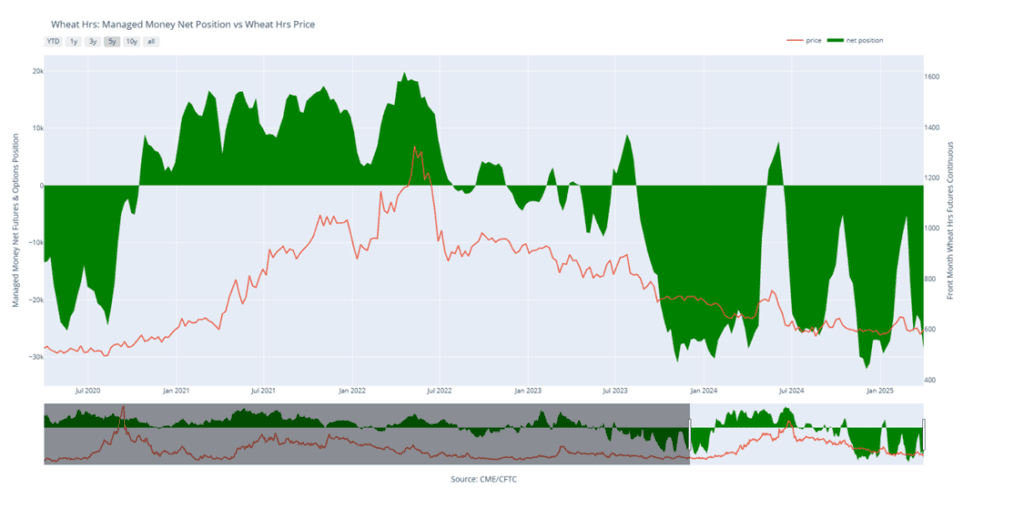

Chicago Wheat Managed Money Funds’ net position as of Tuesday, April 1. Net position in Green versus price in Red. Money Managers net sold 19,453 contracts between March 25 – April 1, bringing their total position to a net short 112,040 contracts.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made so far to date.

- No Changes: Still no active price targets, as the May contract continues to try forming a base in the 550–570 range.

2025 Crop:

- Plan A: Target 677 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made so far to date.

- No Changes: 677 is still the price target to trigger a sixth sales recommendation.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- No Changes: The expectation is still for targets to begin posting in the May – June timeframe.

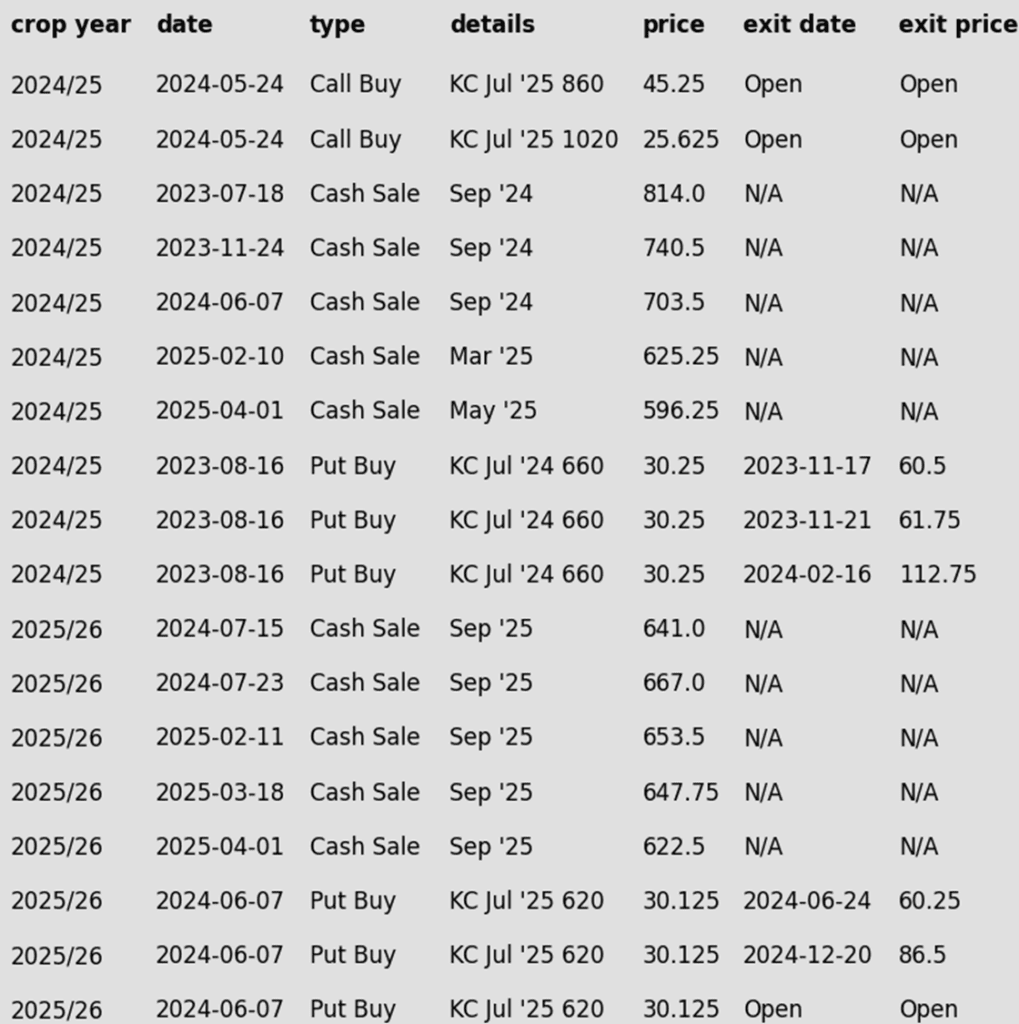

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Seeks Direction After February Whiplash

February was a wild ride for Kansas City wheat, with prices surging higher before tumbling back down, ultimately finishing the month little changed. March ended with weakness, bringing prices back near recent lows, but holding trendline support so far in April remains encouraging. On a rebound, the 200-day moving average is expected to act as initial resistance, with February highs near 640 serving as a more significant barrier. Support near the December lows of 540 should act as stout support on any continued decline.

KC Wheat Managed Money Funds’ net position as of Tuesday, April 1. Net position in Green versus price in Red. Money Managers net sold 225 contracts between March 25 – April 1, bringing their total position to a net short 45,675 contracts.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAY ’25 Cash

2025

Active

Sell SEP ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Sell another portion of your 2024 HRS crop. This marks the fifth sales recommendation to date and brings the average sales price to 695.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations were made prior to last week. With the current recommendation, this marks the fifth sales recommendation for the 2024 crop.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell another portion of your 2025 HRS crop. This marks the fifth sales recommendation to date and brings the average sales price to 646.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations were made prior to last week. With the current recommendation, this marks the fifth sales recommendation for the 2025 crop.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- No Changes: The expectation is still for targets to begin posting in the June – July timeframe.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Hovers Near Support

Spring wheat broke out of its long-standing sideways range in late January, triggering a surge of bullish momentum. The rally gained further traction in mid-February with a close above the 200-day moving average, but late-month weakness wiped out those gains, pushing futures back below key technical levels. Currently, the 200-day moving average acts as a barrier, limiting any rebound attempts, while support near 580 remains crucial in preventing further downside. To reignite the uptrend, futures would need to make a sustained move above the 200-day, with the next upside target at the February highs near 660. With spring wheat acreage expected to be the lowest in the past 55 years, weather volatility is likely to play a significant role in market movements.

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, April 1. Net position in Green versus price in Red. Money Managers net sold 4,961 contracts between March 25 – April 1, bringing their total position to a net short 28,680 contracts.

Other Charts / Weather