4-5 End of Day: Corn Settles Lower Despite Gains in Wheat and Soybeans

All prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’24 | 434.25 | -1 |

| JUL ’24 | 446.75 | -0.75 |

| DEC ’24 | 472.5 | -0.75 |

| Soybeans | ||

| MAY ’24 | 1185 | 5 |

| JUL ’24 | 1196.75 | 4.5 |

| NOV ’24 | 1184.75 | 1 |

| Chicago Wheat | ||

| MAY ’24 | 567.25 | 11 |

| JUL ’24 | 581.75 | 10.25 |

| JUL ’25 | 648.75 | 3.75 |

| K.C. Wheat | ||

| MAY ’24 | 582.25 | 4.75 |

| JUL ’24 | 579.5 | 6.5 |

| JUL ’25 | 633.25 | 3.75 |

| Mpls Wheat | ||

| MAY ’24 | 648 | 1.75 |

| JUL ’24 | 656.5 | 1.75 |

| SEP ’24 | 666.25 | 1.75 |

| S&P 500 | ||

| JUN ’24 | 5251.5 | 54.25 |

| Crude Oil | ||

| JUN ’24 | 85.9 | 0.09 |

| Gold | ||

| JUN ’24 | 2344.7 | 36.2 |

Grain Market Highlights

- Corn’s early support from the wheat and soybean markets faded as the market struggled to find new buyers above key moving averages with demand concerns remaining about the impact of Avian Influenza and the prospect of good planting weather ahead.

- Soybeans are struggling to stay above the 20 and 50-day moving averages as they remain locked in a sideways pattern for the 4th consecutive day. Overall support remains from strong crush demand and firmer soybean oil despite demand concerns for soybean meal.

- Despite the downturn in Malaysian palm oil, soybean oil rebounded from yesterday’s losses, finding strong support near its 20-day moving average. Conversely, soybean meal experienced only marginal losses for the day, as its attempt to rally above resistance near the 20-day moving average fell short.

- Ukrainian attacks on Russian airfields likely spurred further short covering in the wheat complex, rallying prices early. While both Chicago and KC initially traded higher through their 50-day moving averages before retracing, Minneapolis encountered resistance just above its 20-day moving average before declining. Ultimately, all three classes settled mid-range and well off their respective highs.

- To see the updated US 7-day precipitation forecast, 8 – 14 day temperature and precipitation outlooks, and 2-week precipitation forecast for Brazil and N. Argentina, courtesy of the NWS and NOAA.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

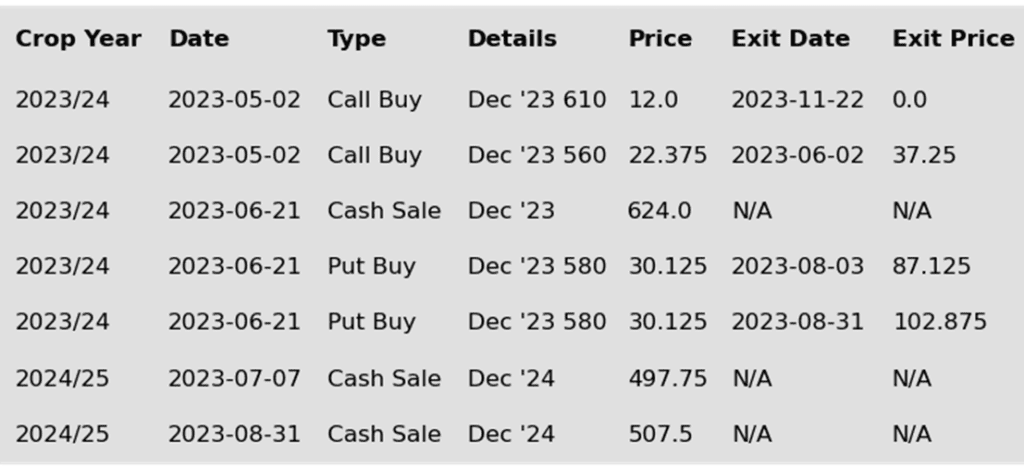

Action Plan: Corn

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Corn Action Plan Summary

From the low on February 26 to the high on March 12, May corn experienced a significant rally of nearly 40 cents. However, since then, it has consolidated within a narrow trading range, fluctuating mostly between 430 and 445. During this period, Managed Money has reduced its net short position by approximately 53,000 contracts, although it still holds a historically large short position of around 252,000 contracts. The size of Managed Money’s net short position, coupled with prevailing macro oversold conditions, suggests potential for further upside as we head into spring planting. While the recovery in corn prices may encounter obstacles, overall market conditions remain conducive to a continued price recovery into May and June.

- No new action is recommended for 2023 corn. The target range to make additional sales is 480 – 520 versus May ’24 futures. If you need to move bushels for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- No new action is recommended for 2024 corn. We are targeting 520 – 560 to recommend making additional sales versus Dec ‘24 futures. For put option hedges, we are looking for 500 – 520 versus Dec ‘24 before recommending buying put options on production that cannot be forward priced prior to harvest.

- No Action is currently recommended for 2025 corn. At the beginning of the year, Dec ’25 corn futures left a gap between 502 ½ and 504 on the daily chart. Considering the tendency for markets to fill price gaps like these, we are targeting the 495 – 510 area to recommend making additional sales.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn prices stayed in a consolidation pattern looking for direction. Despite strong trade in the wheat market and firm trade in the soybean market, corn futures failed to participate. For the week, May corn futures lost 7 ¾ cents and posted its lowest weekly close going back to the last week of February.

- Demand concerns due to the potential impact of HPAI (Avian Influenza) have limited the corn market this week. The cases of HPAI have grown in both poultry and dairy cattle this week, which could limit feed demand usage of corn.

- Chinese corn prices have traded near three-year lows on the Dalian exchange as corn supplies are plentiful. The USDA foreign ag service reduced 24/25 Chinese corn imports citing better expected overall production and increased planting area. China has remained mostly absent from the US corn export market so far this marketing year.

- Climate Prediction Center 8-14 day weather models are forecasting above normal temperatures and below normal precipitation going into Mid-April. That combination and recent rain fall over the past week improved the chances for the next US corn crop to get off to a good start.

- Brazil weather remains unthreatening overall for development of the second (safrinha) corn crop. There are no short-term issues now, but South American weather will remain a key market driver in the weeks ahead.

Above: Since the beginning of March, the corn market has been trading sideways, bound mostly by 445 up top and 430 down below. If prices can breakout and close above resistance between the recent high of 448 and the January high of 452 ¼, they could run toward the next major resistance level of 495 – 510. If they break out to the downside and close below 421, they could slide further to test 400 – 410 support.

Soybeans

Action Plan: Soybeans

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

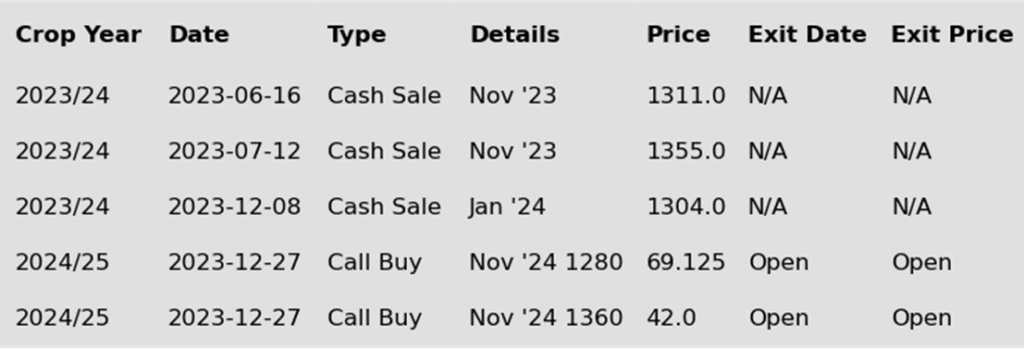

Soybeans Action Plan Summary

The USDA gave little in the way of outright bullish information to trigger great amounts of short covering as their March 1 stocks and prospective soybean plantings estimates were relatively neutral and came in as expected by the market. That said, Managed Money still held a sizable 135,000 contract net short position in the most recent Commitment of Traders report, which can still fuel a short covering rally if issues come up this season, with planting not that far off. Otherwise, prices may still be at risk of retesting the recent lows this spring if weather stays benign and planting goes smoothly.

- No new action is recommended for 2023 soybeans. We are currently targeting a rebound to the 1275 – 1325 area versus May ’24 futures to recommend making further sales. If you need to move inventory for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- No new action is recommended for the 2024 crop. Considering the amount of uncertainty that lies ahead with the 2024 soybean crop, we recommended back in December buying Nov ’24 1280 and 1360 calls to give you confidence to make sales against anticipated production and to protect any sales in an extended rally. We are currently targeting the 1280 – 1320 range versus Nov ’24 futures, which is a modest retracement toward the 2022 highs, to recommend making additional sales.

- No Action is currently recommended for 2025 Soybeans. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher and were bull spread with most of the gains in the front months while new crop soybeans were only 1 cent higher. Support came again from strength in the soybean oil market with May futures closing higher by 1.54% while soybean meal slipped a bit lower.

- For the week, May soybeans lost 6 ½ cents which marks the third consecutive week of losses. November soybeans only lost 1 ½ cents for the week; May soybean meal was down $4.60, while May soybean oil gained 0.94 cents. Last week, funds covered a portion of their net short position but likely sold some of it back out this week.

- With palm oil having traded lower today, strength in soybean oil likely came from higher crude oil. Today, Brent crude oil rose to over $90 today and some analysts expect that it could exceed $100 a barrel. Increasing tensions between Iran and Israel are the likely reason for this week’s rally.

- Export sales remain weak for soybeans with 7.1 mb in sales reported in yesterday’s report as the world largely turns to Brazil for their purchases. Yesterday there was some positive news with Mexico picking up 5.6 mb of old crop US soybeans, but that was the first flash sale reported in weeks.

Above: Support around 1168 appears to be holding for now. Should that area continue to hold, and prices close above the recent high around 1227, they could then run toward the 1291 – 1297 chart gap, though resistance might be found near 1250. If prices drop below 1168, they then run the risk of retreating toward 1130 – 1140.

Wheat

Market Notes: Wheat

- Wheat managed double digit gains in the Chicago class, with Kansas City and Minneapolis having only modest gains. Early strength stemmed from talk that Ukraine attacked Russian airfields, but some of that strength faded into the close, potentially due to a friendly jobs report that rallied the US Dollar Index. And after a back-and-forth trade over the past several sessions, May Chicago did post a weekly gain of seven cents.

- FAO-AMIS has reportedly reduced their estimate of global wheat stockpiles for the 23/24 season. Compared to the March estimate of 318.9 mmt, the new projection has fallen to 317.9 mmt. While they also slightly raised wheat production, the lower stocks are attributed to a cut to Russian inventory.

- Wheat conditions in France are rated 65% good to excellent. For reference, the crop was rated at 93% GTE at this time last year. Very wet conditions in western Europe are to blame for the decline. Other than some dryness in the Black Sea region and the US southern plains, there are not many other concerns for global wheat growing areas.

- While Russia and Ukraine still have the world’s cheapest wheat offers, Russian FOB values have increased from $198 to $213 per ton over the past three weeks. If those export prices continue to rise, it may present the opportunity for the US to become more competitive.

- From a technical perspective, May Chicago wheat rallied above the 50-day moving average of 570 during today’s session. Though it closed below that level, it has not traded above that moving average since late January. Therefore, the chart is beginning to look a bit more friendly, and any supportive news in the future may give wheat reason to run to the upside.

Action Plan: Chicago Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

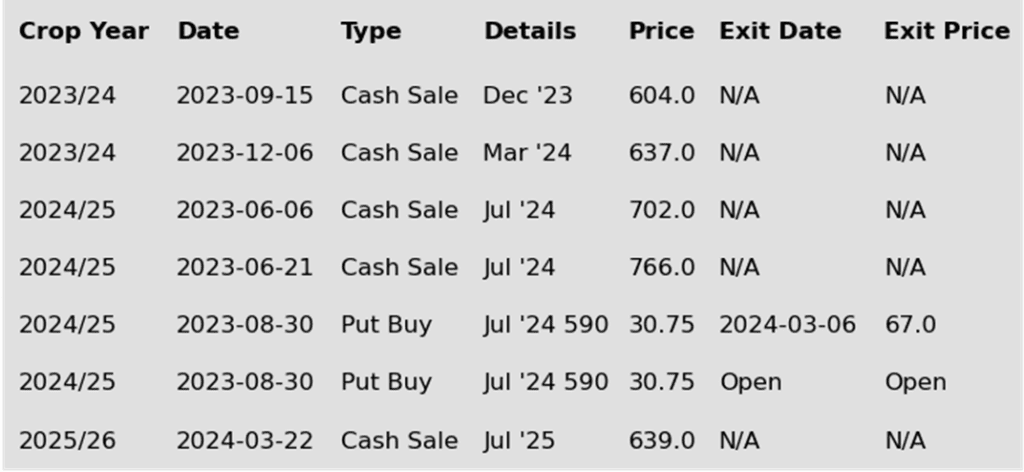

Chicago Wheat Action Plan Summary

Since making a fresh low in early March, Chicago wheat has traded mostly sideways with relatively small gains capped by overhead resistance. Although the lack of any bullish information has been disappointing, the market remains oversold on a macro level, and managed funds continue to hold a significant net short position. Either or both of these factors could fuel a short covering rally at any time as we head into the more active part of the growing season.

- No new action is currently recommended for 2023 Chicago wheat. Any remaining 2023 soft red winter wheat should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 Chicago wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Chicago wheat. At the end of August, we recommended purchasing July ‘24 590 puts to prepare for further price erosion, and recently recommended exiting half of those puts to lock in gains and get closer to a net neutral cost on the remaining position. For now, we are targeting a market rebound back towards 675 – 715 versus May ’24 futures before recommending any additional sales. As for the open 590 put position, we are looking for prices between 475 – 500 versus July ’24 futures to before we recommend exiting half of the remaining July ’24 590 puts.

- No new action is currently recommended for 2025 Chicago Wheat. We recently recommended initiating your first sales for the 2025 SRW crop year as prices pressed back toward the mid-600 range to take advantage of historically good prices for next year’s crop. Since plenty of time remains to market this crop, we are looking for further price appreciation and are currently targeting the 690 – 725 area to recommend making additional sales.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Significant resistance remains above the market around the 50-day moving average. Should prices rebound and close above 567, they could still potentially challenge the 100-day moving average, as well as the congestion area between 585 and 620. Although, if prices retreat and close below 523 ½, there’s a risk of trading downwards toward the next major support level situated around 488.

Action Plan: KC Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

KC Wheat Action Plan Summary

Since the end of February, prices have been trading in a broad range, bound mostly by 555 on the downside and 605 up top, with little fresh bullish news to trade, while US exports continue to suffer from lower world export prices. Although, fundamentals remain weak. Managed funds continue to hold a considerable net short position, and the market is at levels not seen since spring of 2021, which combined could trigger a return to higher prices if unforeseen risks enter the market.

- No new action is recommended for 2023 KC wheat crop. Considering the current US export demand challenges and the sideways nature of the wheat market, we are looking for prices to return to the upper end of the recent range and are targeting the 600 area versus May ’24 to recommend making additional sales.

- No new action is recommended for 2024 KC wheat. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts to protect the downside, and recommended exiting the original position in three separate tranches as the market got further extended into oversold territory to protect any gains that were made. The current strategy is to target 625 – 650 versus July ’24 futures to recommend additional sales.

- No action is currently recommended for 2025 KC Wheat. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following KC recommendations:

Above: Significant resistance remains within the range bound by the 50-day moving average and the March 10 high of 605 ¼. A close above 605 ¼ might pave the way for further advancement toward the congestion area of 610 – 640. Otherwise, should prices retreat below the initial support level of 561, there’s a possibility of testing the March low of 551 ½.

Action Plan: Mpls Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Mpls Wheat Action Plan Summary

Minneapolis wheat has primarily traded within a range since last February until a recent breakout below its lower boundary, marking new contract lows and potentially signaling a continuation of the downtrend initiated last summer. Despite facing resistance from the 50-day moving average and a lack of bullish catalysts, seasonal patterns tend to improve heading into early summer. Furthermore, managed funds still maintain a large net short position, which might trigger a short covering rally at any time.

- No new action is currently recommended for 2023 Minneapolis wheat. The current strategy is to look for a modest retracement of the July high and target 675 – 700 to recommend more sales.

- No new action is recommended for 2024 Minneapolis wheat. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts (due to their higher liquidity and correlation to Minneapolis), to protect the downside, and recommended exiting the original position in three separate tranches as the market got further extended into oversold territory to protect any gains that were made. The current strategy is targeting the 775 – 815 area versus Sept ’24 to recommend making additional sales. We are also targeting the 850 – 900 area to recommend buying upside calls to help protect any sales that would have been made.

- No action is currently recommended for the 2025 Minneapolis wheat crop. We are currently not considering any recommendations at this time for the 2025 crop that will be planted in the spring of next year. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: After posting a key bullish reversal on April 3 and with additional support from being oversold, prices may attempt to extend further and challenge the resistance area around 660 – 670. However, if they fail to rally, they may be at risk of drifting back toward psychological support at 600 and the March ’21 low of 596 ¼.

Other Charts / Weather

US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Brazil and N. Argentina 2-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.