4-30 End of Day: Overbought Conditions Bring Out Commodity Sellers on a Risk Off Day

All prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’24 | 439.5 | 0.25 |

| JUL ’24 | 446.75 | -2.5 |

| DEC ’24 | 469.5 | -3.25 |

| Soybeans | ||

| MAY ’24 | 1145.5 | -15.25 |

| JUL ’24 | 1163 | -19 |

| NOV ’24 | 1159.5 | -18.5 |

| Chicago Wheat | ||

| MAY ’24 | 585 | -5.25 |

| JUL ’24 | 603.25 | -5.25 |

| JUL ’25 | 681.25 | 0 |

| K.C. Wheat | ||

| MAY ’24 | 622.75 | -21 |

| JUL ’24 | 635.25 | -15.25 |

| JUL ’25 | 679.75 | -8 |

| Mpls Wheat | ||

| MAY ’24 | 710.25 | -5 |

| JUL ’24 | 704.25 | -3.5 |

| SEP ’24 | 709.75 | -4.25 |

| S&P 500 | ||

| JUN ’24 | 5100.25 | -46.75 |

| Crude Oil | ||

| JUN ’24 | 81.84 | -0.79 |

| Gold | ||

| JUN ’24 | 2305.1 | -52.6 |

Grain Market Highlights

- Despite the broader market selloff, July corn managed to find support near its 50-day moving average and stave off heavy losses with support from cash markets and the lack of deliveries on First Notice Day.

- July soybeans faced significant pressure from both products in the day session after an overnight rebound attempt stalled at its 50-day moving average and led to its lowest close in over a week.

- Lower palm oil due to weak export demand, and a year over year drop in bean oil usage for biofuel weighed heavily on soybean oil which closed at a fresh three-year low. Meal also closed lower, despite support from the strike and rainy conditions in Argentina.

- Overbought conditions, along with lower Matif wheat and a higher US dollar brought the sellers out in the wheat complex. KC led the complex lower with its double-digit losses, while Minneapolis and Chicago both rebounded from their respective lows, with July Chicago finding support near its 100-day moving average.

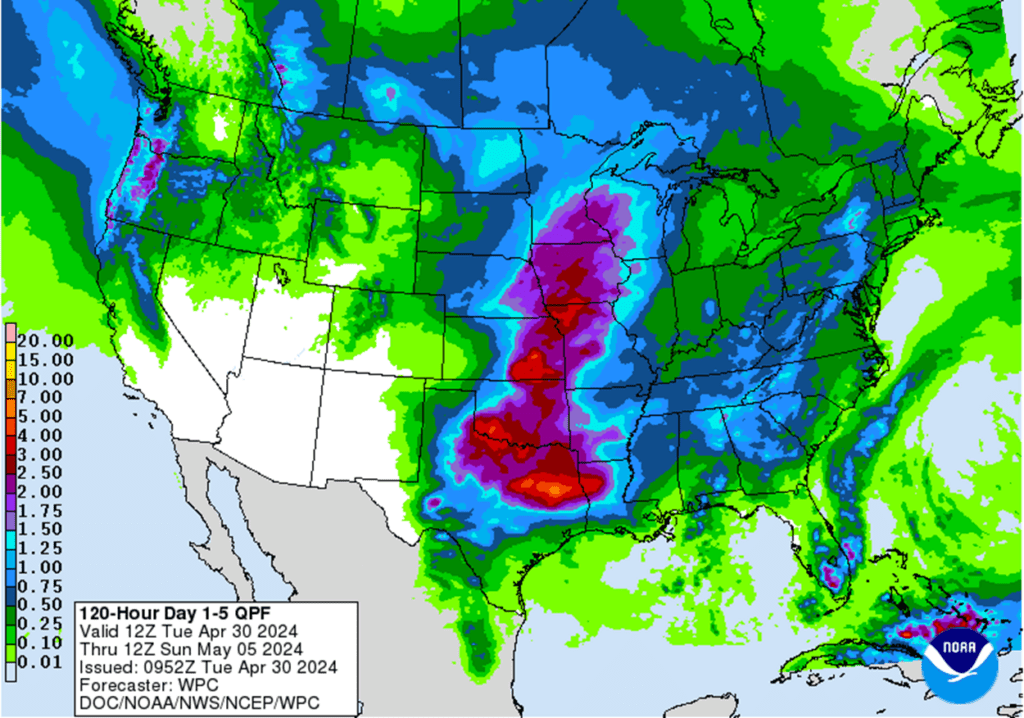

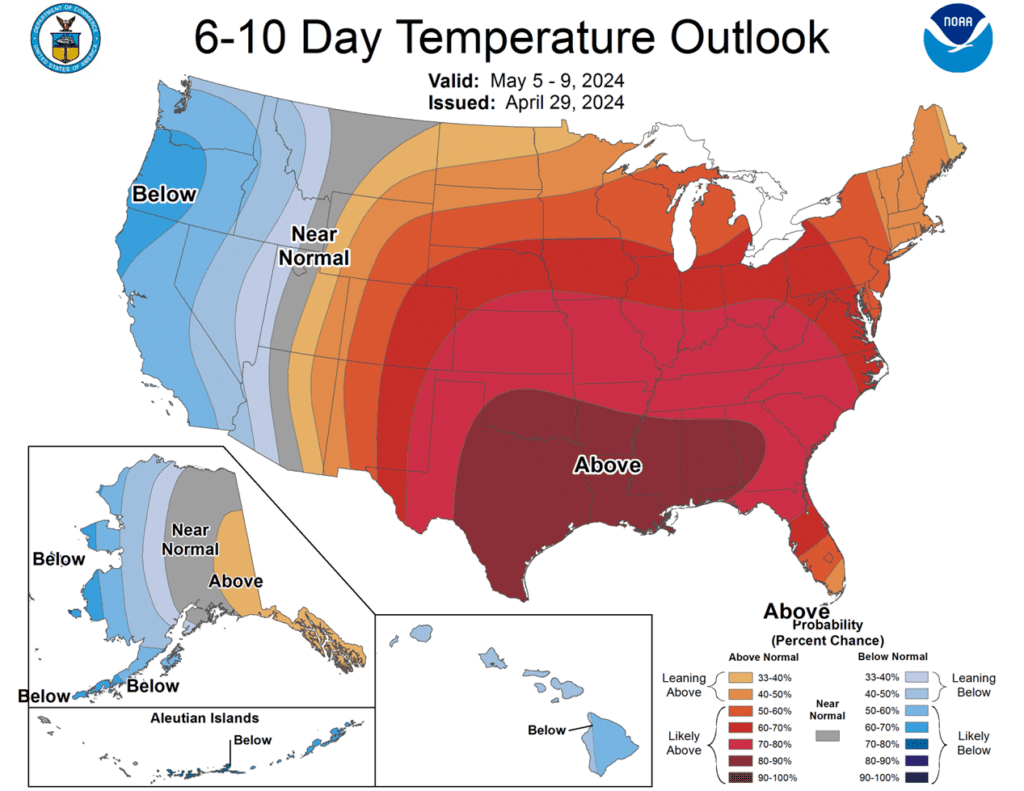

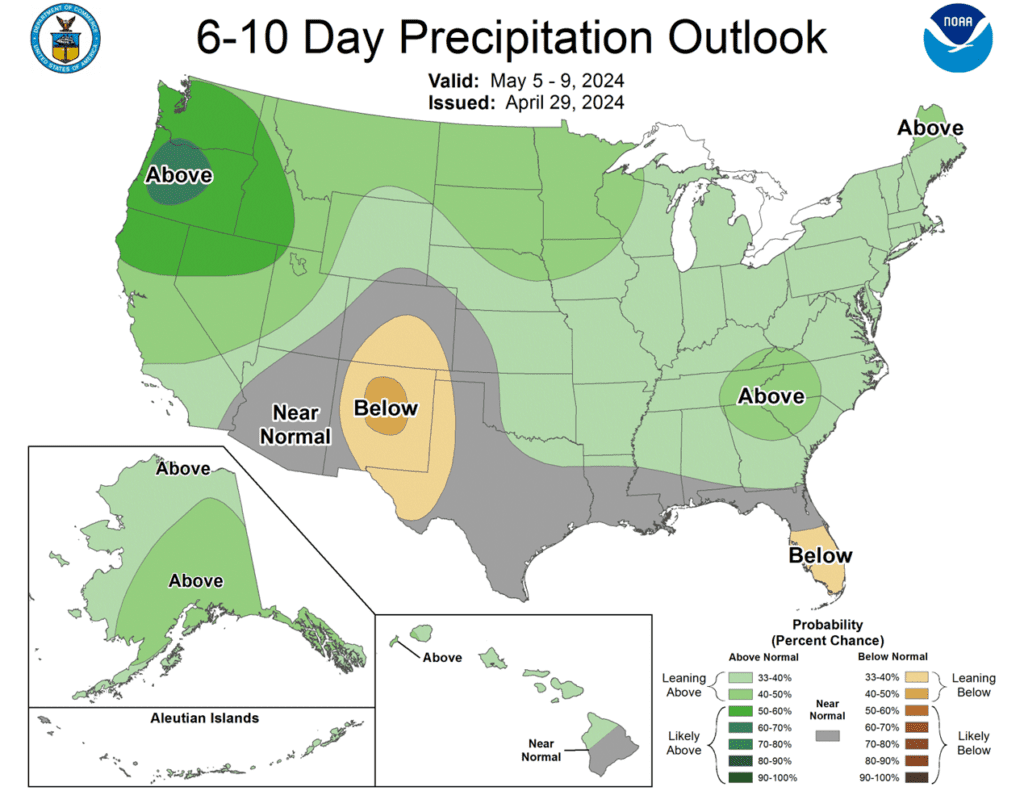

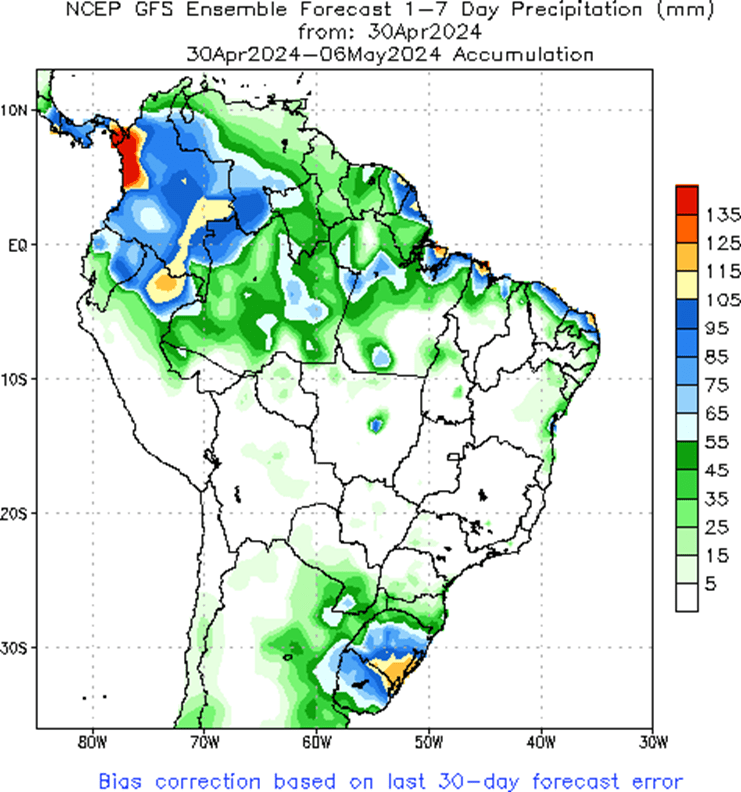

- To see the updated US 5-day precipitation forecast, US 6 – 10 day Temperature and Precipitation Outlooks, and 1-week precipitation forecast for Brazil and N. Argentina courtesy of NOAA and The Climate Prediction Center scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

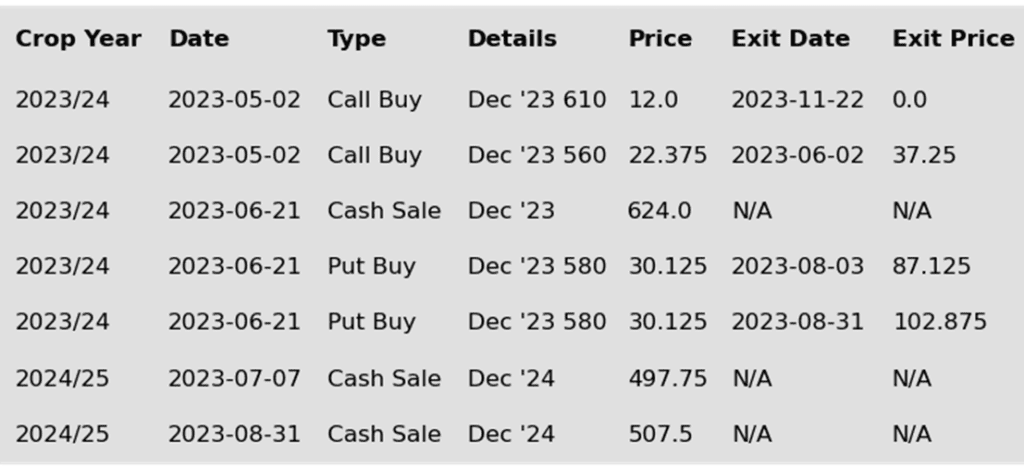

Corn Action Plan Summary

Although July ’24 corn has rallied beyond the congestion range on the front month continuous charts, it remains below its high of 460 that was posted on March 28. With little fresh bullish fundamental news, managed funds have maintained a significant net short position. While the fund’s large net short position likely sparked the recent rise in prices and could fuel a more significant upside move as we move through planting and into the growing season, the market now shows signs of being overbought, which could add resistance to higher prices. Despite potential obstacles along the way, overall market conditions and seasonal tendencies remain conducive to a continued price recovery into May and June.

- No new action is recommended for 2023 corn. The target range to make additional sales is 480 – 520 versus May ’24 futures. If you need to move bushels for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- No new action is recommended for 2024 corn. We are targeting 520 – 560 to recommend making additional sales versus Dec ‘24 futures. For put option hedges, we are looking for 500 – 520 versus Dec ‘24 before recommending buying put options on production that cannot be forward priced prior to harvest.

- No Action is currently recommended for 2025 corn. At the beginning of the year, Dec ’25 corn futures left a gap between 502 ½ and 504 on the daily chart. Considering the tendency for markets to fill price gaps like these, we are targeting the 495 – 510 area to recommend making additional sales.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Despite strong selling in other grain markets, corn futures only saw moderate losses, supported by firm cash markets and zero deliveries against the May futures contract with the arrival of First Notice Day.

- The lack of deliveries may be reflective of the lack of farmers selling stored bushels. The cash basis market has been supportive of prices as producers have been more focused on planting the next crop versus marketing stored bushels. With more farmers out of fields this week due to wetness, the cash market may see more bushels moving in the days ahead.

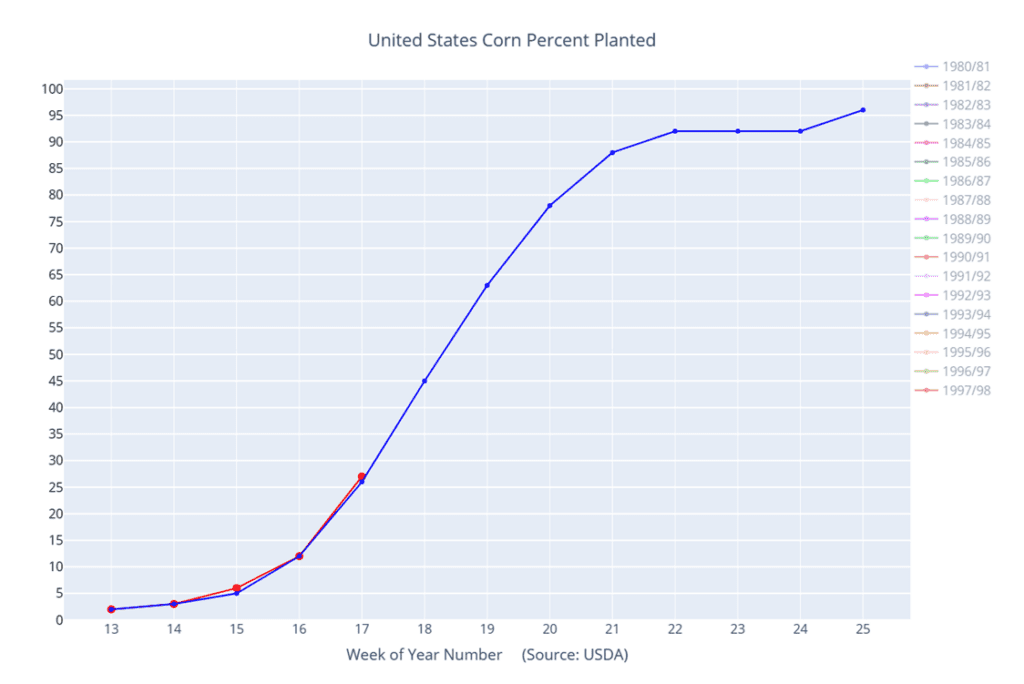

- Corn planting is still running well ahead of schedule as producers pushed to get acres planted before last week’s rain. The corn crop was 27% planted, up 15% from last week. This is also trending 5% above the 5-year average and 4% above last year. Strong progress was noted in western and southern parts of the Corn Belt last week.

- The planting pace is expected to slow over the next couple weeks. Weather models are forecasting rounds of precipitation to push through the Corn Belt, which could limit planting until the middle of May.

- Reports of strong farmer selling in Brazil and Argentina have been limiting the corn market’s rally potential. The movement of corn in South America is making more bushels available to the export market, which could limit US near-term export demand.

Above: The corn market continues to struggle to rally with overhead resistance remaining around 460 in the July contract. A breakout above there could allow prices to test the 495 – 510 area. If prices break to the downside and close below 421, they could slide further to test 400 – 410 support.

Above: Corn percent planted (red) versus the 10-year average (blue).

Soybeans

Action Plan: Soybeans

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

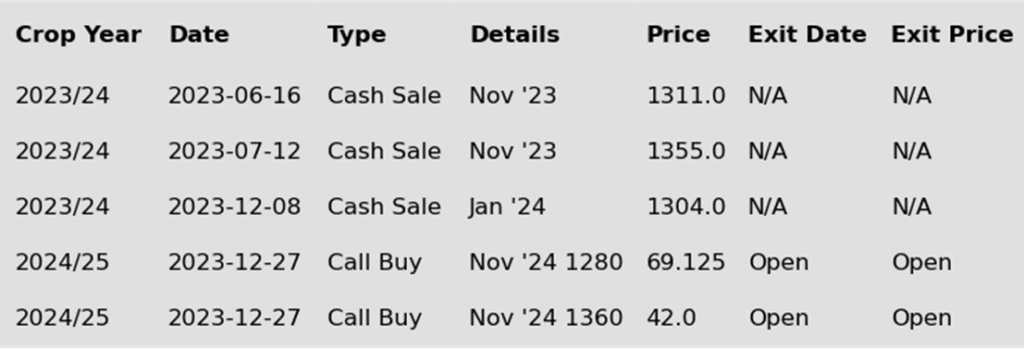

Soybeans Action Plan Summary

In mid to late April soybeans posted an intermediate low and a bullish reversal with some subsequent short covering which rallied the market back toward early April’s congestion area. While that initial rally was limited, and the current supply/demand situation remains somewhat bearish, Managed funds remain short about 149,000 contracts according to the latest Commitment of Traders report. This could still fuel an extended short covering rally should any production concerns arise in the coming weeks. Otherwise, if weather conditions cooperate and planting progresses without major issues, prices could remain susceptible to revisiting recent lows throughout the spring.

- No new action is recommended for 2023 soybeans. We are currently targeting a rebound to the 1275 – 1325 area versus May ’24 futures to recommend making further sales. If you need to move inventory for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- No new action is recommended for the 2024 crop. Considering the amount of uncertainty that lies ahead with the 2024 soybean crop, we recommended back in December buying Nov ’24 1280 and 1360 calls to give you confidence to make sales against anticipated production and to protect any sales in an extended rally. We are currently targeting the 1280 – 1320 range versus Nov ’24 futures, which is a modest retracement toward the 2022 highs, to recommend making additional sales.

- No Action is currently recommended for 2025 Soybeans. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans finished the day sharply lower due to big losses in soybean oil for the second consecutive day. This morning, there were 533 soybean deliveries reported against the May contract and 2,101 deliveries against May soybean oil. Soybean meal was lower today as well but not by as much as soybean oil which lost over 3% as it followed palm oil lower.

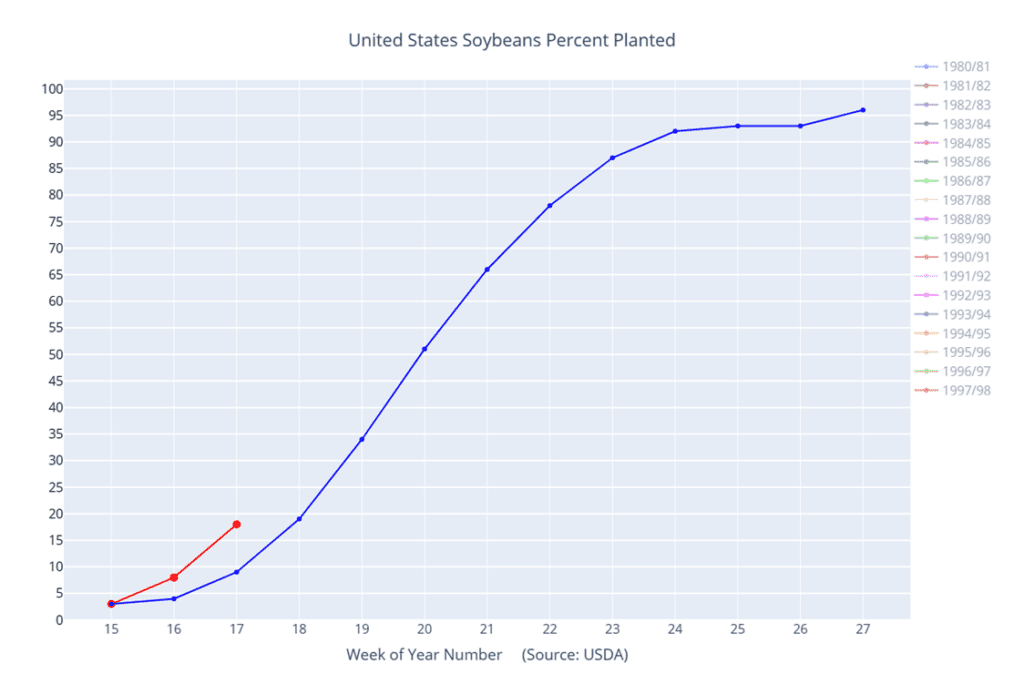

- Yesterday afternoon, the USDA released its Crop Progress report which showed that 18% of the soybean crop has been planted as of this past Sunday. This compares to 8% last week and the 5-year average of 10%. Progress was one point higher than the average trade guess.

- In the eastern part of the Corn Belt, continuous rains are causing some planting delays that are expected to last until May 18. In Argentina, continuous rains are falling as well, which is keeping farmers out of the field and unable to harvest soybeans which could lead to lower total production if yields are impacted.

- In South America, the Brazilian soybean harvest is estimated at 90% complete. Similar to Argentina, the southern region of Brazil is receiving too much rain and holding up harvest progress. Both southern Brazil and Argentina are expected to continue receiving rains throughout the week.

Above: Since posting a bullish reversal on April 19, the market has struggled to stay above 1190. A close above the April 24, 1191 ¾ high could allow the market to run and test the 1227 March high. Otherwise, support below the market remains between 1145 and 1140, if prices slide back toward key support and the February low of 1128 ½.

Above: Soybeans percent planted (red) versus the 10-year average (blue).

Wheat

Market Notes: Wheat

- Wheat experienced a negative close across all three US futures classes, with KC contracts leading the way with double-digit losses. Additionally, lower Matif futures and a stronger US Dollar failed to offer any support, suggesting a risk-off session as numerous other commodities also closed lower. Equities mirrored this trend, with the Dow dropping over 400 points at the time of writing.

- From a technical perspective, all three US wheat classes are either at or near overbought levels, signaling a potential correction to the downside. In particular, daily stochastics indicate potential sell signals, suggesting further downward momentum. However, July Chicago wheat managed to find support at its 100-day moving average (596) and closed above that level.

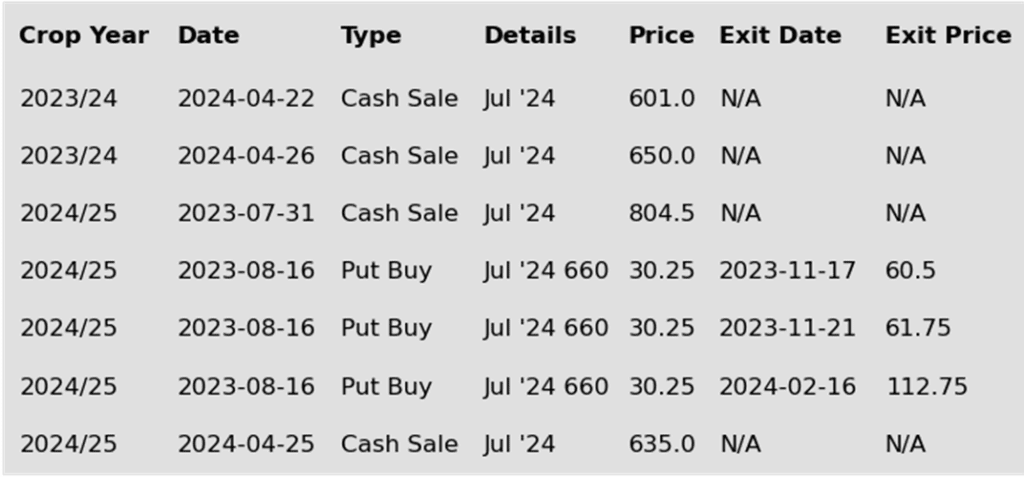

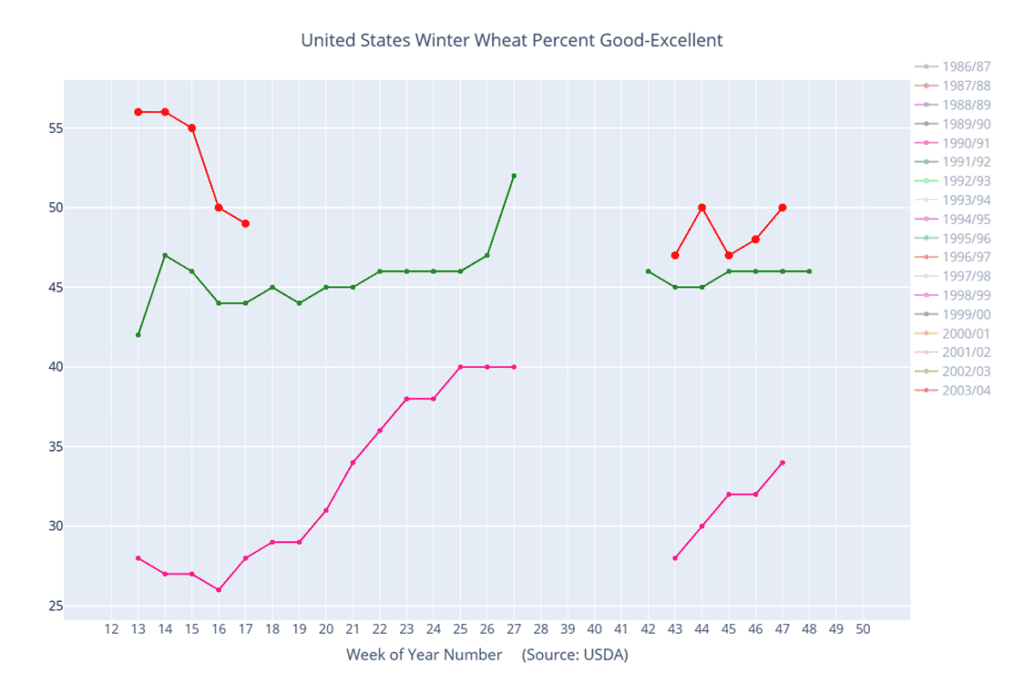

- According to yesterday afternoon’s Crop Progress report from the USDA, winter wheat conditions fell by 1% to 49% rated good to excellent. Despite recent declines, conditions remain significantly better than a year ago and are the highest for this time of year since 2020. Additionally, 30% of the crop is now headed, marking an increase from 23% last year and 21% on average. The USDA also reported that 34% of the spring wheat crop is planted, a substantial jump from 10% a year ago and 19% on average.

- Two vessels containing Russian wheat destined for Egypt are reportedly being held up in port by the Russian government, despite passing inspection by Egyptian officials. This news follows the delay of two vessels in March and early April.

- Brazil’s wheat planted area may shrink this year after increasing by over 70% between 2019 and 2023. CONAB is anticipating a 4.7% drop in area compared to last season, citing uncertain weather, lower prices, and higher costs as contributing factors to the potential decline.

Action Plan: Chicago Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Chicago Wheat Action Plan Summary

After holding downside support near 550, Chicago wheat staged a rally, likely fueled by Managed fund short covering and HRW crop concerns, that took it through the major moving averages on the continuous chart, and towards last December’s highs. Although bearish fundamentals remain, and the market shows signs of being overbought which adds downside risk, Managed funds still hold a large net short position that has the potential to drive an extended short covering rally should any crop more concerns arise as we enter the more dynamic part of the growing season.

- No new action is currently recommended for 2023 Chicago wheat. Any remaining 2023 soft red winter wheat should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 Chicago wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Chicago wheat. Back in August we recommended buying July ’24 590 puts to prepare for further price erosion. Since then, we recommended exiting half of the original position to get closer to a net neutral cost, and then most recently, we recommended exiting another half of the remaining position to lock in further gains in case prices continue higher, leaving 25% of the original position in place. We continue to target a market rebound back towards 675 – 715 versus July ’24 futures before recommending any additional sales. As for the open July ’24 590 put position, we are looking for prices between 475 – 500 versus July ’24 futures to before we recommend exiting any of the last 25%.

- No new action is currently recommended for 2025 Chicago Wheat. We recently recommended initiating your first sales for the 2025 SRW crop year as prices pressed back toward the mid-600 range to take advantage of historically good prices for next year’s crop. Since plenty of time remains to market this crop, we are looking for further price appreciation and are currently targeting the 690 – 725 area to recommend making additional sales.

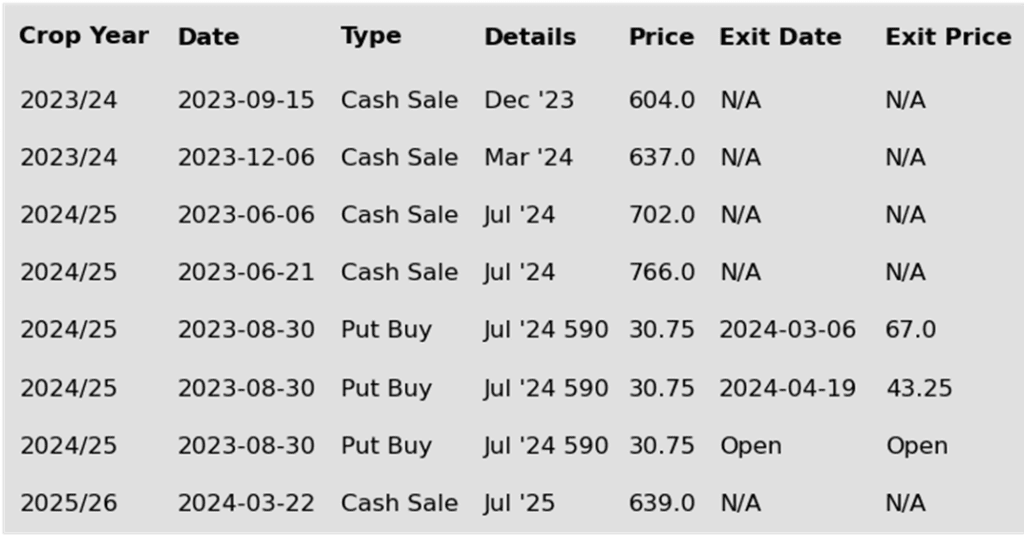

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: After failing to close above the December high of 630, Chicago wheat retreated and found initial support near the 200-day moving average. If initial support holds, and the market turns back higher, a close above the recent 633 ¼ high could open the door for a test of 664 resistance. Otherwise, if prices retreat, initial support is likely around 575 and the 50-day moving average (currently 563).

Action Plan: KC Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

Active

Sell JUL ’24 Cash

2024

Active

Sell JUL ’24 Cash

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

KC Wheat Action Plan Summary

Between the end of February and the middle of April, KC wheat was mostly rangebound between the mid 590’s on the topside and mid 550’s down low, with little to move prices higher. All the while Managed funds continued adding to their large net short positions. Toward the end of April, dryness in the Black Sea region and the US HRW growing areas started becoming more concerning and triggered a short covering rally across the wheat complex, driving prices to levels not seen since last December. While low world export prices continue to be a drag on US demand and prices, and it is likely that Managed funds covered a significant portion of their net short positions, it is also quite possible that they remain short the market. Which could still push prices higher if production concerns persist.

- Grain Market Insider sees a continued opportunity to sell a portion of your 2023 HRW wheat production. Dryness in the Southwestern Plains and Russia, along with elevated geopolitical tensions in the Middle East and Black Sea spurred Managed funds to cover some of their extensive short positions in the wheat complex. As a result, the July ’24 KC wheat futures contract is about 50 cents higher than our previous old crop sales recommendation, and near both the 200-day moving average and the resistance area of last December’s highs. Considering this rally may primarily be weather driven and could be short-lived, as well as being limited on time before the 2024 crop is harvested, we advise you to take advantage of these elevated prices to sell another portion of your 2023 HRW wheat inventory.

- Grain Market Insider sees a continued opportunity to sell a portion of your 2024 HRW wheat production. Since the end of July, the wheat market has been in a downtrend with no significant selling opportunities, while many uncertainties remain that could drive prices even higher. The market is now approximately 90 cents off the March low and entering an area of heavy resistance that coincides with a 25% retracement of the recent downtrend back toward the July high. Grain Market Insider recommends taking advantage of this rally to make an additional sale on your 2024 crop.

- No action is currently recommended for 2025 KC Wheat. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

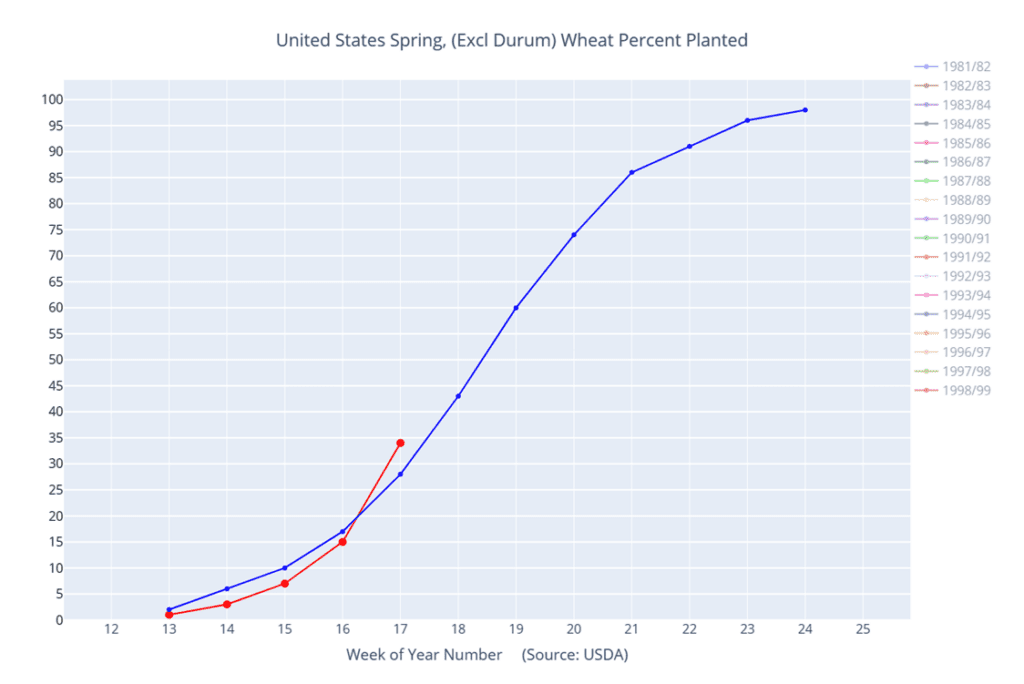

To date, Grain Market Insider has issued the following KC recommendations:

Above: After failing to close above the 200-day moving average and posting a bearish reversal on April 29, the KC wheat market retreated and closed through 640 initial support. The market is now on track to test support near the 100-day moving average (near 604) and the broad support area of 605 – 551. If prices turn back higher and close above 664, they could then run to test the 678 – 700 area.

Above: Winter wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Action Plan: Mpls Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

Active

Sell JUL ’24 Cash

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Mpls Wheat Action Plan Summary

Between mid-February and much of April Minneapolis wheat traded mostly sideways to lower with little bullish fundamental news to drive prices higher. In late April, driven by world wheat crop concerns and dryness in the HRW growing areas, and fueled by likely Managed fund short covering, Minneapolis wheat rallied back toward the January highs. Although bullish fundamentals remain scarce, and the market shows signs of being overbought, historical seasonal trends typically strengthen as we approach late spring and early summer. Furthermore, Managed funds quite possibly still hold a net short position, that could fuel an extended rally if more production concerns arise.

- Grain Market Insider sees a continued opportunity to sell a portion of your 2023 Spring wheat crop. Since the end of July, the wheat market has been in a downtrend due to lower world prices, with no significant rallies to take advantage of. While many unknowns remain that could move prices even higher, the market is now more than 50 cents off its low and entering an area of heavy resistance that coincides with a 23% retracement back to the July high. Grain Market Insider advises taking advantage of this rally, and these still historically good prices, to make an additional sale on your 2023 crop.

- No new action is recommended for 2024 Minneapolis wheat. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts (due to their higher liquidity and correlation to Minneapolis), to protect the downside, and recommended exiting the original position in three separate tranches as the market got further extended into oversold territory to protect any gains that were made. The current strategy is targeting the 775 – 815 area versus Sept ’24 to recommend making additional sales. We are also targeting the 850 – 900 area to recommend buying upside calls to help protect any sales that would have been made.

- No action is currently recommended for the 2025 Minneapolis wheat crop. We are currently not considering any recommendations at this time for the 2025 crop that will be planted in the spring of next year. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The market’s test of the 700 – 712 area has put it into overbought territory and is at risk of falling back. Should this occur, initial support may come between 675 and 660, with further support down toward 632 and 625 ¼. Conversely, if prices close above 712 and continue toward the November high of 752, they may encounter more resistance between 725 and 735.

Above: Spring wheat percent planted (red) versus the 10-year average (blue).

Other Charts / Weather

Above: US 5-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and N. Argentina 1-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.