4-24 End of Day: KC Wheat Leads the Wheat Complex Higher on More Potential Short Covering

All prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’24 | 437.75 | -5.25 |

| JUL ’24 | 448.5 | -4 |

| DEC ’24 | 472.75 | -2 |

| Soybeans | ||

| MAY ’24 | 1166 | -1.5 |

| JUL ’24 | 1181.5 | -0.5 |

| NOV ’24 | 1174.5 | 0.5 |

| Chicago Wheat | ||

| MAY ’24 | 594.5 | 9.5 |

| JUL ’24 | 613 | 10.25 |

| JUL ’25 | 677 | 10.5 |

| K.C. Wheat | ||

| MAY ’24 | 624.25 | 15.5 |

| JUL ’24 | 630 | 15.75 |

| JUL ’25 | 673.25 | 15 |

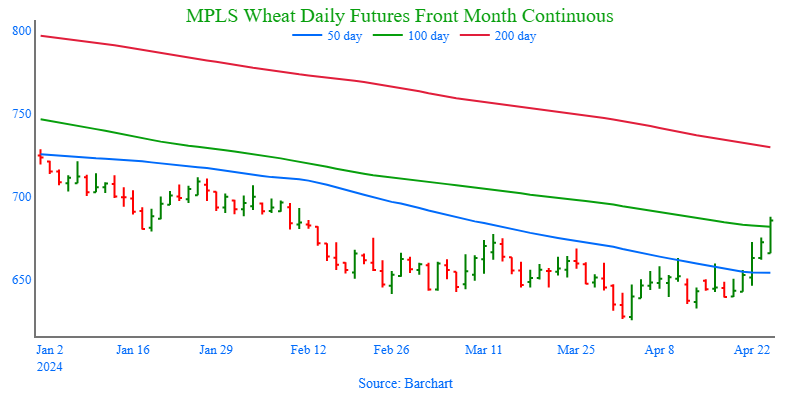

| Mpls Wheat | ||

| MAY ’24 | 679 | 12.5 |

| JUL ’24 | 685.5 | 13.25 |

| SEP ’24 | 693.25 | 12 |

| S&P 500 | ||

| JUN ’24 | 5100.25 | -6.25 |

| Crude Oil | ||

| JUN ’24 | 82.85 | -0.51 |

| Gold | ||

| JUN ’24 | 2332.1 | -10 |

Grain Market Highlights

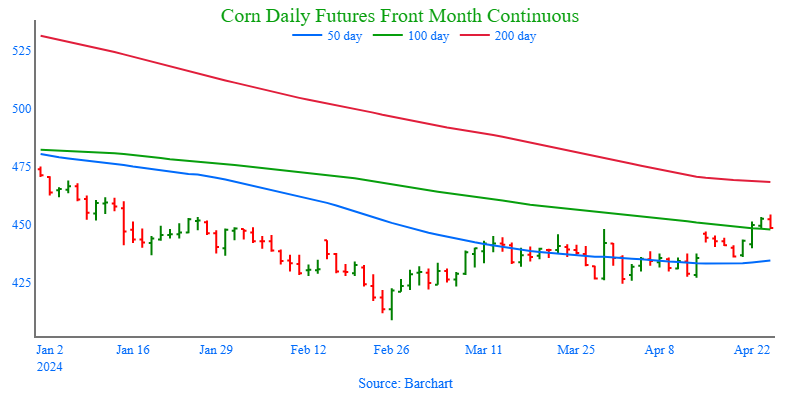

- Despite another strong session in the wheat complex, the corn market disappointed as it failed to continue to the upside and posted a bearish reversal, closing just above yesterday’s low.

- July soybeans were unable to continue its three-day rally after piercing its 50-day moving average and hitting resistance. Soybean oil, which closed the day in a bearish reversal, likely contributed to the resistance in soybeans as it posted a bearish reversal.

- Higher Matif wheat, coupled with global war and weather concerns likely helped drive additional short covering and push the wheat complex higher for the fourth day in a row. The decline in open interest in the most active July contracts for both Chicago and Minneapolis in each session since Friday suggests that traders are unwinding their short positions.

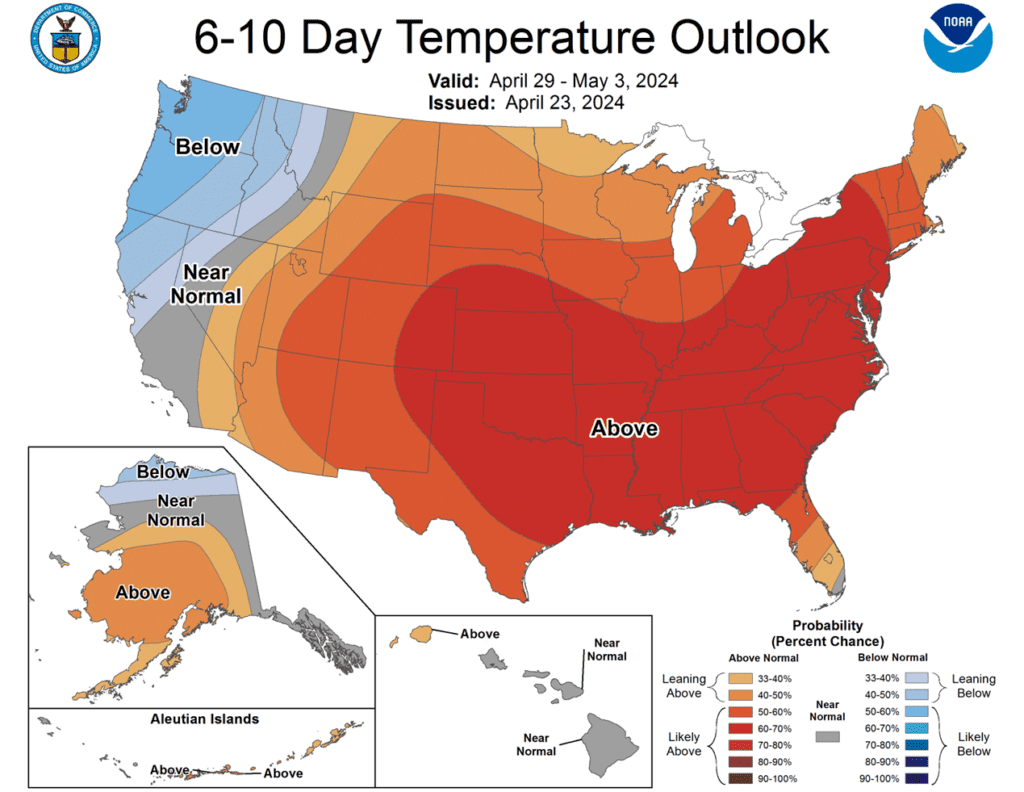

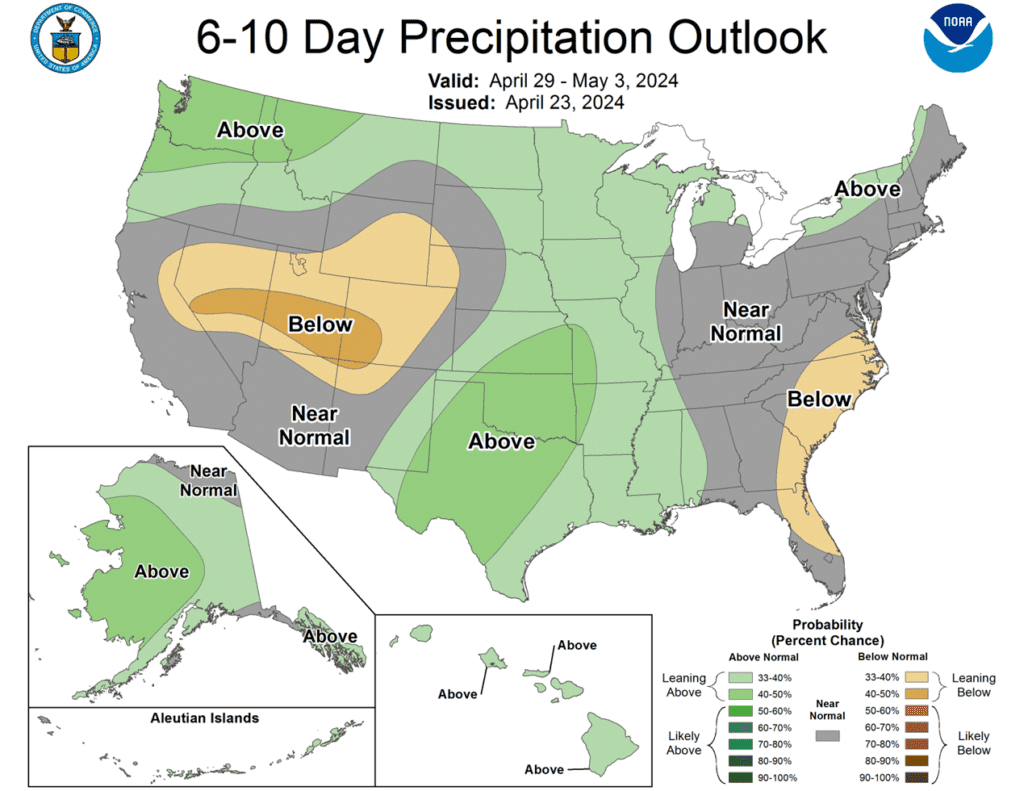

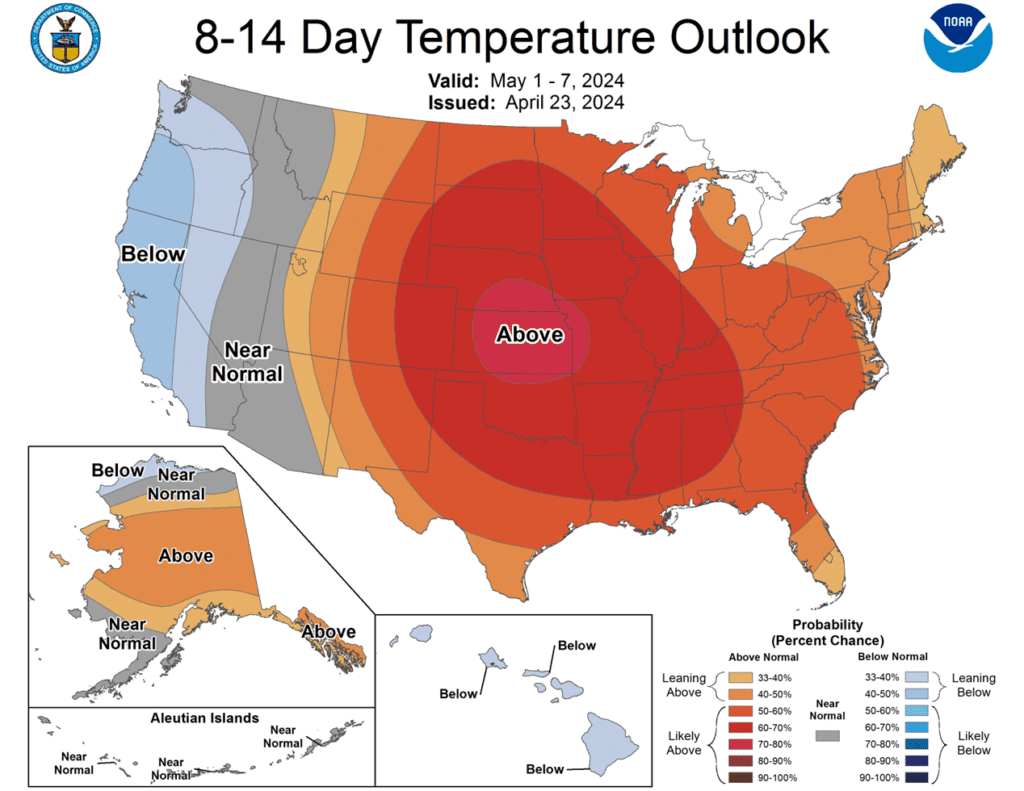

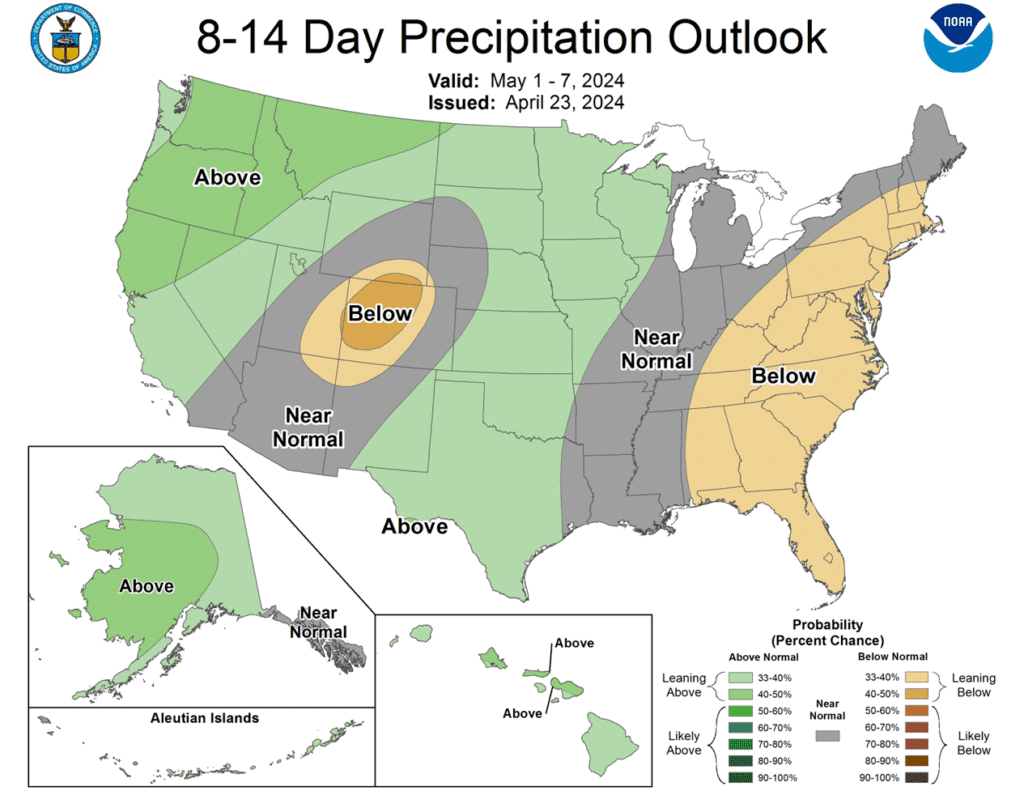

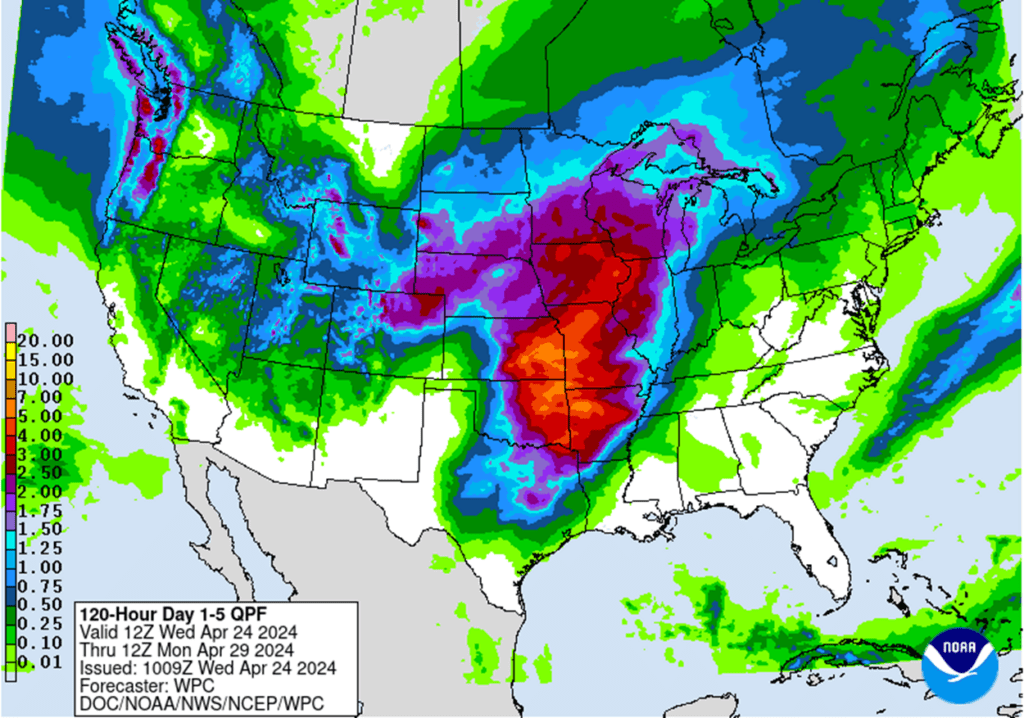

- To see the updated US 5 day precipitation forecast, and the 6 – 10 and 8 – 14 day Temperature and Precipitation Outlooks, courtesy of NOAA and The Climate Prediction Center scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Corn Action Plan Summary

Although July ’24 corn has rallied beyond the congestion range on the front month continuous charts, it remains below its high of 460 that was posted on March 28. With little fresh bullish fundamental news, managed funds have maintained a significant net short position while the market became oversold. The market’s oversold conditions, combined with the large fund net short position, likely sparked the recent rise in prices and could fuel a more significant upside move as we move through planting and into the growing season. While the recovery in corn prices may encounter obstacles along the way, overall market conditions remain conducive to a continued price recovery into May and June.

- No new action is recommended for 2023 corn. The target range to make additional sales is 480 – 520 versus May ’24 futures. If you need to move bushels for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- No new action is recommended for 2024 corn. We are targeting 520 – 560 to recommend making additional sales versus Dec ‘24 futures. For put option hedges, we are looking for 500 – 520 versus Dec ‘24 before recommending buying put options on production that cannot be forward priced prior to harvest.

- No Action is currently recommended for 2025 corn. At the beginning of the year, Dec ’25 corn futures left a gap between 502 ½ and 504 on the daily chart. Considering the tendency for markets to fill price gaps like these, we are targeting the 495 – 510 area to recommend making additional sales.

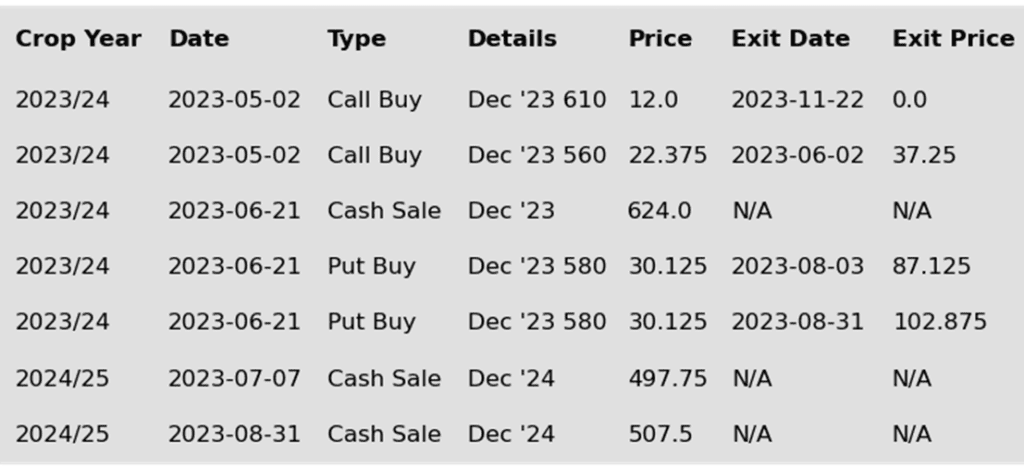

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- It was a disappointing day in the corn market as prices faded during the session. Even a strong wheat market for the day failed to help lift corn prices higher. Weak ethanol production numbers and position squaring for the end of the week limited corn market gains.

- The next few sessions could bring choppy trade to the corn market. May basis contracts will need to be priced or rolled in the next handful of days. May corn options expire on Friday, and First Notice day for May futures is April 30. All three events will likely bring some volatility and price movement into the corn market.

- Weekly ethanol production slipped to 954 thousand barrels/day last week. This was down 1.3% year-over-year and was the second lowest production week for the marketing year. 95.5 mb of corn were used in the ethanol grind last week, which was below the pace needed to reach USDA targets for the marketing year.

- The USDA will release weekly export sales totals on Thursday morning. Expectations are for ales to range between 400,000 – 900,000 mt for old crop and 25,000 – 350,000 MT for new crop. Last week, export sales were soft with a combined 566,000 mt of new sales.

- Weather models are predicting warmer but wetter-than-normal conditions over the next two weeks. The current corn planting pace is off to a good start, but increased precipitation could slow progress going into May.

Above: The corn market transitioned lead months from May to July making the chart look like prices have gapped higher due to the 11-cent premium to July. The market remains largely rangebound and a close above 460 could allow prices to test the 495 – 510 area. If they break out to the downside and close below 421, they could slide further to test 400 – 410 support.

Soybeans

Action Plan: Soybeans

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

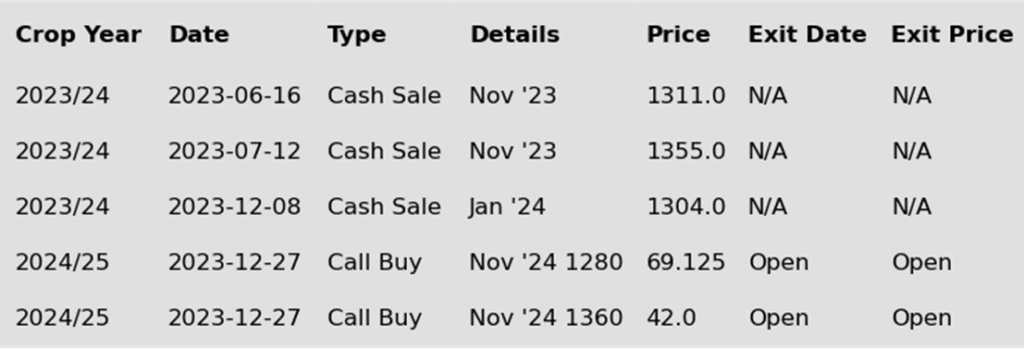

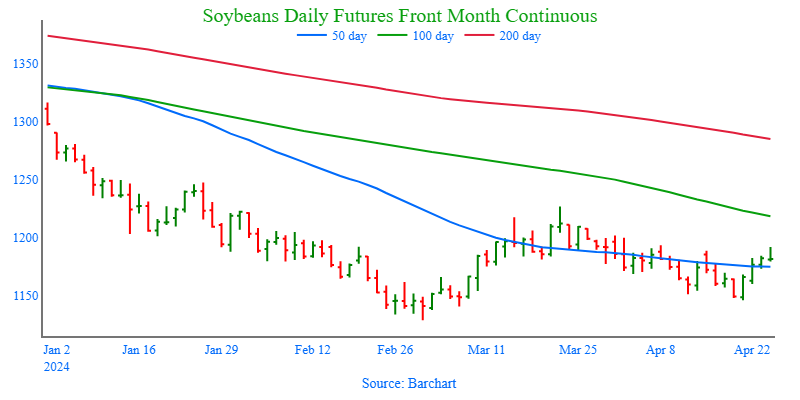

Soybeans Action Plan Summary

The USDA’s April Supply and Demand report failed to provide significant bullish data to prompt substantial short covering, as it mainly reflected recent demand challenges and an increase in ending stocks that aligned with the market’s expectations. However, managed money retains a considerable net short position near 168,000 contracts, as of the latest Commitment of Traders report. This could still fuel a short covering rally should complications arise during planting season, which has just begun. Otherwise, if weather conditions cooperate and planting progresses without major issues, prices could remain susceptible to revisiting recent lows throughout the spring.

- No new action is recommended for 2023 soybeans. We are currently targeting a rebound to the 1275 – 1325 area versus May ’24 futures to recommend making further sales. If you need to move inventory for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- No new action is recommended for the 2024 crop. Considering the amount of uncertainty that lies ahead with the 2024 soybean crop, we recommended back in December buying Nov ’24 1280 and 1360 calls to give you confidence to make sales against anticipated production and to protect any sales in an extended rally. We are currently targeting the 1280 – 1320 range versus Nov ’24 futures, which is a modest retracement toward the 2022 highs, to recommend making additional sales.

- No Action is currently recommended for 2025 Soybeans. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans finished the day mixed with May and July ending lower and the deferred months higher. The July contract ended its three-day winning streak after meeting resistance at the 40 and 50-day moving averages. Soybean meal closed higher today while soybean oil was lower as it followed palm oil down.

- The Brazilian soybean harvest is nearly completed, but the southern region where work is not completely done is forecast to receive rains which could delay the progress. In the US, rains are forecast to fall throughout the Corn Belt which could delay planting but will also benefit soil moisture ahead of a potentially dry La Nina year.

- In South America, the Brazilian real has begun to rebound and Brazilian basis levels have moved higher which makes Brazilian soybeans more expensive to the rest of the world. While the US is still not competitive with Brazil, it could push some export business to the US.

- Before today, soybeans had three consecutively higher closes which made for a gain of 33 cents in the July contract. A large part of that was likely short covering ahead of first notice day on April 30, but open interest declined from Friday through Tuesday which could indicate that funds are not opening new short positions in the July contract.

Above: April 19 July soybeans posted a key bullish reversal, marking support just below the market near 1145 which coincides with the March 6 low of 1140 ¼. Should this support area hold, prices could potentially rebound and test the March high near 1227. Below 1140 ¼ lies, key support near the February low of 1128 ½.

Wheat

Market Notes: Wheat

- Again, wheat managed to close higher across the board in all three classes, despite the US Dollar firming up today. Support came from higher trade in Matif futures, as well as the addition of global weather and war premium. All this combined has likely led to some short covering by the managed funds.

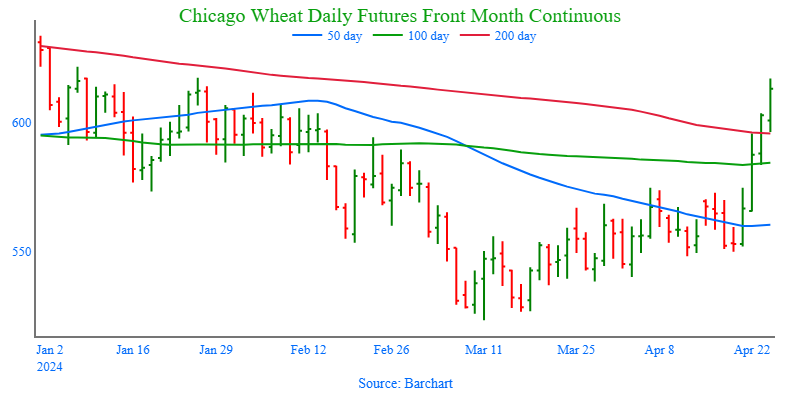

- May Chicago wheat rallied through resistance at the 100-day moving average today and closed above this level for the first time since late January. The next major resistance might be at the 200-day moving average, which is around 619. May Chicago futures have not traded above that level since July of last year.

- While a significant portion of the US Midwest is forecasted to receive beneficial rains starting later this week, the Southwestern Plains are anticipated to be excluded. This situation might contribute to the continued deterioration of HRW wheat crop ratings in that region, although SRW ratings may benefit from the rainfall.

- Eastern Ukraine and Southern Russia have been in a hot and dry pattern, threatening their wheat production. Although some moisture is expected soon, net drying is still expected, and the addition of weather premium may be in part why the market has rallied strongly over the past several sessions.

- According to APK Inform, Ukraine has shipped 40 mmt of grain as of April 24, comparable to last year’s 40.7 mmt at the same time. Since July, Ukraine’s wheat exports have reached 15.2 mmt, slightly lower than the USDA’s estimate of 17.5 mmt. Additionally, SovEcon estimates that Russian wheat exports for April will reach 4.6 mmt, an increase from 4.4 mmt last year.

Action Plan: Chicago Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Chicago Wheat Action Plan Summary

After failing to break through downside support around 550 and likely fueled by the large managed fund net short position, July ’24 Chicago wheat has rallied through the 100-day moving average on the front month continuous chart for the first time since January. Although bearish fundamentals remain, the fund’s large net short position has the potential to drive an extended short covering rally should any crop concerns arise as we enter the more dynamic part of the growing season.

- No new action is currently recommended for 2023 Chicago wheat. Any remaining 2023 soft red winter wheat should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 Chicago wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Chicago wheat. Back in August we recommended buying July ’24 590 puts to prepare for further price erosion. Since then, we recommended exiting half of the original position to get closer to a net neutral cost, and then most recently, we recommended exiting another half of the remaining position to lock in further gains in case prices continue higher, leaving 25% of the original position in place. We continue to target a market rebound back towards 675 – 715 versus July ’24 futures before recommending any additional sales. As for the open July ’24 590 put position, we are looking for prices between 475 – 500 versus July ’24 futures to before we recommend exiting any of the last 25%.

- No new action is currently recommended for 2025 Chicago Wheat. We recently recommended initiating your first sales for the 2025 SRW crop year as prices pressed back toward the mid-600 range to take advantage of historically good prices for next year’s crop. Since plenty of time remains to market this crop, we are looking for further price appreciation and are currently targeting the 690 – 725 area to recommend making additional sales.

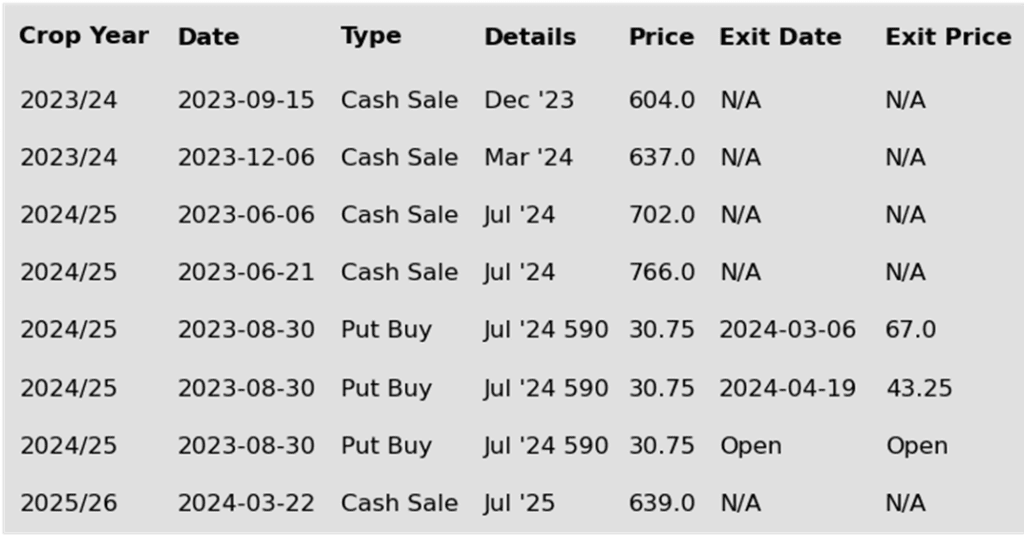

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: July Chicago’s close above the 200-day MA opens the door to test the December high of 630. Although, it may encounter resistance between 617 and 622 before reaching that target. On the downside, if prices retreat, initial support is likely around 548, followed by 538.

Action Plan: KC Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

Active

Sell JUL ’24 Cash

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

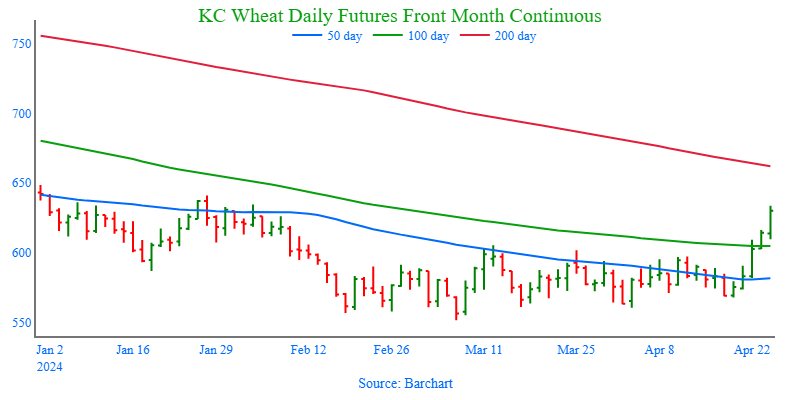

KC Wheat Action Plan Summary

Since the end of February, prices have been trading in a broad range, bound mostly by 555 on the downside and 605 up top. Even though demand fundamentals remain weak, we are entering the more dynamic part of the growing season, and with prices above 605, and considering managed funds still hold a considerable net short position, the market may still have more rally potential if unforeseen risks enter the market.

- Grain Market Insider sees a continued opportunity to sell a portion of your 2023 HRW wheat production. Since the end of February, the market has been moving sideways, constrained by slow export demand and low world export prices, which have capped US prices. July ’24 has returned to the upper end of the 555 – 605 trading range and is approaching resistance near the 100-day moving average. Given that time is getting more limited before the ‘24 KC crop gets harvested, Grain Market Insider is now looking for less aggressive rallies to get the last of the ‘23 KC crop moved.

- No new action is recommended for 2024 KC wheat. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts to protect the downside, and recommended exiting the original position in three separate tranches as the market got further extended into oversold territory to protect any gains that were made. The current strategy is to target 625 – 650 versus July ’24 futures to recommend additional sales.

- No action is currently recommended for 2025 KC Wheat. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

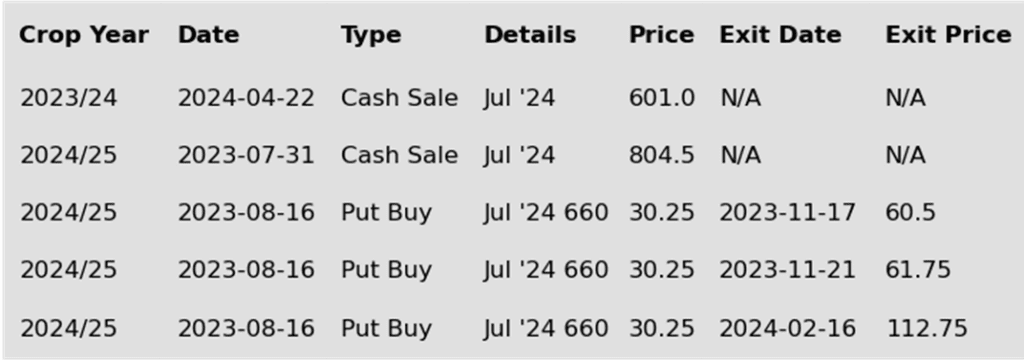

To date, Grain Market Insider has issued the following KC recommendations:

Above: The breakout and close above the March 10 high of 605 ¼ on April 22, opened up the possibility to test January’s 610 – 640 congestion area, a close above which could lead to further advancement toward more significant resistance in the 678 – 700 area. Should the market fall back and not rally, initial support may be found between the 50-day moving average and 678, with key support near the March low of 551 ½.

Action Plan: Mpls Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

New Alert

Sell JUL ’24 Cash

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Mpls Wheat Action Plan Summary

Since February, Minneapolis wheat has largely been rangebound, except for a temporary dip to set a new contract low, from which prices have recovered. Although an overall lack of bullish drivers remains, historical seasonal trends typically strengthen as we approach late spring and early summer. Furthermore, managed funds continue to hold a substantial net short position, that can potentially fuel a short covering rally.

- Grain Market Insider recommends selling a portion of your 2023 Spring wheat crop. Since the end of July, the wheat market has been in a downtrend due to lower world prices, with no significant rallies to take advantage of. While many unknowns remain that could move prices even higher, the market is now more than 50 cents off its low and entering an area of heavy resistance that coincides with a 23% retracement back to the July high. Grain Market Insider advises taking advantage of this rally, and these still historically good prices, to make an additional sale on your 2023 crop.

- No new action is recommended for 2024 Minneapolis wheat. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts (due to their higher liquidity and correlation to Minneapolis), to protect the downside, and recommended exiting the original position in three separate tranches as the market got further extended into oversold territory to protect any gains that were made. The current strategy is targeting the 775 – 815 area versus Sept ’24 to recommend making additional sales. We are also targeting the 850 – 900 area to recommend buying upside calls to help protect any sales that would have been made.

- No action is currently recommended for the 2025 Minneapolis wheat crop. We are currently not considering any recommendations at this time for the 2025 crop that will be planted in the spring of next year. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The market’s close above the March high of 677 ¼ could pave the way for further upward movement and a potential test of the 700 – 712 area. That said, the market is beginning to show signs of being overbought, which can be negative if prices reverse to the downside. If that happens, initial support remains between 632 and 625 ¼, with major psychological support down toward 600 – 595.

Other Charts / Weather

Above: US 5-day precipitation forecast courtesy of NOAA, Weather Prediction Center.