4-23 End of Day: Corn and Wheat Continue Slide While Soybeans Rally on Trade Optimism

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’25 | 472 | -3.75 |

| JUL ’25 | 479.25 | -4 |

| DEC ’25 | 454.5 | -3.5 |

| Soybeans | ||

| MAY ’25 | 1040.25 | 5.25 |

| JUL ’25 | 1050.25 | 4.25 |

| NOV ’25 | 1027.5 | 1 |

| Chicago Wheat | ||

| MAY ’25 | 528.25 | -7.25 |

| JUL ’25 | 543.5 | -6.75 |

| JUL ’26 | 615.25 | -4.25 |

| K.C. Wheat | ||

| MAY ’25 | 537.75 | -8.25 |

| JUL ’25 | 550.25 | -8 |

| JUL ’26 | 621.25 | -6.5 |

| Mpls Wheat | ||

| MAY ’25 | 591.5 | -4 |

| JUL ’25 | 607 | -3.25 |

| SEP ’25 | 622.25 | -2.75 |

| S&P 500 | ||

| JUN ’25 | 5415.5 | 100.75 |

| Crude Oil | ||

| JUN ’25 | 62.24 | -1.43 |

| Gold | ||

| JUN ’25 | 3292.7 | -126.7 |

Grain Market Highlights

- Corn: Corn futures posted a third straight session of losses Wednesday. A firmer U.S. dollar and ongoing weakness in the wheat market pressured values across the corn complex.

- Soybeans: Soybean futures closed higher for a second straight day supported by optimism around potential U.S.–China tariff relief.

- Wheat: Wheat futures extended losses Tuesday as wetter conditions across the Southern Plains continued to weigh on values.

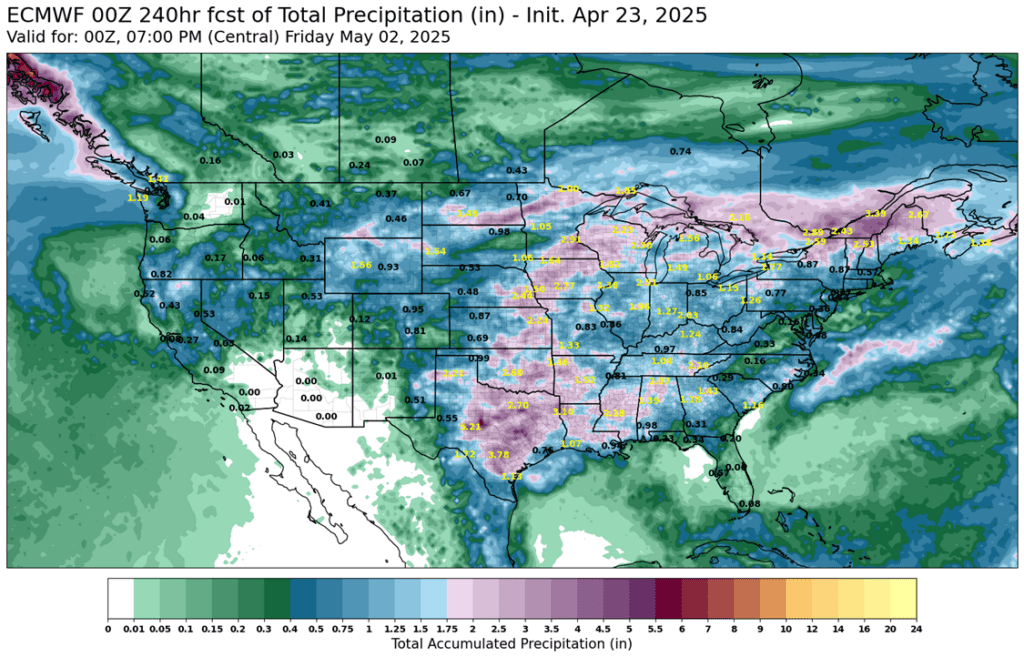

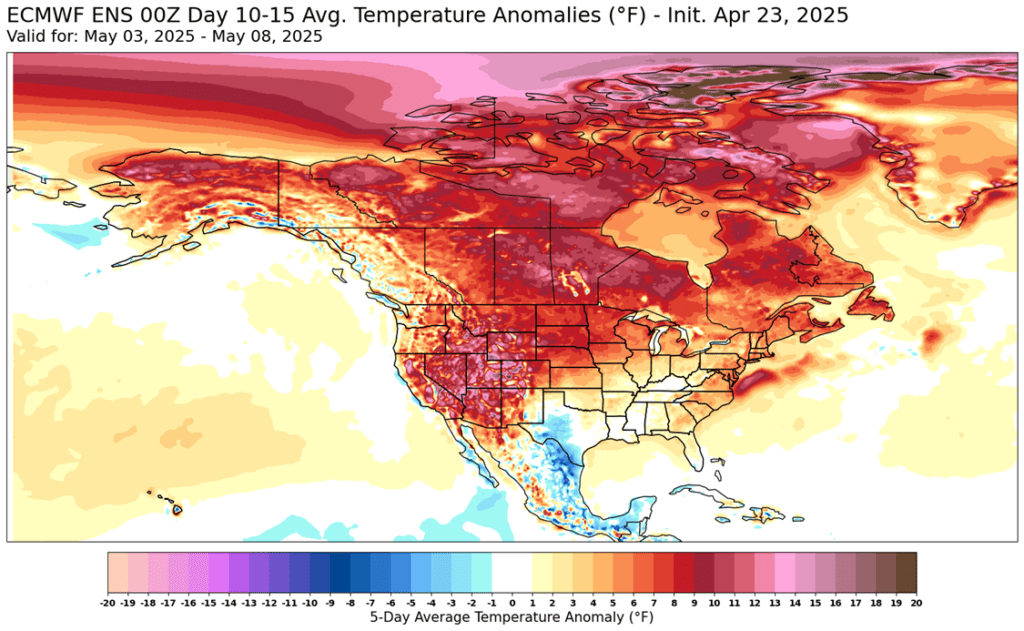

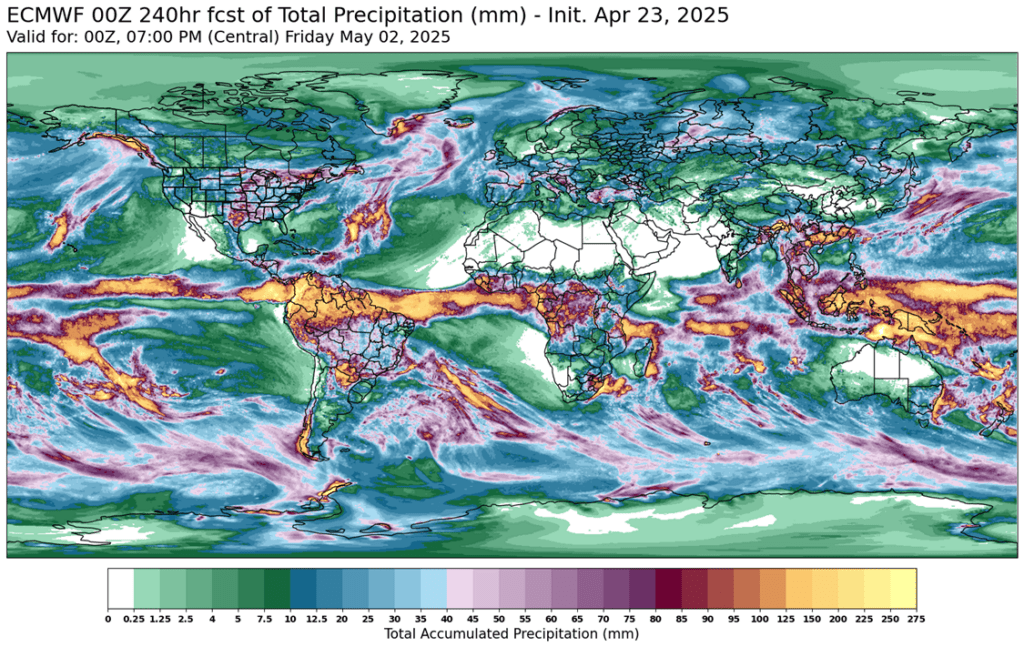

- To see the updated U.S. 10-day precipitation forecast and 10-15-day temperature outlook as well as the 10-day global precipitation forecast scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell JUL ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Sell another portion of your 2024 corn crop. This should be the eighth sale for your 2024 corn crop.

- Plan A: Next cash sale at 546 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Now, eight sales recommendations made to date, with an average price of 494.

- Current Rec: The July contract has recently stalled, encountering strong selling pressure in the 494–496 range. Monday’s Crop Progress report showed U.S. corn planting moving ahead of the five-year average — a trend that, if it continues, could reduce the market’s urgency to bid aggressively for old crop supplies. Additionally, a key Plan B technical indicator that Grain Market Insider closely tracks turned lower on Tuesday, issuing a sell signal. Given the rally from the March low and the seasonal timing, this remains a timely opportunity to make an eighth sale of the 2024 corn crop.

2025 Crop:

- Plan A: Exit all 510 December calls @ 43-5/8 cents. Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Seven sales recommendations have been made to date, with an average price of 461.25.

- No Changes: Exit targets for December options remain unchanged, and no new sales targets posted today.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations have been made to date, with an average price of 460.

- No Changes: Following the recent recommendation to make a third sale, no new sales targets posted today.

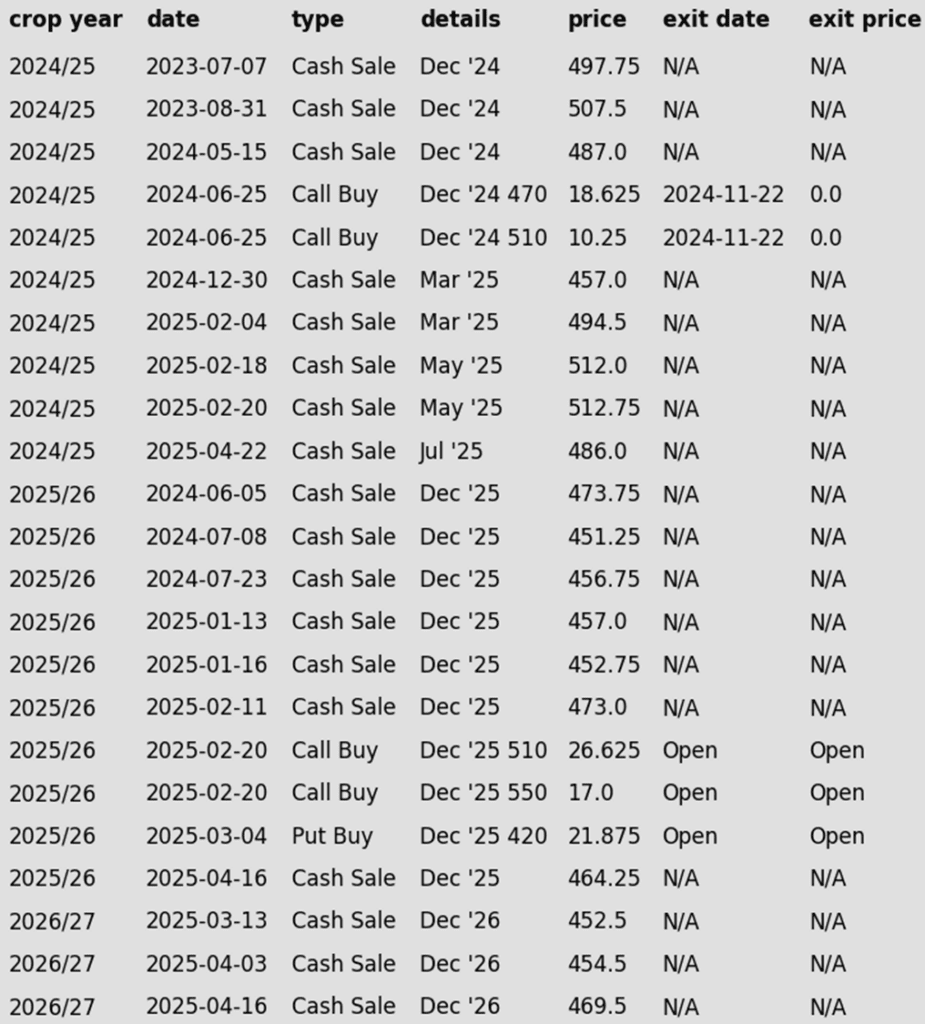

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures saw selling for the third consecutive day as the July contract has traded nearly 20 cents of the most recent high. A strong U.S. dollar and weakness in the wheat market kept a lid on corn prices for the session.

- The U.S. Dollar Index has bounced from recent lows this week, trending higher as market fears surrounding tariffs and trade policy begin to ease. The stronger greenback continues to cap upside potential in corn by dampening export competitiveness.

- Weekly ethanol production rose to 1.033 million barrels per day, up 297.5 million barrels from the previous week and 8% above year-ago levels. Ethanol use accounted for 103.5 million bushels of corn last week — just shy of the pace needed to meet USDA annual projections.

- Traders are eyeing Thursday’s weekly export sales report, with expectations for corn sales between 800,000 and 1.3 MMT. Last week’s total came in at 1.561 MMT, highlighting continued strong demand for U.S. corn.

- With First Notice Day for May corn approaching on April 30, producers are under pressure to price basis contracts. Meanwhile, traders holding long positions must exit to avoid delivery — often leading to additional downside pressure in the market.arket.

Corn on the Move: Bulls Eye 510+ After Breakout

Corn futures broke out in April after holding key support near 450 through much of March. A bullish April WASDE report highlighting stronger demand sparked the rally, with prices pushing through the 50-day moving average. All eyes now turn to planting progress and demand trends to drive the next move. The February highs just above 510 are the next upside target, while support is firming near 470 at the top of the previous range.

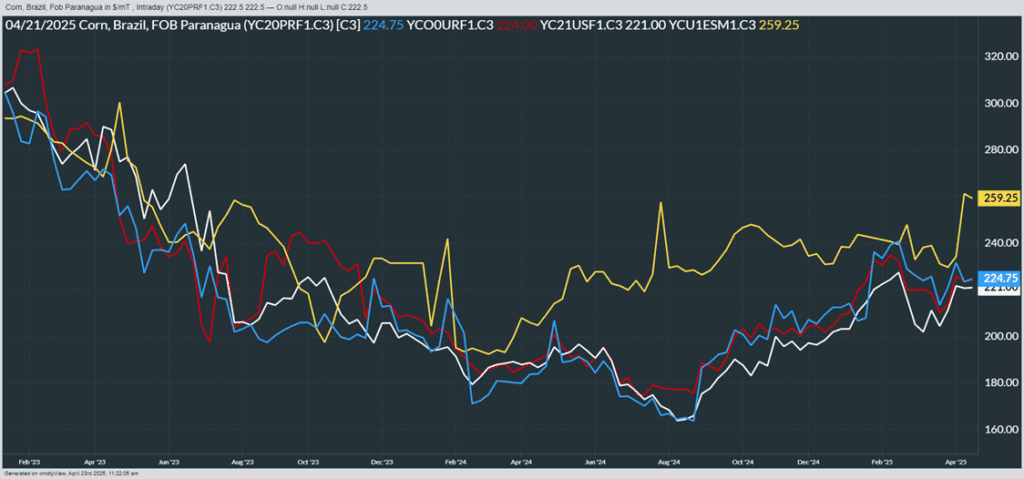

From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- No Changes: With three sales recommendations made to date, continue targeting a move to 1107 to make a fourth sale.

2025 Crop:

- Plan A: Next cash sales at 1093 & 1114 vs November. Exit all 1100 November call options at 88 cents.

- Plan B: Make a cash sale if November closes below 1016.75 support.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Catch-Up Target: If you didn’t make the one sale, aim for 1063 vs November as your catch-up target. This price level aligns with the Grain Market Insider sale recommendation issued back on January 29.

- Plan B Target: While Plan A remains to make the next cash sale at 1093 vs November, markets don’t always cooperate. A new downside stop has been posted as a precaution in case the market falls short of that upside target. Key support for the current uptrend sits at 1016.75. A break below that level could signal a trend shift and reduce the odds of reaching the Plan A target. Grain Market Insider prefers to avoid selling on down days, but sometimes conditions call for flexibility.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- No Changes: The expectation is still for targets to begin posting in a month or two.

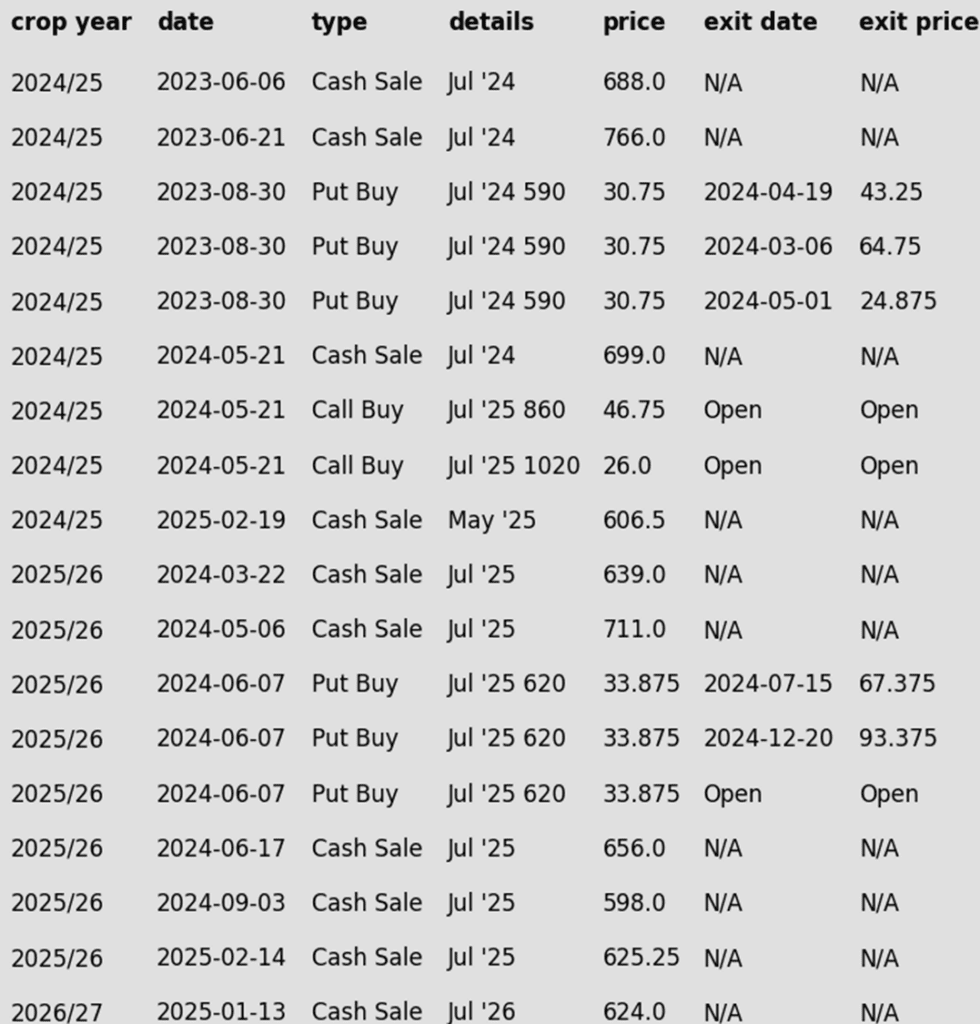

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher for the second consecutive day amid further discussions that President Trump might lower tariffs on certain goods from China. Futures were bull spread with the front months posting the majority of gains and November just 1 cent higher. Soybean meal was lower while soybean oil was higher despite a selloff in crude.

- U.S. soybean planting is off to a strong start, with 8% of the crop planted — ahead of the five-year average. Near-term rains are expected, but longer-range forecasts show a drier May across North America, raising concerns about summer drought potential and adding weather premium to prices.

- Market sentiment was lifted by U.S. Treasury Secretary Scott Bessent’s remarks to investors suggesting a trade deal with China could materialize “sooner than later.” China remains heavily reliant on Brazilian soybean imports for now.

- Estimates for tomorrow’s weekly export sales report see soybean sales in a range between 500k and 700k metric tons. While China has not been a very active buyer of U.S. soybeans, their demand for Brazilian beans has been supportive to prices globally.

Soybean Futures Rebound: Momentum Builds Above Key Support

Soybean futures dropped sharply in early April after newly announced tariffs triggered a break below key support near 1000, a level that had held firm through March. However, strong buying interest fueled a swift rebound, pushing futures back above the pivotal 1000 mark and reclaiming major moving averages — especially the 200-day, which had capped rallies for the past two years. With momentum rebuilding, the market is now eyeing the February highs near 1080, while the 200-day moving average is expected to provide support on any spring pullbacks.

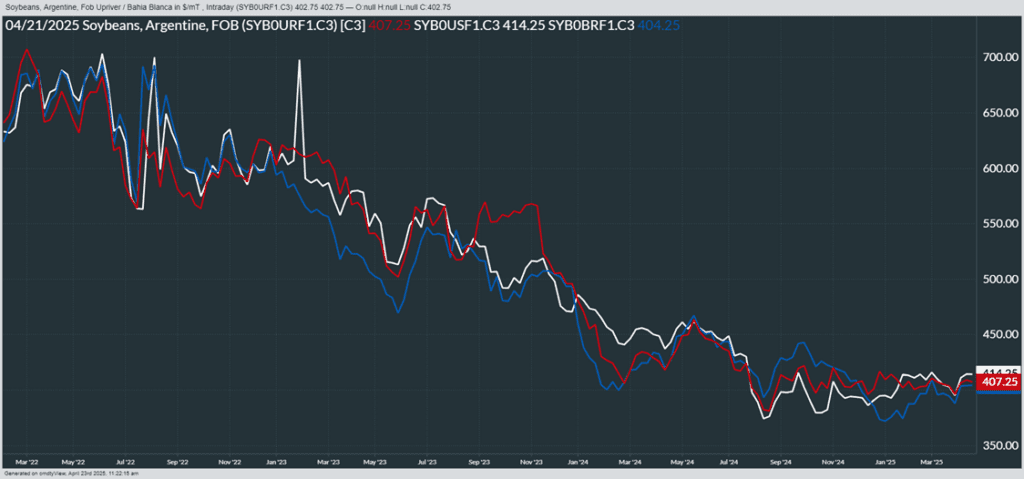

From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

- Wheat closed lower again, continuing to be influenced by the wetter weather in the southern plains. Rainfall totals between 1.5–3 inches are expected, easing drought stress and improving prospects for the winter wheat crop. A stronger U.S. Dollar added further downside pressure.

- Geopolitical uncertainty also resurfaced after reports that Ukrainian President Volodymyr Zelensky rejected a U.S. proposal to recognize Russian control of Crimea in a ceasefire deal. The news renewed concerns over a prolonged conflict, which could affect grain flows out of the Black Sea region.

- Warm and wet conditions over the past couple of weeks in Ukraine have helped to relieve drought and replenish soil moisture, however the risks still remain. Some of their main wheat growing areas still have moisture deficits and above normal temperatures are expected to persist through the end of this week.

- Meanwhile, dry conditions in Argentina have supported soybean and corn harvest progress. However, the country’s winter wheat planting season begins in May, and additional rainfall will be necessary to ensure healthy crop establishment.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 701 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- Nothing New: 701 is still the price target to trigger a fifth sales recommendation.

2025 Crop:

- Plan A: Target 705.50 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Nothing New: Still targeting 705.50 to trigger the sixth sales recommendation.

2026 Crop:

- Plan A: Target 704 against July ‘26 for the next sale

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- Nothing New: 704 is still the price target to trigger a second sales recommendation.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Futures Eye Key Breakout Above 200-Day Moving Average

After months of sideways action, Chicago wheat futures broke higher in February, rallying to early October highs just above 615. However, that mid-month peak quickly turned into a reversal point, sending futures back into the late 2024 trading range. Support near 530 held firm through March, and prices are building upward again this April. The next key test is the 200-day moving average — a decisive weekly close above it could signal a shift in momentum and potentially kickstart a broader upside trend.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- Nothing New: Still no active price targets, as the July contract continues to chop around in the 560–580 range.

2025 Crop:

- Plan A: Target 677 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- Nothing New: 677 is still the price target to trigger a fifth sales recommendation.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- Nothing New: The expectation is still for targets to begin posting in the May – June timeframe.

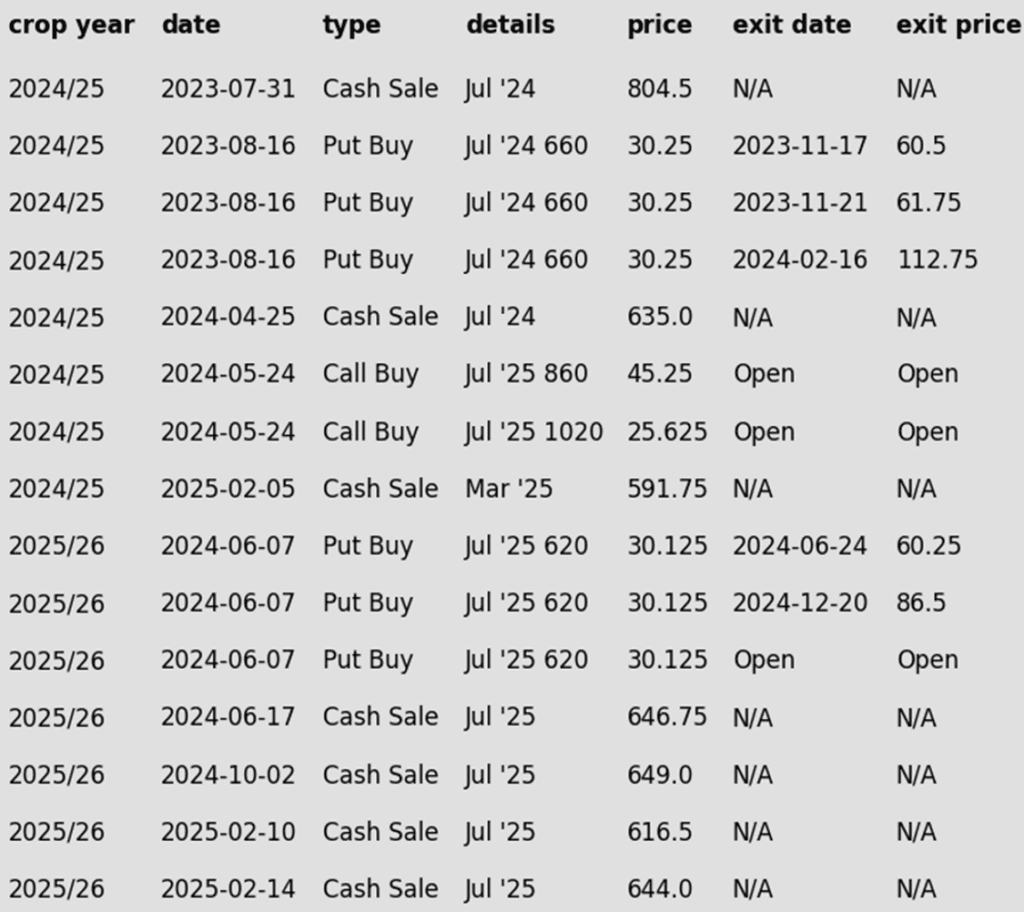

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Holding Support, Watching 200-Day Resistance

February was a volatile month for Kansas City wheat, with prices surging higher before tumbling back and ending the month little changed. March brought additional weakness, dragging prices near recent lows, but the ability to hold trendline support so far in April is encouraging. On a rebound, the 200-day moving average will be the first resistance level to watch, with February highs near 640 serving as a more significant upside barrier. On the downside, support near the December lows around 540 should provide a strong floor if selling pressure continues.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- Nothing New: No active targets for a sixth sales recommendation at this time.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- Nothing New: No active targets for a sixth sales recommendation at this time.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Nothing New: The expectation is still for targets to begin posting in the June – July timeframe.

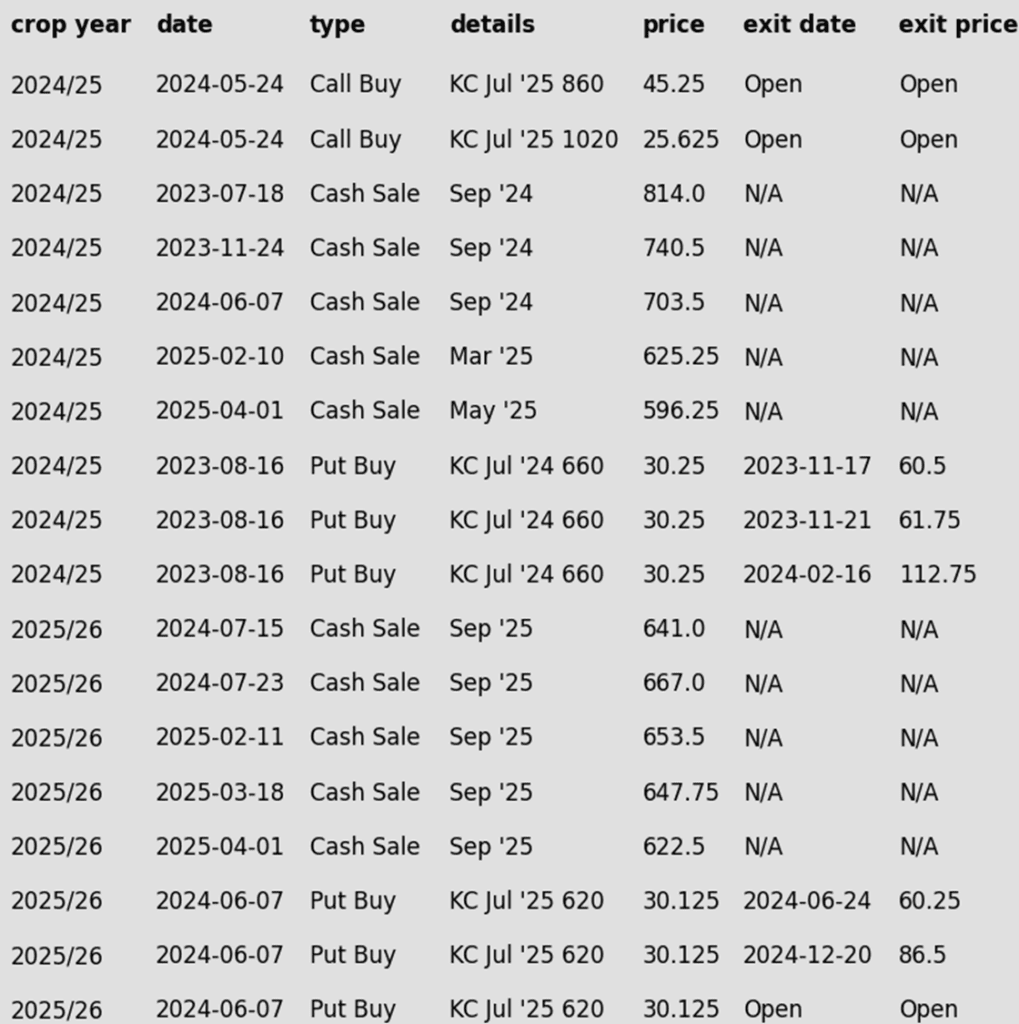

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Holds Above 200-Day

Spring wheat broke out of its long-standing sideways range in late January, triggering a surge of bullish momentum. The rally gained traction in mid-February with a close above the 200-day moving average, though late-month weakness briefly pushed futures back below key technical levels. Unlike winter wheats, spring wheat’s ability to stay above the 200-day remains encouraging, with this level now expected to act as support on any growing season pullbacks. The next upside target is the February highs near 660. With spring wheat acreage projected to be the lowest in 55 years, weather volatility is likely to play a major role in driving price action this season.

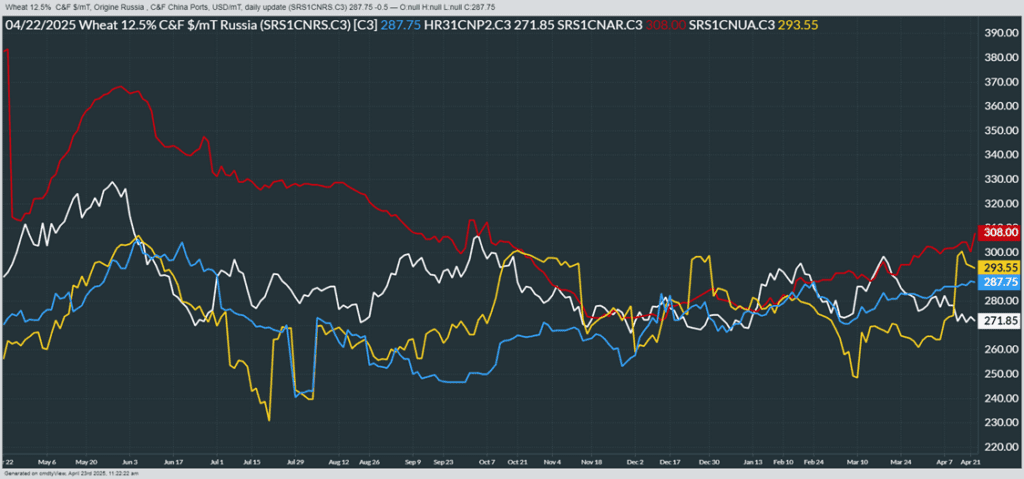

From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather

10-day total precipitation forecast

10-day Global total precipitation forecast