4-18 End of Day: Weakness in Soybeans Weighs on Corn as Wheat Closes Mostly Higher

All prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’24 | 426.75 | -3.5 |

| JUL ’24 | 436.25 | -4.75 |

| DEC ’24 | 460 | -4.75 |

| Soybeans | ||

| MAY ’24 | 1134.25 | -15.25 |

| JUL ’24 | 1149 | -15.25 |

| NOV ’24 | 1149.25 | -12 |

| Chicago Wheat | ||

| MAY ’24 | 536.75 | -0.25 |

| JUL ’24 | 553 | 0.75 |

| JUL ’25 | 628.75 | 1.5 |

| K.C. Wheat | ||

| MAY ’24 | 577.25 | 4.5 |

| JUL ’24 | 575.25 | 6.25 |

| JUL ’25 | 623.75 | 4.25 |

| Mpls Wheat | ||

| MAY ’24 | 638.75 | 5.5 |

| JUL ’24 | 643 | 3.75 |

| SEP ’24 | 652.5 | 2.5 |

| S&P 500 | ||

| JUN ’24 | 5042 | -20.25 |

| Crude Oil | ||

| JUN ’24 | 82.1 | -0.05 |

| Gold | ||

| JUN ’24 | 2395.5 | 7.1 |

Grain Market Highlights

- Another day of choppy two-sided trade with little fresh news dragged on the corn market. Currency fluctuations and technical selling added pressure to July corn which closed near the bottom of its 5 ¼ cent range.

- Soybeans came under pressure from weakness in both soybean meal and oil, with the July contract settling just 8 ½ cents off its February low after seeing volatile trade in a 16 ¾ cent range.

- Soybean oil closed sharply lower on pressure from lower world veg oils and growing monthly stocks numbers from this week’s NOPA crush report. Meanwhile, soybean meal also closed lower, but showed relative resilience, balancing between steady to firmer US basis values and cheaper South American export offers.

- Support from higher Matif wheat futures and a potential correction from oversold conditions lent support to all three wheat classes that closed mid-range and mostly higher across the board.

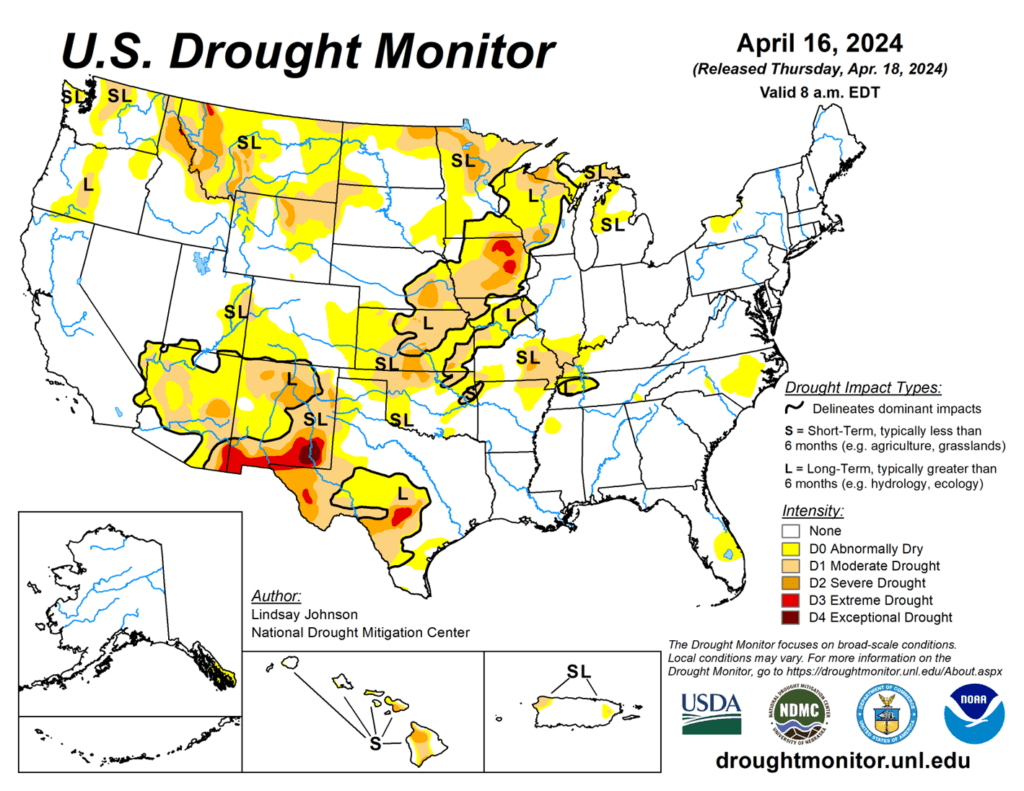

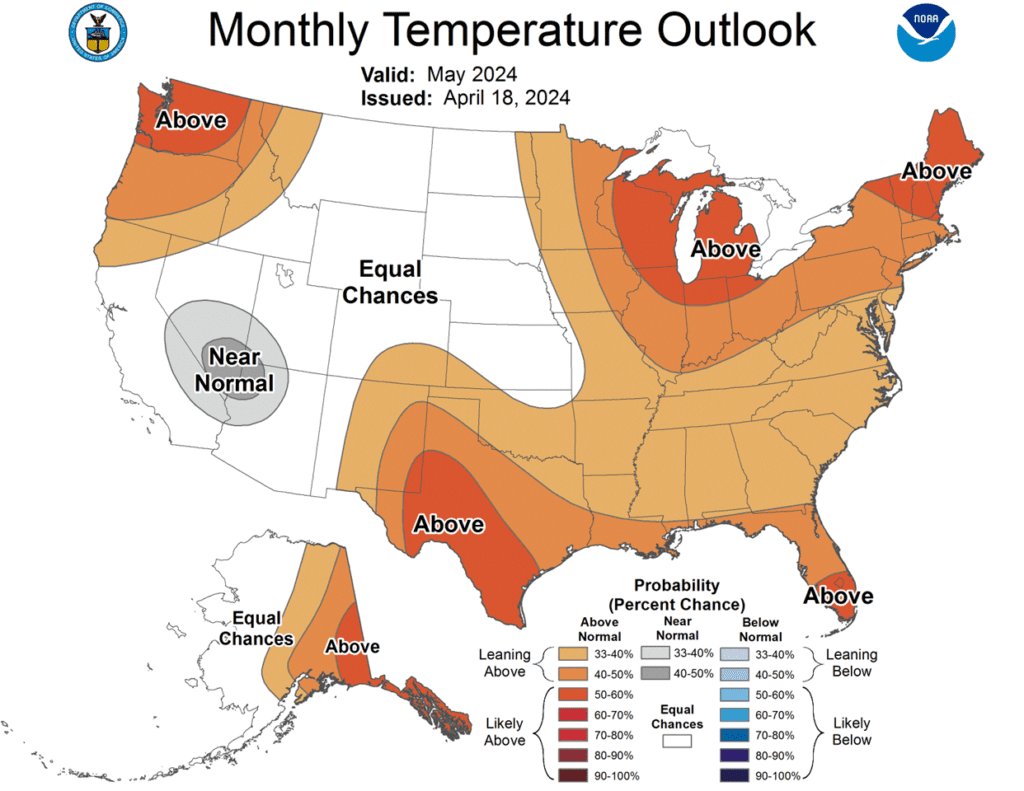

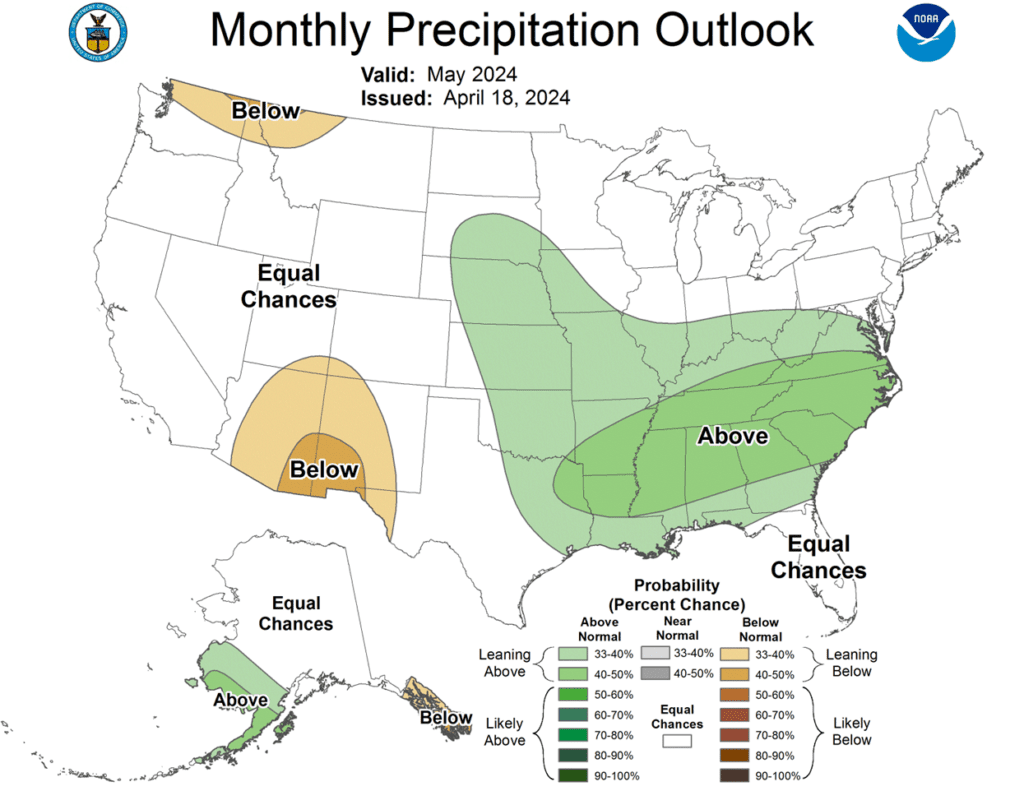

- To see the updated US Drought Monitor, and Monthly Temperature and Precipitation Outlooks courtesy of NOAA and The Climate Prediction Center scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Corn Action Plan Summary

From the low on February 26 to the high on March 12, May corn experienced a significant rally of nearly 40 cents. However, since then, it has consolidated within a narrow trading range, fluctuating mostly between 430 and 445. The size of Managed Money’s net short position, coupled with prevailing macro oversold conditions, suggests potential for further upside as we head into spring planting. While the recovery in corn prices may encounter obstacles, overall market conditions remain conducive to a continued price recovery into May and June.

- No new action is recommended for 2023 corn. The target range to make additional sales is 480 – 520 versus May ’24 futures. If you need to move bushels for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- No new action is recommended for 2024 corn. We are targeting 520 – 560 to recommend making additional sales versus Dec ‘24 futures. For put option hedges, we are looking for 500 – 520 versus Dec ‘24 before recommending buying put options on production that cannot be forward priced prior to harvest.

- No Action is currently recommended for 2025 corn. At the beginning of the year, Dec ’25 corn futures left a gap between 502 ½ and 504 on the daily chart. Considering the tendency for markets to fill price gaps like these, we are targeting the 495 – 510 area to recommend making additional sales.

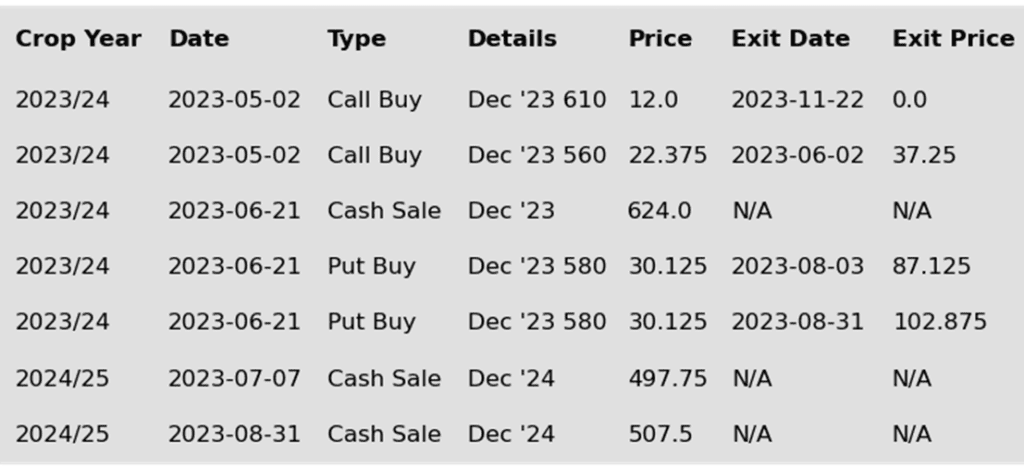

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures broke through key support levels on Thursday as the stronger US Dollar and selling pressure in the soybean market pushed prices lower. July corn closed at its lowest point since February 27.

- The weak price action leaves the market vulnerable to additional selling pressure going into the end of the week. July futures are trading 11 cents lower on the week going into Friday trade.

- Strong trade in the US Dollar versus the Brazilian Real currency has pressured corn and soybean futures. The Brazilian Real has closed at 5-month lows against the dollar, which has triggered strong producer selling of both corn and soybeans, weighing on futures prices.

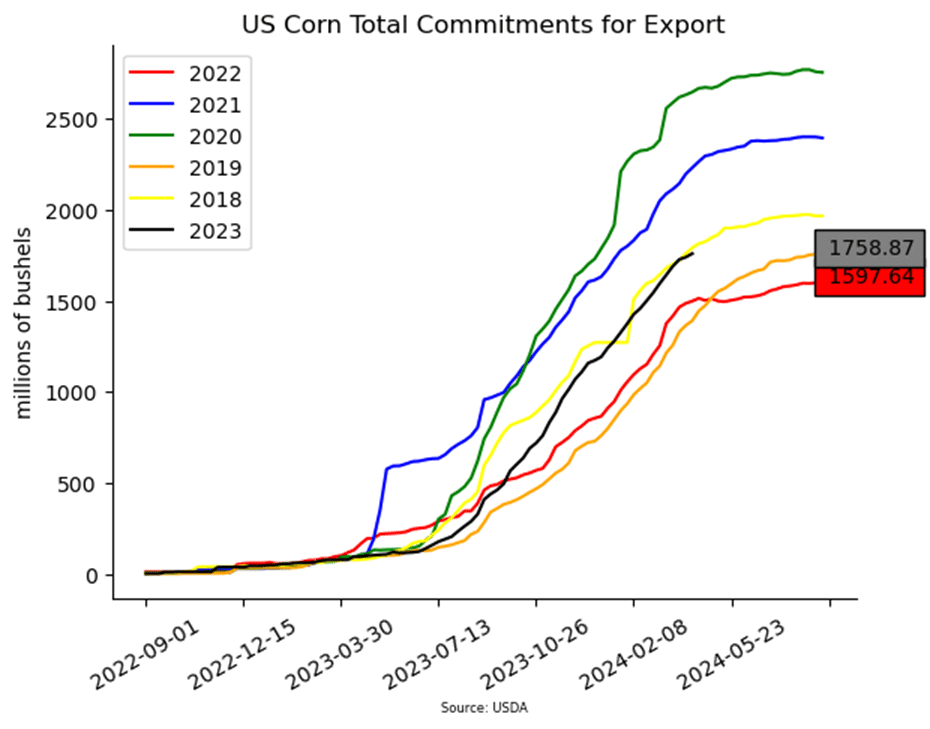

- Weekly export sales for corn came in at 19.7 mb (501,200 mt). Total new sales were within market expectations, but off 54% from the 4-week average. Total commitments are now at 1.759 billion bushels, up 18% from last year.

- The corn market may see additional selling pressure moving into the end of the month. Producers who hold May basis contracts will need to price or roll those contracts by first notice day, April 30, for May futures. This could bring a natural selling environment into the weak market tone for the corn market.

Above: The corn market transitioned lead months from May to July making the chart look like prices have gapped higher due to the 11-cent premium to July. The market remains largely rangebound and a close above 460 could allow prices to test the 495 – 510 area. If they break out to the downside and close below 421, they could slide further to test 400 – 410 support.

Soybeans

Action Plan: Soybeans

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Soybeans Action Plan Summary

The USDA’s April Supply and Demand report failed to provide significant bullish data to prompt substantial short covering, as it mainly reflected recent demand challenges and an increase in ending stocks that aligned with the market’s expectations. However, Managed Money retains a considerable net short position near 139,000 contracts, as of the latest Commitment of Traders report. This could still fuel a short covering rally should complications arise during planting season, which has just begun. Otherwise, if weather conditions cooperate and planting progresses without major issues, prices could remain susceptible to revisiting recent lows throughout the spring.

- No new action is recommended for 2023 soybeans. We are currently targeting a rebound to the 1275 – 1325 area versus May ’24 futures to recommend making further sales. If you need to move inventory for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- No new action is recommended for the 2024 crop. Considering the amount of uncertainty that lies ahead with the 2024 soybean crop, we recommended back in December buying Nov ’24 1280 and 1360 calls to give you confidence to make sales against anticipated production and to protect any sales in an extended rally. We are currently targeting the 1280 – 1320 range versus Nov ’24 futures, which is a modest retracement toward the 2022 highs, to recommend making additional sales.

- No Action is currently recommended for 2025 Soybeans. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

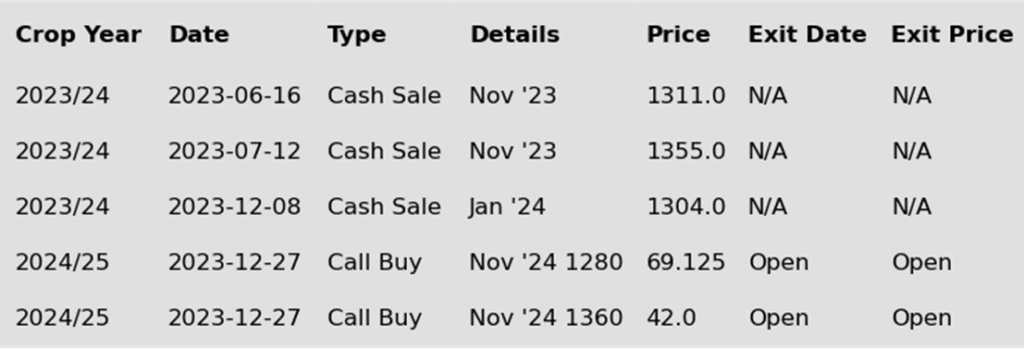

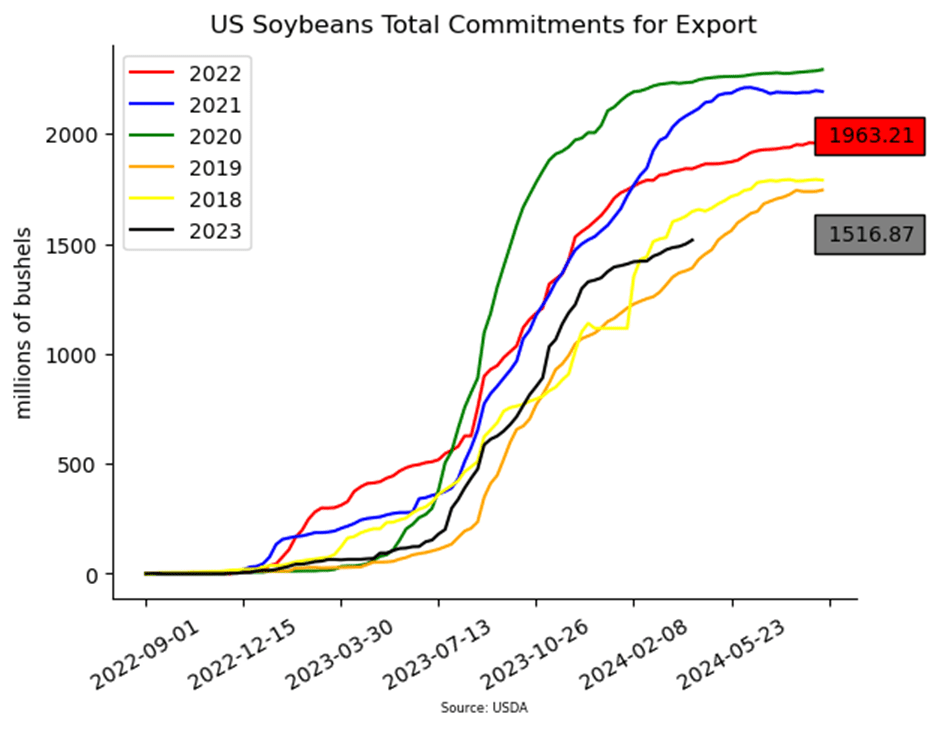

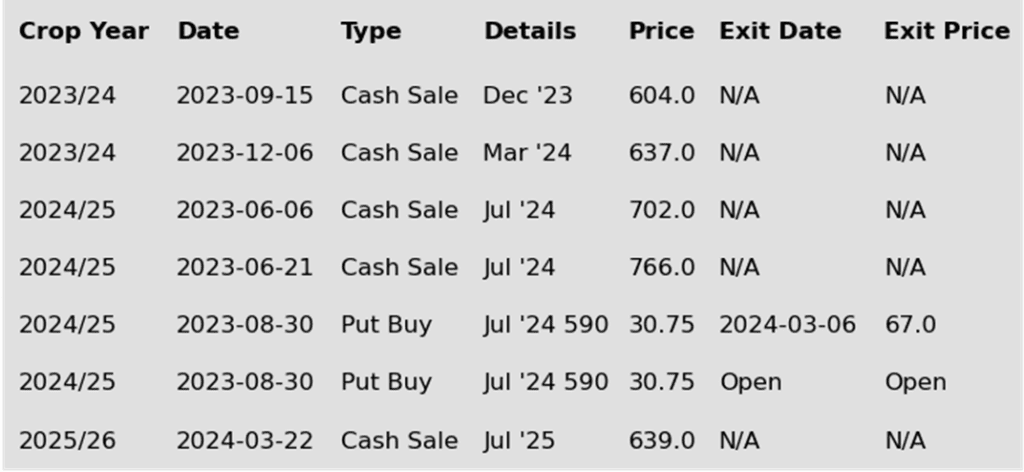

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed sharply lower today as prices faded continuously throughout the day. The July contract is now just 8 ½ cents away from the 1140 ½ contract low from late February. That level will be important to hold and could act as support. Both soybean meal and oil closed lower, but soybean oil posted larger losses, down nearly 2% as palm oil fell.

- Today’s export sales report for soybeans showed an increase of 17.8 mb of sales for 23/24 and an increase of 9.7 mb for 24/25. Sales commitments now total 1.517 bb and are down 18% from a year ago, versus the USDA’s new projection of down 15%. Last week’s export shipments of 17.7 mb were above the 13.0 mb needed each week to meet the USDA’s export estimate of 1.700 bb for 23/24. Primary destinations were to China, Indonesia, and Germany.

- On the positive side, US soybeans are much more competitive with Brazilian offers than they were a year ago. This could mean that the export window in the US could open sooner than it did last year. For the time being, export demand is poor, while domestic demand is at least firm with a record NOPA crush reported on Monday.

- In South America, the Brazilian harvest is now nearly 90% complete but there are very large discrepancies between production estimates which is odd considering that the work is nearly done. Argentina’s harvest is estimated to be 11% complete as of last week and that estimate will be revised again today or tomorrow.

- Strong trade in the US Dollar versus the Brazilian Real currency has pressured corn and soybean futures. The Brazilian Real has closed at 5-month lows against the dollar, which has triggered strong producer selling of both corn and soybeans, weighing on futures prices.

Above: After closing below the 50-day moving average and 1168 support, the market is at risk of drifting lower and testing support between 1140 and the February low of 1128 ½. However, the market is also showing signs of being oversold, which can be supportive to a move higher. For now, initial resistance lies near the 50-day moving average of 1178 ½ with heavier resistance remaining near the recent high of 1226 ¾.

Wheat

Market Notes: Wheat

- Except for May Chicago, all three wheat classes posted gains today. This is despite a higher US Dollar today, and disappointing export sales. Support came from a higher close in Paris milling wheat futures, along with a possible correction from technically oversold conditions.

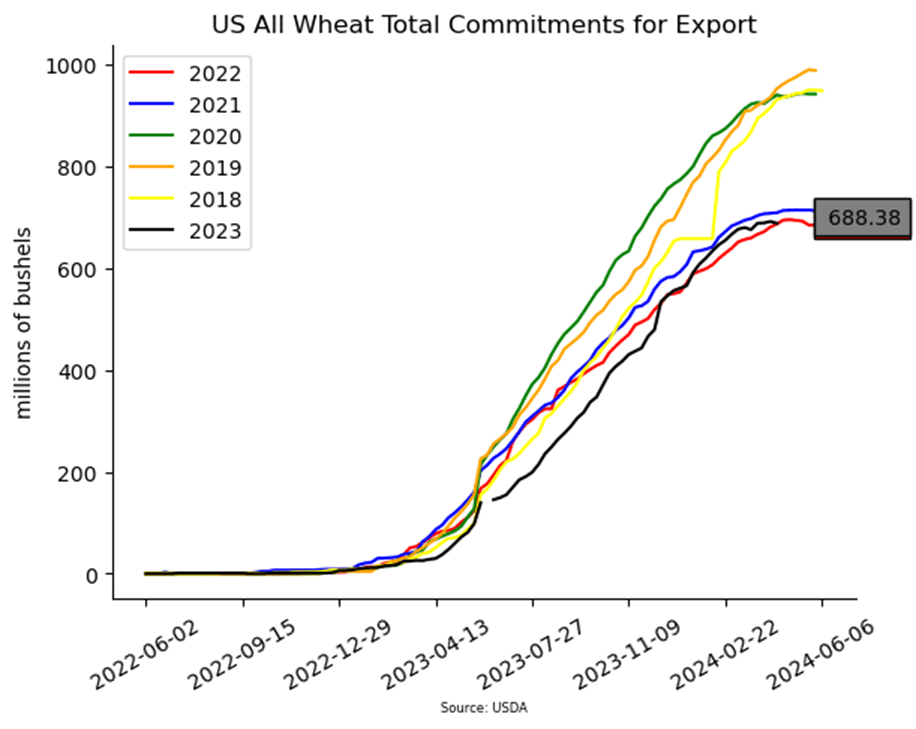

- The USDA reported net cancellations of 3.4 mb of wheat export sales for 23/24, but an increase of 8.2 mb for 24/25. Shipments last week at 17.9 mb exceeded the 17.2 mb pace needed per week to reach the USDA’s goal of 710 mb.

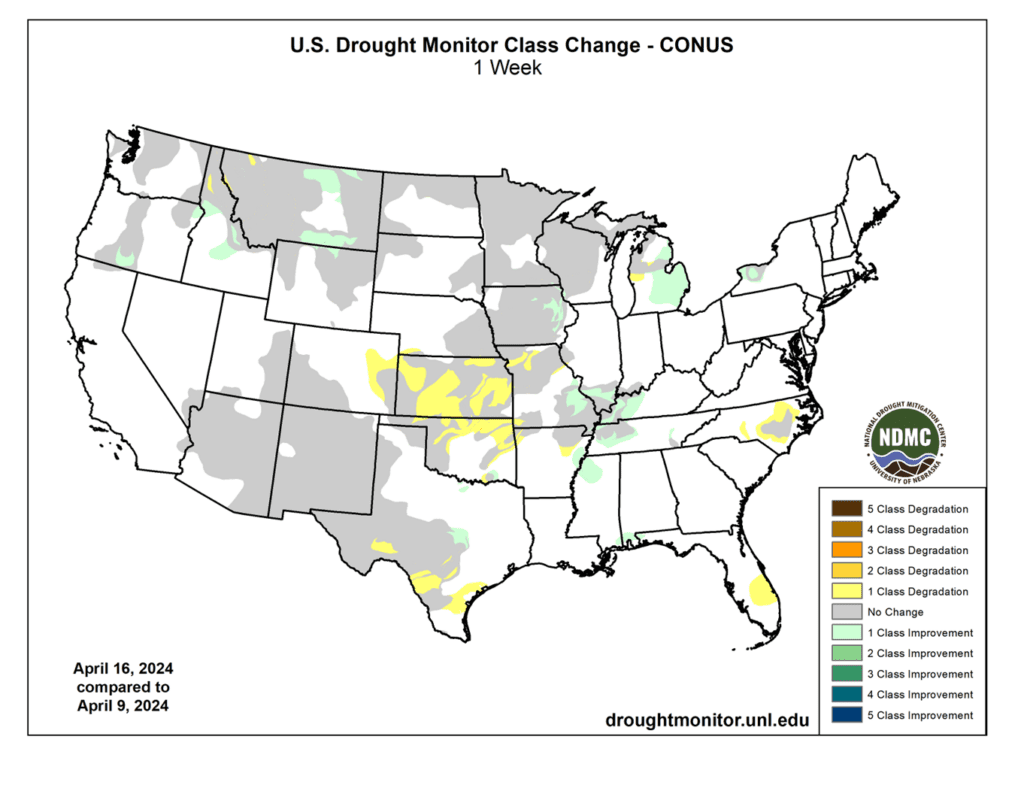

- More rain is moving across parts of the western Corn Belt with the heaviest precipitation in west-central Nebraska, northeast Kansas, and northwest Missouri. While not yet reflected by the US drought monitor, this should help with drought conditions on next week’s release. However, the southwestern Plains continue to be in need of more rain, having missed out on this system.

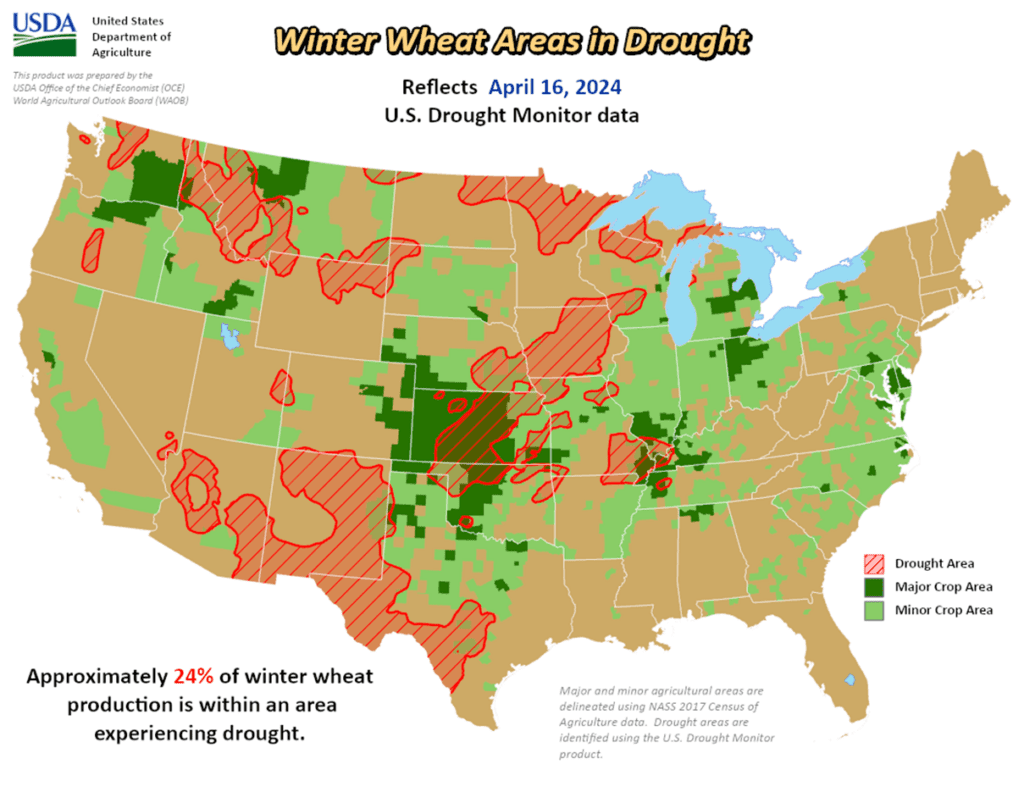

- According to the USDA as of April 16, 24% of the US winter wheat crop is experiencing drought. This is a relatively significant jump from 18% last week. In addition, 26% of the spring wheat growing area is in drought, which is unchanged from last week.

- The Buenos Aires Grain Exchange forecasts that Argentina’s wheat plantings for the upcoming year will remain steady at 5.9 million hectares, mirroring last year’s figures. Planting typically occurs during June and July, and although conditions are expected to be favorable, concerns about the potential impact of La Niña persist. Meanwhile, in France, soft wheat plantings are estimated to decrease by 8% to 4.4 million hectares. Heavy rains since mid-October led to a 6% reduction in their total grain area.

Action Plan: Chicago Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Chicago Wheat Action Plan Summary

Since marking a fresh low in early March, Chicago wheat has traded mostly sideways, seeing limited upward movement due to overhead resistance. While the absence of bullish signals has been disappointing, managed funds continue to maintain a significant net short position. This suggests the potential for a short covering rally to emerge at any moment, especially as we enter the more dynamic part of the growing season.

- No new action is currently recommended for 2023 Chicago wheat. Any remaining 2023 soft red winter wheat should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 Chicago wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Chicago wheat. At the end of August, we recommended purchasing July ‘24 590 puts to prepare for further price erosion, and recently recommended exiting half of those puts to lock in gains and get closer to a net neutral cost on the remaining position. For now, we are targeting a market rebound back towards 675 – 715 versus May ’24 futures before recommending any additional sales. As for the open 590 put position, we are looking for prices between 475 – 500 versus July ’24 futures to before we recommend exiting half of the remaining July ’24 590 puts.

- No new action is currently recommended for 2025 Chicago Wheat. We recently recommended initiating your first sales for the 2025 SRW crop year as prices pressed back toward the mid-600 range to take advantage of historically good prices for next year’s crop. Since plenty of time remains to market this crop, we are looking for further price appreciation and are currently targeting the 690 – 725 area to recommend making additional sales.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: Market weakness pushed July ’24 Chicago wheat below the 50-day moving average but 548 ½ initial support remains intact so far. If support holds, and prices rally back, they could still encounter resistance near the recent high of 574 ¾, before testing 585 – 620. Otherwise, if July ‘24 closes below 548 ¼, it remains at risk of drifting further to test the March low of 523 ½.

Action Plan: KC Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

KC Wheat Action Plan Summary

Since the end of February, prices have been trading in a broad range, bound mostly by 555 on the downside and 605 up top, with little fresh bullish news to trade, while US exports continue to suffer from lower world export prices. Although, fundamentals remain weak. Managed funds continue to hold a considerable net short position, and the market is at levels not seen since spring of 2021, which combined could trigger a return to higher prices if unforeseen risks enter the market.

- No new action is recommended for 2023 KC wheat crop. Considering the current US export demand challenges and the sideways nature of the wheat market, we are looking for prices to return to the upper end of the recent range and are targeting the 600 area versus May ’24 to recommend making additional sales.

- No new action is recommended for 2024 KC wheat. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts to protect the downside, and recommended exiting the original position in three separate tranches as the market got further extended into oversold territory to protect any gains that were made. The current strategy is to target 625 – 650 versus July ’24 futures to recommend additional sales.

- No action is currently recommended for 2025 KC Wheat. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following KC recommendations:

Above: Significant resistance remains within the range bound by the 50-day moving average and the March 10 high of 605 ¼. A close above 605 ½ in the July ’24 might pave the way for further advancement toward the congestion area of 610 – 640. Otherwise, should prices retreat below the initial support level of 561, there’s a possibility of testing the March low of 551 ½.

Action Plan: Mpls Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Mpls Wheat Action Plan Summary

Since February, Minneapolis wheat has largely been rangebound, except for a temporary dip to set a new contract low, from which prices have recovered. Although a lack of bullish drivers and resistance from the 50-day moving average remain, historical seasonal trends typically strengthen as we approach late spring and early summer. Furthermore, managed funds continue to hold a substantial net short position, that potentially sets the stage for a short covering rally at any moment.

- No new action is currently recommended for 2023 Minneapolis wheat. The current strategy is to look for a modest retracement of the July high and target 675 – 700 to recommend more sales.

- No new action is recommended for 2024 Minneapolis wheat. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts (due to their higher liquidity and correlation to Minneapolis), to protect the downside, and recommended exiting the original position in three separate tranches as the market got further extended into oversold territory to protect any gains that were made. The current strategy is targeting the 775 – 815 area versus Sept ’24 to recommend making additional sales. We are also targeting the 850 – 900 area to recommend buying upside calls to help protect any sales that would have been made.

- No action is currently recommended for the 2025 Minneapolis wheat crop. We are currently not considering any recommendations at this time for the 2025 crop that will be planted in the spring of next year. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: Despite recent bearish market reversals, July ’24 Minneapolis wheat remains rangebound since posting a low on April 3. Initial support below the market rests near 632, with the 625 ¼ April low just below that. Should these levels hold, and prices rally above 660 – 677 resistance, they could potentially test 700 – 712. If not, the market could drift toward 595 – 600 psychological support.

Other Charts / Weather