4-16 End of Day: Weakness in the Soybean Complex Weighs on Corn, While Wheat Closes Mixed

All prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’24 | 431 | -0.5 |

| JUL ’24 | 442.75 | -1.5 |

| DEC ’24 | 467.25 | -2 |

| Soybeans | ||

| MAY ’24 | 1145 | -13.25 |

| JUL ’24 | 1160 | -12 |

| NOV ’24 | 1158.5 | -8.75 |

| Chicago Wheat | ||

| MAY ’24 | 549.75 | -2 |

| JUL ’24 | 564.75 | -2.75 |

| JUL ’25 | 633.25 | -4.5 |

| K.C. Wheat | ||

| MAY ’24 | 587.5 | 3.5 |

| JUL ’24 | 583 | 2.25 |

| JUL ’25 | 628.5 | -0.25 |

| Mpls Wheat | ||

| MAY ’24 | 638.25 | 1.25 |

| JUL ’24 | 645 | 1 |

| SEP ’24 | 655.75 | 2 |

| S&P 500 | ||

| JUN ’24 | 5100 | -4 |

| Crude Oil | ||

| JUN ’24 | 84.78 | -0.08 |

| Gold | ||

| JUN ’24 | 2409.3 | 26.3 |

Grain Market Highlights

- With little fresh news, the corn market saw choppy trade that was caught between a lower soybean complex and a mixed wheat complex. The overall trend remains sideways with support below the market still holding.

- Soybeans extended yesterday’s decline, initially influenced by lower soybean oil prices. At midday, additional pressure came from falling soybean meal, which drove beans to fresh six-week lows.

- Soybean oil remained pressured from lower palm oil and yesterday’s NOPA crush data revealing higher-than-anticipated stock numbers, that suggest weaker-than-expected demand for biofuel use. Additionally, meal prices faced further downward pressure due to technical selling, particularly after breaking below the 50-day moving average.

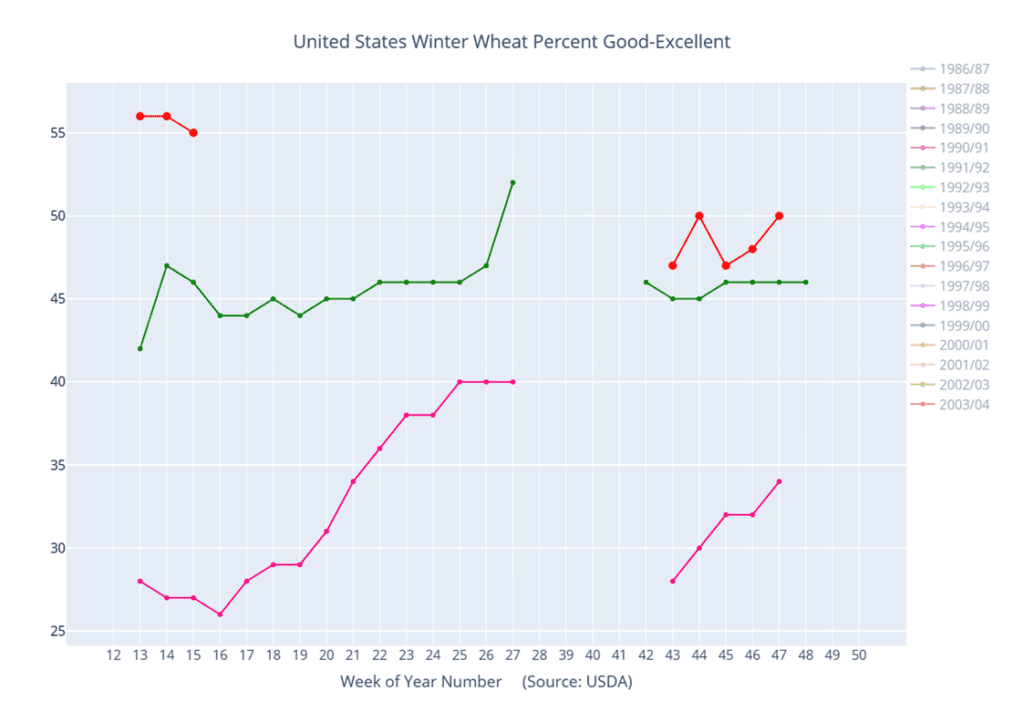

- The wheat market closed mixed, with KC leading Minneapolis higher, potentially influenced by a 6% decrease in the good to excellent ratings in Kansas. Meanwhile, Chicago continued its downward trend from yesterday, ending the day lower but near mid-range.

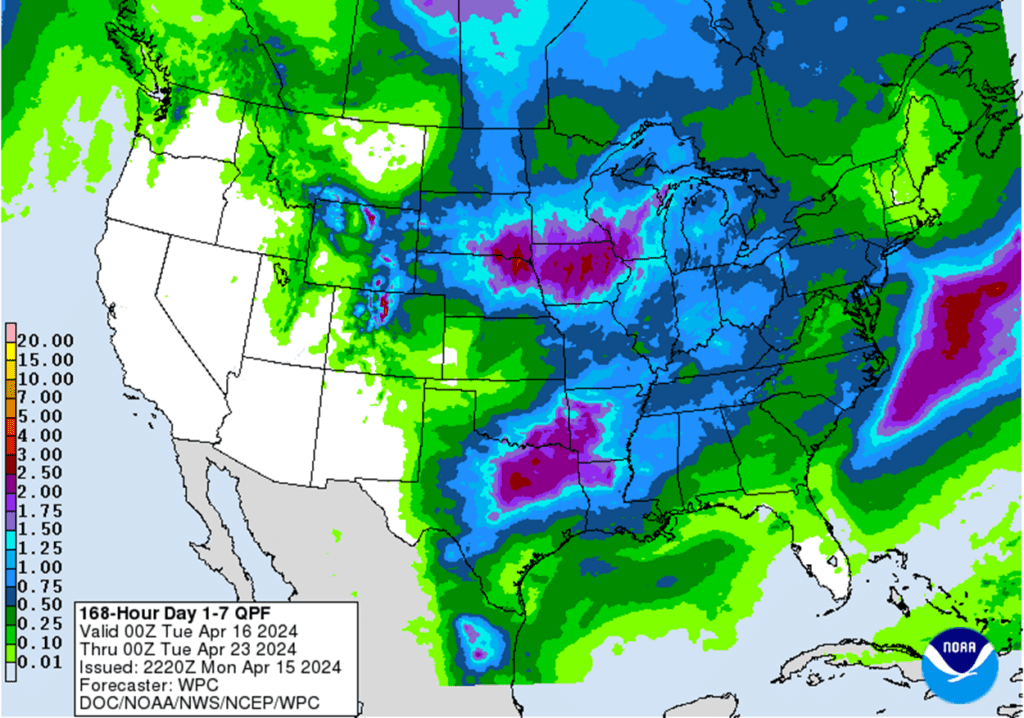

- To see the updated US 7-day precipitation forecast courtesy of NOAA and The Weather Prediction Center scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Corn Action Plan Summary

From the low on February 26 to the high on March 12, May corn experienced a significant rally of nearly 40 cents. However, since then, it has consolidated within a narrow trading range, fluctuating mostly between 430 and 445. The size of Managed Money’s net short position, coupled with prevailing macro oversold conditions, suggests potential for further upside as we head into spring planting. While the recovery in corn prices may encounter obstacles, overall market conditions remain conducive to a continued price recovery into May and June.

- No new action is recommended for 2023 corn. The target range to make additional sales is 480 – 520 versus May ’24 futures. If you need to move bushels for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- No new action is recommended for 2024 corn. We are targeting 520 – 560 to recommend making additional sales versus Dec ‘24 futures. For put option hedges, we are looking for 500 – 520 versus Dec ‘24 before recommending buying put options on production that cannot be forward priced prior to harvest.

- No Action is currently recommended for 2025 corn. At the beginning of the year, Dec ’25 corn futures left a gap between 502 ½ and 504 on the daily chart. Considering the tendency for markets to fill price gaps like these, we are targeting the 495 – 510 area to recommend making additional sales.

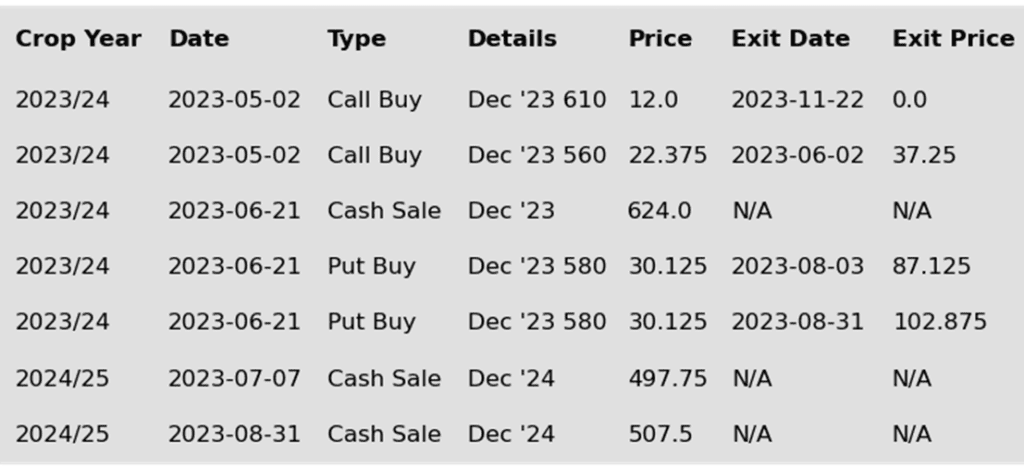

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- A quiet news day led to selling pressure in the corn market as prices are overall trending sideways to lower, caught between losses in the soybean market and mixed trade in the wheat futures. Technically, corn markets are testing and for today holding support levels under the corn market.

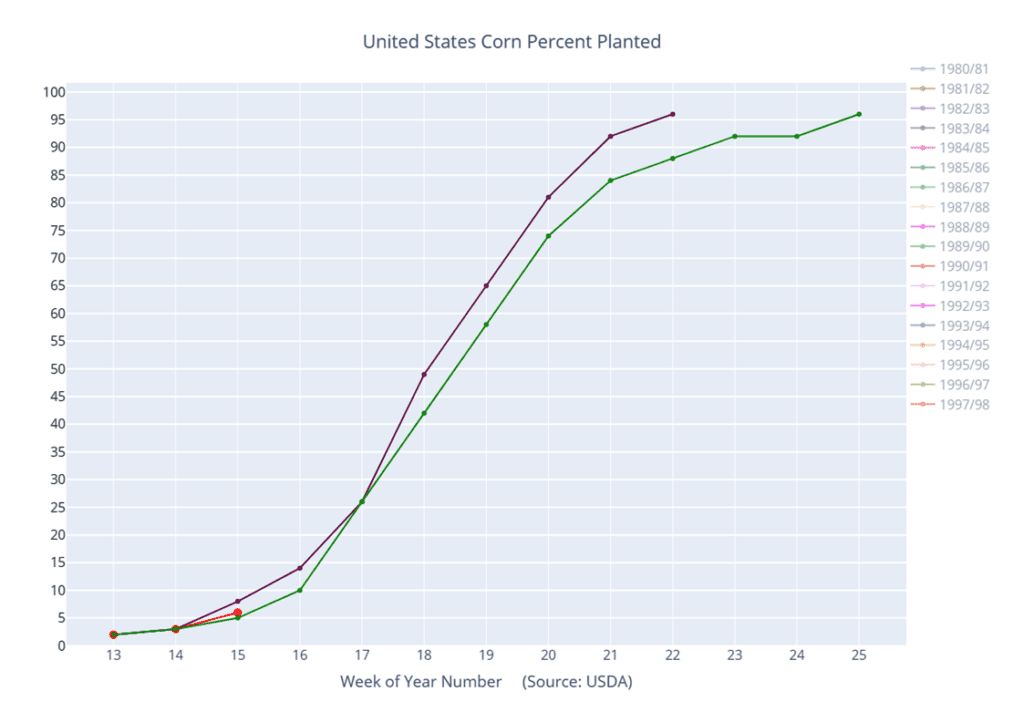

- The USDA released crop progress and planting pace for corn on Monday afternoon. Currently, the corn crop is 6% planted, slightly below expectations and 1% above the 5-year average. Big planting jumps were seen in Missouri, North Carolina, and Kansas. Typically, corn is 27-30% planted by the end of April.

- Weather forecasts and the planting pace will now be the focus of the corn market. Expectations are for temperatures to stay above normal into the end of April, but precipitation looks to stay active during this time window. A wetter pattern may slow planting progress into next week.

- The US Dollar maintained its upward momentum, which is limiting the rally potential in the corn market, as the strong dollar index makes exports originating from the US more expensive.

Above: Since the beginning of March, the corn market has been trading sideways, bound mostly by 445 up top and 425 down below. If prices can breakout and close above resistance between the recent high of 448 and the January high of 452 ¼, they could run toward the next major resistance level of 495 – 510. If they break out to the downside and close below 421, they could slide further to test 400 – 410 support.

Above: Corn percent planted (red) versus the 5-year average (green) and last year (purple).

Soybeans

Action Plan: Soybeans

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Soybeans Action Plan Summary

The USDA’s April Supply and Demand report failed to provide significant bullish data to prompt substantial short covering, as it mainly reflected recent demand challenges and an increase in ending stocks that aligned with the market’s expectations. However, Managed Money retains a considerable net short position near 139,000 contracts, as of the latest Commitment of Traders report. This could still fuel a short covering rally should complications arise during planting season, which has just begun. Otherwise, if weather conditions cooperate and planting progresses without major issues, prices could remain susceptible to revisiting recent lows throughout the spring.

- No new action is recommended for 2023 soybeans. We are currently targeting a rebound to the 1275 – 1325 area versus May ’24 futures to recommend making further sales. If you need to move inventory for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- No new action is recommended for the 2024 crop. Considering the amount of uncertainty that lies ahead with the 2024 soybean crop, we recommended back in December buying Nov ’24 1280 and 1360 calls to give you confidence to make sales against anticipated production and to protect any sales in an extended rally. We are currently targeting the 1280 – 1320 range versus Nov ’24 futures, which is a modest retracement toward the 2022 highs, to recommend making additional sales.

- No Action is currently recommended for 2025 Soybeans. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

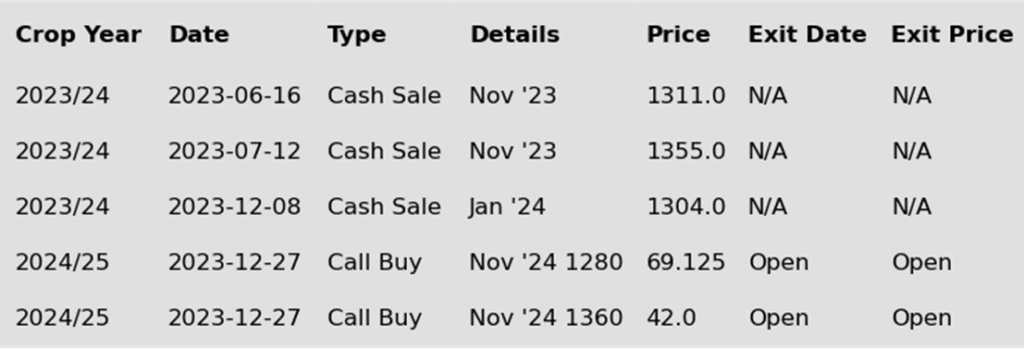

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed lower for the second consecutive day and again were bear spread with the front months posting the bulk of the losses compared to the deferred months. Both soybean meal and oil closed lower as well, but soybean oil had larger losses as it followed palm oil lower.

- Today, crushing group Abiove revised their estimate of Brazilian soybean production higher to 160.3 mmt which throws more confusion into the mix as the USDA kept its estimate at 155 mmt, and CONAB remains much lower at 146 mmt. The discrepancy between estimates is strange considering that 85% of the crop is now reported as harvested.

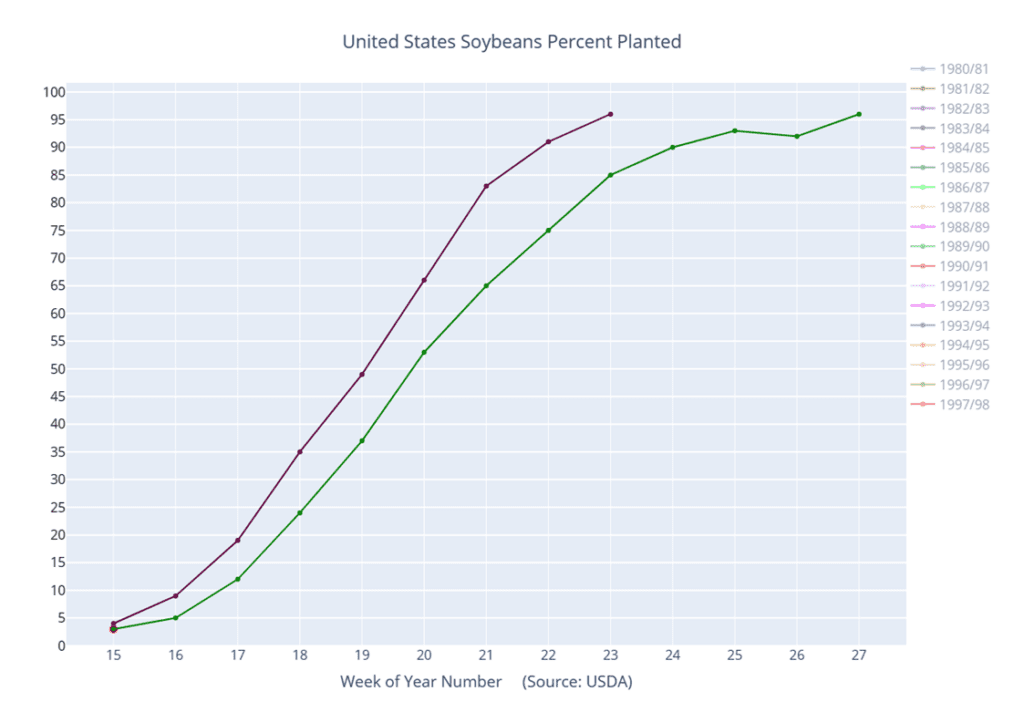

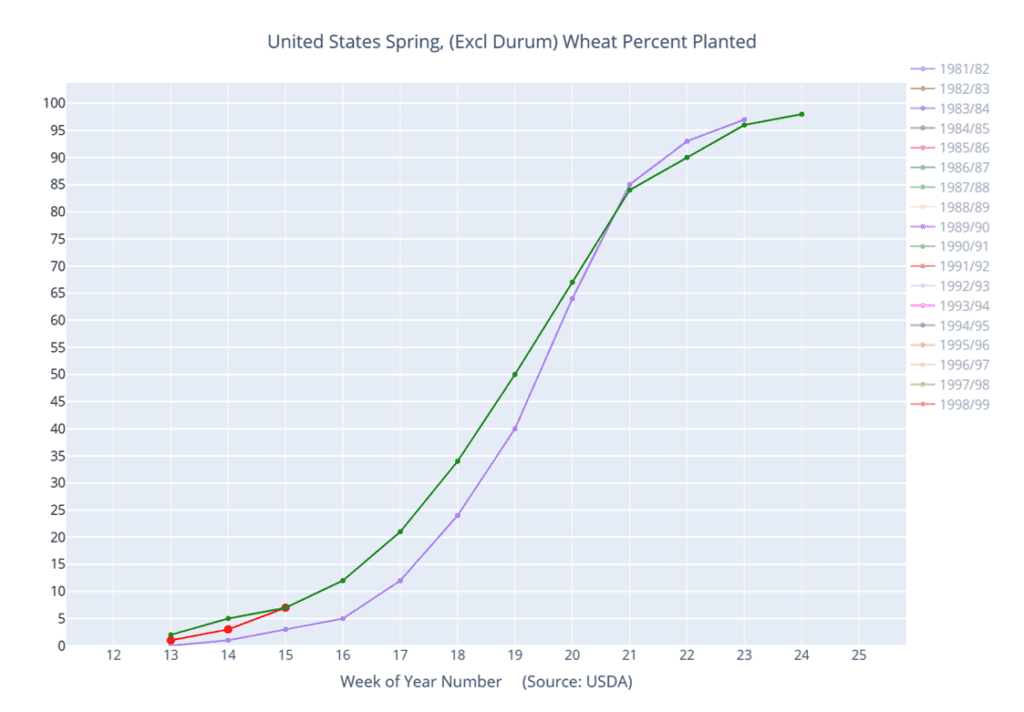

- Yesterday’s Crop Progress report showed soybean planting at 3% complete in the US, which is up from the trade guess at 2% and also up from the 5-year average of 1%. The 7-day forecast features a good amount of rain for eastern Texas as well as central Midwest.

- Yesterday’s NOPA crush report was bearish as it showed soybean oil stocks higher than expectations at 1.851 B/lbs compared to the trade guess of 1.79. Soybean crush was a record for the month of March at 196.406 mb but was below expectations.

Above: After closing below the 50-day moving average and 1168 support, the market is at risk of drifting lower and testing support between 1140 and the February low of 1128 ½. However, the market is also showing signs of being oversold, which can be supportive to a move higher. For now, initial resistance lies near the 50-day moving average of 1178 ½ with heavier resistance remaining near the recent high of 1226 ¾.

Above: Soybeans percent planted (red) versus the 5-year average (green) and last year (purple).

Wheat

Market Notes: Wheat

- Wheat ended the session mixed; Chicago contracts were lower, while KC and Minneapolis were marginally higher. The US Dollar Index continues to climb higher limiting upside potential, and a lack of new fundamental supportive news is keeping wheat relatively rangebound.

- The USDA’s Crop Progress report from yesterday indicated a 1% decline in the winter wheat condition, now at 55% rated good to excellent, compared to 27% at this time last year. Additionally, 11% of the crop is now headed, surpassing last year’s 9% and the 7% average. Moreover, 7% of the spring wheat crop has been planted, contrasting with 2% last year and the 6% average.

- Ukraine’s winter crops, particularly wheat and barley, are reported to be in favorable condition by Ukraine’s Hydrometeorological Center. Despite relatively dry conditions this month, the crops have benefited from unseasonably warm temperatures since January, potentially leading to a production level meeting or exceeding last year’s, as suggested by the head of agriculture at the weather center.

- In contrast, the USDA ag attaché in Ukraine has forecasted a decrease in grain production and exports for 24/25, potentially due to the ongoing war rather than weather factors. Profitability concerns since the onset of the conflict may lead to reduced acreage for the upcoming marketing year, and logistical challenges in the Black Sea region may hamper exports.

- According to the Australian Bureau of Meteorology, the El Nino weather pattern has concluded, potentially paving the way for La Nina conditions. However, uncertainties remain regarding the shift to La Nina, contrary to some forecasts. If La Nina does manifest, it could bring cooler and wetter weather to eastern Australia.

Action Plan: Chicago Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Chicago Wheat Action Plan Summary

Since marking a fresh low in early March, Chicago wheat has traded mostly sideways, seeing limited upward movement due to overhead resistance. While the absence of bullish signals has been disappointing, managed funds continue to maintain a significant net short position. This suggests the potential for a short covering rally to emerge at any moment, especially as we enter the more dynamic part of the growing season.

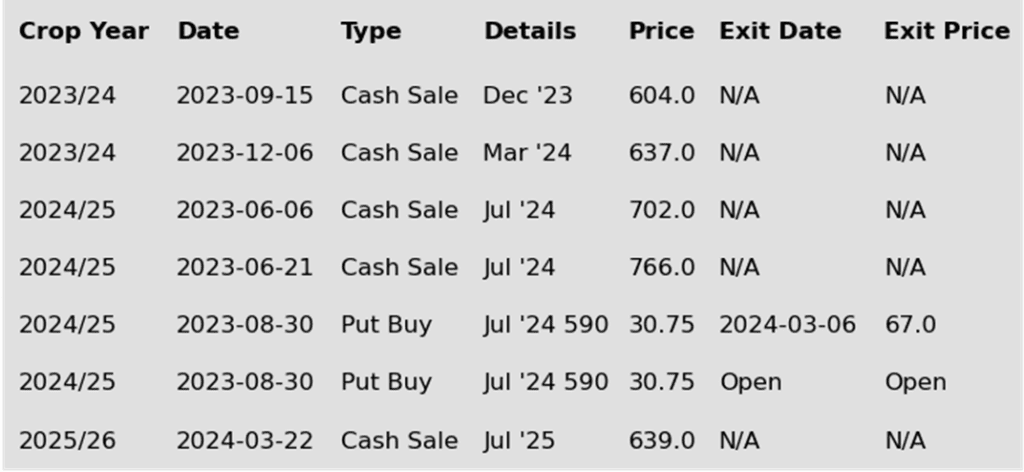

- No new action is currently recommended for 2023 Chicago wheat. Any remaining 2023 soft red winter wheat should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 Chicago wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Chicago wheat. At the end of August, we recommended purchasing July ‘24 590 puts to prepare for further price erosion, and recently recommended exiting half of those puts to lock in gains and get closer to a net neutral cost on the remaining position. For now, we are targeting a market rebound back towards 675 – 715 versus May ’24 futures before recommending any additional sales. As for the open 590 put position, we are looking for prices between 475 – 500 versus July ’24 futures to before we recommend exiting half of the remaining July ’24 590 puts.

- No new action is currently recommended for 2025 Chicago Wheat. We recently recommended initiating your first sales for the 2025 SRW crop year as prices pressed back toward the mid-600 range to take advantage of historically good prices for next year’s crop. Since plenty of time remains to market this crop, we are looking for further price appreciation and are currently targeting the 690 – 725 area to recommend making additional sales.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: The market has fallen away from the 50-day moving average and may be at risk of testing the 523 ½ low if it closes below 537. If prices turn back around and close back above the 50-day moving average, they could still encounter resistance in the 585 – 620 area.

Action Plan: KC Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

KC Wheat Action Plan Summary

Since the end of February, prices have been trading in a broad range, bound mostly by 555 on the downside and 605 up top, with little fresh bullish news to trade, while US exports continue to suffer from lower world export prices. Although, fundamentals remain weak. Managed funds continue to hold a considerable net short position, and the market is at levels not seen since spring of 2021, which combined could trigger a return to higher prices if unforeseen risks enter the market.

- No new action is recommended for 2023 KC wheat crop. Considering the current US export demand challenges and the sideways nature of the wheat market, we are looking for prices to return to the upper end of the recent range and are targeting the 600 area versus May ’24 to recommend making additional sales.

- No new action is recommended for 2024 KC wheat. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts to protect the downside, and recommended exiting the original position in three separate tranches as the market got further extended into oversold territory to protect any gains that were made. The current strategy is to target 625 – 650 versus July ’24 futures to recommend additional sales.

- No action is currently recommended for 2025 KC Wheat. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following KC recommendations:

Above: Significant resistance remains within the range bound by the 50-day moving average and the March 10 high of 605 ¼. A close above 605 ¼ might pave the way for further advancement toward the congestion area of 610 – 640. Otherwise, should prices retreat below the initial support level of 561, there’s a possibility of testing the March low of 551 ½.

Above: Winter wheat condition percent good-excellent (red) versus the 5-year average (green) and last year (pink).

Action Plan: Mpls Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Mpls Wheat Action Plan Summary

Minneapolis wheat has primarily traded within a range since last February until a recent breakout below its lower boundary, marking new contract lows and potentially signaling a continuation of the downtrend initiated last summer. Despite facing resistance from the 50-day moving average and a lack of bullish catalysts, seasonal patterns tend to improve heading into early summer. Furthermore, managed funds still maintain a large net short position, which might trigger a short covering rally at any time.

- No new action is currently recommended for 2023 Minneapolis wheat. The current strategy is to look for a modest retracement of the July high and target 675 – 700 to recommend more sales.

- No new action is recommended for 2024 Minneapolis wheat. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts (due to their higher liquidity and correlation to Minneapolis), to protect the downside, and recommended exiting the original position in three separate tranches as the market got further extended into oversold territory to protect any gains that were made. The current strategy is targeting the 775 – 815 area versus Sept ’24 to recommend making additional sales. We are also targeting the 850 – 900 area to recommend buying upside calls to help protect any sales that would have been made.

- No action is currently recommended for the 2025 Minneapolis wheat crop. We are currently not considering any recommendations at this time for the 2025 crop that will be planted in the spring of next year. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The April 11 close below 638 confirmed the reversal from the 50-day moving average the day before and suggests that prices may slide lower toward the April 3 low, with psychological support near 600 and the March ’21 low of 596 ¼ below that. If bullish input enters the market to turn prices back higher, overhead resistance may still be found in the 660 – 670 area.

Above: Spring wheat percent planted (red) versus the 5-year average (green) and last year (purple).

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.