4-16 End of Day: Grains Rebound on Weaker Dollar

The CME and Total Farm Marketing Offices will be Closed Friday, April 18, in Observance of Good Friday

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’25 | 484.25 | 3 |

| JUL ’25 | 491.75 | 2.25 |

| DEC ’25 | 466.75 | 2.5 |

| Soybeans | ||

| MAY ’25 | 1038.75 | 2.75 |

| JUL ’25 | 1050.25 | 3.75 |

| NOV ’25 | 1034.25 | 4.5 |

| Chicago Wheat | ||

| MAY ’25 | 547.75 | 5.75 |

| JUL ’25 | 561 | 5 |

| JUL ’26 | 626 | 1 |

| K.C. Wheat | ||

| MAY ’25 | 558 | 5 |

| JUL ’25 | 572.25 | 3.75 |

| JUL ’26 | 640 | 2.5 |

| Mpls Wheat | ||

| MAY ’25 | 603.75 | 2.5 |

| JUL ’25 | 617 | 1.5 |

| SEP ’25 | 630.5 | 2 |

| S&P 500 | ||

| JUN ’25 | 5301.25 | -127 |

| Crude Oil | ||

| JUN ’25 | 61.94 | 1.19 |

| Gold | ||

| JUN ’25 | 3353.9 | 113.5 |

Grain Market Highlights

- Corn: Corn futures ended modestly higher in a quiet session, with limited fresh news.

- Soybeans: Soybeans finished higher, recovering from early session losses of up to 10 cents as a sharp drop in the U.S. dollar supported the broader commodity complex.

- Wheat: All three U.S. wheat futures classes closed higher, supported by a sharply lower U.S. dollar, and spillover strength from corn and soybeans.

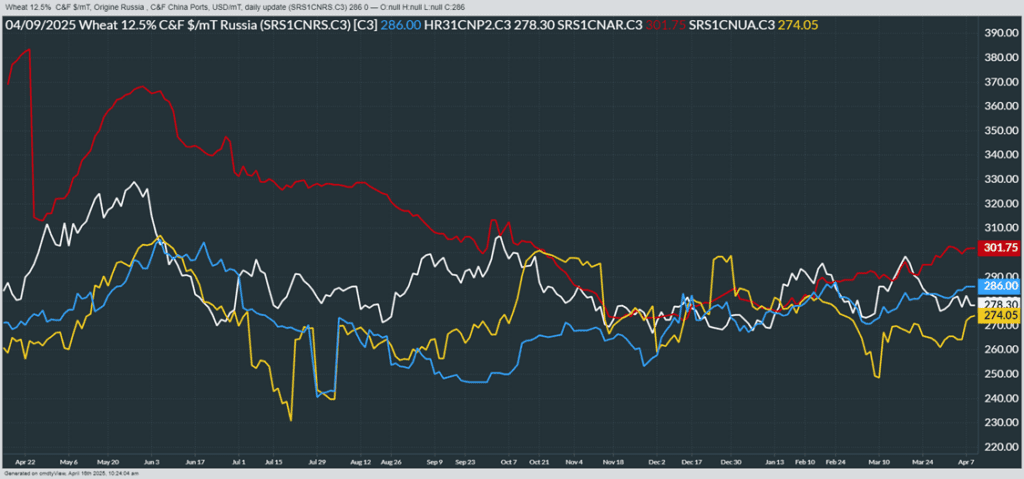

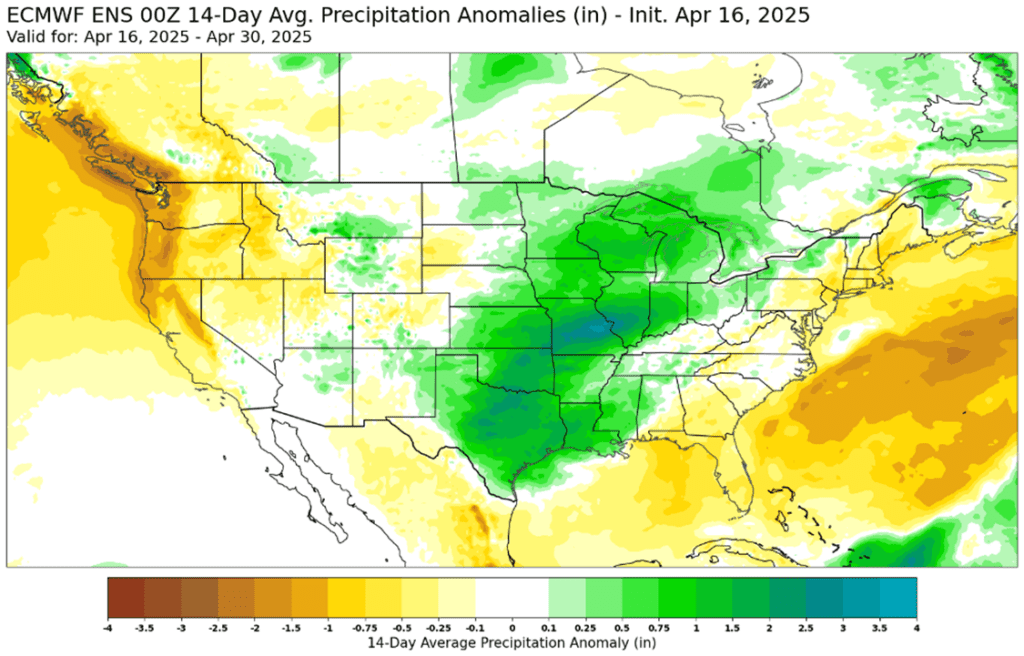

- To see the updated 14-day U.S. and South American precipitation anomaly outlooks scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

New Alert

Sell DEC ’25 Cash

2026

New Alert

Sell DEC ’26 Cash

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 546 vs July.

- Plan B: No active targets.

- Details:

- Continue Catching Up: If you haven’t made all seven sales to date, keep taking advantage of up days in the 487 to 512 range vs July to make catch-up sales.

- Eighth Sales Rec: If July trades to 546 that will trigger the eighth sales recommendation.

2025 Crop:

- NEW ALERT – Sell a portion of your 2025 corn crop today. This is the seventh sales recommendation to date.

- Plan A: Exit all 510 December calls @ 43-5/8 cents. Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: Now, seven sales recommendations have been made to date, with an average price of 461.25.

- Rally: The December ’25 contract has rallied roughly 30 cents from its March 31 low of 436.50.

2026 Crop:

- NEW ALERT – Sell a portion of your 2026 corn crop today. This is the third sales recommendation to date.

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Now, three sales recommendations have been made to date, with an average price of 460.

- Rally: The December ’26 contract has rallied roughly 30 cents from its March 31 low of 443.50 and is now encountering resistance around its February high of 472.50.

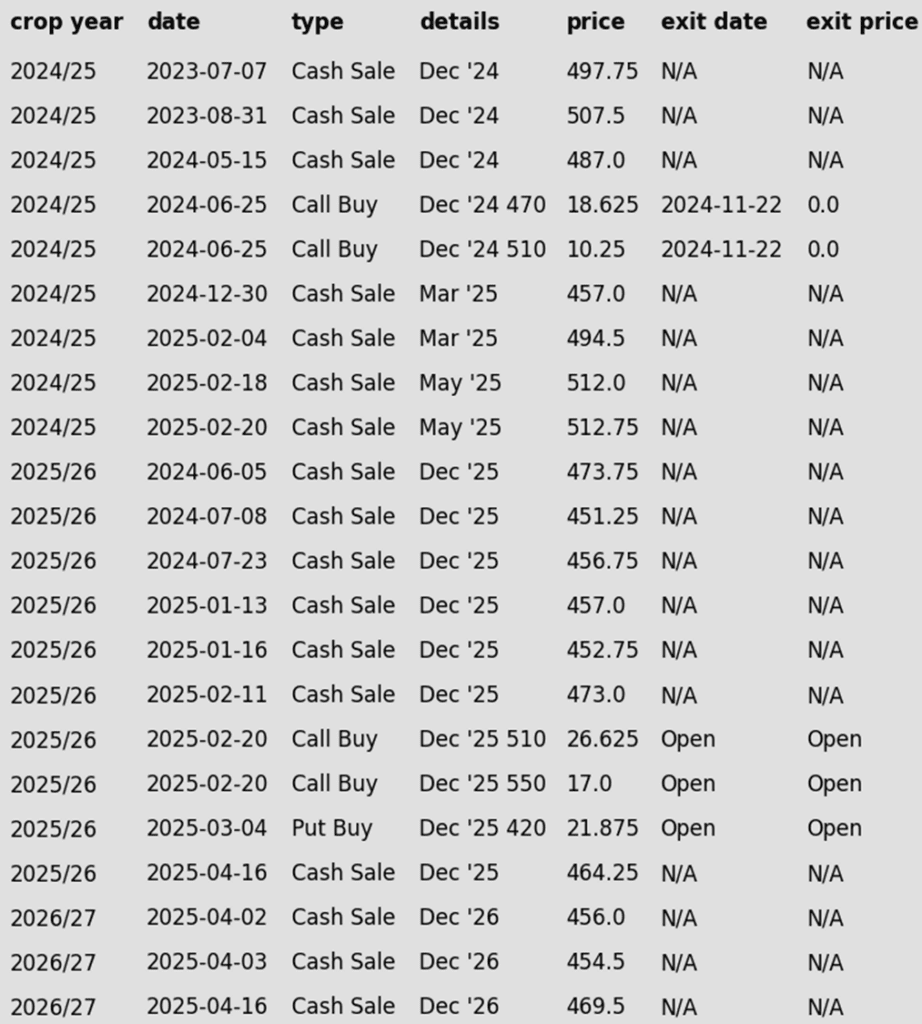

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Quiet day in the corn market as prices finished with small gains on Wednesday’s session. Fresh news for the corn market was limited, but more weakness in the U.S. dollar helped support the grain markets as traders positioned ahead of the 3-day Easter weekend.

- Weekly ethanol production fell to 1.012 million barrels/day, a 7-month low. While down from the previous week, production remains 3% above year-ago levels. Roughly 101 million bushels of corn were used—below the pace needed to meet USDA’s annual target.

- The U.S. dollar continued to soften, nearing its lowest level since April 2022. The ongoing weakness in the dollar is broadly supportive for grain and commodity markets.

- Weather will be closely watched over the weekend as another round of rainfall is slated for the southern Plains. This could compound the issues in that region regarding wetness and limit early-season planting pace.

- USDA will release weekly export sales on Thursday morning. The current export sales pace is trending well ahead of the current USDA pace. Last week, corn export sales were within expectations, but slightly disappointing at 748,000 MT.

Corn Starts April Strong

After spending much of March hovering just above key support at 450, corn futures have surged higher to start April. A friendly April WASDE report—highlighting stronger demand—has helped fuel the rally, with futures pushing through resistance at the 50-day moving average. The next upside target is the February highs just above 500, while near-term support is expected to be near 470, at the upper end of the previous trading range.

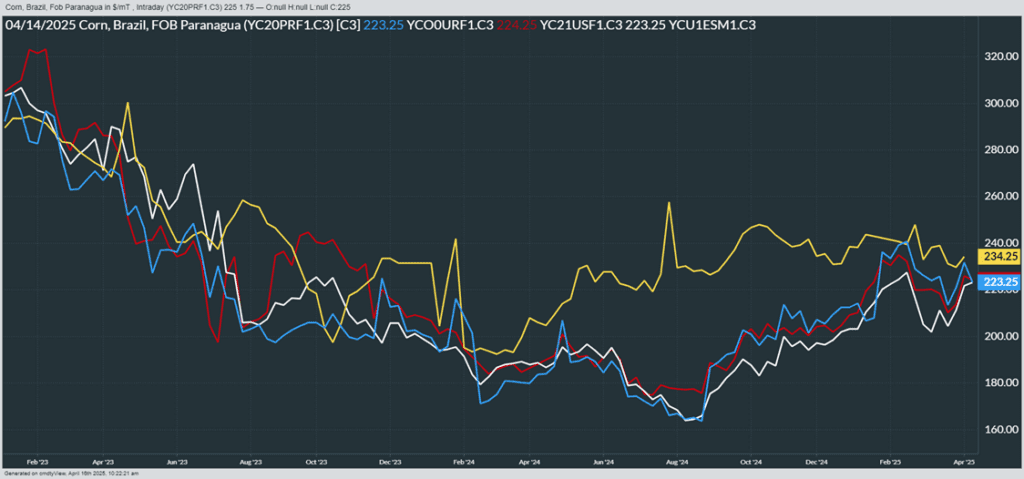

Above: From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine non-GMO (yellow)

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs July.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 1089.

- No Changes: With three sales recommendations made to date, continue targeting a move to 1107 to make a fourth sale.

2025 Crop:

- Plan A: Next cash sales at 1093 & 1114 vs November. Exit all 1100 November call options at 88 cents.

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made so far to date, at 1063.50.

- Catch-Up Target: If you didn’t make the one sale, aim for 1063 vs November as your catch-up target. This price level aligns with the Grain Market Insider sale recommendation issued back on January 29.

- No Changes: With one sales recommendation made to date, a move to 1093 would trigger the second, and 1114 the third. These targets remain unchanged, and Grain Market Insider remains optimistic that the November contract could still reach them.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- No Changes: The expectation is still for targets to begin posting in a month or two.

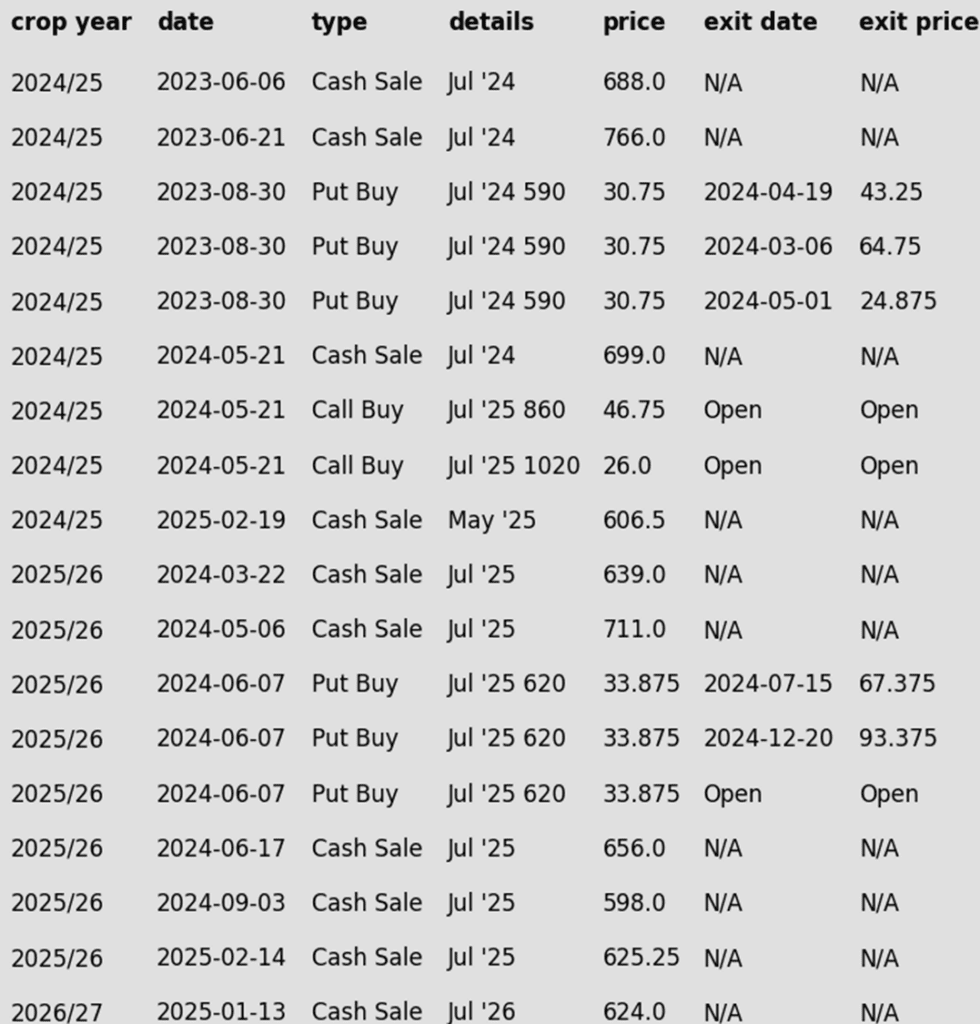

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans were higher to end the day after recovering from lower prices overnight that were down as much as 10 cents. The U.S. dollar fell sharply today which was likely supportive to commodities across the board, and fears of planting delays have likely been supportive as well. Both soybean meal and oil ended the day higher.

- Planting concerns persist as some regions remain wet, though early planting has begun in select areas. Historically, soybeans planted by early May tend to yield better—21% of the crop is typically planted by May 1 on average.

- Brazilian soybean exports are seen at 14.5 mmt for the month of April which compares to a previous estimate of 13.3 mmt. At this point, China is buying virtually all of its soybeans from Brazil and basically none from the U.S.

- Brazil soybean prices have turned softer as harvest is in the back-end stages. China has been a strong purchaser on Brazil soybeans, up to 60-70 cargoes last week, including supplies for Feb-Mar 2026. Farmer selling has picked up, pressuring basis premiums in Brazil, limiting the strength in U.S. soybean prices.

Volatile Start to April for Soybeans

Soybean futures dropped sharply in early April following newly announced tariffs, breaking key support near the 1000 level that had held firm through March. However, early April strength has since fueled a rebound, pushing futures back above the pivotal 1000 mark and reclaiming major moving averages—most notably the 200-day, which has capped rallies over the past two years. With momentum rebuilding, the market is now targeting the February highs near 1080, while the 200-day moving average should offer support on any spring pullbacks.

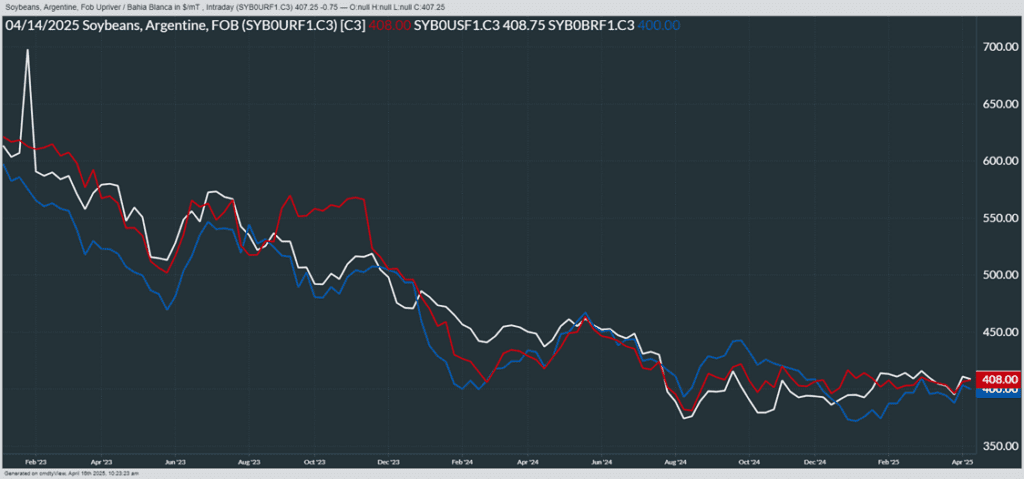

Above: From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

- All three U.S. wheat futures classes closed higher, supported by a sharply lower U.S. dollar, spillover strength from corn and soybeans, and a possible technical rebound after recent losses.

- India’s wheat reserves rose to 11.8 MMT, a three-year high and well above the government’s 7.5 MMT target—a potentially bearish signal for global markets.

- Argentina’s 2025/26 wheat harvest is forecast at 20.5 MMT, according to the Buenos Aires Grain Exchange. That’s 2 MMT above last year, with potential for further growth if a recent export tax reduction is extended. If realized, it would be Argentina’s second-largest wheat crop on record.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 701 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 690.

- No Changes: 701 is still the price target to trigger a fifth sales recommendation.

2025 Crop:

- Plan A: Target 705.50 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- No Changes: Still targeting 705.50 to trigger the sixth sales recommendation.

2026 Crop:

- Plan A: Target 704 against July ‘26 for the next sale

- Plan B: No active targets.

- Details:

- Sales Recs: One sales recommendation made to date, at 624.

- No Changes: 704 is still the price target to trigger a second sales recommendation.

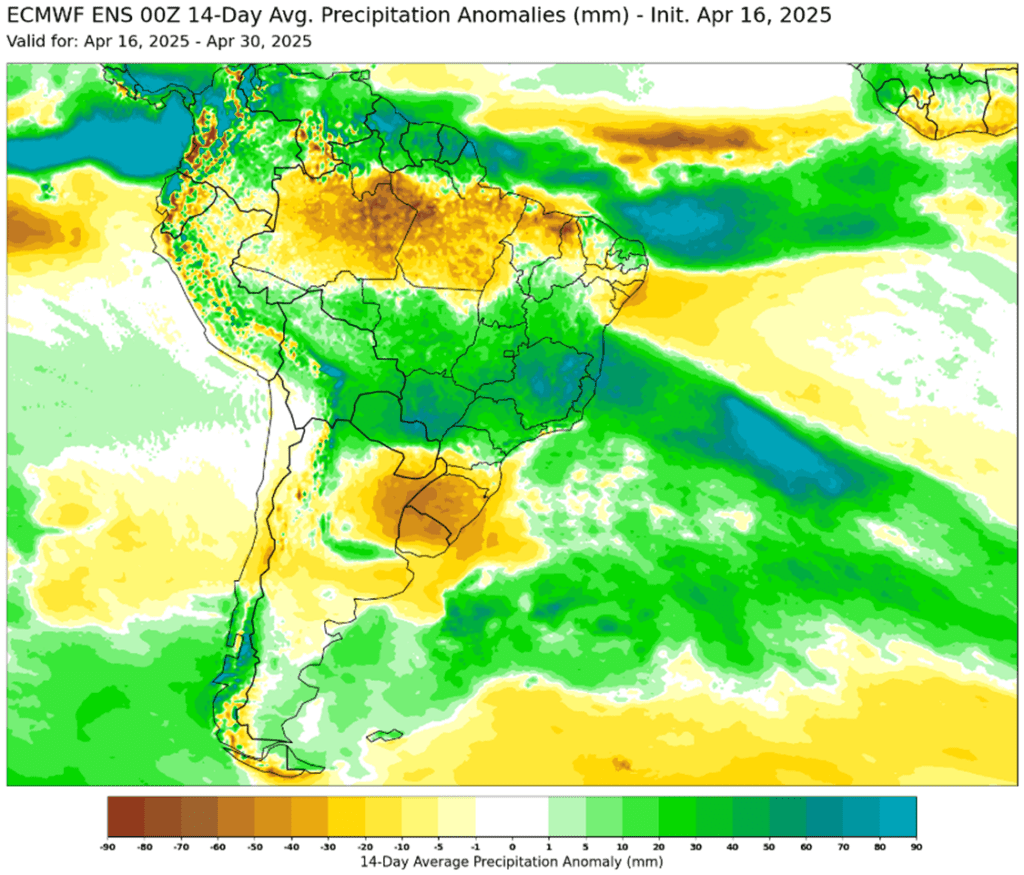

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat – Back to Sideways Trend

After months of sideways movement, Chicago wheat broke higher in February, rallying to early October highs just above 615. However, this mid-month peak quickly turned into a reversal point, with futures sliding back into the trading range that defined late 2024. Currently, support near 530 continues to hold firm. The next major resistance is the 200-day moving average, which now represents a critical test. A decisive weekly close above this level could signal a shift in momentum, potentially marking the beginning of a trend reversal and a return to upside momentum.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Three sales recommendations made to date, with an average price of 677.

- No Changes: Still no active price targets, as the May contract continues to chop around in the 550-580 range.

2025 Crop:

- Plan A: Target 677 against July for the next sale.

- Plan B: No active targets.

- Details:

- Sales Recs: Four sales recommendations made to date, with an average price of 639.

- No Changes: 677 is still the price target to trigger a fifth sales recommendation.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Zero sales recommendations made so far to date.

- No Changes: The expectation is still for targets to begin posting in the May – June timeframe.

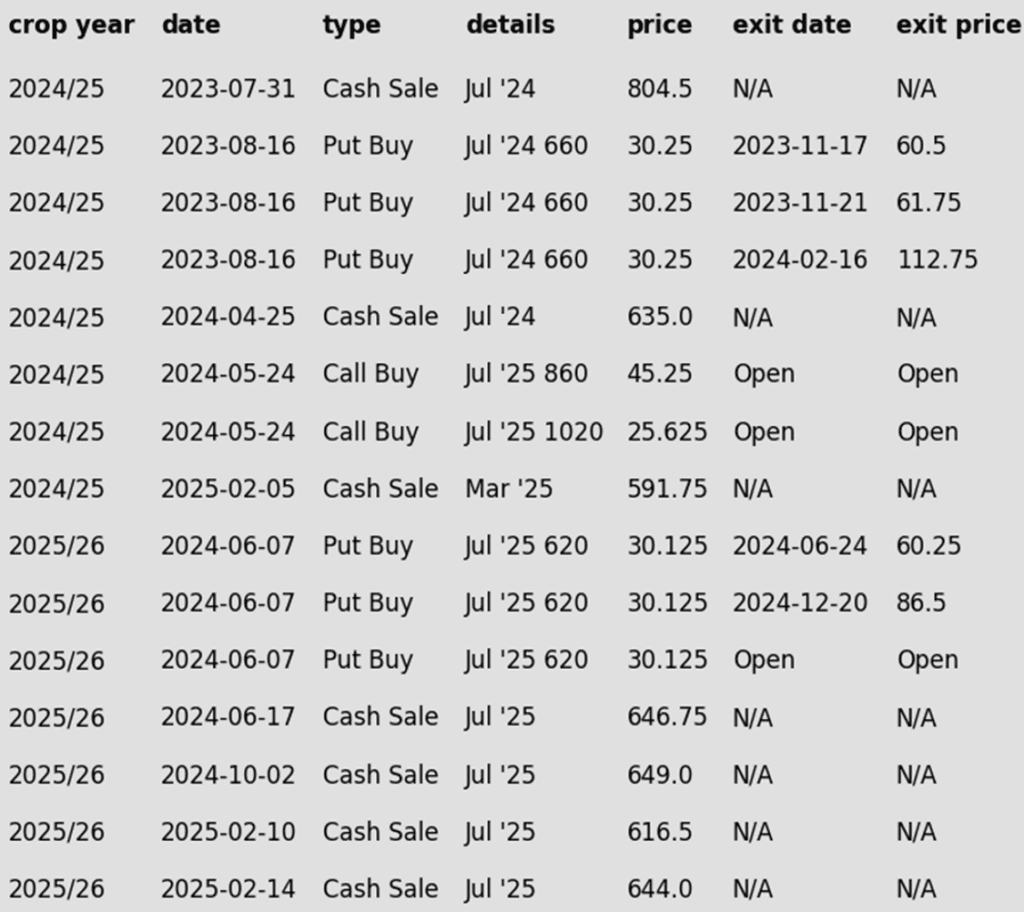

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Seeks Direction After February Whiplash

February was a wild ride for Kansas City wheat, with prices surging higher before tumbling back down, ultimately finishing the month little changed. March ended with weakness, bringing prices back near recent lows, but holding trendline support so far in April remains encouraging. On a rebound, the 200-day moving average is expected to act as initial resistance, with February highs near 640 serving as a more significant barrier. Support near the December lows of 540 should act as stout support on any continued decline.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 696.

- No Changes: No active targets for a sixth sales recommendation at this time.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Sales Recs: Five sales recommendations made to date, with an average price of 646.

- No Changes: No active targets for a sixth sales recommendation at this time.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- No Changes: The expectation is still for targets to begin posting in the June – July timeframe.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Hovers Near Support

Spring wheat broke out of its long-standing sideways range in late January, triggering a surge of bullish momentum. The rally gained further traction in mid-February with a close above the 200-day moving average, but late-month weakness wiped out those gains, pushing futures back below key technical levels. Currently, the 200-day moving average acts as a barrier, limiting any rebound attempts, while support near 580 remains crucial in preventing further downside. To reignite the uptrend, futures would need to make a sustained move above the 200-day, with the next upside target at the February highs near 660. With spring wheat acreage expected to be the lowest in the past 55 years, weather volatility is likely to play a significant role in market movements.

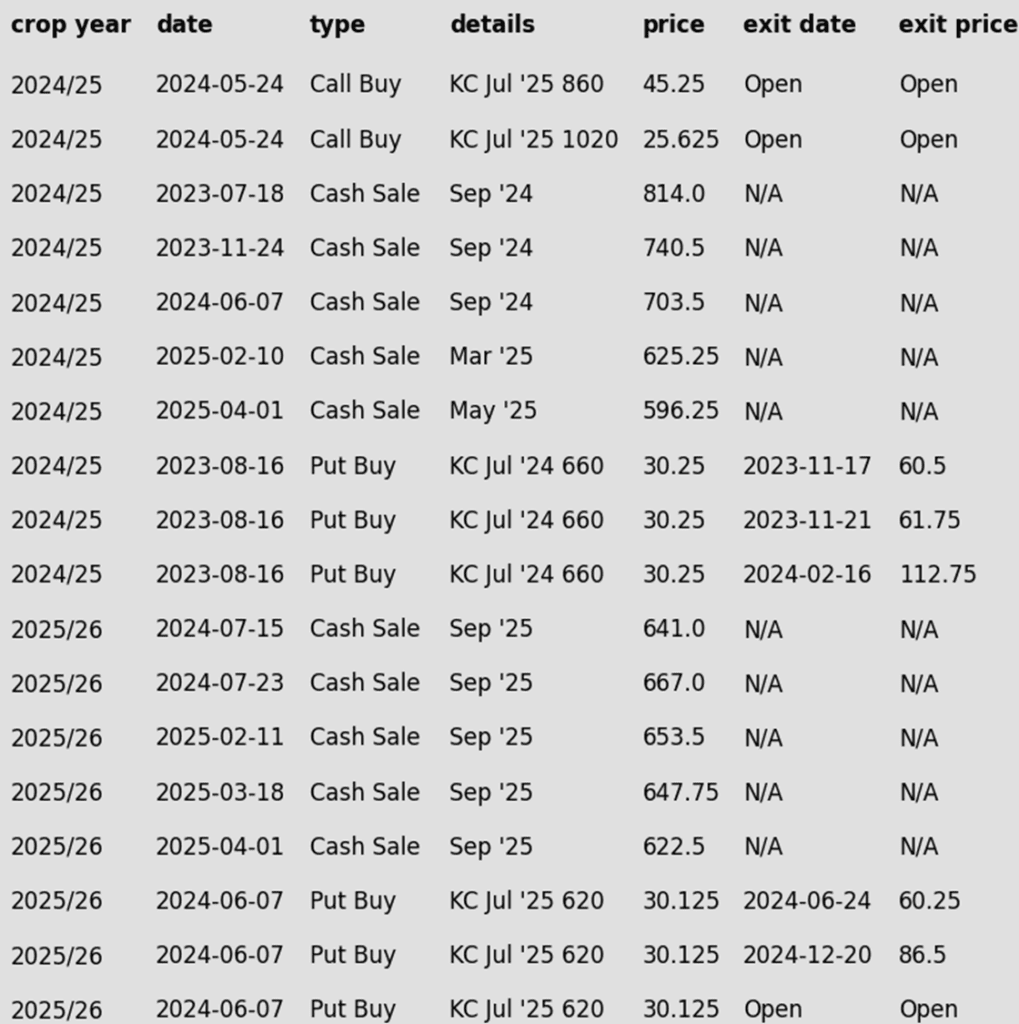

Above: From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather

Above: Courtesy of ag-wx.com

Above: Courtesy of ag-wx.com