4-1 End of Day: Cautious Optimism Lifts Grains Higher Tuesday

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’25 | 461.75 | 4.5 |

| JUL ’25 | 468.25 | 5 |

| DEC ’25 | 449.5 | 7.5 |

| Soybeans | ||

| MAY ’25 | 1034.25 | 19.5 |

| JUL ’25 | 1049.25 | 21 |

| NOV ’25 | 1039.25 | 20 |

| Chicago Wheat | ||

| MAY ’25 | 540.5 | 3.5 |

| JUL ’25 | 553.75 | 3.25 |

| JUL ’26 | 625.5 | 4.5 |

| K.C. Wheat | ||

| MAY ’25 | 565.25 | 8.25 |

| JUL ’25 | 576.75 | 6.75 |

| JUL ’26 | 642 | 5.25 |

| Mpls Wheat | ||

| MAY ’25 | 594 | 2 |

| JUL ’25 | 610 | 3.25 |

| SEP ’25 | 624 | 4.25 |

| S&P 500 | ||

| JUN ’25 | 5631.25 | -22 |

| Crude Oil | ||

| JUN ’25 | 70.78 | -0.17 |

| Gold | ||

| JUN ’25 | 3150.2 | -0.1 |

Grain Market Highlights

- Corn: Corn futures followed soybeans higher on Tuesday, closing in positive territory, with new crop contracts leading the gains.

- Soybeans: Soybeans closed higher today, gaining momentum from yesterday’s bullish Planting Intentions report. However, traders remain cautious ahead of President Trump’s tariff announcement set for tomorrow.

- Wheat: Wheat was the weakest performer in the grain complex today but still managed to close higher across all contracts.

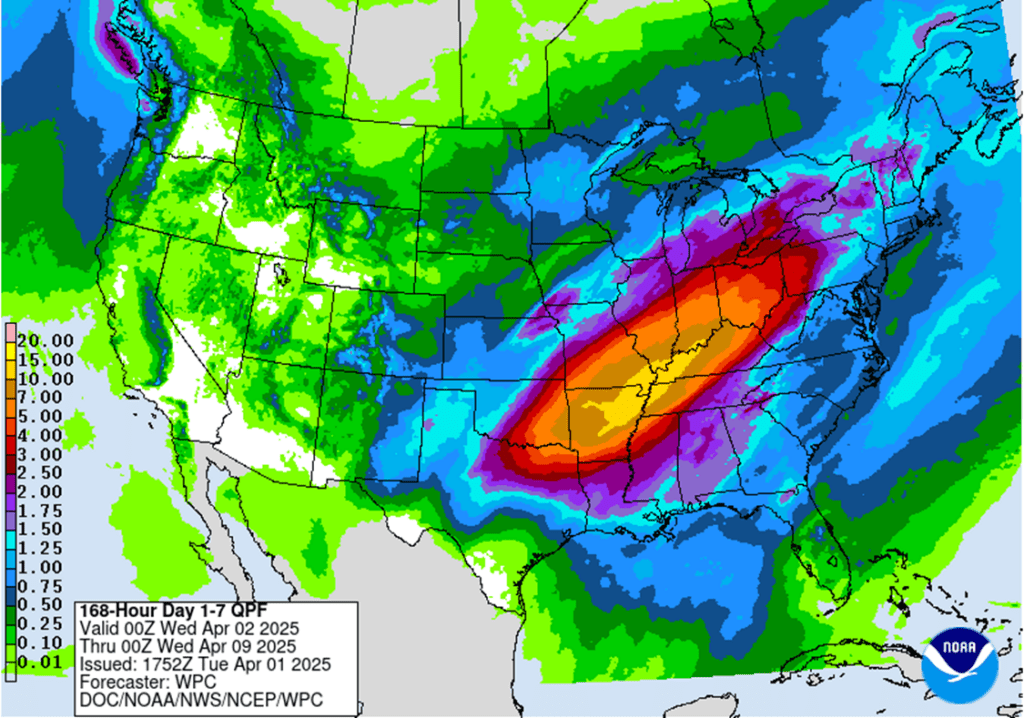

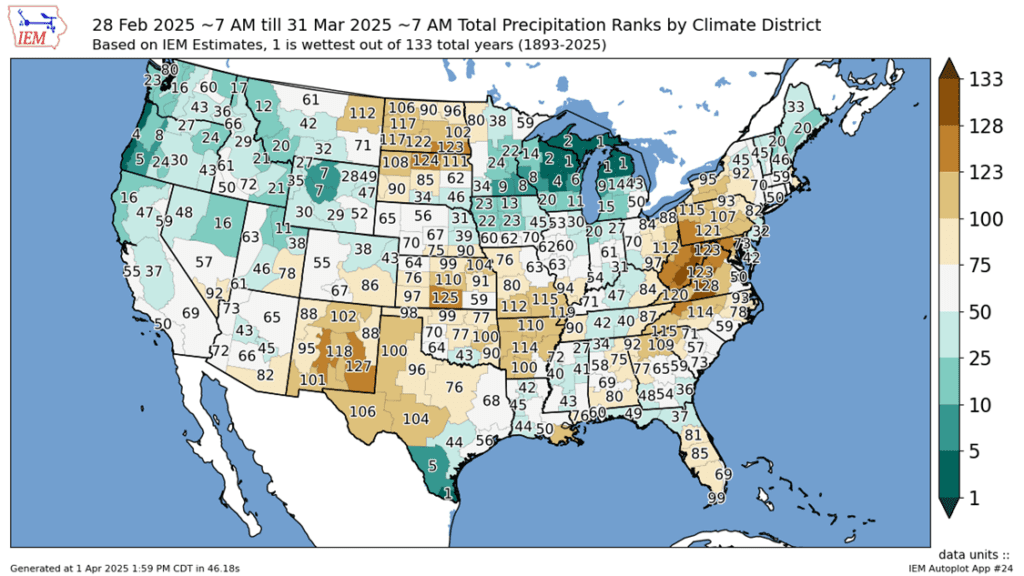

- To see the updated 7-day precipitation forecast for the U.S. as well as the 30-day total precipitation ranks by climate district, scroll down the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

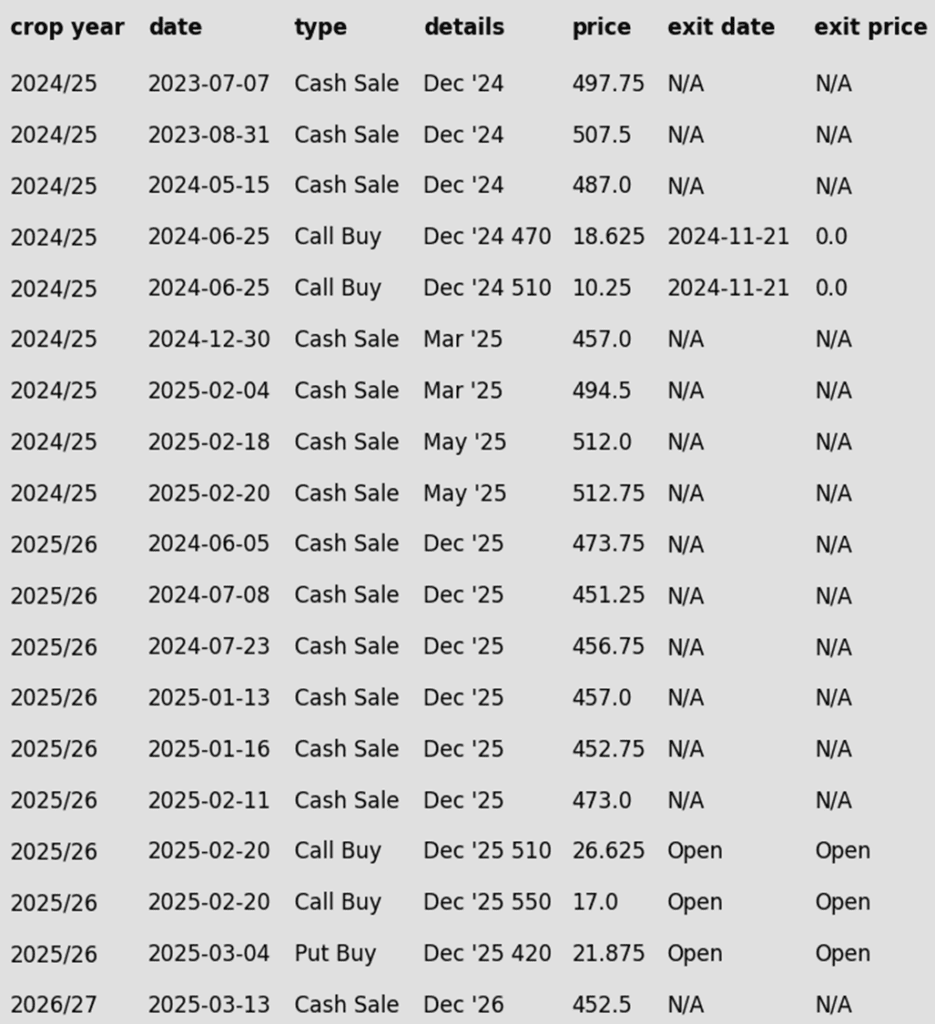

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Recs: Seven sales recommendations made so far to date.

- No Changes Post-Report: The recommendation remains to sit tight yet.

2025 Crop:

- Plan A: Exit all 510 December calls @ 43-5/8 cents. Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Recs: Six sales recommendations made so far to date.

- No Changes Post-Report: No updates to active options targets, and no new sales targets have been posted at this time.

2026 Crop:

- Plan A: Next cash sale at 456 vs December ‘26.

- Plan B: No active targets.

- Details:

- Recs: One sales recommendation made so far.

- New Target: A second sale target for the 2026 crop has been activated at 456.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

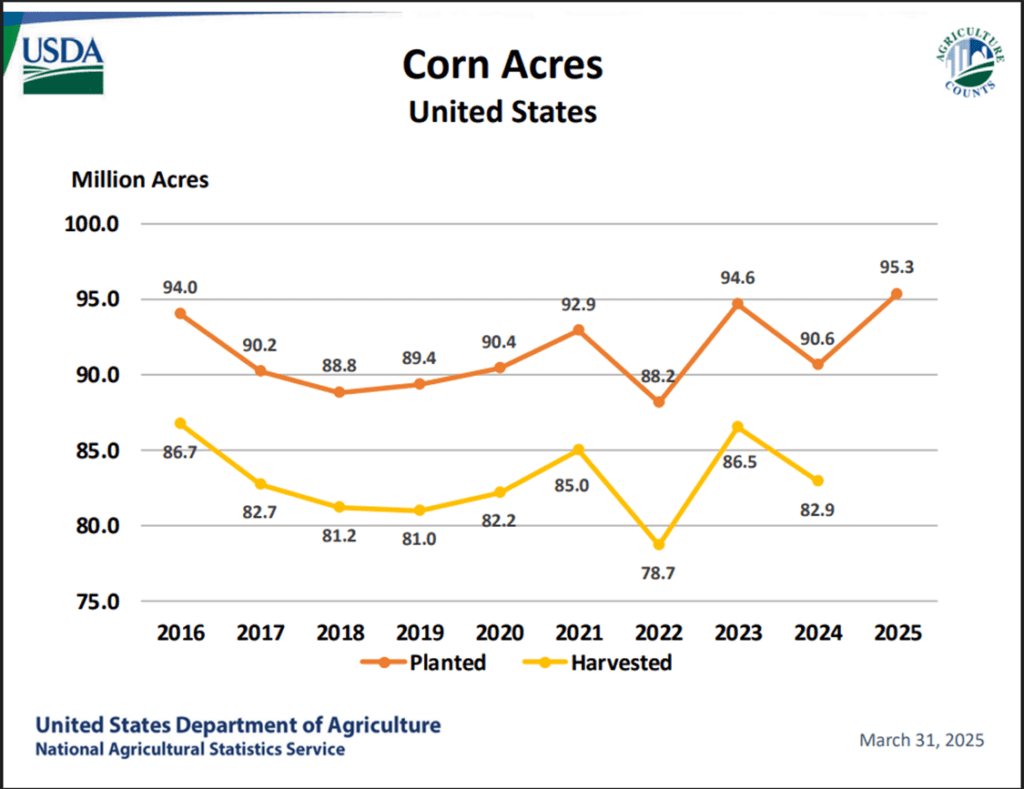

- Corn prices continued to climb throughout the session, supported by strength in the soybean complex and cautious optimism. Traders remain focused on the upcoming reciprocal tariffs set to take effect tomorrow, April 2nd, as well as ongoing analysis of the USDA’s Prospective Plantings report, which confirmed an increase in corn acreage for the year.

- Heavy rains are expected to impact central Oklahoma and stretch northeast through Arkansas, Kentucky, southern Illinois, and southern Indiana over the next five days, raising flood concerns that could delay spring fieldwork and planting.

- The 5-day weather outlook for Brazil predicts warm temperatures, while the 15-day forecast indicates wet weather across most of the country, excluding the Northeast. While the wet conditions may delay the first corn harvest, they will be beneficial for the growth of second-crop corn across Brazil’s growing regions.

- With the increase in corn acreage, ending stocks could easily surpass 2 billion bushels, with both old and new crop futures remaining strong. Corn demand continues to outpace expectations as U.S. corn remains one of the most affordable feed grains globally.

- Brazil continues to challenge the U.S. for the title of top corn exporter, but the U.S. remains the leader, producing 1.8 times the combined output of Argentina, Brazil, and Ukraine.

Corn Finds Its Footing After Sharp Pullback

After soaring to 16-month highs in late February, corn futures took a steep dive, retreating to test key technical levels. Prices recently found support near 450, aligning with both the 100-day moving average and a critical trendline—potentially marking a short-term low as the market pivots toward spring planting.

A rebound from this level suggests renewed strength, but hurdles remain. Initial resistance looms near the 50-day moving average, while stronger support sits deeper at the 200-day moving average. With the USDA’s March Planting Intentions report now behind us, weather developments in both South America and the U.S., volatility could return swiftly, keeping traders on high alert.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs May. Buy calls with a close over 1079.75 vs May.

- Plan B: No active targets.

- Details:

- Recs: Three sales recommendations made so far to date.

- No Changes Post-Report: No updates to the active option target or the single sales target at this time.

2025 Crop:

- Plan A: Next cash sales at 1093 & 1114 vs November. Exit all 1100 November call options at 88 cents.

- Plan B: No active targets.

- Details:

- Recs: One sales recommendation made so far to date.

- New Target: Post-report price action activated an additional sales target at 1093 vs November. With one sales recommendation made to date, a move to 1093 would trigger the second, and 1114 would trigger the third.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Recs: Zero sales recommendations made so far to date.

- No Changes Post-Report: The expectation is still for targets to begin posting in a month or two.

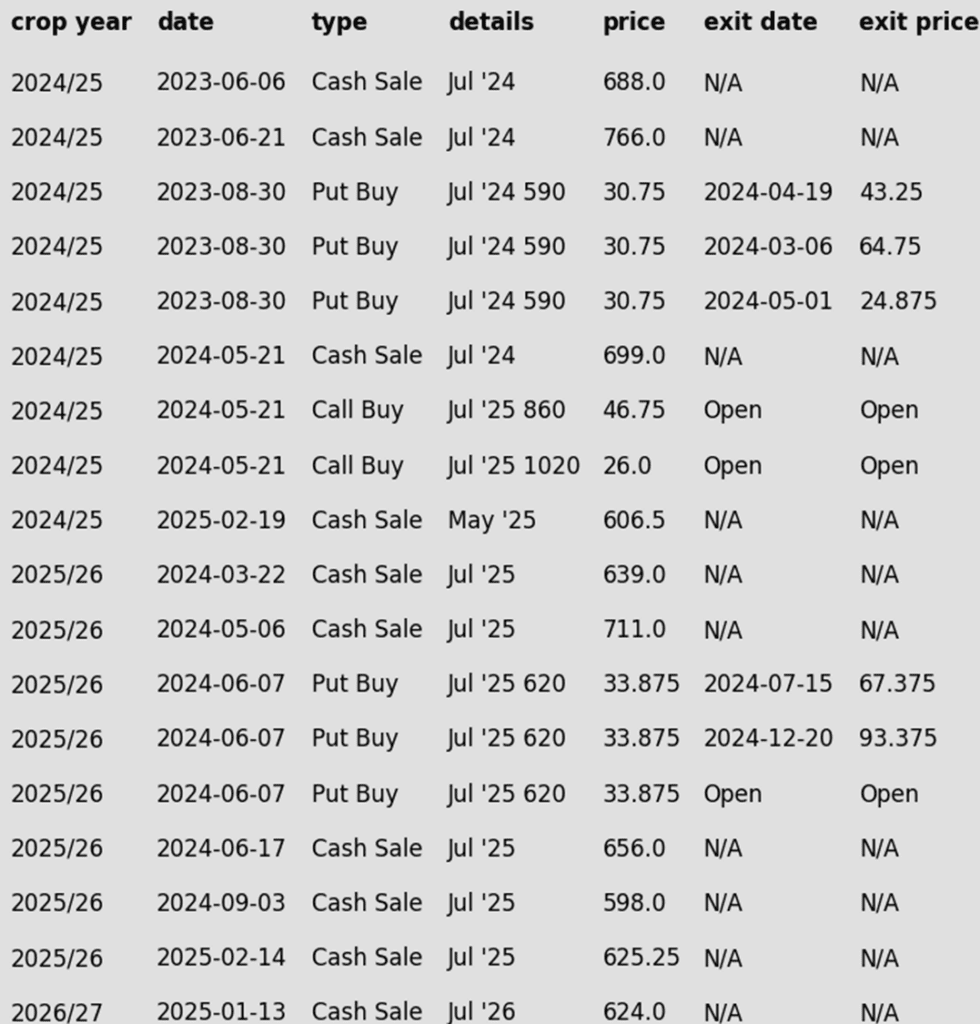

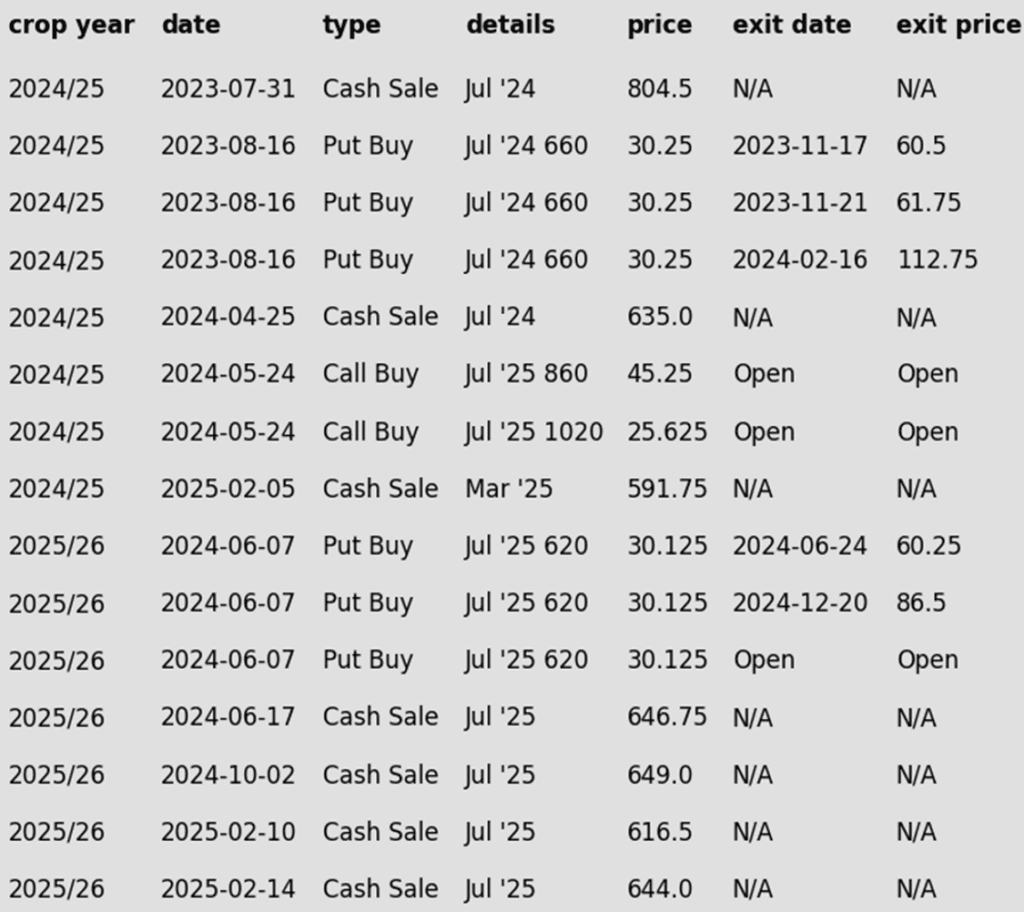

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed higher today, gaining momentum from yesterday’s bullish Planting Intentions report. However, traders remain cautious ahead of President Trump’s tariff announcement set for 2 p.m. Central Time tomorrow. Uncertainty remains over potential measures, with the risk of harsh tariffs — particularly against China — potentially pressuring prices. Within the soybean complex, soybean meal edged slightly lower, while soybean oil provided support.

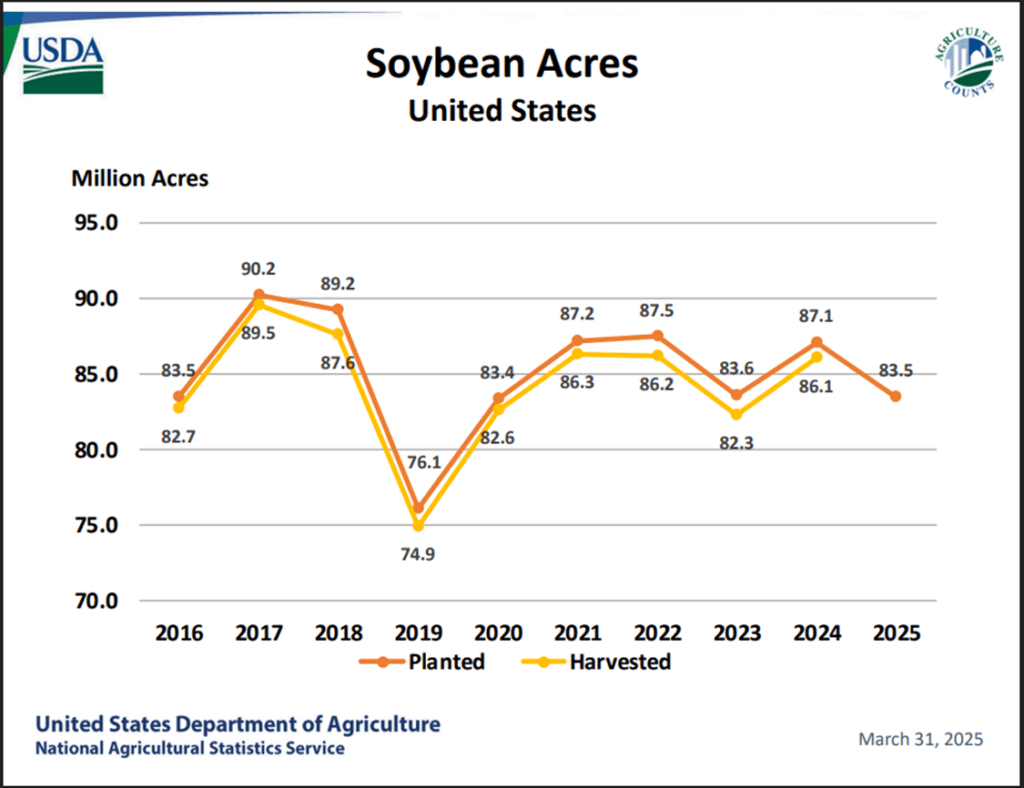

- Yesterday’s Prospective Plantings report pegged 2025 soybean acreage at 83.50 million acres, just below the average trade estimate of 83.76 million and notably lower than last year’s 87.05 million acres. Meanwhile, quarterly stocks aligned closely with expectations.

- The USDA February soybean crush is expected to come in at 188.7 million bushels according to analysts, which would be down 11.2% from the 212.5 mb crushed in January and down 2.4% from January last year at 193.3 mb.

- Yesterday, the USDA said 793k tons of soybeans were inspected for export which compared to 827k tons last week and 515k tons a year ago at this time. Export demand has been expectedly weak as Brazil remains competitive globally.

Soybeans Find Support Near 1000

Soybean futures tested the 200-day moving average in early 2025, a stubborn resistance level that has kept rallies in check for 18 months. As March unfolded, favorable weather and harvest pressure from South America triggered a sharp selloff, sending prices tumbling. Despite the decline, support held firm around the psychological 1000 level, with a stronger backing near 950. If the market continues to rebound, initial resistance sits at 1030, but the 200-day moving average remains a formidable hurdle.

Wheat

Market Notes: Wheat

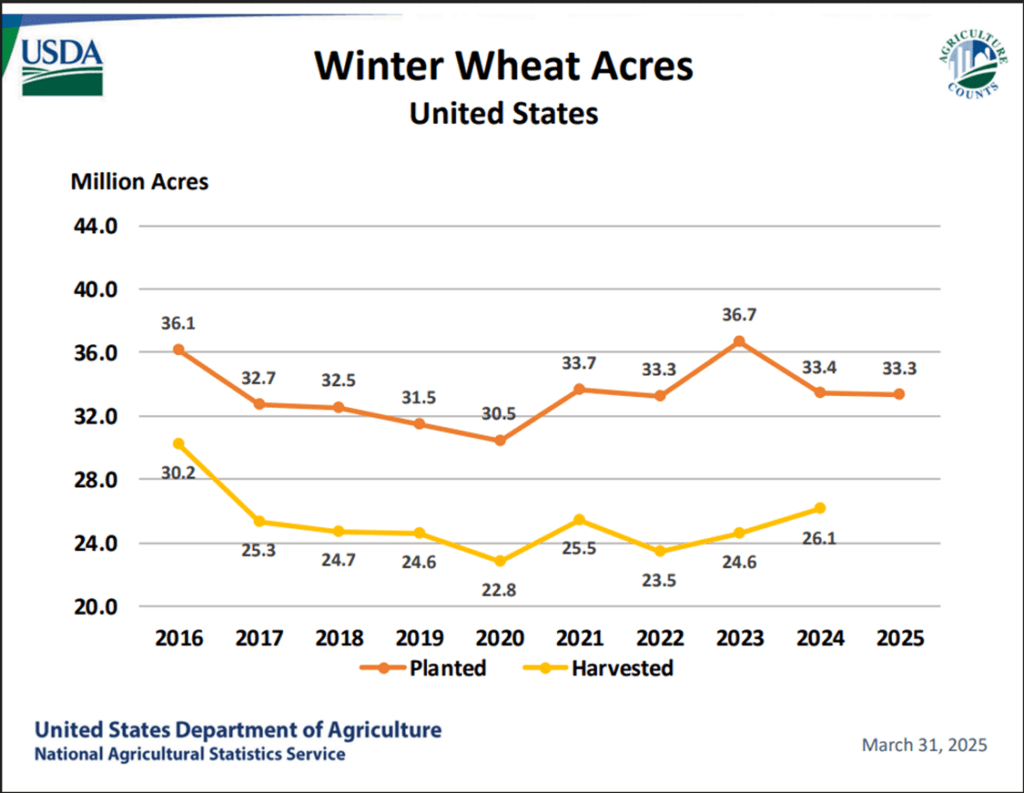

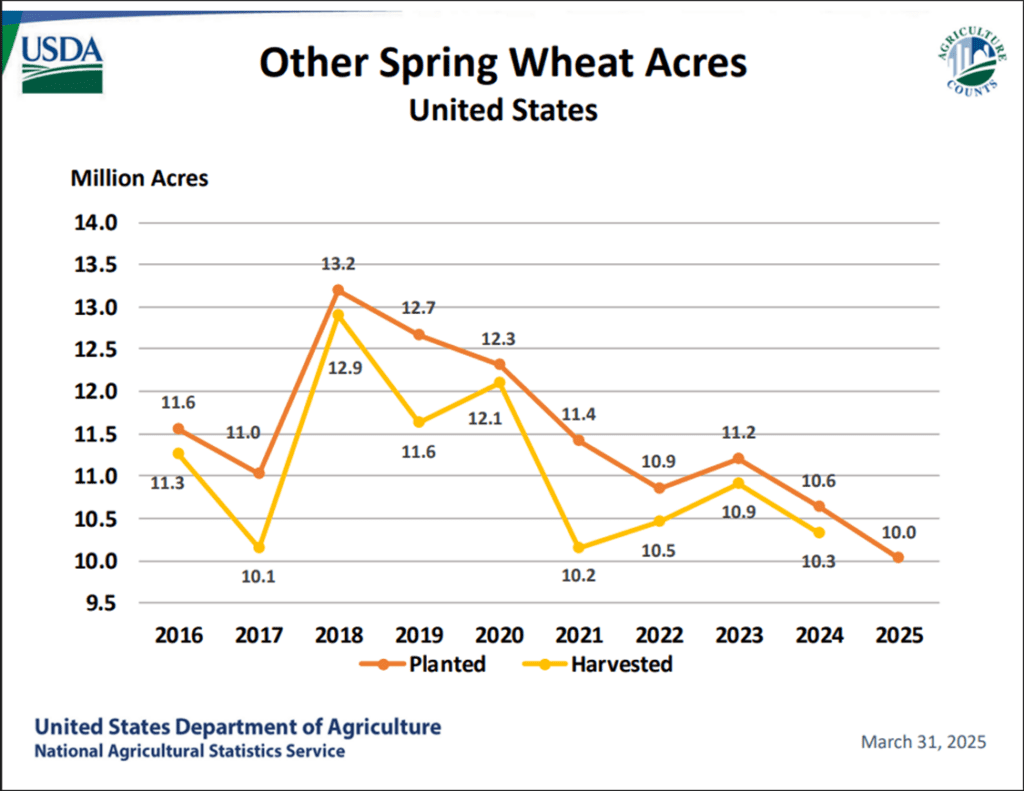

- Wheat was the weakest performer in the grain complex today but still managed to close higher across all contracts. Given the smaller-than-expected acreage figure in yesterday’s USDA report, the market’s muted reaction was somewhat surprising. Forecasted rainfall across much of the U.S. may be tempering bullish momentum.

- Select states released updated winter wheat crop conditions after yesterday’s close. The rating in Kansas held steady at 49% good to excellent. Conditions fell 9% in Montana, 4% in Oklahoma, 1% in South Dakota, and 5% in Texas, but increased 1% in Colorado and 7% in Nebraska.

- Some private estimates out of Australia suggest that their wheat production this year may total only 28.6 mmt due to drought. If accurate, that would be a 16% decline from last year. New South Wales and Western Australia have decent soil moisture, but it is far too dry in Victoria and South Australia.

- Argus has reduced their estimate of the Russian 25/26 wheat production to 80.3 mmt. This is down from 81.5 mmt previously. In the breakdown, the spring wheat was cut to 24.3 mmt due to a smaller planted area, but winter wheat actually increased to 56 mmt.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 701 against May for the next sale.

- Plan B: No active targets.

- Details:

- Recs: Four sales recommendations made so far to date.

- No Changes Post-Report: Post-report price action hasn’t triggered any changes to the current 701 price target.

2025 Crop:

- Plan A: Target 705.50 against July for the next sale.

- Plan B: No active targets.

- Details:

- Recs: Five sales recommendations made so far to date.

- New Target: Post-report price action prompted an adjustment to the prior 714 price target, which has been lowered to 705.50 vs July.

2026 Crop:

- Plan A: Target 704 against July ‘26 for the next sale

- Plan B: No active targets.

- Details:

- Recs: One sales recommendation made so far to date.

- No Changes Post-Report: Post-report price action hasn’t triggered any changes to the current 704 price target.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Faces Key Test After February Surge

After months of sideways grinding, Chicago wheat broke out in February, rallying to early October highs just above 615. However, that mid-month peak quickly turned into a reversal point, with futures slipping back into the previous trading range that defined late 2024. Support near 540 failed to hold late last week, but prices are attempting a rebound to start April. The next key resistance level is the 200-day moving average, which now serves as a major test. A decisive weekly close above this level could shift momentum, potentially signaling a trend reversal and renewed upside.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Recs: Three sales recommendations made so far to date.

- No Changes Post-Report: Post-report price action hasn’t triggered any changes. The recommendation remains to sit tight for now.

2025 Crop:

- Plan A: Target 677 against July for the next sale.

- Plan B: No active targets.

- Details:

- Recs: Five sales recommendations made so far to date.

- No Changes Post-Report: Post-report price action hasn’t triggered any changes to the current 677 price target.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Recs: Zero sales recommendations made so far to date.

- No Changes Post-Report: Post-report price action hasn’t triggered any changes. The expectation is still for targets to begin posting in the May – June timeframe.

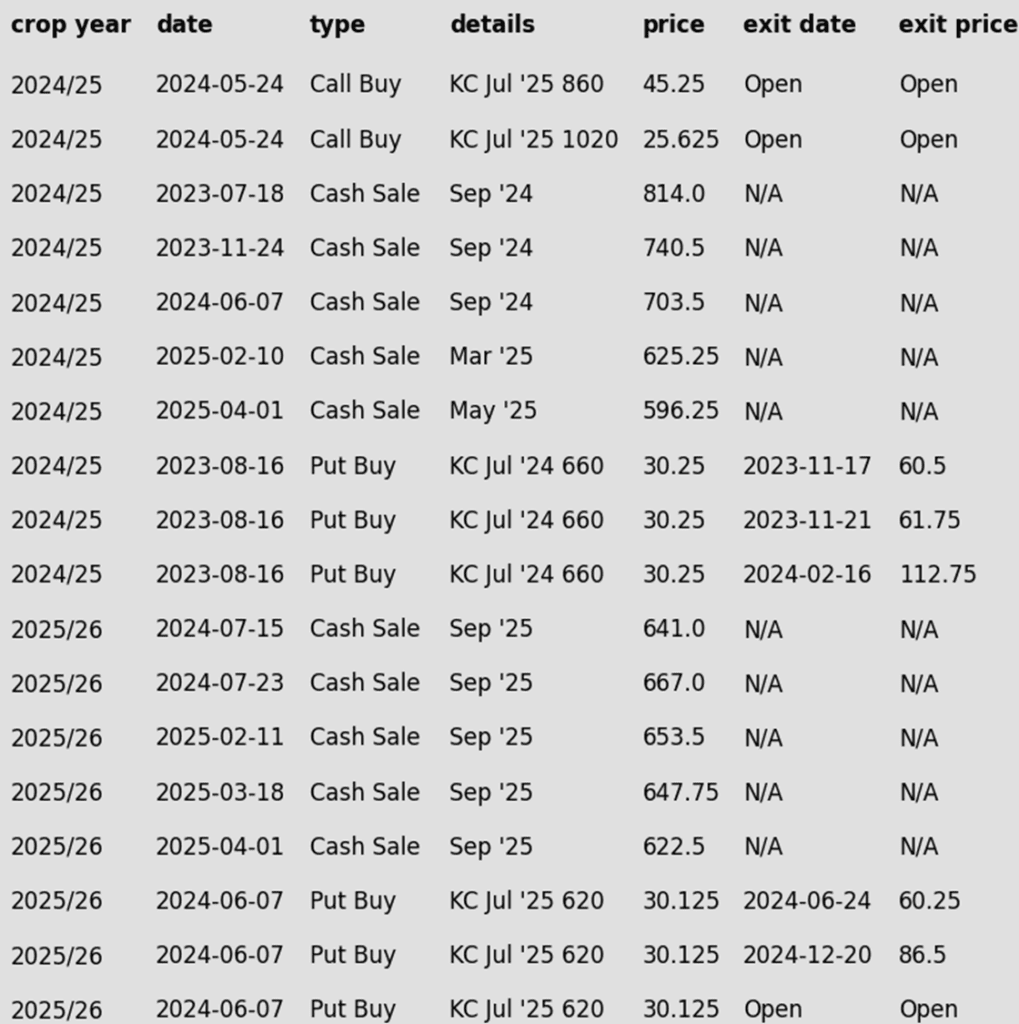

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Seeks Direction After February Whiplash

February was a wild ride for Kansas City wheat, with prices surging higher before tumbling back down, ultimately finishing the month little changed. March ended with weakness, bringing prices back near recent lows, but holding trendline support remains encouraging. On a rebound, the 200-day moving average is expected to act as initial resistance, with February highs near 640 serving as a more significant barrier.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

New Alert

Sell MAY ’25 Cash

2025

New Alert

Sell SEP ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- NEW ACTION – Sell another portion of your 2024 HRS crop. This marks the fifth sales recommendation to date and brings the average sales price to 695.

- Plan A: Hit the 596.25 target vs the May contract today.

- Plan B: No active targets.

- Details:

- Recs: Four sales recommendations had been made prior to today. With the current recommendation, this marks the fifth sales recommendation for the 2024 crop.

2025 Crop:

- NEW ACTION – Sell another portion of your 2025 HRS crop. This marks the fifth sales recommendation to date and brings the average sales price to 646.

- Plan A: Hit the 622.50 target vs the September contract today.

- Plan B: No active targets.

- Details:

- Recs: Four sales recommendations had been made prior to today. With the current recommendation, this marks the fifth sales recommendation for the 2025 crop.dations made on the 2025 crop to date – hitting 622.50 would trigger the fifth.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- No Changes Post-Report: Post-report price action hasn’t triggered any changes. The expectation is still for targets to begin posting in the June – July timeframe.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Struggles to Hold Breakout Amid Volatility

Spring wheat broke out of its long-standing sideways range in late January, sparking a wave of bullish momentum. The rally gained traction in mid-February with a close above the 200-day moving average, but late-month weakness erased those gains, pulling futures back below key technical levels. Now, the 200-day moving average looms as resistance, capping any rebound attempts, while support near 580 remains critical to preventing further downside. To reignite the uptrend, futures would need a sustained move back above the 200-day, with the next upside test at February highs near 660. Until then, the market remains in search of direction amid shifting fundamentals.

Other Charts / Weather