3-7 End of Day: Corn and Soybeans End Volatile Week Near Unchanged

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’25 | 469.25 | 5.25 |

| JUL ’25 | 475.75 | 5 |

| DEC ’25 | 454.25 | 3.25 |

| Soybeans | ||

| MAY ’25 | 1025 | -2.25 |

| JUL ’25 | 1038.75 | -0.75 |

| NOV ’25 | 1025.5 | 4.75 |

| Chicago Wheat | ||

| MAY ’25 | 551.25 | -2.75 |

| JUL ’25 | 565.5 | -2.5 |

| JUL ’26 | 626.5 | -0.5 |

| K.C. Wheat | ||

| MAY ’25 | 564.75 | -1 |

| JUL ’25 | 577.25 | -2.25 |

| JUL ’26 | 627.75 | -3.75 |

| Mpls Wheat | ||

| MAY ’25 | 592.75 | -1.25 |

| JUL ’25 | 606.25 | -1.75 |

| SEP ’25 | 617.5 | -2.5 |

| S&P 500 | ||

| JUN ’25 | 5836.75 | 37.5 |

| Crude Oil | ||

| MAY ’25 | 66.9 | 0.9 |

| Gold | ||

| JUN ’25 | 2945 | -10.2 |

Grain Market Highlights

- Corn: Futures ended the week firm as tariff concerns on Mexico and Canada eased. May corn futures finished ¼ cent lower for the week after volatile trading.

- Soybeans: Soybeans and soybean meal closed mixed on Friday, while soybean oil posted gains. For the week, May soybeans ended near unchanged, recovering 34 cents from early-week lows.

- Wheat: Wheat closed lower across all classes to end the week, despite another down day for the U.S. Dollar, which fell to its lowest level since November.

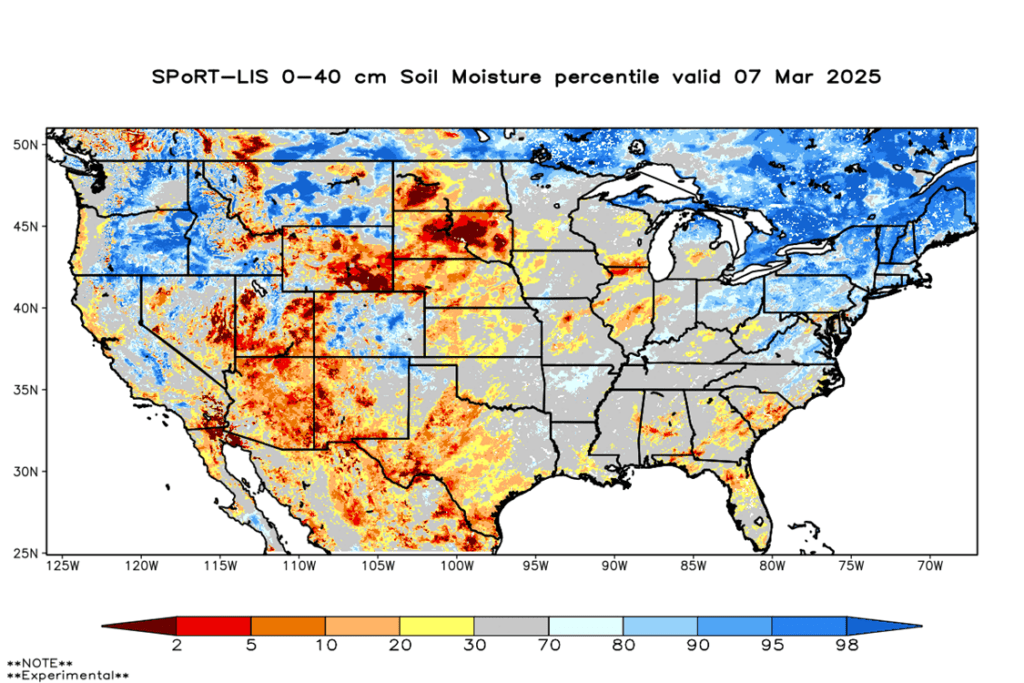

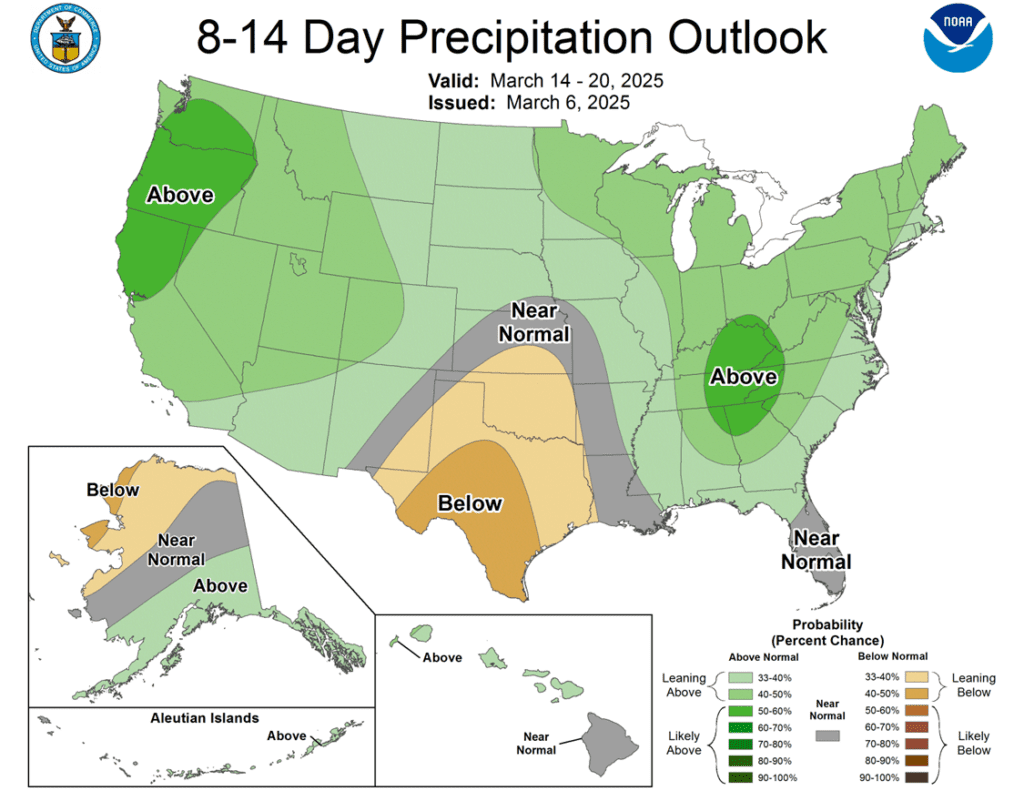

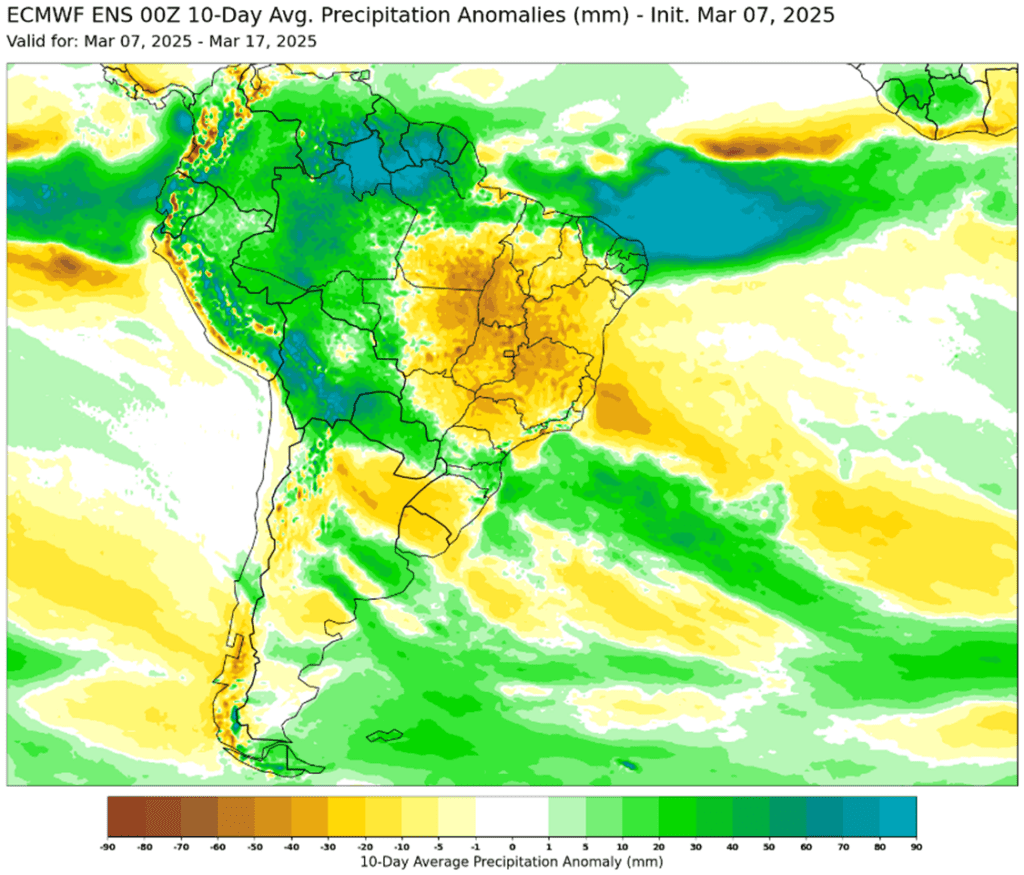

- To see the updated 10-day ECMWF precipitation forecast for South America as well as the 8–14-day U.S. precipitation outlook scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Enter(Buy) DEC ’25 Puts:

420 @ ~ 21c

2026

No New Action

2024 Crop:

- Strong Price Recovery: The May contract closed about 27 cents above this week’s low of 442.50 and ended the week only slightly lower.

- No Official Targets: There have been three official sales recommendations year-to-date, and currently there’s no active target for a fourth sale.

- Catch-Up Zone: If you haven’t made three sales for 2025 yet, the suggested zone is 480–490 vs. May to catch-up.

- Hold Steady: If you’ve followed all three prior recommendations for 2025, Grain Market Insider advises to sit tight for now.

2025 Crop:

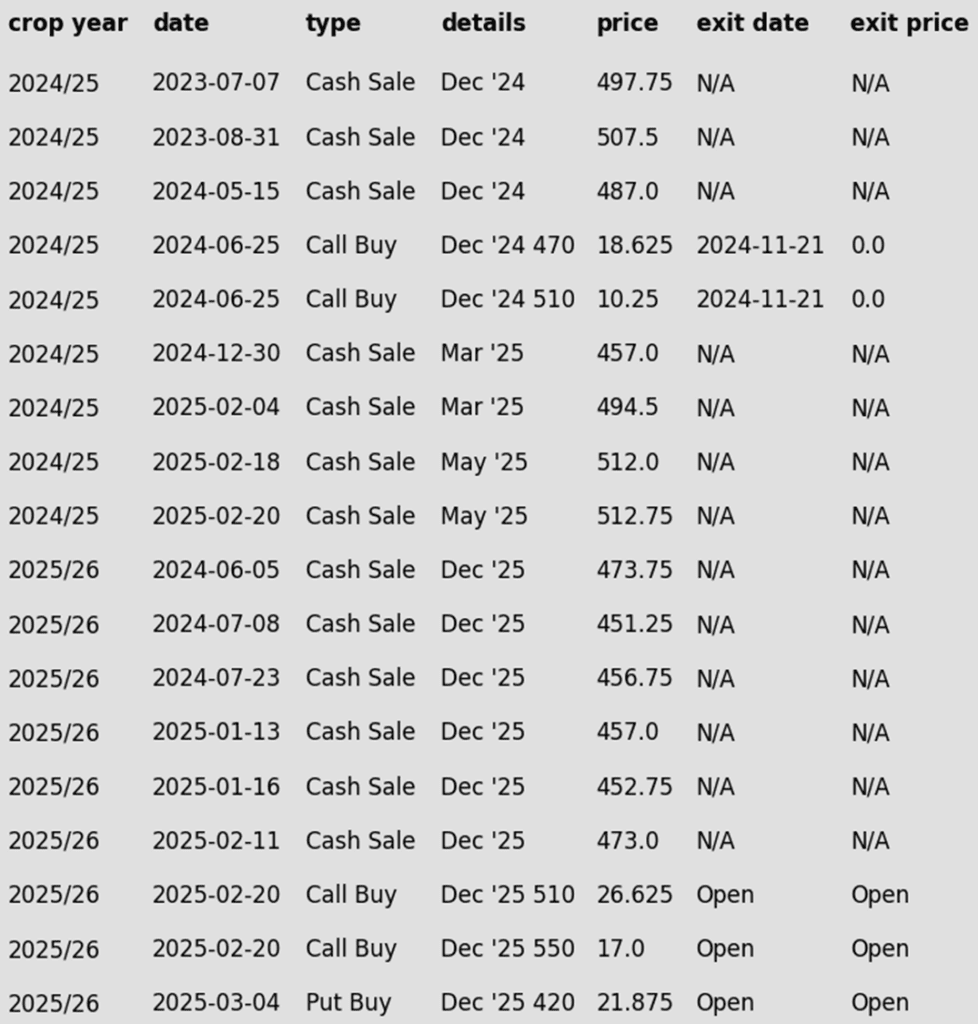

- CONTINUED OPPORTUNITY: Grain Market Insider recommends buying December ‘25 420 corn puts for approximately 21 cents, plus commission and fees.

- Downside Protection: Put options serve as a valuable hedging tool, protecting against further downside price erosion on bushels that cannot be forward sold before harvest. Combined with the existing call options, this creates a Strangle strategy — a common approach when a significant price move is expected, but the direction remains uncertain.

- No Official Targets: There have also been three official sales recommendations year-to-date for the 2025 new crop corn, and currently there’s no active target for a fourth sale.

- Catch-Up Zone: If you haven’t made three sales since January 1 yet, the suggested zone is 462–473 vs. December to catch-up.

- Hold Steady: If you’ve followed all three prior sales recommendations since January 1, Grain Market Insider advises to sit tight for now.

2026 Crop:

- Active Window: The first 2026 upside targets could post at any time — stay tuned for updates!

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures ended the week with modest gains as tariff concerns on Mexico and Canada eased. May corn futures finished ¼ cent lower on the week after volatile trading.

- The Trump administration on Thursday delayed tariffs against Mexico AND Canada for all goods covered under USMCA agreement until at least April 2. This action helped limit trade war fears going into the weekend.

- Reflecting the strong demand tone, the US Census Bureau released corn export totals for the month of January. The USA exported 6.16 MMT (243 mb) of corn in January, edging 1990‘s highs and setting an all-time record.

- The corn market is monitoring Brazil’s weather forecasts, as some key corn-growing regions are experiencing warm and dry conditions, which could impact second-crop production.

- February rains in Argentina’s key grain-producing regions exceeded recent averages and aligned with long-term precipitation trends, marking a recovery after a dry January. March forecasts indicate a wetter pattern until mid-month.

Corn Finds Support Near 450

After hitting 16-month highs in late February, corn prices pulled back sharply to test the 100-day moving average and trendline support near 450. This rebound suggests a potential short-term low, with follow-through gains next week reinforcing the outlook. Initial resistance is expected near the 50-day moving average, while key support remains at 450, with stronger support at the 200-day moving average.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Strong Weekly Reversal: The May contract finished the week 34 cents off this week’s low of 991, and less than a penny lower overall on the week.

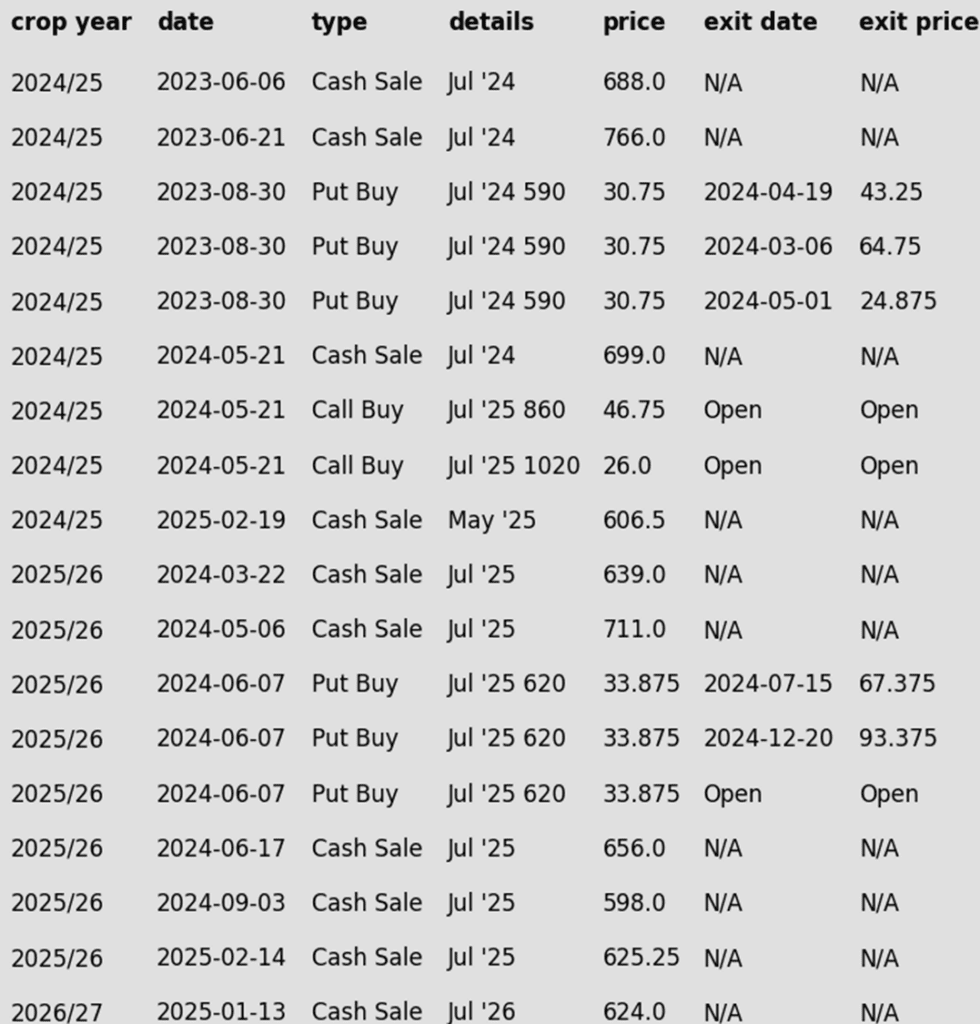

- New Highs: Given the early timing and soybeans’ tendency to post later seasonal highs than corn, Grain Market Insider is currently leaning toward a price target above the February high of 1079.75 for the next sale recommendation.

- Catch-up Zone: There have been three official sales recs on 2024 soybeans year-to-date.

- If you haven’t made three sales since January 1, target 1056–1076 to catch up.

- If you’re in line with the three sales recommendations, the advice is still to sit tight for now.

- Call Strategy Target: February’s close reinforces 1079.75 as a key resistance level. If the May contract stages a strong reversal and closes above 1079.75, Grain Market Insider would recommend a call option strategy to re-own previous sales recommendations.

2025 Crop:

- Guidance Unchanged: No new targets or recommendations to report.

- Call Option Target: The target to exit all the 1100 Nov ‘25 call options is approximately 88 cents in premium. If the 1100 calls can be exited for that price, it should cover the cost of the 1180 Nov ‘25 calls, providing a net-neutral cost position that can continue to protect the upside on previous sales recommendation.

2026 Crop:

- No Change: No initial recommendations or targets have been posted yet. The strategy may remain quiet for a while longer.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- The soybean market ended mixed, still digesting tariff-related news, particularly President Trump’s delay of tariffs on Canada and Mexico. Soybeans and soybean meal closed mixed, while soybean oil posted gains.

- U.S. soybean exports are expected to decline, as a larger portion of Chinese demand is anticipated to shift away from the U.S. Additionally, global buyers are increasingly turning to fresh beans from South America as the harvest season advances.

- Early next week, the USDA’s March Supply and Demand report will take center stage for the markets. There is a high risk that the USDA may lower its soybean export forecast due to China’s 10% retaliatory tariff on U.S. soybeans. If ending stocks rise more than expected, it could trigger a bearish market reaction, potentially explaining today’s minor weakness. While a new trade deal between the U.S. and China could spark a rally, the ongoing tariff uncertainty remains a negative factor for the market.

- The USDA has slightly raised its forecast for Brazil’s 2025 soybean production to 169.18 mmt (6.216 billion bushels), up from the previous estimate of 169 mmt. This marks the first upward revision by the USDA for Brazil’s soybean harvest since September 2024, despite several private consultants predicting production figures of around 170 mmt or higher.

- Despite some recent precipitation, Argentina’s soybean crops remain drought-stressed in several of the country’s top growing regions. As a result, the USDA is expected to reduce its outlook for Argentina’s soybean harvest for the second consecutive month.

Soybeans Find Support Near 1000 Soybean futures tested the 200-day moving average in early 2025, a key resistance level that has capped gains for 18 months. As the calendar flipped to March improved weather and harvest pressure in South America led to a sharp price decline. Support held this week around 1000, with a stronger backing near 950. If prices continue to rebound, initial resistance is at 1030, with the 200-day moving average remaining a key barrier.

Wheat

Market Notes: Wheat

- Wheat closed lower across all classes, following a decline in Paris milling wheat futures and despite a drop in the US Dollar. With little fundamental change, the market remains driven by headlines and uncertainties related to tariffs and geopolitics.

- Next Tuesday will feature the monthly WASDE report. The average pre-report estimate is for a slight bump to the US 24/25 wheat carryout, up 2 mb from last month to 796 mb. As for world ending stocks, the average trade guess is relatively steady at 257.5 mmt, which would be down 0.1 mmt from February.

- According to Tass, Russia may impose limits on grain sales, if their 2025 harvest comes in lower than expected. The government said they will initiate “non-tariff” measures if needed. The wheat crop that was planted in the fall faced a dry spell, which could affect the crop when it is harvested this year.

- FranceAgriMer has released data on French wheat conditions. The soft wheat crop was rated 74% good or very good as of March 3, which is up 1% from the week before. They added that February has been more mild normal.

- The Food and Agriculture Organization (FAO) has estimated world grain stocks at 869.3 mmt for the 24/25 season, which is up 2.7 mmt from the prior estimate and compares with 885.8 mmt last season. Additionally, they project global wheat production at 796 mmt, which is up 1% year over year because of higher EU production.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

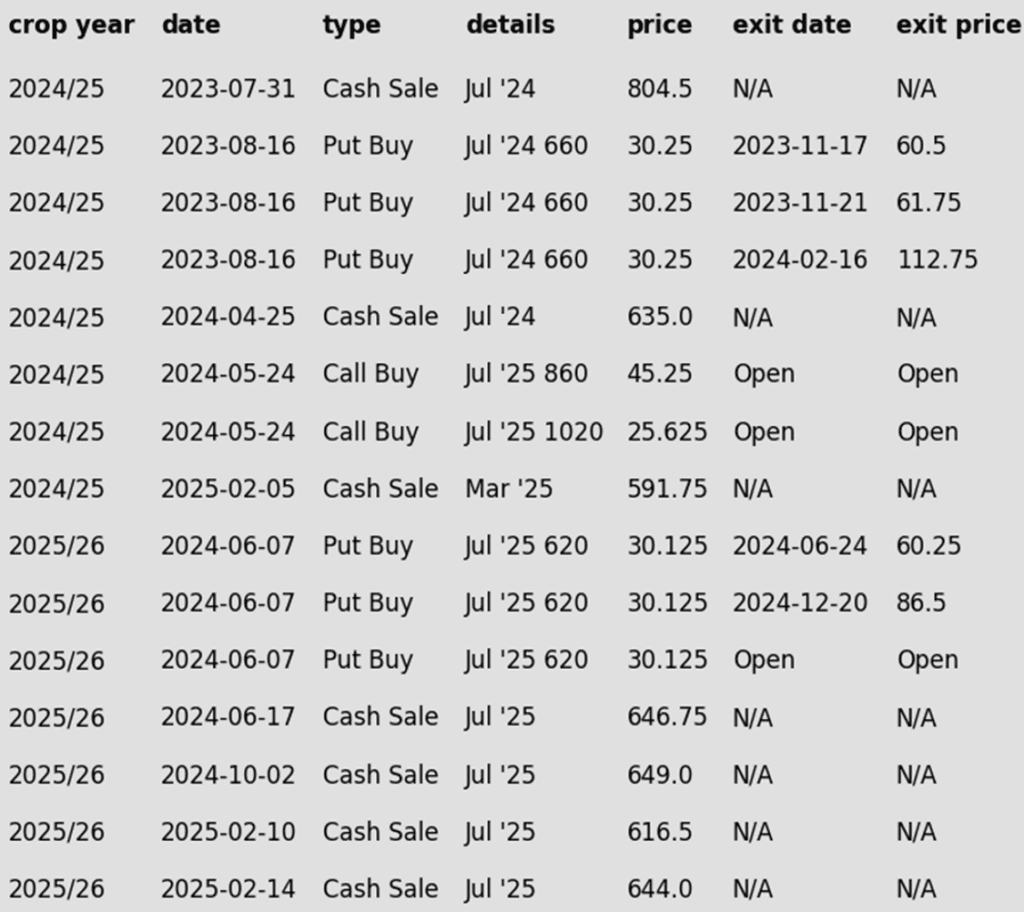

2024 Crop:

- Guidance Unchanged: No new targets or recommendations to report.

2025 Crop:

- Guidance Unchanged: No new targets or recommendations to report.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- No Change: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Head Fake

Chicago wheat broke out of its prolonged sideways trend with a strong February rally, reaching key resistance at the early October highs just above 615. However, since the late February peak, wheat futures have retreated sharply, falling back into the previous trading range that marked the end of 2024. Support is expected near the lower boundary of this range around 540, while the 200-day moving average is likely to act as resistance on any attempted rebound.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Guidance Unchanged: No new targets or recommendations to report.

2025 Crop:

- Guidance Unchanged: No new targets or recommendations to report.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- Hold: No first sales targets or recommendations are expected until the late May, early June window.

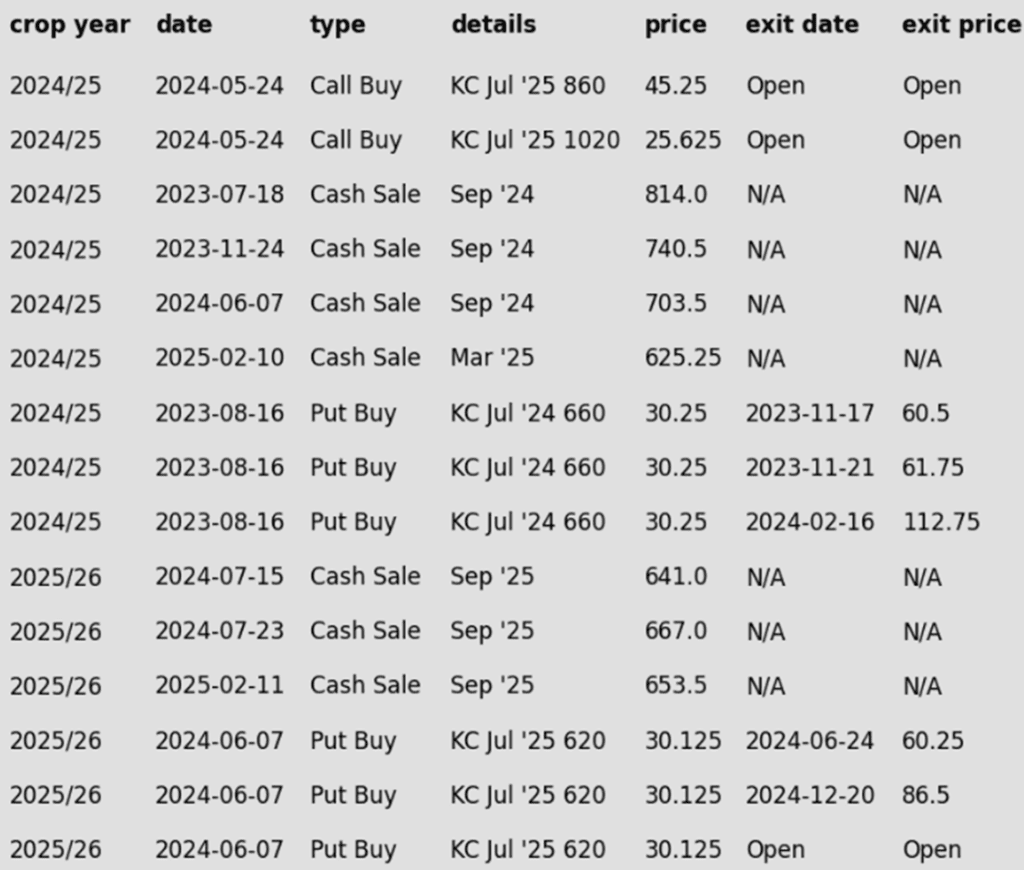

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Breaks Lower

Kansas City wheat futures surged into February with strong bullish momentum, closing above the 200-day moving average and testing multi-month highs near 620. However, since the late February peak, wheat futures have retreated sharply, falling back into the previous trading range. Support is expected near the lower boundary of this range around 540, while the 200-day moving average is likely to act as resistance on any attempted rally.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Upside Target: Looking for a retracement back to 625 vs May to recommend another sale.

2025 Crop:

- Upside Target: Looking for a retracement back to 647.75 vs September to recommend another sale.

- Maintain Put Options: Continue to hold the last quarter of July ‘25 KC 620 put options.

2026 Crop:

- No Change: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

February Whipsaw

Spring wheat broke out of its prolonged sideways range in late January, signaling bullish momentum. A mid-February close above the 200-day moving average reinforced the breakout, but late February weakness erased those gains, sending futures back below key moving averages. Moving forward, the 200-day MA is likely to serve as upside resistance, while previous lows near 580 should provide support.

Other Charts / Weather

Courtesy of ag-wx.com