3-24 End of Day: Grains Mixed: Corn Gains While Soybeans and Wheat Continue to Slip

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’25 | 464.5 | 0.25 |

| JUL ’25 | 472 | 0.5 |

| DEC ’25 | 451.5 | 0.5 |

| Soybeans | ||

| MAY ’25 | 1007.25 | -2.5 |

| JUL ’25 | 1019.5 | -2 |

| NOV ’25 | 1006.5 | -1.25 |

| Chicago Wheat | ||

| MAY ’25 | 548.25 | -10 |

| JUL ’25 | 565.25 | -9.25 |

| JUL ’26 | 633.25 | -5 |

| K.C. Wheat | ||

| MAY ’25 | 578 | -10.75 |

| JUL ’25 | 593 | -10.5 |

| JUL ’26 | 653 | -4.5 |

| Mpls Wheat | ||

| MAY ’25 | 592.25 | -12.75 |

| JUL ’25 | 609.25 | -11.5 |

| SEP ’25 | 625.25 | -10 |

| S&P 500 | ||

| JUN ’25 | 5803.5 | 85.25 |

| Crude Oil | ||

| MAY ’25 | 69.04 | 0.76 |

| Gold | ||

| JUN ’25 | 3040.6 | -7.8 |

Grain Market Highlights

- Corn: Corn futures finished the day higher, following a volatile start to the day, as concerns over drought conditions and positive export inspections provided support for the market.

- Soybeans: Soybean futures closed lower today after a quiet trading session, with concerns lingering over upcoming tariff negotiations and ongoing uncertainties.

- Wheat: Wheat markets closed lower across the board as the US dollar strengthened, coupled with ongoing concerns over the ceasefire negotiations in the Ukraine War.

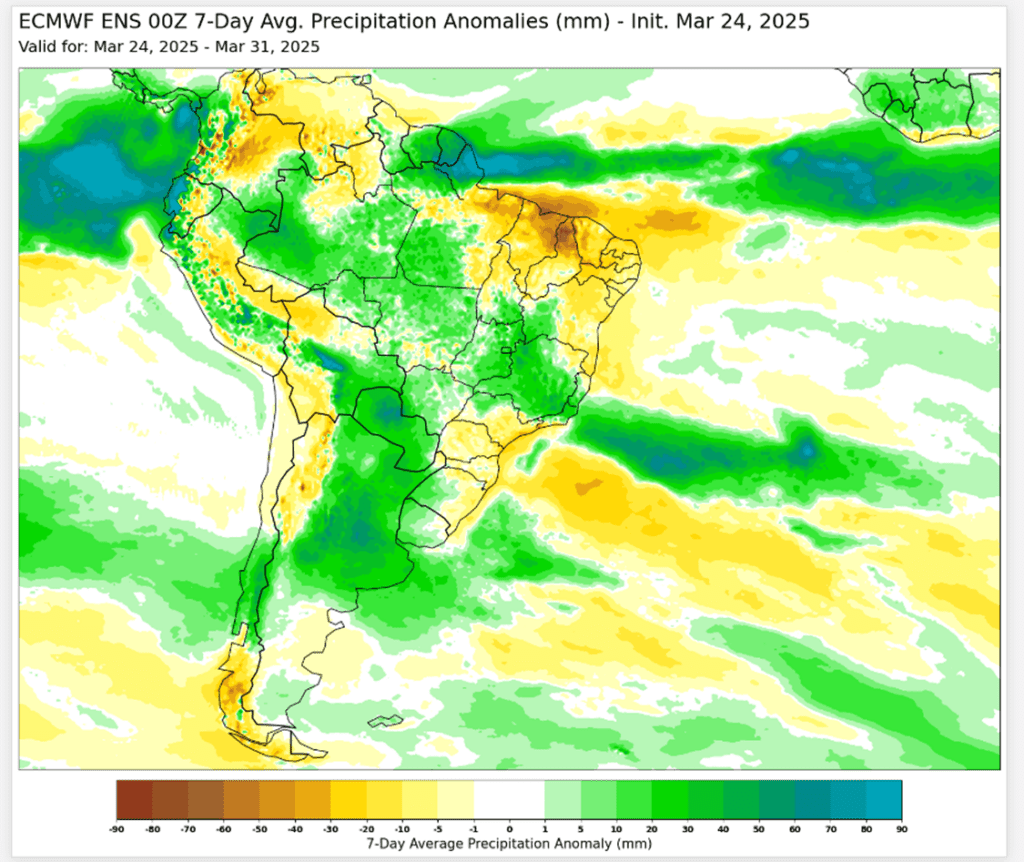

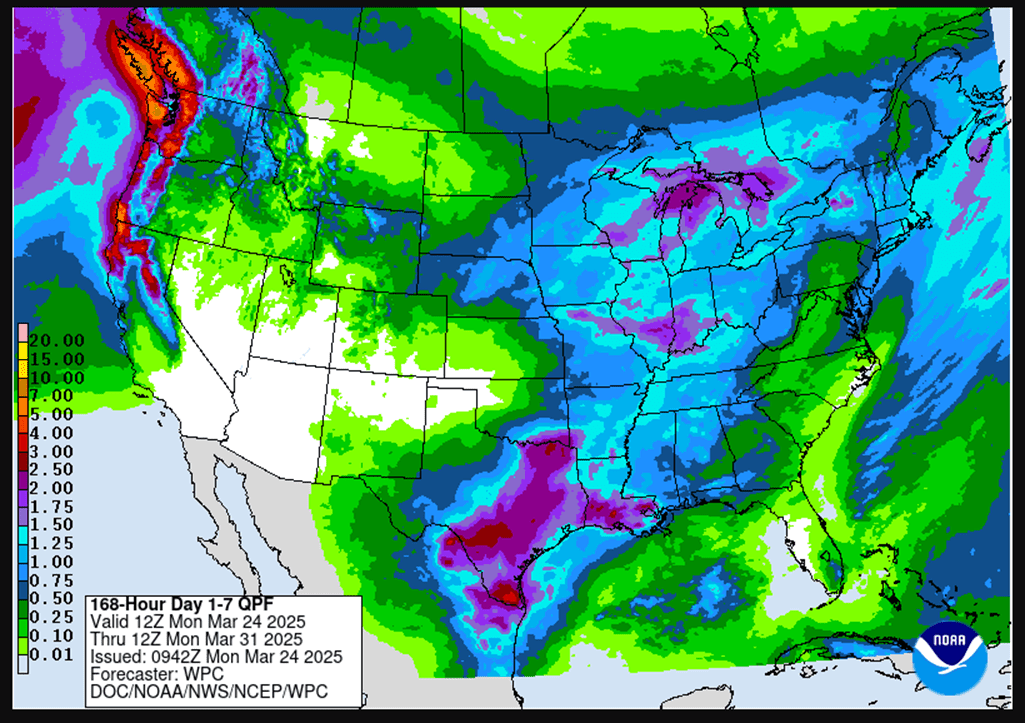

- To see the updated 7-day GEFS precipitation forecast for South America as well as the 7-day precipitation forecast for the U.S. scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Catch-up: If you’re behind on sales, continue targeting 480 vs May as the first catch-up spot.

- Status Quo: No changes to the overall strategy. There are still no new targets for an eighth sales recommendation on the 2024 crop. With the typically volatile Prospective Plantings and Grain Stocks reports coming out next Monday, Grain Market Insider will likely hold off on new recommendations until after the reports — unless market conditions shift significantly.

2025 Crop:

- Plan A: Exit all 510 December calls @ 43-5/8 cents. Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Catch-up: If you’re behind on sales, continue targeting 462 vs December as the first catch-up spot.

- Status Quo: No changes to the overall strategy for new crop corn. The approach remains well-balanced between the sales recommendations, the open 420 put options, and the open 510/550 call options. Bring on the March 31 reports!

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Recs: One sales recommendation made so far.

- No Targets: No new or active targets at this time.

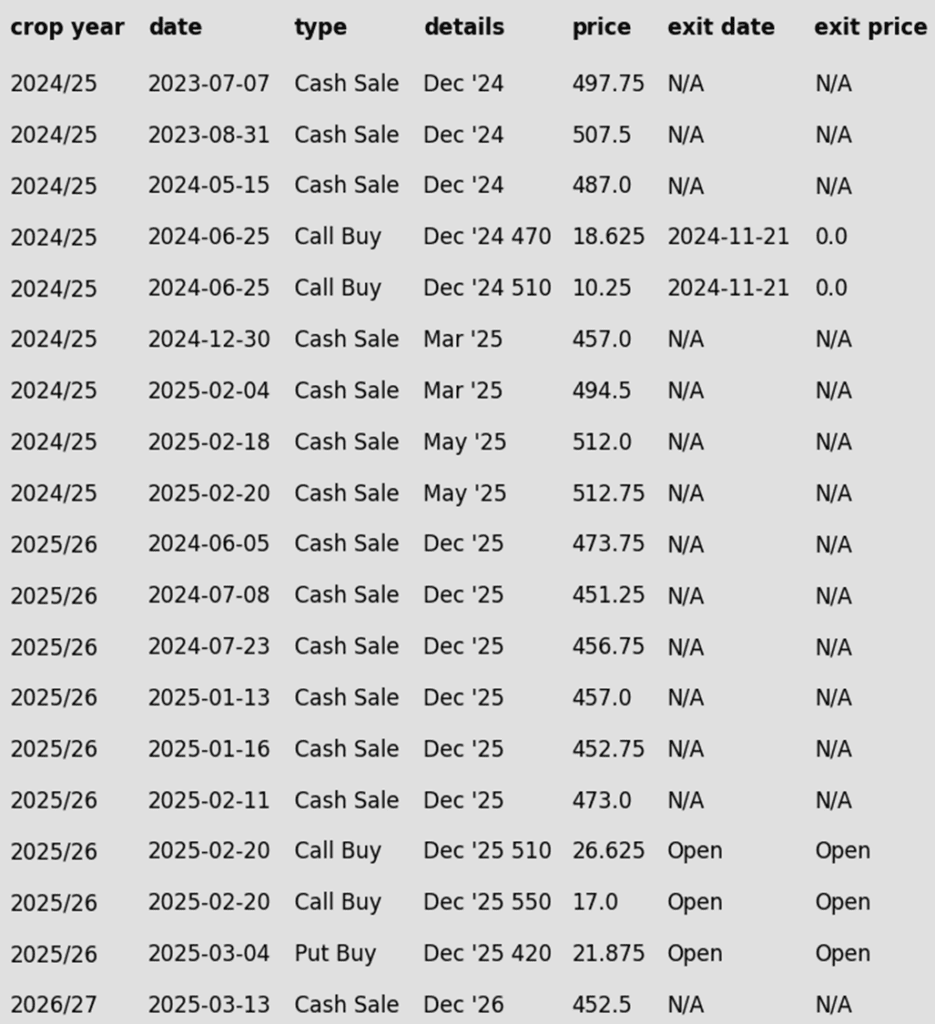

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn closed slightly higher today as export inspections revealed Mexico as the top buyer of U.S. corn, followed by Japan and South Korea.

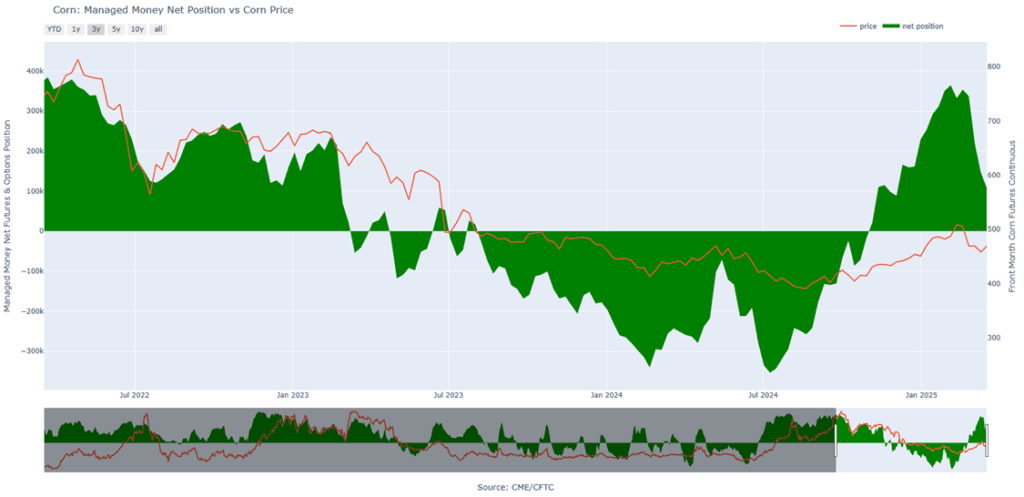

- Managed Money trades continue to liquidate their long position in corn. The Commitment of Traders report from last week showed managed money reducing their net long position by nearly 40,000 contracts, which has brought their net long position to 107,000 contracts, down from 400,000 just a couple of months ago.

- Drought concerns are expected to continue supporting the market, as last week’s drought monitor highlighted worsening dry conditions across much of the Southern Plains. Limited improvements in soil moisture will likely affect crop conditions as planting advances.

- South American weather forecasts have improved with many areas expecting to see some beneficial rainfall, which will help boost corn conditions and development.

- USDA Attache in Mexico City sees Mexico’s corn imports from the US falling for 25/26 as higher local prices are contributing to farmers shifting more acres over to corn.

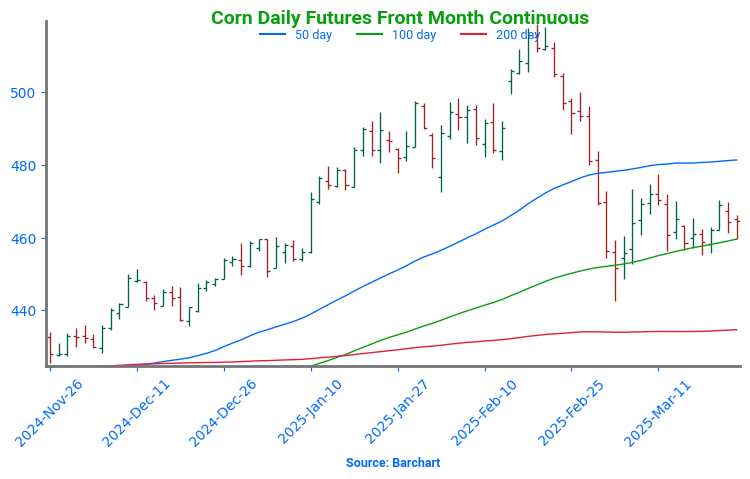

Corn Finds Its Footing After Sharp Pullback

After soaring to 16-month highs in late February, corn futures took a steep dive, retreating to test key technical levels. Prices recently found support near 450, aligning with both the 100-day moving average and a critical trendline — potentially marking a short-term low as the market pivots toward spring planting.

A rebound from this level suggests renewed strength, but hurdles remain. Initial resistance looms near the 50-day moving average, while stronger support sits deeper at the 200-day moving average. With the USDA’s March planting intentions report on the horizon and weather developments in both South America and the U.S., volatility could return swiftly, keeping traders on high alert.

Corn Managed Money Funds net position as of Tuesday, March 18. Net position in Green versus price in Red. Money Managers net sold 39,271 contracts between March 11 – March 18, bringing their total position to a net long 107,270 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

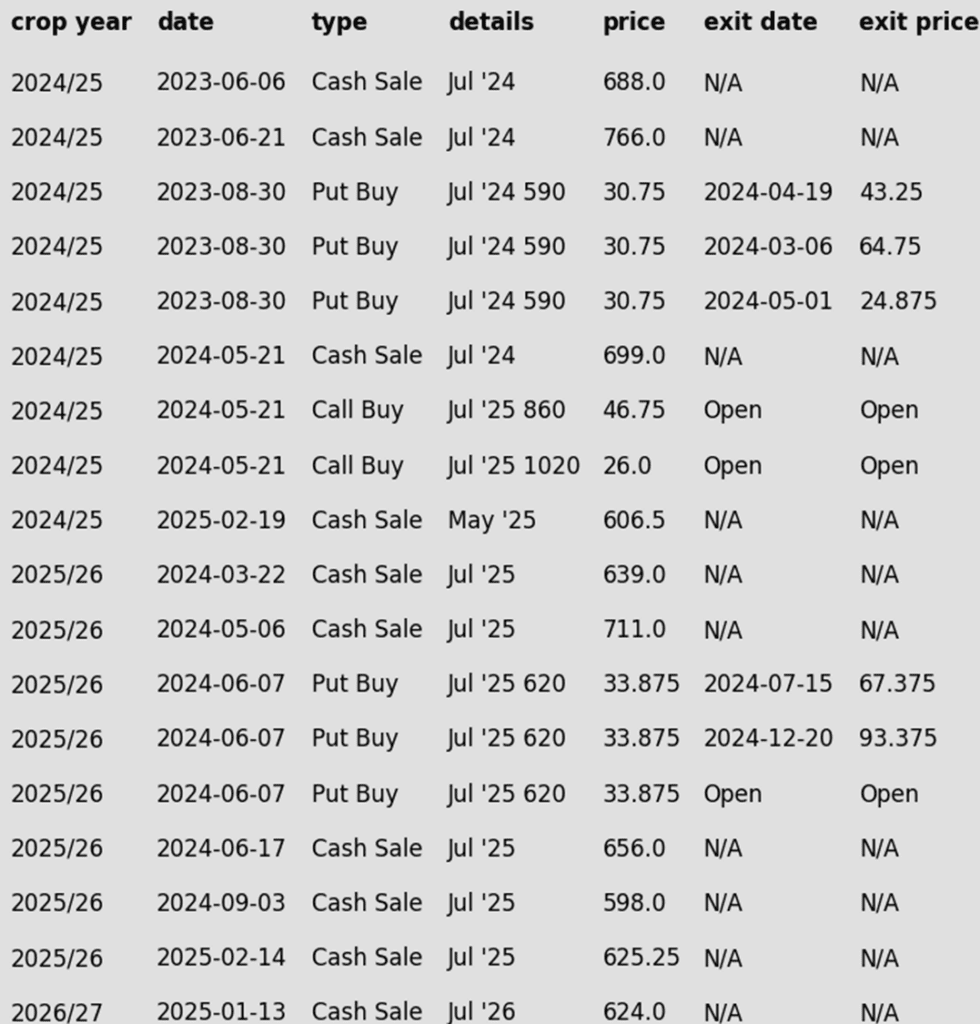

2024 Crop:

- Plan A: Next cash sale at 1107 vs May. Buy calls with a close over 1079.75 vs May.

- Plan B: No active targets.

- Details:

- Catch-up: If you’re behind on sales, continue to target 1056 vs May as a first catch-up spot.

- Status Quo: No changes to the current strategy from last week.

2025 Crop:

- Plan A: Next cash sale at 1114 vs November. Exit all 1100 November call options at 88 cents.

- Plan B: No active targets.

- Details:

- Catch-up: There has been one official sales rec on 2025 soybeans to date. If you’re behind, continue targeting 1040 vs November to catch up.

- Status Quo: No changes to the current strategy from last week.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Status Quo: It will be at least another 1–2 months before the first targets or recommendations are likely to post.

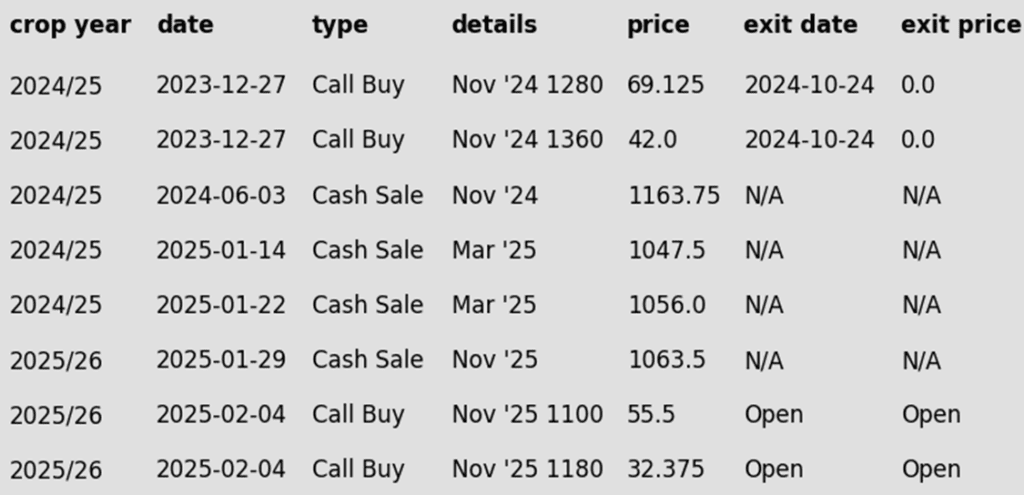

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans were slightly lower to end the day in relatively quiet trade. Concerns over upcoming potential tariffs along with the ongoing Brazilian soybean harvest have put pressure on the market. Export inspections were better than last week, which was supportive. Soybean meal led soybeans lower while soybean oil was higher.

- Today’s export inspections were on the higher side of analyst estimates at 30.2 million bushels for the week ending March 20. This was above last week’s inspections and put total inspections for 24/25 at 1.467 bb, which is up 9% from the previous year.

- In South America, weather conditions have improved in southern Brazil, where 41% of the soybean crop is reportedly filling pods. Argentina has also received more rain as its crop progresses toward maturity, following a relatively dry season.

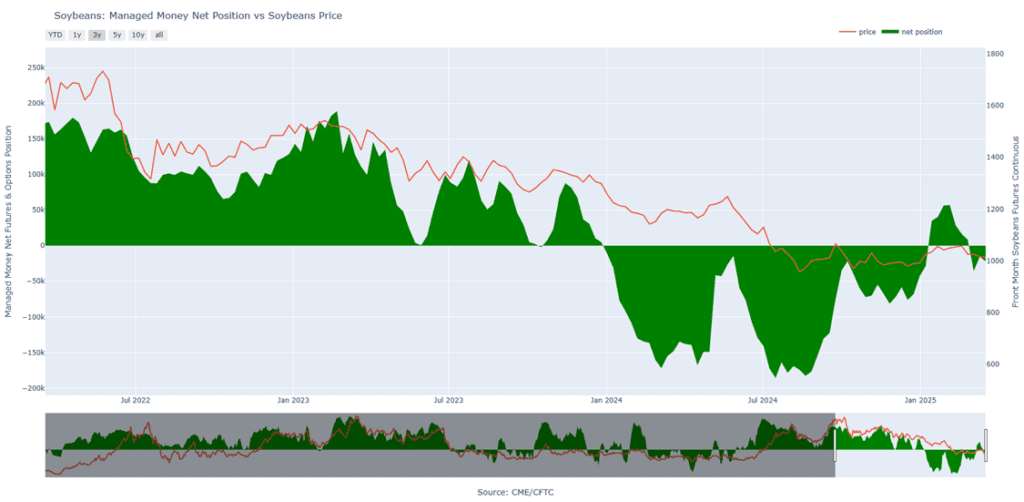

- Friday’s CFTC report saw funds as sellers of soybeans by 6,461 contracts increasing their net short position to 22,005 contracts. They sold 13,757 contracts of bean oil and bought 11,014 contracts of meal.

Soybeans Find Support Near 1000

Soybean futures tested the 200-day moving average in early 2025, a stubborn resistance level that has kept rallies in check for 18 months. As March unfolded, favorable weather and harvest pressure from South America triggered a sharp selloff, sending prices tumbling. Despite the decline, support held firm around the psychological 1000 level, with a stronger backing near 950. If the market continues to rebound, initial resistance sits at 1030, but the 200-day moving average remains a formidable hurdle.

Soybean Managed Money Funds net position as of Tuesday, March 18. Net position in Green versus price in Red. Money Managers net sold 6,461 contracts between March 11 – March 18, bringing their total position to a net short 22,005 contracts.

Wheat

Market Notes: Wheat

- Wheat closed lower across the board, pressured by sharply lower Paris milling wheat futures and a strengthening US Dollar Index. Traders are also closely monitoring ceasefire discussions related to the Ukraine war, with talks between US and Russian officials commencing today in Saudi Arabia.

- Weekly wheat export inspections at 17.8 mb bring the total 24/25 inspections figure to 619 mb, which is up 18% from last year. The inspection pace is steady with the USDA’s projection; exports for 24/25 are estimated at 835 mb, up 18% from the year prior.

- IKAR has increased their estimate of 2025 Russian wheat production by 1.5 mmt to 82.5 mmt. In related news, the Russian agriculture ministry reduced their wheat export tax by 23% to 1,847 Rubles per mt – this applies from March 26 to April 1.

- According to the USDA ag attaché to Mexico, corn imports for the 2025/26 season are expected to decline, while wheat imports are projected to rise. The increase in wheat imports is attributed to a forecasted drop in production due to low dam levels in key growing regions. Additionally, rising wheat consumption is expected to further drive the demand for imports.

- The Ukrainian agriculture ministry has announced that the country has planted spring grains on 18% more acreage than last year, covering 250,400 hectares. Specifically, spring wheat planting is forecast to increase by 27% year-on-year.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 701 against May for the next sale.

- Plan B: No active targets.

- Details:

- Status Quo: No changes to the current strategy from last week.

- Preemptive Sale: Monitoring various indicators for sell signals that could suggest the need for a preemptive sale — before 701 hits. This applies to Plan B.

2025 Crop:

- Plan A: Target 714 against July for the next sale.

- Plan B: No active targets.

- Details:

- Status Quo: No changes to the current strategy from last week.

- Preemptive Sale: Monitoring various indicators for sell signals that could suggest the need for a preemptive sale — before 714 hits. This applies to Plan B.

2026 Crop:

- Plan A: Target 704 against July ‘26 for the next sale

- Plan B: No active targets.

- Details:

- Status Quo: No changes to the current strategy from last week.

- Preemptive Sale: Monitoring various indicators for sell signals that could suggest the need for a preemptive sale — before 704 hits. This applies to Plan B.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

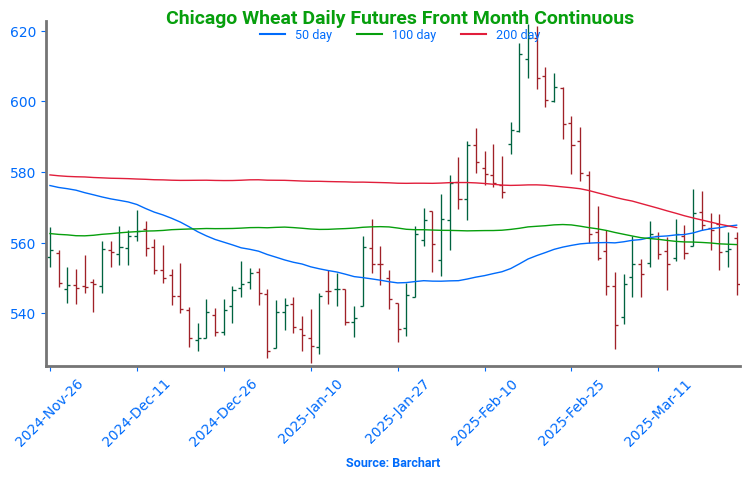

Chicago Wheat Faces Key Test After February Surge

After months of sideways grinding, Chicago wheat broke out in February, rallying to early October highs just above 615. However, that mid-month peak quickly turned into a reversal point, with futures slipping back into the previous trading range that defined late 2024. For now, support near 540 has held firm, marking the lower boundary of this range, while the 200-day moving stands as the next major test. A decisive weekly close above this level could shift momentum, potentially setting the stage for a trend reversal and renewed upside.

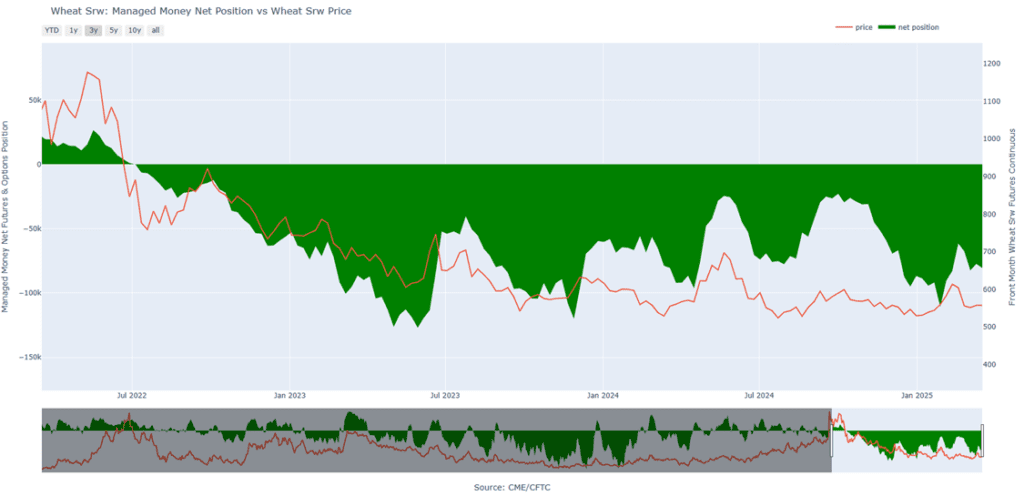

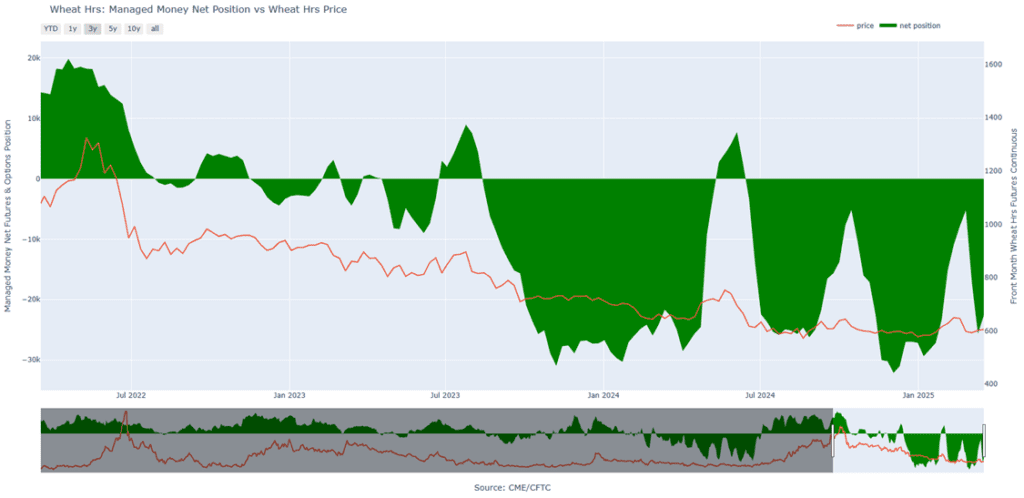

Chicago Wheat Managed Money Funds’ net position as of Tuesday, March 18. Net position in Green versus price in Red. Money Managers net sold 3,256 contracts between March 11 – March 18, bringing their total position to a net short 80,668 contracts.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- One Change: The 717 upside target has been cancelled for now.

2025 Crop:

- Plan A: Target 677 against July for the next sale.

- Plan B: No active targets.

- Details:

- Status Quo: No changes to the current strategy from last week.

- Preemptive Sale: Monitoring various indicators for sell signals that could suggest the need for a preemptive sale — before 677 hits. This applies to Plan B.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Status Quo: Still not expecting the first targets for another two to three months — likely around May or June.

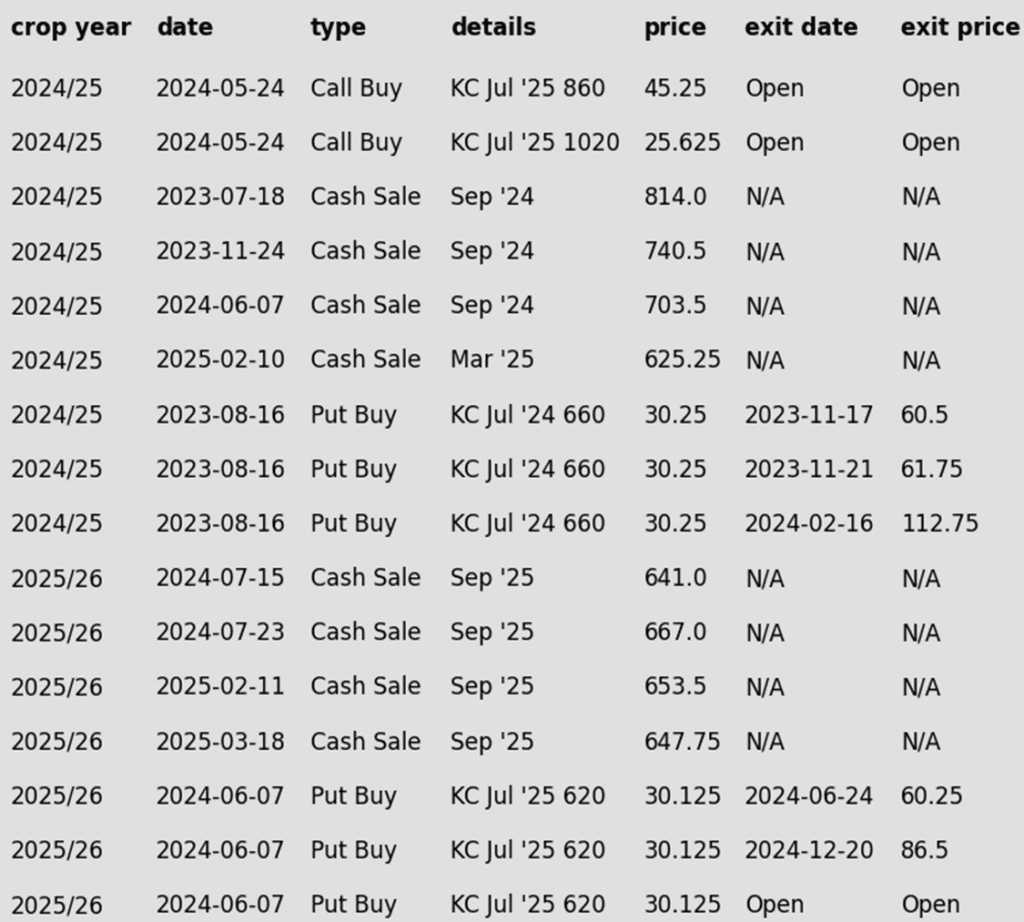

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Seeks Direction After February Whiplash

February was a wild ride for Kansas City wheat, with prices surging higher before tumbling back down, ultimately finishing the month little changed. Now, with weather concerns heating up in March, futures have regained momentum, climbing back above the pivotal 200-day moving average. Looking ahead, the 200-day moving average should act as support on any pullback, while February highs near 640 remain a formidable barrier to the upside. A breakout above this level could signal a more sustained rally, but for now, the market remains in a tug-of-war between bullish weather risks and technical resistance.

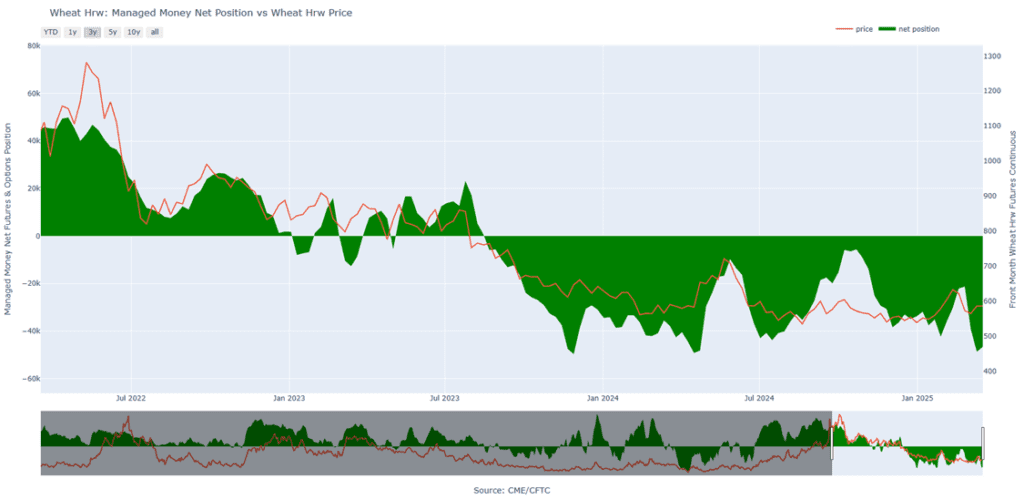

KC Wheat Managed Money Funds’ net position as of Tuesday, March 18. Net position in Green versus price in Red. Money Managers net bought 2,059 contracts between March 11 – March 18, bringing their total position to a net short 46,663 contracts.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 625 against May for the next sale.

- Plan B: No active targets.

- Details:

- Status Quo: No changes to the current strategy from last week.

- Preemptive Sale: Monitoring various indicators for sell signals that could suggest the need for a preemptive sale — before 625 hits. This applies to Plan B.

2025 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Status Quo: No changes to the current strategy from last week.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Status Quo: Still not expecting the first targets for another three to four months — likely around June or July.

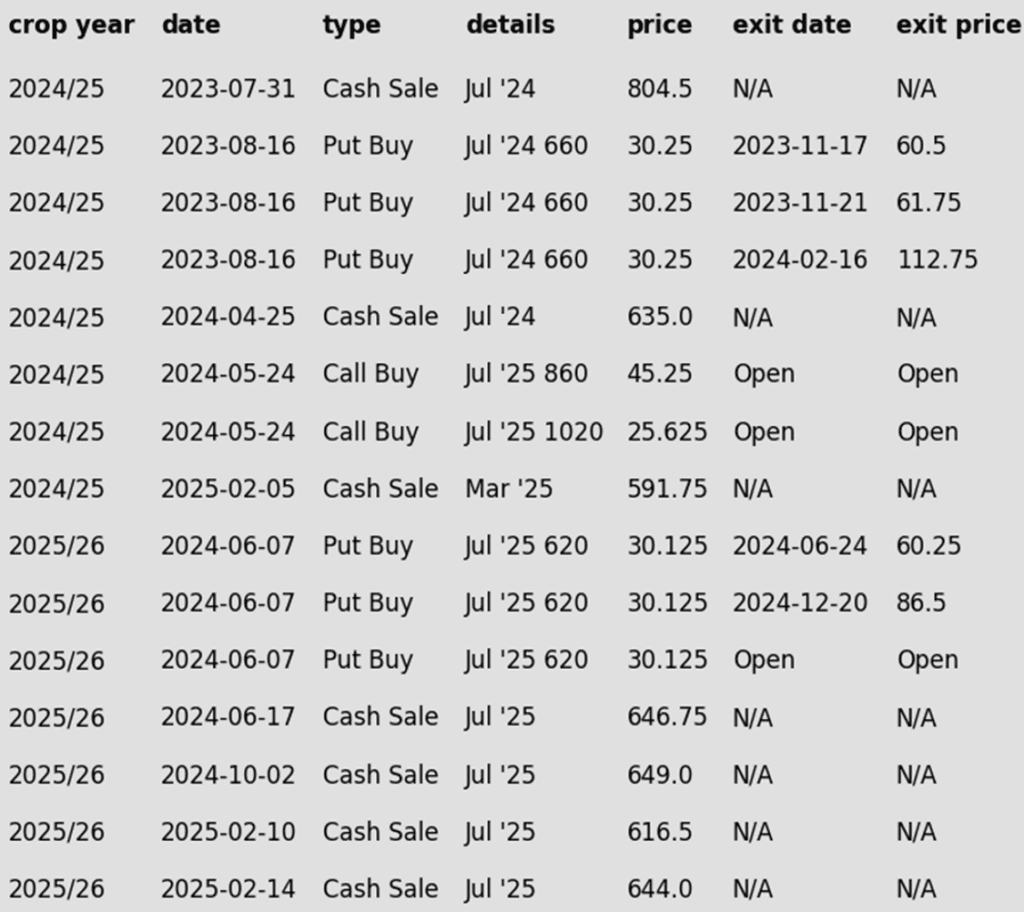

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

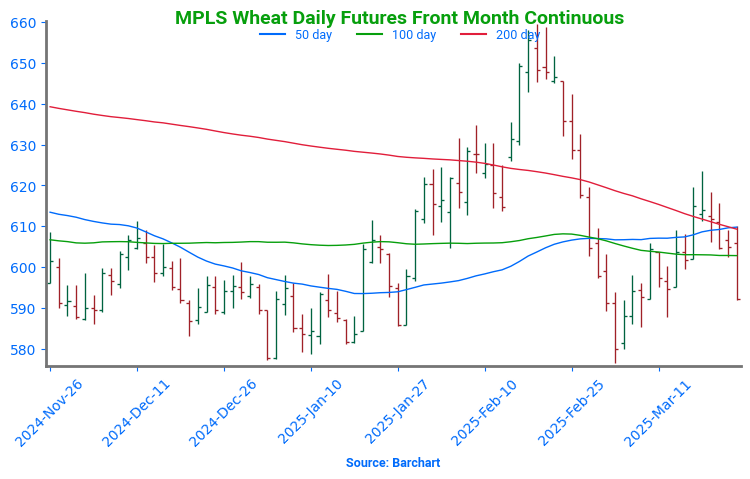

Spring Wheat Struggles to Hold Breakout Amid Volatility

Spring wheat broke out of its long-standing sideways range in late January, sparking a wave of bullish momentum. The rally gained traction in mid-February with a close above the 200-day moving average, but late-month weakness erased those gains, pulling futures back below key technical levels. Now, the 200-day moving average looms as resistance, capping any rebound attempts, while support near 580 remains critical to preventing further downside. To reignite the uptrend, futures would need a sustained move back above the 200-day, with the next upside test at February highs near 660. Until then, the market remains in search of direction amid shifting fundamentals.

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, March 18. Net position in Green versus price in Red. Money Managers net bought 3,076 contracts between March 11 – March 18, bringing their total position to a net short 22,566 contracts.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.