3-15 End of Day: Soybean Oil Leads Beans to a Higher Weekly Close

All prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’24 | 436.75 | 3 |

| JUL ’24 | 449 | 2.75 |

| DEC ’24 | 470.75 | 3 |

| Soybeans | ||

| MAY ’24 | 1198.25 | 3 |

| JUL ’24 | 1212.5 | 2.75 |

| NOV ’24 | 1190.75 | 3.75 |

| Chicago Wheat | ||

| MAY ’24 | 528.5 | -3.75 |

| JUL ’24 | 544 | -3.25 |

| JUL ’25 | 618.25 | 0 |

| K.C. Wheat | ||

| MAY ’24 | 566.25 | -8.5 |

| JUL ’24 | 559.75 | -8.25 |

| JUL ’25 | 608.5 | -5.25 |

| Mpls Wheat | ||

| MAY ’24 | 646.5 | -8.75 |

| JUL ’24 | 653.5 | -7 |

| SEP ’24 | 660 | -5.75 |

| S&P 500 | ||

| JUN ’24 | 5183 | -35 |

| Crude Oil | ||

| MAY ’24 | 80.59 | -0.15 |

| Gold | ||

| JUN ’24 | 2183.8 | -5.3 |

Grain Market Highlights

- A flash sale totaling 125,000 mt of corn to Mexico and carryover support from neighboring soybeans helped lift corn futures and regain some of yesterday’s losses.

- Strong NOPA crush numbers and sharply higher soybean oil lent support to soybeans which closed at the top end of their 16 ½ cent range and above the 50-day moving average for the first time in nearly three months.

- The monthly NOPA crush numbers revealed a record-breaking quantity of soybeans crushed for the month of February. While this is supportive for soybeans, the record crush also indicates a surge in meal and oil production, likely adding pressure to the meal market. Conversely, soybean oil stocks hit a nine-year low for the month, implying robust demand and supporting bean oil prices.

- Concerns regarding Chinese demand for wheat, along with a higher US dollar from hotter than expected PPI (Producer Price Index) data continue to hang over the wheat complex. All three classes of wheat closed lower for the third consecutive day and lower on the week.

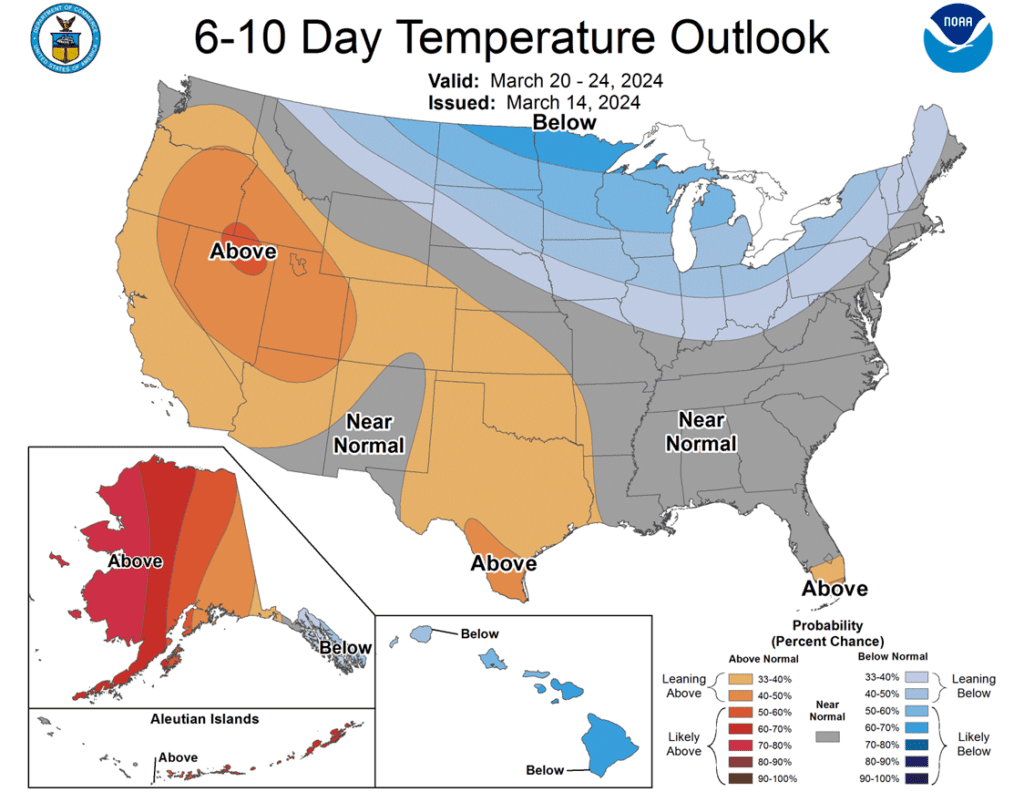

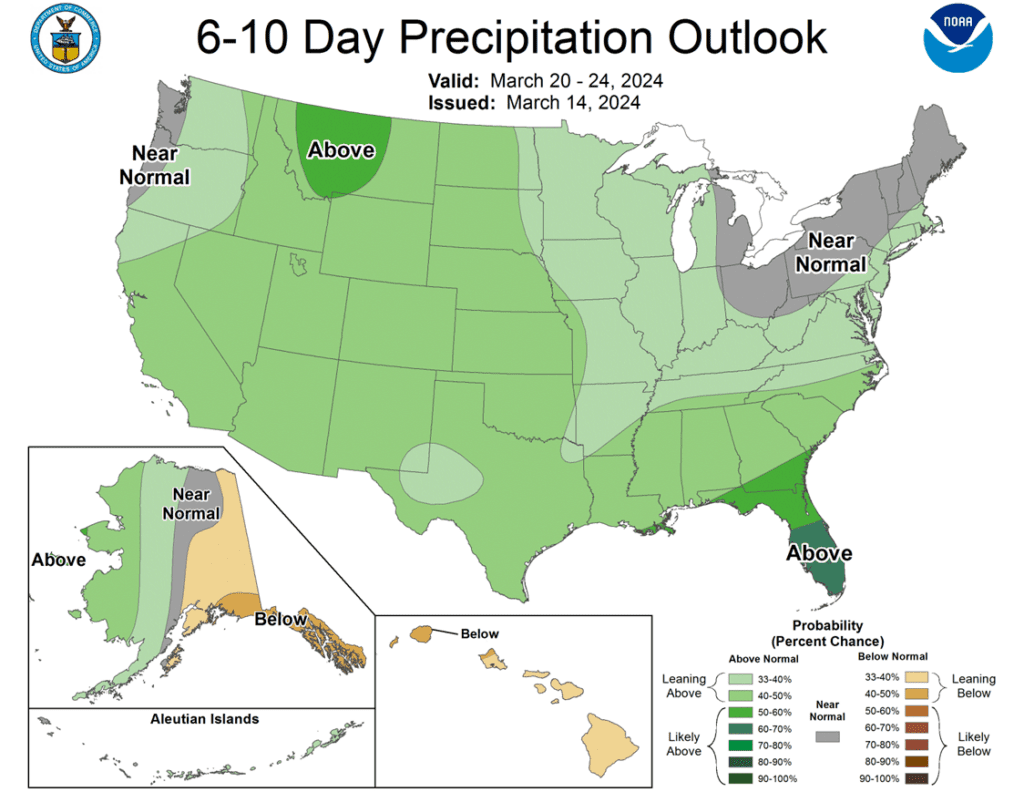

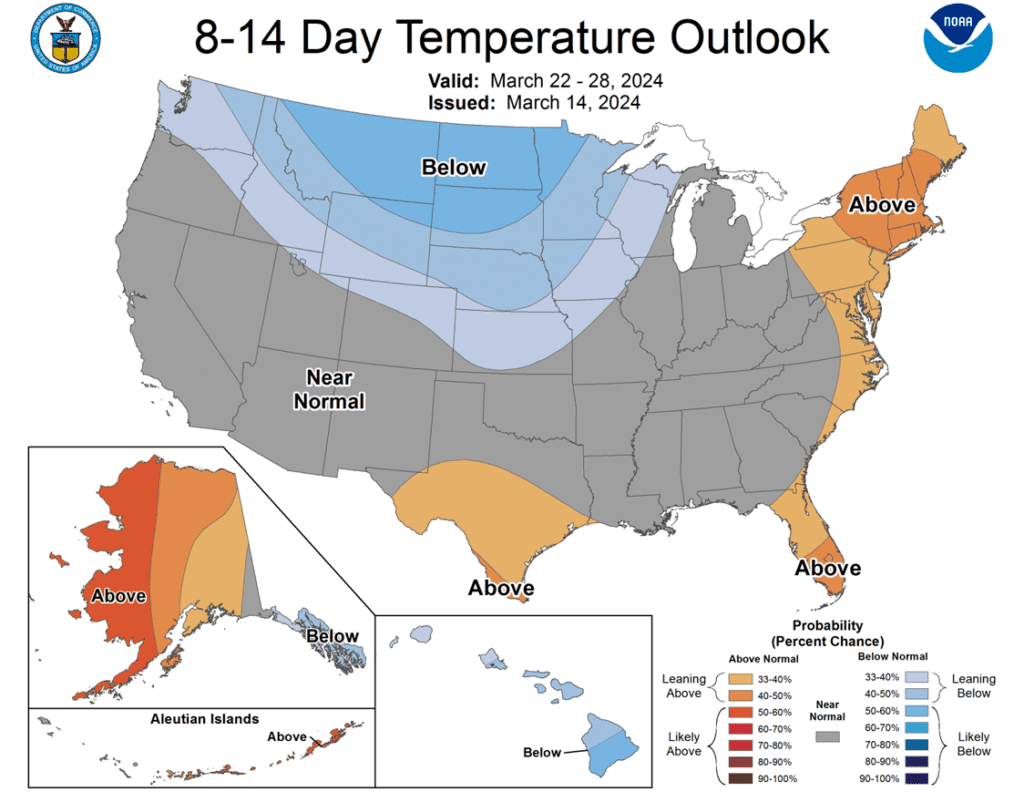

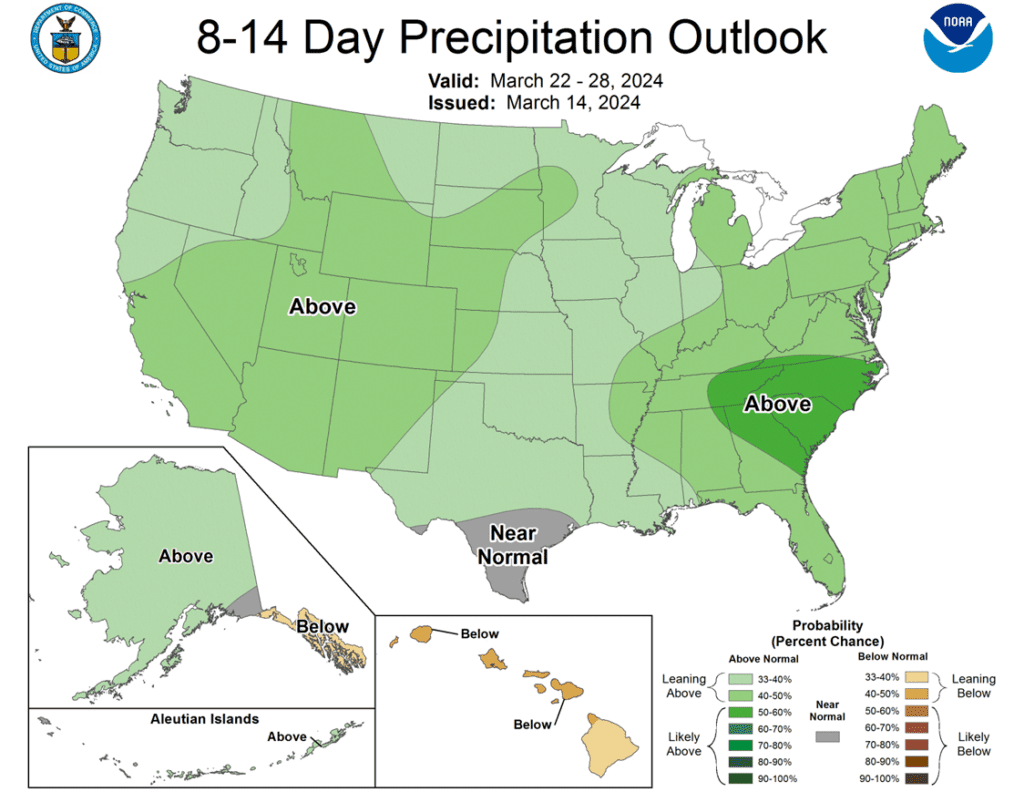

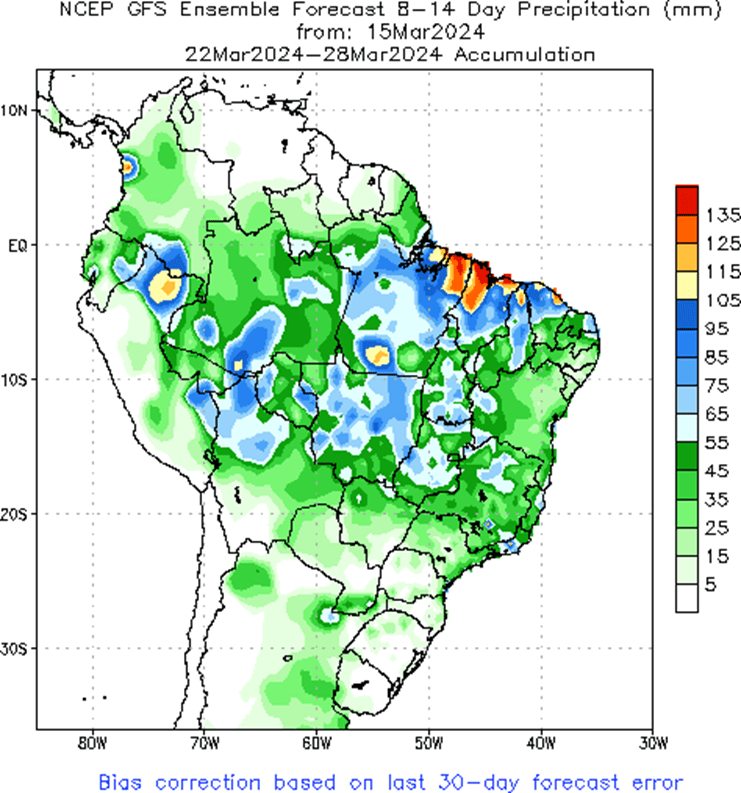

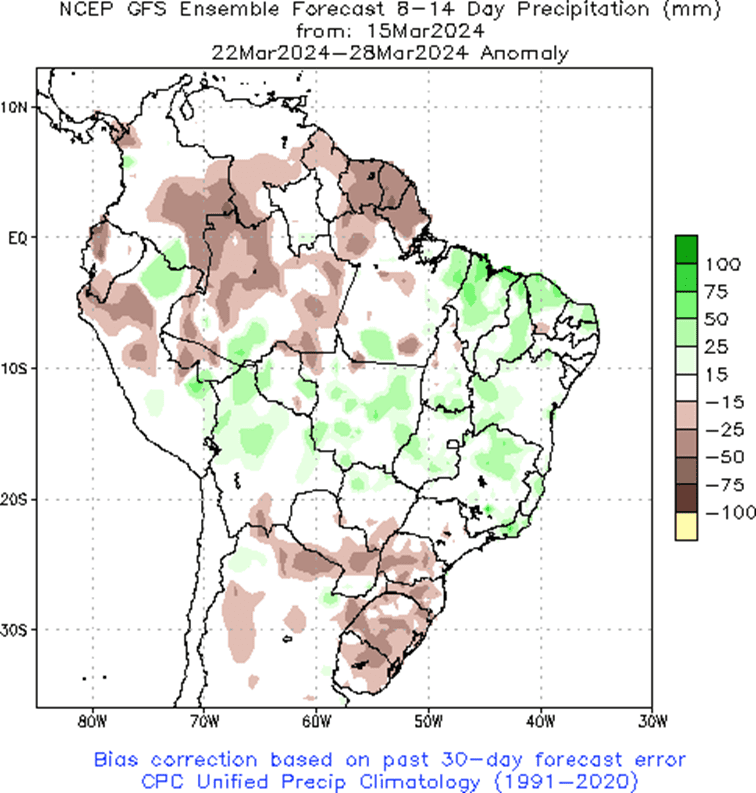

- To see the updated US 6 – 10 day and 8 – 14 day temperature and precipitation outlooks, and 2-week precipitation forecast (also percent of normal) for Brazil, courtesy of the NWS, CPC, and NOAA, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Corn Action Plan Summary

In late February, after languishing in a downtrend that began last October and managed funds posting a record net short position exceeding 340,000 contracts, corn posted a bullish key reversal. Since that time, the market has rallied as the funds covered some of their short positions, though they remain heavily short the market, which could fuel an extended rally as we head into the uncertainty of the spring planting window.

- No new action is recommended for 2023 corn. The recommendation for now is to hold off on additional sales until May corn recovers back toward the 500 level. If you need to move bushels for cash or logistics reasons, consider re-owning any sold bushels with September call options.

- No new action is recommended for 2024 corn. Given the amount of time and uncertainty that remains to market the 2024 crop, we will consider recommending additional sales on a retracement toward the low to mid 500 level.

- No Action is currently recommended for 2025 corn. For now, we aren’t considering any recommendations at this time for the 2025 crop that will be planted next year. It will probably be spring or summer of 2024 before Grain Market Insider starts considering the first sales targets.

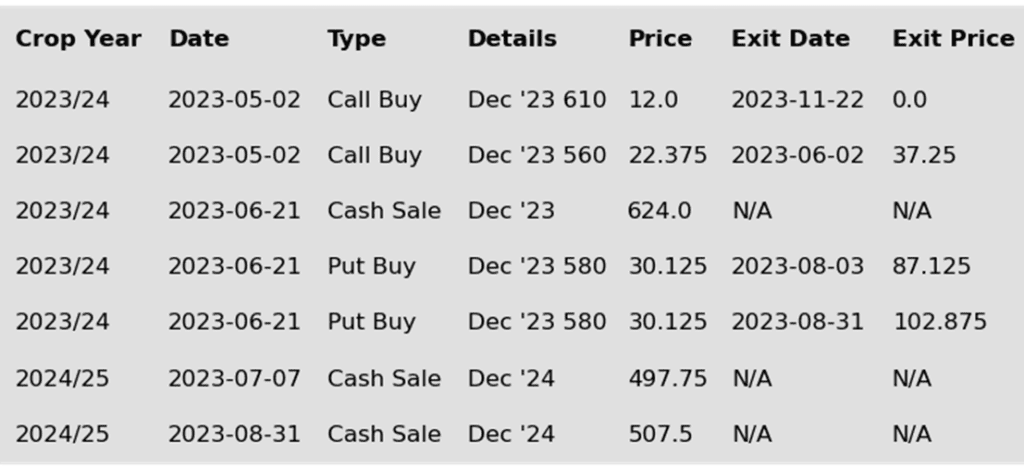

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished higher on the session as late buying strength in soybeans and positive demand news helped lift corn futures in a relatively quiet day. May corn gained 2 ¾ cents on the session. For the week, May corn futures ended 3 cents lower.

- USDA reported a flash export sale of corn this morning. Unknown destinations bought 4.8 mb (125,000 mt) for the 23/24 marketing year. That was the second published sale of corn this week as US corn represents good value in the export market.

- Improved weather forecast has put selling pressure back into the Brazil corn market. Weather may look more questionable as the calendar turns into April, but weakening corn prices in Brazil may limit rally potential for US corn.

- The Argentina corn crop remains in good condition, but ratings slipped slightly last week. Currently 25% of the Argentina crop is rated good to excellent, and 17% poor to very poor. Argentina is forecasted to produce a record corn crop this growing season after the past 2 years of drought.

- Managed funds are still holding a large short position in the corn market. Last week, Managed funds were still net short 296,795 contracts. Expectations are that the funds have covered some short corn positions given the recent price strength. The next Commitment of Traders report will be released on Friday afternoon.

Above: The corn market continues to battle the 50-day moving average and the 435 – 445 resistance area. If it can close above it, the market could then test the January high of 452 ¼. If prices fall back, and close below 421, then they may slide to test downside support between 400 and 410.

Soybeans

Action Plan: Soybeans

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Soybeans Action Plan Summary

Since old crop soybeans broke out of the 1290 – 1400 range in January, prices appear to have made a near term low. Managed funds have also established a record net short position for this time of year, and world carryout has dropped according to the USDA. While new lows could still be made, US planting is not far off, and the funds current short position could fuel an extended short covering rally on a smaller South American crop, lower world soybean carryout, and potential US weather concerns.

- No new action is recommended for 2023 soybeans. The current recommendation is to hold off on making additional sales until prices post a modest 30% retracement back toward the 2022 high of 1759.

- No new action is recommended for the 2024 crop. Considering the amount of uncertainty that lies ahead with the 2024 soybean crop, we recommended back in December buying Nov ’24 1280 and 1360 calls to give you confidence to make sales against anticipated production and to protect any sales in an extended rally. Based on our research, the possibility remains that prices could retest the upper 1300 range near the 2022 highs going into spring/summer, at which point we would consider recommending additional sales.

- No Action is currently recommended for 2025 Soybeans. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

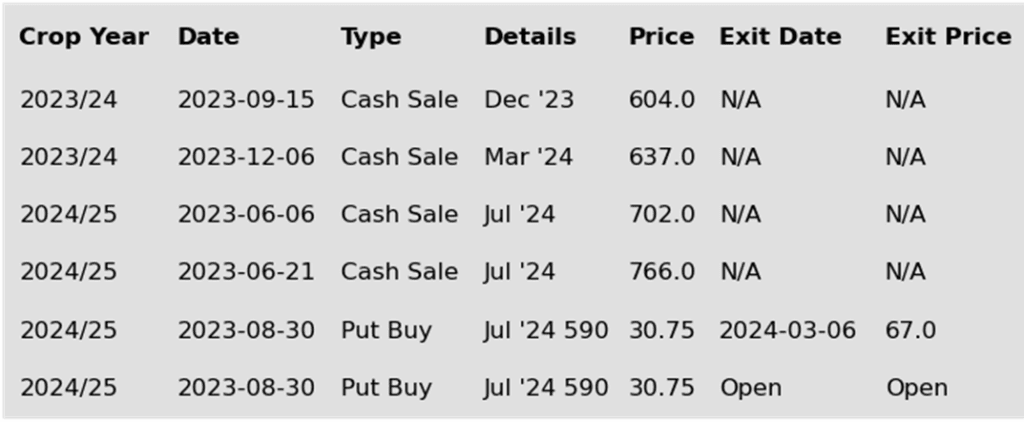

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed higher today after another day of volatility which saw May futures down as much as 12 cents at one point before recovering into the end of the day. Yesterday, May futures were up as much as 20 cents before selling off for a loss on the day. May ended the day just below the 50-day moving average at 1198 ½.

- For the week, May futures gained 14 ¼ cents, May soybean meal lost $6.70, and May soybean oil gained 3.25 cents, a big move thanks to contract highs in palm oil. The palm oil market has rallied sharply this week which has benefited soybean oil and other edible oils and was likely the main driver in soybeans this week.

- The NOPA crush report was released today and showed 186.194 mb of soybeans crushed in February. This was above the average trade guess of 178 mb, was a record for February, and 12.6% above the previous year. Soybean oil stocks came in at 1.69 billion pounds, which was above the average trade guess, but also the lowest in 9 years for the month.

- In Argentina, the states of Cordoba and Buenos Aires are receiving significant rain which has greatly improved soil moisture in the growing regions, in addition, the Argentine government is rumored to be planning a fifth round of the soy dollar program to encourage farmer selling.

Above: Following the brief run-up off the recent low, soybeans posted a bearish reversal on March 14, indicating a potential market reversal to the downside. Initial support down below may be found near 1175, and again between 1130 and 1140. If the market closes above the 50-day ma and continues higher, it may find resistance near the recent 1217 ½ high before testing the January high of 1247 ½.

Wheat

Market Notes: Wheat

- Wheat had another down day for the third consecutive session. Talk that China cancelled US wheat sales, may have cancelled French sales, and either cancelled or rolled forward up to 1 mmt of Australian sales continued to weigh on the market. Light bear spreading was noted in Chicago futures, where there was greater selling pressure in the front months versus the deferred and could be a result of the recent cancellations as well.

- In addition to the cancelled sales, yesterday’s negative PPI data showed inflation higher than anticipated. This had the US Dollar Index up sharply yesterday and marginally again today, keeping pressure on wheat futures. This may also indicate that the Federal Reserve will be slower to cut interest rates, which may have longer term implications on the direction of the US Dollar and therefore, wheat prices.

- On a bullish note, the EU soft wheat production estimate for the 24/25 season was reduced 1 mmt from last month, now at 121.6 mmt, according to Strategie Grains. In addition, the French wheat crop is rated the poorest in four years, 66% good to excellent. France struggled with heavy rain and snow during their planting season that caused an acreage reduction, with current weather also to blame for the declining condition.

- The International Grains Council has projected higher grain stocks for the 24/25 season at 601 mmt. At the end of this season, stocks are expected to be 599 mmt. Additionally, the total 24/25 grain production is forecasted at 2.33 billion mt, up 1% from the 23/24 estimate.

- According to the USDA, the areas of US winter and spring wheat in drought as of March 12 are unchanged from the previous week. About 14% of winter wheat and about 30% of spring wheat areas are said to be experiencing drought conditions.

Action Plan: Chicago Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Chicago Wheat Action Plan Summary

Since the early December runup, Chicago wheat has suffered in a lower trend while going on to make new contract lows. Although the lack of any bullish information has been disappointing, the market is in a significantly oversold condition, and managed funds continue to hold a significant net short position. Either or both could fuel a short covering rally at any time as we head into the more active part of the growing season.

- No new action is currently recommended for 2023 Chicago wheat. Any remaining 2023 soft red winter wheat should be getting priced into market strength. Grain Market Insider won’t have any “New Alerts” for 2023 Chicago wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Chicago wheat. At the end of August, we recommended purchasing July ‘24 590 puts to prepare for further price erosion, and recently recommended exiting half of those puts to lock in gains and get closer to a net neutral cost on the remaining position. For now, the current recommendation is to hold off on making any additional sales unless the market moves back toward last summer’s highs. At which point, we are prepared to recommend adding to current sales levels and possibly even purchasing call options to protect those sales. Otherwise, the remaining July ‘24 590 put position will add a layer of protection if prices erode further.

- No action is currently recommended for 2025 Chicago Wheat. The strategy for the 2025 crop year remains to hold off on making any sales. Though if prices rally toward the mid-600s, we will consider taking advantage of those better prices to make sales recommendations.

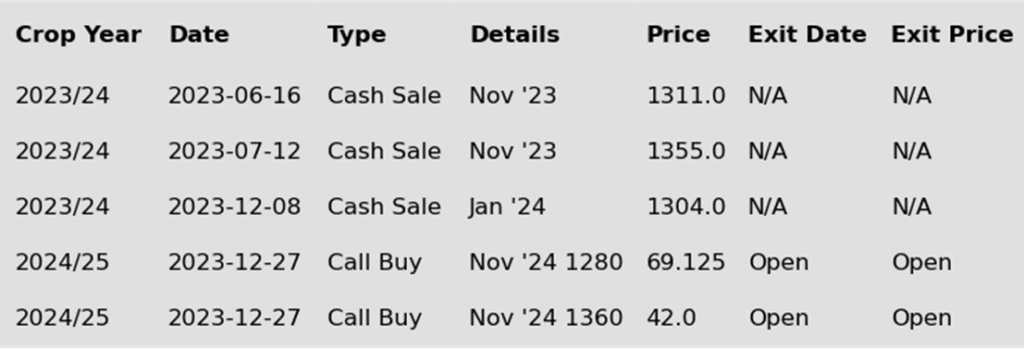

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: After posting a bullish reversal on March 11, prices appear to have stalled around 555 and could retreat toward the support area near the recent low of 523 ½. Below there, further support may be found around 470 – 488. If prices regain their bullish footing, and close above 556, they then could challenge the 50 and 100-day moving averages that coincide with the 585 – 620 congestion area.

Action Plan: KC Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

KC Wheat Action Plan Summary

Since December’s brief runup, prices have continued to erode as US exports continue to suffer from lower world export prices. Although fundamentals remain weak. Managed funds continue to hold a considerable net short position, and the market is at levels not seen since spring of 2021, which combined could trigger a return to higher prices if any unforeseen risks enter the market.

- No new action is recommended for 2023 KC wheat crop. The current strategy is to look for price appreciation as weather becomes a more prominent market mover and consider suggesting additional sales if prices make a modest 20% retracement of the 2022 highs back toward the upper 600s

- No new action is recommended for 2024 KC wheat. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts to protect the downside, and recommended exiting the original position in three separate tranches as the market got further extended into oversold territory to protect any gains that were made. Taking the equity gained from the closed July 660 put position into account, the current strategy for the 2024 crop is to wait for better opportunities and consider recommending additional sales if July ‘24 retraces back toward the January highs in the mid-630s.

- No action is currently recommended for 2025 KC Wheat. We currently aren’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following KC recommendations:

Above: The failure of the market to advance above the 50-day moving average indicates heavy resistance in the area, and it may test support near the 551 ½ low. Should prices turn around and close above the 50-day moving average, they could still make a run toward the 610 to 640 congestion area. While there appears to be significant support around 551 ½, if prices fall below there, they could test 530.

Action Plan: Mpls Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Mpls Wheat Action Plan Summary

Since last summer, Minneapolis wheat has slowly stair-stepped lower with weaker world prices and little bullish news to move markets higher. During this time, the 50-day moving average has acted as resistance, above which the market has not been able to hold for very long. Managed funds have also established and maintained a record (or near record) short position for much of the same time. Although bullish headwinds remain, the market has become very oversold, and the large fund net short position continues to leave the market susceptible to a short-covering rally at any time.

- No new action is currently recommended for 2023 Minneapolis wheat. The current strategy is to look for a modest retracement of the July high and consider additional sales in the neighborhood of 675 – 700.

- No new action is recommended for 2024 Minneapolis wheat. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts (due to their higher liquidity and correlation to Minneapolis), to protect the downside, and recommended exiting the original position in three separate tranches as the market got further extended into oversold territory to protect any gains that were made. From here, the strategy for the 2024 crop is to consider recommending additional sales if Sep ‘24 posts a modest 22% retracement back toward the 2022 highs of 1400.

- No action is currently recommended for the 2025 Minneapolis wheat crop. We are currently not considering any recommendations at this time for the 2025 crop that will be planted in the spring of next year. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: Minneapolis wheat continues to trade in a congestion pattern following the retreat from overhead resistance near the 50-day moving average. Initial support below the market remains near the recent low of 641, with support near 600 if prices fall further. Overhead, if the market reverses and closes above 675 – 680 resistance, they could challenge the 700 – 710 area.

Other Charts / Weather

Brazil 2-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.

Brazil 2-week forecast precipitation, percent of normal, courtesy of the National Weather Service, Climate Prediction Center.