3-14 End of Day: Corn and Wheat End the Week Lower, While Soybeans Post Gains

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’25 | 458.5 | -6.75 |

| JUL ’25 | 467.5 | -4.75 |

| DEC ’25 | 451 | -1.25 |

| Soybeans | ||

| MAY ’25 | 1016 | 5.25 |

| JUL ’25 | 1030 | 5 |

| NOV ’25 | 1018 | 6.25 |

| Chicago Wheat | ||

| MAY ’25 | 557 | -5.5 |

| JUL ’25 | 573 | -5.25 |

| JUL ’26 | 640 | -1.25 |

| K.C. Wheat | ||

| MAY ’25 | 586 | -1.5 |

| JUL ’25 | 598.75 | -2 |

| JUL ’26 | 649.75 | -3 |

| Mpls Wheat | ||

| MAY ’25 | 601.75 | -2 |

| JUL ’25 | 616.5 | -1.25 |

| SEP ’25 | 629.75 | -0.25 |

| S&P 500 | ||

| JUN ’25 | 5678.75 | 100.5 |

| Crude Oil | ||

| MAY ’25 | 66.95 | 0.68 |

| Gold | ||

| JUN ’25 | 3021.8 | 2.3 |

Grain Market Highlights

- Corn: Feeding off the weakness in the wheat market, corn futures ultimately ended the trading day lower, despite the export sale announcement earlier this morning.

- Soybeans: Despite the weakness in the corn and wheat markets, soybeans managed to end the week on a positive note, closing higher on the day, supported by lower soybean production estimates in Argentina.

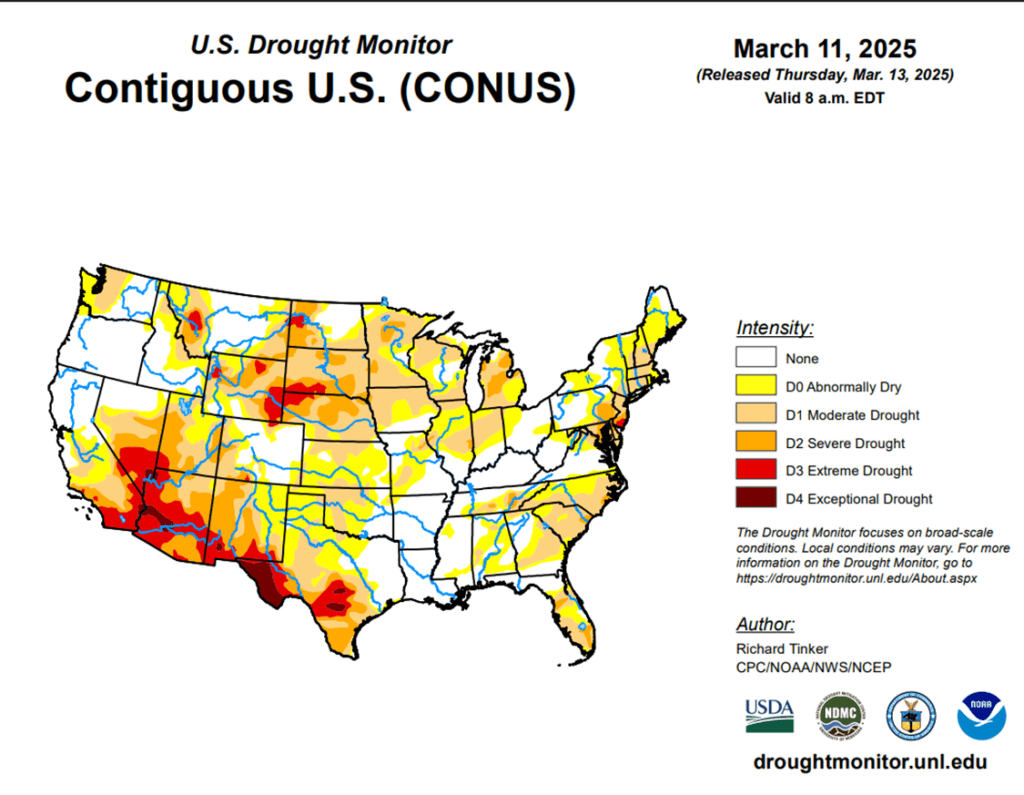

- Wheat: Wheat ended the week with losses across the board, as weather concerns in the U.S. Southern Plains and the Black Sea region persist.

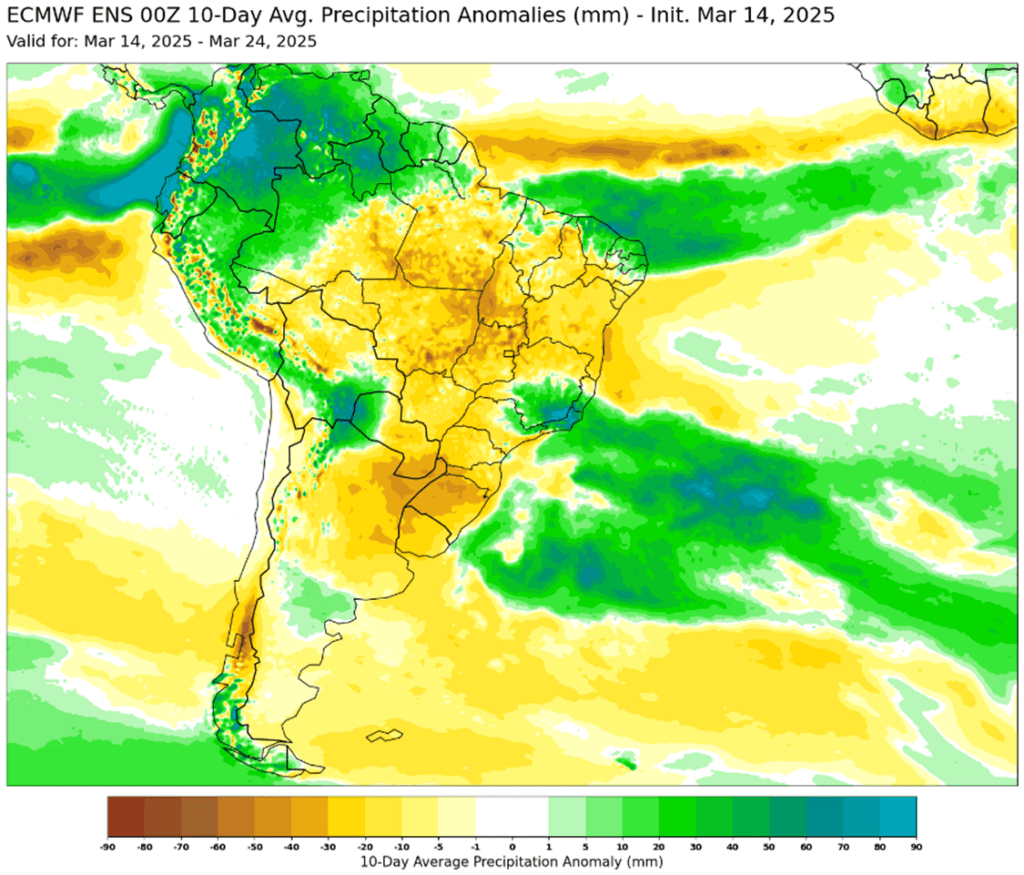

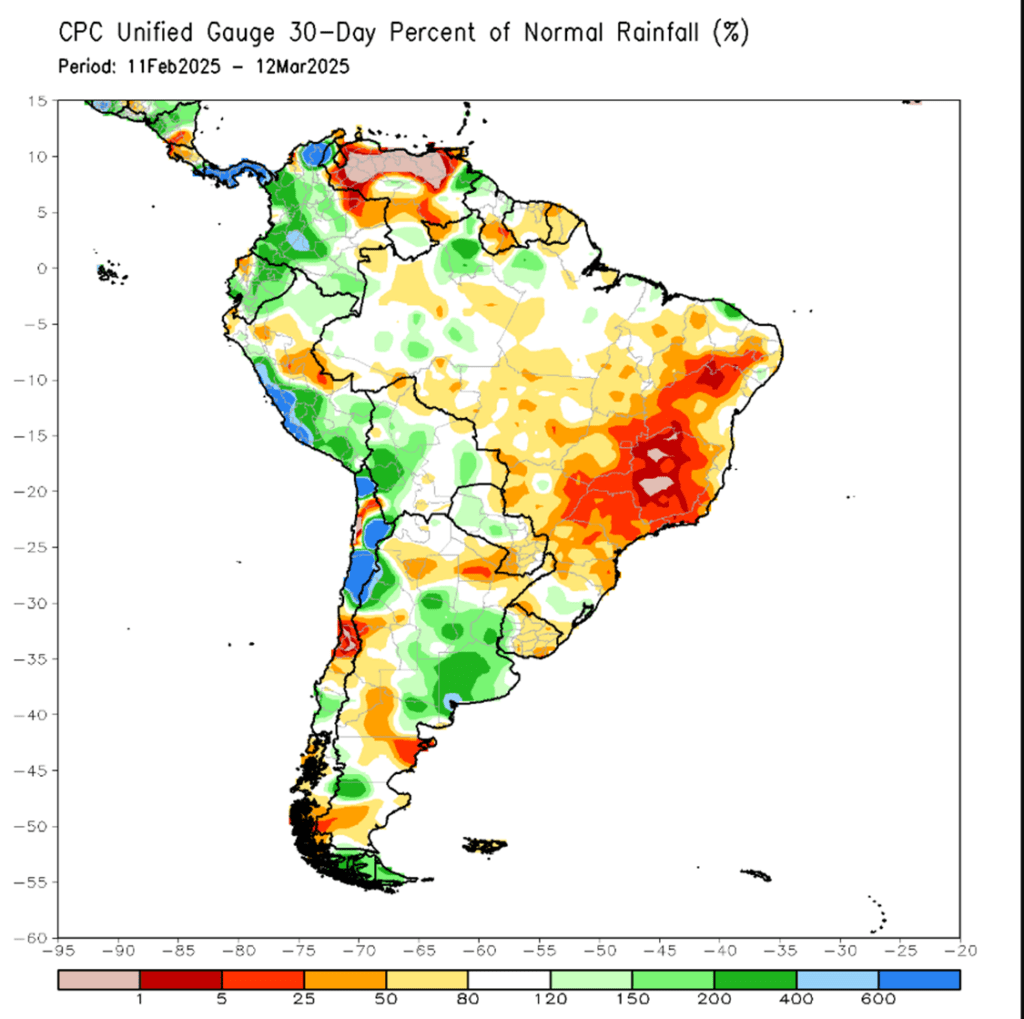

- To see the updated 30-day percent of normal rainfall map for South America as well as the updated U.S. drought monitor, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

Active

Sell DEC ’26 Cash

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

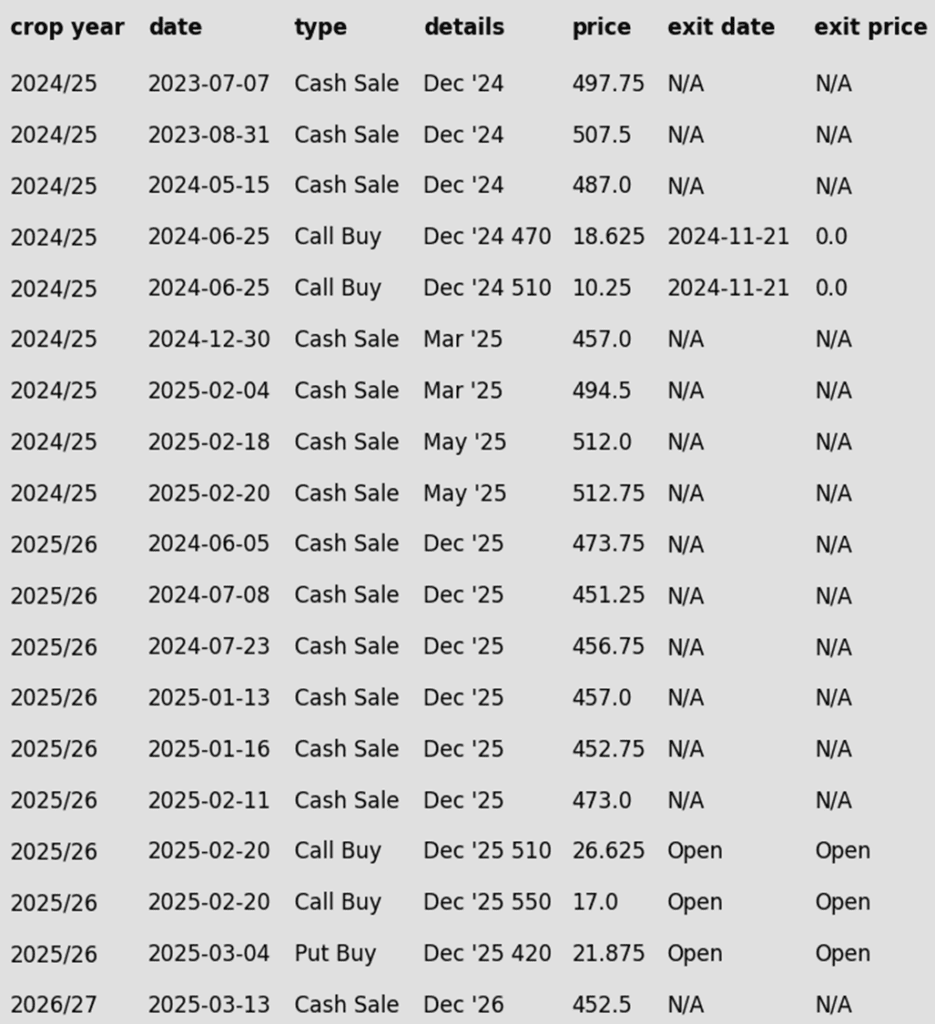

- Since last summer, seven official sales recommendations have been made at an average price of 495.50. If you are behind, target 480 vs May as a first spot to begin catching up.

- Grain Market Insider has not yet set an official price target for an eighth sale but remains satisfied with the sales recommendations made to date. The Prospective Plantings and Grain Stocks reports, scheduled for release on March 31, are approaching quickly. Given the high volatility typically seen on report day, Grain Market Insider is likely to hold off on any new recommendations until after the report — unless market conditions shift significantly.

2025 Crop:

- Plan A: Exit all 510 December calls @ 43-5/8 cents. Exit half of the December 420 puts @ 43-3/4 cents.

- Plan B: No active targets.

- Details:

- Since last spring, six sales recommendations have been made for the 2025 crop at an average price of 460.75. If you are behind, target 462 vs December as a first spot to begin catching up.

- Grain Market Insider feels confident about the overall strategy heading into the volatile March 31 reports and into spring/summer. There are the six sales recommendations on the books at an average price of 460.75. Additionally, 510 and 550 call options are in place to capture upside potential if the highs are not in. On the downside, 420 put options cover unsold bushels, providing protection against lower prices. This balanced strategy allows flexibility to adjust as the market moves in either direction.

2026 Crop:

- CONTINUED OPPORTUNITY – Sell the first portion of your 2026 corn crop.

- Details: Early sales can be impactful in years when prices trend sideways or lower. For last year’s 2024 corn crop, the sales recommendations made in 2023 at 497.75 and 507.50 ended up outperforming anything offered after January 1, 2024, for bushels that had to be sold at harvest. While this won’t be the case every year, history shows that sideways or lower years tend to outnumber higher years. Consistently applying early sales strategies year after year can provide long-term benefits.

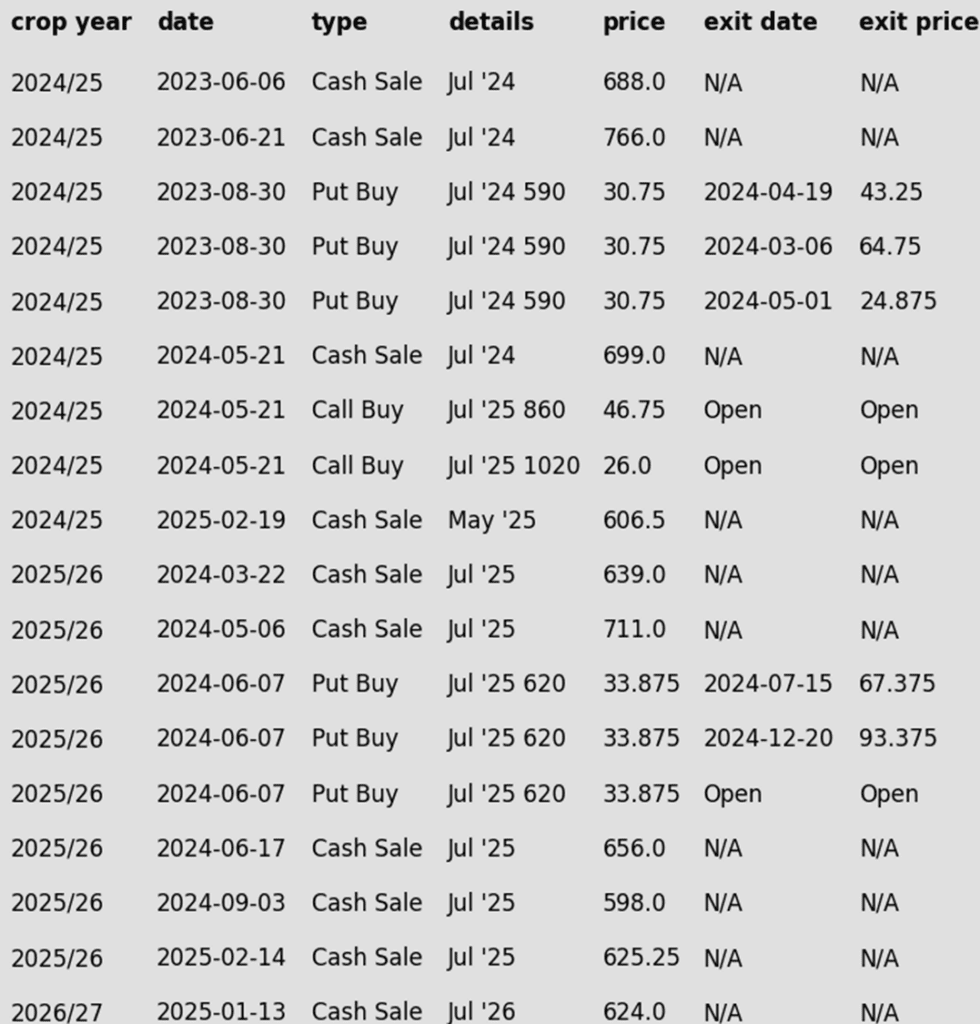

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

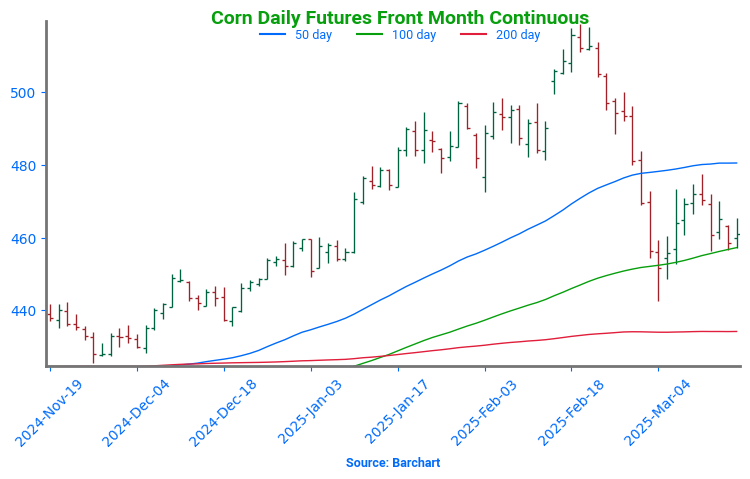

- Corn futures finished lower on the day, posting moderate losses in the front-month contracts. Despite an announced export sale in the morning, weakness in wheat and the expiration of the March futures limited gains to end the week. For the week, May corn futures closed 10 ¾ cents lower, nearly 20 cents off the highs of the week.

- The March corn futures finished its trading life on Friday, settling at 445 ½. The softer trade on Friday limited gains in the front month contacts. May futures closed the day with a 14-cent premium to the final March trade.

- The USDA announced a corn export sale on Friday morning. For the current marketing, US exporters sold 218,604 MT (8.6 MB) to an unknown destination. This was the third report corn export sale for the month of March.

- The Rosario Grain Exchange in Argentina posted their projection for the upcoming corn harvest on Friday morning. The exchange lowered estimated production by 8 MMt to 44.5 MMT. This was a significant drop compared to the Buenos Aires Grain Exchange cutting the crop by only 1MMT on Thursday.

- The weather forecast in Brazil is mostly favorable for the development of their key 2nd corn crop. Despite that, dry conditions in the east need to be monitored. The market is concerned about a possible spread into the center-south corn producing regions.

Corn Finds Support Near 450

After hitting 16-month highs in late February, corn prices pulled back sharply to test the 100-day moving average and trendline support near 450. This rebound suggests a potential short-term low that can be built off as we head towards spring. Initial resistance is expected near the 50-day moving average, while key support remains at 450, with stronger support at the 200-day moving average.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Next cash sale at 1107 vs May. Buy calls with a close over 1079.75 vs May.

- Plan B: No active targets.

- Details:

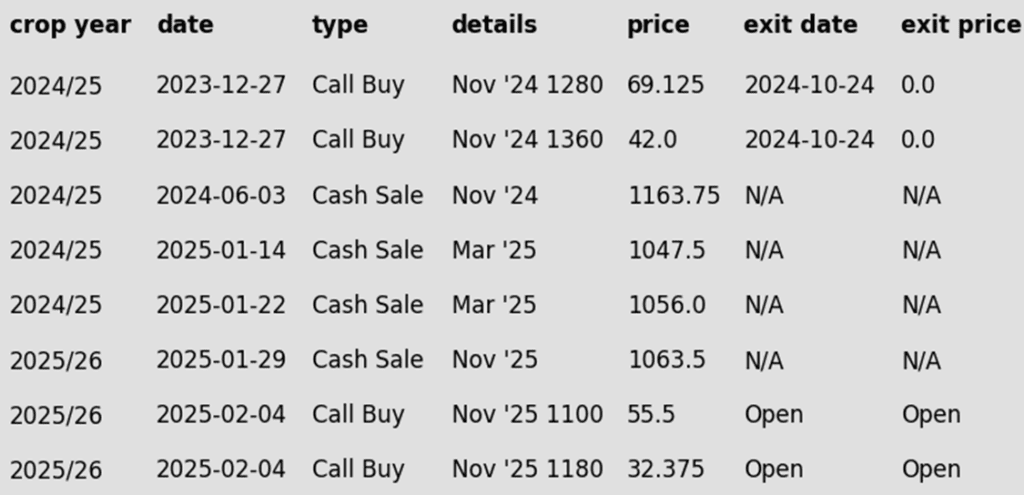

- Since last spring, three official sales recommendations have been made at an average price of 1089. If you’re behind, consider targeting 1056 vs May as a good starting point to begin catching up.

- The official target for a fourth sale is 1107 vs May. Since soybeans tend to have later seasonal pricing opportunities than corn, the plan is to aim for an aggressive target for now.

- A close above the February high resistance of 1079.75 would trigger a recommendation to re-own the three prior sales with August call options.

2025 Crop:

- Plan A: Next cash sale at 1114 vs November. Exit all 1100 November call options at 88 cents.

- Plan B: No active targets.

- Details:

- There has been one official sales rec on 2025 soybeans to date. If you’re behind, consider targeting 1040 vs November to catch up.

- If the 1100 November calls can be exited for 88 cents, that should cover the cost of the 1180 calls, providing a net-neutral cost position that can continue to protect the upside on the previous sales recommendation.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Still not expecting the first targets for at least another couple months.

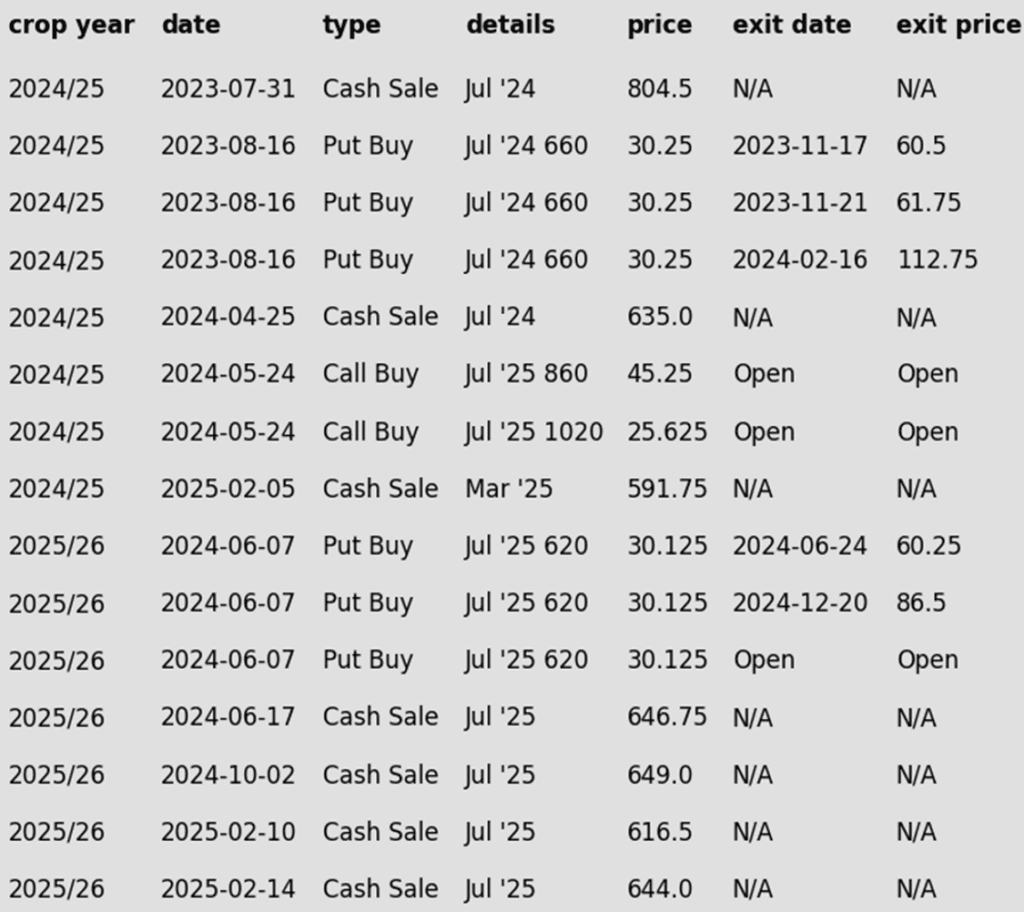

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher after a quiet trading session that saw futures mostly unchanged until the latter part of the day. Lowered soybean production estimates from Argentina earlier this week have been supportive. Soybean meal closed lower, while soybean oil led the complex higher, buoyed by rising crude oil prices.

- This morning, private exporters reported to the USDA an export sale of 20,000 metric tons of soybean oil for delivery to unknown destinations during the 24/25 marketing year. While soybean export demand has been poor due to a large Brazilian harvest, yesterday’s export sales were above the average trade estimate for soybeans.

- In Argentina, the Rosario Grain Exchange has lowered its estimate for soybean production to 46.1 mmt which is down 1 mmt from February. This comes after Brazil’s CONAB brought its estimate for production below the USDA’s guess. Also in Brazil, weather is set to be dry throughout the southern regions of the country during pod fill which could also be supportive.

- For the week, May soybeans lost 9 cents to $10.16 while November soybeans lost 7-1/2 cents to $10.18. The lack of carry in the market is interesting given anticipation of fewer new crop bean acres to be planted this year. May soybean meal gained $1.50 to $305.90 and May soybean oil lost 1.83 cents to 41.59 cents.

Soybeans Find Support Near 1000

Soybean futures tested the 200-day moving average in early 2025, a key resistance level that has capped gains for 18 months. As March began, improved weather and harvest pressure in South America caused a sharp price decline. Support held around the 1000 level, with stronger support near 950. If prices continue to rebound, initial resistance is at 1030, with the 200-day moving average remaining a critical barrier.

Wheat

Market Notes: Wheat

- Wheat closed with small to moderate losses across the board. May Paris milling wheat had gapped higher yesterday but reversed to fill that gap today, ultimately closing lower. Today’s weakness comes despite ongoing concerns about dryness in the U.S. Southern Plains and the Black Sea region.

- According to Ukraine’s agriculture ministry, spring wheat plantings are estimated at 5.7 million hectares, which is in line with year ago levels.

- FranceAgriMer has reported their soft wheat crop condition at 74% good to excellent – this is unchanged from the week prior. However, durum wheat conditions fell 1% to 81% good to excellent.

- The U.S. Northern Plains are forecast to receive storms bringing a mix of scattered showers and snow. The addition of heavy winds could lead to blizzard conditions, but with the current lack of soil moisture, this precipitation may be welcomed by producers as they approach spring wheat planting.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 701 vs May to make the next sale.

- Plan B: No active targets. Monitoring various indicators for the development of sell signals that could suggest making a preemptive sale — before 701 hits.

2025 Crop:

- Plan A: Target 714 vs July ‘25 to make the next sale.

- Plan B: No active targets. Monitoring various indicators for the development of sell signals that could suggest making a preemptive sale — before 714 hits.

2026 Crop:

- Plan A: Target 704 vs July ‘26 to make the next sale.

- Plan B: No active targets. Monitoring various indicators for the development of sell signals that could suggest making a preemptive sale — before 704 hits.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat’s Volatile Breakout and Retreat

Chicago wheat broke out of its prolonged sideways trend with a strong February rally, surging to key resistance at the early October highs just above 615. However, the late February peak proved to be a turning point, as futures retreated sharply, slipping back into the previous trading range that defined the end of 2024. Support has so far held near 540, the lower boundary of this range, while the 200-day moving average looms as a key resistance level near 570. A decisive weekly close above the 200-day could signal a potential trend reversal and renewed upside momentum.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 717 vs May to make the next sale.

- Plan B: No active targets. Monitoring various indicators for the development of sell signals that could suggest making a preemptive sale — before 717 hits.

2025 Crop:

- Plan A: Target 677 vs July ’25 to make the next sale.

- Plan B: No active targets. Monitoring various indicators for the development of sell signals that could suggest making a preemptive sale — before 677 hits.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Still not expecting the first targets for another two to three months — likely around May or June.

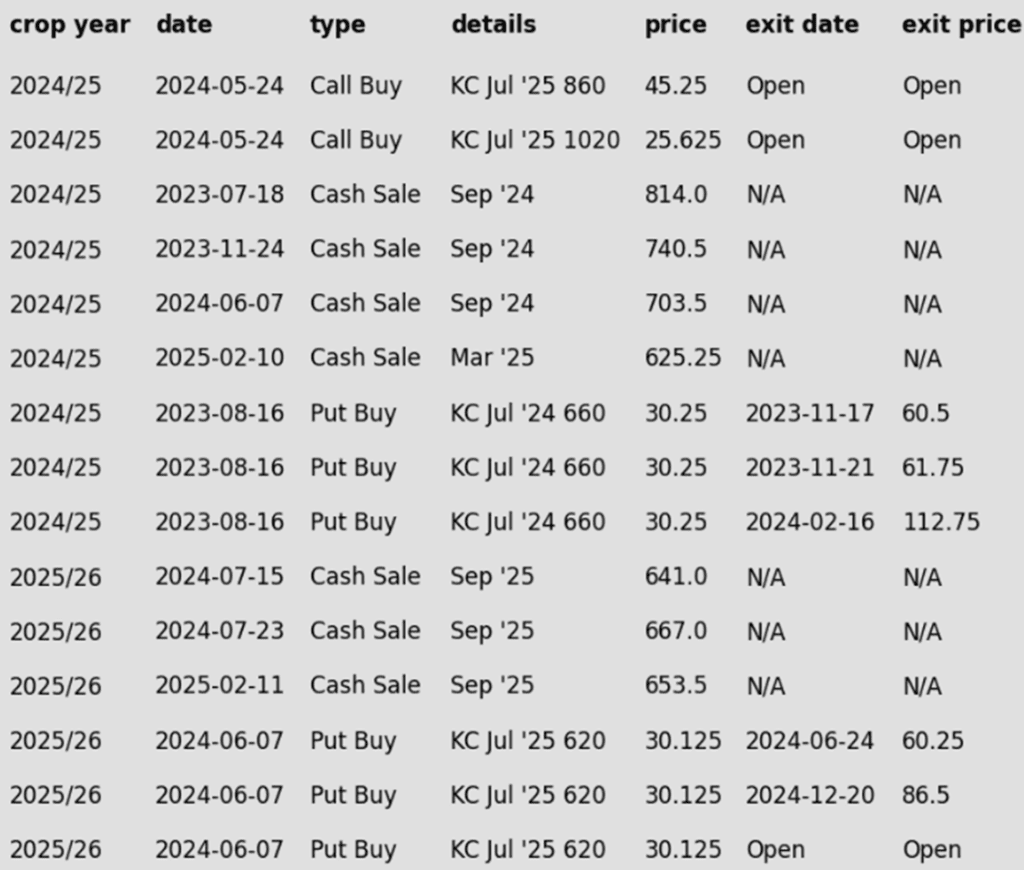

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Faces Key Technical Test

Kansas City wheat futures surged into February with strong bullish momentum, closing above the 200-day moving average and testing multi-month highs near 620. However, the rally lost steam in late February, leading to a sharp retreat back into the previous trading range. Support has held firm near 540, the lower boundary of this range, while the 200-day moving average is expected to serve as resistance on any attempted rebound. A decisive close above key resistance will be crucial for reigniting the uptrend as the market heads into spring.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 625 vs May to make the next sale.

- Plan B: No active targets. Monitoring various indicators for the development of sell signals that could suggest making a preemptive sale — before 625 hits.

2025 Crop:

- Plan A: Target 647.75 vs September to make the next sale.

- Plan B: No active targets. Monitoring various indicators for the development of sell signals that could suggest making a preemptive sale — before 647.75 hits.

2026 Crop:

- Plan A: No active targets.

- Plan B: No active targets.

- Details:

- Still not expecting the first targets for another three to four months — likely around June or July.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Struggles to Hold Breakout

Spring wheat broke out of its prolonged sideways range in late January, sparking bullish momentum. A mid-February close above the 200-day moving average reinforced the breakout, but late February weakness erased those gains, dragging futures back below key moving averages. Looking ahead, the 200-day moving average is expected to act as resistance on any rebound, while previous lows near 580 should provide a key support level. A sustained move above resistance would be needed to reignite the uptrend.

Other Charts / Weather

Above: 10-Day Average Precipitation Anomalies of South America courtesy of the National Weather Service, Climate Prediction Center.

Above: Unified Gauge 30-Day Percent of Normal Rainfall courtesy of the National Weather Service, Climate Prediction Center.