3-12 End of Day: Grains Pressured Wednesday

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’25 | 460.75 | -9.5 |

| JUL ’25 | 467.5 | -9.5 |

| DEC ’25 | 448.25 | -6.25 |

| Soybeans | ||

| MAY ’25 | 1000.5 | -10.75 |

| JUL ’25 | 1015.5 | -10 |

| NOV ’25 | 1006.5 | -9 |

| Chicago Wheat | ||

| MAY ’25 | 554 | -2.75 |

| JUL ’25 | 569.5 | -2.25 |

| JUL ’26 | 635.5 | -0.75 |

| K.C. Wheat | ||

| MAY ’25 | 573 | 1 |

| JUL ’25 | 586.75 | 1.25 |

| JUL ’26 | 640.25 | 1.25 |

| Mpls Wheat | ||

| MAY ’25 | 594.5 | -2.75 |

| JUL ’25 | 608.25 | -3 |

| SEP ’25 | 619.5 | -3.25 |

| S&P 500 | ||

| JUN ’25 | 5678.5 | 50.5 |

| Crude Oil | ||

| MAY ’25 | 67.42 | 1.49 |

| Gold | ||

| JUN ’25 | 2971.1 | 22.1 |

Grain Market Highlights

- Corn: The corn market faced technical selling pressure following Tuesday’s WASDE report, with concerns over trade policy and an unchanged balance sheet weighing on prices.

- Soybeans: Soybeans extended their losing streak to a fourth consecutive session as ongoing tariff threats created an unpredictable trade environment, prompting a risk-off tone across the grain complex.

- Wheat: Wheat futures finished mixed as markets reacted to geopolitical tensions following an overnight Russian missile strike on Ukraine’s port of Odessa, where workers were loading a wheat shipment.

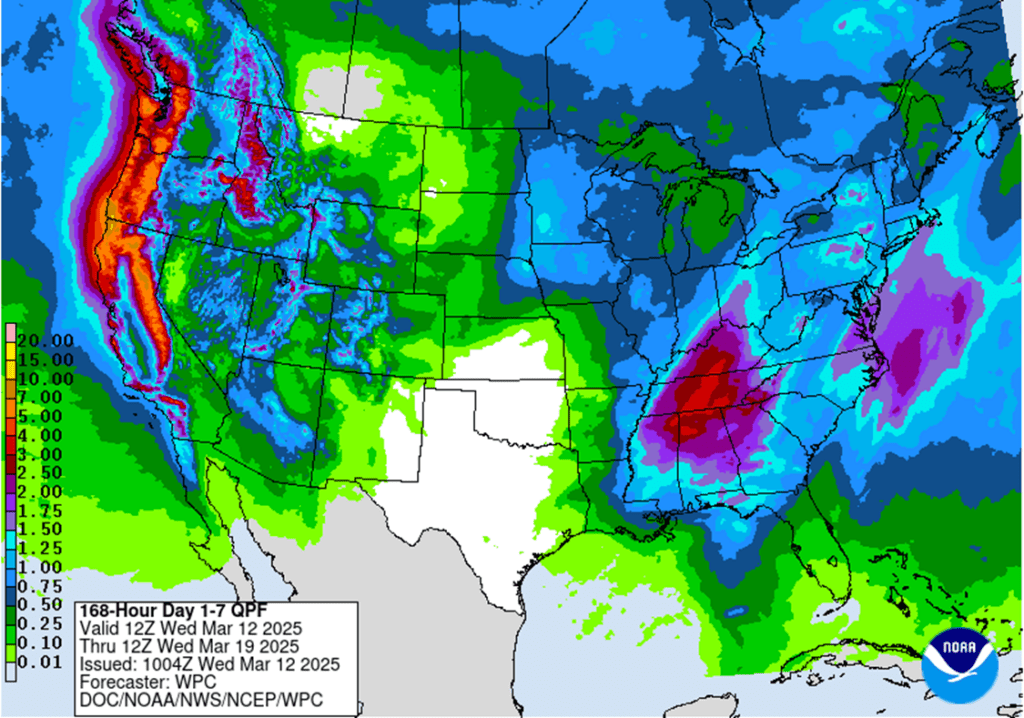

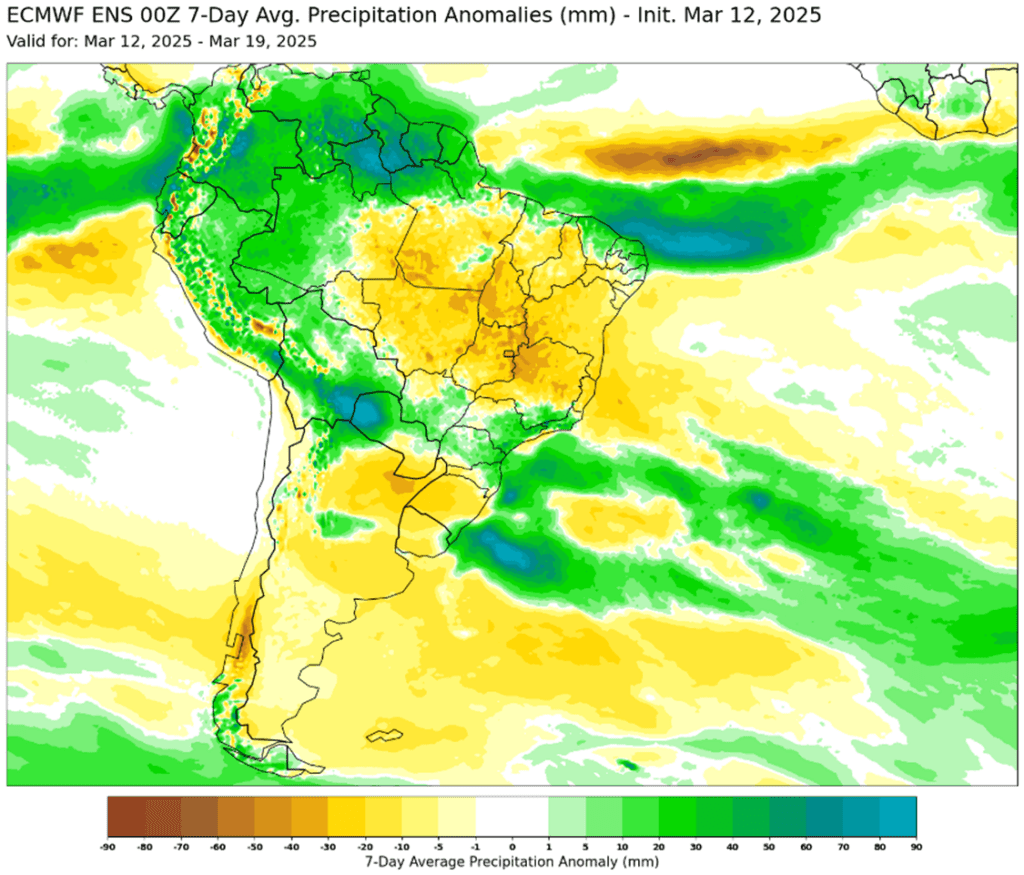

- To see the updated 7-day precipitation outlook for the U.S. and the 7-day precipitation forecast for South America, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

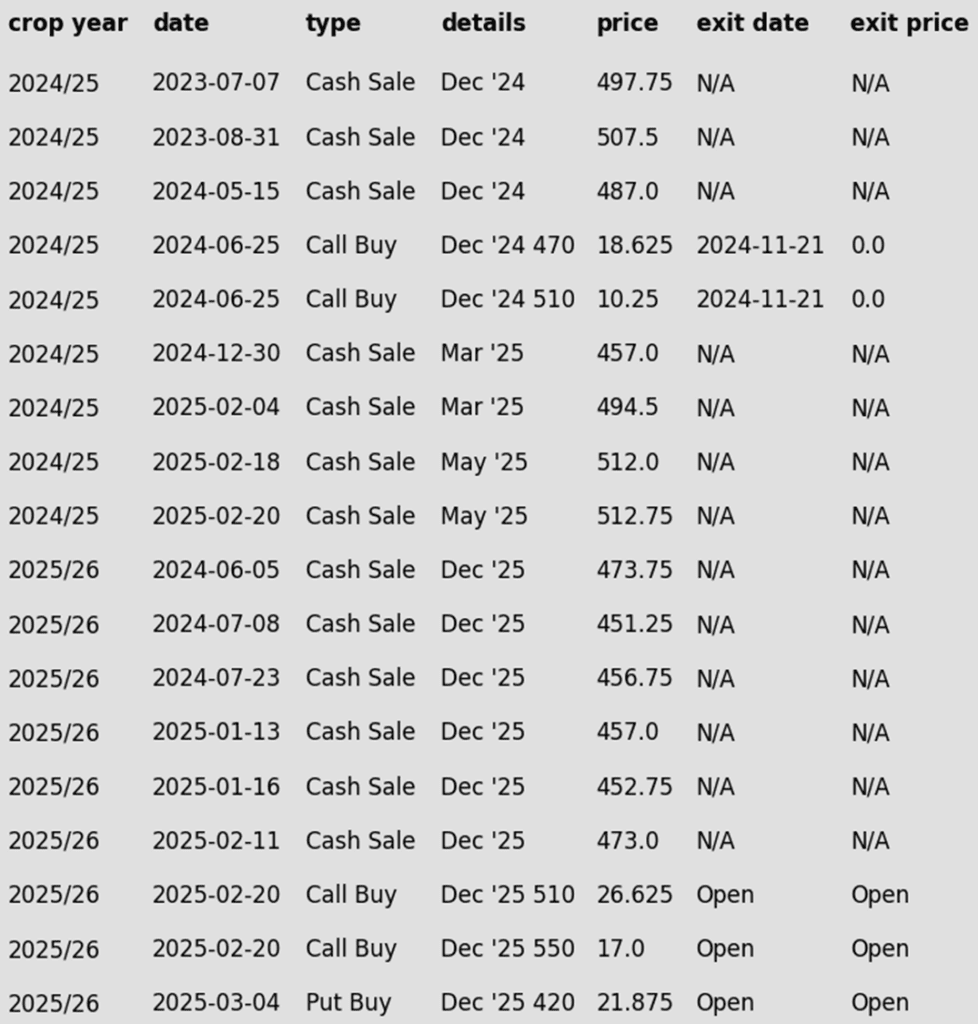

2024 Crop:

- No Official Targets: There have been three official sales recommendations year-to-date, and currently there’s no active target for a fourth sale.

- Catch-Up Zone: If you haven’t made three sales for 2025 yet, the suggested zone is 480 vs. May to catch up. At today’s high, May got within about three cents of the lower end of this range.

- Hold Steady: If you’ve followed all three prior recommendations for 2025, Grain Market Insider advises to sit tight for now.

2025 Crop:

- No Official Targets: There have also been three official sales recommendations year-to-date for the 2025 new crop corn, and currently there’s no active target for a fourth sale.

- Catch-Up Zone: If you haven’t made three sales since January 1 yet, the suggested zone is 462 vs. December to catch up. At today’s high December got within about four cents of the lower end of this range.

- Hold Steady: If you’ve followed all three prior sales recommendations since January 1, Grain Market Insider still advises you to sit tight for now.

2026 Crop:

- First Sales Rec: The first sales recommendation for the 2026 corn crop could be issued tomorrow. Seasonally, now is the time to consider locking in the first early sales. More details to come.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market faced technical selling pressure following Tuesday’s WASDE report, with concerns over trade policy and an unchanged balance sheet weighing on prices. This sparked additional long liquidation as traders reassessed positions.

- Weekly ethanol production declined to 312 million gallons, down 9 million gallons from the previous week but still 3.7% higher than a year ago. Corn usage for ethanol totaled 106 mb, continuing to outpace the USDA’s target for the marketing year.

- The recent weakness in crude oil prices has squeezed margins for ethanol producers. Production has remained overall strong, but ethanol stocks are high at 27.4 million barrels. The combination of tighter margins and trade concerns with Canada for ethanol exports could limit production in weeks ahead as a possible trend.

- Canada farms intend to plant more corn and wheat acres in 2025 according to released Stats Canada estimates this morning. While the corn for grain acre number is small, it is intended to be 3.2% higher than last year. Market analyst could use this as an estimate to the possible trend for U.S. producers with the USDA Prospective Plantings report to be released at the end of the month.

- Weather outlook for Brazil is mostly favorable for the second crop corn. The central and southern regions of Brazil will see friendly forecast with a good balance of rain and sunshine. The eastern portions of Brazil are reflecting concerns with an overall drier forecast trend.

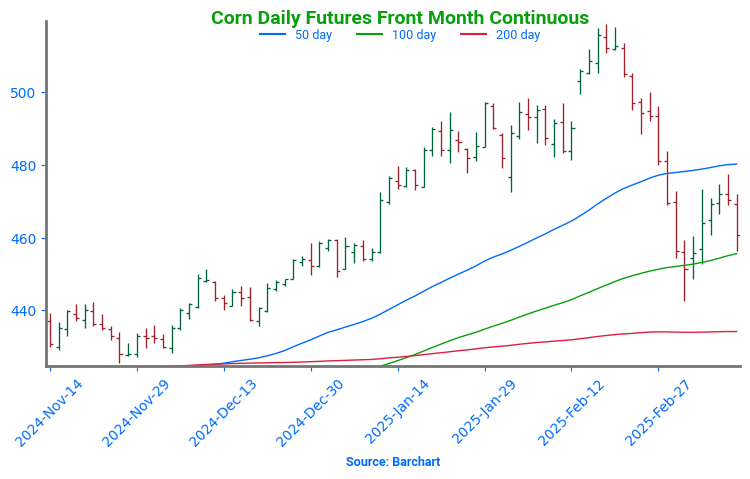

Corn Finds Support Near 450

After hitting 16-month highs in late February, corn prices pulled back sharply to test the 100-day moving average and trendline support near 450. This rebound suggests a potential short-term low that can be built off as we head towards spring. Initial resistance is expected near the 50-day moving average, while key support remains at 450, with stronger support at the 200-day moving average.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Catch-up Zone: There have been three official sales recs on 2024 soybeans year-to-date.

- If you haven’t made three sales since January 1, target 1056 to catch up.

- If you’re in line with the three sales recommendations, the advice is still to sit tight for now.

- Call Strategy Target: February’s close reinforces 1079.75 as a key resistance level. If the May contract stages a strong reversal and closes above 1079.75, Grain Market Insider would recommend a call option strategy to re-own previous sales recommendations.

2025 Crop:

- Catch-up Zone: There has been one official sales rec on 2025 soybeans year-to-date.

- If you haven’t made a sale since January 1, target 1040 vs November to catch up.

- If you’re in line with the one sales recommendation, the advice is still to sit tight for now.

- Call Option Target: The target to exit all the 1100 Nov ‘25 call options is approximately 88 cents in premium. If the 1100 calls can be exited for that price, it should cover the cost of the 1180 Nov ‘25 calls, providing a net-neutral cost position that can continue to protect the upside on previous sales recommendation.

2026 Crop:

- No Change: No initial recommendations or targets have been posted yet. The strategy may remain quiet for a while longer.

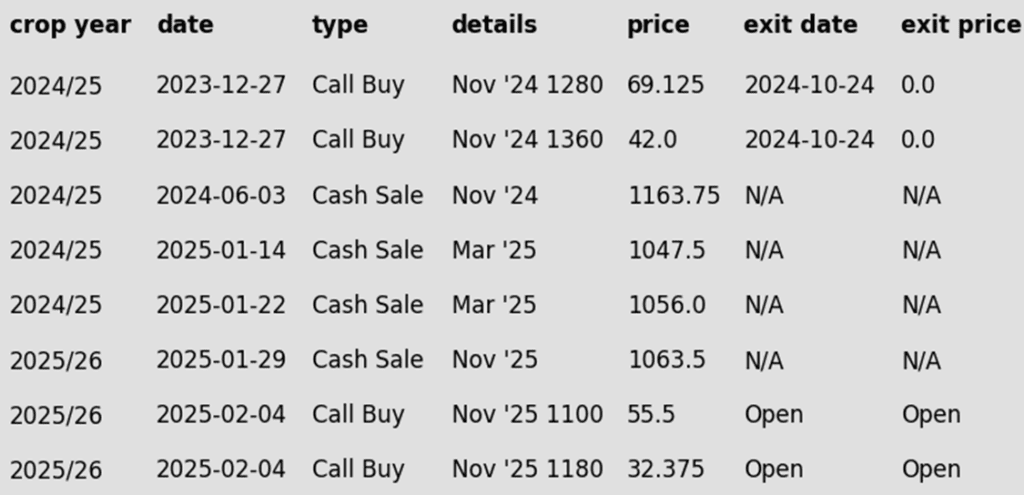

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans extended their losing streak to a fourth consecutive session as ongoing tariff threats created an unpredictable trade environment, prompting a risk-off tone across the grain complex. Soybean meal and oil also finished lower, despite support from rising crude oil prices.

- A Bloomberg survey is estimating Brazilian soybean production at 168.7 mmt for 24/25 which is just a hair below the USDA’s estimate. This would be 2.7 mmt higher than the agency’s last estimate in February.

- There may be some pressure on the soybean market as a result of precipitation in the forecast across areas of the country with poor soil moisture levels. The country has been very dry overall, and many traders have been looking for an upcoming rally on dry weather into planting season.

- Yesterday’s WASDE report saw US ending stocks untouched at 380 mb. There was a slight decline in world ending stocks which was the bullish part of the report, and no changes to Brazilian or Argentinian soybean production which are at 169 mmt and 49.0 mmt respectively.

Soybeans Find Support Near 1000

Soybean futures tested the 200-day moving average in early 2025, a key resistance level that has capped gains for 18 months. As March began, improved weather and harvest pressure in South America caused a sharp price decline. Support held around the 1000 level, with stronger support near 950. If prices continue to rebound, initial resistance is at 1030, with the 200-day moving average remaining a critical barrier.

Wheat

Market Notes: Wheat

- Wheat markets were mixed on the day, with Kansas City futures managing to eke out a small gain while Chicago and Minneapolis wheat settled slightly lower. A stronger U.S. dollar added pressure following Tuesday’s somewhat bearish WASDE report, though gains in Matif wheat and concerns over warmth and dryness in the U.S. Southern Plains helped prop up KC wheat.

- Geopolitical tensions remained in focus after a Russian missile strike on Ukraine’s port of Odessa reportedly killed four Syrian workers who were loading a wheat shipment. While the U.S. and Ukraine have negotiated a temporary ceasefire, Russia has yet to agree to the deal.

- The Russian ag ministry has issued an order to distribute more of the remaining 2025 wheat export quota. The 2025 quota totals 10.6 mmt between February 15 and June 30, but 8.6 mmt was already distributed in February.

- Today’s CPI data was not as bad as feared, with an increase of 0.2% in February, bringing annual inflation to 2.8%. This was 0.1% below estimates and the level from last month. This may indicate that inflation is easing, which could have broader impacts on the economy, financial markets, and the US Dollar – all of which could affect wheat prices.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 701 vs May to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 701 level.

2025 Crop:

- Plan A: Target 714 vs July ‘25 to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 714 level.

2026 Crop:

- Plan A: Target 704 vs July ‘26 to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 704 level.

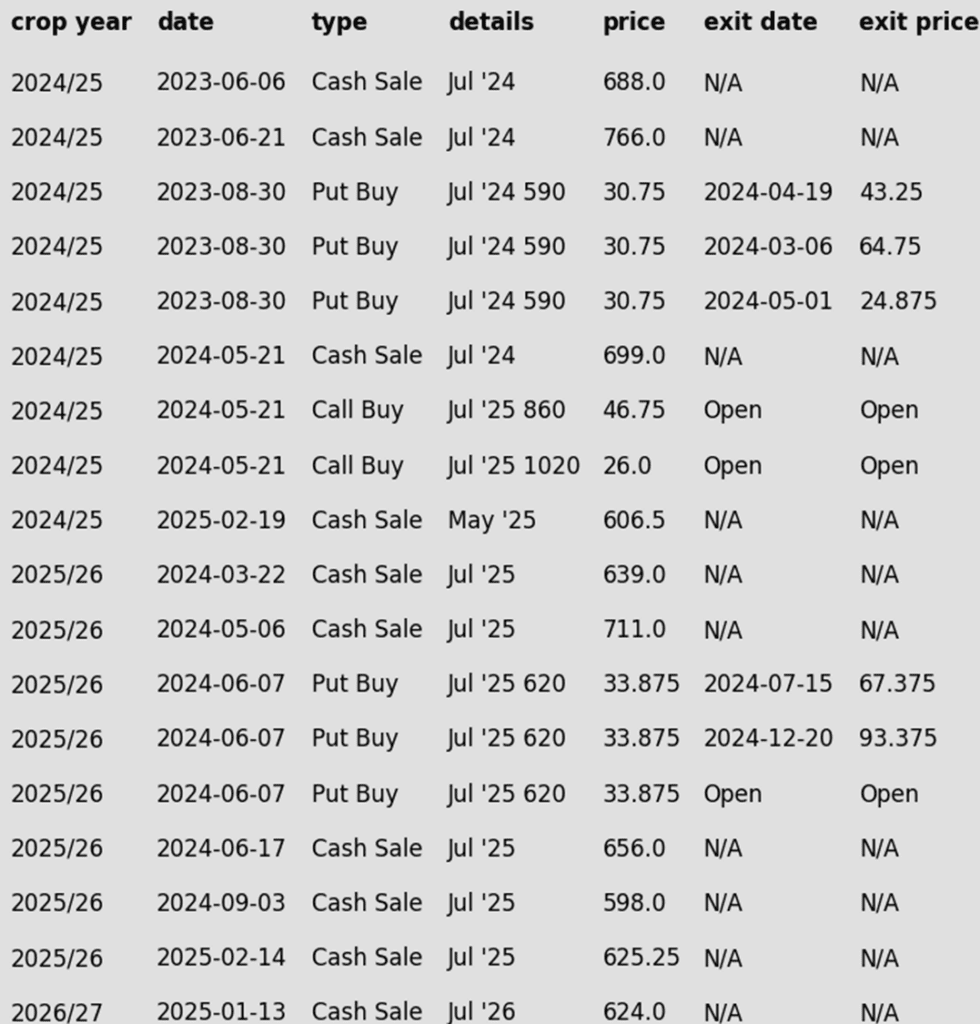

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

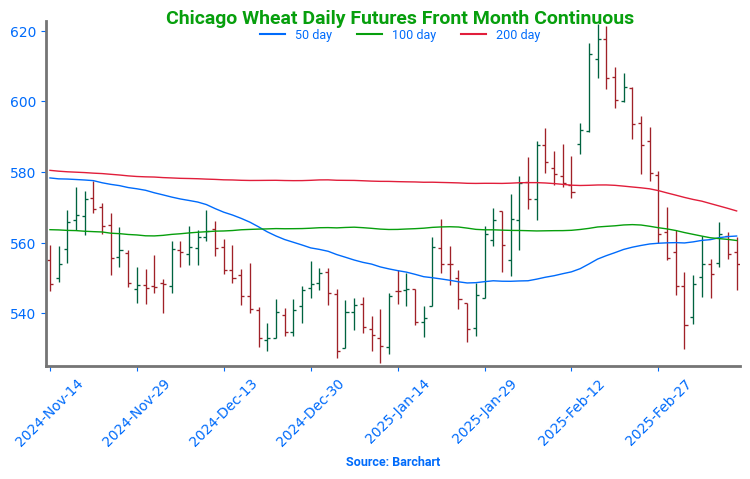

Chicago Wheat’s Volatile Breakout and Retreat

Chicago wheat broke out of its prolonged sideways trend with a strong February rally, surging to key resistance at the early October highs just above 615. However, the late February peak proved to be a turning point, as futures retreated sharply, slipping back into the previous trading range that defined the end of 2024. Support has so far held near 540, the lower boundary of this range, while the 200-day moving average looms as a key resistance level near 570. A decisive weekly close above the 200-day could signal a potential trend reversal and renewed upside momentum.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 717 vs May to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 717 level.

2025 Crop:

- Plan A: Target 677 vs July ’25 to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 677 level.

2026 Crop:

- Hold: No first sales targets or recommendations are expected until the late May, early June window.

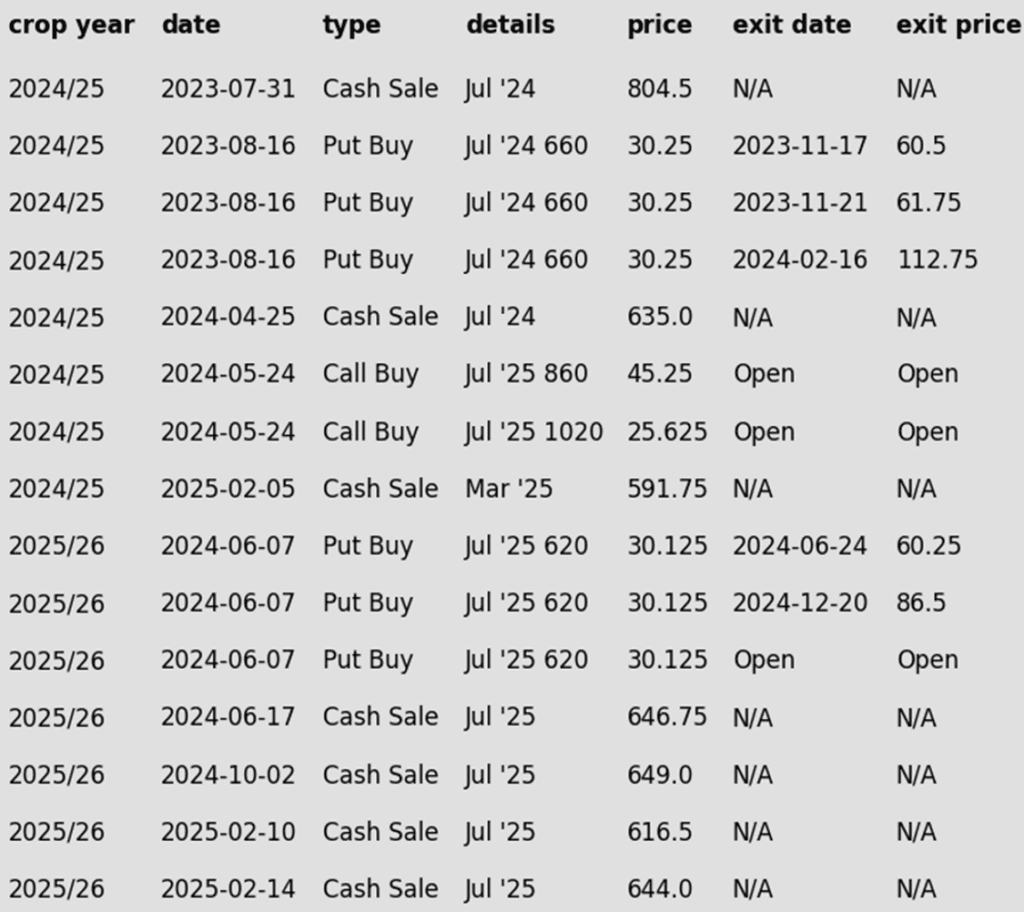

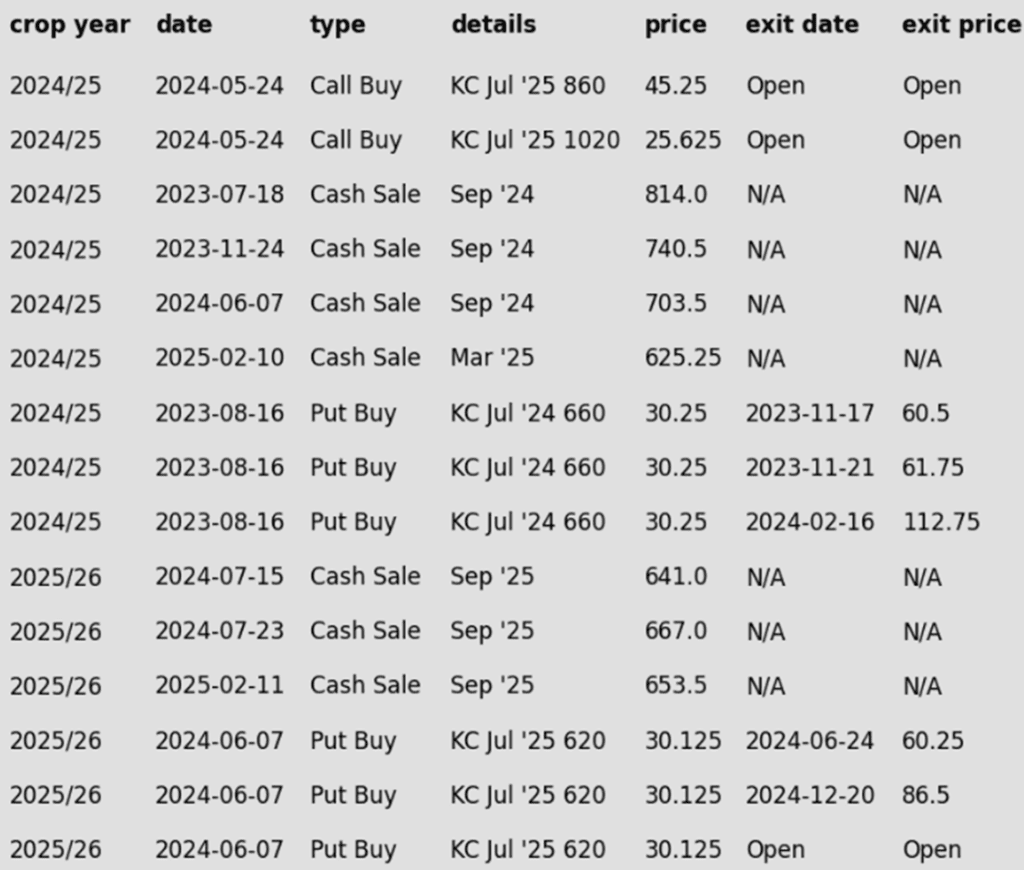

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Faces Key Technical Test

Kansas City wheat futures surged into February with strong bullish momentum, closing above the 200-day moving average and testing multi-month highs near 620. However, the rally lost steam in late February, leading to a sharp retreat back into the previous trading range. Support has held firm near 540, the lower boundary of this range, while the 200-day moving average is expected to serve as resistance on any attempted rebound. A decisive close above key resistance will be crucial for reigniting the uptrend as the market heads into spring.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 625 vs May to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 625 level.

2025 Crop:

- Plan A: Target 647.75 vs September to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 647.75 level.

2026 Crop:

- No Change: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

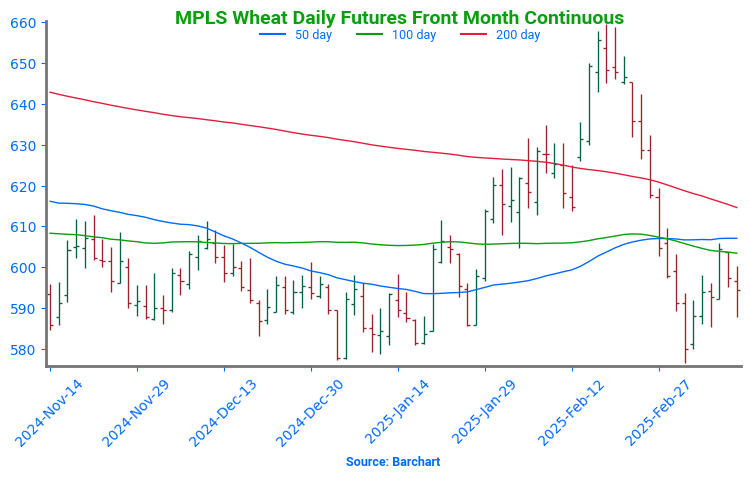

Spring Wheat Struggles to Hold Breakout

Spring wheat broke out of its prolonged sideways range in late January, sparking bullish momentum. A mid-February close above the 200-day moving average reinforced the breakout, but late February weakness erased those gains, dragging futures back below key moving averages. Looking ahead, the 200-day moving average is expected to act as resistance on any rebound, while previous lows near 580 should provide a key support level. A sustained move above resistance would be needed to reignite the uptrend.

Other Charts / Weather