3-11 End of Day: WASDE Keeps Corn and Soybean Carryout Steady, Wheat Carryout Higher

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’25 | 470.25 | -1.75 |

| JUL ’25 | 477 | -1.5 |

| DEC ’25 | 454.5 | -0.5 |

| Soybeans | ||

| MAY ’25 | 1011.25 | -2.75 |

| JUL ’25 | 1025.5 | -2.75 |

| NOV ’25 | 1015.5 | -2.25 |

| Chicago Wheat | ||

| MAY ’25 | 556.75 | -5.75 |

| JUL ’25 | 571.75 | -5.5 |

| JUL ’26 | 636.25 | -0.75 |

| K.C. Wheat | ||

| MAY ’25 | 572 | -6.5 |

| JUL ’25 | 585.5 | -5.75 |

| JUL ’26 | 639 | -1.25 |

| Mpls Wheat | ||

| MAY ’25 | 597.25 | -7.25 |

| JUL ’25 | 611.25 | -7 |

| SEP ’25 | 622.75 | -6.5 |

| S&P 500 | ||

| JUN ’25 | 5684.75 | 13 |

| Crude Oil | ||

| MAY ’25 | 66.19 | 0.51 |

| Gold | ||

| JUN ’25 | 2952.5 | 25 |

Grain Market Highlights

- Corn: With the U.S. corn balance sheet unchanged from last month’s USDA estimates, corn futures pulled back from early session highs, finishing slightly lower on the day.

- Soybeans: Like corn, the U.S. soybean balance sheet remained unchanged in today’s WASDE report. Similarly, soybean futures retreated from early session highs to close lower on the day.

- Wheat: An unexpected increase in U.S. wheat carryout pressured wheat futures lower today.

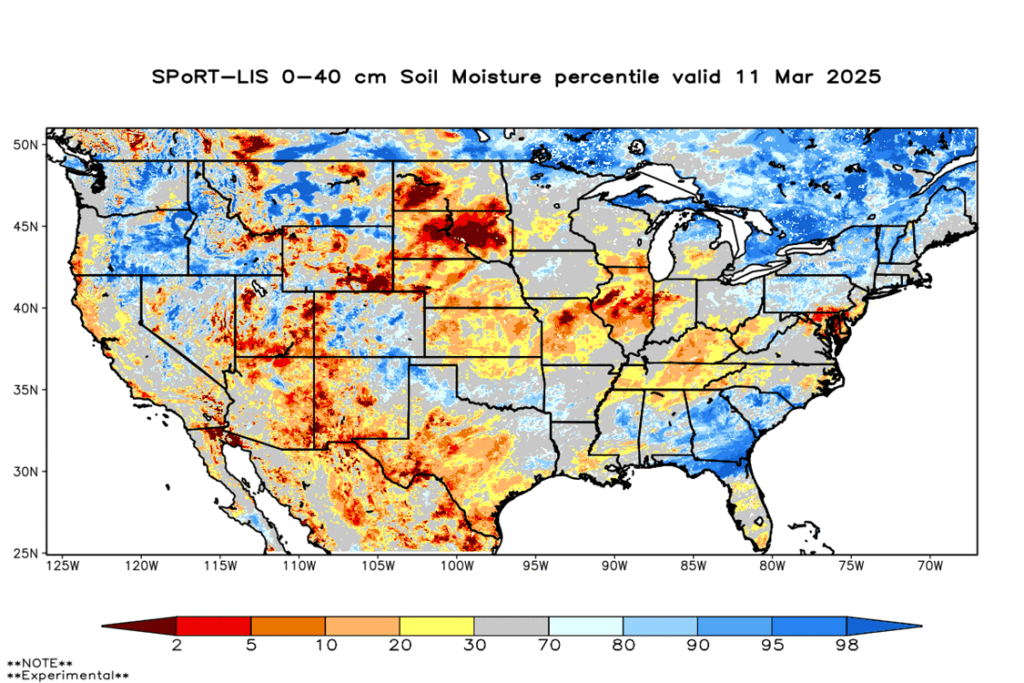

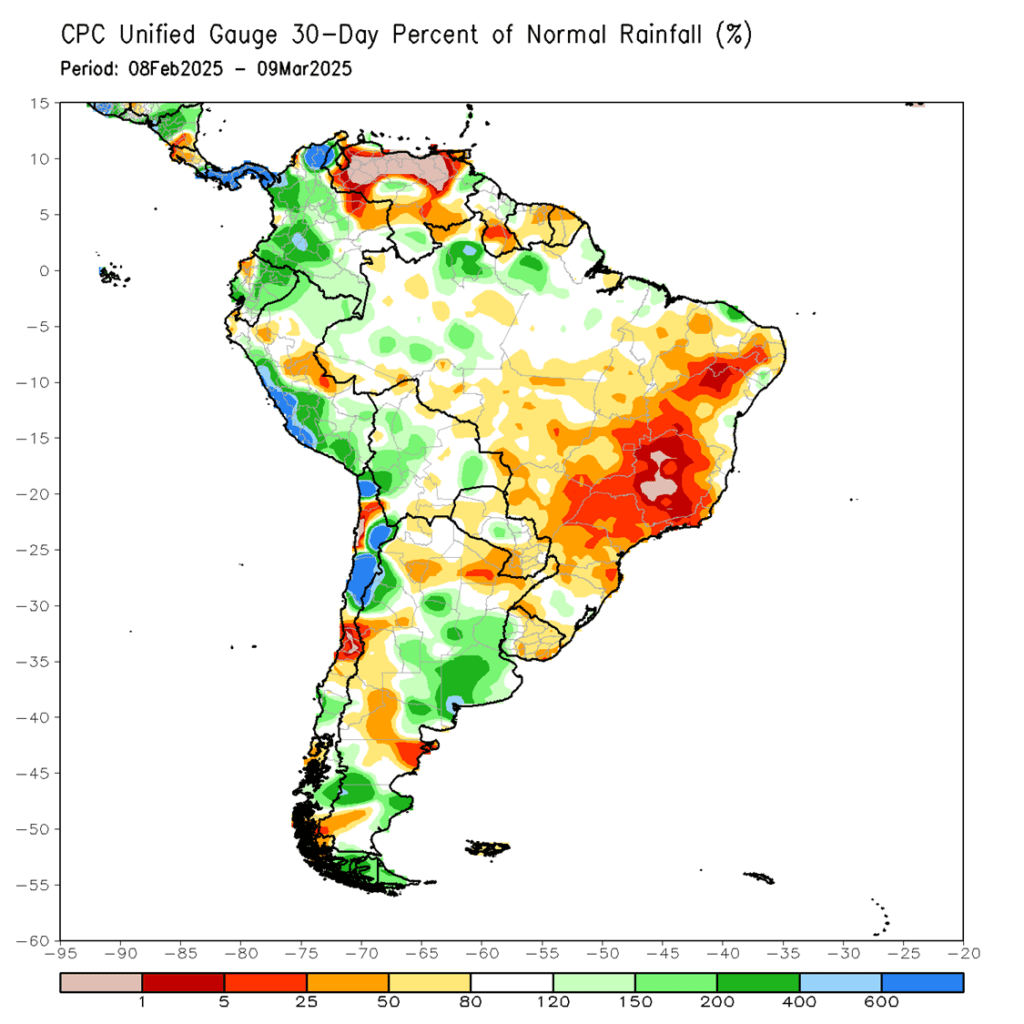

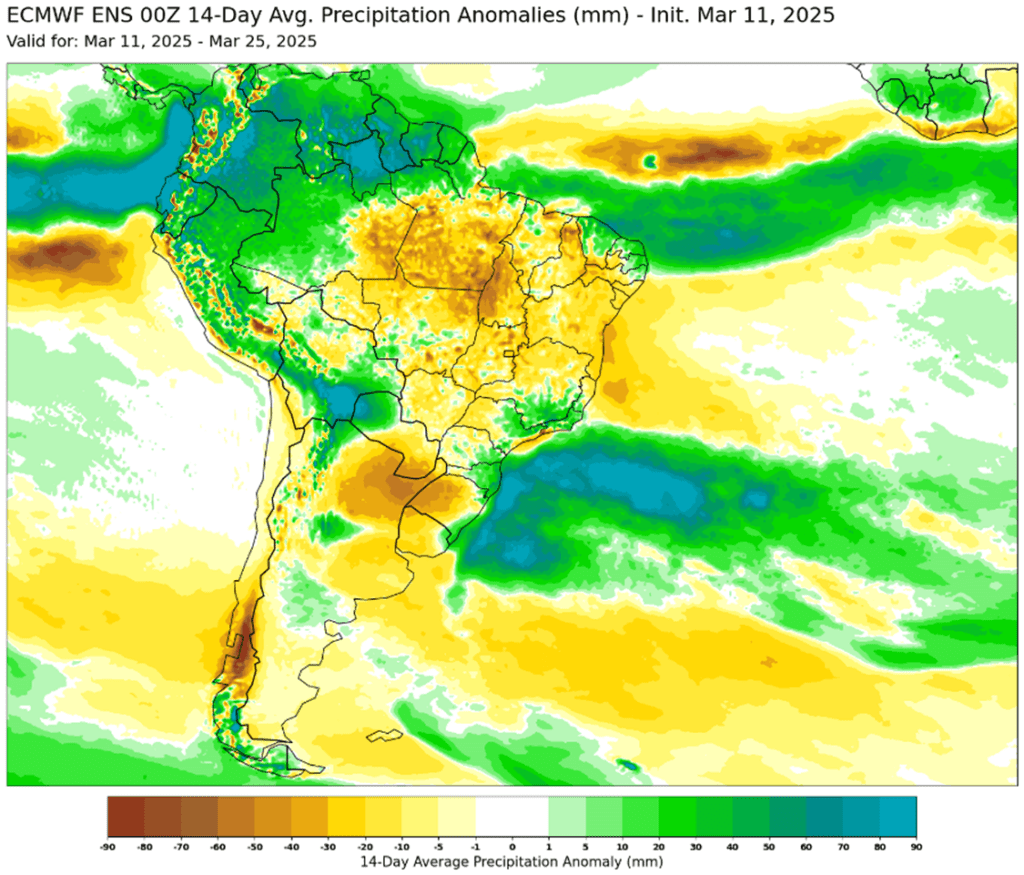

- To see the updated U.S. 0-40 cm Soil Moisture Percentile as well as the 30-day percent of normal rainfall map and the 14-day precipitation outlook for South America, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Enter(Buy) DEC ’25 Puts:

420 @ ~ 21c

2026

No New Action

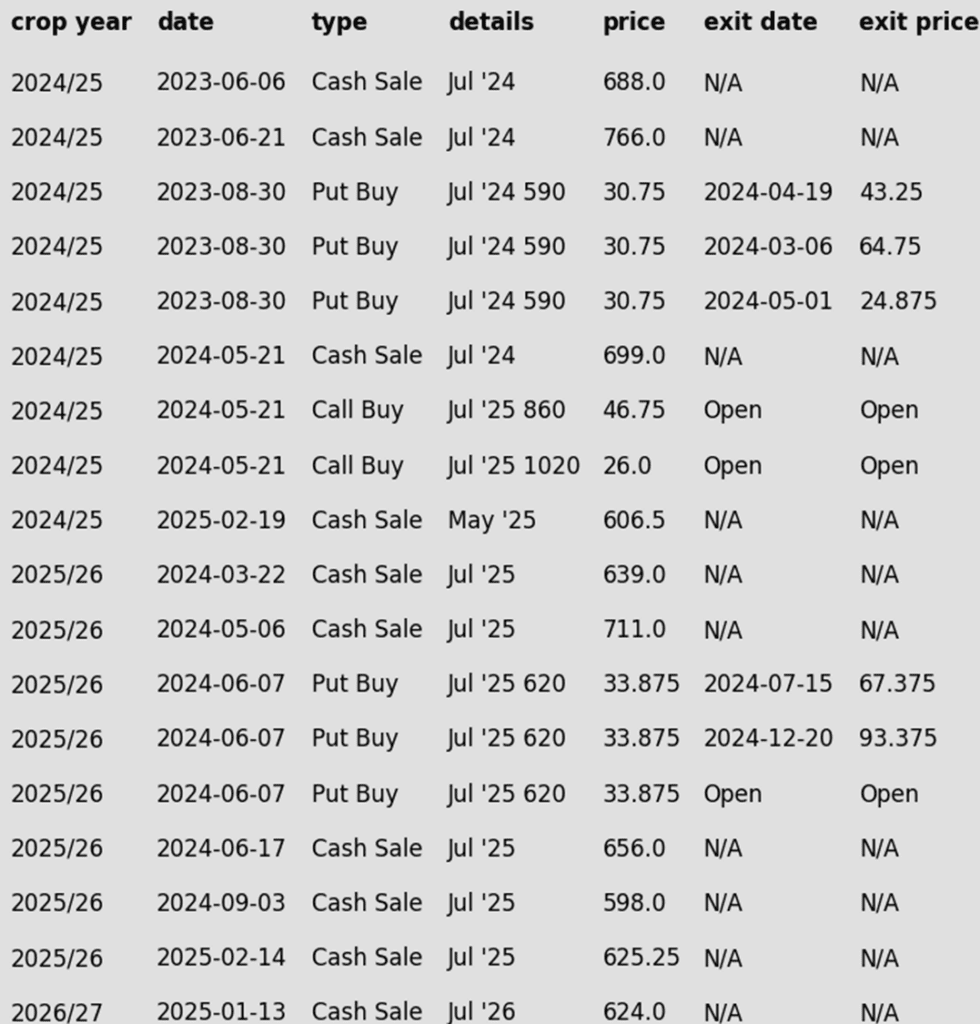

2024 Crop:

- No Official Targets: There have been three official sales recommendations year-to-date, and currently there’s no active target for a fourth sale.

- Catch-Up Zone: If you haven’t made three sales for 2025 yet, the suggested zone is 480–490 vs. May to catch-up. At today’s high, May got within about three cents of the lower end of this range.

- Hold Steady: If you’ve followed all three prior recommendations for 2025, Grain Market Insider advises to sit tight for now.

2025 Crop:

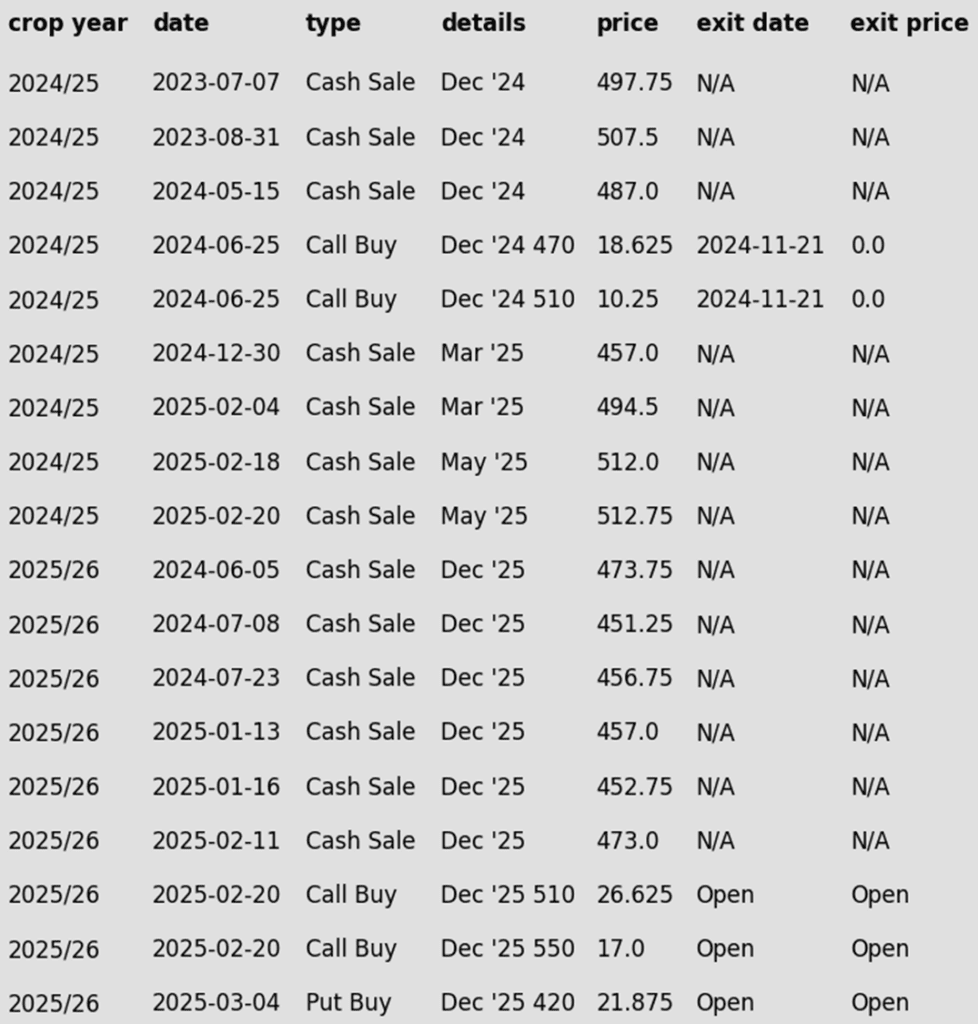

- CONTINUED OPPORTUNITY: Grain Market Insider recommends buying December ‘25 420 corn puts for approximately 21 cents, plus commission and fees.

- Downside Protection: Put options serve as a valuable hedging tool, protecting against further downside price erosion on bushels that cannot be forward sold before harvest. Combined with the existing call options, this creates a Strangle strategy — a common approach when a significant price move is expected, but the direction remains uncertain.

- No Official Targets: There have also been three official sales recommendations year-to-date for the 2025 new crop corn, and currently there’s no active target for a fourth sale.

- Catch-Up Zone: If you haven’t made three sales since January 1 yet, the suggested zone is 462–473 vs. December to catch-up. At today’s high December got within about four cents of the lower end of this range.

- Hold Steady: If you’ve followed all three prior sales recommendations since January 1, Grain Market Insider advises to sit tight for now.

2026 Crop:

- Active Window: The first 2026 upside targets could post at any time — stay tuned for updates!

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures retreated from early session highs as the USDA made no adjustments to the supply and demand balance sheets in the March WASDE report. Continued selling pressure in the equity markets further limited gains in the corn market on Tuesday.

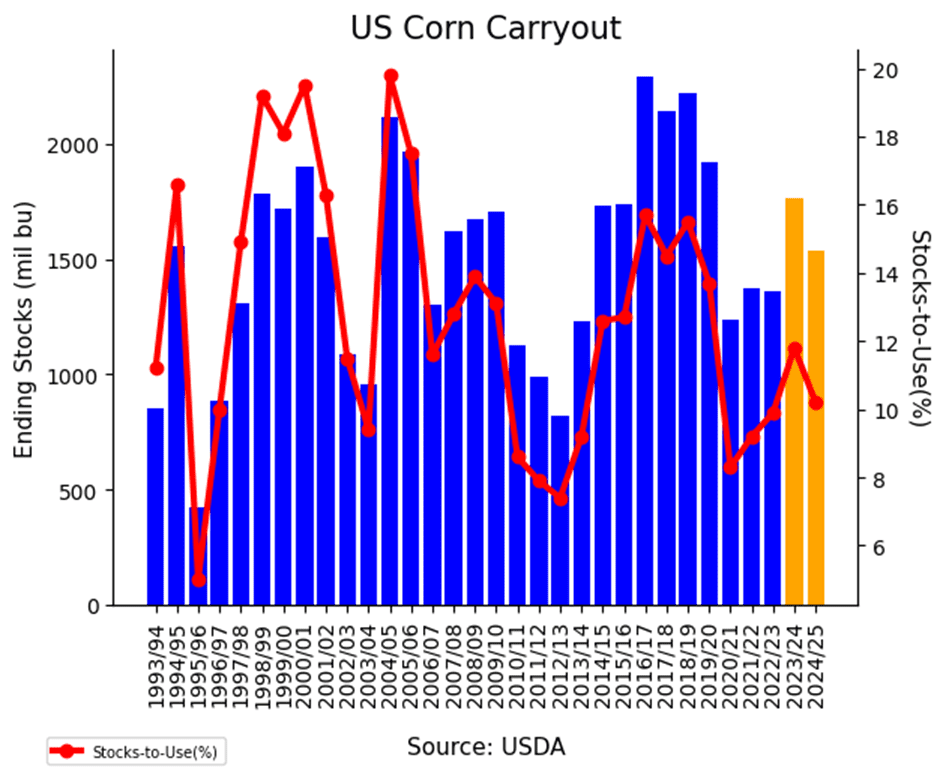

- The USDA’s March WASDE report, released Tuesday morning, kept all components of the corn supply and demand balance sheet unchanged from February, leaving carryover at 1.540 billion bushels. Market analysts had anticipated a slight reduction to 1.516 billion bushels, and the lack of revisions kept upside momentum in check.

- In the export market, U.S. corn remains highly competitive for importers through June. However, as South American supplies enter the market, increased competition is expected to weigh on bids.

- A sharp sell-off in equity markets may be contributing to a broader “risk-off” sentiment, as growing economic recession concerns limit capital flows into commodity markets.

- The U.S. Dollar Index remains under pressure, trading at its lowest level since October 2024. A weaker dollar relative to other currencies should help support U.S. commodity purchases on the global market.

Corn Finds Support Near 450

After hitting 16-month highs in late February, corn prices pulled back sharply to test the 100-day moving average and trendline support near 450. This rebound suggests a potential short-term low that can be built off as we head towards spring. Initial resistance is expected near the 50-day moving average, while key support remains at 450, with stronger support at the 200-day moving average.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

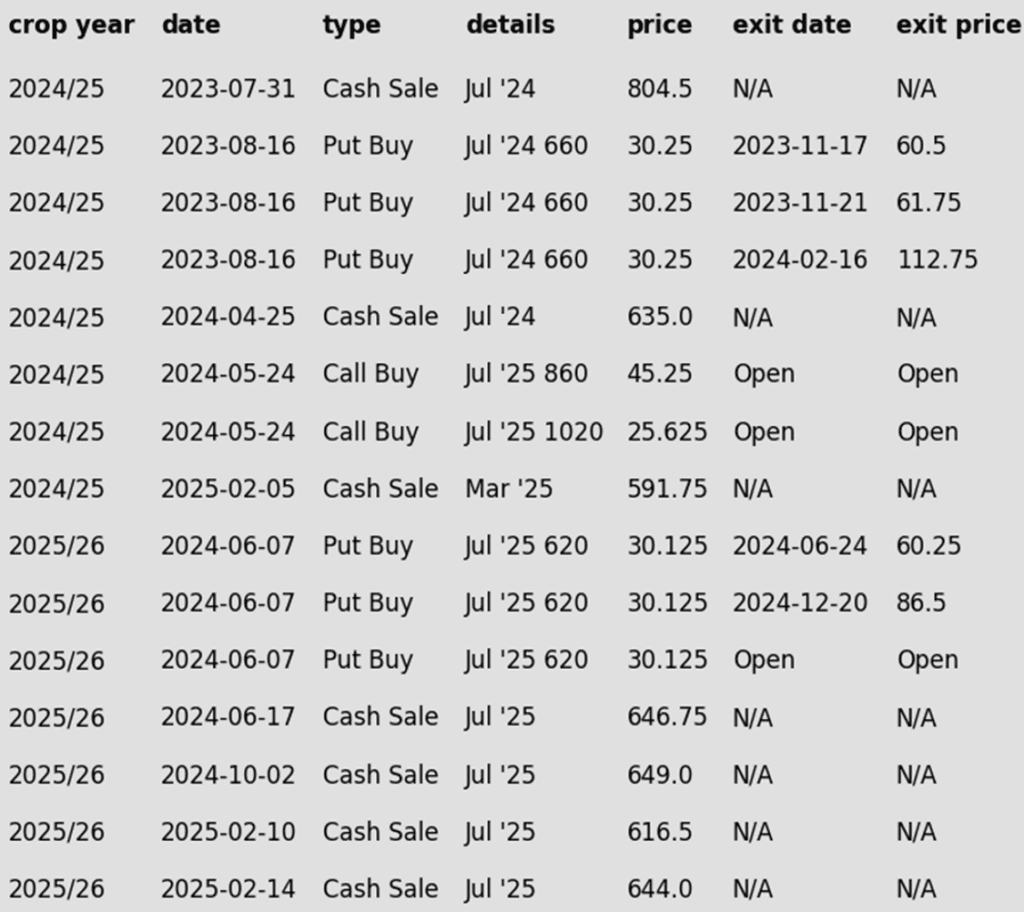

2024 Crop:

- New Highs: Given the early timing and soybeans’ tendency to post later seasonal highs than corn, Grain Market Insider is currently leaning toward a price target above the February high of 1079.75 for the next sale recommendation.

- Catch-up Zone: There have been three official sales recs on 2024 soybeans year-to-date.

- If you haven’t made three sales since January 1, target 1056–1076 to catch up.

- If you’re in line with the three sales recommendations, the advice is still to sit tight for now.

- Call Strategy Target: February’s close reinforces 1079.75 as a key resistance level. If the May contract stages a strong reversal and closes above 1079.75, Grain Market Insider would recommend a call option strategy to re-own previous sales recommendations.

2025 Crop:

- Guidance Unchanged: No new targets or recommendations to report.

- Call Option Target: The target to exit all the 1100 Nov ‘25 call options is approximately 88 cents in premium. If the 1100 calls can be exited for that price, it should cover the cost of the 1180 Nov ‘25 calls, providing a net-neutral cost position that can continue to protect the upside on previous sales recommendation.

2026 Crop:

- No Change: No initial recommendations or targets have been posted yet. The strategy may remain quiet for a while longer.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed lower after giving back earlier gains in response to a largely uneventful WASDE report. Soybean oil led the complex lower, extending losses from yesterday following China’s announcement of tariffs on Canadian canola products. Soybean meal also ended the session in negative territory.

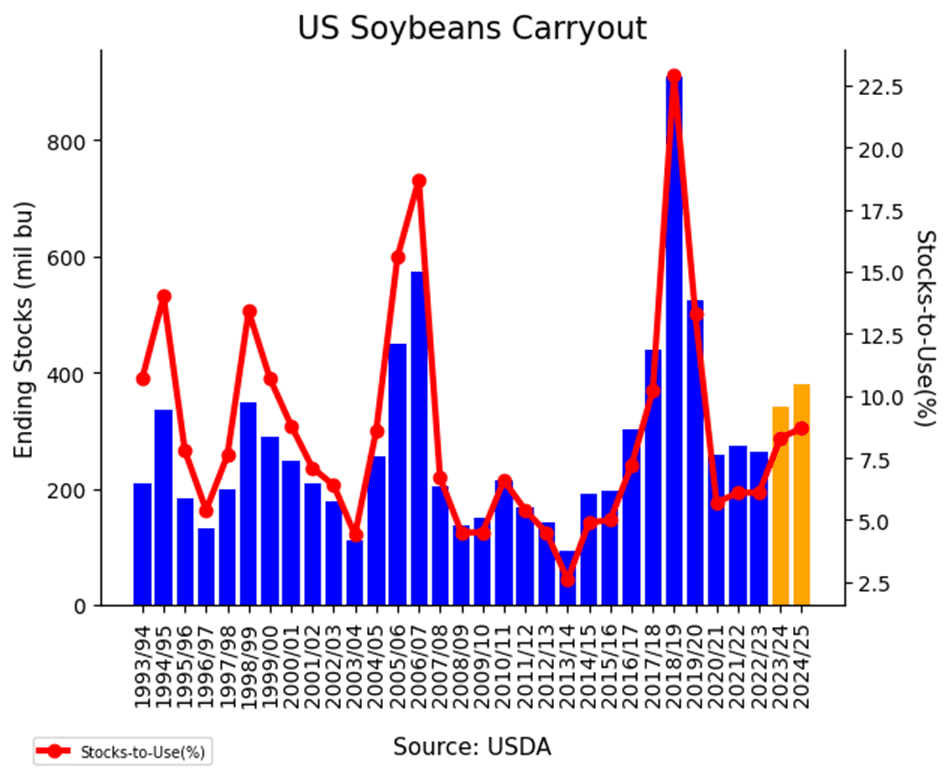

- Today’s WASDE report saw very few changes to soybeans with the U.S. ending stocks number unchanged from last month at 380 mb, but world stockpiles were reduced to 121.4 mmt from 124.3 mmt from February. Brazilian soybean production was left unchanged at 169.0 mmt and Argentina’s production was also unchanged at 49.0 mmt.

- China’s decision to impose 100% tariffs on Canadian canola meal, oil, and peas sent Canadian prices tumbling, with spillover pressure weighing on U.S. soybean markets. Ongoing uncertainty surrounding trade relations between the U.S., China, and Canada has also contributed to soybean price weakness.

- The Brazilian soybean harvest is reportedly 61% complete as of last Thursday which compares to 55% at this time last year which is impressive after the country’s late start to planting.

Soybeans Find Support Near 1000

Soybean futures tested the 200-day moving average in early 2025, a key resistance level that has capped gains for 18 months. As March began, improved weather and harvest pressure in South America caused a sharp price decline. Support held around the 1000 level, with stronger support near 950. If prices continue to rebound, initial resistance is at 1030, with the 200-day moving average remaining a critical barrier.

Wheat

Market Notes: Wheat

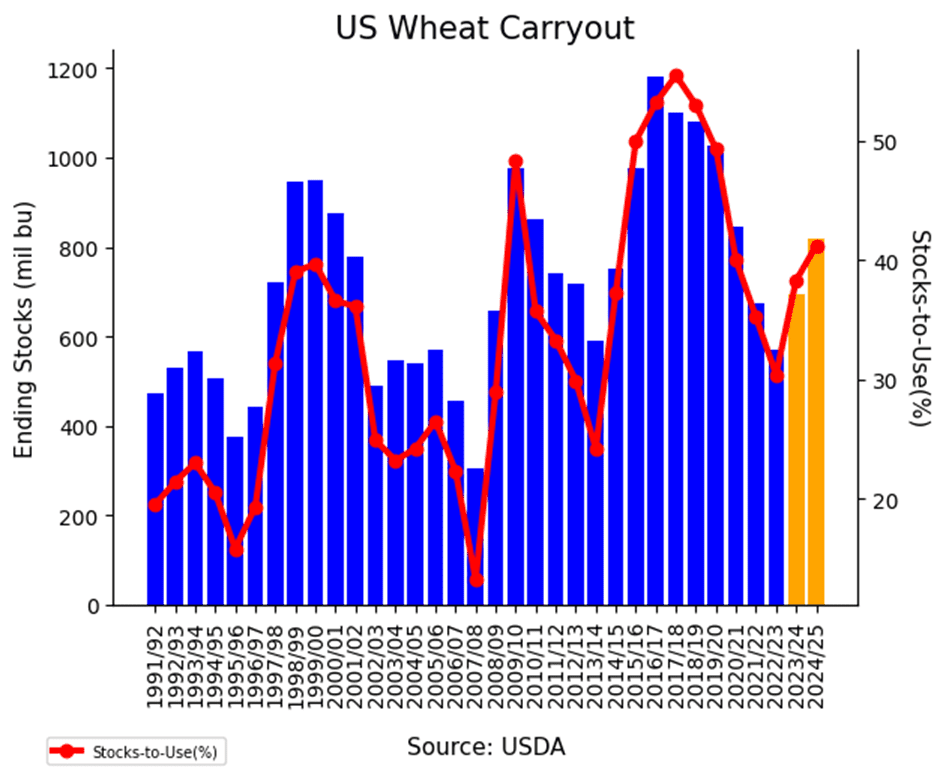

- All three wheat classes posted modest losses today, as the USDA report leaned bearish for the market. Higher global production estimates and a 1.5 mmt reduction in Chinese imports weighed on prices, while lower Matif wheat futures provided no support for U.S. markets.

- The USDA raised U.S. 24/25 wheat carryout from 794 mb to 819 mb, while global ending stocks increased from 257.6 mmt to 260.1 mmt — both above average trade estimates. Additionally, U.S. wheat exports were lowered from 850 mb to 835 mb.

- World wheat production was revised higher from 793.79 mmt to 797.23 mmt, with increases coming from Russia, Ukraine, Argentina, and Australia. Russian export projections declined slightly by 0.5 mmt to 45.0 mmt, while Ukrainian exports held steady at 15.5 mmt. Australian exports rose by 1.0 mmt to 26.0 mmt.

- Select states released crop condition data yesterday afternoon. Winter wheat ratings in Kansas fell 2% to 54% good to excellent, while in Texas they declined by 6% to 28%. Oklahoma, however, saw an increase of 11% to 46% GTE. Above average temperatures this week along with high winds in the central and southern plains could zap soil moisture, which may result in worsening conditions.

- In Argentina, wheat planting will begin in May. Recent heavy rains in main growing areas have led to favorable conditions which could benefit the 25/26 wheat harvest. In recent years, Argentina has dealt with drought, so this moisture will be beneficial.

- According to Coceral, their combined EU and UK 2025 grain harvest estimate has declined from 297.8 mmt to 296.1 mmt. For soft wheat specifically, their estimate was reduced from 140.4 mmt to 137.2 mmt. However, that would still be above the 2024 harvest at 125.1 mmt.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 701 vs May to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 701 level.

2025 Crop:

- Plan A: Target 714 vs July ‘25 to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 714 level.

2026 Crop:

- Plan A: Target 704 vs July ‘26 to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 704 level.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat’s Volatile Breakout and Retreat

Chicago wheat broke out of its prolonged sideways trend with a strong February rally, surging to key resistance at the early October highs just above 615. However, the late February peak proved to be a turning point, as futures retreated sharply, slipping back into the previous trading range that defined the end of 2024. Support has so far held near 540, the lower boundary of this range, while the 200-day moving average looms as a key resistance level near 570. A decisive weekly close above the 200-day could signal a potential trend reversal and renewed upside momentum.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 717 vs May to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 717 level.

2025 Crop:

- Plan A: Target 677 vs July ’25 to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 677 level.

2026 Crop:

- Hold: No first sales targets or recommendations are expected until the late May, early June window.

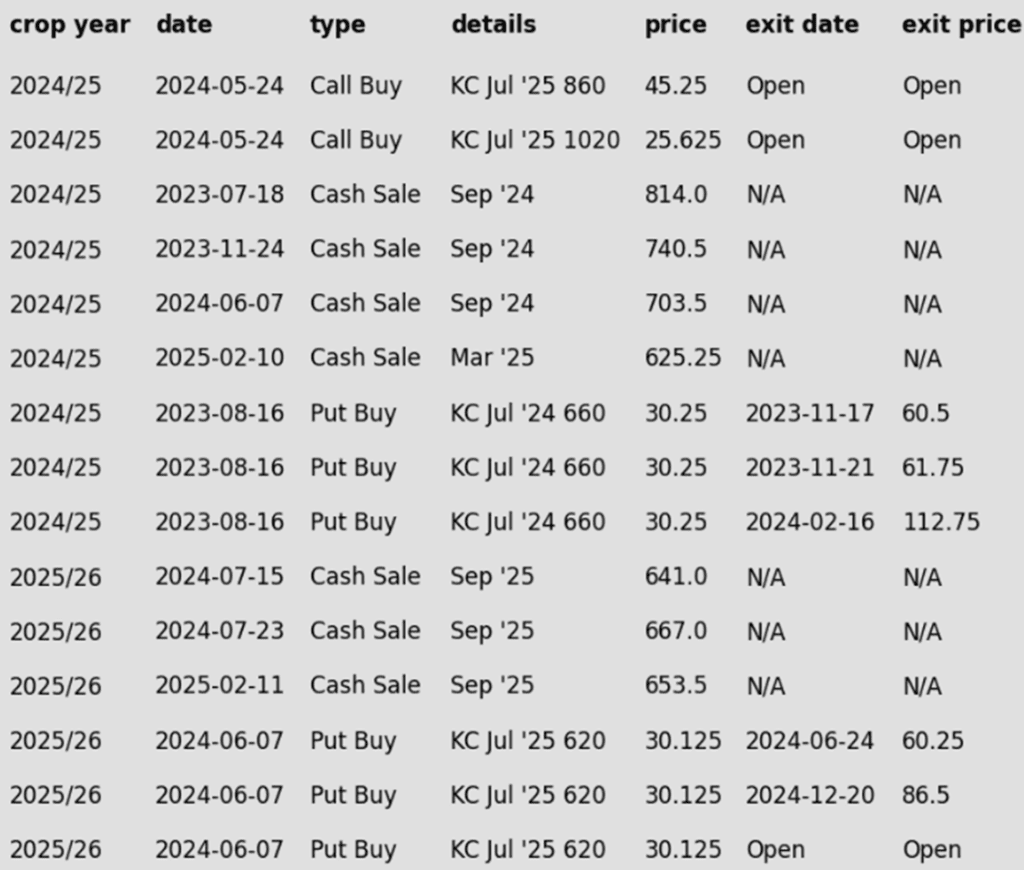

To date, Grain Market Insider has issued the following KC recommendations:

Kansas City Wheat Faces Key Technical Test

Kansas City wheat futures surged into February with strong bullish momentum, closing above the 200-day moving average and testing multi-month highs near 620. However, the rally lost steam in late February, leading to a sharp retreat back into the previous trading range. Support has held firm near 540, the lower boundary of this range, while the 200-day moving average is expected to serve as resistance on any attempted rebound. A decisive close above key resistance will be crucial for reigniting the uptrend as the market heads into spring.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 625 vs May to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 625 level.

2025 Crop:

- Plan A: Target 647.75 vs September to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 647.75 level.

2026 Crop:

- No Change: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Struggles to Hold Breakout

Spring wheat broke out of its prolonged sideways range in late January, sparking bullish momentum. A mid-February close above the 200-day moving average reinforced the breakout, but late February weakness erased those gains, dragging futures back below key moving averages. Looking ahead, the 200-day moving average is expected to act as resistance on any rebound, while previous lows near 580 should provide a key support level. A sustained move above resistance would be needed to reignite the uptrend.

Other Charts / Weather