3-10 End of Day: Wheat Higher, Beans Lower on Monday

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’25 | 472 | 2.75 |

| JUL ’25 | 478.5 | 2.75 |

| DEC ’25 | 455 | 0.75 |

| Soybeans | ||

| MAY ’25 | 1014 | -11 |

| JUL ’25 | 1028.25 | -10.5 |

| NOV ’25 | 1017.75 | -7.75 |

| Chicago Wheat | ||

| MAY ’25 | 562.5 | 11.25 |

| JUL ’25 | 577.25 | 11.75 |

| JUL ’26 | 637 | 10.5 |

| K.C. Wheat | ||

| MAY ’25 | 578.5 | 13.75 |

| JUL ’25 | 591.25 | 14 |

| JUL ’26 | 640.25 | 12.5 |

| Mpls Wheat | ||

| MAY ’25 | 604.5 | 11.75 |

| JUL ’25 | 618.25 | 12 |

| SEP ’25 | 629.25 | 11.75 |

| S&P 500 | ||

| JUN ’25 | 5656 | -173.75 |

| Crude Oil | ||

| MAY ’25 | 65.6 | -1.15 |

| Gold | ||

| JUN ’25 | 2921 | -21.9 |

Grain Market Highlights

- Corn: Started the week higher, with old crop contracts seeing the strongest gains. Strong export inspections and a flash sale to Japan reinforced the strong demand tone.

- Soybeans: Soybeans were lower on Monday, despite a flash sale to unknown destinations, ahead of tomorrow’s USDA report.

- Wheat: Posted double-digit gains to start the week, as early dryness concerns in the Southern Plains and technical buying fueled the move higher.

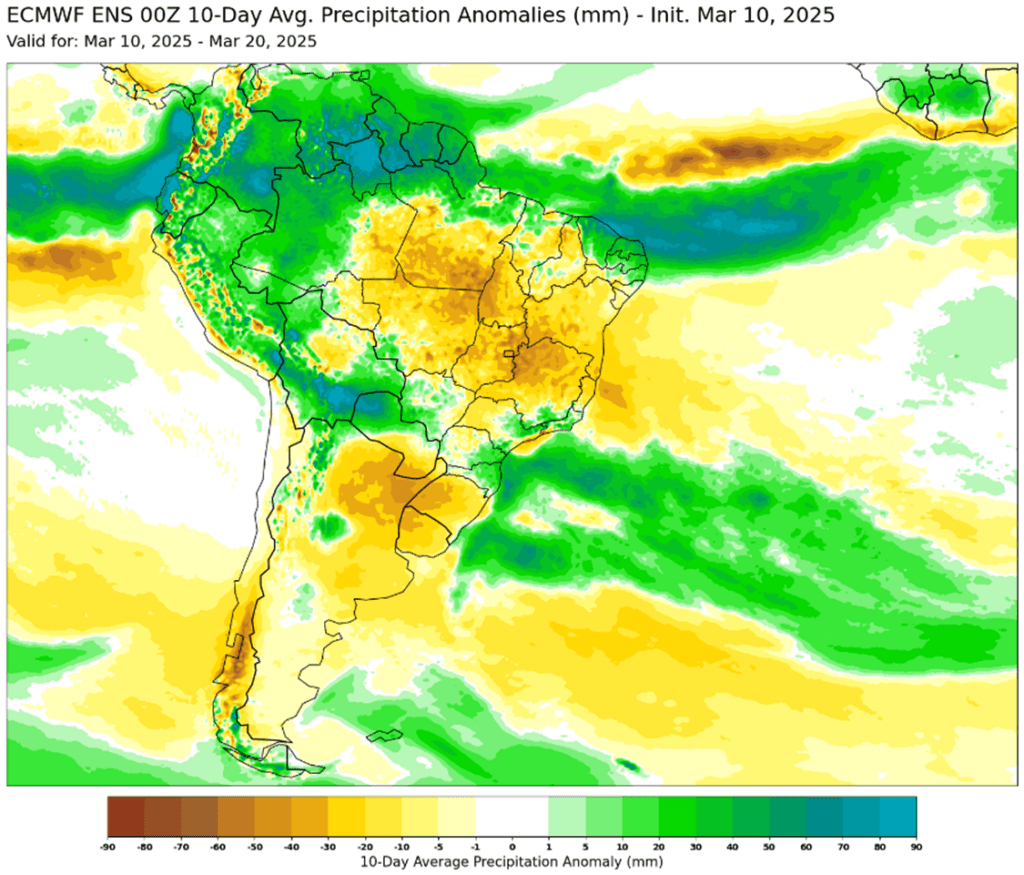

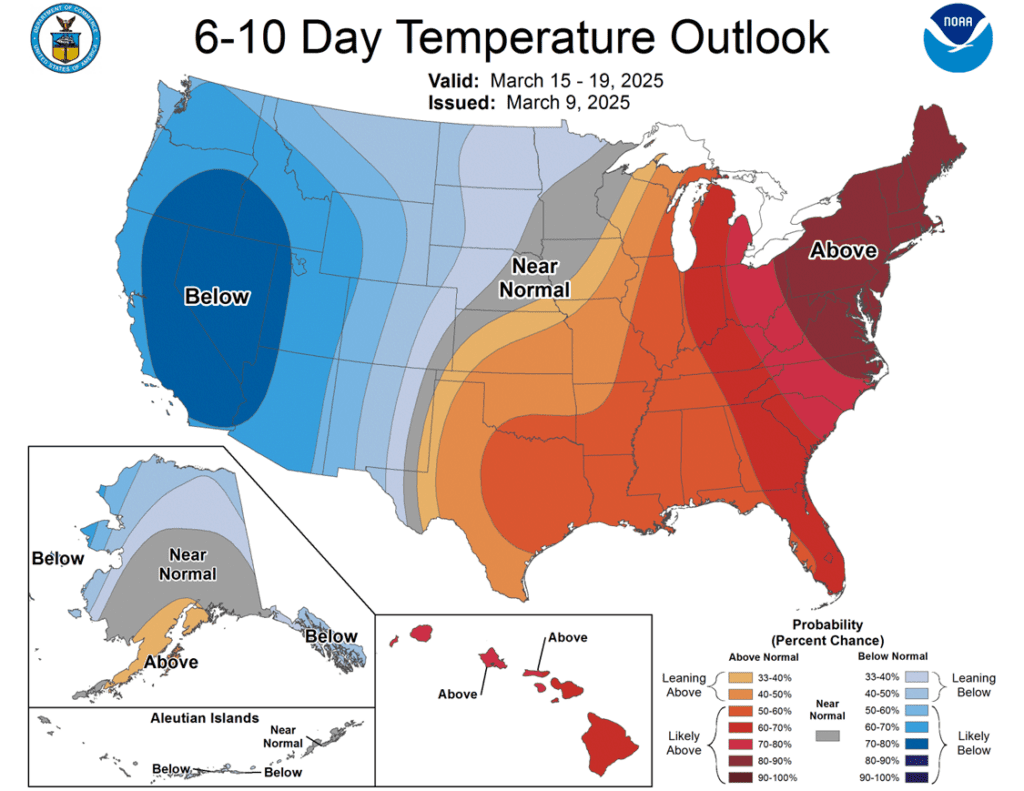

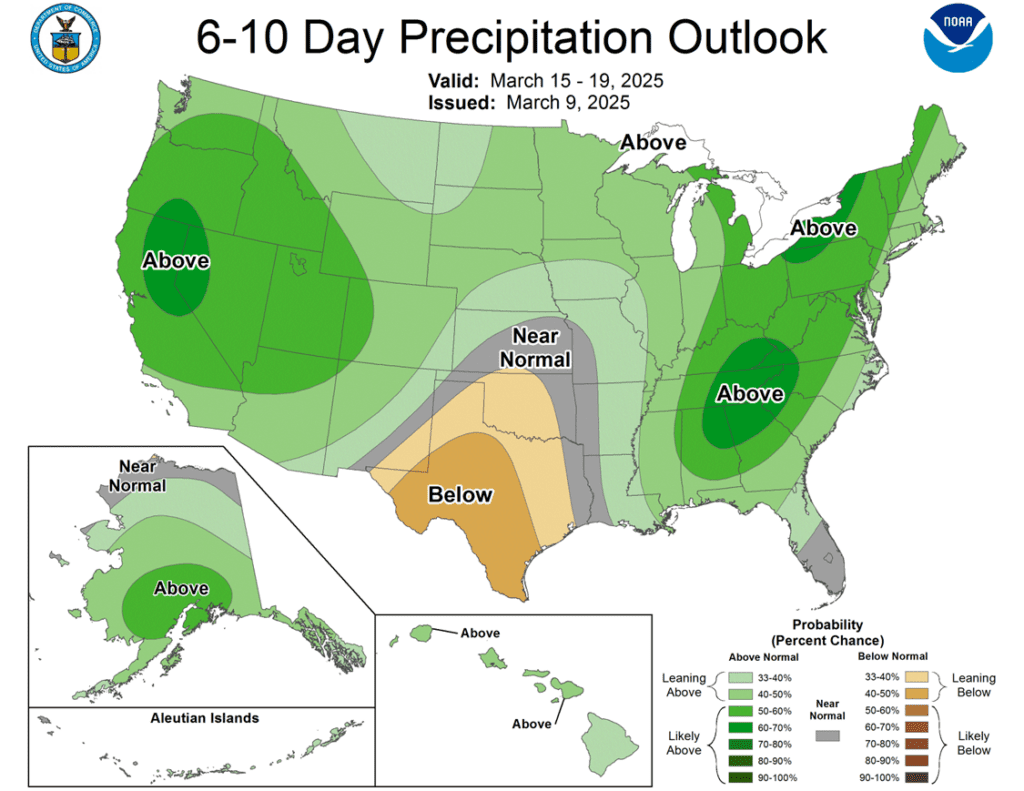

- To see the updated ECMWF 10-day precipitation forecast anomaly for South America and the 6–10-day precipitation and forecast outlook for the U.S., scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

Active

Enter(Buy) DEC ’25 Puts:

420 @ ~ 21c

2026

No New Action

2024 Crop:

- No Official Targets: There have been three official sales recommendations year-to-date, and currently there’s no active target for a fourth sale.

- Catch-Up Zone: If you haven’t made three sales for 2025 yet, the suggested zone is 480–490 vs. May to catch-up.

- Hold Steady: If you’ve followed all three prior recommendations for 2025, Grain Market Insider advises to sit tight for now.

2025 Crop:

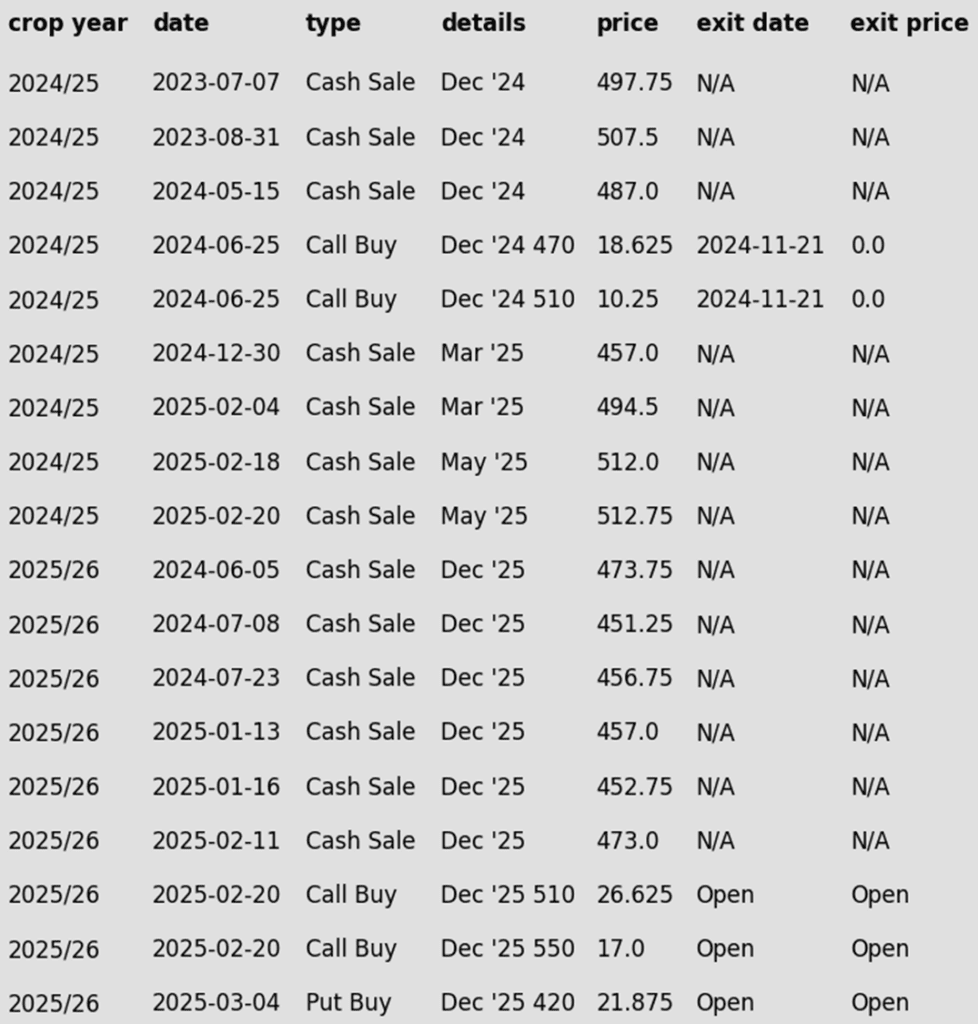

- CONTINUED OPPORTUNITY: Grain Market Insider recommends buying December ‘25 420 corn puts for approximately 21 cents, plus commission and fees.

- Downside Protection: Put options serve as a valuable hedging tool, protecting against further downside price erosion on bushels that cannot be forward sold before harvest. Combined with the existing call options, this creates a Strangle strategy — a common approach when a significant price move is expected, but the direction remains uncertain.

- No Official Targets: There have also been three official sales recommendations year-to-date for the 2025 new crop corn, and currently there’s no active target for a fourth sale.

- Catch-Up Zone: If you haven’t made three sales since January 1 yet, the suggested zone is 462–473 vs. December to catch-up. At today’s high December got within about five cents of the lower end of this range.

- Hold Steady: If you’ve followed all three prior sales recommendations since January 1, Grain Market Insider advises to sit tight for now.

2026 Crop:

- Active Window: The first 2026 upside targets could post at any time — stay tuned for updates!

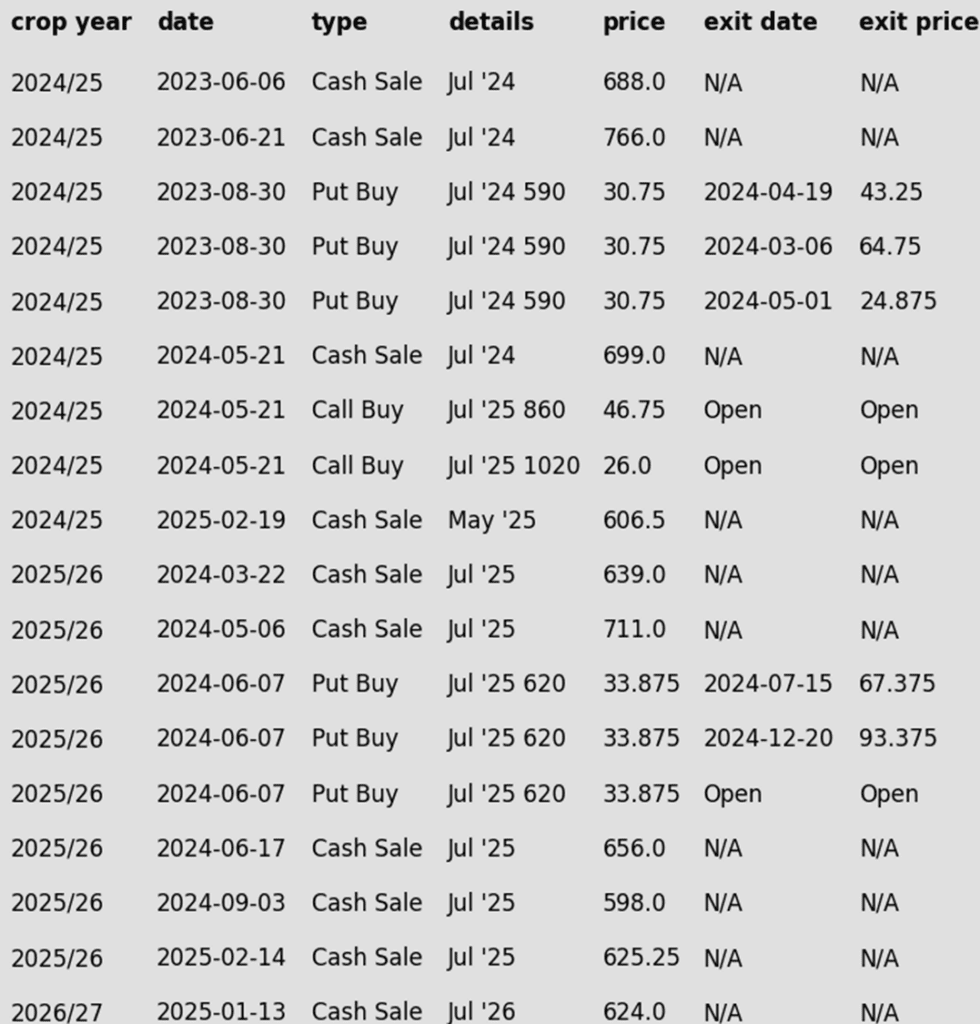

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures finished slightly higher, supported by strong demand and buying in the wheat market. The front end of the market saw the most active buying, lifting deferred futures.

- Weekly corn export inspections were strong at 1.820 MMT, exceeding the top end of expectations. Total corn inspections are trending 33% higher than last year and remain ahead of the pace needed to reach the USDA export target.

- The USDA announced a flash sale of corn on Monday morning. Japan stepped into the export market and purchased 126,000 MT (5.0 mb) of corn for the current marketing year.

- Second crop corn planting in central and southern Brazil is on pace. Ag consulting group AgRural estimates corn planting in those key regions to be 92% complete, only 1% behind last year’s pace.

- Brazil weather conditions for development of the second crop corn will be a major focus in the market. Mato Grasso, Brazil’s largest corn producing province is see very good weather conditions, but area wet and south of Mato Grasso are concerned as forecasts remain warm and dry for that region.

Corn Finds Support Near 450

After hitting 16-month highs in late February, corn prices pulled back sharply to test the 100-day moving average and trendline support near 450. This rebound suggests a potential short-term low that can be built off as we head towards spring. Initial resistance is expected near the 50-day moving average, while key support remains at 450, with stronger support at the 200-day moving average.

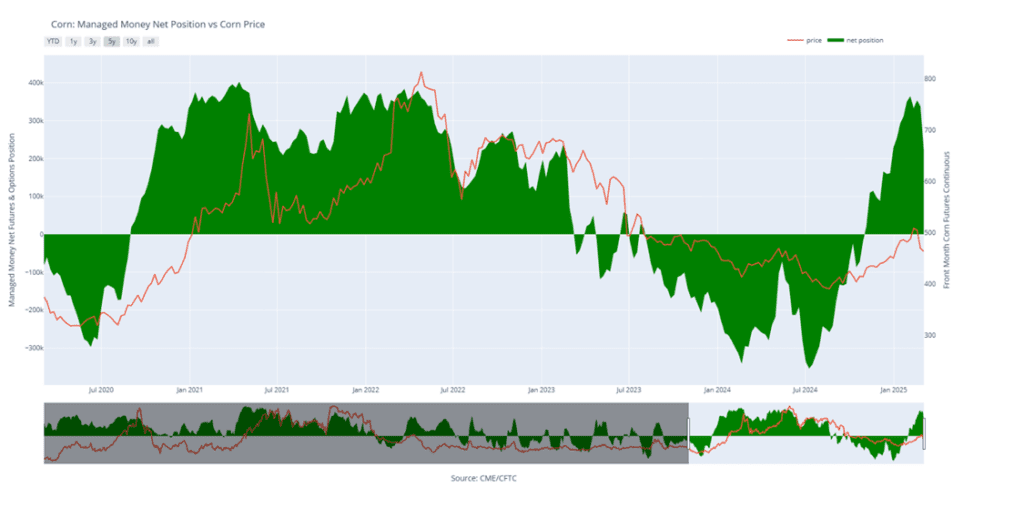

Corn Managed Money Funds net position as of Tuesday, March 4. Net position in Green versus price in Red. Money Managers net sold 117,702 contracts between February 25 – March 4, bringing their total position to a net long 219,752 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- New Highs: Given the early timing and soybeans’ tendency to post later seasonal highs than corn, Grain Market Insider is currently leaning toward a price target above the February high of 1079.75 for the next sale recommendation.

- Catch-up Zone: There have been three official sales recs on 2024 soybeans year-to-date.

- If you haven’t made three sales since January 1, target 1056–1076 to catch up.

- If you’re in line with the three sales recommendations, the advice is still to sit tight for now.

- Call Strategy Target: February’s close reinforces 1079.75 as a key resistance level. If the May contract stages a strong reversal and closes above 1079.75, Grain Market Insider would recommend a call option strategy to re-own previous sales recommendations.

2025 Crop:

- Guidance Unchanged: No new targets or recommendations to report.

- Call Option Target: The target to exit all the 1100 Nov ‘25 call options is approximately 88 cents in premium. If the 1100 calls can be exited for that price, it should cover the cost of the 1180 Nov ‘25 calls, providing a net-neutral cost position that can continue to protect the upside on previous sales recommendation.

2026 Crop:

- No Change: No initial recommendations or targets have been posted yet. The strategy may remain quiet for a while longer.

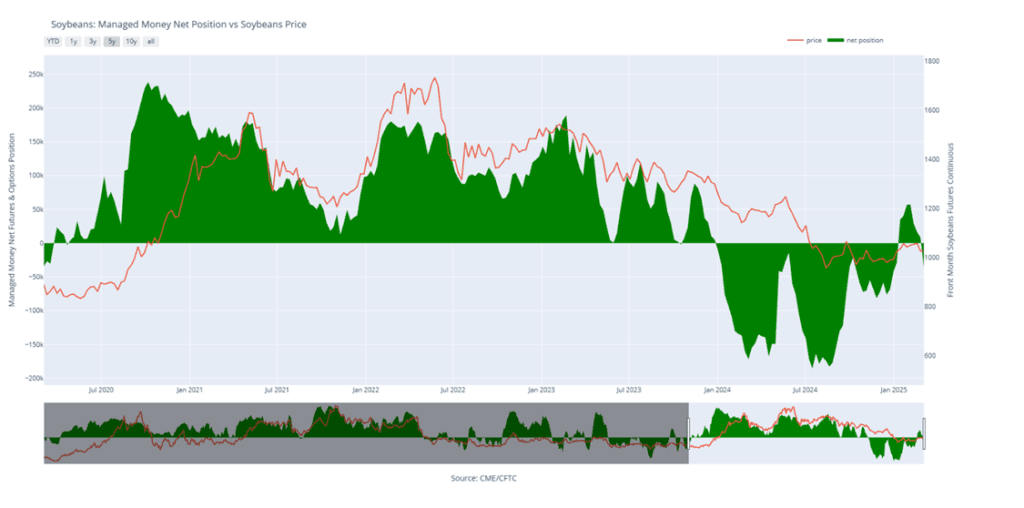

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower with pressure from both soybean meal and oil after a Chinese decision was announced to place tariffs on Canadian canola products. A slow export pace and large Brazilian crop continue to bring prices lower in a downward trending market over the past month. The USDA reported a sale of 195,000 tons of soybeans to unknown destinations for 24/25.

- Over the weekend, China announced that they would place 100% tariffs on Canadian canola meal, oil, and peas. This caused Canadian prices to tumble and had a spillover effect into the US market. General uncertainty over tariffs between the US, China, and Canada have also lent to the recent weakness in soybeans.

- The USDA will release its WASDE report tomorrow at 11 a.m., but few changes are expected. Ending stocks for 24/25 soybeans are expected to remain unchanged at 380 mb, as any declines in export demand are likely to be offset by increased crush demand.

- Today’s export inspections report saw soybean inspections totaling 31 mb for the week ending March 6. This was towards the higher end of trade estimates and was above last week. Total inspections are now up 10% from last year.

- Friday’s CFTC report saw funds as sellers of soybeans by 43,696 contracts leaving them with a new net short position of 35,487 contracts. They sold 33,383 contracts of bean oil and 22,151 contracts of bean meal.

Soybeans Find Support Near 1000

Soybean futures tested the 200-day moving average in early 2025, a key resistance level that has capped gains for 18 months. As March began, improved weather and harvest pressure in South America caused a sharp price decline. Support held around the 1000 level, with stronger support near 950. If prices continue to rebound, initial resistance is at 1030, with the 200-day moving average remaining a critical barrier.

Soybean Managed Money Funds net position as of Tuesday, March 4. Net position in Green versus price in Red. Money Managers net sold 43,696 contracts between February 25 – March 4, bringing their total position to a net short 35,487 contracts.

Wheat

Market Notes: Wheat

- Wheat posted double-digit gains across all three classes, led by Kansas City. Paris milling wheat futures added support after opening slightly higher. Additionally, drier weather, record high temperatures, and heavy winds in the U.S. Southern Plains this week could negatively impact the winter wheat crop as it exits dormancy.

- Weekly wheat inspections reached 7.9 mb, bringing total 24/25 inspections to 582 mb, up 20% from last year. However, inspections are lagging the USDA’s projected pace, with total 24/25 exports estimated at 850 mb, an 18% increase from the previous year.

- According to IKAR, the Russian wheat export price declined last week by $1 to $247/mt. Additionally, SovEcon reported that Russia’s wheat exports last week totaled 310,000 mt, up from the 280,000 mt the week before. However, they are projecting March ’25 exports at 1.4-1.8 mmt which would be far below 4.8 mmt of exports in March ’24.

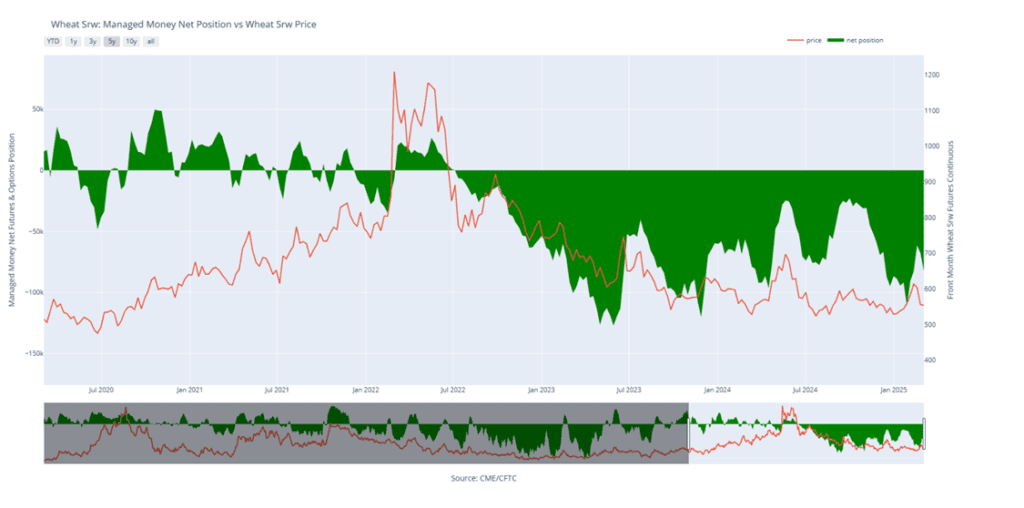

- Friday afternoon’s data from the CFTC indicated that managed funds added nearly 18,000 contracts to their net short position in Kansas City wheat between February 25 and March 4. This is about an 84% change for the week and brings their total net short in KC wheat to about 39,000 contracts. In Chicago wheat, they added just under 15,000 shorts in the same time period, for a total net short of just over 82,000 contracts.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 701 vs May to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 701 level.

2025 Crop:

- Plan A: Target 714 vs July ‘25 to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 714 level.

2026 Crop:

- Plan A: Target 704 vs July ‘26 to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 704 level.

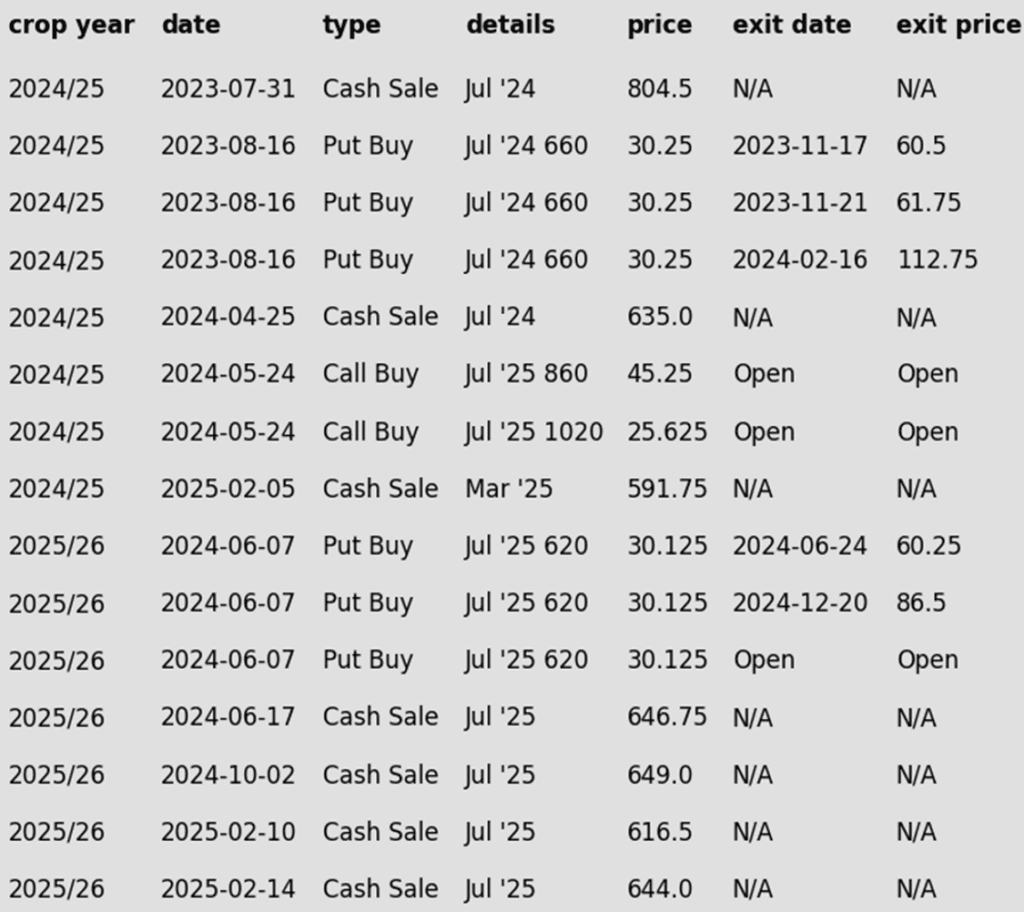

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Head Fake

Chicago wheat broke out of its prolonged sideways trend with a strong February rally, reaching key resistance at the early October highs just above 615. However, since the late February peak, wheat futures have retreated sharply, falling back into the previous trading range that marked the end of 2024. Support is expected near the lower boundary of this range around 540, while the 200-day moving average is likely to act as resistance on any attempted rebound.

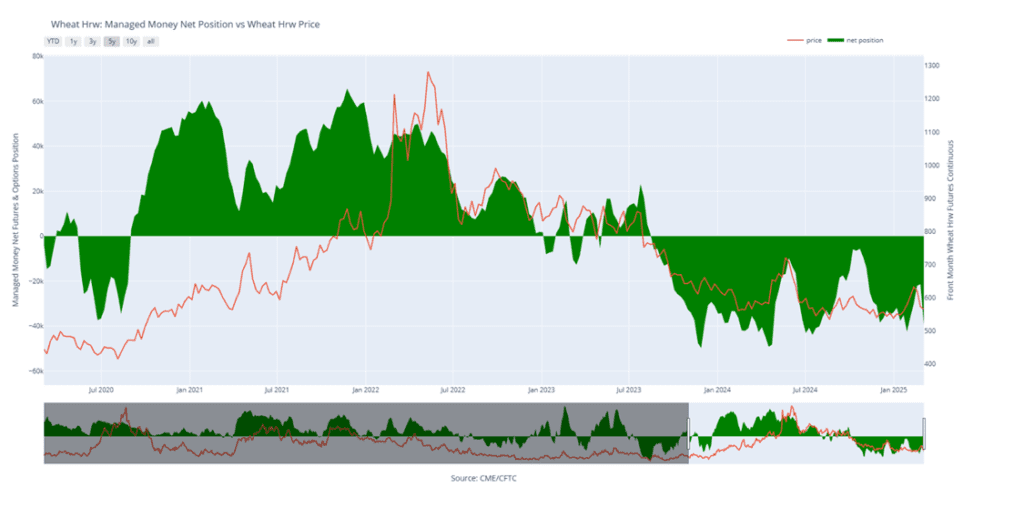

Chicago Wheat Managed Money Funds’ net position as of Tuesday, March 4. Net position in Green versus price in Red. Money Managers net sold 14,785 contracts between February 25 – March 4, bringing their total position to a net short 82,399 contracts.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 717 vs May to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 717 level.

2025 Crop:

- Plan A: Target 677 vs July ’25 to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 677 level.

2026 Crop:

- Hold: No first sales targets or recommendations are expected until the late May, early June window.

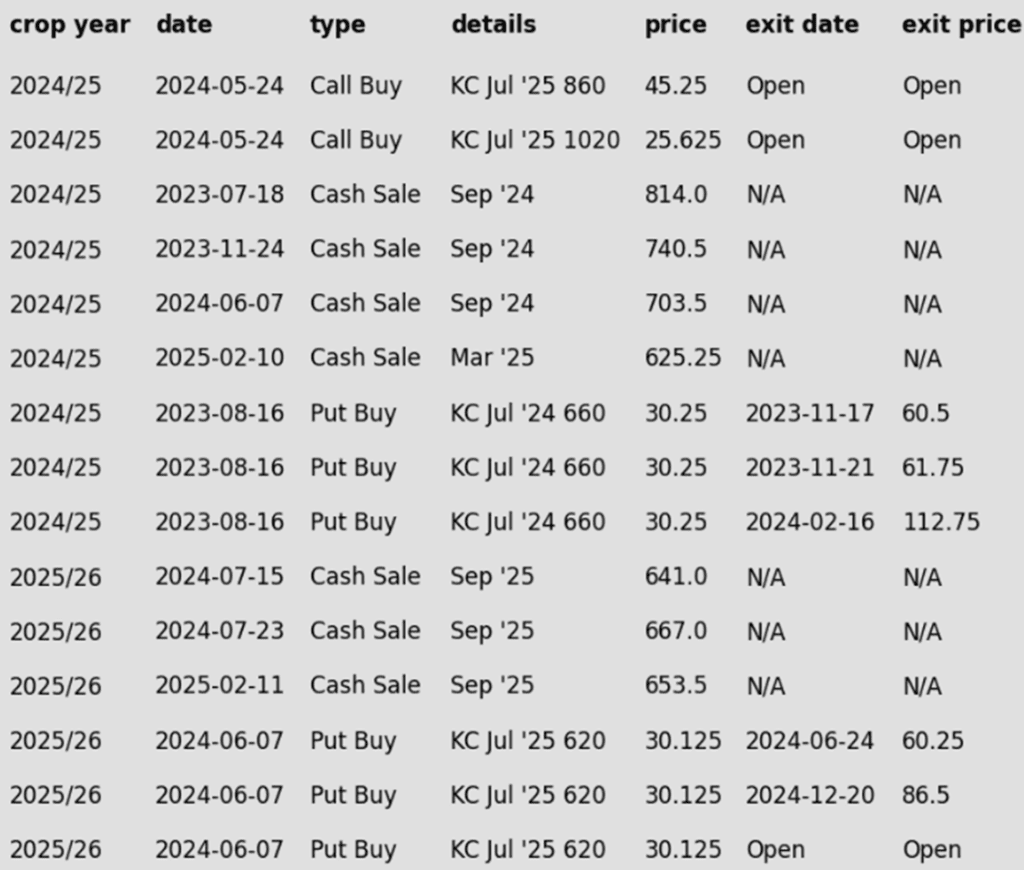

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Breaks Lower

Kansas City wheat futures surged into February with strong bullish momentum, closing above the 200-day moving average and testing multi-month highs near 620. However, since the late February peak, wheat futures have retreated sharply, falling back into the previous trading range. Support is expected near the lower boundary of this range around 540, while the 200-day moving average is likely to act as resistance on any attempted rally.

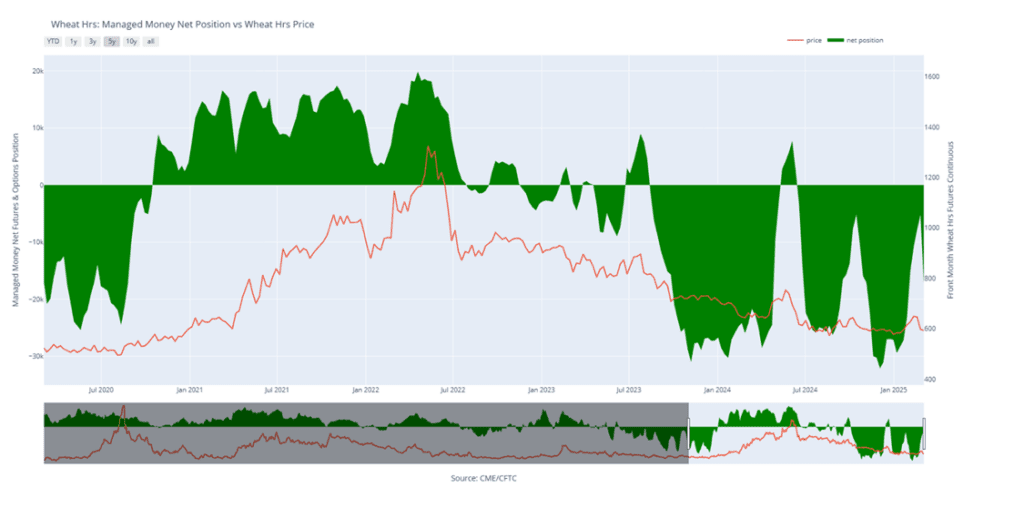

KC Wheat Managed Money Funds’ net position as of Tuesday, March 4. Net position in Green versus price in Red. Money Managers net sold 17,947 contracts between February 25 – March 4, bringing their total position to a net short 39,282 contracts.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Plan A: Target 625 vs May to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 625 level.

2025 Crop:

- Plan A: Target 647.75 vs September to make the next sale.

- Plan B: Just a heads-up — if the stars align, so to speak, across the market indicators that Grain Market Insider monitors, we might issue a sales recommendation prior to reaching that 647.75 level.

2026 Crop:

- No Change: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

February Whipsaw

Spring wheat broke out of its prolonged sideways range in late January, signaling bullish momentum. A mid-February close above the 200-day moving average reinforced the breakout, but late February weakness erased those gains, sending futures back below key moving averages. Moving forward, the 200-day MA is likely to serve as upside resistance, while previous lows near 580 should provide support.

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, March 4. Net position in Green versus price in Red. Money Managers net sold 11,983 contracts between February 25 – March 4, bringing their total position to a net short 17,192 contracts.

Other Charts / Weather