3-04 End of Day: Grain Markets Slide Amid Tariff Concerns and Trade Uncertainty

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAY ’25 | 451.5 | -4.75 |

| JUL ’25 | 459.25 | -4.5 |

| DEC ’25 | 446.75 | -4.5 |

| Soybeans | ||

| MAY ’25 | 999 | -12.5 |

| JUL ’25 | 1013.75 | -12 |

| NOV ’25 | 1003.5 | -15.25 |

| Chicago Wheat | ||

| MAY ’25 | 536.75 | -11 |

| JUL ’25 | 551.25 | -10 |

| JUL ’26 | 618.25 | -3 |

| K.C. Wheat | ||

| MAY ’25 | 548.5 | -13.5 |

| JUL ’25 | 563.25 | -12.75 |

| JUL ’26 | 620.5 | -6.75 |

| Mpls Wheat | ||

| MAY ’25 | 580 | -11.25 |

| JUL ’25 | 594.25 | -9.75 |

| SEP ’25 | 607.25 | -9.25 |

| S&P 500 | ||

| JUN ’25 | 5926.5 | 11 |

| Crude Oil | ||

| MAY ’25 | 67.94 | -0.12 |

| Gold | ||

| JUN ’25 | 2959.1 | 29.9 |

Grain Market Highlights

- Corn: Futures ended the day lower as tariff concerns and retaliatory measures weighed on the market. May corn futures are now testing key support near 450.

- Soybeans: Soybeans extended their losing streak to five consecutive sessions following President Trump’s confirmation that tariffs on Canada, Mexico, and China would proceed.

- Wheat: Wheat futures continued their downward trend today alongside corn and soybeans as concerns over tariffs and a potential trade war weighed on the market.

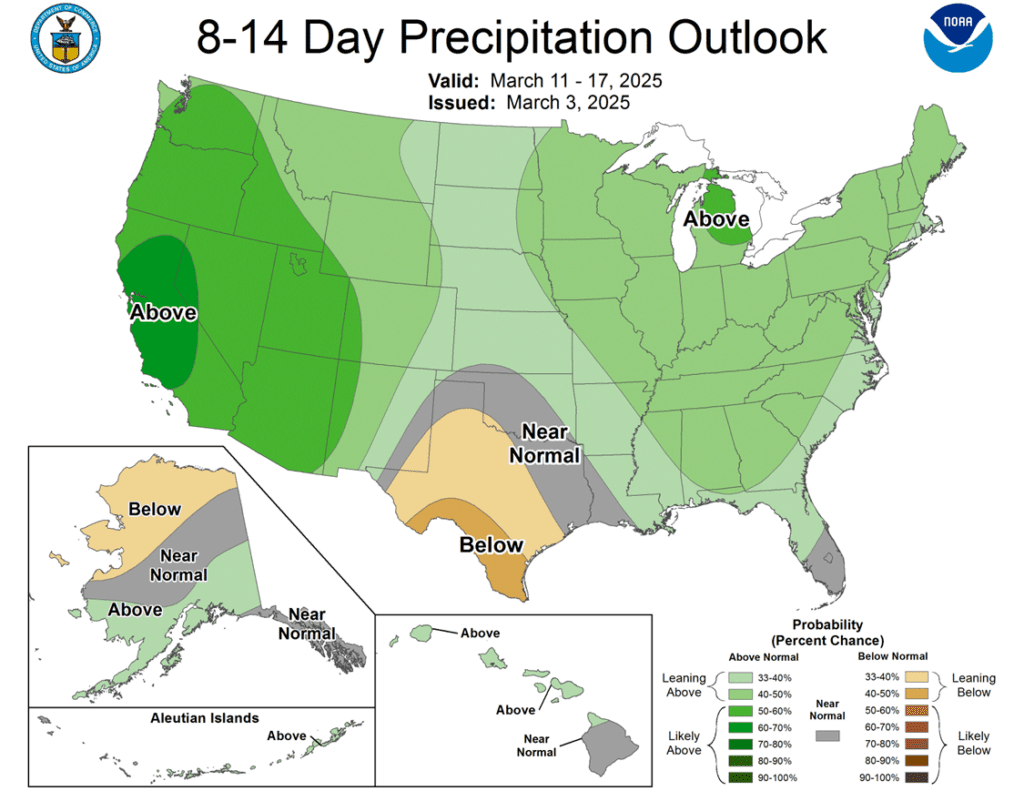

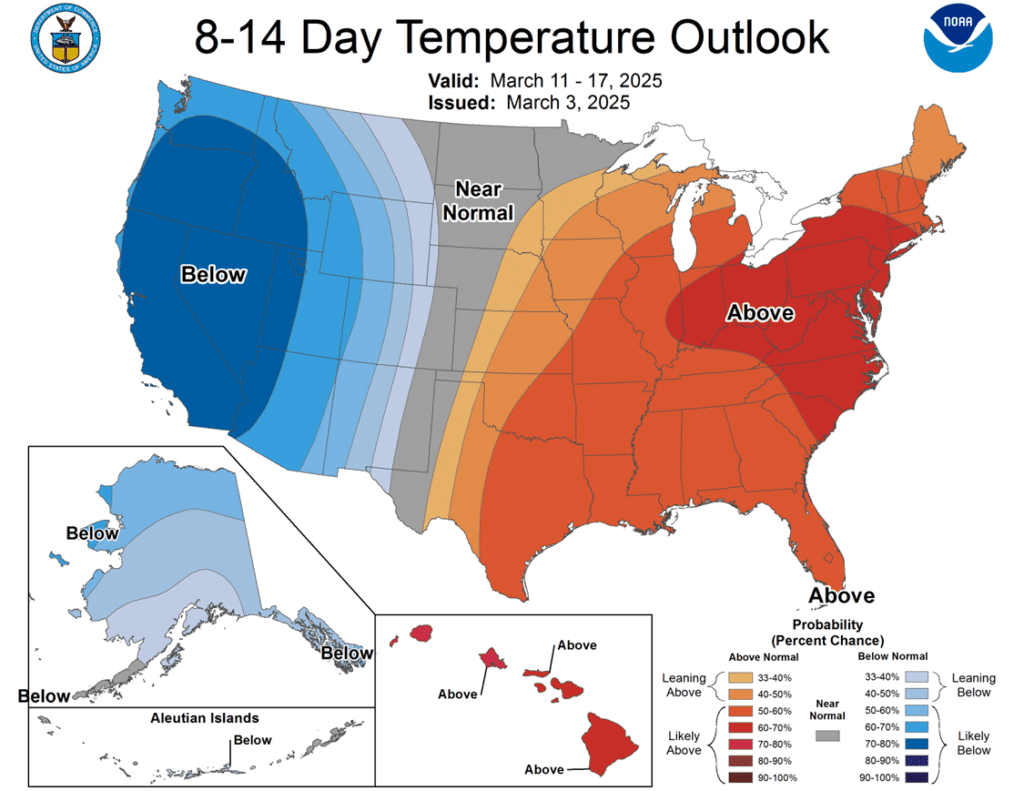

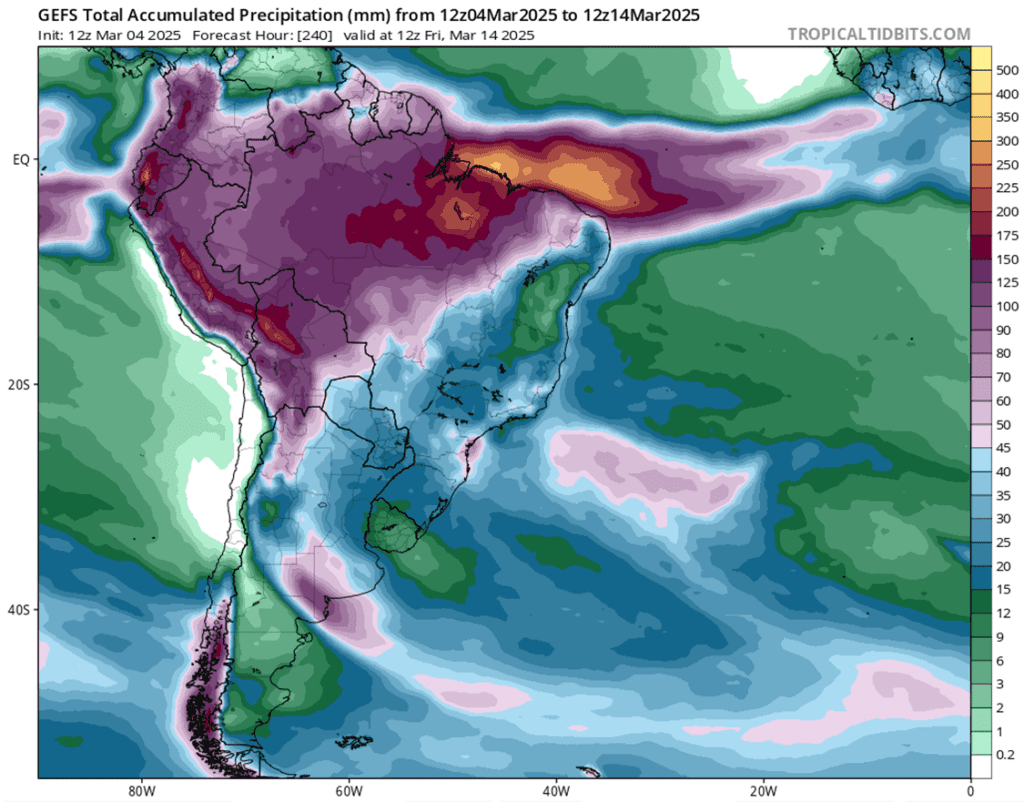

- To see the updated 8–14-day precipitation and temperature outlooks for the U.S. as well as the 10-day GEFS precipitation forecast for South America, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

New Alert

Enter(Buy) DEC ’25 Puts:

420 @ ~ 21c

2026

No New Action

2024 Crop:

- Unchanged Guidance: With the severity of this ongoing selloff and three February sales recommendations already in place, Grain Market Insider advises holding off on any additional old crop sales.

- Catch-Up Opportunities: If you missed some or all of the February sales recommendations, watch for a retracement to 480–490 — approximately a 50%-62% recovery from the drop between the February high of 518.75 and today’s low of 442.50.

2025 Crop:

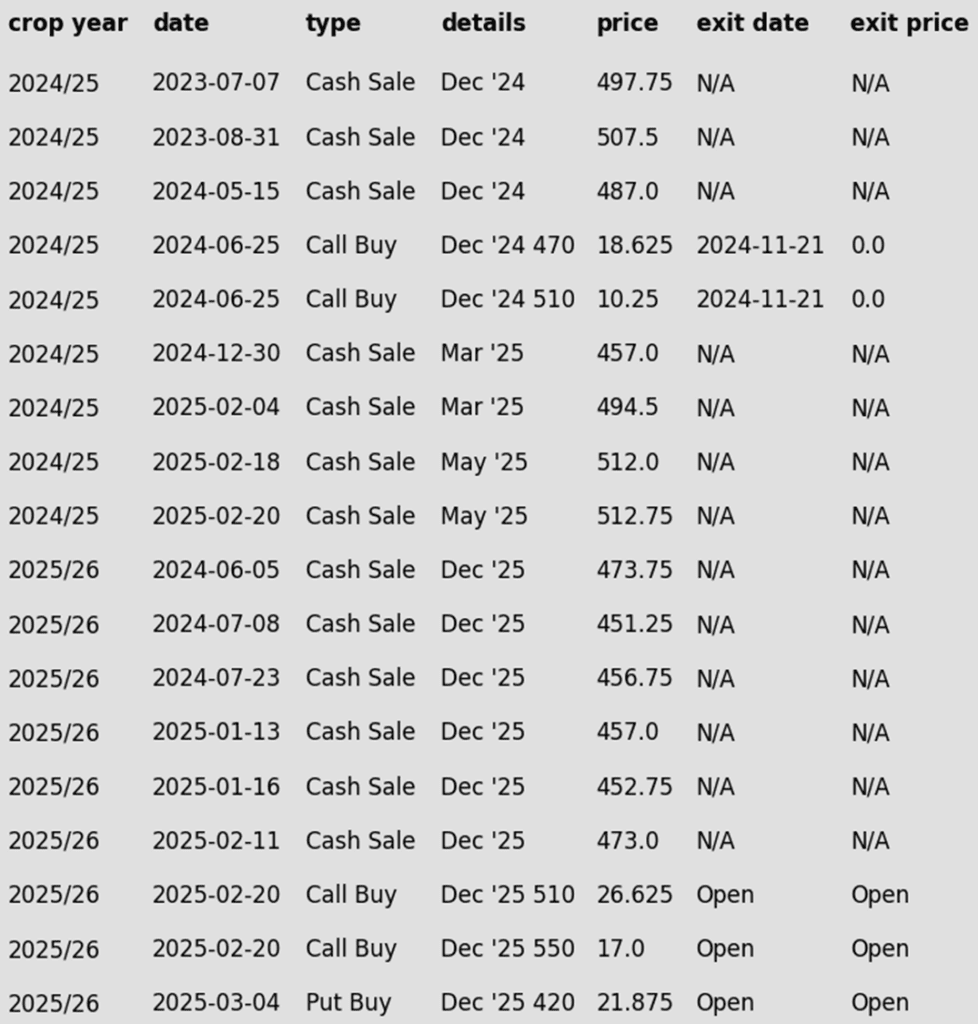

- NEW ACTION: Grain Market Insider recommends buying December ‘25 420 corn puts for approximately 21 cents, plus commission and fees. These options serve as a valuable hedging tool, protecting against further downside price erosion on bushels that cannot be forward sold before harvest. Combined with the existing call options, this creates a Strangle strategy — a common approach when a significant price move is expected, but the direction remains uncertain.

2026 Crop:

- Active Window: The first 2026 upside targets could post at any time — stay tuned for updates!

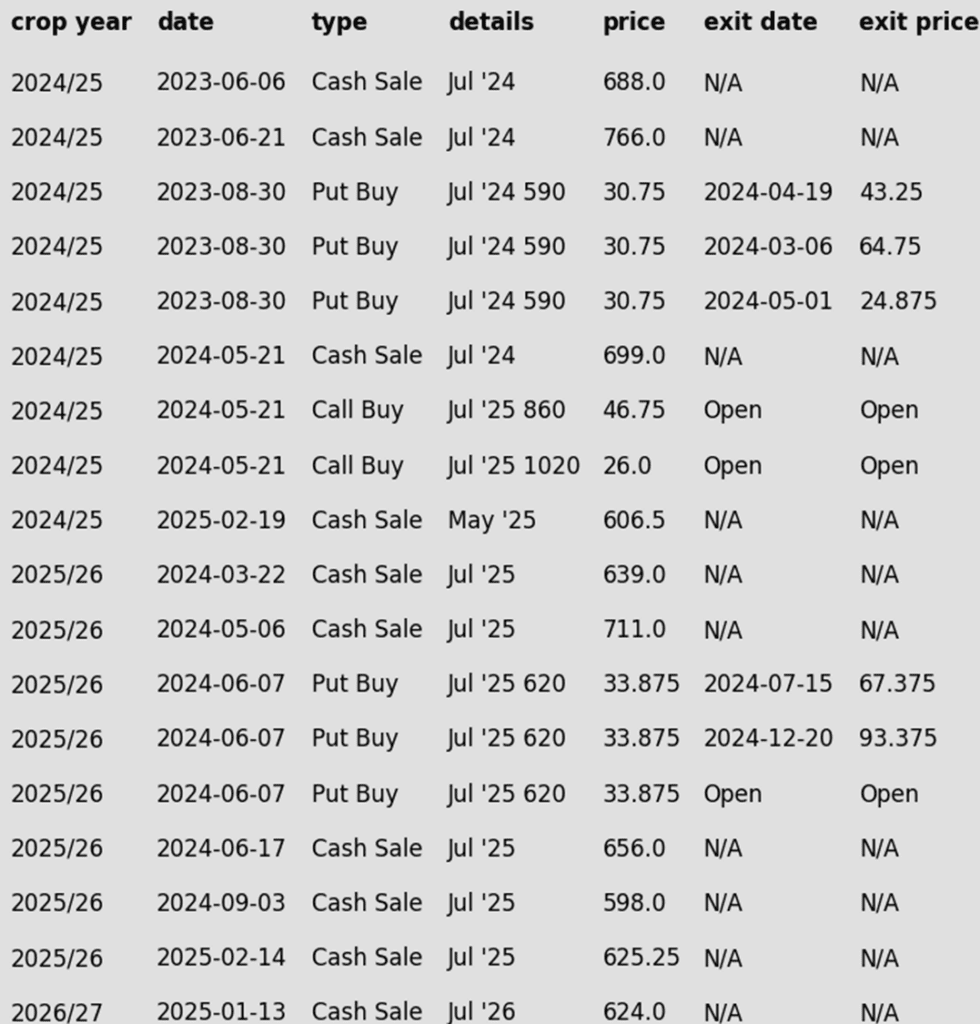

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures extended their decline as concerns over tariffs and retaliatory actions fueled additional long liquidation. May corn futures, at their session low, traded 76 cents below the most recent high from February 19.

- May futures are now testing key support at the 450 level — if this level fails to hold, the market could be vulnerable to a further drop toward the August low of 420, as sellers maintain control.

- U.S. tariffs of 25% for Canada and Mexico and an additional 10% tariff on Chinese goods were triggered last night as the potential for a trade war has increased. China countered with a 15% tariff on U.S. agriculture goods, including U.S. corn imports, and a 10% tariff on soybeans. In addition, China will stop receiving soybeans from three U.S. exporters. Mexico will announce a retaliatory plan on Sunday unless an agreement can be reached.

- The impact of tariffs could curb demand as U.S. goods become more expensive for affected countries. However, other markets not involved in the tariff dispute may benefit from lower U.S. prices, especially with the U.S. dollar trending downward.

- The market will be watching to see if demand picks up at these lower price levels. Demand has been the driver in the corn market, and old crop corn supplies remain tight until South American harvest later this spring into early summer.

Corn Rally Pauses

The corn market had been performing well in 2025, with steady demand keeping buyers engaged and driving prices to 16-month highs. Late in February, technical indicators reached overbought levels, and without new positive developments, prices began to pull back. Support for corn should hold near the 450 area. On the other hand, if buyers step back in, the next target would be 535, with more significant resistance at the spring 2023 lows near 550.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Unchanged Guidance: Two sales recommendations were issued in January at 1047.50 and 1056.00. With those already in place — and the market down in seven of the last eight trading days — today’s guidance remains the same: hold off on any additional sales for now.

- Call Strategy Target: February’s close reinforces 1079.75 as a key resistance level. If the May contract stages a strong reversal and closes above 1079.75, Grain Market Insider would recommend a call option strategy to re-own previous sales recommendations.

2025 Crop:

- Unchanged Guidance: Grain Market Insider issued its first 2025 crop sales recommendation on January 29 at 1063.50. For now, there are no new recommendations — current guidance is to hold steady.

- Call Option Target: The target to exit all the 1100 Nov ‘25 call options is approximately 88 cents in premium. If the 1100 calls can be exited for that price, it should cover the cost of the 1180 Nov ‘25 calls, providing a net-neutral cost position that can continue to protect the upside on previous sales recommendation.

2026 Crop:

- No Change: No initial recommendations or targets have been posted yet. The strategy may remain quiet for a while longer.

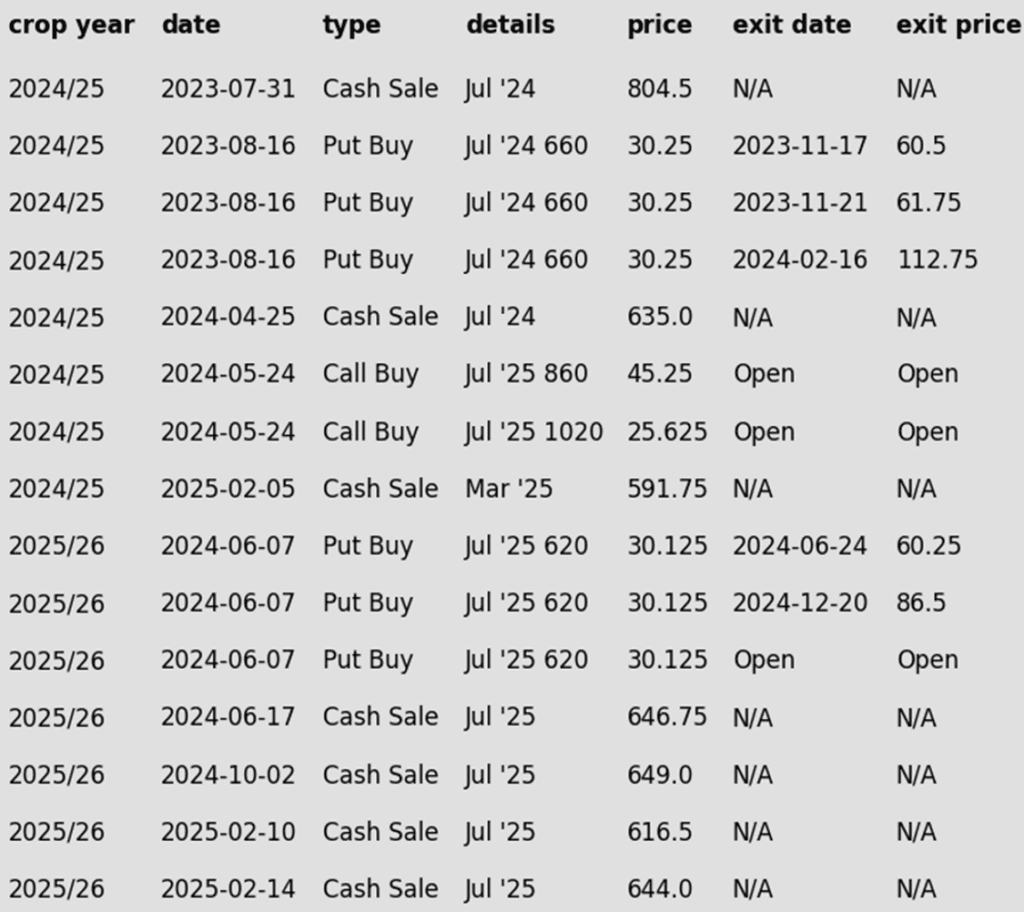

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower for the fifth consecutive day after President Trump announced that tariffs on Canada, Mexico, and China would indeed go through. Funds continued to sell across the ag complex today, bringing May soybean futures to close below $10.00. Both soybean meal and oil ended the day lower as well.

- In response to Trump’s announcement to double tariffs on Chinese goods to 20%, China stated it would halt soybean imports from three U.S. entities, suspend lumber imports, and impose a 15% tariff on other U.S. agricultural products.

- The USDA’s January soybean crush report showed 211.1 million bushels crushed, aligning with trade expectations but down 3% from December’s 217.7 million bushels.

- StoneX is expected to cut its forecast for Brazilian soybean production, citing weather related issues that could hinder output. They maintain that the South American supplies will overwhelm the global market.

Soybeans Fall on Tariff Worries

Front-month soybean futures continued to test the 200-day moving average in early 2025, a key resistance level that has limited gains for over 18 months. Improved weather conditions in South America and newly announced tariffs from the Trump Administration at the start of March triggered a sharp decline in prices. Support is expected around 1000, with stronger backing near recent lows of 950. If prices rebound, initial resistance is likely at 1030, with the 200-day moving average serving as a more significant hurdle.

Wheat

Market Notes: Wheat

- All three US wheat classes posted losses again today in tandem with corn and soybeans. The continued threat of tariffs and a trade war has pushed ag commodities lower so far this week. Most notably, China has pledged to retaliate with tariffs on US goods, including 15% on wheat imports.

- Winter wheat crop condition updates showed mixed results across key states. Kansas improved by 4% to 54% good to excellent, while Texas declined by 3% to 34%. Colorado saw a notable 10% improvement, whereas South Dakota conditions fell by 9%.

- According to Rusagrotrans, Russia’s wheat exports in February totaled 1.9 mmt, which is the lowest figure for that month since 2020. Furthermore, they are estimating March exports will be around 1.5-1.7 mmt, which would be the lowest March export figure since 2021.

- In Australia, ABARES projected a 25/26 wheat harvest of 30.5 mmt, down 10% from the previous season but still 15% above the 10-year average. They also raised their estimate for the 24/25 harvest by 7% compared to their December report.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Unchanged Guidance: Grain Market Insider made one old crop sales recommendation in February, selling at 606.50 on February 19. Given the severity of the recent selloff, the guidance is to pause any additional sales for now.

2025 Crop:

- Unchanged Guidance: Given the severity of the recent selloff, the guidance is to continue to sit tight for now.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- No Change: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Head Fake

Chicago wheat broke out of its prolonged sideways trend with a strong February rally, reaching key resistance at the early October highs just above 615. However, since the late February peak, wheat futures have retreated sharply, falling back into the previous trading range that marked the end of 2024. Support is expected near the lower boundary of this range around 540, while the 200-day moving average is likely to act as resistance on any attempted rebound.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Unchanged Guidance: For now, continue to hold steady—Grain Market Insider has no new actionable recommendations today.

2025 Crop:

- Unchanged Guidance: For now, continue to hold steady—Grain Market Insider has no new actionable recommendations today.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- Hold: No first sales targets or recommendations are expected until the late May, early June window.

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Breaks Lower

Kansas City wheat futures surged into February with strong bullish momentum, closing above the 200-day moving average and testing multi-month highs near 620. However, since the late February peak, wheat futures have retreated sharply, falling back into the previous trading range. Support is expected near the lower boundary of this range around 540, while the 200-day moving average is likely to act as resistance on any attempted rally.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Unchanged Guidance: For now, continue to hold steady—Grain Market Insider has no new actionable recommendations today.

2025 Crop:

- Unchanged Guidance: For now, continue to hold steady—Grain Market Insider has no new actionable recommendations today.

- Maintain Put Options: Continue to hold the last quarter of July ‘25 KC 620 put options.

2026 Crop:

- No Change: No first sales recommendations are expected until early summer.

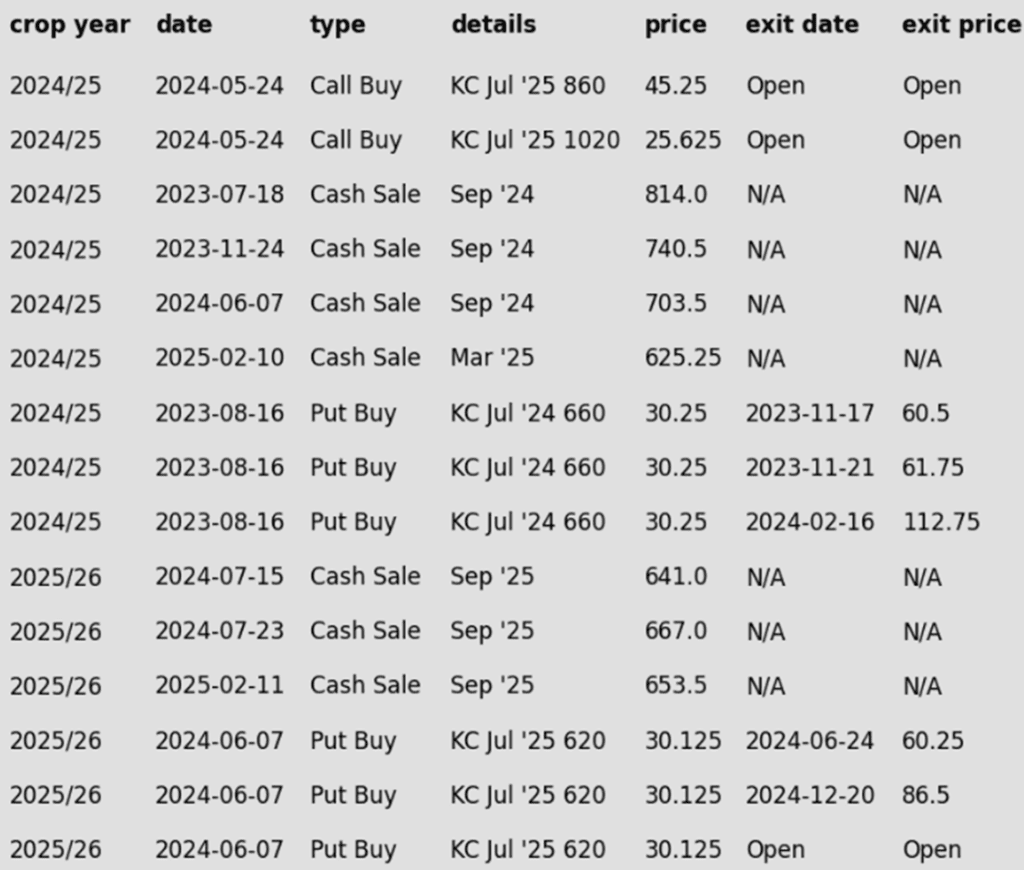

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

February Whipsaw

Spring wheat broke out of its prolonged sideways range in late January, signaling bullish momentum. A mid-February close above the 200-day moving average reinforced the breakout, but late February weakness erased those gains, sending futures back below key moving averages. Moving forward, the 200-day MA is likely to serve as upside resistance, while previous lows near 580 should provide support.

Other Charts / Weather