2-26 End of Day: Grains Continue Lower Wednesday

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 478.25 | -1.5 |

| JUL ’25 | 498.5 | -0.75 |

| DEC ’25 | 467 | -3 |

| Soybeans | ||

| MAR ’25 | 1024.5 | -6.75 |

| JUL ’25 | 1056.25 | -7.25 |

| NOV ’25 | 1045.5 | -5.5 |

| Chicago Wheat | ||

| MAR ’25 | 566 | -6.75 |

| JUL ’25 | 593.75 | -8.5 |

| JUL ’26 | 646.5 | -9.25 |

| K.C. Wheat | ||

| MAR ’25 | 585 | -6.75 |

| JUL ’25 | 611.25 | -7.25 |

| JUL ’26 | 653.5 | -6.75 |

| Mpls Wheat | ||

| MAR ’25 | 599.5 | -13.5 |

| JUL ’25 | 632.25 | -10 |

| SEP ’25 | 644.5 | -9 |

| S&P 500 | ||

| MAR ’25 | 5968.5 | -1.5 |

| Crude Oil | ||

| APR ’25 | 68.79 | -0.14 |

| Gold | ||

| APR ’25 | 2929.4 | 10.6 |

Grain Market Highlights

- Corn: Sellers pressured the corn market again on Wednesday, with weaker weekly ethanol production and expectations for a large 2025 planted acreage estimate weighing on prices.

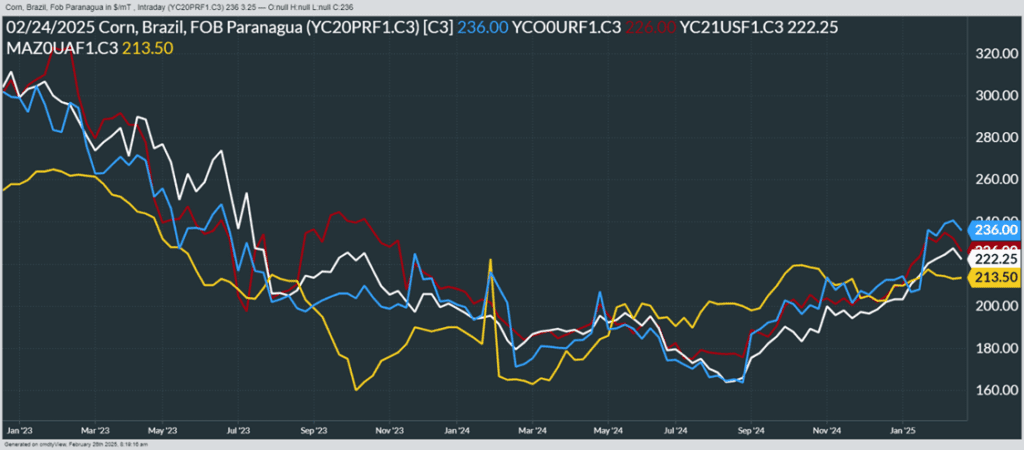

- Soybeans: Soybeans closed lower on Wednesday as ongoing harvest pressure from Brazil weighed on prices. Both soybean meal and oil were lower today as well.

- Wheat: Wheat futures extended their decline on Wednesday, with Minneapolis wheat leading the losses.

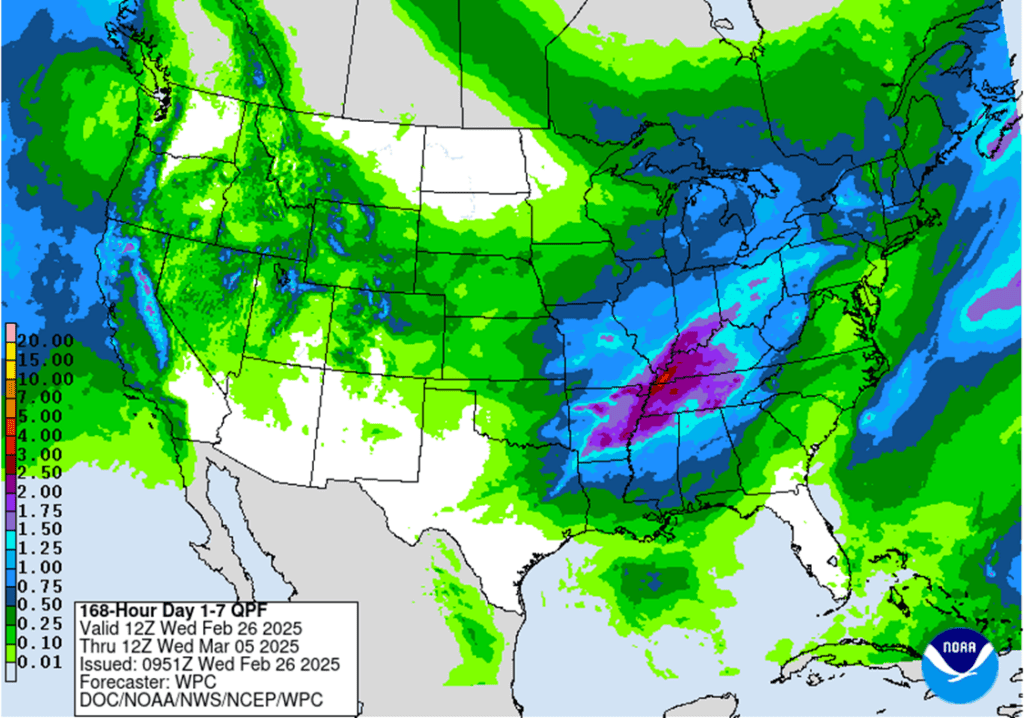

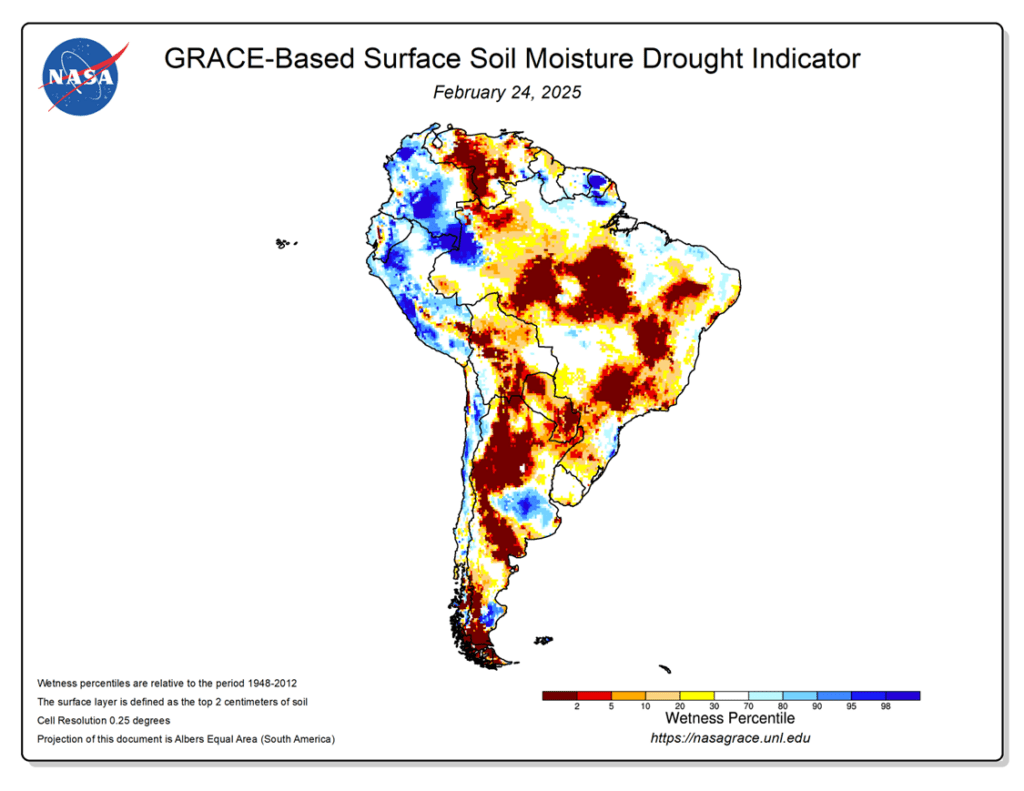

- To see the updated U.S. 7-day precipitation forecast as well as the surface soil moisture drought indicator for South America, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

Active

Enter(Buy) DEC ’25 Calls:

510 @ ~ 26c & 550 @ ~ 17c

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

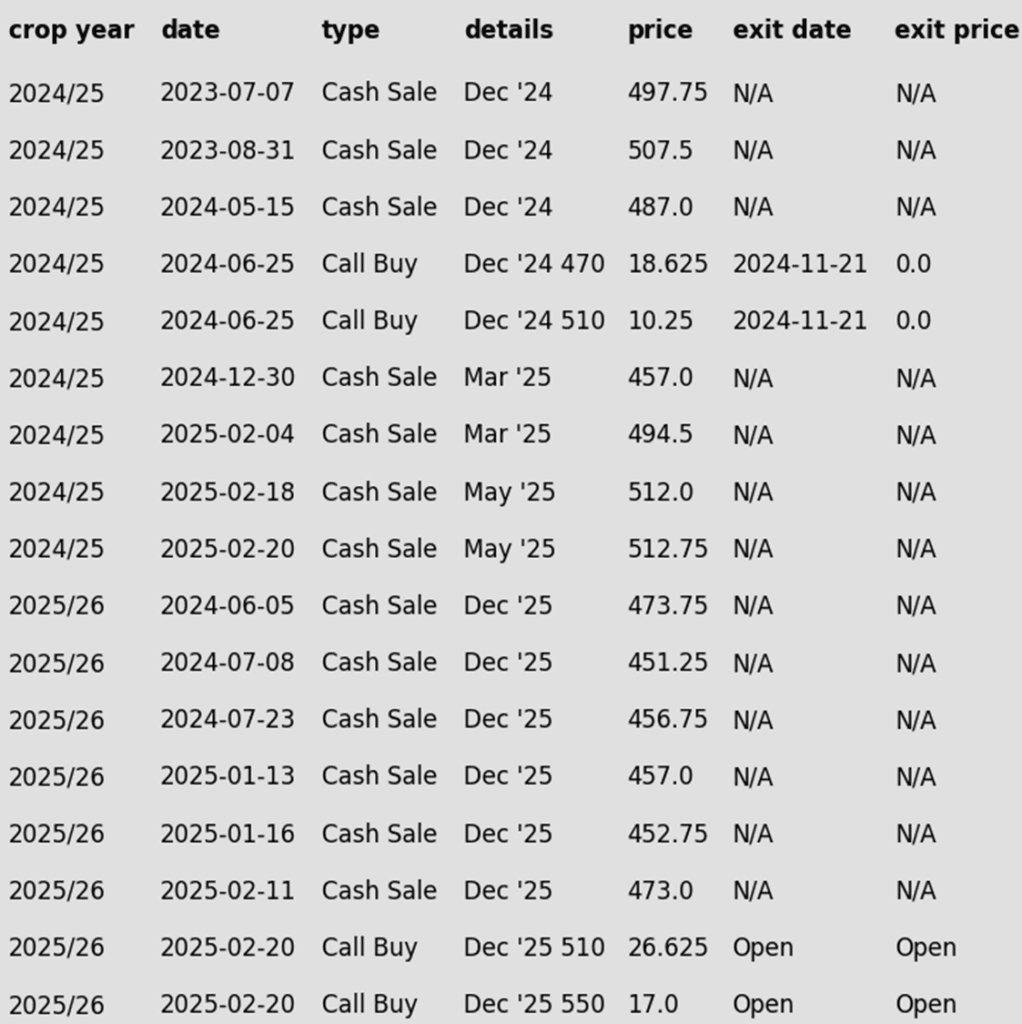

2024 Crop:

- Last week Grain Market Insider made two sales recommendations for your 2024 corn crop.

- Hold Recommendation: Following last week’s two sales recommendations, the advice is to pause making any additional sales for now. The May contract is undergoing a correction, having closed lower in five of the last six sessions.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends buying December ‘25 510 corn calls and December ‘25 550 corn calls in equal quantities, with a total net spend of approximately 43 cents plus commission and fees.

- Scenario Planning: With the existing sales recommendations and this call option strategy, Grain Market Insider aims to be positioned for any market direction. Given the many unpredictable wild cards that will influence the market in the months ahead — especially weather — it is critical to be prepared for both $7–$8 corn on the upside and $3–$4 corn on the downside.

- Balanced Approach: Last week’s sales recommendations provide a stronger buffer against downside price scenarios, while the active call options strategy reopens upside opportunities on those prior sales recommendations. This balanced approach ensures flexibility in an unpredictable market.

- Looking ahead: Next week, the first week of March, Grain Market Insider will evaluate a potential put option recommendation — details to come.

2026 Crop:

- Hold Recommendation: No sales targets are expected to post for the crop to be planted in spring 2026 for at least another week.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- The corn market faced additional selling pressure on Wednesday, as First Notice Day and expectations for a large acreage projection at the USDA Outlook Forum on Thursday triggered further long liquidation.

- The USDA will release its baseline projection at the Ag Outlook forum on Thursday morning. These are baseline budgetary items but give the market a possible direction for 2025-26 marketing year. Expectations are for the USDA to forecast 93.6 million acres of corn for the 2025-26 marketing year. This would be up 3 million acres for 24-25. If realized, potential carryout projections for the next marketing year could push back towards the 2-billion-bushel level.

- February 28 is first notice day for March futures, which can trigger additional volatility and selling pressure on the market. Traders who hold long March futures positions need to roll those positions or risk delivery after that date.

- The USDA will release weekly export sales data on Thursday, with expectations for new sales for the week ending February 20 ranging from 900,000 to 1.65 MMT. The last reported export sale was on February 14, yet overall sales remain ahead of pace for the marketing year.

- Weekly ethanol production slipped last week to 318 million gallons, down 1 million from last week. Production was still at the top of expectations. Approximately 108 mb of corn was used last week in ethanol production, which is still trending ahead of the USDA pace for the marketing year.

Corn Rally Pauses

The corn market has been performing well in 2025, with steady demand keeping buyers engaged and driving prices to 16-month highs. Last week, technical indicators reached overbought levels, and without new positive developments, prices began to pull back. If this correction continues, support is expected around 475, with stronger support near 450. On the other hand, if buyers step back in, the next target would be 535, with more significant resistance at the spring 2023 lows near 550.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Hold: Given recent recommendations, the current guidance is to continue to sit tight for now on any additional sales.

- Potential Call Strategy: If May soybeans close above 1079.75, Grain Market Insider may recommend a call option strategy to reown previous sales recommendations…stay tuned.

2025 Crop:

- Sales Target Range: 1090 – 1125 remain the upside target range vs November ‘25.

- Call Option Target: The target to exit all the 1100 Nov ‘25 call options is approximately 88 cents in premium. If the 1100 calls can be exited for that price, it should cover the cost of the 1180 Nov ‘25 calls, providing a net-neutral cost position that can continue to protect the upside on the recent sales recommendation.

2026 Crop:

- No Change: Still no sales recommendations expected until spring.

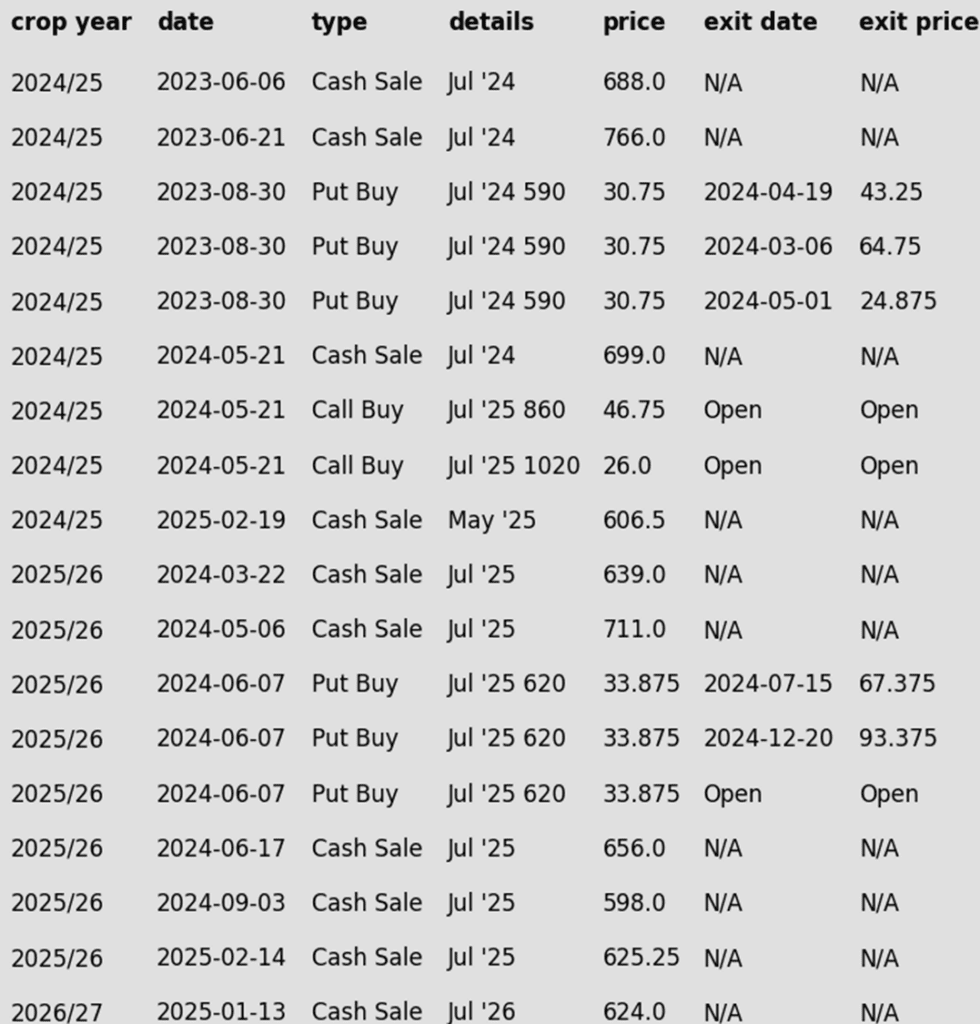

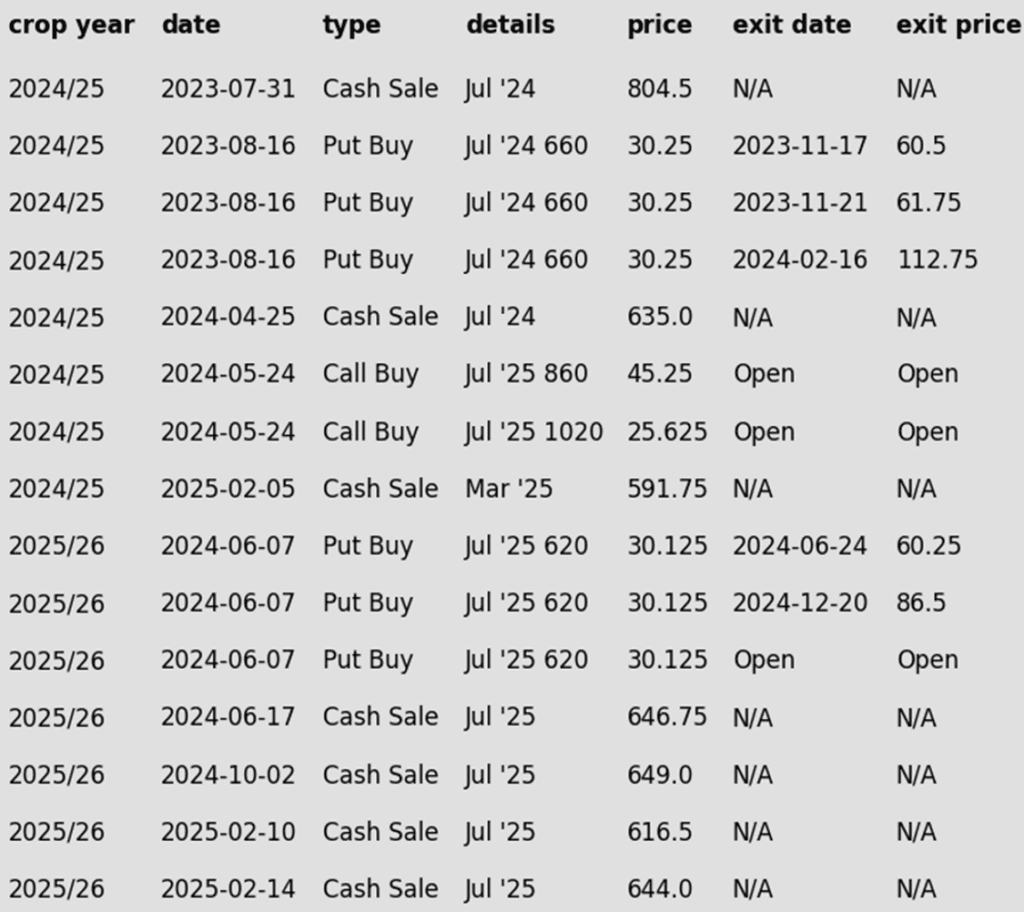

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower today as pressure from Brazil’s ongoing harvest continues, but May futures found support at the 50-day moving average both yesterday and today. First notice day for March soybeans is on Friday which could be pressuring prices. Both soybean meal and oil were lower today.

- Estimates for tomorrow’s USDA Outlook Forum see analysts expecting a decline in soybean planted acres in 2025 in favor of corn acres. The average trade estimate sees soybean acres at 84.4 million compared to 87.1 ma last year. These are only rough estimates but would be friendly.

- Tomorrow’s USDA Outlook Forum will also show estimates for 25/26 US ending stocks that see soybean ending stocks unchanged from last year at 0.380 billion bushels, but the range is anywhere from 0.282 to 0.434 billion bushels.

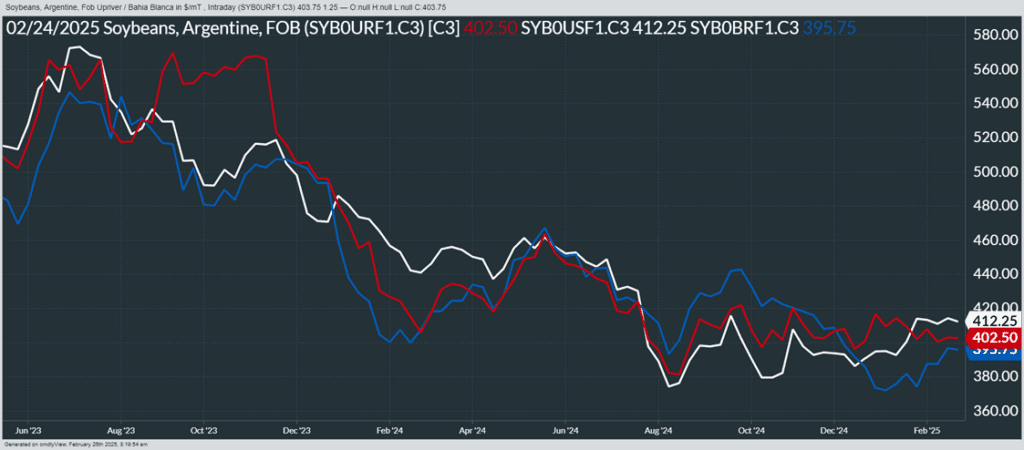

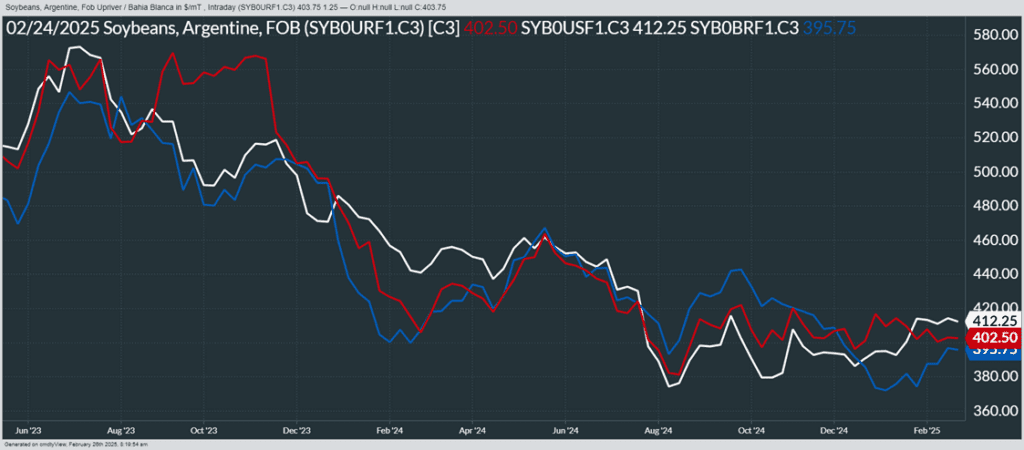

- In Argentina, soybeans on the national level are reportedly seeing better than expected crop ratings after a period of drought that lowered crop conditions. There have been three weeks of rain following the drought that have slowed down yield losses in the country’s core growing zone.

Soybeans Continue Sideways Grind

Front-month soybean futures continue to flirt with the 200-day moving average, a formidable resistance that has capped gains for over 18 months. A decisive move past this level could trigger bullish momentum, paving the way for a rise toward the key 1100 mark. Should prices dip, reliable support is expected near 1030, with a more stable floor around 1000.

Wheat

Market Notes: Wheat

- Wheat continued to fade lower today, with Minneapolis futures leading the way down. A lower close for Matif wheat futures and a higher US Dollar Index offered no support. Without much other fundamental news to drive the market, technical momentum is dragging wheat lower.

- Reports suggest Ukraine has agreed to allow U.S. access to a portion of its mineral resources, though details remain unclear. Speculation that this could indicate progress toward ending the war with Russia may be pressuring wheat prices, as a resolution could lead to increased wheat exports from the region.

- A Reuters poll projects U.S. wheat stocks for the 2025-26 marketing year to rise by 35 million bushels to 830 million. Traders will look to the USDA’s estimates at this week’s Outlook Forum, though history suggests the agency tends to underestimate stocks at this stage, having done so in 10 of the past 11 years.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Recent Sale: Last Wednesday Grain Market Insider issued the first sales recommendation for your 2024 SRW wheat crop since May of last year.

- Hold: The May contract has closed lower in four of the last five sessions and is down about 35 cents from its recent high. Current guidance is to hold off on additional old crop sales for now.

- Maintain Call Options: Continue to hold onto the July ‘25 860 and 1020 call options.

2025 Crop:

- Next Target: If the July contract can maintain its uptrend, the next sales target range would be 690-715 vs. July ‘25.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- No Change: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Surges Past Resistance

Chicago wheat broke out of its prolonged sideways trend with a strong February rally, reaching key resistance at the early October highs just above 615. A decisive weekly close above the 200-day moving average now positions it as a potential support level on any near-term pullbacks. The next upside targets are near 650, with stronger resistance in the 680-700 range.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Hold: The May contract has closed lower in five of the last six sessions and is down about 44 cents from its recent high. Current guidance is to hold off on additional old crop sales for now.

- Maintain Call Options: Continue to hold onto the July ‘25 860 and 1020 call options.

2025 Crop:

- Hold: Given the recent sales recommendations, the current guidance is to continue to sit tight for now on any additional sales.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- Hold: No first sales targets or recommendations are expected until the late May, early June window.

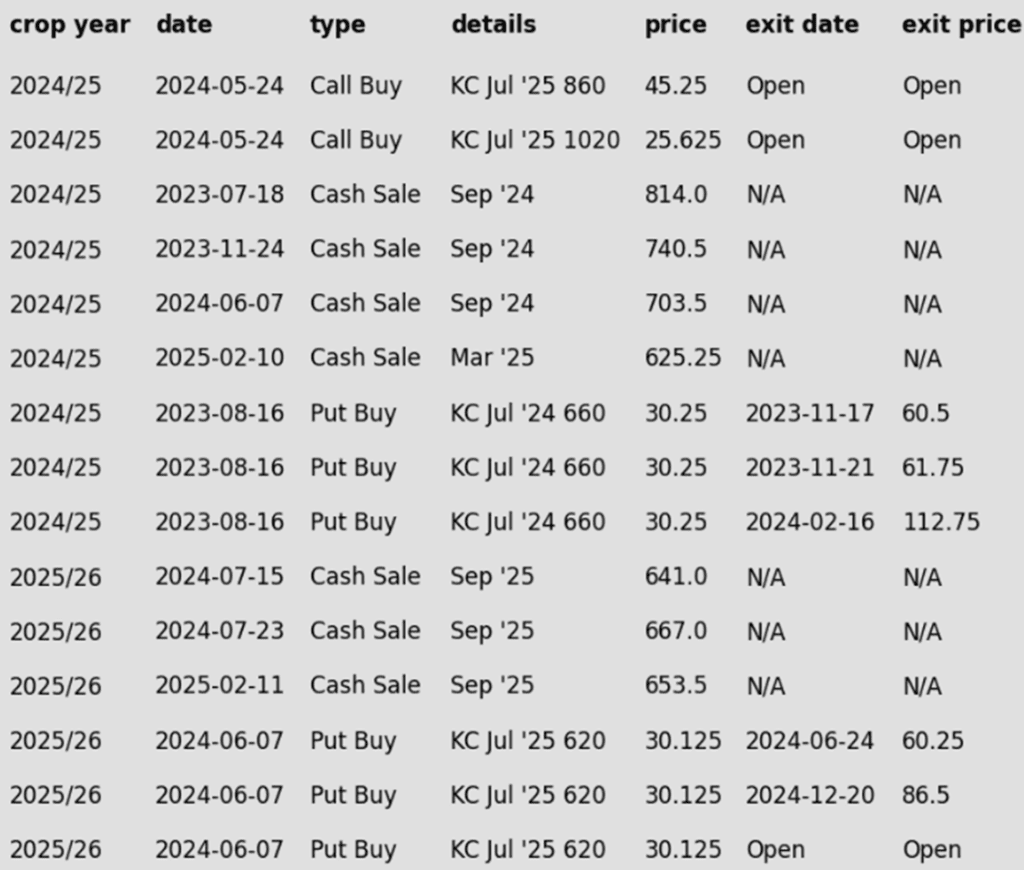

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Signals Breakout Potential

Kansas City wheat futures surged into February with strong bullish momentum, closing above the 200-day moving average and testing multi-month highs near 620. A breakout above the October peak of 623 could fuel a rally toward the key 700 level. On the downside, the 200-day moving average provides initial support, with stronger backing around 575.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Hold: The May contract has closed lower for six consecutive sessions and is down about 42 cents from its recent high. Current guidance is to hold off on additional old crop sales for now.

- Maintain Call Options: Continue to hold onto the July ‘25 KC 860 and 1020 call options.

2025 Crop:

- Hold: Given recent recommendations, the current guidance is to continue to sit tight for now on any additional sales.

- Maintain Put Options: Continue to hold the last quarter of July ‘25 KC 620 put options.

2026 Crop:

- No Change: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Confirms Breakout

Spring wheat broke free from its prolonged sideways range in late January, signaling bullish momentum. A mid-February close above the 200-day moving average reinforces the breakout, with initial support at the 200-day MA and stronger backing near 615 — the top of the previous range. On the upside, 650 is the next key resistance before bulls target the elusive 700 level.

Other Charts / Weather