2-24 End of Day: Grains Stumble to Start the Week

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 482.5 | -8.75 |

| JUL ’25 | 502 | -7.5 |

| DEC ’25 | 470.75 | -4.25 |

| Soybeans | ||

| MAR ’25 | 1029 | -10.5 |

| JUL ’25 | 1063.25 | -9.75 |

| NOV ’25 | 1051.75 | -8 |

| Chicago Wheat | ||

| MAR ’25 | 579 | -11 |

| JUL ’25 | 608 | -9.25 |

| JUL ’26 | 659.75 | 0.5 |

| K.C. Wheat | ||

| MAR ’25 | 596.5 | -12.75 |

| JUL ’25 | 622 | -11.75 |

| JUL ’26 | 664 | -5.25 |

| Mpls Wheat | ||

| MAR ’25 | 621.5 | -10.25 |

| JUL ’25 | 649.25 | -10.75 |

| SEP ’25 | 659.75 | -10.25 |

| S&P 500 | ||

| MAR ’25 | 6022.5 | -6.5 |

| Crude Oil | ||

| APR ’25 | 70.66 | 0.26 |

| Gold | ||

| APR ’25 | 2963.7 | 10.5 |

Grain Market Highlights

- Corn: A break of technical support, coupled with weakness in wheat and soybean futures, pressured corn prices to start the week.

- Soybeans: Ongoing harvest pressure in Brazil and an improved weather outlook for Argentina pushed soybeans lower to start the week.

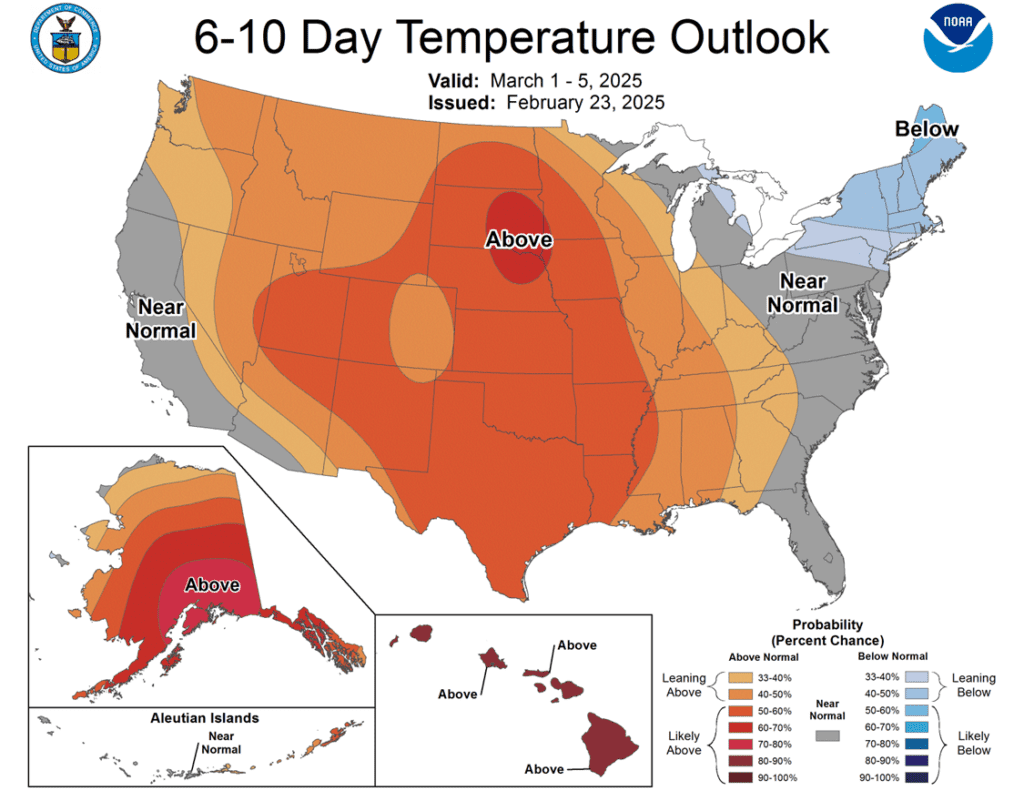

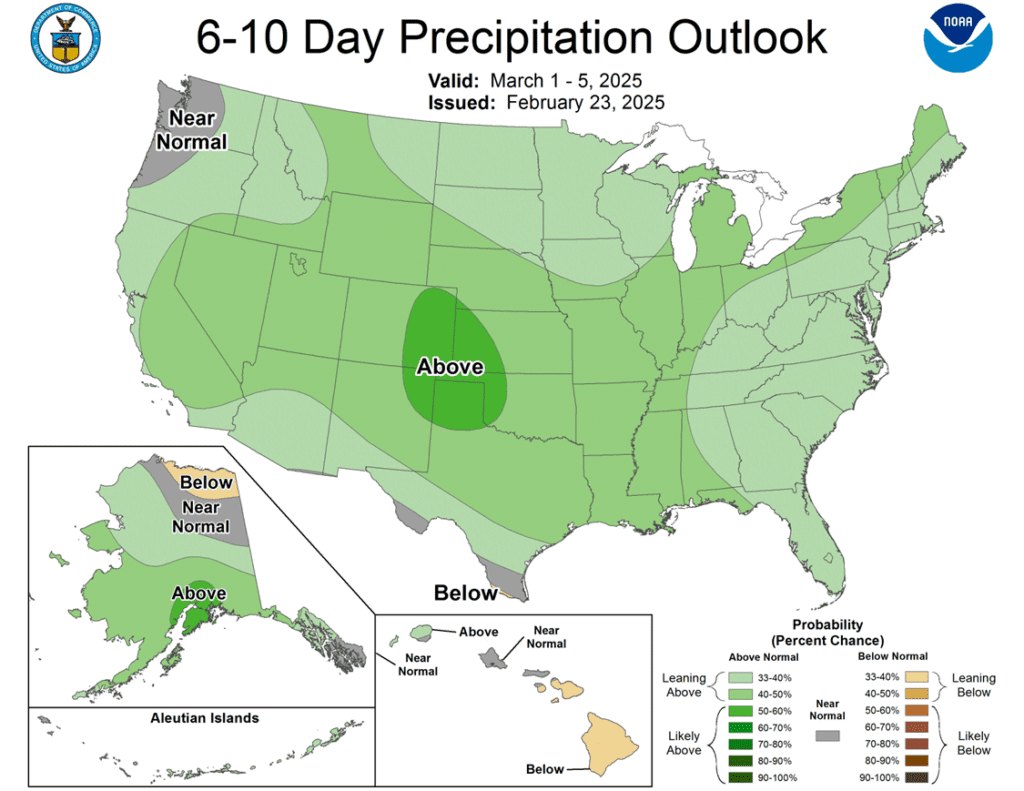

- Wheat: Forecasted moisture for both the U.S. Plains and the Black Sea region pressured wheat futures to start the week.

- To see the updated 6–10-day U.S. temperature and precipitation outlooks as well as the updated 10-day GEFS for South America, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

Active

Enter(Buy) DEC ’25 Calls:

510 @ ~ 26c & 550 @ ~ 17c

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

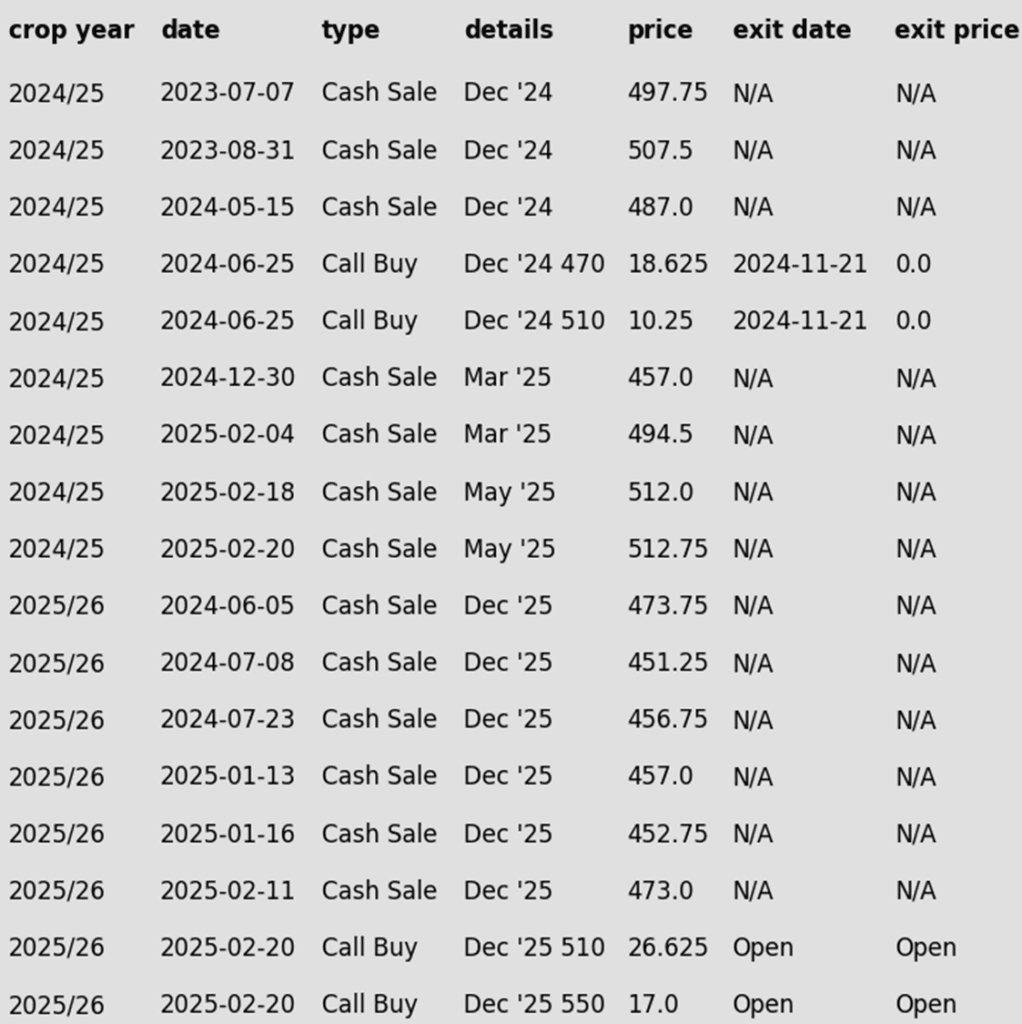

2024 Crop:

- Last week Grain Market Insider made two sales recommendations for your 2024 corn crop.

- Hold Recommendation: After last week’s two sales recommendations, the advice now is to hold off on making any additional sales for the time being.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends buying December ‘25 510 corn calls and December ‘25 550 corn calls in equal quantities, with a total net spend of approximately 43 cents plus commission and fees.

- Scenario Planning: With the existing sales recommendations and this call option strategy, Grain Market Insider aims to be positioned for any market direction. Given the many unpredictable wild cards that will influence the market in the months ahead — especially weather — it is critical to be prepared for both $7–$8 corn on the upside and $3–$4 corn on the downside.

- Balanced Approach: Last week’s sales recommendations provide a stronger buffer against downside price scenarios, while the active call options strategy reopens upside opportunities on those prior sales recommendations. This balanced approach ensures flexibility in an unpredictable market.

- Looking ahead: Next week, Grain Market Insider will evaluate a potential put option recommendation — details to come.

2026 Crop:

- Hold Recommendation: No sales targets are expected to post for the crop to be planted in spring 2026 for at least another week.

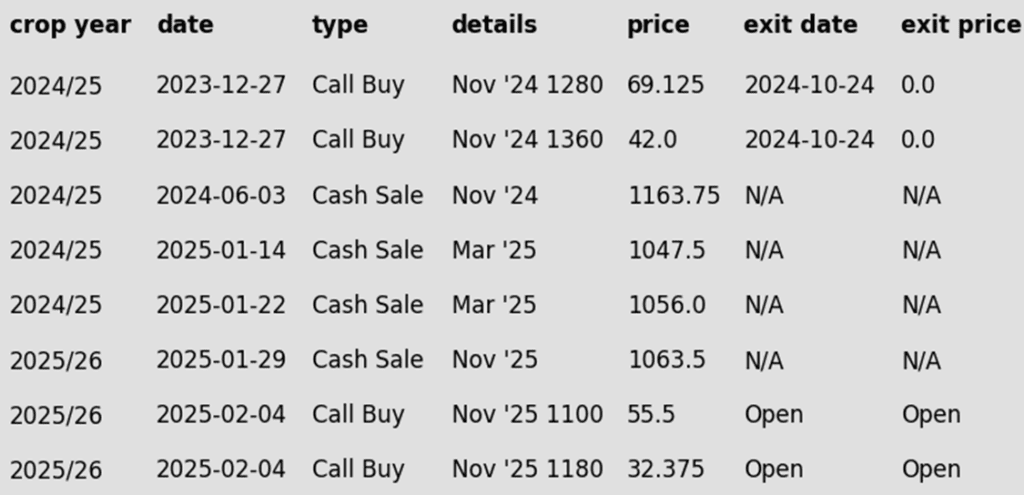

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

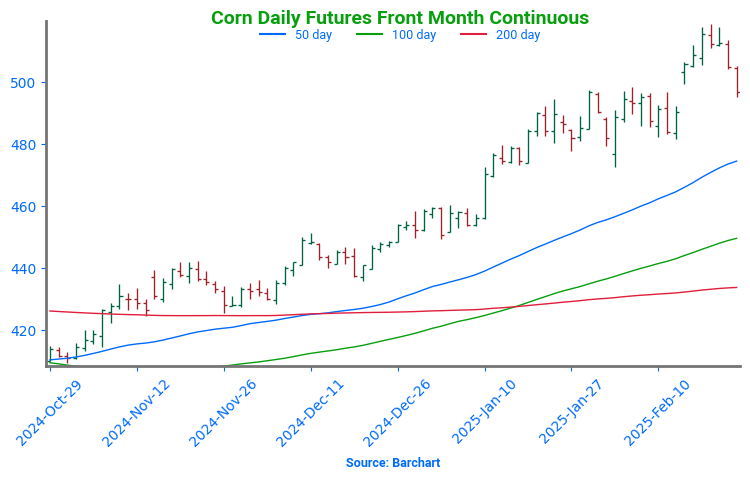

- Moderately strong selling pressure pushed corn prices lower for the second consecutive session as technical selling triggered long liquidation in the corn market. The weak close technically on Monday will likely leave room for additional selling pressure going into tomorrow’s session.

- The last week of February is historically a period of weakness in the corn market. This week is typically a pricing period for March basis contracts, and first notice day for March futures, which can trigger selling pressure.

- The USDA released weekly export inspections on Monday morning. For the week ending Feb 20, U.S. exports shipped 1.134 MMT (44.7 mb). This total was toward the lower end of expectations and down approximately 500,000 MT from last week’s total. Regardless, corn export shipments are still ahead of the USDA target and up 32% YOY.

- Strong corn demand has been a supportive factor, with export sales and shipments maintaining strength. However, the USDA has not announced a reported corn export sale since February 14, during a period when demand is expected to stay active. If the market perceives a slowdown in demand, prices could be vulnerable to correction.

- South America weather has added to the selling pressure on corn prices. Argentina weather forecast remain improved, helping to support and stabilize the corn crop after periods of hot and dry weather. Brazil weather has turned more favorable for planting of the key second crop Brazil corn.

Corn Rally Pauses

The corn market has been performing well in 2025, with steady demand keeping buyers engaged and driving prices to 16-month highs. Last week, technical indicators reached overbought levels, and without new positive developments, prices began to pull back. If this correction continues, support is expected around 475, with stronger support near 450. On the other hand, if buyers step back in, the next target would be 535, with more significant resistance at the spring 2023 lows near 550.

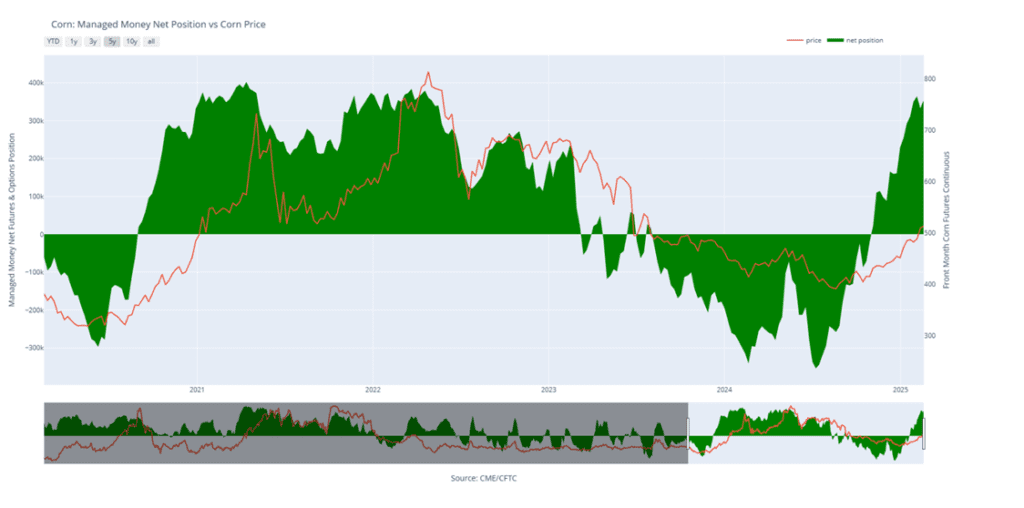

Corn Managed Money Funds net position as of Tuesday, February 18. Net position in Green versus price in Red. Money Managers net bought 21,114 contracts between February 11 – February 18, bringing their total position to a net long 353,533 contracts.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Hold: Given recent recommendations, the current guidance is to continue to sit tight for now on any additional sales.

- Potential Call Strategy: If May soybeans close above 1079.75, Grain Market Insider may recommend a call option strategy to reown previous sales recommendations…stay tuned.

2025 Crop:

- Sales Target Range: 1090 – 1125 remain the upside target range vs November ‘25.

- Call Option Target: The target to exit all the 1100 Nov ‘25 call options is approximately 88 cents in premium. If the 1100 calls can be exited for that price, it should cover the cost of the 1180 Nov ‘25 calls, providing a net-neutral cost position that can continue to protect the upside on the recent sales recommendation.

2026 Crop:

- No Change: Still no sales recommendations expected until spring.

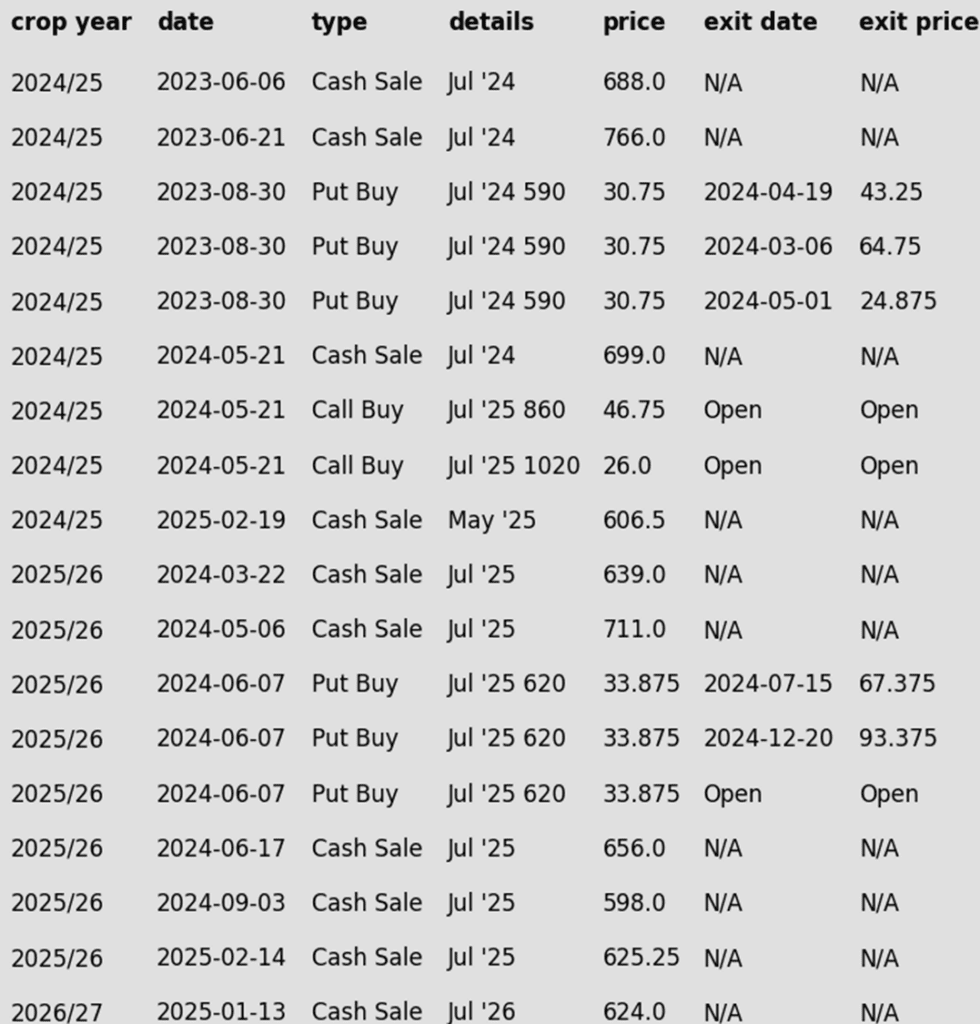

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower along with the rest of the grain complex in a very risk-off trading session. Pressure continues to come from the ongoing Brazilian harvest and slowing US export sales in favor of cheaper Brazilian beans. Both soybean meal and oil were lower, but bean oil led the way down.

- Today’s export inspections report was within trade estimates at 31.6 million bushels and was also slightly higher than last week. Total inspections in 24/25 are now at 1.355 bb which is up 11% from the previous year. Export sales have slowed noticeably in the past few months with cheaper Brazilian soybeans.

- In Argentina, soybeans on the national level are reportedly seeing better than expected after a period of drought that lowered crop conditions. There have been 3 weeks of rains following the drought that have slowed down yield losses in the country’s core growing zone.

- Friday’s CFTC report saw funds as sellers of soybeans by 11,949 contracts leaving them net long 16,526 contracts. They were buyers of soybean oil by 6,912 contracts leaving them long 53,472 contracts but sellers of soybean meal by 9,761 contracts which increased their net short position to 22,090 contracts.

Soybeans Continue Sideways Grind

Front-month soybean futures continue to flirt with the 200-day moving average, a formidable resistance that has capped gains for over 18 months. A decisive move past this level could trigger bullish momentum, paving the way for a rise toward the key 1100 mark. Should prices dip, reliable support is expected near 1030, with a more stable floor around 1000.

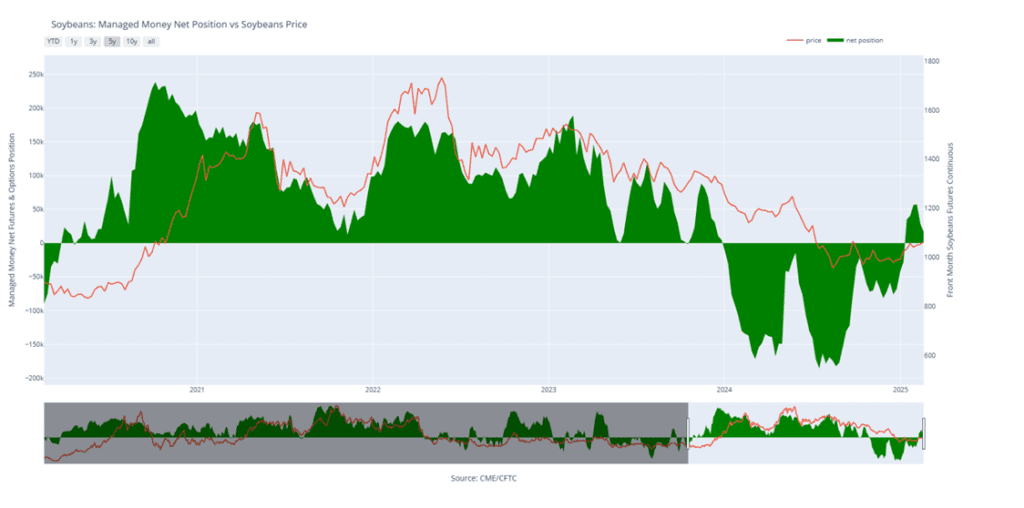

Soybean Managed Money Funds net position as of Tuesday, February 18. Net position in Green versus price in Red. Money Managers net sold 11,949 contracts between February 11 – February 18, bringing their total position to a netlong16,526 contracts.

Wheat

Market Notes: Wheat

- Wheat posted double digit losses in each of the three classes, leading the grain complex lower. Early weakness stemmed from Matif wheat futures which gapped lower on their open; front month March managed to close the gap, but a small one remains present for the May contract. Also, the fact that much of the central US is wet and warming up should be favorable for winter wheat as it leaves dormancy, eroding any weather premium still in the market.

- Weekly wheat inspections totaled 13.8 million bushels, bringing the 2024/25 total to 559 million bushels, up 21% from last year. Inspections remain slightly ahead of the USDA’s estimated pace, with the agency projecting total 2024/25 exports at 850 million bushels, a 20% increase from the prior year.

- Weekend temperatures in Russia were not cold enough to stress the wheat crop, and upcoming rains are expected. These factors pressured the global wheat market today.

- On a bullish note, IKAR has said that Russia’s wheat export values ended last week at $251/mt, which is up $4 from the week before. Nevertheless, their wheat exports last week were steady, compared with the prior week at 420,000 mt, according to SovEcon.

- According to Friday’s CFTC data, managed funds bought back 32,500 wheat contracts combined, among all three futures classes. This brings their net short position to 91,510 contracts, which is the smallest in three months. The Chicago contract accounts for the majority of this short position; it was reduced by about 21,000 contracts to 61,500 contracts.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAY ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Sell a portion of your 2024 SRW wheat crop.

- Maintain Call Options: Continue to hold onto the July ‘25 860 and 1020 call options.

2025 Crop:

- Next Target: If the July contract can maintain its uptrend, the next sales target range would be 690-715 vs. July ‘25.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- No Change: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

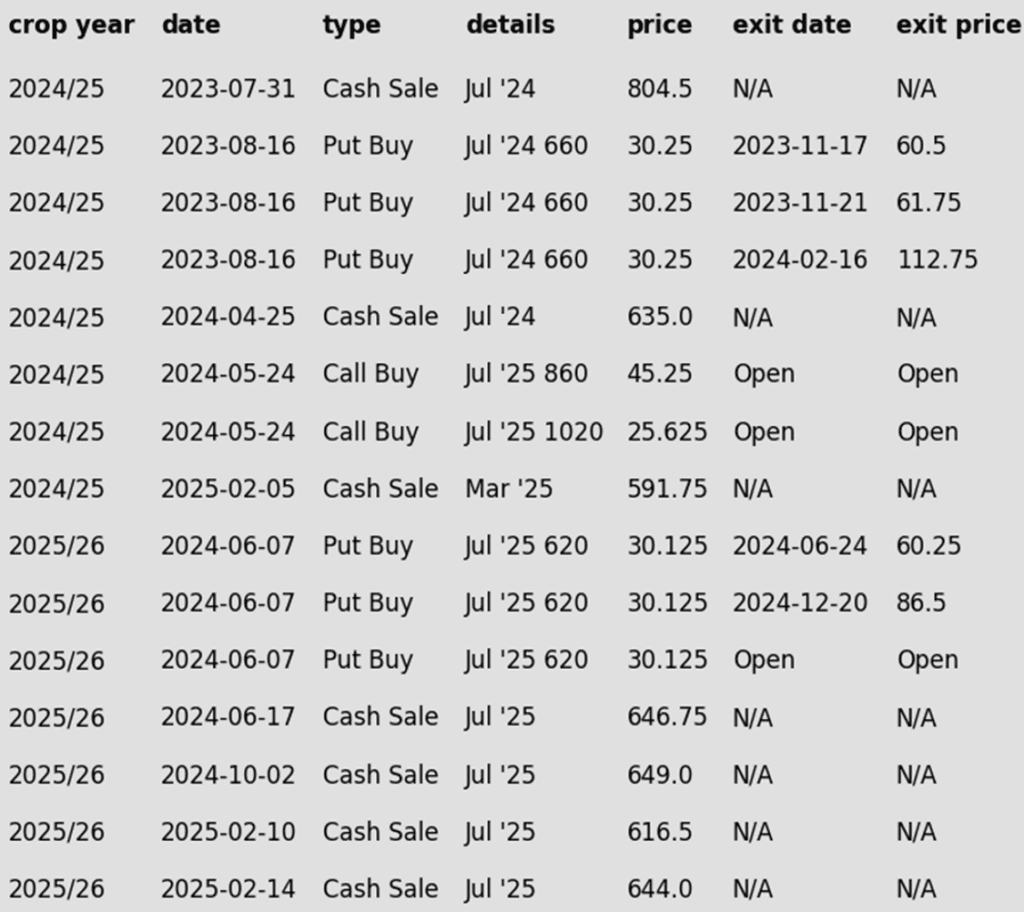

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Breaks Out with Force

Chicago wheat shattered its prolonged sideways grind with a powerful February surge, hitting key resistance at the early October highs just above 615. This decisive weekly close above the 200-day moving average sets the stage for the MA to act as firm support on any near-term dips. Next upside targets loom near 650, with stronger resistance waiting in the 680-700 zone.

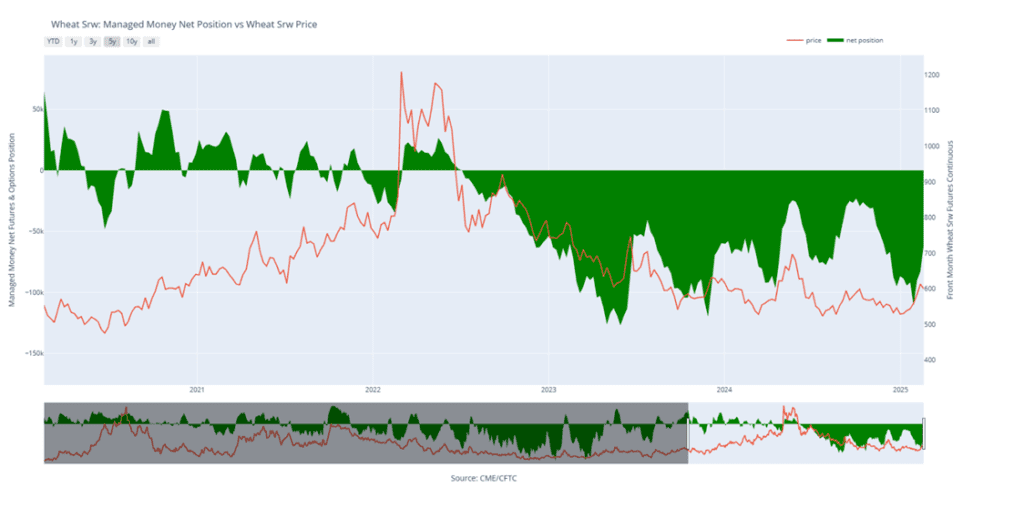

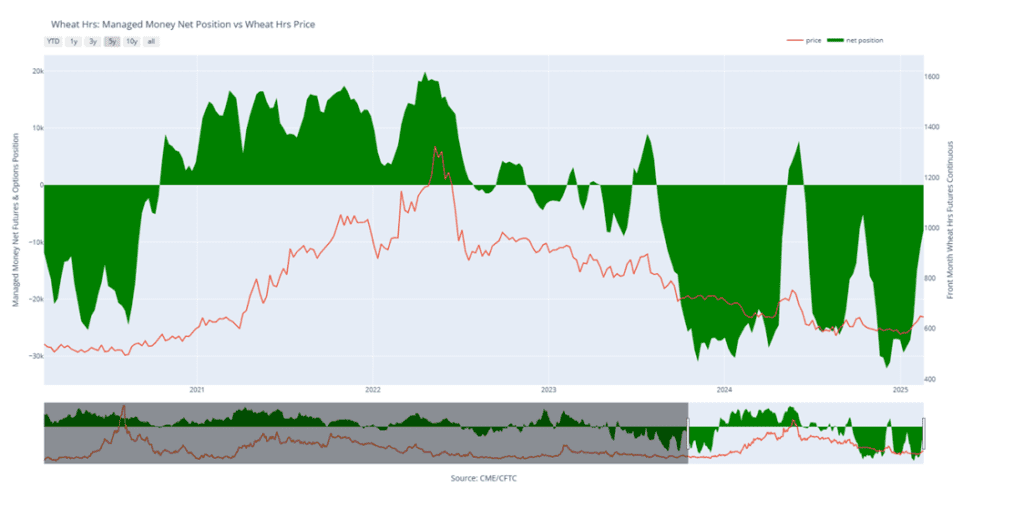

Chicago Wheat Managed Money Funds’ net position as of Tuesday, February 18. Net position in Green versus price in Red. Money Managers net bought 21,232 contracts between February 11 – February 18, bringing their total position to a net short 61,577 contracts.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Hold: Given the recent sale recommendation, the current guidance is to continue to sit tight for now on any additional sales.

- Maintain Call Options: Continue to hold onto the July ‘25 860 and 1020 call options.

2025 Crop:

- Hold: Given the recent sales recommendations, the current guidance is to continue to sit tight for now on any additional sales.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

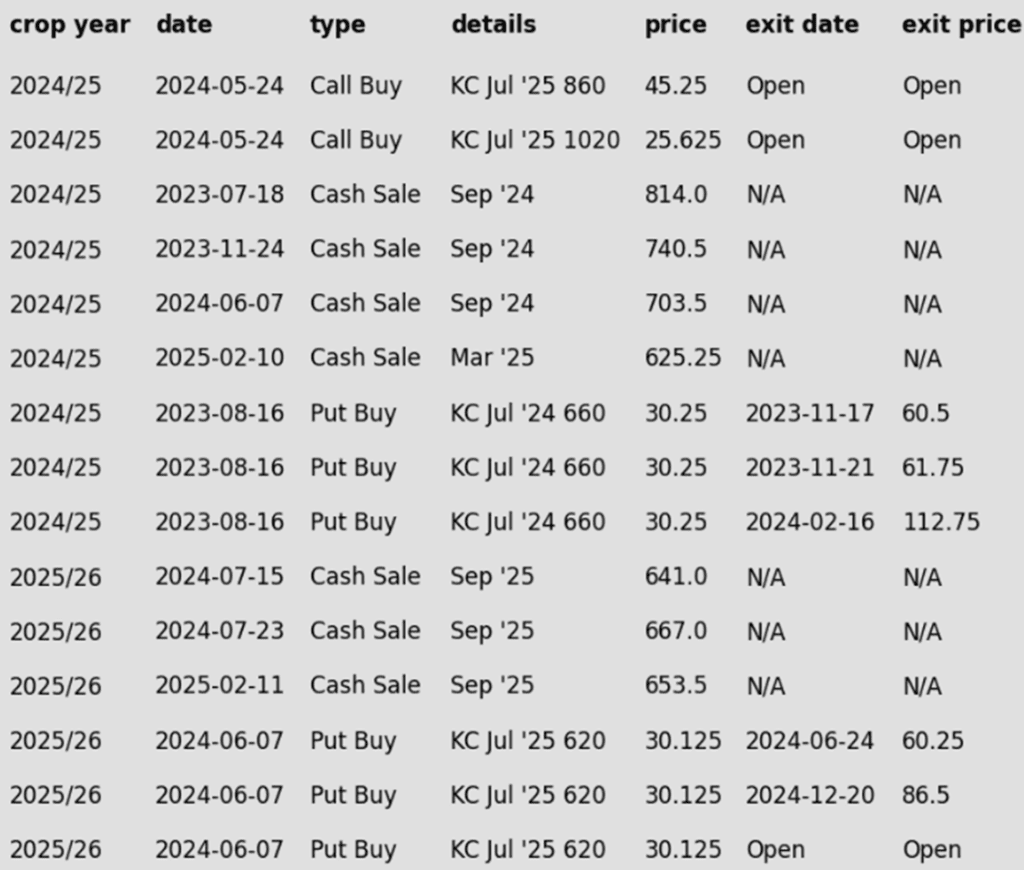

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Ignites Rally Potential

Kansas City wheat futures launched into February with bullish momentum, closing above the 200-day moving average and challenging multi-month highs near 620. A breakout above the October peak of 623 could spark a run toward the coveted 700 mark. On the flip side, the 200-day MA offers initial support, with a sturdier safety net resting near 575.

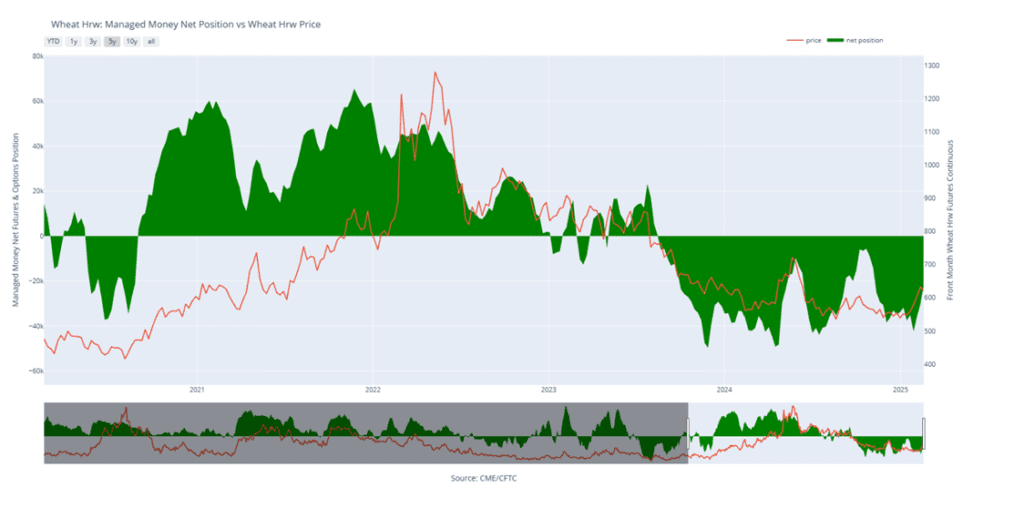

KC Wheat Managed Money Funds’ net position as of Tuesday, February 18. Net position in Green versus price in Red. Money Managers net bought 8,158 contracts between February 11 – February 18, bringing their total position to a net short 22,090 contracts.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Hold: Given recent recommendations, the current guidance is to continue to sit tight for now on any additional sales.

- Maintain Call Options: Continue to hold onto the July ‘25 KC 860 and 1020 call options.

2025 Crop:

- Hold: Given recent recommendations, the current guidance is to continue to sit tight for now on any additional sales.

- Maintain Put Options: Continue to hold the last quarter of July ‘25 KC 620 put options.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Breakout Confirmed

Spring wheat shook off its doldrums in late January, surging past its prolonged sideways range and flashing bullish signals. A mid-February close above the 200-day moving average strengthens the breakout case. Initial support stands at the 200-day MA, with firmer footing near 615 — the top of the old range. On the upside, 650 is the first hurdle to clear before bulls set their sights on the elusive 700 mark.

Minneapolis Wheat Managed Money Funds’ net position as of Tuesday, February 18. Net position in Green versus price in Red. Money Managers net bought 3,069 contracts between February 11 – February 18, bringing their total position to a net short 7,843 contracts.

Other Charts / Weather