2-21 End of Day: Corn and Soybeans Slide to End the Week

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 491.25 | -6.75 |

| JUL ’25 | 509.5 | -7.25 |

| DEC ’25 | 475 | -4.5 |

| Soybeans | ||

| MAR ’25 | 1039.5 | -6 |

| JUL ’25 | 1073 | -4.75 |

| NOV ’25 | 1059.75 | -1.5 |

| Chicago Wheat | ||

| MAR ’25 | 590 | 4.5 |

| JUL ’25 | 617.25 | 3.25 |

| JUL ’26 | 659.25 | 2.25 |

| K.C. Wheat | ||

| MAR ’25 | 609.25 | 1.75 |

| JUL ’25 | 633.75 | 1.75 |

| JUL ’26 | 669.25 | 3.25 |

| Mpls Wheat | ||

| MAR ’25 | 631.75 | -1 |

| JUL ’25 | 660 | -0.25 |

| SEP ’25 | 670 | 0.5 |

| S&P 500 | ||

| MAR ’25 | 6031.25 | -105.25 |

| Crude Oil | ||

| APR ’25 | 70.34 | -2.14 |

| Gold | ||

| APR ’25 | 2955.7 | -0.4 |

Grain Market Highlights

- Corn: March corn futures hit resistance at $5 this week, with selling pressure continuing into Friday. Improved South American weather added to the downside momentum.

- Soybeans: Soybeans ended Friday lower as weak export sales and Brazil’s advancing harvest weighed on the market.

- Wheat: Despite weakness in corn and soybeans, wheat futures closed higher, with Chicago leading the gains.

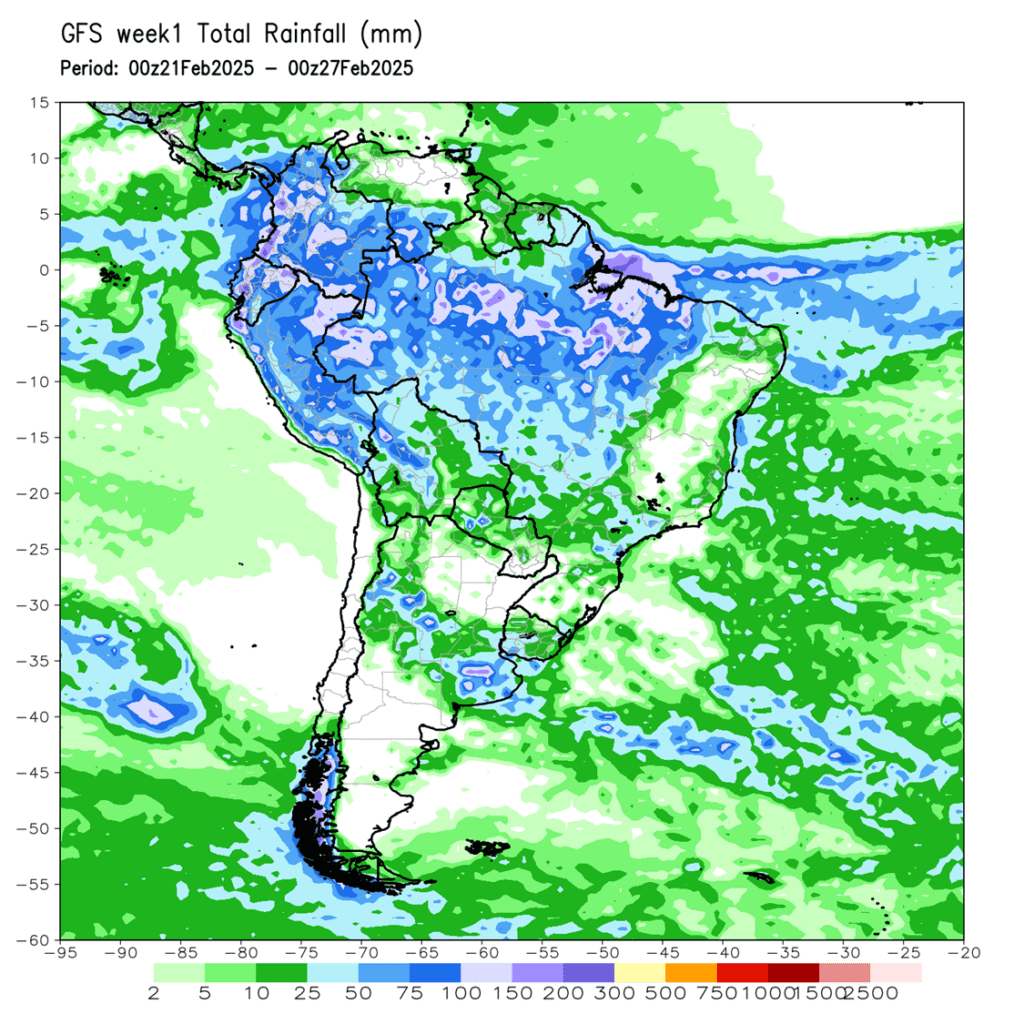

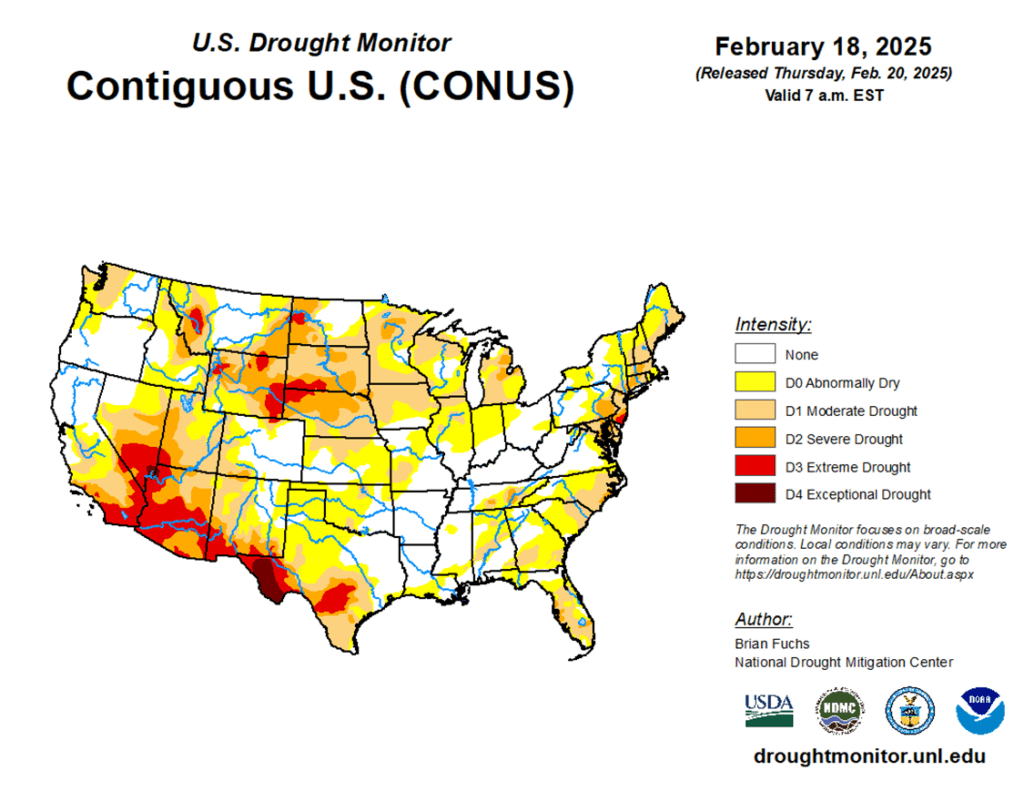

- To see the updated U.S. drought monitor as well as the updated week one GFS forecast for South America, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

Active

Enter(Buy) DEC ’25 Calls:

510 @ ~ 26c & 550 @ ~ 17c

2026

No New Action

Cash

2024

Active

Sell MAY ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

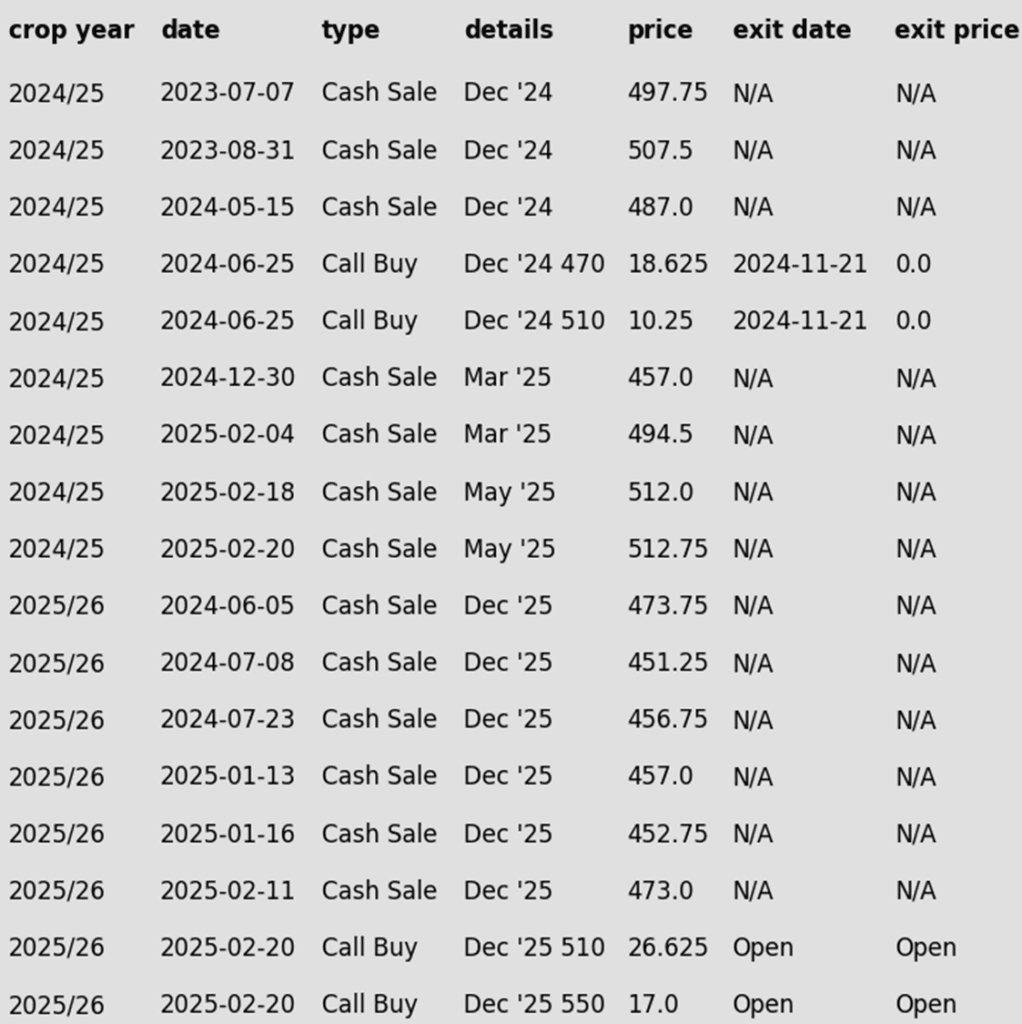

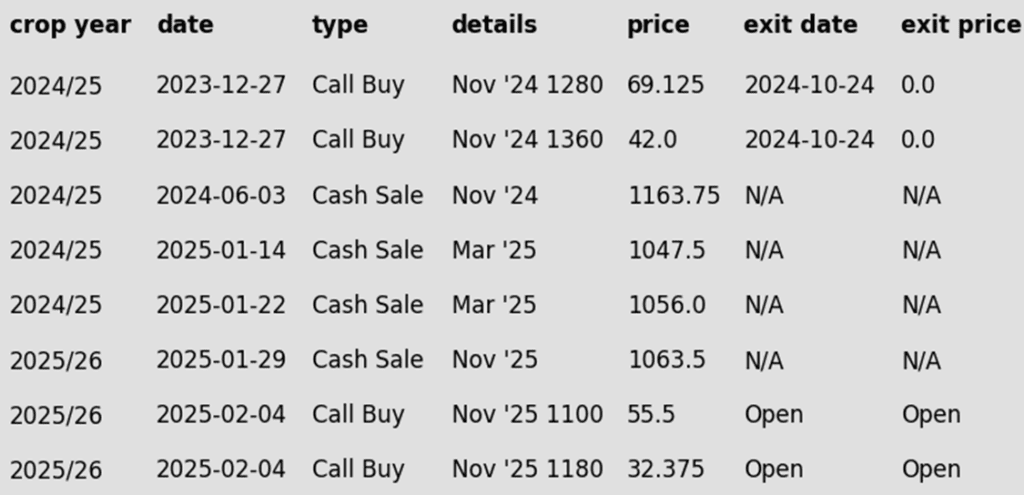

- CONTINUED OPPORTUNITY – Sell another portion of your 2024 corn crop. This is the second sales recommendation this week.

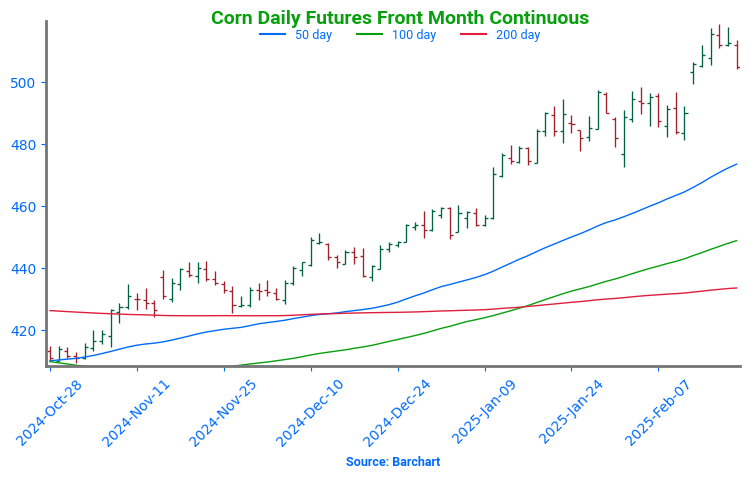

- Target Range Hit: The May contract once again attempted to break through the upper end of Grain Market Insider’s target range (495–515) yesterday but failed to advance. This potentially stalling momentum triggered yesterday’s new sale recommendation. Keep in mind as the sentiment of market participants has shifted to extremely bullish, that at yesterday’s close, the front month continuous price was already up nearly 38% from the August 12 low of 372.50 – bird in the hand…

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends buying December ‘25 510 corn calls and December ‘25 550 corn calls in equal quantities, with a total net spend of approximately 43 cents plus commission and fees.

- The December ‘25 contract closed above 479 resistance yesterday, signaling potential for continued upside movement. Purchasing these call options reopens upside potential on the sales recommendations made to date. Additionally, buying two strikes provides flexibility—the lower strike can be exited once it covers the cost of the upper strike.

- Scenario Planning: With the existing sales recommendations and this call option strategy, Grain Market Insider aims to be positioned for any market direction. Given the many unpredictable wild cards that will influence the market in the months ahead—especially weather—it is critical to be prepared for both $7–$8 corn on the upside and $3–$4 corn on the downside.

- Current sales recommendations are building a buffer against downside scenarios, while the call options purchase helps reopen upside opportunities on those prior sales recommendations. This balanced approach ensures flexibility in an unpredictable market.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 1–2 weeks.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Corn futures ended the week with moderate losses as the March contract slipped 5 cents, once again failing to break above the key $5 resistance level. This came despite strong export sales and support from the wheat market.

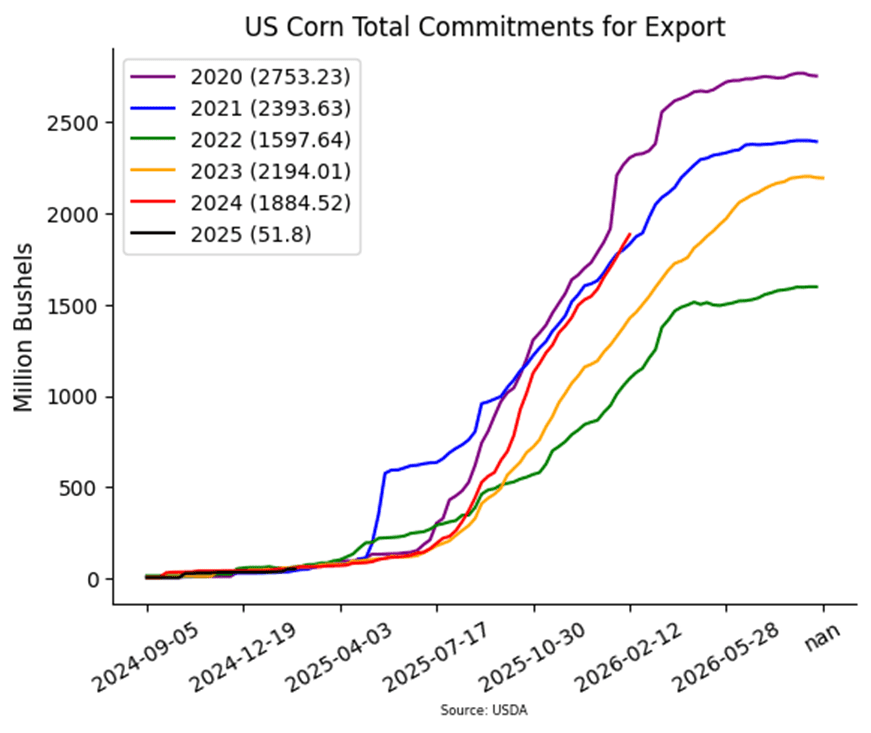

- The USDA announced weekly export sales totals on Friday morning. For the week ending February 13, U.S. exporters posted new sales of 1.454 MMT (57.2 mb). Total accumulated sales are now running 29% above last year and well ahead of the pace to reach the USDA corn export target.

- The Buenos Aires Grain Exchange raised its corn crop ratings, citing recent rainfall that helped stabilize conditions. The percentage of the crop rated “good” increased by 3%, while the “poor” category declined by the same amount.

- Recent improved weather in the Brazil state of Mato Grasso has allowed corn planting of the second crop corn to catch up to pace. The Brazil Ag analyst group IMEA forecast the corn planting in Mato Grasso is 67.2% complete, just slightly behind the 5-year pace of 70.2%. Mato Grasso produces just under 50% of the Brazil second crop corn.

Corn Bulls Charge Ahead, Eyeing $5 Breakout

Corn’s rally since harvest shows no signs of slowing, fueled by aggressive fund buying and steady demand. Strong technical support remains at 475, with an added safety net near the 450-breakout zone. Now, the market is locked in on the $5 mark—a pivotal resistance level that could open the gates for the next leg higher. With bullish momentum firmly in the driver’s seat, the question remains: can the bulls break through, or will the rally hit a wall?

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

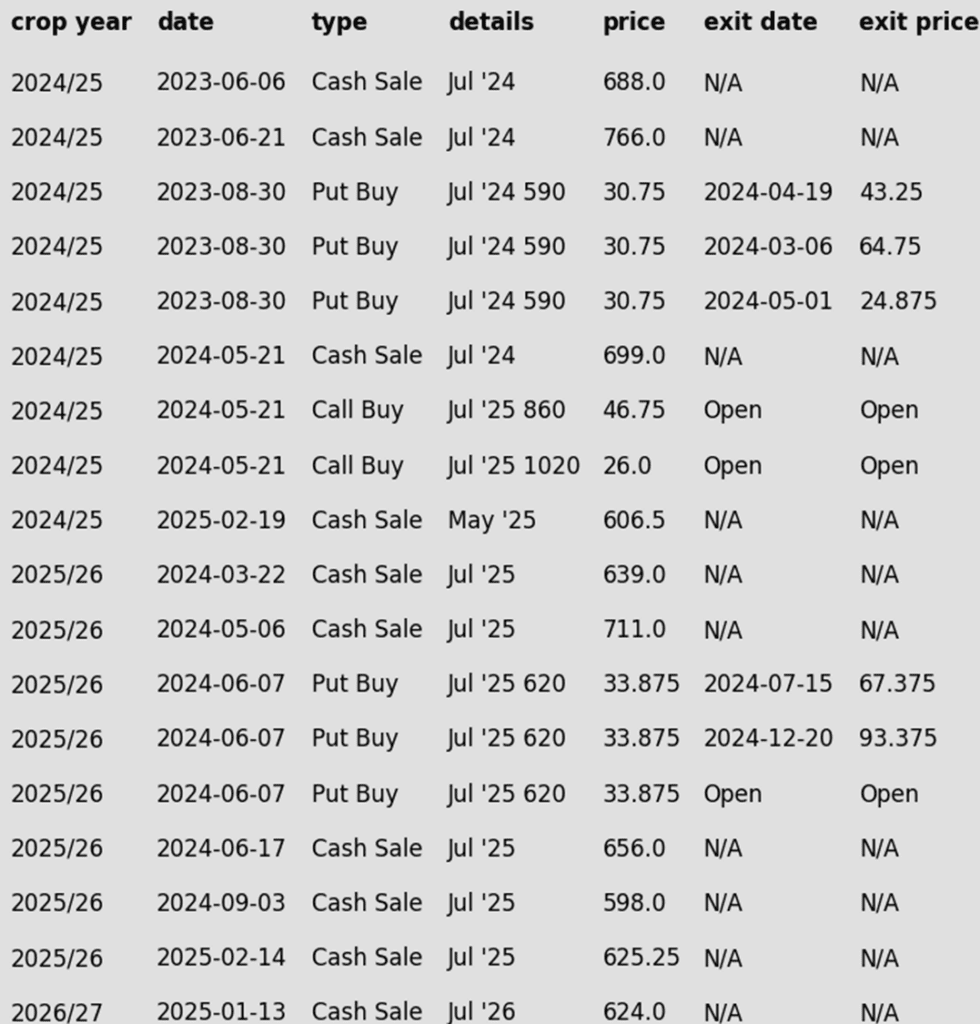

2024 Crop:

- Hold: Given recent recommendations, the current guidance is to sit tight for now on any additional sales.

2025 Crop:

- Sales Target Range: 1090 – 1125 remain the upside target range vs November ‘25.

- Call Option Target: The target to exit all the 1100 Nov ‘25 call options is approximately 88 cents in premium. If the 1100 calls can be exited for that price, it should cover the cost of the 1180 Nov ‘25 calls, providing a net-neutral cost position that can continue to protect the upside on the recent sales recommendation.

2026 Crop:

- No Change: Still no sales recommendations expected until spring.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower but have maintained a narrow trading range over the past week. Pressure today came from poor export sales and a general decline in export demand recently. Soybean meal was mixed with losses in the front months and gains in the deferred contracts while soybean oil was lower.

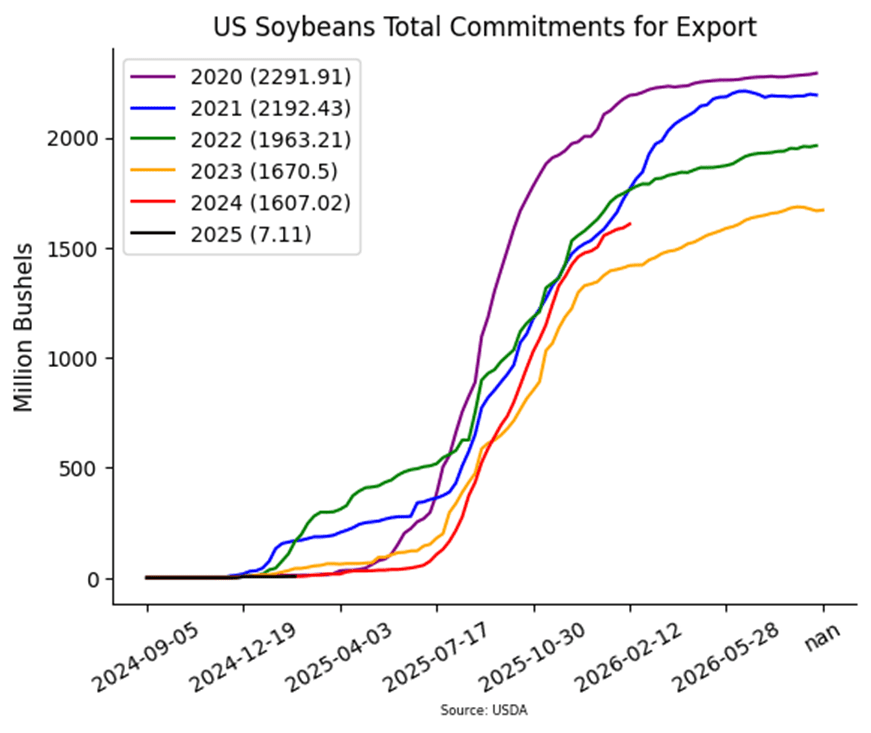

- Today’s export sales report was poor for soybeans with an increase of 18 million bushels. While this was within trade expectations, export demand has slipped with ongoing Brazilian harvest. Sales were up from last week, but down 23% from the previous 4-week average.

- For the week, March soybeans gained 3-1/2 cents to $10.39-1/2 while November soybeans gained 7-3/4 cents to $10.59-3/4. March soybean meal lost $1.10 to $294.80, and March soybean oil gained 0.74 cents to 46.81 cents.

- The International Grains Council decreased their estimate of global soybean production by 2 mmt to 418 mmt. This is said to be largely due to smaller production in Argentina and Paraguay. For reference, the USDA’s February forecast sits at 421 mmt.

Soybeans Eye Breakout After Repeated Tests

Front-month soybean futures are knocking on the door of the 200-day moving average, a formidable resistance that has capped gains for over 18 months. A clean break above this level could ignite bullish momentum and signal a fresh leg higher. On any retreat, solid support is seen near $10, while initial resistance stands at $11, with a bigger hurdle looming near $11.40. The battle lines are drawn—will soybeans finally break free?

Wheat

Market Notes: Wheat

- In the face of lower corn and soybeans, a higher U.S. Dollar Index, and a negative close for Paris milling wheat futures, U.S. wheat had a relatively strong close. Chicago futures led the wheat complex to the upside, despite little in the way of fresh news to drive the market. Support at the 10-day moving average has kept all three classes propped up.

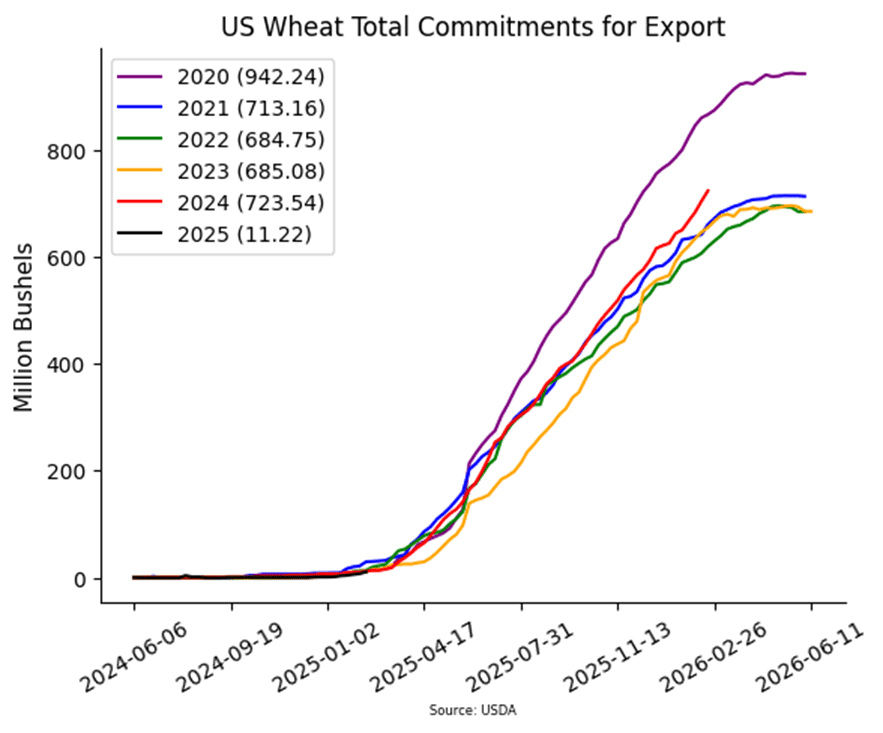

- Weekly wheat export sales totaled 19.6 mb for 24/25 and 3.6 mb for 25/26. Shipments last week at 8.6 mb fell below the 19.5 mb pace needed per week to reach the USDA’s export estimate of 850 mb. Total commitments at 724 mb are up 11% compared to a year ago, though the USDA forecast calls for a 20% increase.

- CoBank estimates U.S. spring wheat acreage will decline 6% to 10 million acres this year. Next week’s USDA Outlook Forum may provide further insight, though it won’t be official data.

- The Russian ag ministry is reported to have reduced their wheat export tax by 24.6% to 2,742.60 Rubles per mt, valid through March 4.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAY ’25 Cash

2025

Active

Sell JUL ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Sell a portion of your 2024 SRW wheat crop.

- Maintain Call Options: Continue to hold onto the July ‘25 860 and 1020 call options.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell a portion of your 2025 SRW wheat crop.

- Next Target: If the July contract can maintain its uptrend, the next sales target range would be 690-715 vs. July ‘25.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- No Change: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

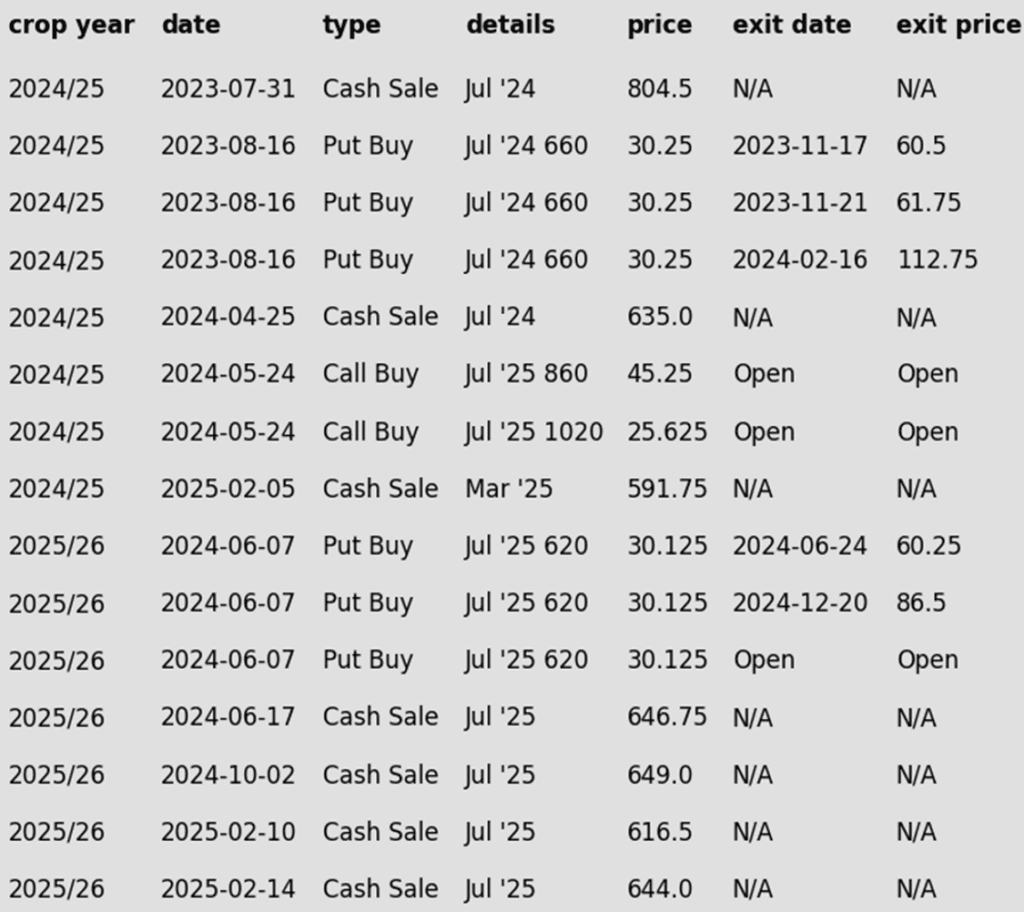

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Breaks Out with Force

Chicago wheat shattered its prolonged sideways grind with a powerful February surge, hitting key resistance at the early October highs just above 615. This decisive weekly close above the 200-day moving average sets the stage for the MA to act as firm support on any near-term dips. Next upside targets loom near 650, with stronger resistance waiting in the 680-700 zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell JUL ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Hold: Given the recent sale recommendation, the current guidance is to continue to sit tight for now on any additional sales.

- Maintain Call Options: Continue to hold onto the July ‘25 860 and 1020 call options.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell another portion of your 2025 HRW wheat crop.

- Two Sales: Grain Market Insider advised two sales last week—one on Monday and another on Friday—as the July ’25 contract extended its rally for a fourth straight week.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

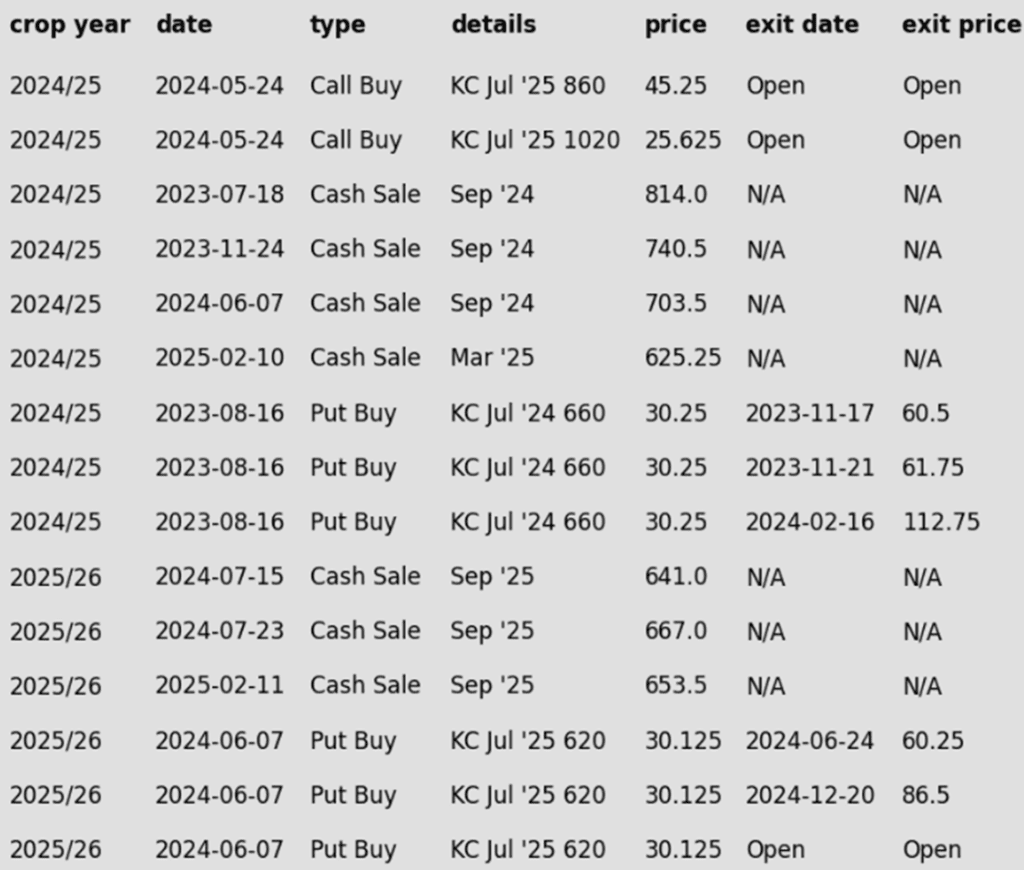

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Ignites Rally Potential

Kansas City wheat futures launched into February with bullish momentum, closing above the 200-day moving average and challenging multi-month highs near 620. A breakout above the October peak of 623 could spark a run toward the coveted 700 mark. On the flip side, the 200-day MA offers initial support, with a sturdier safety net resting near 575.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Hold: Given recent recommendations, the current guidance is to continue to sit tight for now on any additional sales.

- Maintain Call Options: Continue to hold onto the July ‘25 KC 860 and 1020 call options.

2025 Crop:

- Hold: Given recent recommendations, the current guidance is to continue to sit tight for now on any additional sales.

- Maintain Put Options: Continue to hold the last quarter of July ‘25 KC 620 put options.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Breakout Confirmed

Spring wheat shook off its doldrums in late January, surging past its prolonged sideways range and flashing bullish signals. A mid-February close above the 200-day moving average strengthens the breakout case. Initial support stands at the 200-day MA, with firmer footing near 615 — the top of the old range. On the upside, 650 is the first hurdle to clear before bulls set their sights on the elusive 700 mark.

Other Charts / Weather