2-20 End of Day: Wheat Leads the Markets’ Strong Start to the Week.

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’24 | 418.75 | 2.25 |

| JUL ’24 | 443.25 | 3 |

| DEC ’24 | 463 | 4.25 |

| Soybeans | ||

| MAR ’24 | 1179 | 6.75 |

| JUL ’24 | 1192 | 7.25 |

| NOV ’24 | 1157.75 | 9.25 |

| Chicago Wheat | ||

| MAR ’24 | 582.75 | 22.25 |

| JUL ’24 | 580 | 18.25 |

| JUL ’25 | 616.75 | 13 |

| K.C. Wheat | ||

| MAR ’24 | 585.75 | 18.5 |

| JUL ’24 | 572.75 | 17.5 |

| JUL ’25 | 613.25 | 14.5 |

| Mpls Wheat | ||

| MAR ’24 | 665.5 | 10.75 |

| JUL ’24 | 668.5 | 9 |

| SEP ’24 | 675.25 | 8.25 |

| S&P 500 | ||

| MAR ’24 | 4983 | -36.75 |

| Crude Oil | ||

| APR ’24 | 77.15 | -1.31 |

| Gold | ||

| APR ’24 | 2038.6 | 14.5 |

Grain Market Highlights

- Early strength in the corn market from wheat and word of year-round E15 approval likely faded when news broke that the approval would be delayed until 2025. March corn recovered somewhat mid-session to settle mid-range, 3 cents off the high.

- Soybeans ended the day near the low end of the range following choppy trade after prices faded from early morning highs on news of additional measures by China to stimulate their economy after it came back from its weeklong New Year’s celebrations.

- Soybean meal continued its rally from last week with support coming from firmer basis and continued tight supplies from last month’s slowdown in crush. Soybean oil was firmer to start the day, but gave up its gains and took some support away from soybeans as follow through selling from Friday entered the market.

- The wheat complex rebounded in today’s session with the Chicago contracts leading the way higher. While Front month KC also reversed higher, the lead contracts in both Chicago and Minneapolis closed the day posting bullish key reversals. The market reversals from oversold conditions likely triggered short covering which added to the day’s strength.

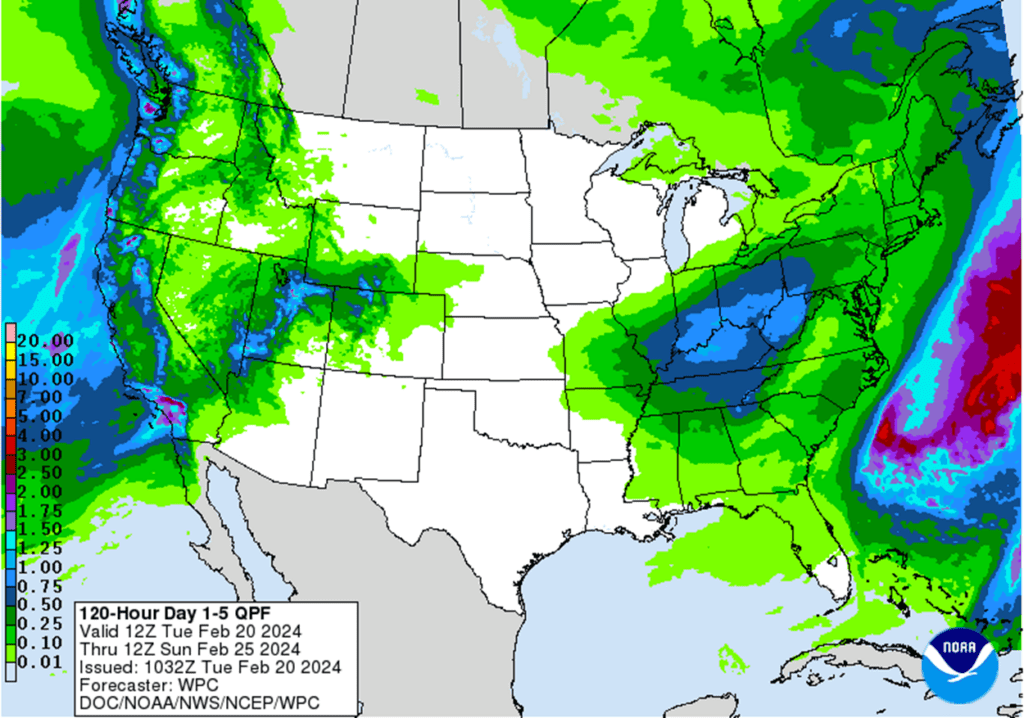

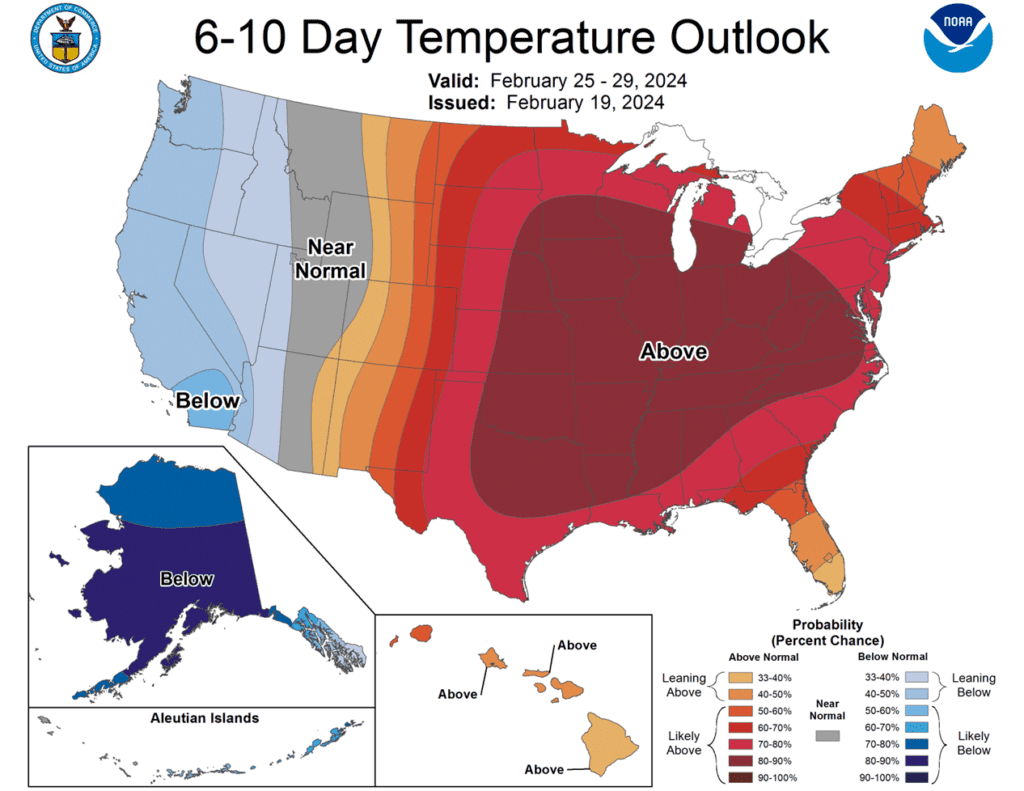

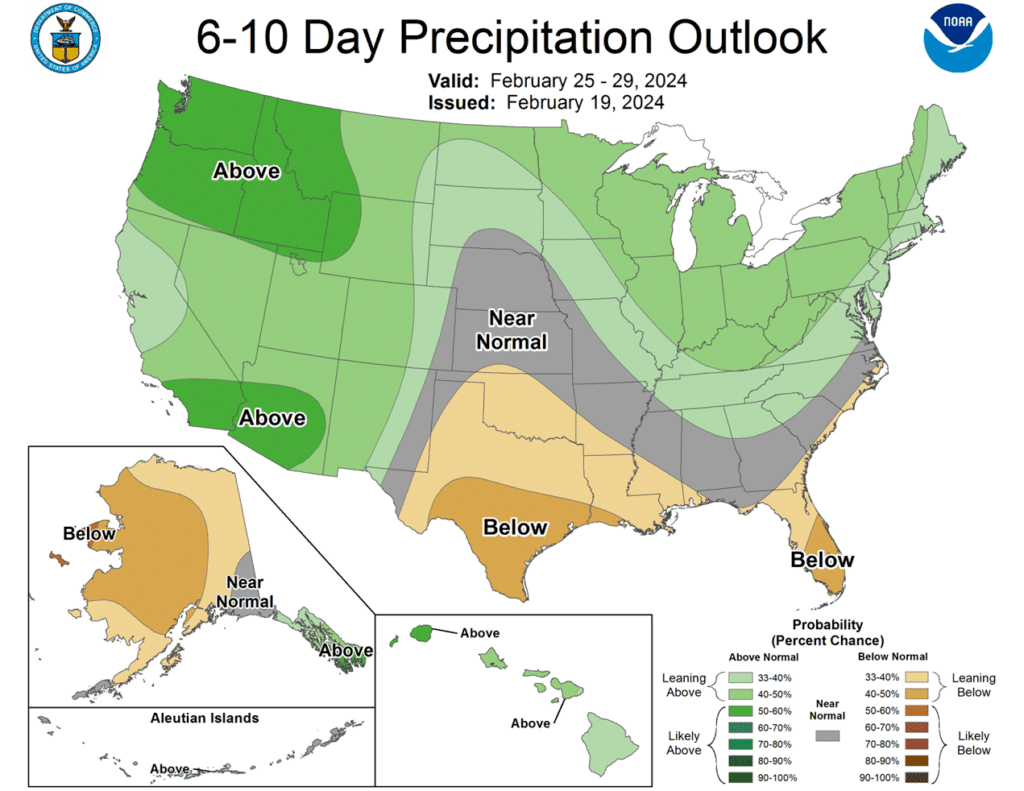

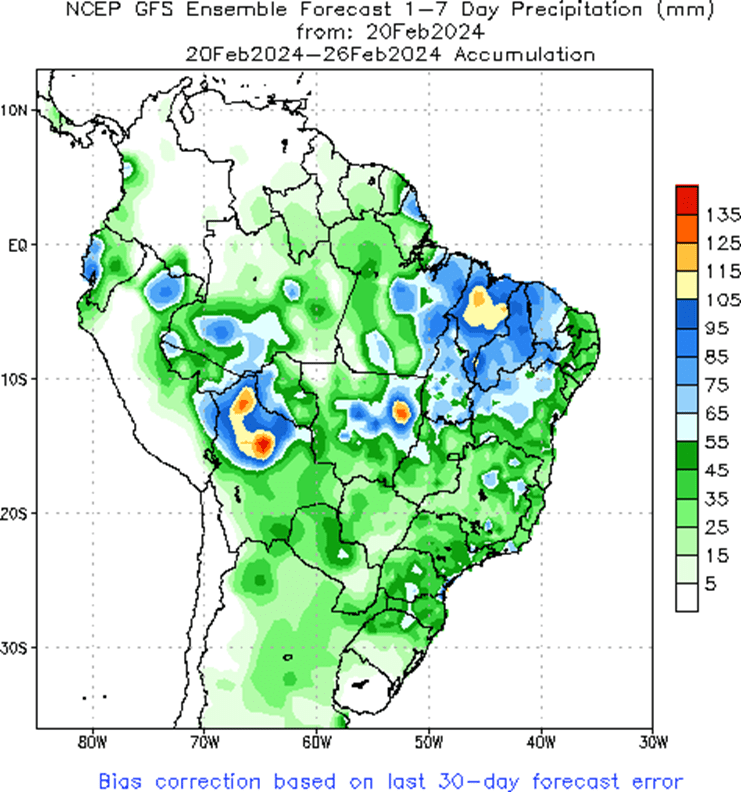

- To see the updated US 5-day total precipitation forecast, 6 – 10 day US temperature and precipitation outlooks, and Brazil’s 1-week precipitation forecast, courtesy of the National Weather Service and the Climate Prediction Center, and NOAA, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

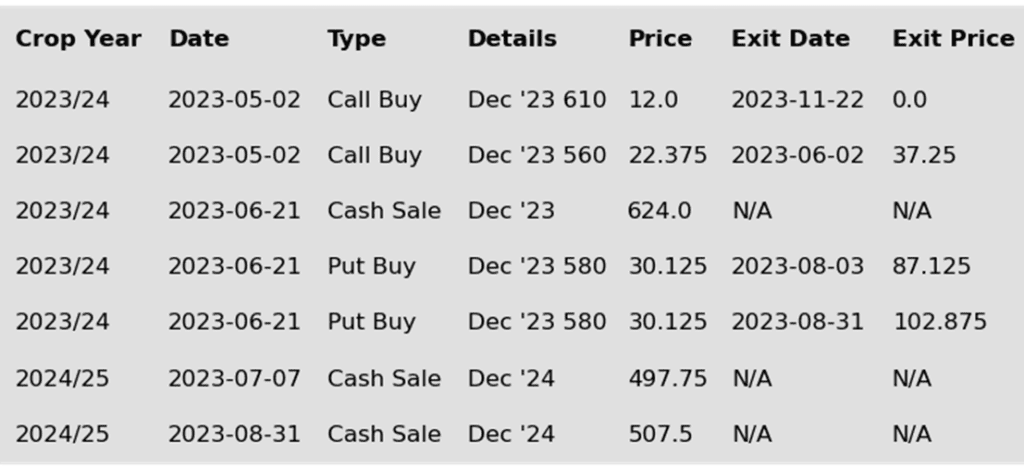

Corn Action Plan Summary

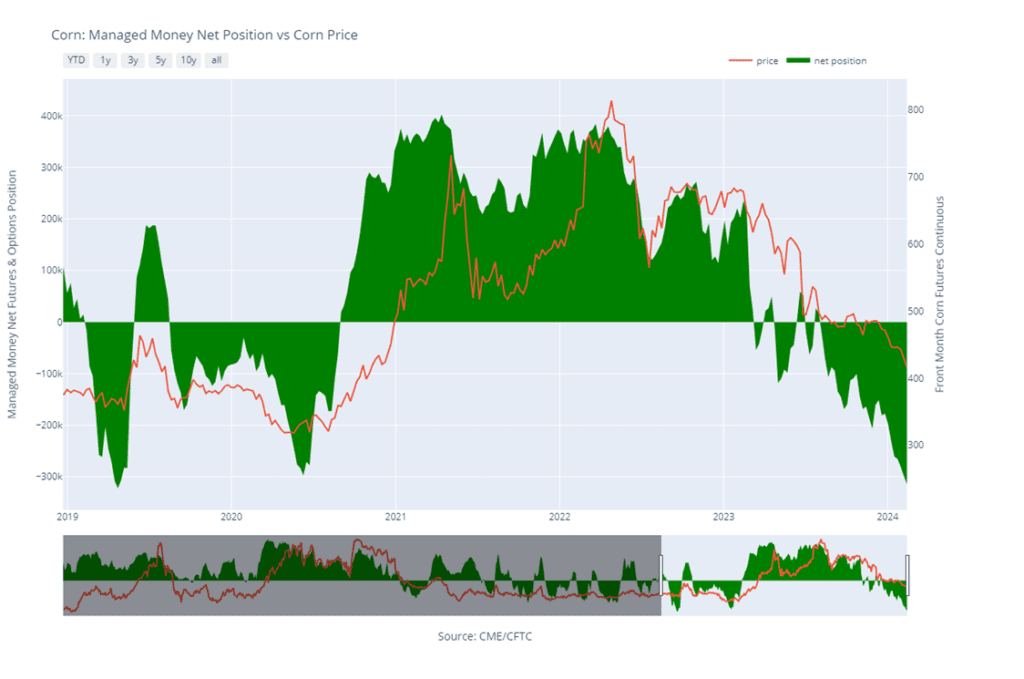

- No new action is recommended for 2023 corn. With a general lack of bullish news and an estimated US carryout over 2.1 billion bushels, front month corn has languished in a sideways to lower trend since printing a high last October. While the lack of a bullish catalyst has been disappointing, the market is in a significantly oversold condition, and managed funds continue to hold a sizable net short position. Either or both could trigger a short covering rally at any time heading into the spring planting window. For now, Grain Market Insider continues to sit tight on any further sales recommendations for the next few weeks with the objective of seeking out better pricing opportunities. If the market has not turned around by then, Grain Market Insider may sit tight on the next sales recommendations until spring or even summer.

- No new action is recommended for 2024 corn. In January, Dec ’24 broke through the bottom end of the 485 ¾ to 602 range that had been in place since February ’22. While this was a disappointing development, bear spreading has allowed Dec ’24 to maintain more of its value versus old crop as traders attempt to price in a larger 2023 carryout with more uncertainty ahead for the 2024 crop. Additionally, Dec ’24 is significantly oversold on the weekly chart, which is supportive for a technical rally to begin at any time as the spring planting window quickly approaches. Given the amount of time and uncertainty that remains for the 2024 crop, Grain Market Insider will consider recommending additional sales on a retracement toward the low to mid 500 level.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next year. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Strong support from the wheat market and news regarding E15 helped support corn futures to start the week. March corn added 2 ¼ cents and May was 3 cents higher on the session.

- The Biden administration will approve the request from a group of Midwest Governors to allow year-around sales of gasoline with higher ethanol blends. This paves the way for E15 but will wait for 2025 to start. The news brings mixed reactions – glad that change is coming, but disappointed to have to wait until 2025.

- The USDA announced a flash export sale of corn to Japan. The 6.1 mb (155,000 mt) was slated for the 24/25 marketing year.

- Weekly corn export inspections last week reached 36.2 mb (919,000 mt), which was within expectations. Total inspections are now at 713 mb, up 32% over last year’s disappointing totals.

- The March futures contract reaches First Notice Day, February 29. In this window, producers with basis contracts will need to roll to the next month or price bushels against the basis.

Above: The front month has rolled from the March to the May contract where May has about a 13-cent premium over the March. The May contract also shows support around 428 which equates to about 415 in the March when considering the difference in premium between the two. So far, that support is holding, and prices could turn back toward the 450 – 460 area if a bullish input enters the market. If not, prices may continue to slide toward 400 psychological support or possibly 390.

Corn Managed Money Funds net position as of Tuesday, Feb. 13. Net position in Green versus price in Red. Managers net sold 16,597 contracts between Feb. 7 – 13, bringing their total position to a net short 314,341 contracts.

Soybeans

Action Plan: Soybeans

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

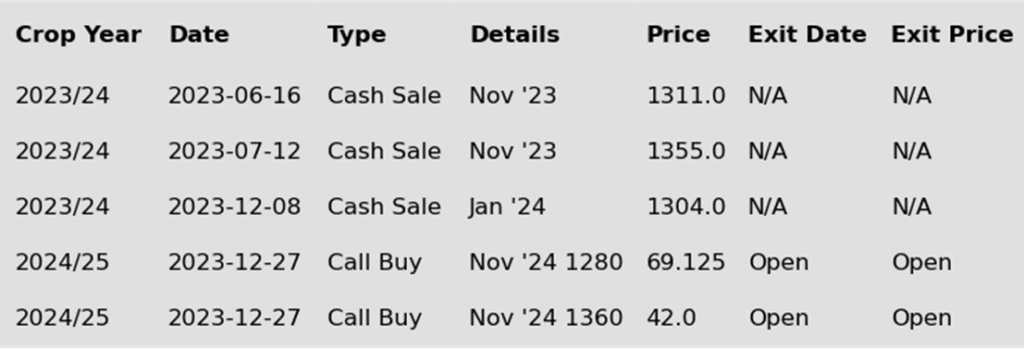

Soybeans Action Plan Summary

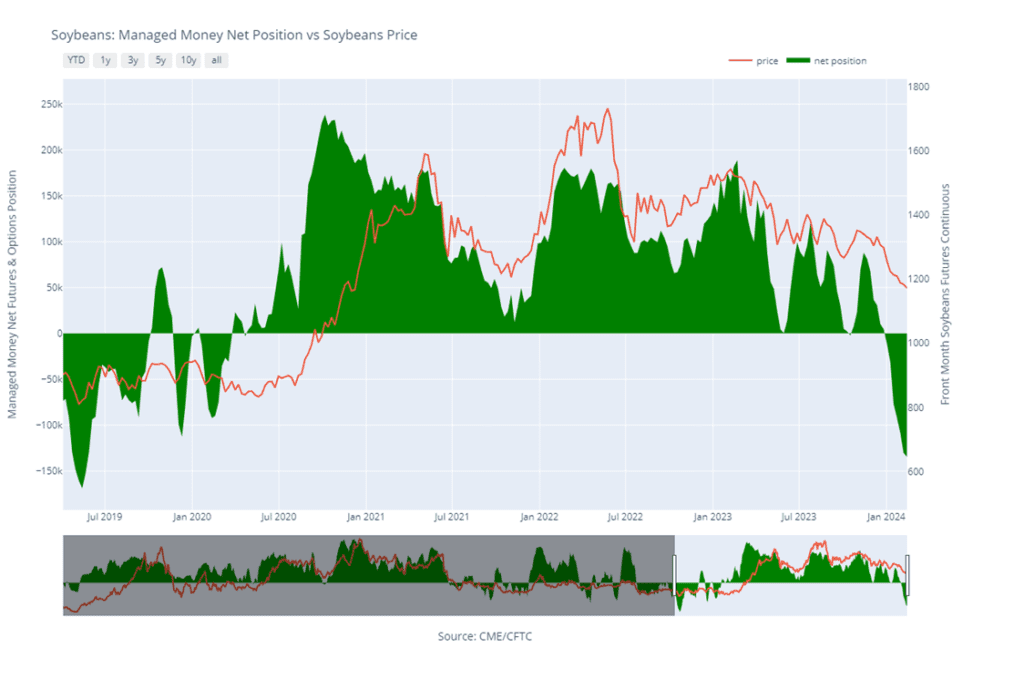

- No new action is recommended for 2023 soybeans. In early January, front month soybeans broke through the bottom side of the 1290 – 1400 range that had been in place since mid-October. As South American weather forecasts improved, the potential for a reduction in the record large global carryout also lessened, bringing prices down toward the 1180 support level. For now, 1180 support appears to be holding, and though the weak price action has been disappointing, time remains in the South American growing season, and the old crop marketing year, for unforeseen changes to push prices back higher. Given the potential of a downside breakout back in December, Grain Market Insider recommended adding to sales as prices remained historically good, and Grain Market Insider will continue to look at additional sales opportunities heading into spring.

- No new action is recommended for the 2024 crop. After the Nov ’24 contract broke through the bottom side of the 1233 – 1320 range, prices continued to retreat as South American weather conditions improved. Even though Nov ’24 runs similar downside risks as the front month contracts, which could press new crop prices toward 1150 or possibly the May ’23 low near 1115, plenty of time remains to market this crop. Considering the amount of uncertainty that lies ahead with the 2024 soybean crop, Grain Market Insider recommended back in December buying Nov ’24 1280 and 1360 calls to give you confidence to make sales against anticipated production, and to protect any sales in an extended rally. Additionally, the possibility remains that prices could retest the 2022 highs, at which point Grain Market Insider may consider recommending additional sales.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day higher but backed significantly off their earlier morning highs by about 10 cents. Soybean meal ended the day higher while soybean oil closed lower along with lower crude oil. A potentially strengthening Chinese economy, good exports, and funds nearing their record large short positions were all friendly today.

- Over the weekend, China’s government announced that it would cut the country’s benchmark 5-year loan prime rate which was the first time it has been lowered since June. The move comes as the Chinese government looks to stimulate the economy which could be friendly for soybean demand.

- For the week ending February 15, soybean inspections totaled 43.6 mb. This was towards the higher range of estimates and was a good number for this time of year. Total inspections of 1,175 mb are down 23% from last year.

- The USDA announced a flash sale of soybean meal to the Philippines this morning. The sale of 228,000 mt of soybean meal were scheduled for the current marketing year. In addition to this, China is back from their holiday which could bring more purchases from the US.

- Last week’s CFTC report showed non-commercials as sellers of 4,200 contracts of soybeans which increased their net short position to 134,500 contracts and nearing their record short position.

Above: With the failure of 1180 support, it appears that front month soybeans could continue to drift lower towards 1140 – 1145 without fresh bullish input to turn the market around. The market continues to show signs of being oversold which can add support if a reversal happens. Overhead, nearby resistance may come in between 1200 and 1205, with additional resistance around 1220 – 1225.

Soybean Managed Money Funds net position as of Tuesday, Feb. 13. Net position in Green versus price in Red. Money Managers net sold 4,200 contracts between Feb. 7 – 13, bringing their total position to a net short 134,500 contracts.

Wheat

Market Notes: Wheat

- It was a banner day for the wheat market, with all three US classes posting double digit gains. The first two months in Chicago wheat in particular rallied more than 20 cents. Bull spreading was noted, in which nearby futures showed more strength than deferred contracts. This may indicate some of today’s action may be short covering by the funds as well as a technical correction of oversold conditions and last week’s lows.

- Weekly wheat inspections of 14.0 mb bring the 23/24 total to 444 mb. This is down 18% from last year and is running below the USDA’s projected pace. Exports for 23/24 are estimated at 725 mb.

- As stated by their Agriculture Ministry, only 1% to 2% of Ukraine’s winter wheat crop will be damaged and not survive the winter. Over 95% of wheat in Ukraine is winter wheat, and on average, up to 7% of the crop dies due to frost or ice. This year’s winter has been relatively mild, which accounts for the less than normal damage.

- France’s wheat crop is said to be rated just 68% good to excellent versus 93% at this time last year. This is the poorest rating since 2020. Heavy rains during planting are cited as the reason for the lower rating. Additionally, France also planted less wheat acres than average due to the earlier weather issues.

- Despite another three dollar per ton FOB decline in Russian wheat values last week, Ukraine is said to have offered wheat even more cheaply. At $218 per mt FOB, Ukraine found some business in Egypt’s tender, in the amount of two cargoes. Regardless, Russia is sure to remain stiff competition on the export market since both IKAR and Sov Econ estimate their wheat crop to be around 93 mmt.

- According to the Australian Bureau of Meteorology, El Nino still persists, but is also steadily weakening. Four out of seven international climate models suggest that the pattern will return to neutral by April, while all seven models agree on a neutral pattern by May.

Action Plan: Chicago Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Chicago Wheat Action Plan Summary

- No new action is currently recommended for 2023 Chicago wheat. The wheat market has continued to be dominated by lower world export prices that have stymied US export sales and depressed US prices. In early December, Grain Market Insider recommended taking advantage and making a sale on a short covering rally which was sparked by several Chinese purchases of US wheat. Since then, China has been silent in the US wheat export market, and prices remain somewhat elevated. Any remaining 2023 soft red winter wheat should be getting priced into market strength with the goal of having zero bushels unpriced by the end of January. Grain Market Insider won’t have any “New Alerts” for 2023 Chicago wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Chicago wheat. Since early December, the July ’24 contract has traded mostly sideways to slightly lower after its brief short covering runup on Chinese buying. Although China has since been absent from the US wheat export market, prices appear to have found support above 585, and managed funds continue to hold a sizeable, short position that could trigger another short covering rally if a bullish impetus enters the market. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for further price erosion. Although, if the market receives the needed stimulus to move prices back toward this summer’s highs, Grain Market Insider is prepared to recommend adding to current sales levels and possibly even purchasing call options to protect those sales. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset much of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Since early September, the July ’25 contract has been mostly rangebound with 632 at the low end and 685 at the top. Grain Market Insider’s strategy for the 2025 crop year up to this point has been to sit tight. Though if prices rally toward the upper end of this range, we will consider taking advantage of the rally’s historically good prices to make sales recommendations.

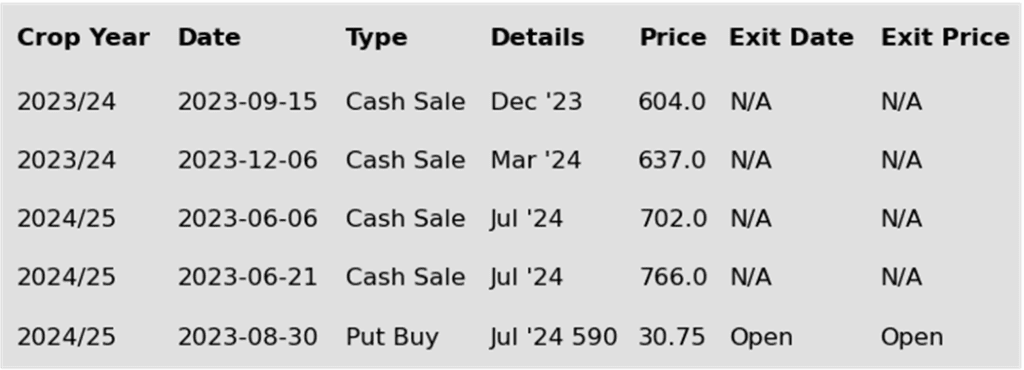

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: The downside breakout from the 584 – 618 congestion pattern suggests that prices may attempt to test the next support level around 555. If the 555 can hold and prices turn back higher, upside resistance will again be found between 584 and 618. If not, the next major level of support remains near the September low of 540.

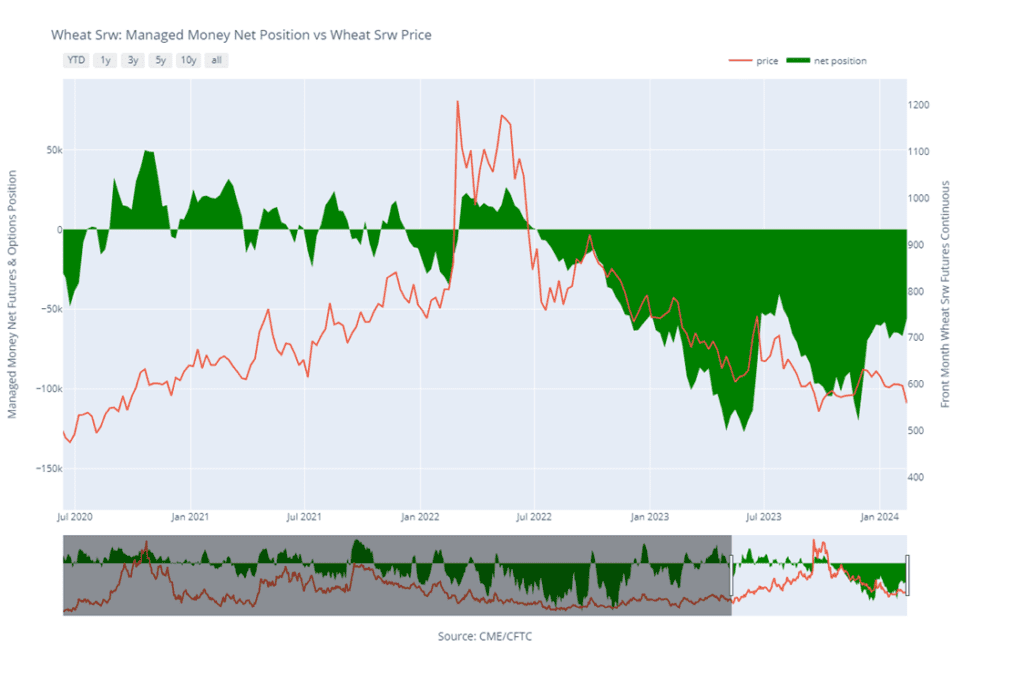

Chicago Wheat Managed Money Funds net position as of Tuesday, Feb. 13. Net position in Green versus price in Red. Money Managers net bought 11,066 contracts between Feb. 7 – 13, bringing their total position to a net short 55,672 contracts.

Action Plan: KC Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

KC Wheat Action Plan Summary

- No new action is recommended for 2023 KC wheat crop. Since last fall, front month KC wheat has been mostly rangebound between 678 up top and the 590 area down below. The latter has held as support for the past three months. Although fundamentals remain weak, considering support lies just below the market and managed funds continue to carry a sizable short position, these factors could trigger a return to higher prices if any unforeseen risks enter the market. Grain Market Insider’s strategy is to look for price appreciation as weather becomes a more prominent market mover and may consider suggesting additional sales if prices make a modest 20% retracement of the 2022 highs back toward 730.

- No new action is recommended for 2024 KC wheat. In early December the July ’24 contract posted a 70-cent rally mostly on short covering activity in the front month contracts. Since then, July ’24 has drifted lower as growing conditions have seen improvement. Still, much of the growing season remains, and managed funds continue to carry a significantly short position in old crop. Even though bullish headwinds remain, this could fuel another short covering rally if any production concerns come to the forefront. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts to protect the downside. As the market got further extended into oversold territory and July ’24 showed signs of support near 630, Grain Market Insider recommended exiting 75% of the originally recommended position. Grain Market Insider also recommended on Friday to exit the remaining KC 660 puts. If you did not have a chance to exit those puts, Grain Market Insider will express a continued opportunity to exit those puts if the market retraces today’s strength back towards 570.

- No action is currently recommended for 2025 KC Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following KC recommendations:

Above: Front month KC wheat appears very oversold, and the reversal higher indicates support around 555. If prices continue to appreciate, they may run into overhead resistance between 590 and 600. If prices retreat back through 555, the next major support level remains below the market around 530.

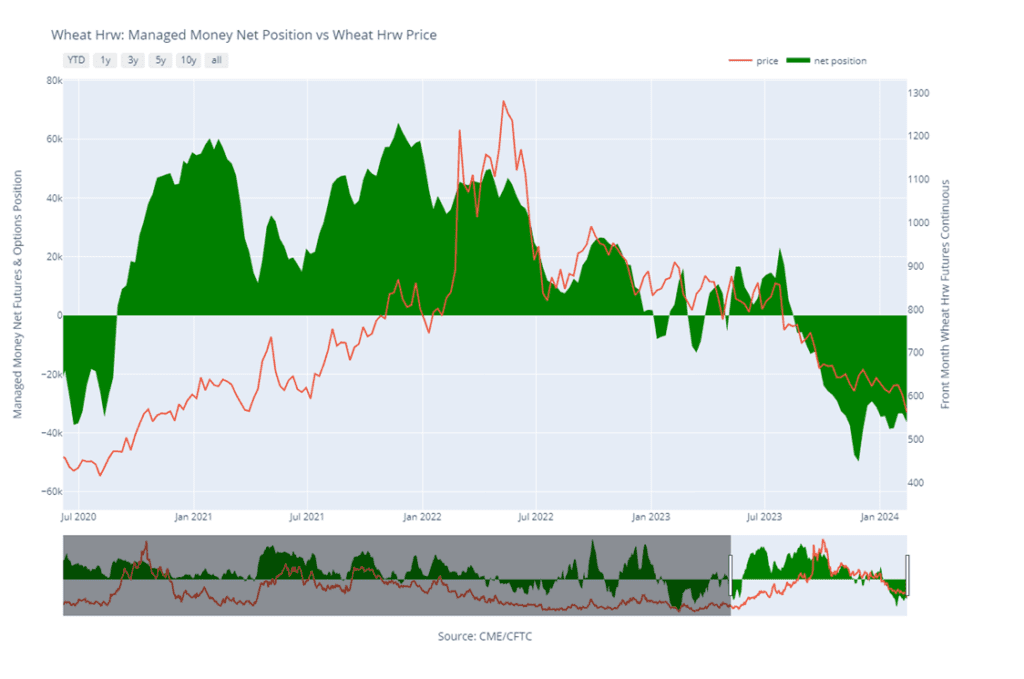

KC Wheat Managed Money Funds net position as of Tuesday, Feb. 13. Net position in Green versus price in Red. Money Managers net sold 3,011 contracts between Feb. 7 – 13, bringing their total position to a net short 36,408 contracts.

Action Plan: Mpls Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Mpls Wheat Action Plan Summary

- No new action is currently recommended for 2023 Minneapolis wheat. Since last summer, front month Minneapolis wheat has slowly stair-stepped lower with weaker world prices and little bullish news to move markets higher. During this time, the 50-day moving average has acted as resistance, above which the market has not been able to hold for very long. Managed funds have also established and maintained a record (or near record) short position for much of the same time. Although bullish headwinds remain, the market has become very oversold, and the large fund net short position continues to leave the market susceptible to a short-covering rally at any time here. Grain Market Insider’s strategy is to look for a modest retracement of the July high and consider additional sales around 725 – 750.

- No new action is recommended for 2024 Minneapolis wheat. Much like the front month contracts, Sept ’24 has been in a downward trend since last summer. And just as Sept ’24 has been influenced to the downside by the front months, it could be similarly influenced to the upside by the front months if a bullish impetus enters the scene and triggers a short covering rally due to the fund’s large short position. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts to protect the downside following a 1-year range breakout in KC wheat, and in November recommended exiting 75% of the originally recommended position as July ’24 KC wheat showed signs of support around 630. While in the same time frame, Grain Market Insider also recommended making an additional sale as the Sept ’24 Minneapolis contract broke long time 743 support. On Friday, Grain Market Insider recommended exiting the remaining KC 660 puts. If you did not have a chance to exit those puts, Grain Market Insider will express a continued opportunity to exit those puts if the market retraces today’s strength back towards 570.

- No action is currently recommended for the 2025 Minneapolis wheat crop. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted in the spring of next year. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: The bullish key reversal on Feb. 20 indicates that there is support below the market around 650. This reversal and the fact that the market is oversold could trigger short covering and lead prices toward 680 – 690 resistance. If the reversal doesn’t hold and prices retreat further, the next major support level remains near 595.

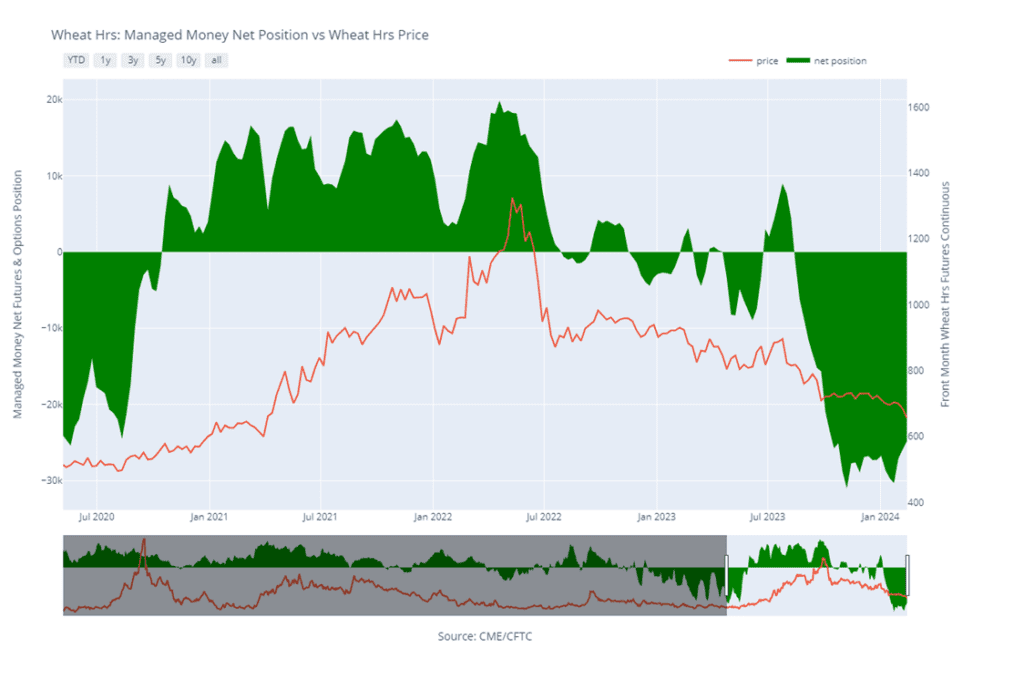

Minneapolis Wheat Managed Money Funds net position as of Tuesday, Feb. 13. Net position in Green versus price in Red. Money Managers net bought 1,074 contracts between Feb. 7 – 13, bringing their total position to a net short 24,832 contracts.

Other Charts / Weather

Brazil 1-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.

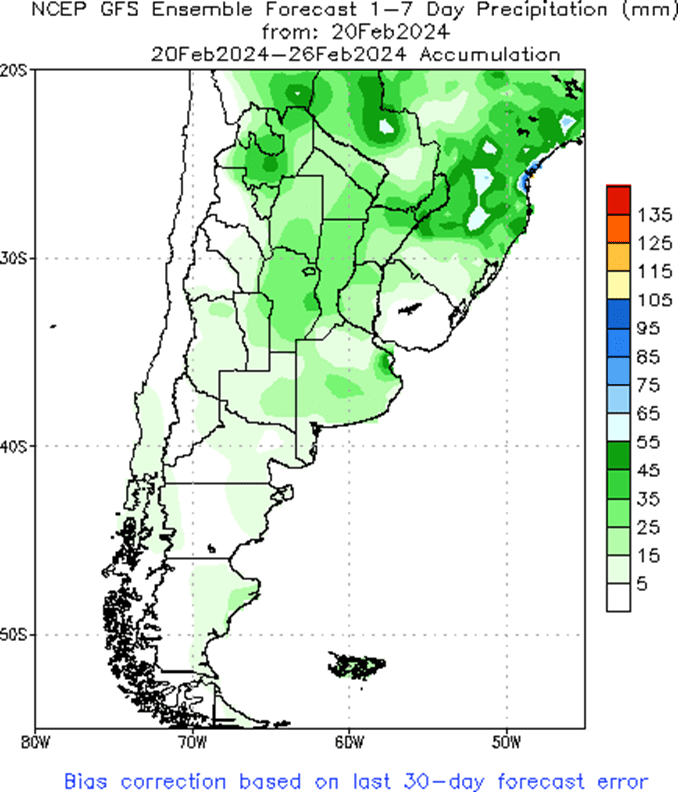

Argentina 1-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.