2-20 End of Day: Corn and Soybeans Post Gains, Wheat Remains Under Pressure

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 498 | 0.5 |

| JUL ’25 | 516.75 | 1.5 |

| DEC ’25 | 479.5 | 3 |

| Soybeans | ||

| MAR ’25 | 1045.5 | 13.75 |

| JUL ’25 | 1077.75 | 13.75 |

| NOV ’25 | 1061.25 | 10 |

| Chicago Wheat | ||

| MAR ’25 | 585.5 | -6.5 |

| JUL ’25 | 614 | -5.75 |

| JUL ’26 | 657 | -4 |

| K.C. Wheat | ||

| MAR ’25 | 607.5 | -6.25 |

| JUL ’25 | 632 | -6 |

| JUL ’26 | 666 | -5.25 |

| Mpls Wheat | ||

| MAR ’25 | 632.75 | -0.75 |

| JUL ’25 | 660.25 | -1.25 |

| SEP ’25 | 669.5 | -2.25 |

| S&P 500 | ||

| MAR ’25 | 6131.5 | -31.5 |

| Crude Oil | ||

| APR ’25 | 72.5 | 0.4 |

| Gold | ||

| APR ’25 | 2954.8 | 18.7 |

Grain Market Highlights

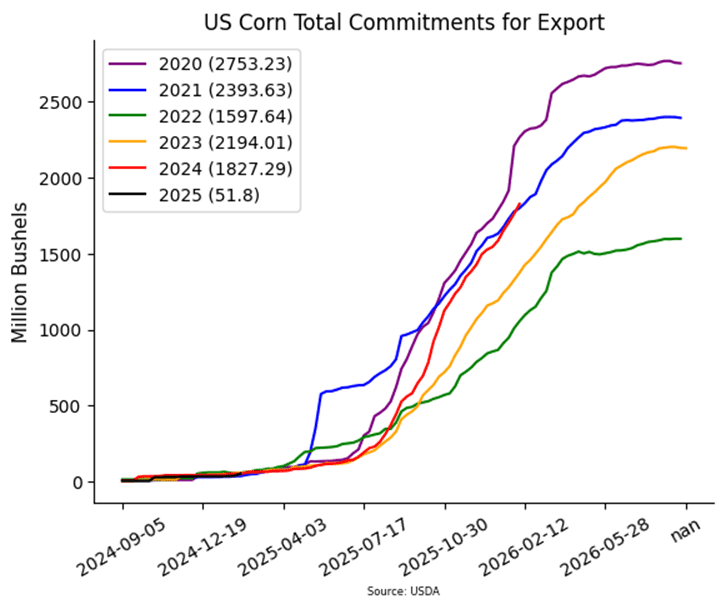

- Corn: The corn market closed the day with modest gains, receiving support from the soybean market and a continued positive outlook in the weekly export report, which remains favorable for corn demand.

- Soybeans: Soybeans finished the day higher, recovering yesterday’s losses and then some, supported by both soybean oil and soybean meal.

- Wheat: The wheat market faced resistance today, closing the session with losses as concerns over cold weather eased, with warmer temperatures expected to move into the affected regions by the weekend.

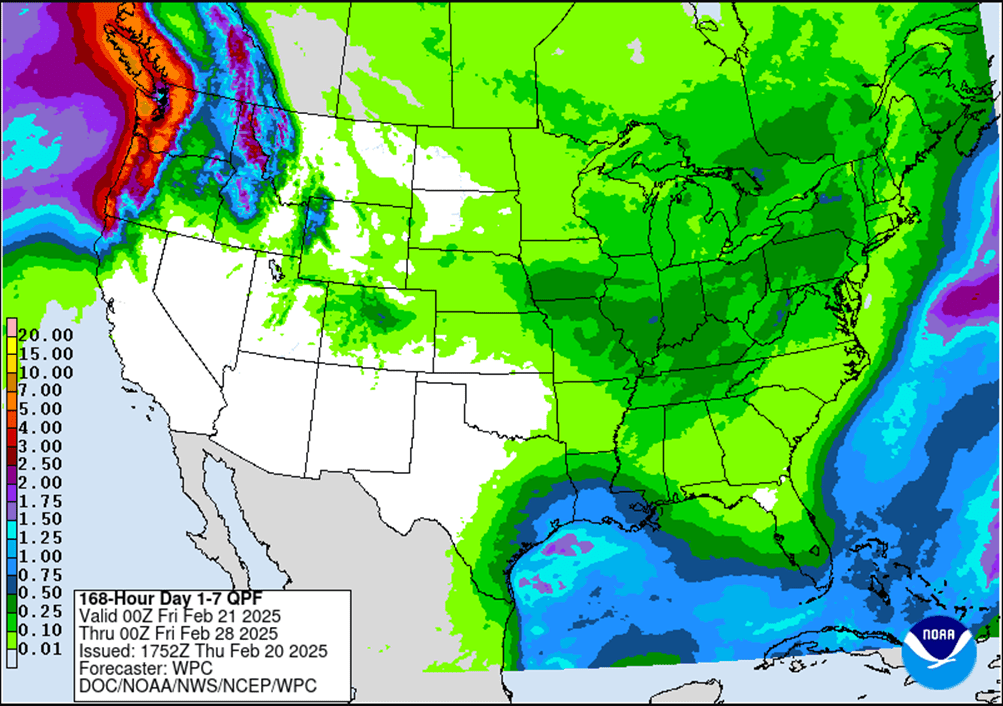

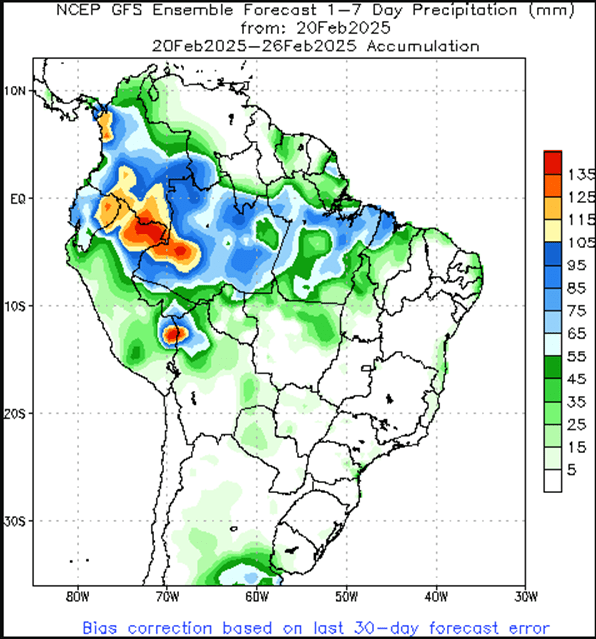

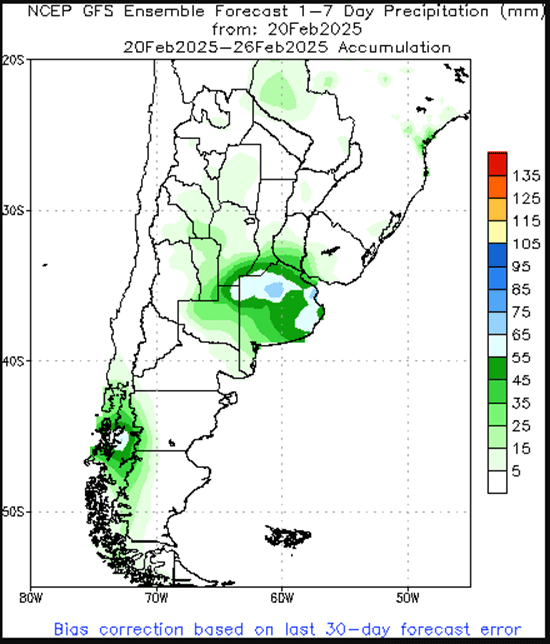

- To see the updated U.S. 7-day precipitation forecast as well as the Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center and NOAA scroll down to the other Charts/Wheat section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

New Alert

Enter(Buy) DEC ’25 Calls:

510 @ ~ 26c & 550 @ ~ 17c

2026

No New Action

Cash

2024

New Alert

Sell MAY ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- NEW ACTION – Sell another portion of your 2024 corn crop today. This is the second sales recommendation this week.

- Target Range Hit: The May contract once again attempted to break through the upper end of Grain Market Insider’s target range (495–515) today but failed to advance. This stalled momentum triggered today’s new sale recommendation.

2025 Crop:

- NEW ACTION – Grain Market Insider recommends buying December ‘25 510 corn calls and December ‘25 550 corn calls in equal quantities, with a total net spend of approximately 43 cents plus commission and fees.

- The December ‘25 contract closed above 479 resistance today, signaling potential for continued upside movement. Purchasing these call options reopens upside potential on the sales recommendations made to date. Additionally, buying two strikes provides flexibility—the lower strike can be exited once it covers the cost of the upper strike.

- Scenario Planning: With the existing sales recommendations and today’s call option strategy, Grain Market Insider aims to be positioned for any market direction. Given the many unpredictable wild cards that will influence the market in the months ahead—especially weather—it is critical to be prepared for both $7–$8 on the upside and $3–$4 on the downside.

- Current sales recommendations are building a buffer against downside scenarios, while today’s call option purchase helps reopen upside opportunities on those prior sales recommendations. This balanced approach ensures flexibility in an unpredictable market.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 1–2 weeks.

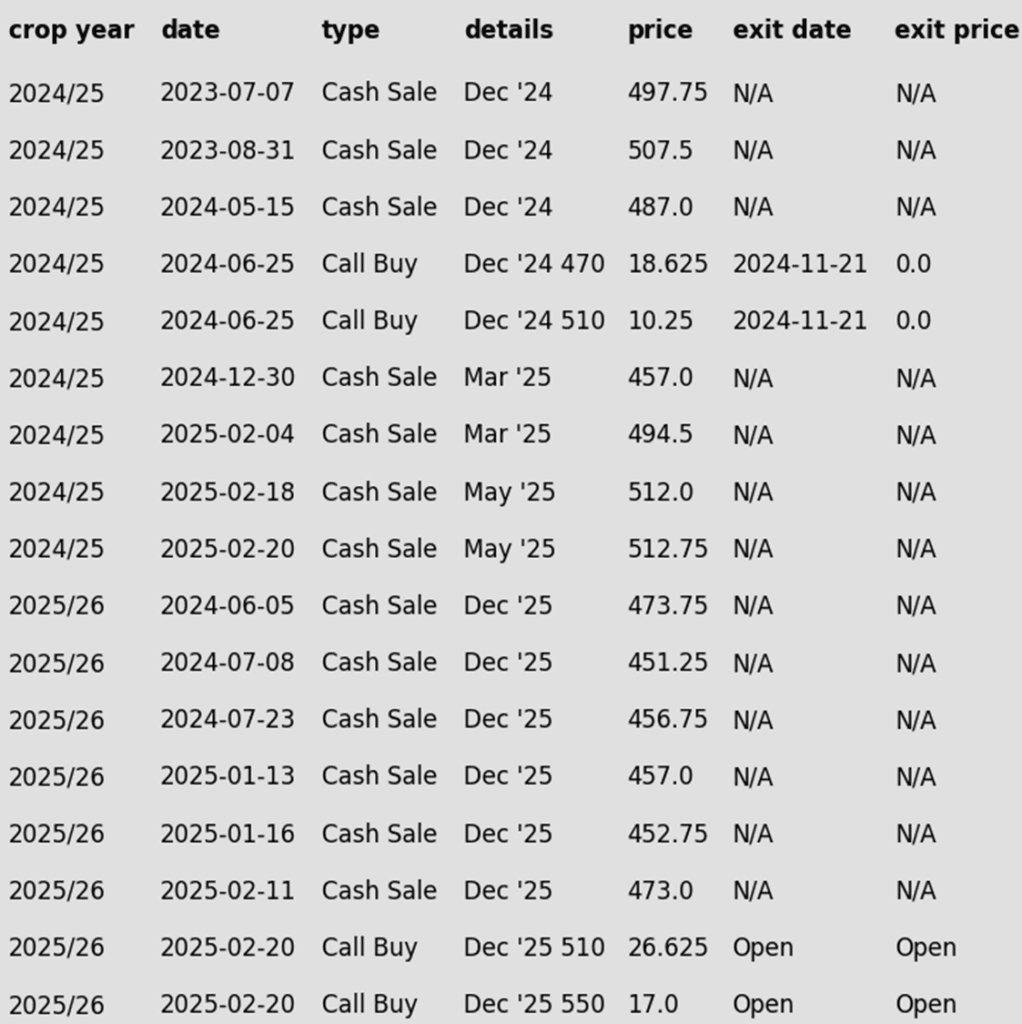

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Choppy trade in the corn market saw prices finish with modest gains for the session. With March options expiring on Friday, strength in the soybean market provided support and added volatility to the corn market.

- March corn options will expire on Friday, potentially increasing volatility as traders adjust positions ahead of the deadline. The 500 level of March calls is the largest area of open interest, and prices may hold near that level.

- The International Grains Council (IGC) released its latest global corn production estimates, lowering the world crop by 3 mmt due to weather-related impacts on South American production this growing season. However, the IGC’s estimates remain higher than those of the USDA for global corn production.

- The weekly ethanol production report continues to support corn demand. Production rebounded to 319 million gallons, showing a slight increase from the previous week. An estimated 109 MB of corn were used for ethanol production, keeping pace ahead of the required rate to meet USDA targets for the marketing year.

- The USDA will release weekly export sales totals on Friday morning. Expectations are for the week ending February 13, that new sales range from 900,000 MT –1.6 MMT. Last week total sales were 1.65 MMT as export demand stays supportive in the corn market.

Corn Bulls Charge Ahead, Eyeing $5 Breakout

Corn’s rally since harvest shows no signs of slowing, fueled by aggressive fund buying and steady demand. Strong technical support remains at 475, with an added safety net near the 450-breakout zone. Now, the market is locked in on the $5 mark—a pivotal resistance level that could open the gates for the next leg higher. With bullish momentum firmly in the driver’s seat, the question remains: can the bulls break through, or will the rally hit a wall?

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Hold: Given recent recommendations, the current guidance is to sit tight for now on any additional sales.

2025 Crop:

- Sales Target Range: 1090 – 1125 remain the upside target range vs November ‘25.

- Call Option Target: The target to exit all the 1100 Nov ‘25 call options is approximately 88 cents in premium. If the 1100 calls can be exited for that price, it should cover the cost of the 1180 Nov ‘25 calls, providing a net-neutral cost position that can continue to protect the upside on the recent sales recommendation.

2026 Crop:

- No Change: Still no sales recommendations expected until spring.

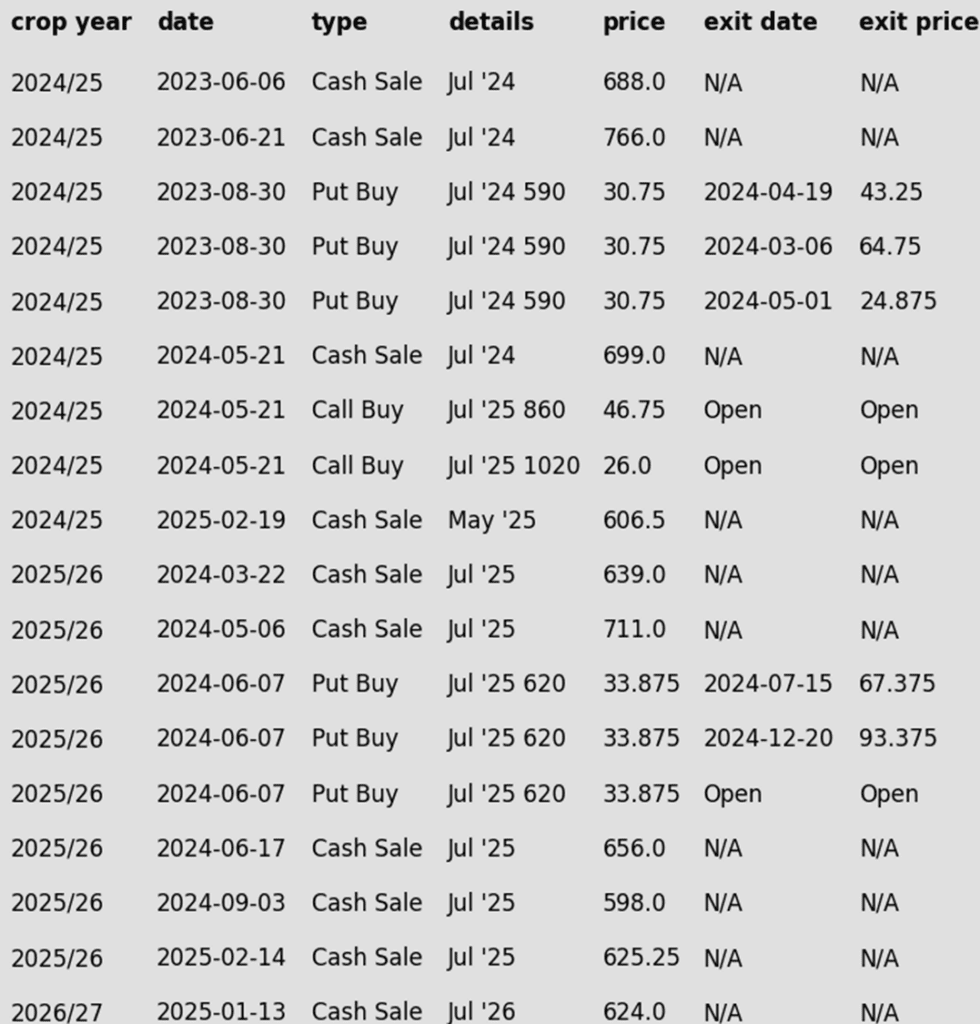

To date, Grain Market Insider has issued the following soybean recommendations:

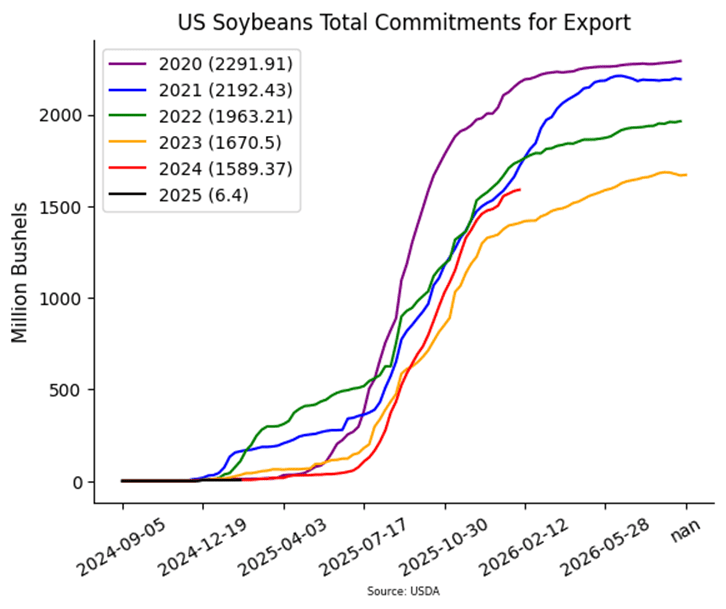

Market Notes: Soybeans

- Soybeans closed higher, recovering all of yesterday’s losses and then some. However, prices have remained rangebound over the past week, with support at the 40-day moving average. Soybean oil also rebounded, regaining all of yesterday’s losses, while soybean meal was higher as well, with both products providing support for soybeans.

- Agroconsult has revised its estimate for the Brazilian soybean crop down by 1.1 mmt, but the new estimate remains a record at 171.3 mmt. This is 15.8 mmt higher than last year’s crop, with the majority of the gains coming from the Center-North region.

- The International Grains Council decreased their estimate of global soybean production by 2 mmt to 418 mmt. This is said to be largely due to smaller production in Argentina and Paraguay. For reference, the USDA’s February forecast sits at 421 mmt.

- The Buenos Aires Grain Exchange raised their rating of Argentina’s soybean conditions by 2% to 66% of the crop rated normal to excellent. Additionally, soil moisture conditions were also improved by 5 points. With that, critical weather still lies ahead, as most of that crop has not started filling pods yet.

- Tomorrow’s export sales report is expected to show soybean sales in a range between 300,000 and 500,000 tons. Export demand has been on the decline recently as the Brazilian soybean harvest progresses and they offer soybeans at a discount to US offers.

Soybeans Eye Breakout After Repeated Tests

Front-month soybean futures are knocking on the door of the 200-day moving average, a formidable resistance that has capped gains for over 18 months. A clean break above this level could ignite bullish momentum and signal a fresh leg higher. On any retreat, solid support is seen near $10, while initial resistance stands at $11, with a bigger hurdle looming near $11.40. The battle lines are drawn—will soybeans finally break free?

Wheat

Market Notes: Wheat

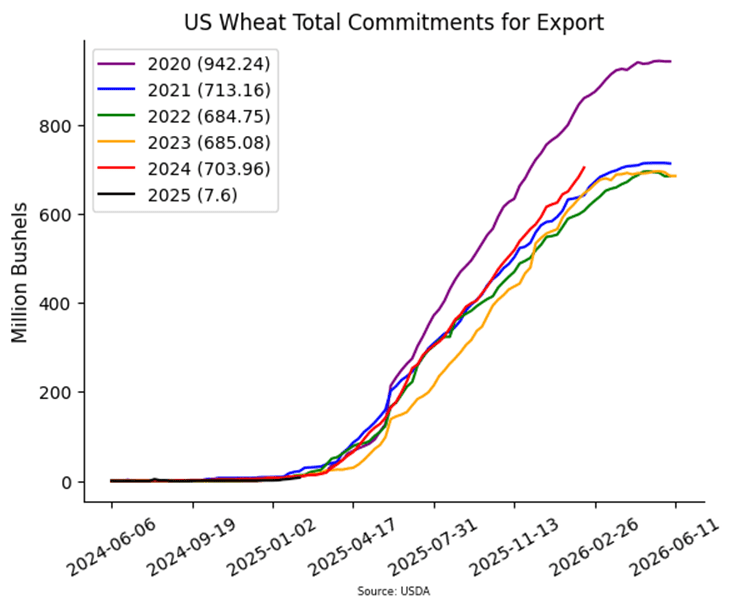

- Wheat faced pressure today, closing with losses across all three classes. Minneapolis futures performed the best, likely supported by concerns over drought conditions in the U.S. Northern Plains. However, easing concerns about winter wheat crop damage may have contributed to today’s weakness, as temperatures in the nation’s midsection are expected to warm up by the weekend.

- According to the USDA, as of February 18, an estimated 20% of U.S. winter wheat acreage is facing drought conditions, marking a 3% improvement from the previous week. However, spring wheat acreage remained steady, with 40% experiencing drought compared to the week prior, well above last year’s 22% for this time period.

- The International Grains Council has increased their estimate of global wheat production by 1 mmt to 797 mmt. This is above the USDA’s February estimate of 794 mmt. The IGC’s increase is said to be mainly due to a bigger harvest in Kazakhstan.

- According to their ag ministry, France planted 6.35 million hectares of winter grains for the 2025 harvest, which is up 7.2% from 2024, but still 1.3% below the five-year average. The planted area for soft wheat specifically is up 10% year over year at 4.57 million hectares.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAY ’25 Cash

2025

Active

Sell JUL ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Sell a portion of your 2024 SRW wheat crop.

- Maintain Call Options: Continue to hold onto the July ‘25 860 and 1020 call options.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell a portion of your 2025 SRW wheat crop.

- Next Target: If the July contract can maintain its uptrend, the next sales target range would be 690-715 vs. July ‘25.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- No Change: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

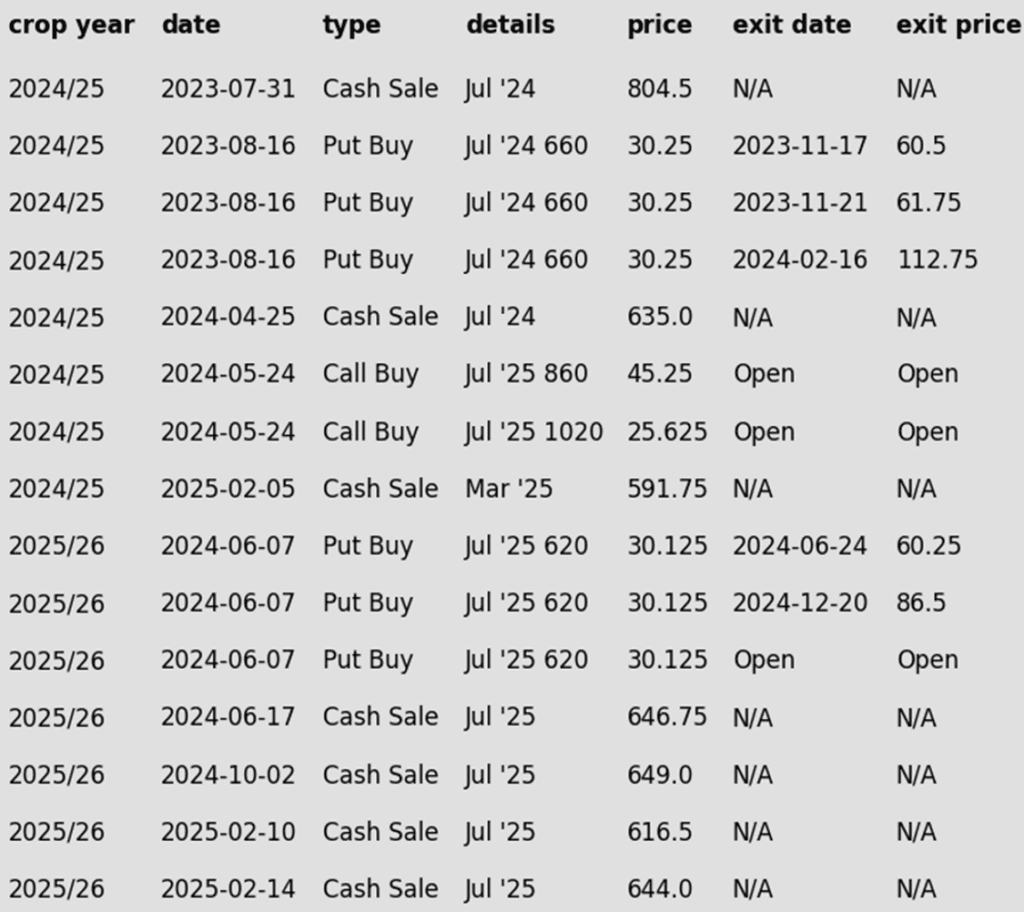

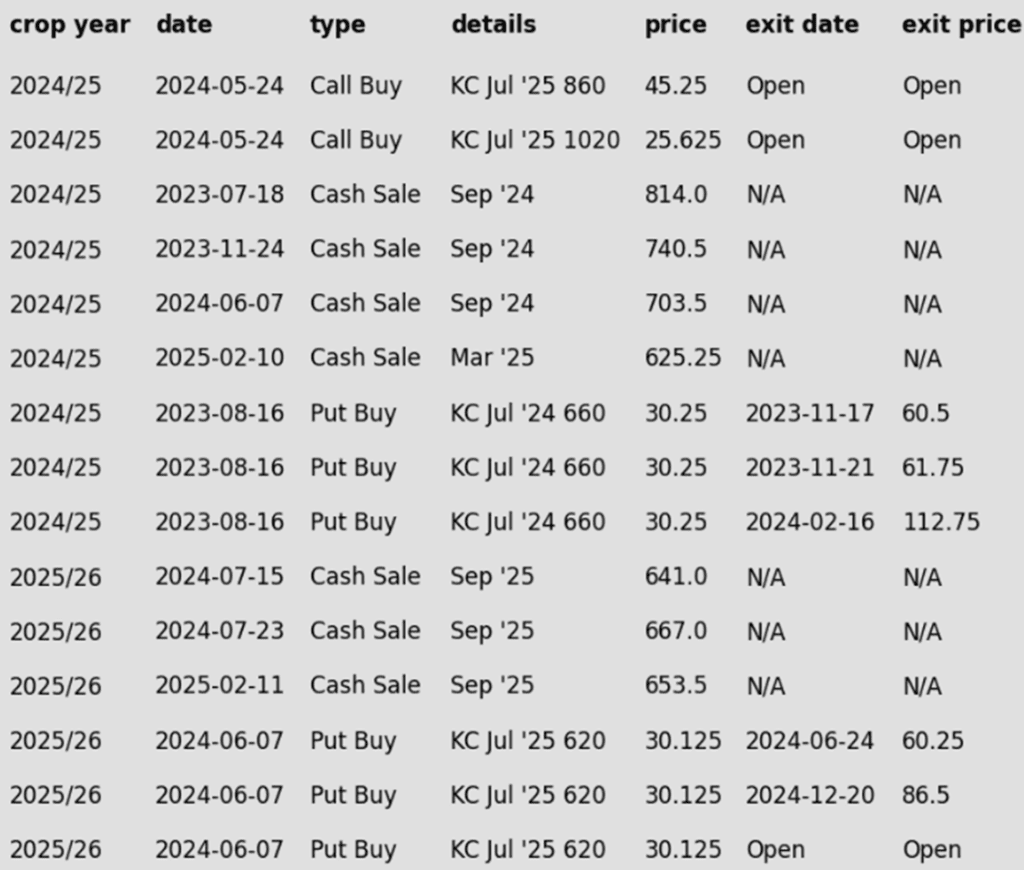

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Breaks Out with Force

Chicago wheat shattered its prolonged sideways grind with a powerful February surge, hitting key resistance at the early October highs just above 615. This decisive weekly close above the 200-day moving average sets the stage for the MA to act as firm support on any near-term dips. Next upside targets loom near 650, with stronger resistance waiting in the 680-700 zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell JUL ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Grain Market Insider recommended selling a portion of your 2024 HRW wheat crop on February 5 at 591.75 vs March ‘25.

- No Official Targets: Following the latest sales recommendation, there are currently no active target ranges to make additional sales.

- Maintain Call Options: Continue to hold onto the July ‘25 860 and 1020 call options.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell another portion of your 2025 HRW wheat crop.

- Two Sales: Grain Market Insider advised two sales last week—one on Monday and another on Friday—as the July ’25 contract extended its rally for a fourth straight week.

- Key Levels: The July ’25 contract is now just 4 cents below the September high of 653.75, marking a 99-cent rebound from the December low.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Ignites Rally Potential

Kansas City wheat futures launched into February with bullish momentum, closing above the 200-day moving average and challenging multi-month highs near 620. A breakout above the October peak of 623 could spark a run toward the coveted 700 mark. On the flip side, the 200-day MA offers initial support, with a sturdier safety net resting near 575.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Grain Market Insider recently recommended selling a portion of your 2024 HRS wheat crop on February 10.

- Hold: Given recent recommendations, the current guidance is to continue to sit tight for now on any additional sales.

- Maintain Call Options: Continue to hold onto the July ‘25 KC 860 and 1020 call options.

2025 Crop:

- Hold: Given recent recommendations, the current guidance is to continue to sit tight for now on any additional sales.

- Maintain Put Options: Continue to hold the last quarter of July ‘25 KC 620 put options.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Breakout Confirmed

Spring wheat shook off its doldrums in late January, surging past its prolonged sideways range and flashing bullish signals. A mid-February close above the 200-day moving average strengthens the breakout case. Initial support stands at the 200-day MA, with firmer footing near 615 — the top of the old range. On the upside, 650 is the first hurdle to clear before bulls set their sights on the elusive 700 mark.

Other Charts / Weather

Above: US 7-day precipitation forecast courtesy of NOAA, Weather Prediction Center.

Above: Brazil and Argentina one-week forecast total precipitation courtesy of the National Weather Service, Climate Prediction Center.