2-19 End of Day: Wheat Weakness Pressures Grains Wednesday

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 497.5 | -4.5 |

| JUL ’25 | 515.25 | -3.25 |

| DEC ’25 | 476.5 | -1 |

| Soybeans | ||

| MAR ’25 | 1031.75 | -6.75 |

| JUL ’25 | 1064 | -7.5 |

| NOV ’25 | 1051.25 | -6.75 |

| Chicago Wheat | ||

| MAR ’25 | 592 | -12.75 |

| JUL ’25 | 619.75 | -10.25 |

| JUL ’26 | 661 | -6 |

| K.C. Wheat | ||

| MAR ’25 | 613.75 | -13.5 |

| JUL ’25 | 638 | -11.75 |

| JUL ’26 | 671.25 | -5 |

| Mpls Wheat | ||

| MAR ’25 | 633.5 | -7.5 |

| JUL ’25 | 661.5 | -7.75 |

| SEP ’25 | 671.75 | -7.75 |

| S&P 500 | ||

| MAR ’25 | 6163.75 | 17 |

| Crude Oil | ||

| APR ’25 | 72.12 | 0.29 |

| Gold | ||

| APR ’25 | 2946.6 | -2.4 |

Grain Market Highlights

- Corn: Spillover weakness from wheat dragged corn lower on Wednesday, knocking front-month futures back below the $5 mark.

- Soybeans: Soybean meal futures held onto slight gains, while soybeans and soybean oil faced selling pressure throughout the session.

- Wheat: Futures corrected from overbought territory today, easing concerns about winterkill along with weaker Matif wheat futures added pressure.

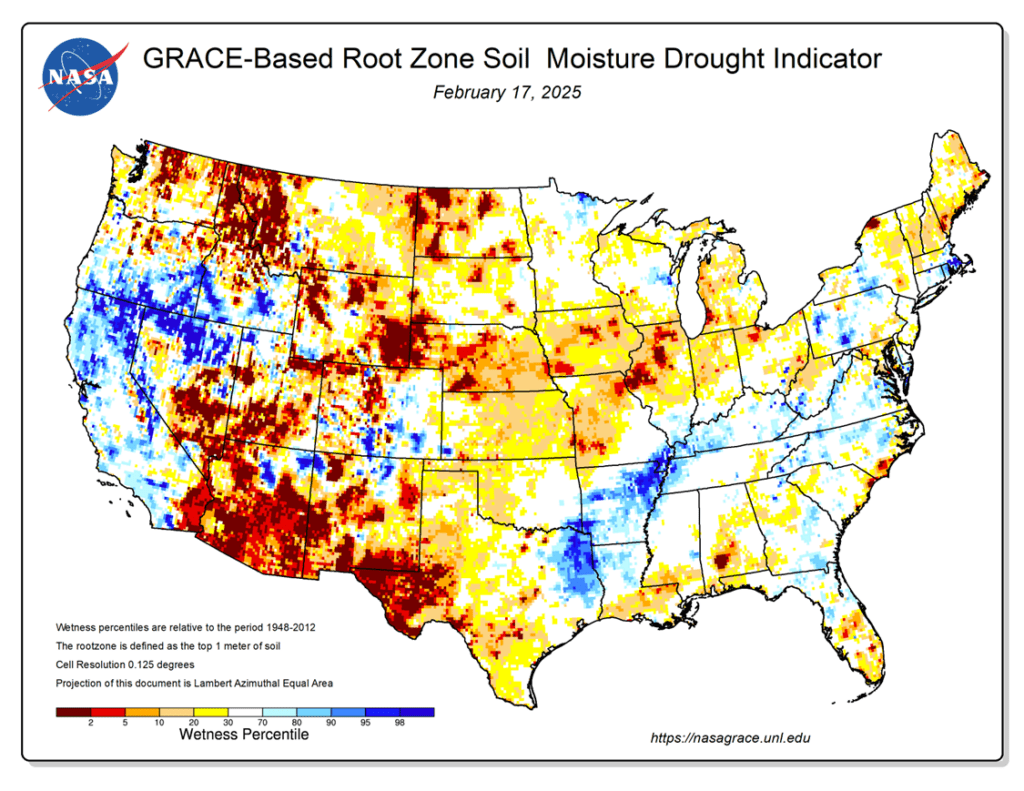

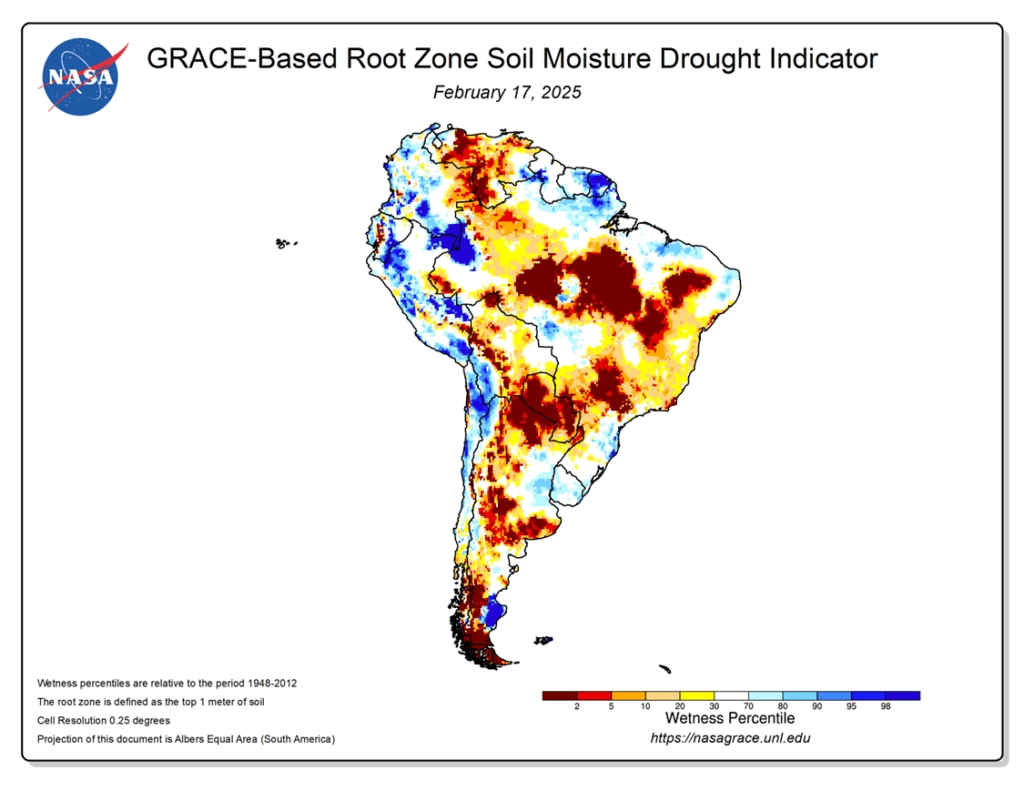

- To see the updated U.S. and South America GRACE-Based root zone soil moisture drought indicator maps, scroll down to the other charts/weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAY ’25 Cash

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Sell a portion of your 2024 corn crop.

- Target Range Hit: Yesterday’s market strength pushed May ’25 to the upper end of the 495–515 target range, triggering a recommendation to sell a portion of your 2024 corn crop.

2025 Crop:

- Hold: Given recent sales recommendations, the current guidance is to sit tight for now on any additional sales.

- Major Resistance at 479: December ‘25 faces strong resistance at 479. A decisive close above this level could signal broader upside potential as we move into the spring planting window.

- Potential Call Option Strategy: If prices break through 479, stay tuned for a possible call option recommendation. This strategy would hedge against existing sales while positioning you for upside exposure in the event of an extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 1–3 weeks.

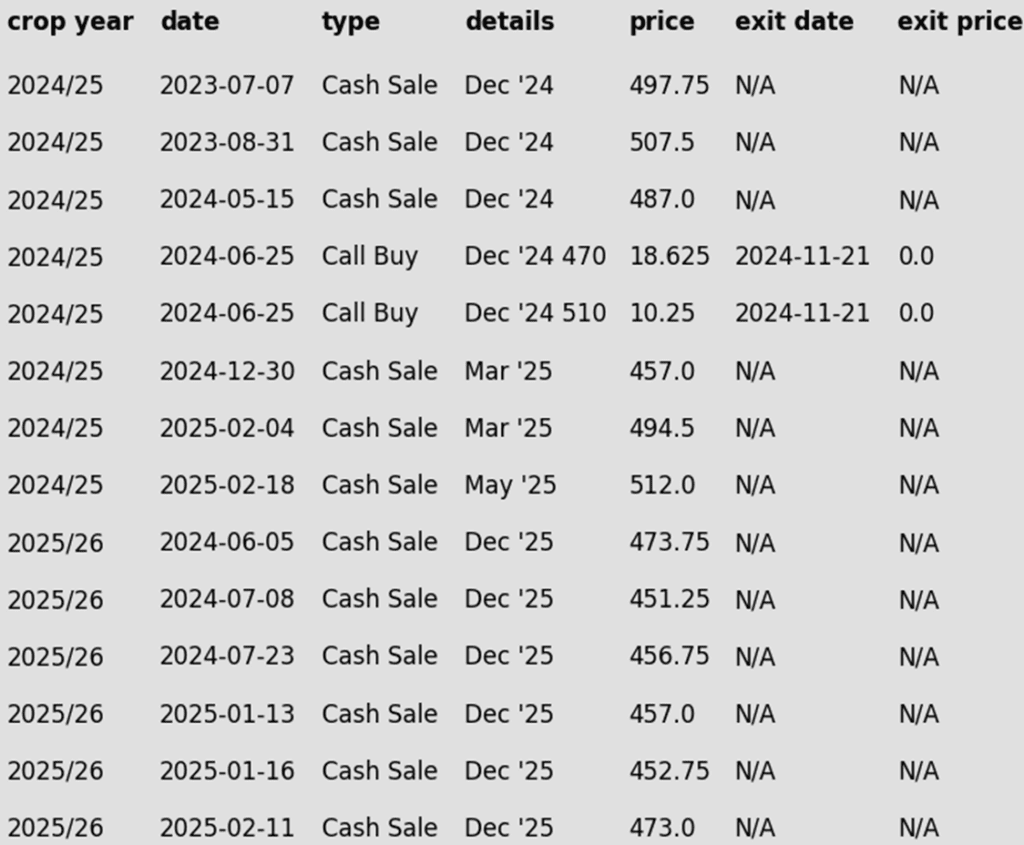

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Selling pressure from wheat weighed on corn Wednesday, pulling futures off early highs to close with moderate losses. The March contract’s failure to hold the $5 level could spark additional long liquidation as the market nears overbought conditions.

- March corn options expire on Friday, which could bring some volatility as positions prepare for that trading deadline. The 500 level of March call is the largest area of open interest, and price may hold near that level.

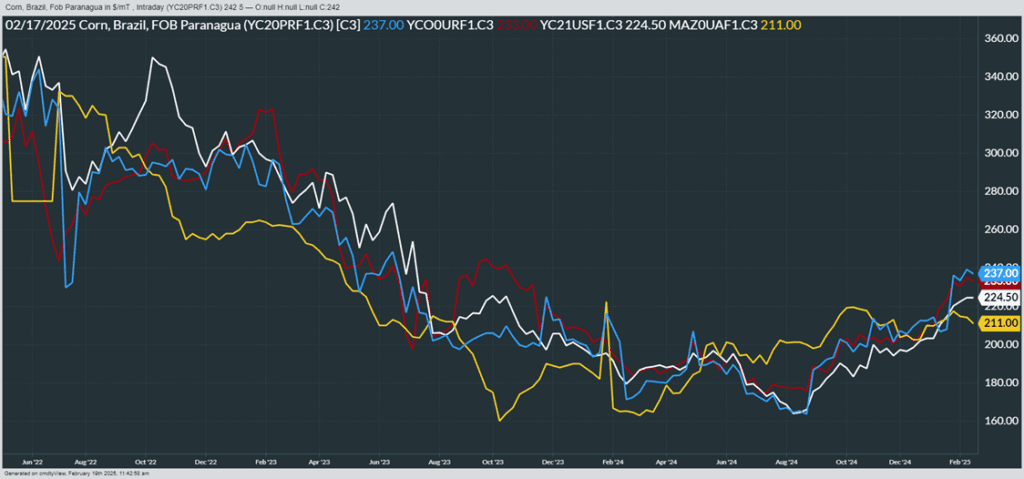

- Improved weather in Brazil is accelerating second-crop corn planting, though progress remains behind in key regions. This crop will compete directly with U.S. corn in the summer export market.

- Strong demand continues to support old-crop corn, with exports and shipments well ahead of USDA targets. The market appears to be pricing in a lower carryout than the 1.54 billion bushels projected in the February USDA report.

Corn Bulls Charge Ahead, Eyeing $5 Breakout

Corn’s rally since harvest shows no signs of slowing, fueled by aggressive fund buying and steady demand. Strong technical support remains at 475, with an added safety net near the 450-breakout zone. Now, the market is locked in on the $5 mark—a pivotal resistance level that could open the gates for the next leg higher. With bullish momentum firmly in the driver’s seat, the question remains: can the bulls break through, or will the rally hit a wall?

Above: From Barchart – World Corn Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red), Ukraine (Yellow)

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Hold: Given recent recommendations, the current guidance is to sit tight for now on any additional sales.

2025 Crop:

- New Sales Target Range: 1090 – 1125 vs November ‘25.

- Call Option Target: The target to exit all the 1100 Nov ‘25 call options is approximately 88 cents in premium. If the 1100 calls can be exited for that price, it should cover the cost of the 1180 Nov ‘25 calls, providing a net-neutral cost position that can continue to protect the upside on the recent sales recommendation.

2026 Crop:

- No Change: Still no sales recommendations expected until spring.

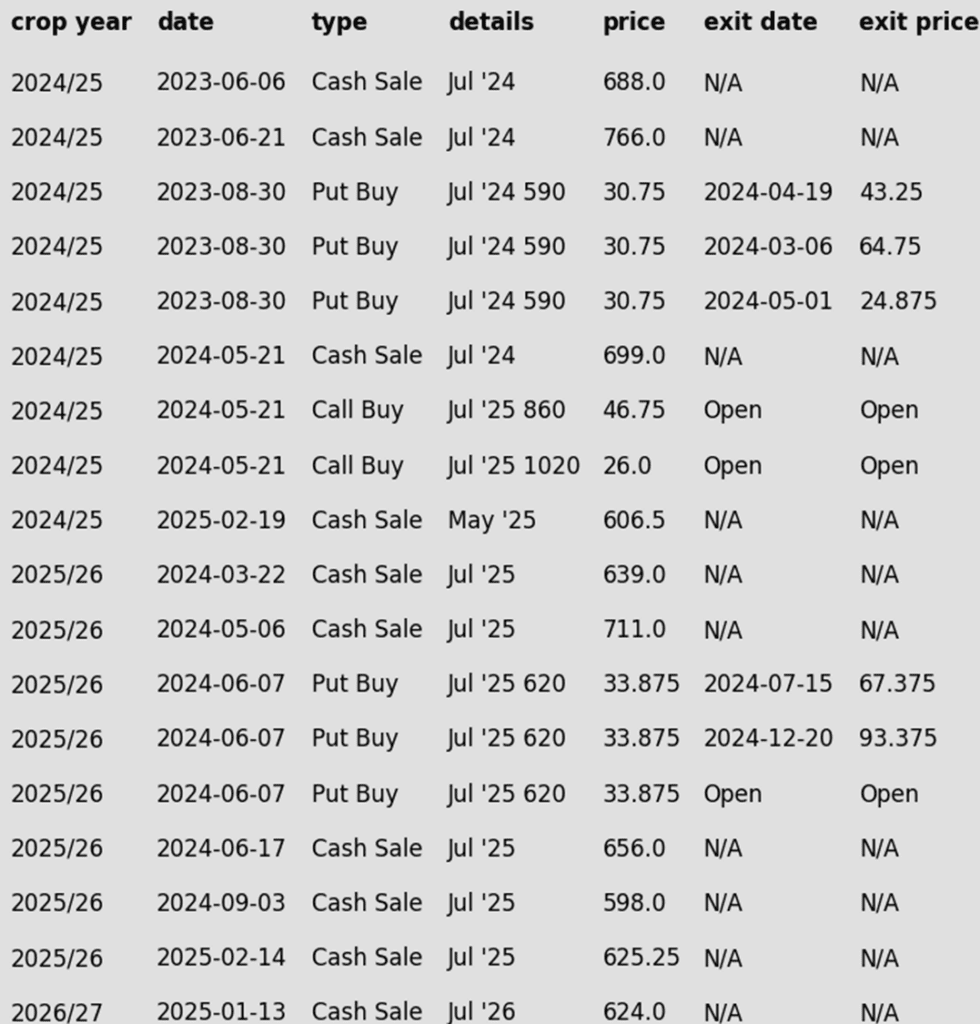

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans ended the day lower after falling from earlier morning highs. Wheat led the way in losses today bringing the entire grain complex lower apart from soybean meal. Soybean oil was down 1.14 cents to 46.15 cents in the March contract. Pressure has come from improving South American weather and Brazilian harvest.

- In Brazil, conditions have improved for harvest, and the state of Parana is now estimated to be 40% harvested as of this Monday. This was up 7% from the previous week, and 78% of the state’s soybeans have been rated good, 19% average, and just 3% poor.

- January’s NOPA crush came in at 200.38 million bushels, below the trade estimate of 204.5 mb and December’s 206.6 mb, but higher than last year’s 185.8 mb.

- Yesterday’s inspections report sales of 720k tons of soybeans inspected for export compared to 1,097k the previous week and 1,292k a year ago. Primary destinations were China, Egypt, and Mexico.

Soybeans Eye Breakout After Repeated Tests

Front-month soybean futures are knocking on the door of the 200-day moving average, a formidable resistance that has capped gains for over 18 months. A clean break above this level could ignite bullish momentum and signal a fresh leg higher. On any retreat, solid support is seen near $10, while initial resistance stands at $11, with a bigger hurdle looming near $11.40. The battle lines are drawn—will soybeans finally break free?

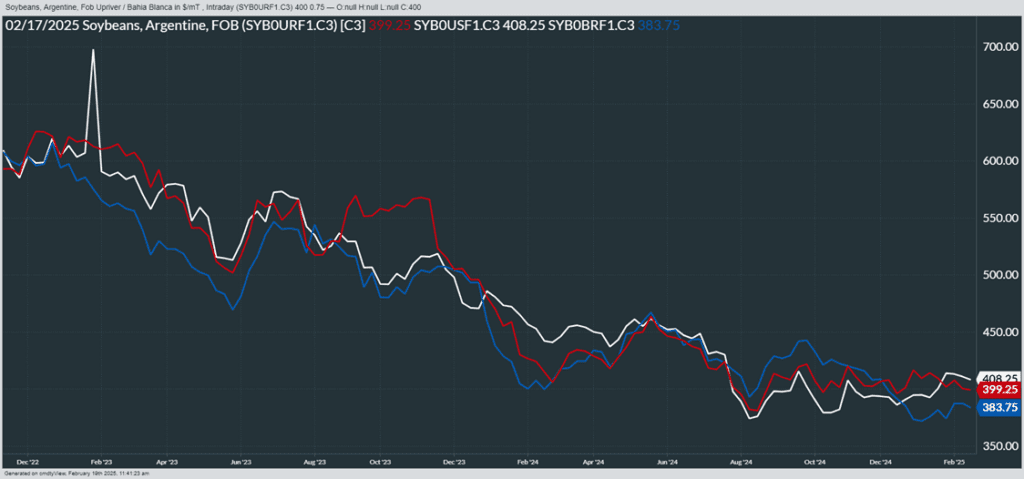

Above: From Barchart – World Soybean Export Prices in U.S. Dollars per metric ton. Brazil (Blue), U.S. NOLA (White), Argentina (Red)

Wheat

Market Notes: Wheat

- Wheat futures tumbled Wednesday, posting double-digit losses in Chicago and Kansas City, with Minneapolis not far behind. Technical correction played a role, as all three March contracts were overbought on daily stochastics. Easing winterkill concerns and a lower Matif wheat close added pressure.

- Conditions for the winter wheat crop in Texas were released by the USDA, with 33% of the crop rated good to excellent, representing a decline of 3% from the previous figure. Additionally, the fair category fell 3% as well. The poor category was raised by 6% to 24%.

- The new Egyptian state wheat buyer, Mostakbal Misr, is prepared to supply 2.7 mmt of wheat between January and the end of April to GASC. A reported 777,000 mt have already been received. These supplies will go towards Egypt’s national subsidized bread program. Egypt is a top global wheat importer, with the USDA estimating 12.5 mmt of imports during the 24/25 season.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

New Alert

Sell MAY ’25 Cash

2025

Active

Sell JUL ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- NEW ACTION – Sell a portion of your 2024 SRW wheat crop today.

- Maintain Call Options: Continue to hold onto the July ‘25 860 and 1020 call options.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell a portion of your 2025 SRW wheat crop.

- Next Target: If the July contract can maintain its uptrend, the next sales target range would be 690-715 vs. July ‘25.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- No Change: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

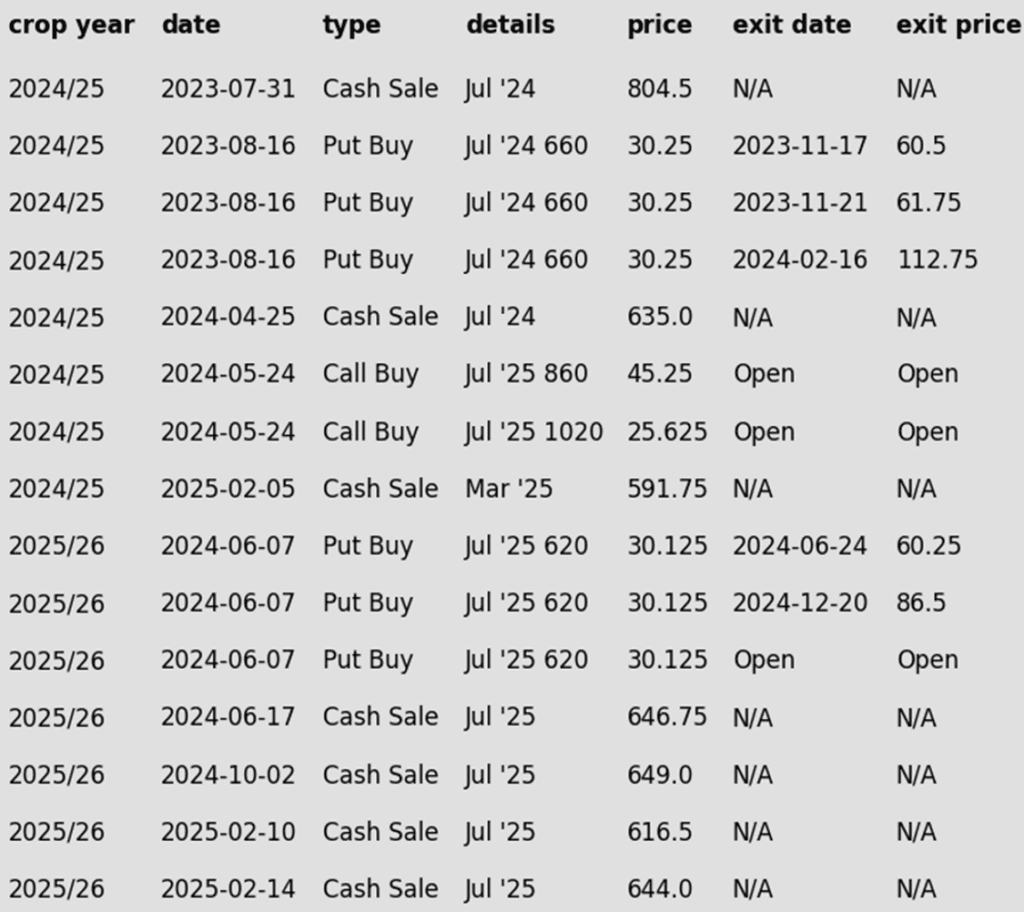

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Breaks Out with Force

Chicago wheat shattered its prolonged sideways grind with a powerful February surge, hitting key resistance at the early October highs just above 615. This decisive weekly close above the 200-day moving average sets the stage for the MA to act as firm support on any near-term dips. Next upside targets loom near 650, with stronger resistance waiting in the 680-700 zone.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell JUL ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Grain Market Insider recommended selling a portion of your 2024 HRW wheat crop on February 5 at 591.75 vs March ‘25.

- No Official Targets: Following the latest sales recommendation, there are currently no active target ranges to make additional sales.

- Maintain Call Options: Continue to hold onto the July ‘25 860 and 1020 call options.

2025 Crop:

- CONTINUED OPPORTUNITY – Sell another portion of your 2025 HRW wheat crop.

- Two Sales: Grain Market Insider advised two sales last week—one on Monday and another on Friday—as the July ’25 contract extended its rally for a fourth straight week.

- Key Levels: The July ’25 contract is now just 4 cents below the September high of 653.75, marking a 99-cent rebound from the December low.

- Maintain Put Options: Continue holding the final quarter of July ’25 620 put options.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

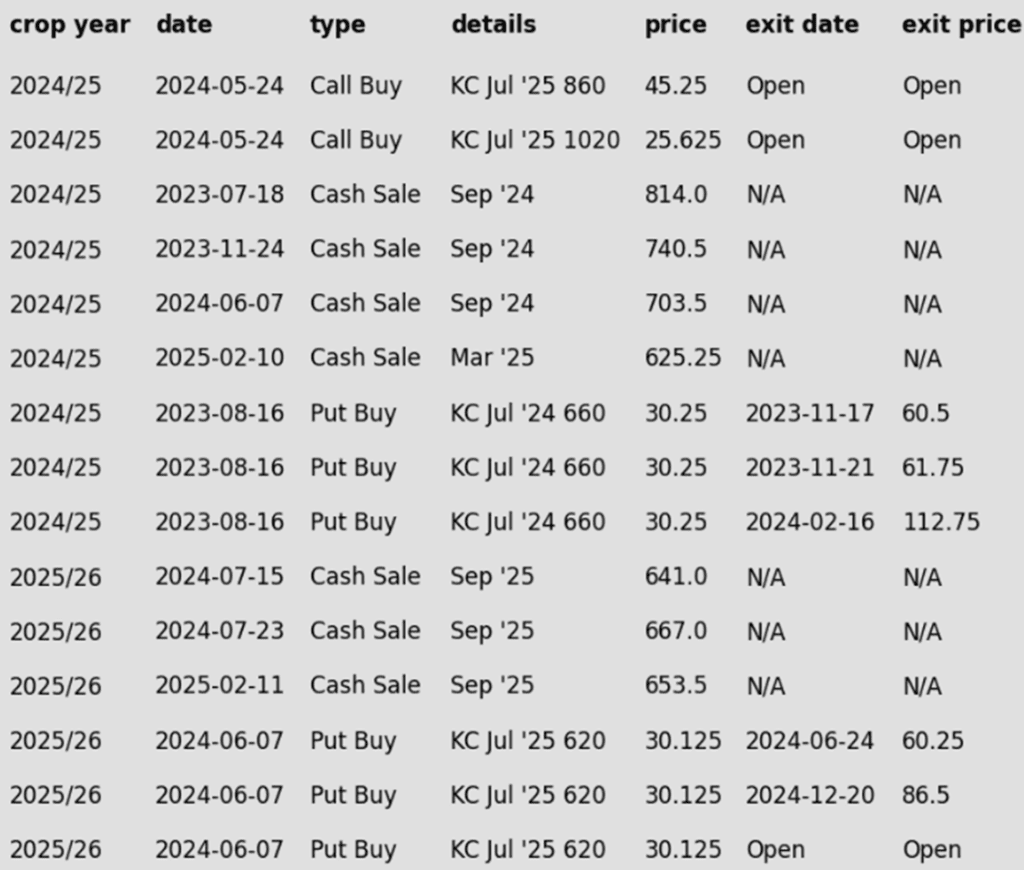

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Ignites Rally Potential

Kansas City wheat futures launched into February with bullish momentum, closing above the 200-day moving average and challenging multi-month highs near 620. A breakout above the October peak of 623 could spark a run toward the coveted 700 mark. On the flip side, the 200-day MA offers initial support, with a sturdier safety net resting near 575.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Grain Market Insider recently recommended selling a portion of your 2024 HRS wheat crop on February 10.

- Hold: Sit tight on making any additional sales for now given the recent recommendation.

- Maintain Call Options: Continue to hold onto the July ‘25 KC 860 and 1020 call options.

2025 Crop:

- Hold: No additional sales are recommended at this time, given the recent guidance.

- Maintain Put Options: Continue to hold the last quarter of July ‘25 KC 620 put options.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Breakout Confirmed

Spring wheat shook off its doldrums in late January, surging past its prolonged sideways range and flashing bullish signals. A mid-February close above the 200-day moving average strengthens the breakout case. Initial support stands at the 200-day MA, with firmer footing near 615 — the top of the old range. On the upside, 650 is the first hurdle to clear before bulls set their sights on the elusive 700 mark.

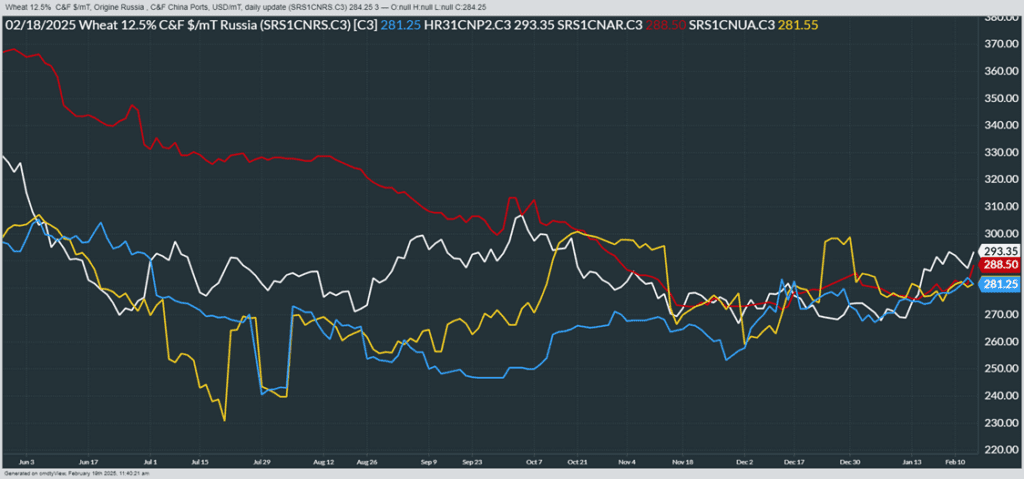

Above: From Barchart – World Wheat Export Prices in U.S. Dollars per metric ton. Russia (Blue), U.S. PNW (White), Argentina (Red), Ukraine (Yellow)

Other Charts / Weather