2-15 End of Day: Markets Continue Downward Slide with All Contracts Closing in the Red

The CME and Total Farm Marketing offices will be closed Monday, February 19, in observance of Presidents Day

All prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’24 | 417.75 | -6.5 |

| JUL ’24 | 439.75 | -7.5 |

| DEC ’24 | 456.75 | -7.5 |

| Soybeans | ||

| MAR ’24 | 1162.25 | -8.25 |

| JUL ’24 | 1175.25 | -11 |

| NOV ’24 | 1140.75 | -14.25 |

| Chicago Wheat | ||

| MAR ’24 | 567 | -18.5 |

| JUL ’24 | 570 | -14.25 |

| JUL ’25 | 611.25 | -12.5 |

| K.C. Wheat | ||

| MAR ’24 | 575.75 | -12 |

| JUL ’24 | 563.5 | -12.5 |

| JUL ’25 | 610.25 | -11.75 |

| Mpls Wheat | ||

| MAR ’24 | 658 | -4.5 |

| JUL ’24 | 662.75 | -6 |

| SEP ’24 | 670.5 | -5.75 |

| S&P 500 | ||

| MAR ’24 | 5042.75 | 24.75 |

| Crude Oil | ||

| APR ’24 | 77.64 | 1.28 |

| Gold | ||

| APR ’24 | 2016.7 | 12.4 |

Grain Market Highlights

- A weak technical picture and projections for growing supplies from the USDA Outlook Forum kept downward pressure on the corn market despite solid export sales that came in at the upper end of expectations and ahead of last year’s numbers.

- While NOPA crush members crushed a record amount of soybeans for the month of January, the totals came in well below expectations, and that along with bearish, though not surprising, USDA Outlook Forum numbers, was enough to press soybeans lower for the third consecutive day.

- Soybean meal and oil also closed lower on the day, both posting losses mostly in line with soybeans, though March Board crush margins narrowed 3 ¾ cents to 90 ¾ cents per bushel.

- All three wheat classes ended the day in the red with Chicago again leading the charge south, and both March contracts in KC and Minneapolis set fresh contract lows. Adding to the negativity were bearish USDA Ag Outlook Forum numbers and an updated forecast from SovEcon that raised expectations of a bigger Russian wheat crop.

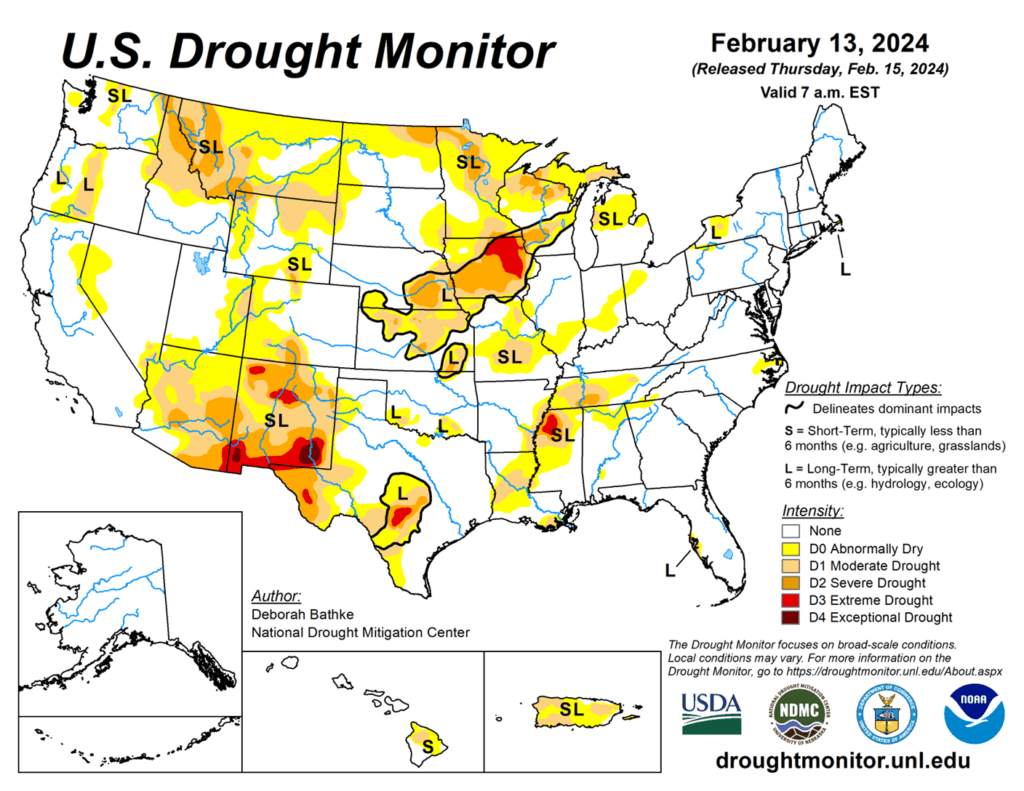

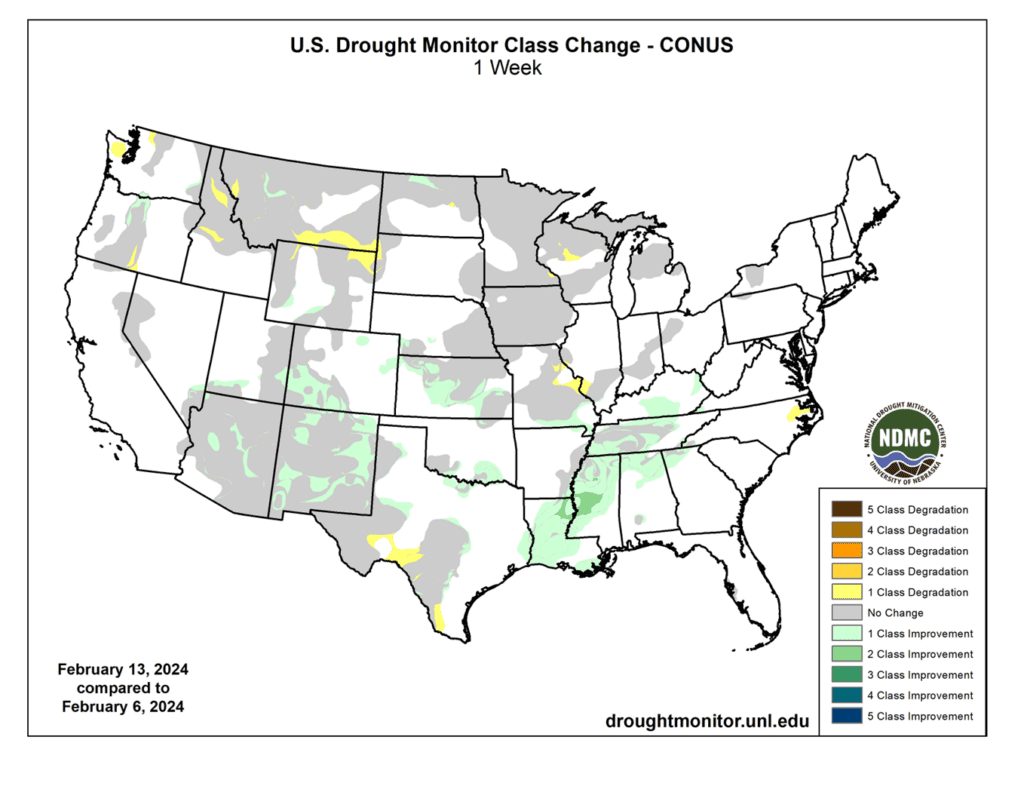

- To see the updated US Drought Monitor, courtesy of the National Drought Mitigation Center, scroll down to the other Charts/Weather section.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Corn Action Plan Summary

- No new action is recommended for 2023 corn. With a general lack of bullish news and an estimated US carryout over 2.1 billion bushels, front month corn has languished in a sideways to lower trend since printing a high last October. While the lack of a bullish catalyst has been disappointing, the market is in a significantly oversold condition, and managed funds continue to hold a sizable net short position. Either or both could trigger a short covering rally at any time heading into the spring planting window. For now, Grain Market Insider continues to sit tight on any further sales recommendations for the next few weeks with the objective of seeking out better pricing opportunities. If the market has not turned around by then, Grain Market Insider may sit tight on the next sales recommendations until spring or even summer.

- No new action is recommended for 2024 corn. In January, Dec ’24 broke through the bottom end of the 485 ¾ to 602 range that had been in place since February ’22. While this was a disappointing development, bear spreading has allowed Dec ’24 to maintain more of its value versus old crop as traders attempt to price in a larger 2023 carryout with more uncertainty ahead for the 2024 crop. Additionally, Dec ’24 is significantly oversold on the weekly chart, which is supportive for a technical rally to begin at any time as the spring planting window quickly approaches. Given the amount of time and uncertainty that remains for the 2024 crop, Grain Market Insider will consider recommending additional sales on a retracement toward the low to mid 500 level.

- No Action is currently recommended for 2025 corn. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next year. It will probably be late winter or early spring of 2024 before Grain Market Insider starts considering the first sales targets.

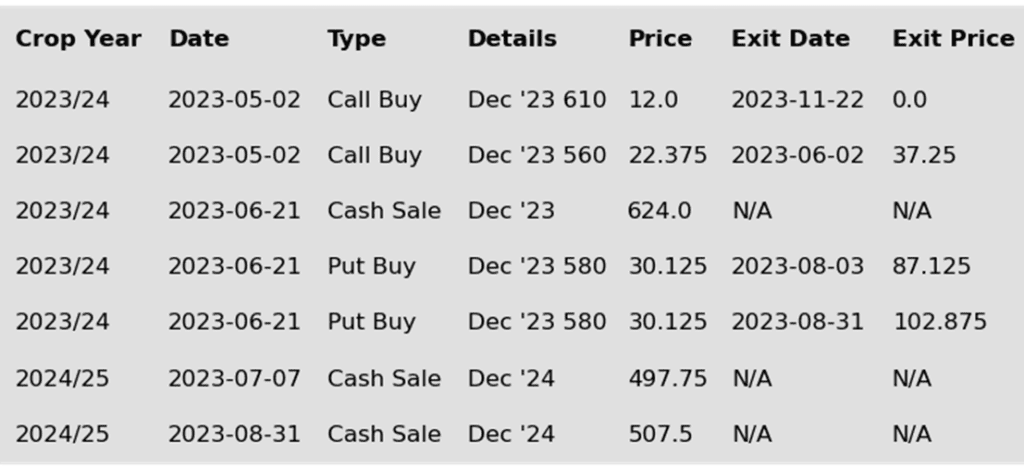

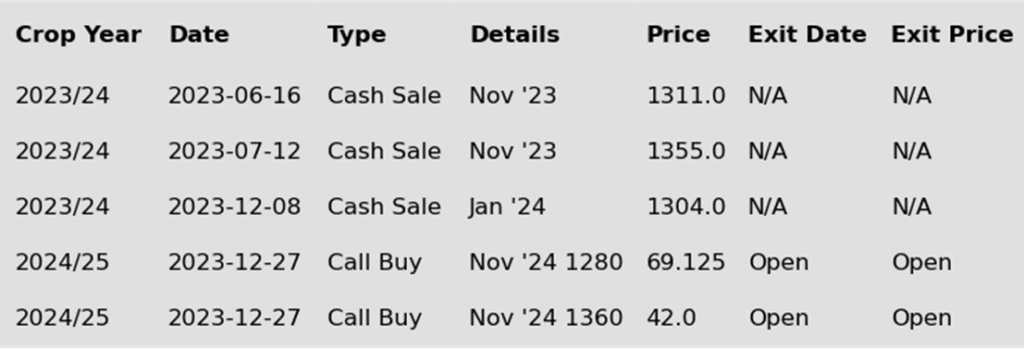

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- Difficult day in grain markets, and that pressured corn futures to new lows. The USDA Outlook Forum projections detailed the possibility of growing corn supplies into the next marketing year. March corn lost 6 ½ cents on the session.

- The technical picture and price action in corn remains weak and the March contract closed under 420, leaving the market more susceptible to downside pressure.

- The USDA Outlook projections estimated corn acreage for the 24/25 crop at 91 million acres and trend line yield at 181 bpa. This combination puts estimated production at 15.040 billion bushels and forecasts new crop carryout to 2.532 billion bushels.

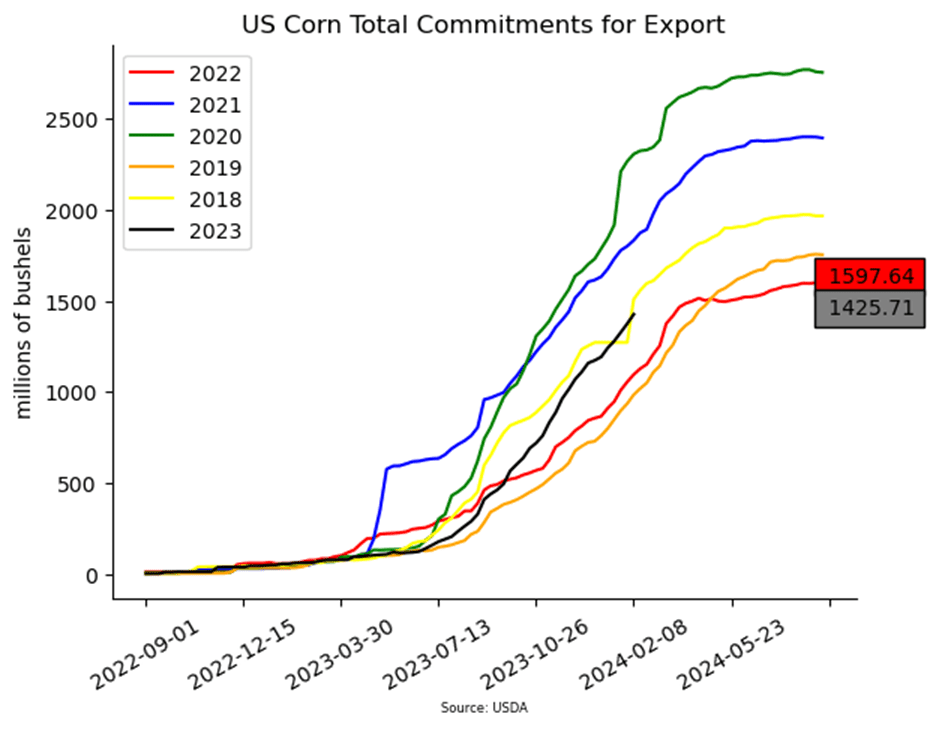

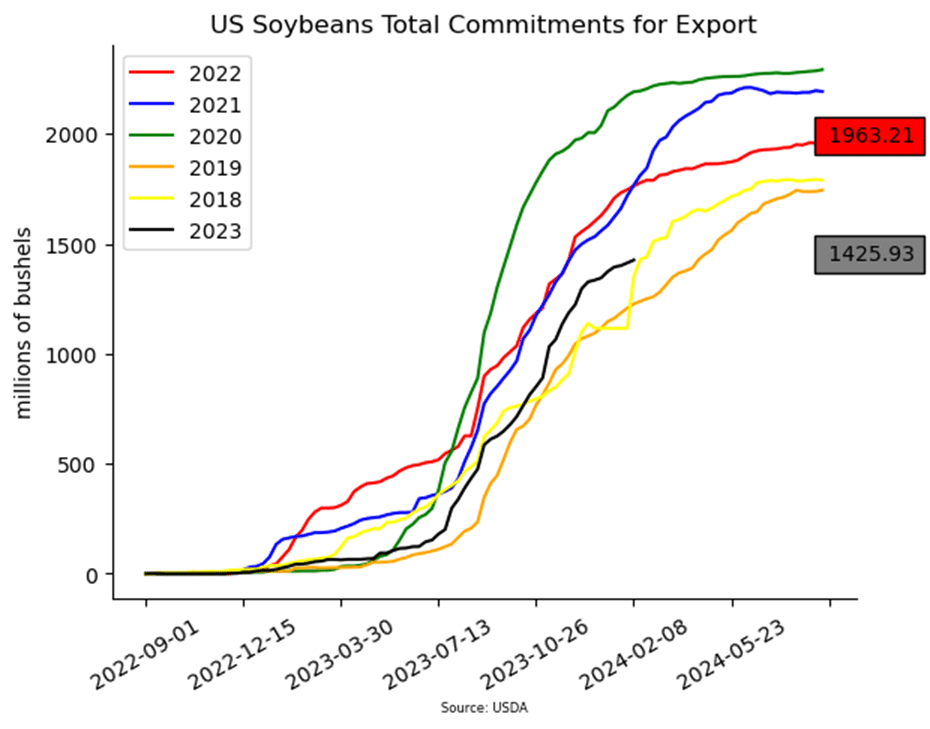

- Corn export sales stay active. Weekly export sales were near the top end of expectations at 51.5 mb (1.307 mmt), and export pace needs to stay strong in this window to meet the USDA’s goal. Total corn sales are now at 1.426 billion bushels, up 30% from last year.

- The March futures contract is closing in on first notice day, February 29. In this window, producers with basis contracts and commercials with a large net long position in the corn market will need to roll to the next month or price bushels against the basis. This can add additional selling pressure to the already weak corn market.

Above: The continued slide in front month corn is knocking on the door of 415 support and is showing signs of being extremely oversold. If support can hold and a bullish story enters the market, the oversold status can bring additional support to rally prices back toward the 450 – 460 resistance area. If not, prices may continue to slide toward 400 psychological support or possibly 390.

Soybeans

Action Plan: Soybeans

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Soybeans Action Plan Summary

- No new action is recommended for 2023 soybeans. In early January, front month soybeans broke through the bottom side of the 1290 – 1400 range that had been in place since mid-October. As South American weather forecasts improved, the potential for a reduction in the record large global carryout also lessened, bringing prices down toward the 1180 support level. For now, 1180 support appears to be holding, and though the weak price action has been disappointing, time remains in the South American growing season, and the old crop marketing year, for unforeseen changes to push prices back higher. Given the potential of a downside breakout back in December, Grain Market Insider recommended adding to sales as prices remained historically good, and Grain Market Insider will continue to look at additional sales opportunities heading into spring.

- No new action is recommended for the 2024 crop. After the Nov ’24 contract broke through the bottom side of the 1233 – 1320 range, prices continued to retreat as South American weather conditions improved. Even though Nov ’24 runs similar downside risks as the front month contracts, which could press new crop prices toward 1150 or possibly the May ’23 low near 1115, plenty of time remains to market this crop. Considering the amount of uncertainty that lies ahead with the 2024 soybean crop, Grain Market Insider recommended back in December buying Nov ’24 1280 and 1360 calls to give you confidence to make sales against anticipated production, and to protect any sales in an extended rally. Additionally, the possibility remains that prices could retest the 2022 highs, at which point Grain Market Insider may consider recommending additional sales.

- No Action is currently recommended for 2025 Soybeans. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next year, and it may be some time before conditions are conducive to consider making any recommendations. Be patient as we monitor the markets for signs of improvement.

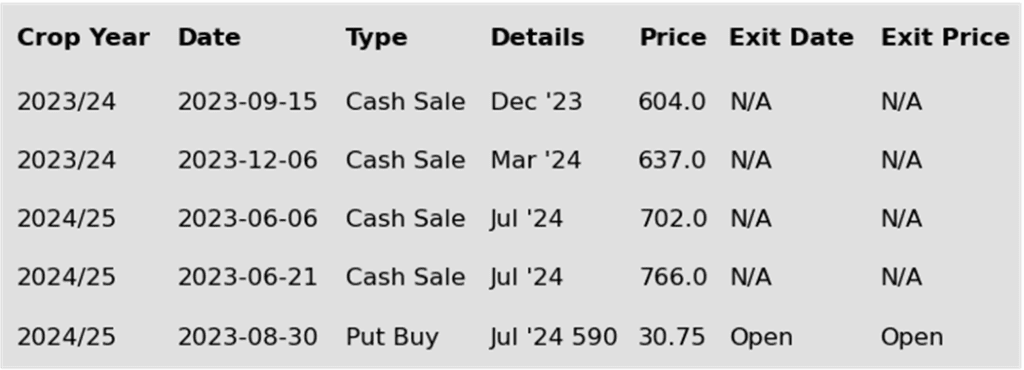

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans closed significantly lower again today after yesterday’s close that saw March soybeans losing nearly 16 cents. Neither the USDA’s Outlook Forum numbers nor today’s export sales report were friendly. Both soybean meal and oil ended the day lower.

- This morning’s Outlook Forum numbers showed expected planted soybean acres for 24/25 increased as expected from 83.6 ma to 87.5 ma. With this increase in expected planted acres and using the higher trendline yield of 52.0 bpa, ending soybean stocks are estimated higher at 435 mb.

- For the week ending February 8, the USDA reported an increase of 13.0 mb for 23/24 and an increase of 0.9 mb for 24/25. Export sales were on the lower end of expectations and sales are now 19% behind a year ago. Last week’s export shipments of 53.4 mb were well above the 20.3 mb needed each week to achieve the USDA’s estimates. Primary destinations were to China, Japan, and Spain.

- The NOPA crush report for January showed 185.8 mb of soybeans crushed, which was below the average trade guess of 189.9 mb but was still a record large number for January. Soybean oil stocks came in at 1.507 billion pounds compared to estimates of 1.409 billion.

- Argentinian weather is expected to improve further over the next week, and Brazil is forecast to continue receiving scattered showers as well. Argentinian soy production has been estimated slightly higher by Refinitiv Commodities Research to 51.9 mmt which is up 1% from a previous update.

Above: With the failure of 1180 support, it appears that front month soybeans could continue to drift lower towards 1140 – 1145 without fresh bullish input to turn the market around. The market continues to show signs of being oversold which can add support if a reversal happens. Overhead, nearby resistance may come in between 1200 and 1205, with additional resistance around 1220 – 1225.

Wheat

Market Notes: Wheat

- Along with corn and soybeans, the wheat complex closed in the red with the USDA Ag Outlook Forum numbers, and an upward revision to the Russian wheat crop by SovEcon adding to the negativity.

- This morning’s USDA’s Ag Outlook numbers for wheat showed estimates of planted wheat acres falling to 47.0 million acres in 24/25 from 49.6 ma last year, and using a trendline yield of 49.2 bpa, estimated wheat ending stocks for 24/25 came out to 769 mb. This compares to the average trade guess of 717 mb and 23/24 ending stocks of 658 mb.

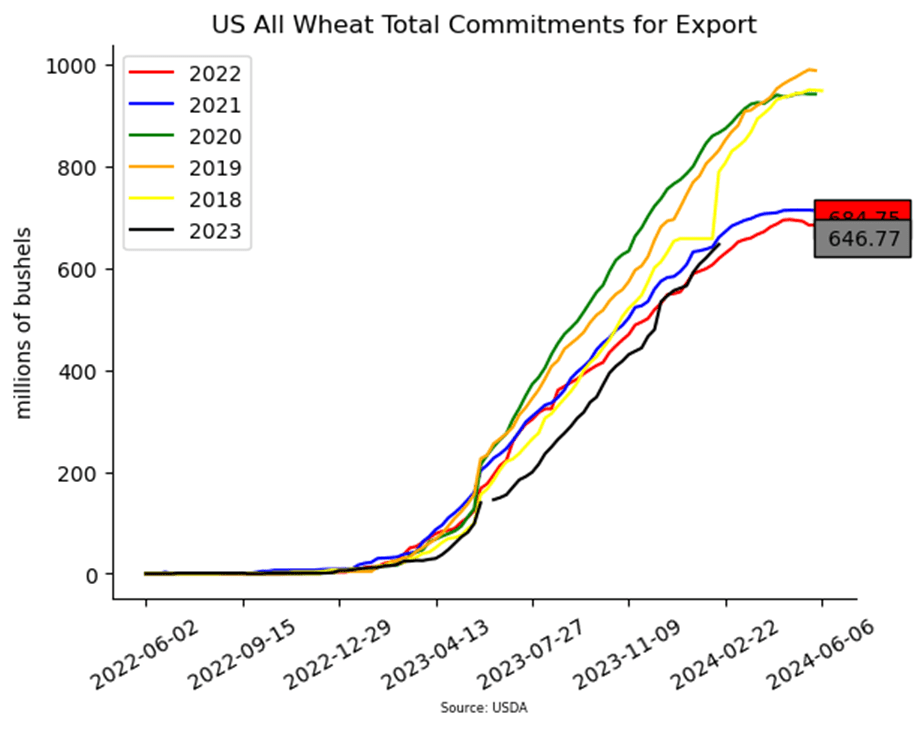

- In addition to the USDA Ag Outlook Forum numbers, the USDA released weekly export sales as of February 8. For the 23/24 marketing year, the USDA reported new sales totaling 12.8 mb (349k mt) which brings total commitments for the 23/24 marketing year to 646.8 mb, a 7% increase over last year. The USDA also reported 1.8 mb in new sales for 24/25.

- Consulting firm SovEcon increased its forecast for Russia’s 2024 wheat crop by 1.4 mmt to 93.6 mmt due to good growing weather in most of the regions. This represents a 400,000 mt increase from last year. This news added yet another layer of bearishness to the already weak wheat markets since weak Russian prices have been a major hurdle for US prices and exports for some time.

- France’s 23/24 soft wheat stocks were seen 37% higher than the previous year at 3.5m tons which was up from a previous estimate of 3.44 and represents the highest total since the 2018/19 season. The country’s soft wheat exports are currently estimated at 16.7 mmt, near unchanged from last month.

- Japan’s Ministry of Agriculture, Forestry and Fisheries bought just over 115k mt of food-grade milling wheat in a tender from the US, Canada, and Australia that closed on Thursday. Bangladesh also issued an international tender to purchase 50k mt of milling wheat.

Action Plan: Chicago Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Chicago Wheat Action Plan Summary

- No new action is currently recommended for 2023 Chicago wheat. The wheat market has continued to be dominated by lower world export prices that have stymied US export sales and depressed US prices. In early December, Grain Market Insider recommended taking advantage and making a sale on a short covering rally which was sparked by several Chinese purchases of US wheat. Since then, China has been silent in the US wheat export market, and prices remain somewhat elevated. Any remaining 2023 soft red winter wheat should be getting priced into market strength with the goal of having zero bushels unpriced by the end of January. Grain Market Insider won’t have any “New Alerts” for 2023 Chicago wheat – either Cash, Calls, or Puts, as we have moved focus onto 2024 and 2025 Crop Year Opportunities.

- No new action is recommended for 2024 Chicago wheat. Since early December, the July ’24 contract has traded mostly sideways to slightly lower after its brief short covering runup on Chinese buying. Although China has since been absent from the US wheat export market, prices appear to have found support above 585, and managed funds continue to hold a sizeable, short position that could trigger another short covering rally if a bullish impetus enters the market. At the end of August, Grain Market Insider recommended purchasing July 590 puts to prepare for further price erosion. Although, if the market receives the needed stimulus to move prices back toward this summer’s highs, Grain Market Insider is prepared to recommend adding to current sales levels and possibly even purchasing call options to protect those sales. Otherwise, the current recommended put position will add a layer of protection if prices erode further, and Grain Market Insider will be prepared to recommend covering some of those puts to offset much of the original cost and move toward a net neutral cost for the remaining position.

- No action is currently recommended for 2025 Chicago Wheat. Since early September, the July ’25 contract has been mostly rangebound with 632 at the low end and 685 at the top. Grain Market Insider’s strategy for the 2025 crop year up to this point has been to sit tight. Though if prices rally toward the upper end of this range, we will consider taking advantage of the rally’s historically good prices to make sales recommendations.

To date, Grain Market Insider has issued the following Chicago wheat recommendations:

Above: The downside breakout from the 584 – 618 congestion pattern suggests that prices may attempt to test the next support level around 555. If the 555 can hold and prices turn back higher, upside resistance will again be found between 584 and 618. If not, the next major level of support remains near the September low of 540.

Action Plan: KC Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

KC Wheat Action Plan Summary

- No new action is recommended for 2023 KC wheat crop. Since last fall, front month KC wheat has been mostly rangebound between 678 up top and the 590 area down below. The latter has held as support for the past three months. Although fundamentals remain weak, considering support lies just below the market and managed funds continue to carry a sizable short position, these factors could trigger a return to higher prices if any unforeseen risks enter the market. Grain Market Insider’s strategy is to look for price appreciation as weather becomes a more prominent market mover and may consider suggesting additional sales if prices make a modest 20% retracement of the 2022 highs back toward 730.

- No new action is recommended for 2024 KC wheat. At the end of August, the July ’24 contract broke out of roughly a one-year trading range and stepped down to a 609 ¼ low in late November, largely driven by managed fund selling in the front month on weak US export demand and lower world wheat prices. Since then, the funds covered part of their large short position which also rallied prices in the July ’24 contract. While bearish headwinds remain, managed funds continue to hold a sizable, short position, and price seasonals remain positive for adding weather risk premium. These are two factors that could fuel additional short covering and rally prices in the months ahead. Back in August, Grain Market Insider recommended buying Jul’24 KC wheat 660 puts to protect the downside following the range breakout. As the market recently got further extended into oversold territory and the July contract showed signs of support near 630, Grain Market Insider recommended exiting 75% of the originally recommended position. Moving forward, Grain Market Insider is prepared to recommend exiting the last 25% on any further supportive market developments.

- No action is currently recommended for 2025 KC Wheat. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted next fall. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following KC recommendations:

Above: Front month Minneapolis wheat broke through nearby downside support of 688 and may continue to drift lower to test the January low of 678 ¾. If the 678 ¾ area fails, the next major support level may come in around 669. Overhead, resistance remains between 710 and 720.

Action Plan: Mpls Wheat

Calls

2023

No New Action

2024

No New Action

2025

No New Action

Cash

2023

No New Action

2024

No New Action

2025

No New Action

Puts

2023

No New Action

2024

No New Action

2025

No New Action

Mpls Wheat Action Plan Summary

- No new action is currently recommended for 2023 Minneapolis wheat. Since last summer, front month Minneapolis wheat has slowly stair-stepped lower with weaker world prices and little bullish news to move markets higher. During this time, the 50-day moving average has acted as resistance, above which the market has not been able to hold for very long. Managed funds have also established and maintained a record (or near record) short position for much of the same time. Although bullish headwinds remain, the market has become very oversold, and the large fund net short position continues to leave the market susceptible to a short-covering rally at any time here. Grain Market Insider’s strategy is to look for a modest retracement of the July high and consider additional sales around 725 – 750.

- No new action is recommended for 2024 Minneapolis wheat. Much like the front month contracts, Sept ’24 has been in a downward trend since last summer. And just as Sept ’24 has been influenced to the downside by the front months, it could be similarly influenced to the upside by the front months if a bullish impetus enters the scene and triggers a short covering rally due to the fund’s large short position. Back in August, Grain Market Insider recommended buying July ’24 KC wheat 660 puts to protect the downside following a 1-year range breakout in KC wheat, and in November recommended exiting 75% of the originally recommended position as July ’24 KC wheat showed signs of support around 630. While in the same time frame, Grain Market Insider also recommended making an additional sale as the Sept ’24 Minneapolis contract broke long time 743 support. Grain Market Insider remains prepared to recommend exiting the last 25% of the open puts on any further supportive market developments and consider recommending additional sales if prices make a modest retracement of the 2022 highs.

- No action is currently recommended for the 2025 Minneapolis wheat crop. Grain Market Insider isn’t considering any recommendations at this time for the 2025 crop that will be planted in the spring of next year. It may be late spring or summer before Grain Market Insider starts considering the first sales targets.

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Above: Front month Minneapolis wheat continues to drift lower, and with the failure of 669 support, the market is at risk of drifting further toward the next major support level around 595 unless a bullish catalyst enters the scene. Although, prices are trending lower. The market is showing signs of being oversold, which can be supportive if prices reverse from fresh bullish input. If that happens, the first level of resistance may come in around 680 – 690.

Other Charts / Weather