2-14 End of Day: Wheat Leads Grains Higher Friday

The CME and Total Farm Marketing offices will be closed Monday, February 17, in observance of Presidents Day

All Prices as of 2:00 pm Central Time

| Corn | ||

| MAR ’25 | 496.25 | 2.75 |

| JUL ’25 | 511.25 | 2.25 |

| DEC ’25 | 473 | 0.25 |

| Soybeans | ||

| MAR ’25 | 1036 | 6 |

| JUL ’25 | 1068.25 | 5.25 |

| NOV ’25 | 1052 | 6.75 |

| Chicago Wheat | ||

| MAR ’25 | 600 | 22.25 |

| JUL ’25 | 625.25 | 22.25 |

| JUL ’26 | 657.25 | 7.75 |

| K.C. Wheat | ||

| MAR ’25 | 621.25 | 23 |

| JUL ’25 | 642.5 | 23 |

| JUL ’26 | 668.5 | 15 |

| Mpls Wheat | ||

| MAR ’25 | 633.5 | 16.75 |

| JUL ’25 | 661.5 | 17.5 |

| SEP ’25 | 672 | 17.25 |

| S&P 500 | ||

| MAR ’25 | 6136 | 0.75 |

| Crude Oil | ||

| APR ’25 | 70.67 | -0.47 |

| Gold | ||

| APR ’25 | 2895.4 | -50 |

Grain Market Highlights

- Corn: A strong rally in the wheat market provided support to corn futures, with March contracts testing resistance near the $5 mark.

- Soybeans: Soybeans followed the broader grain complex higher on Friday, with soybean meal closing firm while soybean oil dipped alongside weaker crude oil prices.

- Wheat: All three wheat classes surged sharply higher on Friday, driven by escalating tensions from a Russian drone strike and ongoing concerns about potential winterkill.

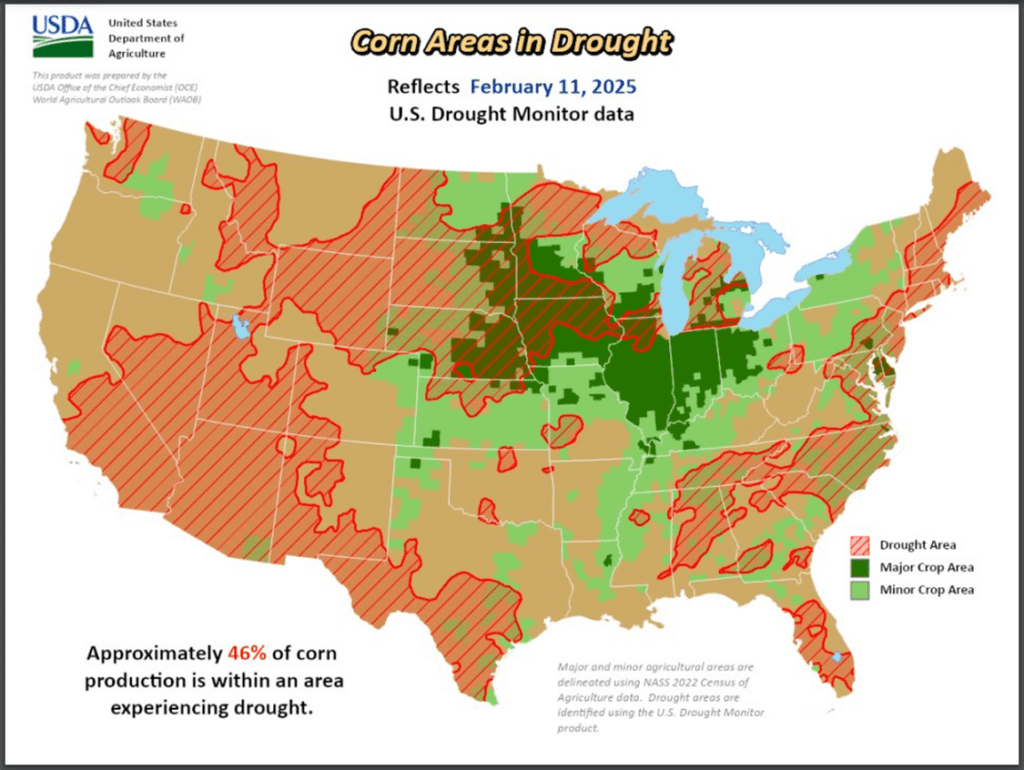

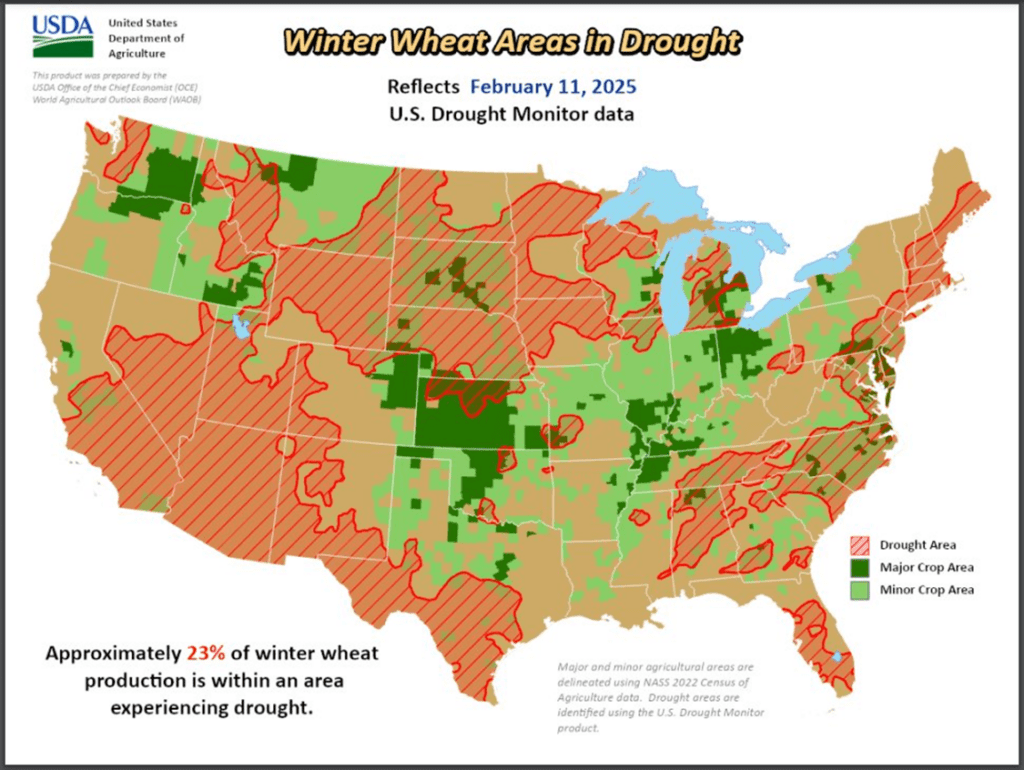

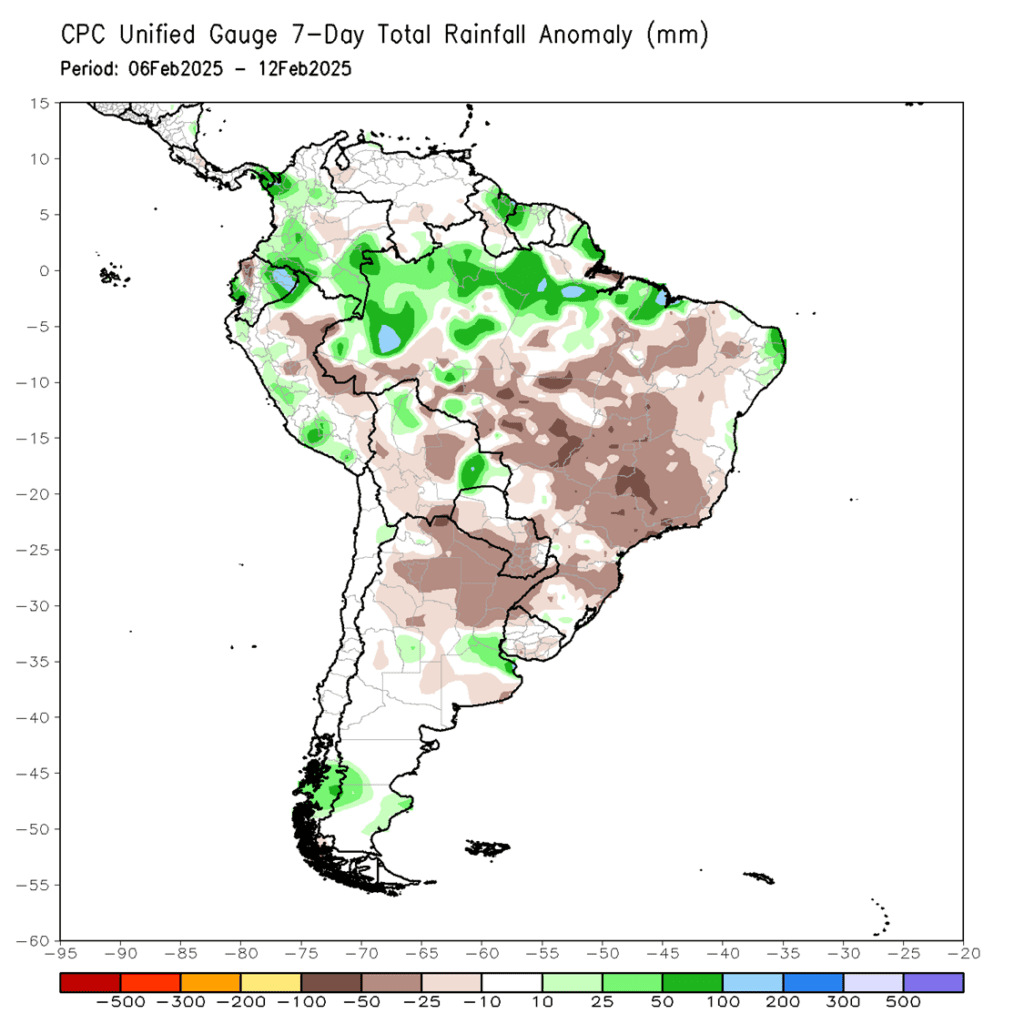

- To see the updated U.S. corn and winter wheat areas in drought as well as the South America 7-day rainfall anomaly.

Note – For the best viewing experience, some Grain Market Insider content is best viewed with your phone held horizontally.

Corn

Action Plan: Corn

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

Active

Sell DEC ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

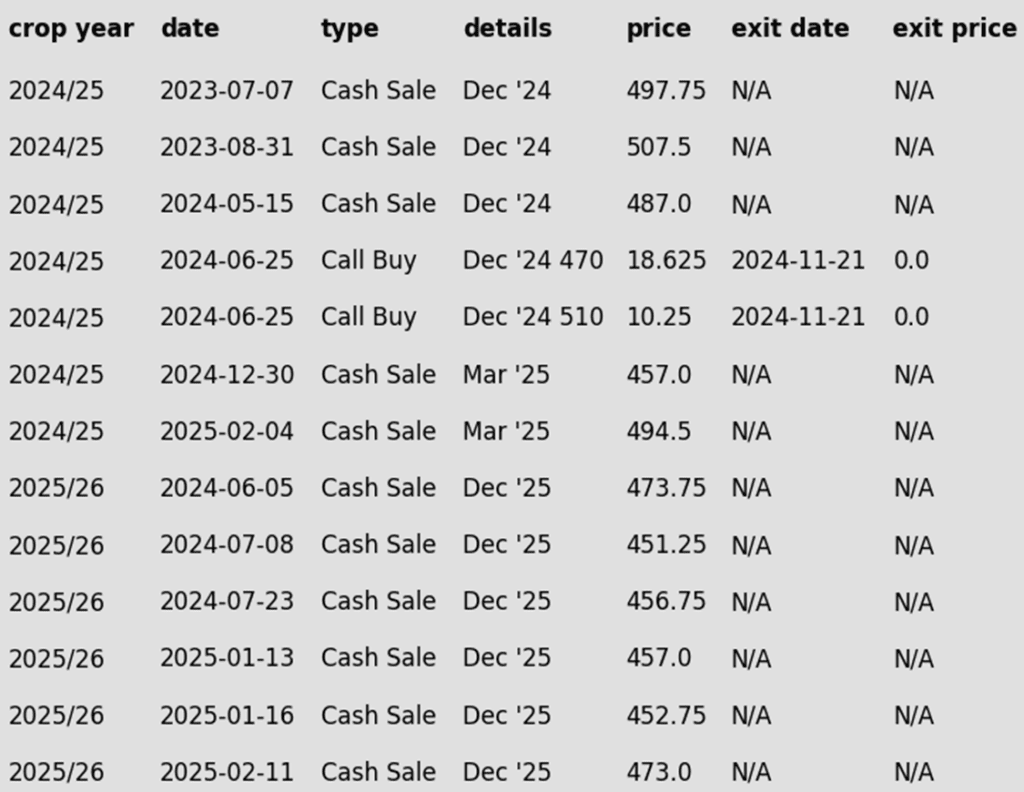

2024 Crop:

- Last Sales Recommendation: Grain Market Insider last recommended a 2024 crop sale on February 4 at 494.50.

- Another Attempt at 500: The March ‘25 contract made its eighth attempt to break the 500 level since January 29, reaching an intraday high today of 499.75 before slipping back below prior resistance at 498.50.

- New Resistance at 499.75: With today’s new high, previous resistance at 498.50 has shifted up to 499.75. A decisive break above this level could open the door for a run toward the May 1996 high of 513.50.

- Strategy: Still no Plan B for now as Grain Market Insider recently recommended a sale within the current range, so the focus remains on giving March ‘25 a shot at clearing 499.75. If it breaks through, the next upside target would be 512, just below the 1996 high of 513.50.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2025 corn crop at the current price level.

- Major Resistance at 479: December ‘25 faces strong resistance at 479. A decisive close above this level could signal broader upside potential as we move into the spring planting window.

- Potential Call Option Strategy: If prices break through 479, stay tuned for a possible call option recommendation. This strategy would hedge against existing sales while positioning you for upside exposure in the event of an extended rally.

2026 Crop:

- Hold Recommendation: No sales recommendations are anticipated for the crop to be planted in spring 2026 for at least another 1–3 weeks.

To date, Grain Market Insider has issued the following corn recommendations:

Market Notes: Corn

- A strong rally in the wheat market provided support to corn futures, but selling resistance at the $5.00 level on the March contract capped gains, leading to a weaker close in the afternoon. Despite this, March corn futures ended the week 8 ¾ cents higher, marking a positive weekly performance.

- Demand stayed supportive in the corn market as the USDA announced another flash export sale on Friday morning. Colombia purchased 100,000 mt (3.9 mb) for corn for the current marketing year.

- Despite recent rainfall, crop condition for Argentina corn continued to slide last week. Only 16% of the crop is in good condition, down from 25% last week. Approximately 1/3 of the Argentina corn crop is struggling from recent hot and dry weather.

- The corn market still has a supportive tone given the global stocks-to-use ratios. Excluding China, global stocks-to-use is at a 29-year low at 7.9%, and with China large supply calculated in, stocks-to-use is at an 11-year low.

Corn Bulls in Control, Eyeing Key Resistance

The corn market’s post-harvest rally remains intact, driven by strong fund buying and robust demand. Solid support holds at 475, with additional footing near the breakout zone around 450. On the upside, prices are pressing against the 500 mark — a critical resistance level that could dictate the next move. With buyers still engaged, all eyes are on whether momentum can propel corn beyond this key threshold.

Soybeans

Action Plan: Soybeans

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

No New Action

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Break of 1039: This week the March ‘25 contract posted a daily closed below 1039 for the first time since January 17, setting a new monthly low by breaking the February 3 low of 1031.75. This marks the first lower low since the market bottomed on December 19, interrupting the previous pattern of higher highs and higher lows that led to the February 5 high of 1079.75.

- Possible Trend Change: The break below the previous February low of 1031.75 could indicate a potential trend shift, but confirmation will require additional downside follow-through in the coming sessions.

2025 Crop:

- Recent Recommendation: Grain Market Insider recently advised selling the first portion of your 2025 soybean crop and purchasing call options. For full details, see the recommendations summary table below.

- Current Recommendation: Hold off on any additional actions for now. With recent recommendations in place, Grain Market Insider is comfortable waiting for higher price levels, especially given how early it is in the year.

2026 Crop:

- Hold Recommendation: No sales recommendations are expected until spring.

To date, Grain Market Insider has issued the following soybean recommendations:

Market Notes: Soybeans

- Soybeans were higher to end the day ahead of the long Presidents Day weekend. The grain complex was primarily led higher by large gains in wheat after a Russian drone strike escalated tensions in Ukraine. Soybean meal was higher, while soybean oil followed crude oil lower.

- Yesterday’s export sales report was poor for soybeans coming in below the range of analyst estimates at 7.7 million bushels. Primary destinations were to China, Egypt, and the Netherlands. Brazilian soybeans remain competitive with the US which is limiting export demand.

- For the week, March soybeans lost 13-1/2 cents while November soybeans lost 5-1/2 cents. March soybean meal lost $5.50 to $295.90, and March soybean oil gained 0.09 cents to 46.07 cents. Pressure this week came from ongoing harvest in Brazil.

- Yesterday, CONAB released its new estimates for 24/25 grain production this morning and lowered them from the previous month. The new estimates for soybeans are 166.014 mmt which compared to 166.328 mmt in January. This is below the USDA’s last estimate of 169 mmt.

Soybeans Attempting to Breakout

Front-month soybean futures have repeatedly tested but failed to clear resistance at the 200-day moving average in recent weeks — a stubborn ceiling that has limited upside momentum for over 18 months. A decisive close above this level would be a strong signal for potential further upside. Support is expected to be near 1000 on a pullback. Initial resistance lies near the 1100 level, with larger resistance near 1140.

Wheat

Market Notes: Wheat

- All three U.S. wheat classes closed sharply higher on Friday, fueled by reports of a Russian drone strike on the Chernobyl reactor shield. Although reports indicate the damage was not severe and no radiation leakage occurred, the market reacted to the news, likely driven by perception and fund short covering. Continued concerns about potential winterkill, a higher close for Matif wheat, and a weaker U.S. dollar also supported the rally.

- ABARE is not expected to update their total Australian wheat production estimate until March. However, the Western Australian Grain Industry Association has said that their state’s wheat harvest totaled 12.45 mmt, exceeding the December estimate of only 10.8 mmt. Furthermore, their total 2024 grain production at 22.4 mmt is said to be the third largest on record.

- FranceAgriMer rated 73% of the French soft wheat crop as good to very good, up from 68% a year ago, indicating a strong crop condition.

- The 2025 Russian grain harvest could reach between 140-145 mmt, according to OZK Group. For reference, the 2024 crop totaled 128 mmt. This estimate is said to be on the optimistic side, but even conservative estimates project a bigger harvest than last year. On a related note, Russia is expected to export 55 mmt of grain during the 24/25 season, which includes 44 mmt of wheat.

Action Plan: Chicago Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

New Alert

Sell JUL ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- No Change: The 680-705 range for March ‘25 remains the next potential target for a sale.

- Slide Ended: The March ‘25 contract snapped its four-day losing streak today, posting a nearly four-cent gain. The overall pullback from the February 7 high appears constructive and orderly, which could set the stage for a move back higher.

2025 Crop:

- NEW ACTION – Grain Market Insider recommends selling a portion of your 2025 SRW wheat crop today.

- First Sale Since September: This marks the first sales recommendation for the 2025 SRW wheat crop since September 3. With the July ‘25 contract up 19 cents this week and logging its sixth consecutive weekly gain, Grain Market Insider is recommending taking advantage of the 78-cent rally from the January low.

- Next Target: If the July contract maintains its uptrend, the next target range would be 690-715 vs. July ‘25.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations were provided for the other three-quarters in July and December. The current strategy is to hold the remaining position for now.

2026 Crop:

- Sales Target Range: The next target range for a sale on the 2026 crop remains 700–720 vs July ‘26.

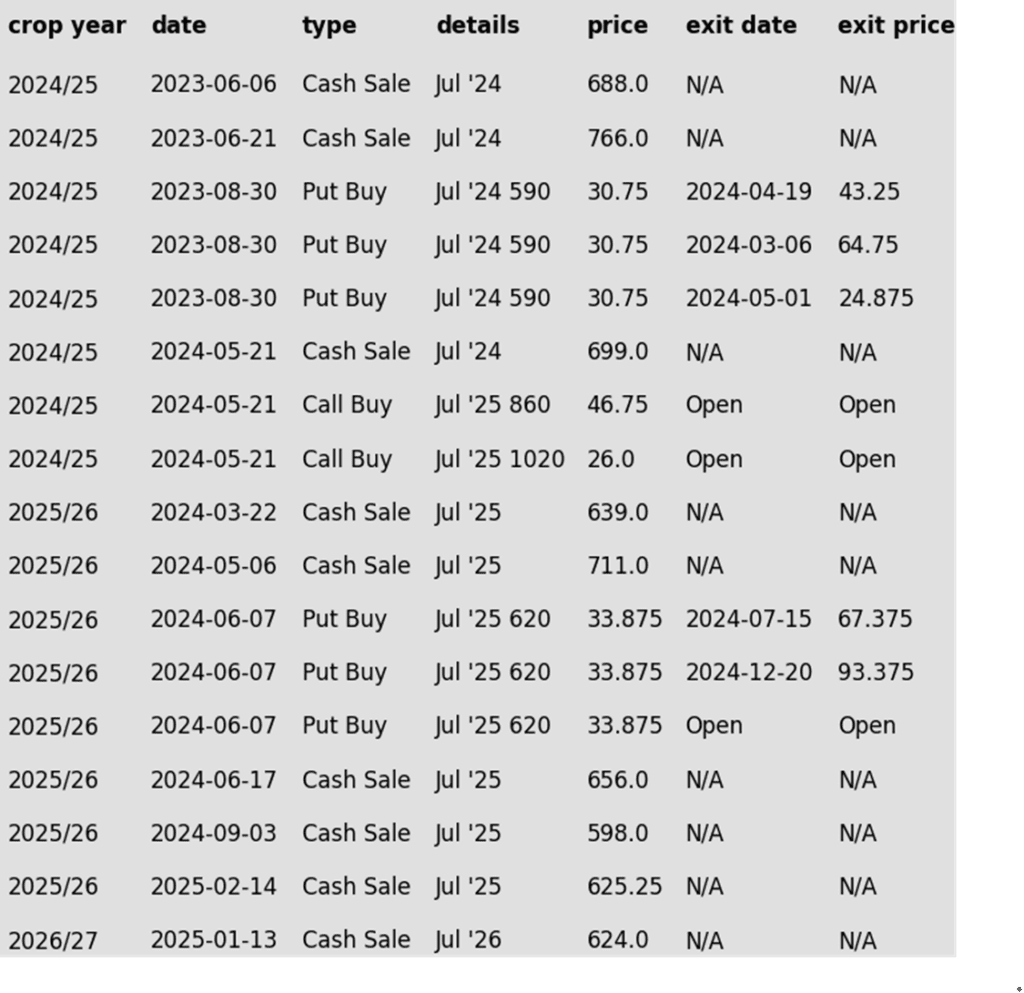

To date, Grain Market Insider has issued the following Chicago Wheat recommendations:

Chicago Wheat Breaks Higher

Chicago wheat broke out of its prolonged sideways range with a strong February rally, reaching key resistance at the early October highs just above 615. This marks a significant weekly close above the 200-day moving average, which is expected to provide support during any near-term pullbacks.

Action Plan: KC Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

No New Action

2025

New Alert

Sell JUL ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- Grain Market Insider recommended selling a portion of your 2024 HRW wheat crop on February 5 at 591.75 vs March ‘25.

- No Official Targets: Following the latest sales recommendation, there are currently no active target ranges to make additional sales.

- Open Call Options: If you’re holding the previously recommended July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about five months until expiration in the third week of June.

2025 Crop:

- NEW ACTION – Grain Market Insider recommends selling another portion of your 2025 HRW wheat crop today.

- Second Sale Recommended: Grain Market Insider is advising a second sale this week, as the July ‘25 contract closed up 23 cents today and marked its fourth consecutive weekly gain.

- Key Levels: The July ‘25 contract is now just 11 cents shy of the September high of 653.75 and has rallied 92 cents from the December low.

- Open Put Options: One-quarter of the originally recommended 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The current plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until late spring or early summer.

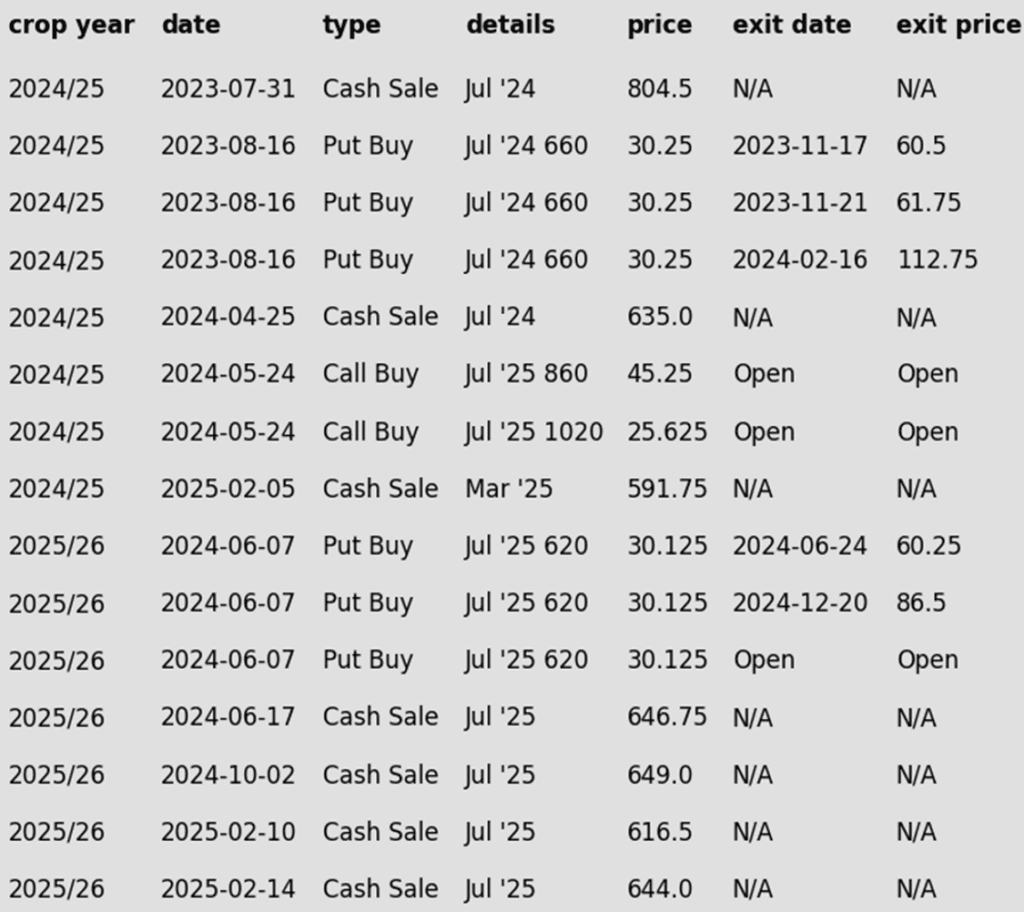

To date, Grain Market Insider has issued the following KC recommendations:

KC Wheat Attempts to Break Out

Kansas City wheat futures kicked off February on a strong note, closing above the 200-day moving average and testing multi-month highs near 620. A decisive close above the October peak of 623 could open the door for a rally toward the 700 level. On the downside, initial support lies near the 200-day moving average, with stronger support around 575.

Action Plan: Mpls Wheat

Calls

2024

No New Action

2025

No New Action

2026

No New Action

Cash

2024

Active

Sell MAR ’25 Cash

2025

Active

Sell SEP ’25 Cash

2026

No New Action

Puts

2024

No New Action

2025

No New Action

2026

No New Action

2024 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2024 HRS wheat crop.

- Latest Sales Rec: This is the first sale recommendation that Grain Market Insider has made for the 2024 Minneapolis wheat crop since June 7 of last year.

- Open Call Options: If you’re holding the previously recommended KC July ’25 860 and 1020 call options, stay the course. While actionable targets remain distant, these options still have about four months until expiration in the third week of June.

2025 Crop:

- CONTINUED OPPORTUNITY – Grain Market Insider recommends selling a portion of your 2025 HRS wheat crop.

- Stalling Momentum: The September ’25 contract has struggled to maintain its upward momentum, facing strong resistance around 660 for the past four sessions. With the price up about 8% from the January 3 low of 605, Grain Market Insider recommends selling another portion of your 2025 new crop Minneapolis wheat today. This marks the first recommendation for the 2025 crop since July 23 of last year.

- Open Put Options: One-quarter of the originally recommended KC 620 July ’25 put option position remains. Scale-out recommendations for the other three-quarters were issued in July and December. The plan is to hold the remaining position for now.

2026 Crop:

- Hold Recommendation: No first sales recommendations are expected until early summer.

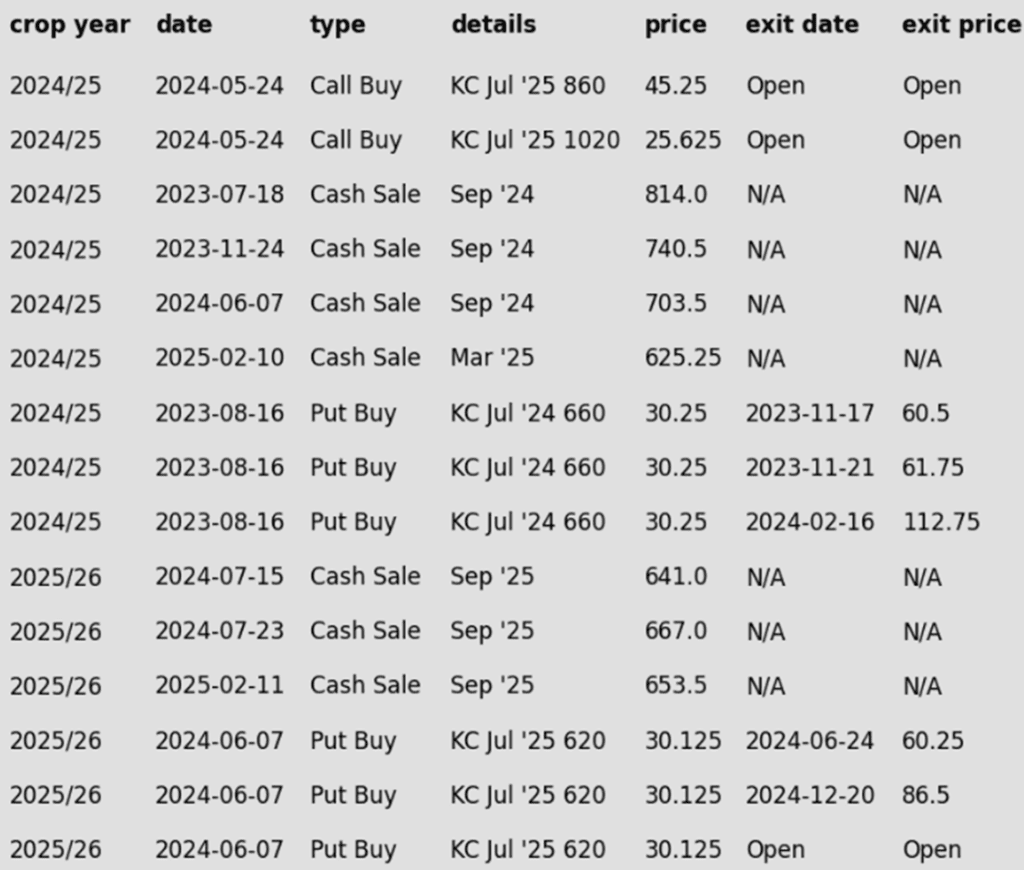

To date, Grain Market Insider has issued the following Minneapolis wheat recommendations:

Spring Wheat Breakout: Rally or False Start?

After months of treading water, spring wheat finally found its spark in late January, surging beyond its previous range and signaling a potential breakout. The next big test lies at the 200-day moving average near 625, a level that could either fuel further momentum or stand as a stubborn ceiling. However, any near-term weakness or a close back below 613 could snuff out the rally, pulling prices back into their familiar rangebound pattern.

Other Charts / Weather